Key Insights

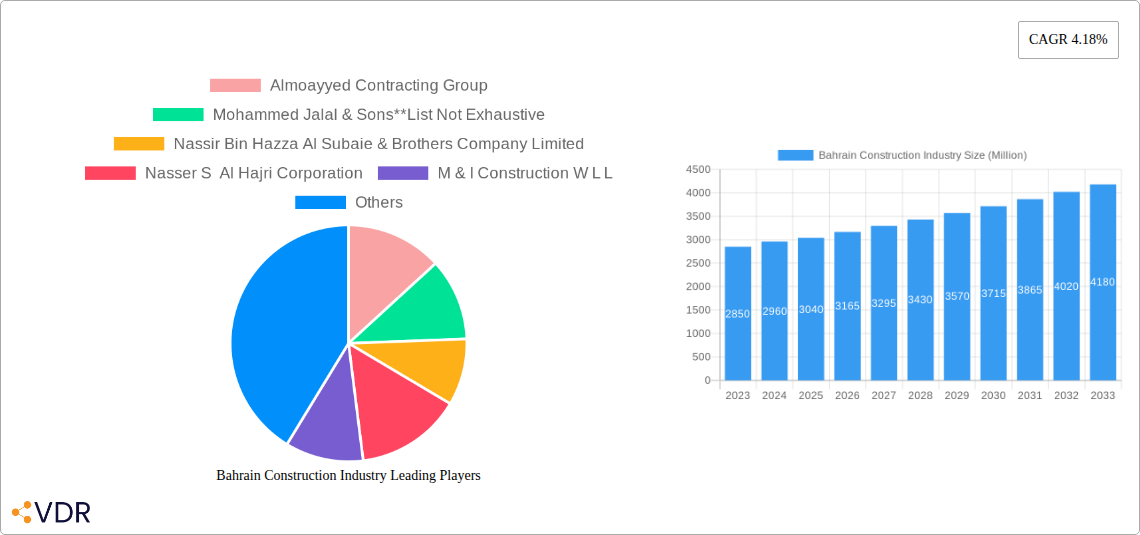

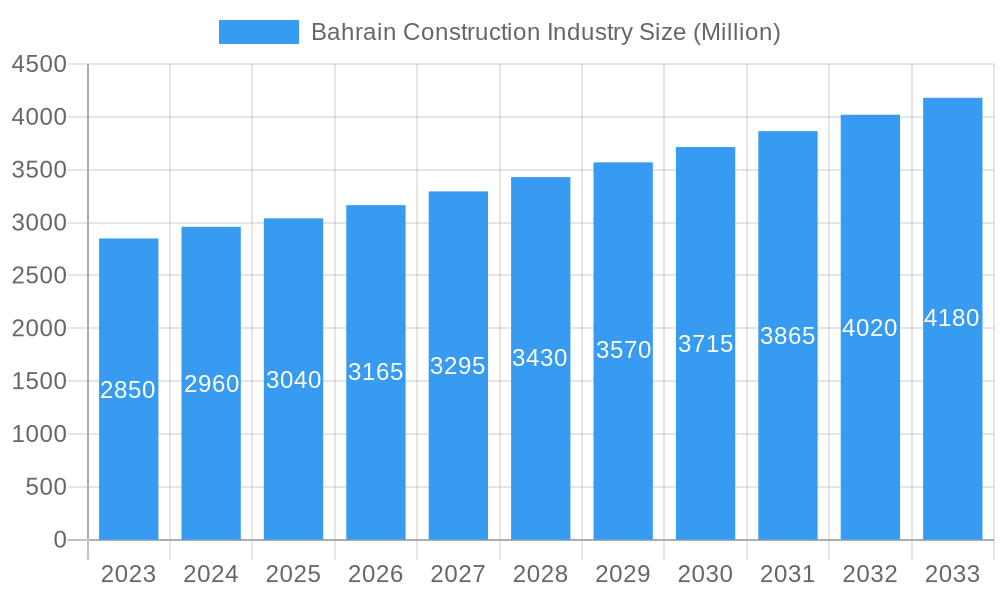

The Bahrain construction industry is poised for robust growth, projected to reach a market size of $3.04 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.18% through to 2033. This expansion is primarily fueled by significant investments in infrastructure development, particularly in transportation networks and the energy and utilities sector. The government's commitment to diversifying its economy and enhancing its urban landscape is a key driver, leading to substantial projects in commercial, residential, and industrial construction. Trends indicate a rising demand for sustainable building practices and smart infrastructure solutions, aligning with global environmental and technological advancements. The increasing focus on developing sophisticated residential communities and modern commercial hubs further underpins this positive market trajectory.

Bahrain Construction Industry Market Size (In Billion)

Despite the strong growth outlook, the sector faces certain restraints. These include potential challenges in securing skilled labor, fluctuations in the cost of raw materials, and the need for continuous adaptation to evolving regulatory frameworks. Nevertheless, the strategic initiatives by the Bahraini government, coupled with the active participation of prominent construction firms like Almoayyed Contracting Group, Mohammed Jalal & Sons, and Nass Corporation, are expected to mitigate these challenges. The market is characterized by intense competition and a growing emphasis on innovation to deliver high-quality projects efficiently. The projected expansion across various segments, from large-scale infrastructure to bespoke residential developments, highlights the dynamic and evolving nature of Bahrain's construction landscape.

Bahrain Construction Industry Company Market Share

Bahrain Construction Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the intricate Bahrain construction industry, offering a detailed analysis of market dynamics, growth trajectories, and future projections. Leveraging high-traffic keywords such as "Bahrain construction," "GCC construction market," "infrastructure development Bahrain," "residential construction Bahrain," "commercial construction Bahrain," and "industrial construction Bahrain," this report is optimized for maximum search engine visibility and engagement with industry professionals, investors, and stakeholders. We provide an in-depth examination of parent and child market segments, presenting all values in millions of units for clarity and actionable insights.

Bahrain Construction Industry Market Dynamics & Structure

The Bahrain construction industry exhibits a moderately concentrated market structure, with a blend of large established players and emerging local and international firms. Technological innovation is a key driver, particularly in areas like sustainable building materials, modular construction, and smart city integration. Regulatory frameworks, while evolving, are geared towards fostering foreign investment and streamlining project approvals. Competitive product substitutes are emerging, especially in the residential and commercial sectors, with pre-fabricated solutions and advanced material technologies gaining traction. End-user demographics are shifting, with a growing demand for high-quality, energy-efficient, and technologically advanced properties across all segments. Merger and acquisition (M&A) trends are indicative of consolidation opportunities and strategic partnerships aimed at expanding market reach and capabilities.

- Market Concentration: Dominated by a few large conglomerates alongside a vibrant SME landscape.

- Technological Innovation Drivers: Focus on sustainability, smart technologies, and efficient construction methods.

- Regulatory Frameworks: Government initiatives aimed at attracting foreign direct investment (FDI) and enhancing project delivery efficiency.

- Competitive Product Substitutes: Increased adoption of pre-fabricated components and innovative building materials.

- End-User Demographics: Growing demand for modern, sustainable, and technologically integrated living and working spaces.

- M&A Trends: Strategic acquisitions and joint ventures to enhance market presence and expand service portfolios.

Bahrain Construction Industry Growth Trends & Insights

The Bahrain construction industry is poised for significant growth, driven by a robust pipeline of infrastructure projects and sustained demand across commercial and residential sectors. The market size evolution is projected to witness a steady upward trajectory, fueled by government vision and private sector investment. Adoption rates of advanced construction technologies, including Building Information Modeling (BIM) and sustainable practices, are on the rise, enhancing project efficiency and reducing environmental impact. Technological disruptions, such as the increasing use of pre-fabrication and modular construction, are transforming project timelines and cost-effectiveness. Consumer behavior shifts are evident, with a growing preference for sustainable, smart, and aesthetically appealing constructions. The forecast period (2025–2033) is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5%, with market penetration of green building technologies reaching an estimated 35% by 2033.

Dominant Regions, Countries, or Segments in Bahrain Construction Industry

The Infrastructure (Transportation) Construction segment is the primary growth engine for the Bahrain construction industry, propelled by ambitious government plans for national development and connectivity. This segment is characterized by large-scale projects, significant capital investment, and a direct impact on the nation's economic competitiveness. The recent announcement regarding the Bahrain Metro project, a multi-stage endeavor involving a 109 km, fully automated urban railway network, underscores the government's commitment to enhancing public transportation and urban mobility. The initial procurement phase for Phase 1, spanning 29 kilometers, highlights the significant investment and competitive interest from global infrastructure players. Furthermore, the ongoing development of greenfield airport projects and upgrades to existing transportation networks contribute substantially to this segment's dominance.

- Infrastructure (Transportation) Construction Dominance: Driven by large-scale public and private investments in transportation networks.

- Key Drivers:

- Government Vision: Strategic initiatives aimed at improving national connectivity and logistics.

- Economic Diversification: Infrastructure development as a catalyst for economic growth and FDI attraction.

- Urbanization Trends: Increasing need for efficient public transport and urban mobility solutions.

- Tourism & Trade Growth: Expansion of airport and port facilities to support economic activities.

- Market Share & Growth Potential: This segment is projected to account for over 40% of the total construction market value by 2030, with a CAGR of approximately 8.2%.

- Project Examples: Bahrain Metro development, greenfield airport expansion, road network upgrades, and port enhancements.

The Commercial Construction segment also plays a crucial role, driven by the Kingdom's status as a regional business hub and its focus on diversifying the economy beyond oil. The growth in this sector is supported by new office developments, retail spaces, and hospitality projects aimed at attracting businesses and tourists.

The Residential Construction segment continues to be a steady contributor, responding to population growth and the demand for modern housing solutions. Government initiatives promoting affordable housing and private sector developments focusing on premium residential units contribute to its sustained importance.

The Industrial Construction segment is experiencing a gradual upswing, fueled by the government's efforts to boost manufacturing and logistics sectors. Investments in industrial zones and specialized facilities are driving this growth.

The Energy and Utilities Construction segment, while subject to fluctuations in global energy prices, remains vital, with ongoing projects in power generation, water treatment, and renewable energy contributing to its stability.

Bahrain Construction Industry Product Landscape

The Bahrain construction industry is witnessing a surge in product innovation focused on sustainability, efficiency, and technological integration. Advanced building materials such as self-healing concrete, high-performance insulation, and eco-friendly composites are gaining prominence. The application of Building Information Modeling (BIM) in project design and execution is becoming standard, leading to improved accuracy and reduced waste. Smart building technologies, including integrated automation systems for lighting, HVAC, and security, are increasingly incorporated into both commercial and residential developments. Performance metrics are being redefined by a focus on energy efficiency, durability, and lifecycle cost-effectiveness, with a growing emphasis on achieving green building certifications.

Key Drivers, Barriers & Challenges in Bahrain Construction Industry

Key Drivers:

- Government Initiatives & Investment: Significant public spending on mega-projects like the Bahrain Metro and airport expansion fuels market growth. Vision 2030 strategies prioritize infrastructure development.

- Economic Diversification: Bahrain's push to become a regional hub for business, tourism, and logistics necessitates robust construction activity.

- Foreign Direct Investment (FDI): Favorable government policies and strategic location attract international companies, bringing capital and expertise.

- Population Growth & Urbanization: Increasing demand for housing, commercial spaces, and improved urban amenities.

- Technological Advancements: Adoption of sustainable building practices, smart technologies, and efficient construction methods enhances project viability.

Barriers & Challenges:

- Skilled Labor Shortage: A consistent challenge in the GCC region, impacting project timelines and quality.

- Supply Chain Disruptions: Global and regional logistical issues can lead to material shortages and price volatility. Estimated impact: 5-10% cost increase.

- Regulatory Hurdles: While improving, complex approval processes can sometimes lead to project delays.

- Financing & Cash Flow Management: Access to timely financing and efficient cash flow management remains critical for project sustainability.

- Geopolitical Instability: Regional tensions can influence investor confidence and project funding.

- Environmental Regulations: Increasing stringency in environmental compliance may require upfront investment and adaptation.

Emerging Opportunities in Bahrain Construction Industry

Emerging opportunities in the Bahrain construction industry lie in the growing demand for sustainable and green building solutions. As environmental consciousness rises, projects focusing on renewable energy integration, water conservation technologies, and energy-efficient designs present significant potential. The "smart city" concept is gaining traction, creating opportunities for integrated technology solutions in new developments and retrofitting existing infrastructure. The expansion of tourism and hospitality sectors will continue to drive demand for unique and high-quality construction projects, including resorts and entertainment facilities. Furthermore, the focus on diversifying the economy beyond oil presents opportunities in developing specialized industrial zones and logistics hubs.

Growth Accelerators in the Bahrain Construction Industry Industry

Long-term growth in the Bahrain construction industry will be accelerated by several key factors. Continued government commitment to infrastructure development, particularly in transportation and logistics, will provide a sustained pipeline of projects. Strategic partnerships between local contractors and international firms will foster knowledge transfer and enhance project execution capabilities. The increasing adoption of digital technologies, such as AI and IoT in construction management, will drive efficiency and innovation. Furthermore, the growing emphasis on sustainability and ESG (Environmental, Social, and Governance) principles in construction will open up new markets for green building technologies and practices. The development of a skilled national workforce through targeted training programs will also be a crucial accelerator.

Key Players Shaping the Bahrain Construction Industry Market

- Almoayyed Contracting Group

- Mohammed Jalal & Sons

- Nassir Bin Hazza Al Subaie & Brothers Company Limited

- Nasser S Al Hajri Corporation

- M & I Construction W L L

- Nass Corporation

- Projects Holding Company W L L

- Mannai Holding

- Delta Construction Co W L L

- The Al Namal Group and the VKL

Notable Milestones in Bahrain Construction Industry Sector

- November 2022: Bahrain announced plans for significant procurement for its metro network project to commence in Q1 2023, indicating a major infrastructure push.

- February 2023 (Estimated): 11 major global infrastructure companies were reported to be competing for Phase 1 of the Bahrain Metro, a 29-kilometer segment of the ambitious 109 km, four-line network developed under a Public-Private Partnership (PPP) model.

- May 2023: The Ministry of Transportation & Telecommunications awarded a contract worth $1.437 million to Netherlands Airport Consultants for an initial study on Bahrain's greenfield airport project, estimated to cost $10 billion.

In-Depth Bahrain Construction Industry Market Outlook

The Bahrain construction industry is set for a period of robust growth, driven by a clear national vision for economic diversification and infrastructure enhancement. Key growth accelerators include sustained government investment in transportation and urban development, coupled with increasing private sector participation. The projected market size is expected to grow from approximately $3.5 billion in 2024 to an estimated $6.2 billion by 2033. Strategic opportunities lie in embracing sustainable building technologies, developing smart city solutions, and catering to the growing demand for high-quality commercial and residential properties. The industry's outlook is positive, supported by a favorable investment climate and a commitment to developing world-class infrastructure.

Bahrain Construction Industry Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

Bahrain Construction Industry Segmentation By Geography

- 1. Bahrain

Bahrain Construction Industry Regional Market Share

Geographic Coverage of Bahrain Construction Industry

Bahrain Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Focus on green buildings4.; Increased investment in infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High value of construction material

- 3.4. Market Trends

- 3.4.1. Increase in the number of Construction Projects driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Almoayyed Contracting Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mohammed Jalal & Sons**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nassir Bin Hazza Al Subaie & Brothers Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nasser S Al Hajri Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 M & I Construction W L L

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nass Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Projects Holding Company W L L

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mannai Holding

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Delta Construction Co W L L

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Al Namal Group and the VKL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Almoayyed Contracting Group

List of Figures

- Figure 1: Bahrain Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Bahrain Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Bahrain Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Bahrain Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Bahrain Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Bahrain Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Construction Industry?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Bahrain Construction Industry?

Key companies in the market include Almoayyed Contracting Group, Mohammed Jalal & Sons**List Not Exhaustive, Nassir Bin Hazza Al Subaie & Brothers Company Limited, Nasser S Al Hajri Corporation, M & I Construction W L L, Nass Corporation, Projects Holding Company W L L, Mannai Holding, Delta Construction Co W L L, The Al Namal Group and the VKL.

3. What are the main segments of the Bahrain Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Focus on green buildings4.; Increased investment in infrastructure.

6. What are the notable trends driving market growth?

Increase in the number of Construction Projects driving the market.

7. Are there any restraints impacting market growth?

4.; High value of construction material.

8. Can you provide examples of recent developments in the market?

November 2022: According to the local publication Gulf Daily News, Bahrain will start a significant procurement for building a metro network in the first quarter of 2023. According to prior reports by Zawya Projects and others, 11 major global infrastructure companies are competing for a 29-kilometer Phase 1 of Bahrain Metro, which is being developed in a Public-Private Partnership (PPP) model. The 109 km, four transit line, the fully automated urban railway network will be built out in four stages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Construction Industry?

To stay informed about further developments, trends, and reports in the Bahrain Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence