Key Insights

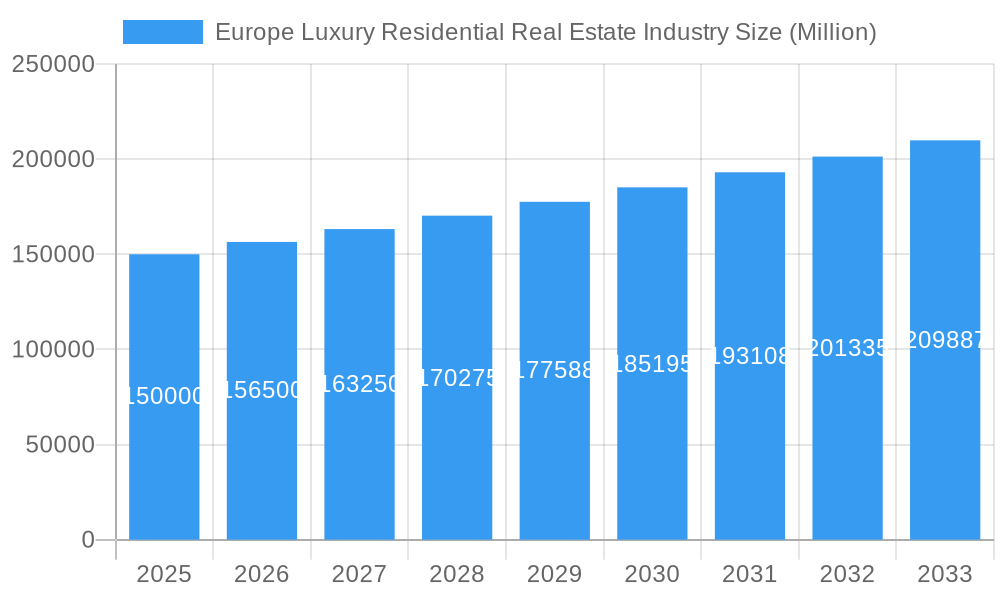

The European Luxury Residential Real Estate market is projected for substantial expansion, forecasted to grow from €12.25 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 10.36% through 2033. This growth is driven by increasing demand from high-net-worth individuals (HNWIs) and international investors for prime European properties. Key market trends include a preference for smart and sustainable homes, the rise of branded residences, and an emphasis on lifestyle amenities. The pandemic has also boosted demand for larger, private residences with enhanced outdoor spaces. Luxury real estate is increasingly viewed as a stable, appreciating asset class, attracting significant capital investment.

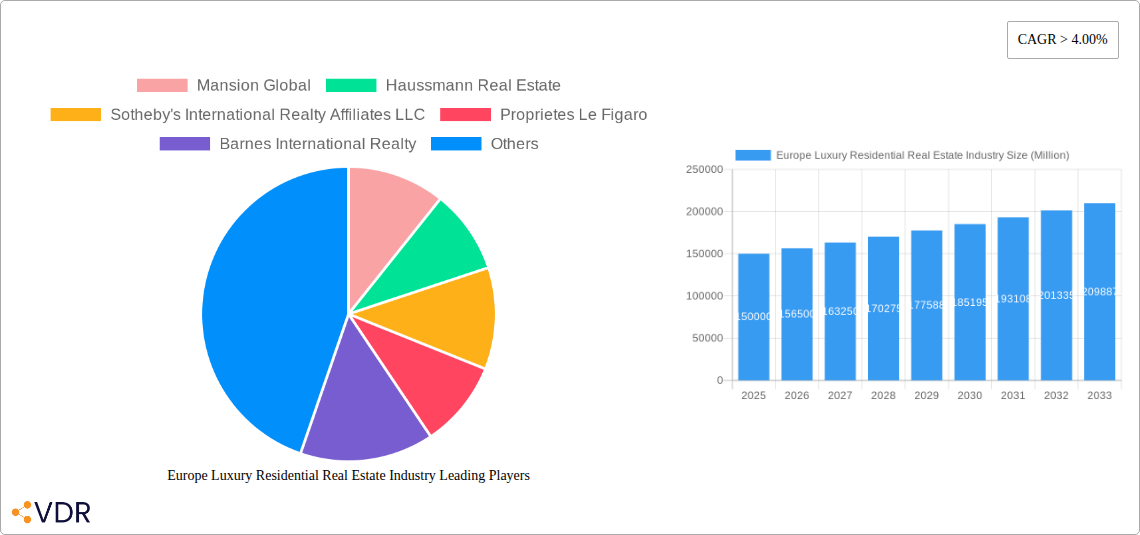

Europe Luxury Residential Real Estate Industry Market Size (In Billion)

Market restraints include economic uncertainties, fluctuating interest rates, geopolitical instability, and evolving property tax regulations. However, the enduring appeal of European cities and a continuous influx of wealth will sustain demand. The market segments into Villas/Landed Houses and Condominiums/Apartments, catering to diverse buyer motivations. Leading players like Mansion Global, Sotheby's International Realty Affiliates LLC, and Barnes International Realty are active in key markets such as the United Kingdom, France, Germany, and Spain, driving strategic expansion and capitalizing on emerging opportunities.

Europe Luxury Residential Real Estate Industry Company Market Share

Europe Luxury Residential Real Estate Industry Report: Market Dynamics, Growth Trends, and Regional Dominance (2019-2033)

This comprehensive report offers an in-depth analysis of the Europe luxury residential real estate industry, meticulously examining market dynamics, growth trajectories, and regional landscapes from 2019 to 2033. Leveraging a wealth of data and expert insights, this report provides actionable intelligence for investors, developers, and industry stakeholders seeking to navigate the complexities of this high-value market. Focusing on both parent markets and child markets, we deliver a granular understanding of investment opportunities and strategic imperatives.

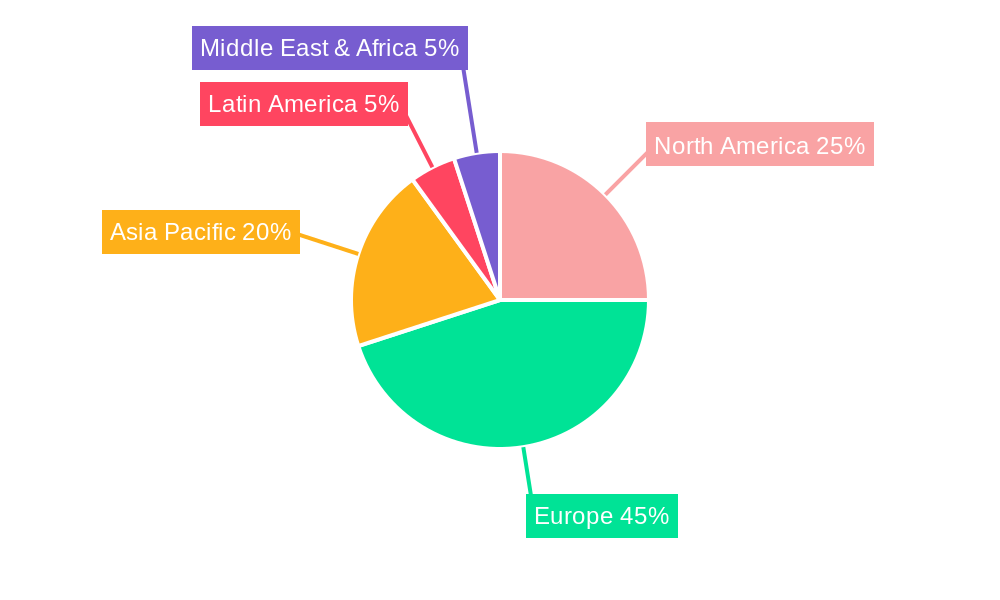

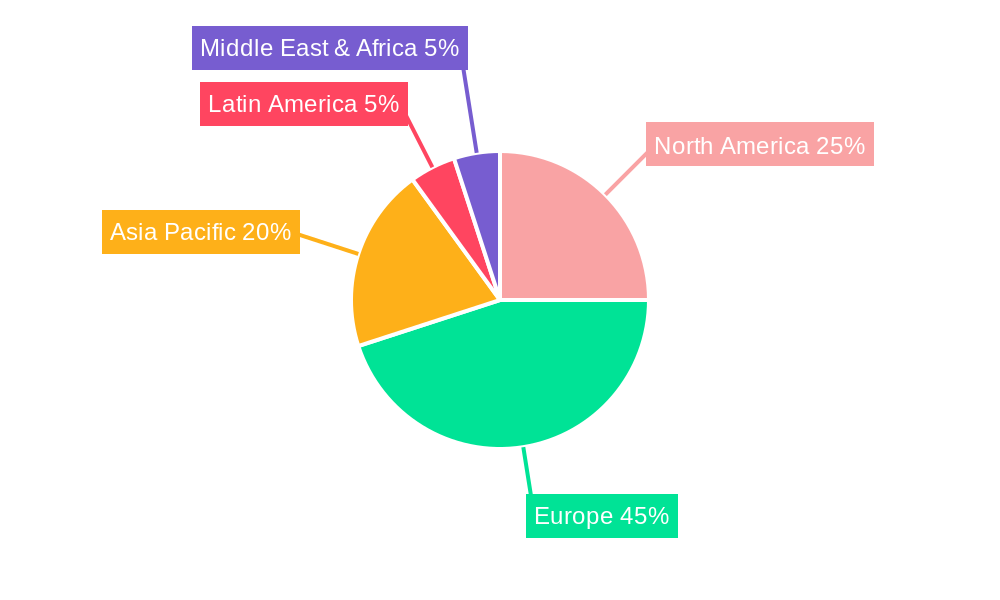

Europe Luxury Residential Real Estate Industry Regional Market Share

Europe Luxury Residential Real Estate Industry Market Dynamics & Structure

The Europe luxury residential real estate industry is characterized by a moderate market concentration, with a few prominent players holding significant sway. Technological innovation is increasingly driven by smart home integration, sustainable building practices, and advanced property management platforms, though adoption barriers remain for some traditional segments. Regulatory frameworks, particularly concerning environmental standards and foreign ownership, play a crucial role in shaping development and investment. Competitive product substitutes are emerging in the form of high-end fractional ownership and serviced residences. End-user demographics are shifting towards younger, affluent individuals seeking unique lifestyle experiences and investment diversification. Mergers and Acquisitions (M&A) trends indicate a consolidation in prime urban centers and sought-after holiday destinations, with deal volumes for high-value properties steadily increasing over the historical period.

- Market Concentration: Dominated by established international agencies and select private developers, with a growing number of boutique firms specializing in niche luxury segments.

- Technological Innovation Drivers: Smart home technology, AI-driven property management, sustainable construction materials, and virtual property tours are key innovations.

- Regulatory Frameworks: Stringent environmental regulations (e.g., energy efficiency standards), evolving taxation policies, and varying foreign investment laws significantly influence market activity.

- Competitive Product Substitutes: Fractional ownership, luxury serviced apartments, and exclusive co-living spaces offer alternative high-end residential solutions.

- End-User Demographics: Increasing interest from ultra-high-net-worth individuals (UHNWIs) from emerging economies, coupled with a growing demand from affluent millennials and Gen Z for experiential living.

- M&A Trends: Notable M&A activity focused on acquiring prime portfolios in established luxury hubs and expanding into emerging luxury markets, with an estimated XX M&A deal volumes in the historical period.

Europe Luxury Residential Real Estate Industry Growth Trends & Insights

The Europe luxury residential real estate industry is poised for robust growth, driven by persistent demand for premium properties and a recovering global economy. Market size evolution will be characterized by steady appreciation in established markets and significant expansion in emerging luxury destinations. Adoption rates for sustainable and smart technologies are projected to accelerate, enhancing property appeal and value. Technological disruptions, such as the increasing use of AI in property valuation and virtual reality in property showcasing, will further refine the market. Consumer behavior shifts are evident, with buyers prioritizing lifestyle, privacy, and bespoke amenities over mere square footage. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Market penetration for ultra-luxury segments remains high, fueled by a continuous influx of global wealth.

- Market Size Evolution: Projected to grow from an estimated USD XXX billion in the base year 2025 to USD YYY billion by 2033, indicating sustained expansion.

- Adoption Rates: Increasing adoption of sustainable building practices and smart home technologies, with an estimated XX% of new luxury developments incorporating these features by 2030.

- Technological Disruptions: AI-powered analytics for market forecasting, blockchain for secure property transactions, and advanced virtual staging are transforming the sales process.

- Consumer Behavior Shifts: A pronounced move towards properties offering enhanced well-being, remote working facilities, and proximity to nature or cultural attractions.

- Market Penetration: High penetration in established markets like London, Paris, and Geneva, with growing penetration in emerging luxury hubs such as Lisbon, Vienna, and select coastal regions.

Dominant Regions, Countries, or Segments in Europe Luxury Residential Real Estate Industry

The Europe luxury residential real estate industry sees Villas/Landed Houses emerging as a dominant segment, particularly in regions offering exclusivity, privacy, and scenic vistas. Countries like France (French Riviera, Provence), Italy (Tuscany, Lake Como), Spain (Marbella, Mallorca), and the UK (prime countryside estates) lead this segment's growth. The appeal of expansive living spaces, private gardens, and a sense of seclusion continues to resonate with affluent buyers seeking a retreat from urban environments. Economic policies that encourage foreign investment, coupled with robust infrastructure development, further bolster the attractiveness of these regions. Market share for Villas/Landed Houses is estimated to be XX% of the total luxury residential market.

- Dominant Segment: Villas/Landed Houses consistently outperform other segments due to demand for privacy, space, and unique architectural designs.

- Key Drivers:

- Growing preference for secluded living and private amenities.

- Increased demand for second homes and holiday residences.

- Significant foreign investment inflows seeking stable asset appreciation.

- Key Drivers:

- Leading Countries & Regions:

- France: Côte d'Azur, Provence, Paris suburbs.

- Italy: Tuscany, Lake Como, Amalfi Coast.

- Spain: Marbella, Mallorca, Costa del Sol.

- UK: Prime countryside estates, London's exclusive enclaves.

- Growth Potential: These regions exhibit strong growth potential owing to their established reputation, lifestyle appeal, and ongoing infrastructure improvements.

- Market Share: Villas/Landed Houses represent an estimated XX% of the total Europe luxury residential real estate market value.

Europe Luxury Residential Real Estate Industry Product Landscape

The Europe luxury residential real estate industry is witnessing a surge in product innovation focused on bespoke living experiences and sophisticated design. Villas and apartments are increasingly equipped with state-of-the-art smart home technology, offering seamless control over lighting, climate, security, and entertainment systems. Sustainable building materials and energy-efficient designs are becoming standard, reflecting a growing environmental consciousness among buyers. Exclusive amenities, such as private spas, home cinemas, and integrated wellness facilities, are defining the premium offering. Performance metrics are measured by enhanced lifestyle integration, energy savings, and long-term capital appreciation.

- Product Innovations: Integration of AI-powered smart home systems, advanced biometric security, and personalized climate control.

- Applications: Focus on creating seamless living environments, maximizing energy efficiency, and offering unparalleled comfort and convenience.

- Performance Metrics: Elevated property values due to enhanced features, reduced operational costs through energy efficiency, and superior occupant well-being.

Key Drivers, Barriers & Challenges in Europe Luxury Residential Real Estate Industry

Key Drivers:

- Economic Stability and Wealth Accumulation: A strong and stable European economy, coupled with continued wealth creation among high-net-worth individuals globally, fuels demand for luxury properties.

- Safe Haven Asset Class: Luxury real estate in established European markets is perceived as a safe haven for capital preservation, attracting international investors.

- Lifestyle and Cultural Appeal: Europe's rich history, diverse cultures, and desirable lifestyles continue to draw buyers seeking unique living experiences.

- Technological Advancements: Smart home integration and sustainable building practices are enhancing the appeal and functionality of luxury residences.

Barriers & Challenges:

- Regulatory Hurdles and Taxation: Complex and varying property laws, capital gains taxes, and foreign ownership restrictions in some countries can deter investment.

- Supply Chain Disruptions and Labor Shortages: Global supply chain issues and a shortage of skilled labor can impact construction timelines and costs for new luxury developments.

- Geopolitical Uncertainties: Global and regional geopolitical instability can lead to investor caution and impact market sentiment.

- Affordability and Accessibility: Rising construction costs and high property values can make prime luxury properties inaccessible to a broader range of affluent buyers.

Emerging Opportunities in Europe Luxury Residential Real Estate Industry

Emerging opportunities within the Europe luxury residential real estate industry lie in the burgeoning demand for sustainable and eco-friendly properties. The development of net-zero energy homes, properties with integrated renewable energy sources, and those built with recycled materials presents a significant growth avenue. Furthermore, the rise of remote work continues to fuel demand for larger, well-appointed residences with dedicated home office spaces, particularly in picturesque and tranquil locations outside major metropolitan centers. The integration of advanced wellness amenities, such as private gyms, yoga studios, and health-focused interior designs, is another key area for expansion.

Growth Accelerators in the Europe Luxury Residential Real Estate Industry Industry

Technological breakthroughs in sustainable construction and smart home automation are significant growth accelerators. Strategic partnerships between luxury developers, high-end interior designers, and technology providers are creating innovative living solutions that appeal to discerning buyers. The expansion of luxury tourism infrastructure, including world-class hotels and resorts, often spurs adjacent luxury residential development. Furthermore, government incentives aimed at promoting sustainable building and revitalizing urban centers are creating new avenues for growth. The increasing demand for experiential living, where properties offer unique lifestyles and access to exclusive amenities, will continue to drive market expansion.

Key Players Shaping the Europe Luxury Residential Real Estate Industry Market

- Mansion Global

- Haussmann Real Estate

- Sotheby's International Realty Affiliates LLC

- Proprietes Le Figaro

- Barnes International Realty

- Rodgaard Ejendomme

- John Taylor

- BellesDemeures

- Juvel Ejendomme

- Luxury places SA

Notable Milestones in Europe Luxury Residential Real Estate Industry Sector

- August 2022: Slate Asset Management acquired a portfolio of 36 key real estate properties in Norway for over NOK 1.5 billion (USD 0.15 billion), expanding its Norwegian presence to 63 assets.

- January 2022: Instone Real Estate sold approximately 330 apartments in Germany to LEG, including 96 privately financed rental apartments in Bonn-Endenich and 236 rental apartments in Essen, highlighting significant transaction volumes in the residential development sector.

In-Depth Europe Luxury Residential Real Estate Industry Market Outlook

The Europe luxury residential real estate industry is set for continued expansion, driven by a confluence of factors including global wealth growth, the enduring allure of European lifestyles, and advancements in sustainable and smart living. Future market potential is significant, particularly in emerging luxury hubs and for properties offering unique wellness and experiential amenities. Strategic opportunities abound for developers and investors who can adapt to evolving consumer preferences, embracing eco-friendly construction and integrating cutting-edge technology. The anticipated growth trajectory underscores the resilience and dynamism of this sector, positioning it as a key investment avenue for years to come.

Europe Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

Europe Luxury Residential Real Estate Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Europe Luxury Residential Real Estate Industry

Europe Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Largest Real Estate Companies in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mansion Global

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haussmann Real Estate

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Realty Affiliates LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Proprietes Le Figaro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Barnes International Realty

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rodgaard Ejendomme

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 John Taylor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BellesDemeures**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Juvel Ejendomme

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luxury places SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mansion Global

List of Figures

- Figure 1: Europe Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Luxury Residential Real Estate Industry?

The projected CAGR is approximately 10.36%.

2. Which companies are prominent players in the Europe Luxury Residential Real Estate Industry?

Key companies in the market include Mansion Global, Haussmann Real Estate, Sotheby's International Realty Affiliates LLC, Proprietes Le Figaro, Barnes International Realty, Rodgaard Ejendomme, John Taylor, BellesDemeures**List Not Exhaustive, Juvel Ejendomme, Luxury places SA.

3. What are the main segments of the Europe Luxury Residential Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Largest Real Estate Companies in Europe.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2022: Slate Asset Management, a global alternative investment platform that focuses on real assets, stated that it had paid more than NOK 1.5 billion (USD 0.15 billion) for a portfolio of 36 key real estate properties in Norway. Following closely on the heels of the company's initial two portfolio purchases in the area in December 2021 and March 2022, this deal increases Slate's presence in Norway to a total of 63 critical real estate assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Europe Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence