Key Insights

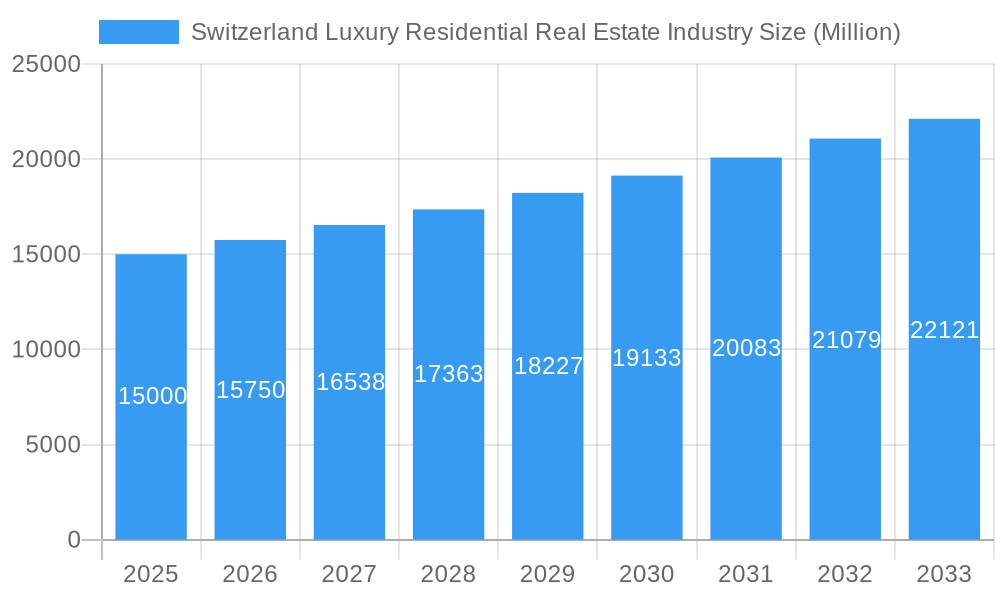

Switzerland's luxury residential real estate market, valued at $10 billion in 2024, is poised for significant expansion with a projected Compound Annual Growth Rate (CAGR) of 4.8%. This growth is underpinned by Switzerland's unwavering political and economic stability, coupled with its reputation for safety, attracting affluent global investors. Limited supply in prime locations such as Zurich, Geneva, and Bern is a key driver of sustained price appreciation. Increasing demand from domestic and international buyers, seeking wealth preservation and exclusive residences, further fuels market dynamics. The development of sophisticated luxury amenities and infrastructure enhances property desirability and value.

Switzerland Luxury Residential Real Estate Industry Market Size (In Billion)

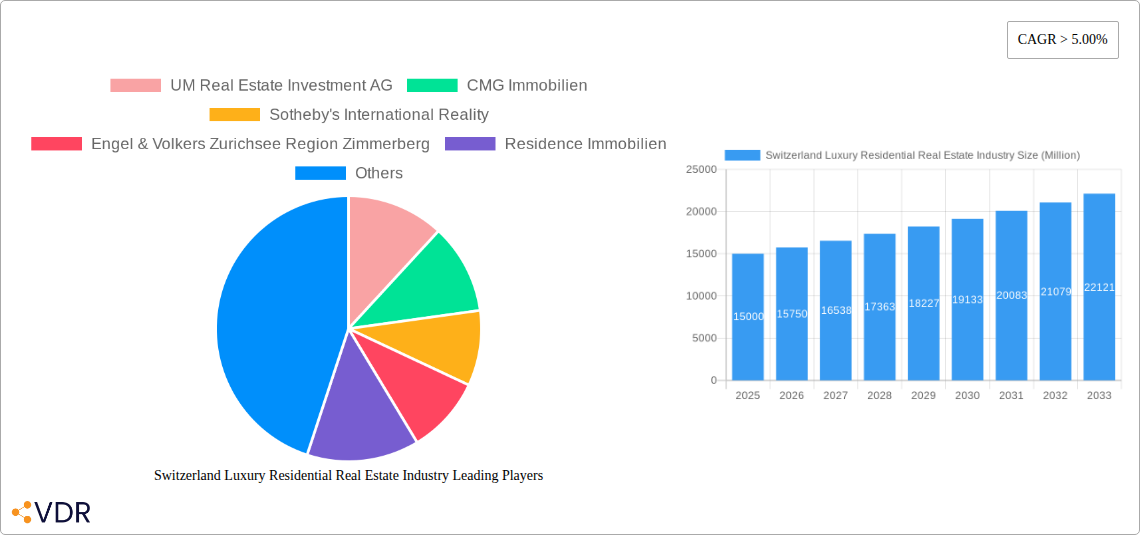

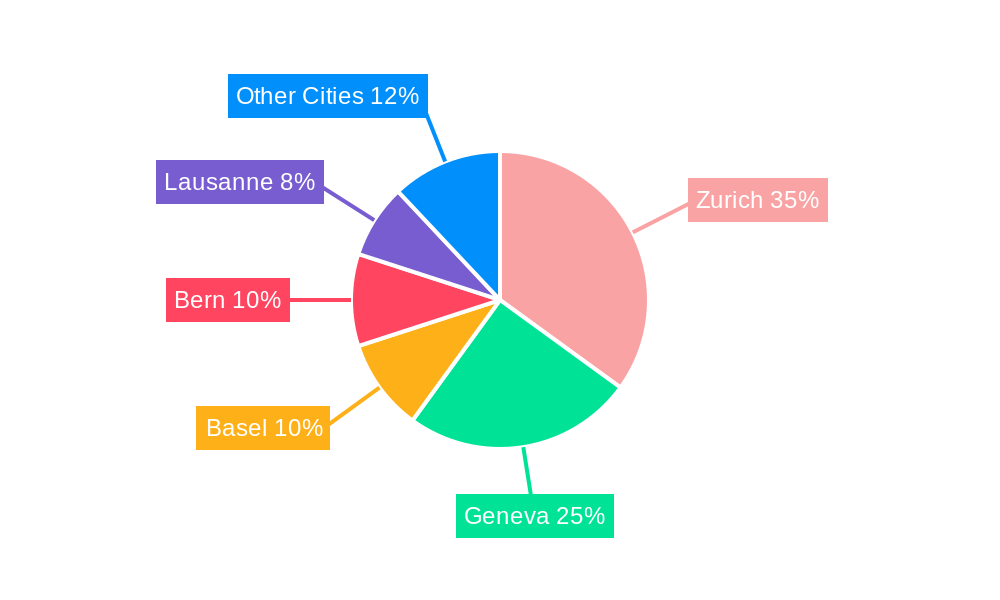

The market is segmented by property type, including villas, landed houses, apartments, and condominiums, and by key cities such as Bern, Zurich, Geneva, Basel, and Lausanne. Zurich and Geneva lead market share, benefiting from their robust financial sectors and international appeal. While growth in cities like Basel and Lausanne is at a moderated pace, the overall trajectory remains positive. Stringent building regulations and high construction costs represent potential market constraints, though their impact on the overall growth forecast is expected to be minimal. Prominent entities like UM Real Estate Investment AG, CMG Immobilien, and Sotheby's International Realty are strategically positioned to leverage this burgeoning market. Future projections indicate sustained demand for premium properties, fostering continued expansion and market consolidation.

Switzerland Luxury Residential Real Estate Industry Company Market Share

Switzerland Luxury Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Switzerland luxury residential real estate market, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and anyone seeking to understand this dynamic and lucrative sector. The report utilizes a robust methodology, incorporating both quantitative and qualitative data to provide a holistic view of the market's current state and future trajectory. The Base Year is 2025, with an Estimated Year of 2025 and a Forecast Period spanning 2025-2033. The Historical Period covered is 2019-2024. Market values are presented in millions.

Keywords: Switzerland luxury real estate, Swiss luxury homes, Geneva real estate, Zurich property, Basel luxury villas, Lausanne apartments, Swiss real estate market, luxury residential market, real estate investment Switzerland, high-end property Switzerland, Swiss property market analysis, real estate market trends Switzerland

Switzerland Luxury Residential Real Estate Industry Market Dynamics & Structure

The Swiss luxury residential real estate market is characterized by high concentration amongst a select group of players, significant technological innovation in marketing and property management, and a robust, albeit complex regulatory framework. The market is witnessing increasing demand for sustainable and eco-friendly properties, a trend impacting development and influencing consumer choices. Competitive substitutes include alternative luxury investments, such as art or private equity. The end-user demographic skews towards high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), both domestic and international. M&A activity is moderate but growing, with larger firms strategically acquiring smaller players to expand market share and geographic reach.

- Market Concentration: Highly concentrated, with the top 5 players controlling approximately xx% of the market in 2024.

- Technological Innovation: Significant adoption of VR/AR technology for virtual viewings, sophisticated CRM systems for client relationship management, and data analytics for market prediction.

- Regulatory Framework: Stringent building codes, environmental regulations, and tax implications influence market dynamics.

- Competitive Substitutes: Alternative luxury asset classes compete for HNWIs' investment portfolios.

- End-User Demographics: Predominantly HNWIs and UHNWIs, with a growing segment of younger, tech-savvy buyers.

- M&A Trends: Moderate but increasing deal volume, primarily focused on strategic acquisitions and expansion.

Switzerland Luxury Residential Real Estate Industry Growth Trends & Insights

The Swiss luxury residential real estate market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by strong domestic demand and significant international investor interest. The market size in 2024 was estimated at xx Million, and is projected to reach xx Million by 2025 and xx Million by 2033. Technological disruptions, such as the increased use of online platforms and virtual tours, have reshaped consumer behaviour. Buyers are increasingly informed and expect a seamless, digitally-driven experience. Market penetration of luxury properties remains relatively low due to limited supply and high pricing, which further drives prices upwards. The shift in consumer preferences toward sustainable and eco-friendly developments creates a considerable opportunity for market players adopting such practices.

Dominant Regions, Countries, or Segments in Switzerland Luxury Residential Real Estate Industry

Zurich and Geneva consistently dominate the Swiss luxury residential market, representing xx% and xx% market share respectively in 2024. Villas and landed houses constitute the largest segment by type (xx% market share), followed by apartments and condominiums (xx%). This is driven by factors such as desirability of established neighborhoods, sophisticated infrastructure, excellent schools, and proximity to international business hubs. Basel and Lausanne also demonstrate strong growth potential. Other cities are expected to experience significant, albeit slower, growth in the forecast period.

- Key Drivers in Zurich & Geneva: High concentration of HNWIs, strong economic activity, established infrastructure, and international appeal.

- Market Share and Growth Potential: Zurich and Geneva retain dominance but other cities such as Basel and Lausanne are experiencing considerable growth.

- Key Drivers in Villas and Landed Houses: Demand for privacy, spaciousness, and larger plots of land.

Switzerland Luxury Residential Real Estate Industry Product Landscape

The Swiss luxury residential market showcases a diverse range of properties, encompassing opulent villas, exclusive apartments in prime locations, and modern, sustainable developments. Technological advancements are impacting the product landscape, with increased focus on smart home technology, energy efficiency, and environmentally friendly materials. Unique selling propositions often include exceptional views, exclusive amenities (e.g., private pools, spas, concierge services), and prime locations in sought-after neighbourhoods.

Key Drivers, Barriers & Challenges in Switzerland Luxury Residential Real Estate Industry

Key Drivers: Strong domestic demand, increasing international investment, limited supply, and the appeal of Switzerland's political and economic stability. Technological advancements are also a strong driver, increasing efficiency and market access.

Key Barriers and Challenges: High construction costs, complex regulatory environment, limited land availability, and intense competition amongst luxury developers. Supply chain disruptions and fluctuating material prices impact development costs. Regulatory hurdles and stringent building codes increase development time and cost.

Emerging Opportunities in Switzerland Luxury Residential Real Estate Industry

Emerging opportunities include the development of sustainable and eco-friendly luxury properties, catering to environmentally conscious buyers. The increasing use of technology in property marketing and management creates opportunities for specialized service providers. A growing segment of younger, digitally-savvy buyers creates opportunities for innovative marketing and sales approaches.

Growth Accelerators in the Switzerland Luxury Residential Real Estate Industry Industry

Strategic partnerships, such as that recently formed by Honeywell Immobilier and WOTR, increase brand image and can contribute to market expansion. Technological breakthroughs will continue to improve efficiency, enhance the buyer experience, and broaden access to the market. Focus on sustainable development practices appeals to growing consumer preference.

Key Players Shaping the Switzerland Luxury Residential Real Estate Market

- UM Real Estate Investment AG

- CMG Immobilien

- Sotheby's International Realty

- Engel & Volkers Zurichsee Region Zimmerberg

- Residence Immobilien

- Honeywell Immobilier

- SJS ImmoArch AG

- Swiss Capital Property

- Luxury Places SA

- La Roche Residential

Notable Milestones in Switzerland Luxury Residential Real Estate Industry Sector

- January 2022: Engel & Volkers Zurichsee Region Zimmerberg expands to over 50 locations in Switzerland, strengthening its market presence.

- March 2023: Honeywell Immobilier partners with WOTR, focusing on sustainable development and enhancing its brand image.

In-Depth Switzerland Luxury Residential Real Estate Industry Market Outlook

The Swiss luxury residential real estate market is poised for continued growth, driven by strong underlying demand, technological advancements, and the increasing focus on sustainability. Strategic partnerships, innovative marketing strategies, and development of eco-friendly properties will shape the market's future trajectory. The forecast period (2025-2033) presents significant opportunities for businesses to capitalize on emerging trends and capitalize on the enduring appeal of Switzerland as a luxury residential destination.

Switzerland Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Bern

- 2.2. Zurich

- 2.3. Geneva

- 2.4. Basel

- 2.5. Lausanne

- 2.6. Other Cities

Switzerland Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Switzerland

Switzerland Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Switzerland Luxury Residential Real Estate Industry

Switzerland Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Bern

- 5.2.2. Zurich

- 5.2.3. Geneva

- 5.2.4. Basel

- 5.2.5. Lausanne

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UM Real Estate Investment AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMG Immobilien

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Reality

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engel & Volkers Zurichsee Region Zimmerberg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Residence Immobilien

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Immobilier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SJS ImmoArch AG**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Capital Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxury places SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Roche Residential

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UM Real Estate Investment AG

List of Figures

- Figure 1: Switzerland Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Switzerland Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 3: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 6: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Luxury Residential Real Estate Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Switzerland Luxury Residential Real Estate Industry?

Key companies in the market include UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Reality, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG**List Not Exhaustive, Swiss Capital Property, Luxury places SA, La Roche Residential.

3. What are the main segments of the Switzerland Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 10 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

March 2023: Honeywell Immobilier recently entered into a partnership with Watershed Organization Trust (WOTR) to focus on soil and water conservation in rural ecosystems. WOTR is involved in restoring rural water bodies, boosting the water table and helping farmers and women with livelihood opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Switzerland Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence