Key Insights

The Israel commercial real estate market is projected for significant expansion, with an estimated market size of $25 billion in 2025, anticipating a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. Growth drivers include a thriving technology sector and increased foreign investment, boosting demand for office spaces in key cities like Tel Aviv and Jerusalem. The e-commerce boom is fueling demand for modern logistics and warehouse facilities, while the tourism sector supports growth in hospitality and retail real estate. Government infrastructure development and urban renewal initiatives further bolster this positive outlook. Potential challenges encompass interest rate volatility, global economic uncertainties, and skilled labor availability affecting construction timelines. The market is segmented by property type (office, retail, industrial, residential) and end-user (businesses, government, individuals). Leading companies such as Azrieli Group Ltd, Gazit-Globe Ltd, and Melisron Ltd are prominent market players. Regional expansion opportunities exist within the Middle East and Africa, though accompanied by inherent challenges.

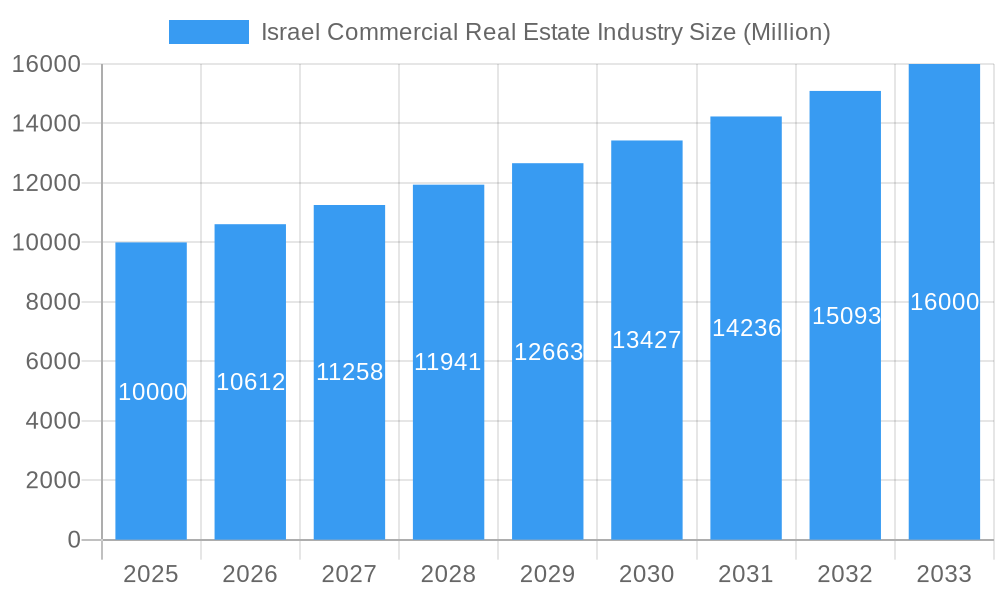

Israel Commercial Real Estate Industry Market Size (In Billion)

The forecast period (2025-2033) presents considerable investment potential in specialized market niches. Continued expansion of the technology sector and a growing emphasis on sustainable building practices offer particularly attractive investment prospects. Prudent assessment of macroeconomic conditions and potential regulatory shifts is essential for risk mitigation and return optimization. Strategic decision-making will benefit from an analysis of regional demand variations, particularly within the Middle East and Africa. Navigating the competitive landscape requires a thorough understanding of dominant players' strategies and adaptability to evolving market dynamics. Future growth will likely be shaped by technological advancements in building design and management, the increasing adoption of smart building technologies, and the growing significance of ESG (Environmental, Social, and Governance) considerations in investment decisions.

Israel Commercial Real Estate Industry Company Market Share

Israel Commercial Real Estate Market Analysis: 2019-2033

This comprehensive report delivers an in-depth analysis of the Israel commercial real estate market from 2019 to 2033. It offers critical insights into market dynamics, growth trajectories, key stakeholders, and future opportunities, serving as an indispensable resource for investors, developers, and industry professionals. The report utilizes extensive data to provide a clear overview of this dynamic sector, focusing on Office, Retail, Industrial, and Residential segments catering to Businesses, Government, and Individuals.

Israel Commercial Real Estate Industry Market Dynamics & Structure

The Israeli commercial real estate market exhibits moderate concentration, with several major players dominating specific segments. Technological innovation, driven by smart building technologies and PropTech solutions, is gradually transforming the sector. However, high construction costs and stringent regulatory frameworks pose significant barriers to entry and innovation. The market is susceptible to global economic fluctuations and geopolitical events. M&A activity has been relatively consistent, with an estimated xx Million deals in the historical period (2019-2024).

- Market Concentration: High in certain segments (e.g., Office in Tel Aviv), moderate overall.

- Technological Innovation: Smart building technologies, PropTech adoption is increasing but faces challenges.

- Regulatory Framework: Stringent regulations impact development timelines and costs.

- Competitive Substitutes: Limited direct substitutes, but alternative investment options exist.

- End-User Demographics: Growing urban population fuels demand, particularly in major cities.

- M&A Trends: Steady activity, driven by consolidation and expansion strategies. Estimated xx Million in deal value from 2019-2024.

Israel Commercial Real Estate Industry Growth Trends & Insights

The Israeli commercial real estate market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx Million in 2024. Driven by a robust economy, increased foreign investment, and a growing tech sector, the market is projected to maintain healthy growth throughout the forecast period (2025-2033), reaching xx Million by 2033 and maintaining a CAGR of xx%. Technological disruptions, such as the rise of remote work, are impacting demand dynamics for certain product types, while consumer behavior shifts reflect a growing preference for sustainable and technologically advanced spaces. Adoption rates for smart building technologies are steadily increasing, albeit from a low base.

Dominant Regions, Countries, or Segments in Israel Commercial Real Estate Industry

Tel Aviv remains the dominant region, driven by strong economic activity, high concentration of tech companies, and limited land availability, resulting in high property values. The Office segment within Tel Aviv holds the largest market share, fueled by the growing tech sector. The Industrial segment is also experiencing significant growth, particularly in areas surrounding major cities, benefiting from government investment in infrastructure and logistics.

- Tel Aviv: High demand, limited supply, resulting in premium pricing.

- Office Segment (Tel Aviv): Strongest growth, fueled by the tech sector and limited supply.

- Industrial Segment: Growth driven by e-commerce expansion and logistics improvements.

- Government Initiatives: Infrastructure investments and supportive policies stimulate development.

Israel Commercial Real Estate Industry Product Landscape

The Israeli commercial real estate market is witnessing increased product innovation, with a focus on sustainable and smart building technologies. Green building certifications are gaining traction, and technological advancements such as IoT sensors and automated systems are improving building efficiency and tenant experience. Unique selling propositions increasingly emphasize sustainability, technology integration, and prime locations.

Key Drivers, Barriers & Challenges in Israel Commercial Real Estate Industry

Key Drivers: Strong economic growth, burgeoning tech sector, government investments in infrastructure, and increasing foreign direct investment are propelling market expansion.

Key Challenges: High construction costs, land scarcity, stringent regulations, and the potential impact of geopolitical instability pose significant hurdles to market growth. Supply chain disruptions can cause delays and cost overruns, and intense competition can suppress profit margins.

Emerging Opportunities in Israel Commercial Real Estate Industry

The expansion of the tech sector, the increasing demand for flexible workspace solutions, and the growing interest in sustainable building practices present significant opportunities. Untapped potential lies in developing smart city infrastructure and integrating renewable energy solutions into commercial buildings.

Growth Accelerators in the Israel Commercial Real Estate Industry Industry

Technological advancements in building management systems and the adoption of sustainable construction practices are key growth catalysts. Strategic partnerships between developers and technology providers will further accelerate market expansion.

Key Players Shaping the Israel Commercial Real Estate Industry Market

- Azrieli Group Ltd

- Gazit-Globe Ltd

- Melisron Ltd

- Arko Holdings Ltd

- Ashtrom Group Ltd

- Elbit Imaging Ltd

Notable Milestones in Israel Commercial Real Estate Industry Sector

- 2021: Completion of the xx Tower in Tel Aviv, marking a significant addition to the city's skyline.

- 2022: Launch of a major government initiative to support sustainable building practices.

- 2023: Significant M&A activity among smaller developers.

In-Depth Israel Commercial Real Estate Industry Market Outlook

The Israeli commercial real estate market is poised for continued growth, driven by sustained economic strength and technological advancements. Strategic investments in sustainable development and innovative technologies will be crucial for maximizing future market potential. The focus on smart cities and technological integration will shape the future landscape.

Israel Commercial Real Estate Industry Segmentation

- 1. Offices

- 2. Industrial

- 3. Retail

- 4. Hotels

- 5. Other Property Types

Israel Commercial Real Estate Industry Segmentation By Geography

- 1. Israel

Israel Commercial Real Estate Industry Regional Market Share

Geographic Coverage of Israel Commercial Real Estate Industry

Israel Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. Shortage of Building Land and Labor Availability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 5.2. Market Analysis, Insights and Forecast - by Industrial

- 5.3. Market Analysis, Insights and Forecast - by Retail

- 5.4. Market Analysis, Insights and Forecast - by Hotels

- 5.5. Market Analysis, Insights and Forecast - by Other Property Types

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Offices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 8 COMPANY PROFILES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Azrieli Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gazit-Globe Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melisron Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arko Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ashtrom Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elbit Imaging Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 8 COMPANY PROFILES

List of Figures

- Figure 1: Israel Commercial Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Israel Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Israel Commercial Real Estate Industry Revenue billion Forecast, by Offices 2020 & 2033

- Table 2: Israel Commercial Real Estate Industry Revenue billion Forecast, by Industrial 2020 & 2033

- Table 3: Israel Commercial Real Estate Industry Revenue billion Forecast, by Retail 2020 & 2033

- Table 4: Israel Commercial Real Estate Industry Revenue billion Forecast, by Hotels 2020 & 2033

- Table 5: Israel Commercial Real Estate Industry Revenue billion Forecast, by Other Property Types 2020 & 2033

- Table 6: Israel Commercial Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Israel Commercial Real Estate Industry Revenue billion Forecast, by Offices 2020 & 2033

- Table 8: Israel Commercial Real Estate Industry Revenue billion Forecast, by Industrial 2020 & 2033

- Table 9: Israel Commercial Real Estate Industry Revenue billion Forecast, by Retail 2020 & 2033

- Table 10: Israel Commercial Real Estate Industry Revenue billion Forecast, by Hotels 2020 & 2033

- Table 11: Israel Commercial Real Estate Industry Revenue billion Forecast, by Other Property Types 2020 & 2033

- Table 12: Israel Commercial Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Commercial Real Estate Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Israel Commercial Real Estate Industry?

Key companies in the market include 8 COMPANY PROFILES, Azrieli Group Ltd, Gazit-Globe Ltd, Melisron Ltd, Arko Holdings Ltd, Ashtrom Group Ltd, Elbit Imaging Lt.

3. What are the main segments of the Israel Commercial Real Estate Industry?

The market segments include Offices, Industrial, Retail, Hotels, Other Property Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

Shortage of Building Land and Labor Availability.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Israel Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence