Key Insights

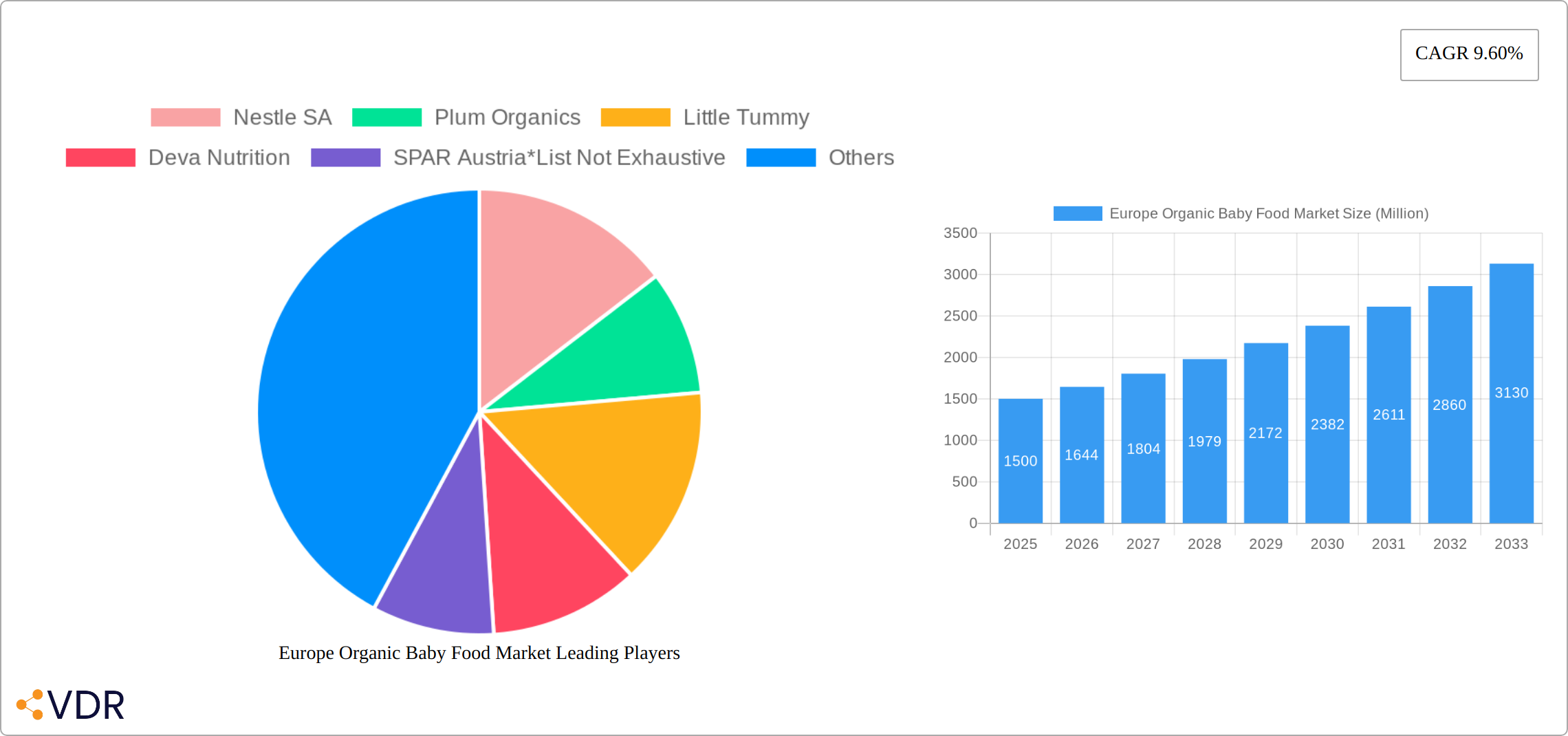

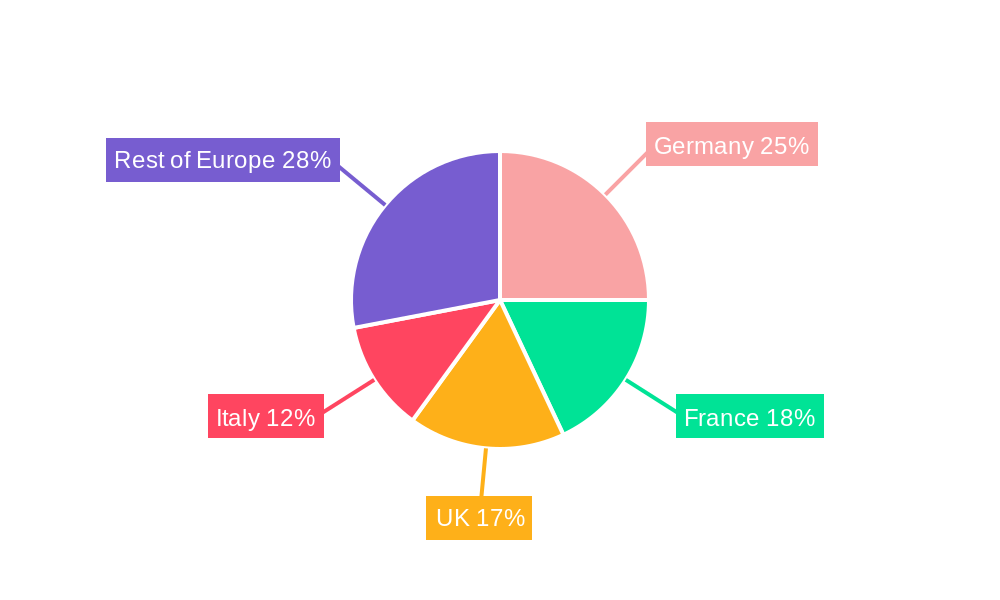

The European organic baby food market, valued at approximately €X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.60% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer awareness regarding the health benefits of organic food for infants, coupled with rising disposable incomes and a growing preference for premium, naturally-sourced products, are significantly boosting market demand. The shift towards healthier lifestyles and a preference for products free from artificial additives, pesticides, and genetically modified organisms (GMOs) further strengthens market growth. The diverse range of product types, including milk formula, prepared baby food, and dried baby food, caters to varied consumer needs and preferences, while various distribution channels – supermarkets, online retailers, and specialty stores – provide ample access to these products. The presence of established multinational players like Nestlé and Danone, alongside smaller, niche organic brands, fosters competition and innovation within the market. However, factors like price sensitivity among certain consumer segments and potential supply chain challenges related to organic ingredient sourcing could present some restraints on overall market expansion. Germany, France, the UK, and Italy are expected to dominate the European market due to their higher purchasing power and established organic food culture.

Market segmentation plays a crucial role in understanding growth trajectories. The milk formula segment is likely the largest, driven by the high demand for convenient and nutritious infant feeding options. Online retail channels are expected to show significant growth, mirroring wider e-commerce trends and offering consumers a wider variety and more convenient shopping experience. Competitive intensity is likely to increase as more brands enter the organic segment, leading to greater innovation in product offerings and marketing strategies. Future market growth will depend on maintaining consumer trust in organic certifications, addressing supply chain challenges, and responding to evolving consumer preferences for sustainability and ethical sourcing. Continued innovation in product formulations and packaging, alongside targeted marketing campaigns emphasizing the health and nutritional advantages of organic baby food, will be vital for sustained market expansion.

Europe Organic Baby Food Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe organic baby food market, encompassing market dynamics, growth trends, regional performance, competitive landscape, and future outlook. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand this dynamic market segment. This report analyzes both the parent market (baby food) and the child market (organic baby food), delivering a granular view of the current landscape and future potential. The total market value in Million Units is projected at xx Million in 2025.

Europe Organic Baby Food Market Dynamics & Structure

The European organic baby food market exhibits a moderately concentrated structure, with key players like Nestlé SA, Danone SA, and HiPP UK Ltd holding significant market share. However, smaller, specialized brands are also gaining traction, driven by increasing consumer demand for organic and ethically sourced products. Technological innovation, particularly in areas like sustainable packaging and improved preservation techniques, is a key driver. Stringent EU regulations regarding organic certification and food safety contribute to market growth, while consumer preference for natural and healthy ingredients further fuels demand. The market also faces competitive pressures from conventional baby food brands, and innovation barriers associated with cost-effective organic sourcing. Mergers and acquisitions are becoming more frequent, as larger players seek to expand their organic portfolios and gain access to new technologies.

- Market Concentration: Moderately concentrated, with leading players holding xx% market share (2025 estimate).

- Technological Drivers: Sustainable packaging, advanced preservation methods.

- Regulatory Framework: Stringent EU organic standards & food safety regulations.

- Competitive Substitutes: Conventional baby food products.

- End-User Demographics: Growing millennial and Gen Z parents with higher disposable income and health consciousness.

- M&A Activity: Increasing deal volumes, driven by portfolio expansion and technological access. (xx deals in the last 5 years)

Europe Organic Baby Food Market Growth Trends & Insights

The European organic baby food market is experiencing robust growth, fueled by a confluence of factors. A rising tide of health-conscious parents, coupled with increasing disposable incomes across many European nations, is significantly driving demand for premium, organic baby food options. The market exhibited a strong Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). This sustained growth is underpinned by the evolving consumer landscape, showcasing a clear preference for healthier and more sustainably sourced food choices. Technological advancements, particularly the rise of e-commerce platforms and enhanced online delivery infrastructure, have expanded market reach and significantly improved consumer convenience. Furthermore, the increasing awareness of the long-term health benefits associated with organic foods for infants plays a pivotal role in market expansion. Market penetration of organic baby food stands at xx% (2025 estimate) and is poised for substantial growth throughout the forecast period. This growth is further amplified by stricter regulations and labeling requirements promoting transparency and consumer trust.

Dominant Regions, Countries, or Segments in Europe Organic Baby Food Market

Germany, France, and the United Kingdom remain the leading markets within the European organic baby food sector. This dominance is attributed to several key factors: high consumer awareness regarding the benefits of organic food, a strong preference for premium-quality products, and robust retail infrastructures that support the distribution of these goods. The Prepared Baby Food segment commands the largest market share, reflecting the convenience and diverse product offerings it provides to parents. Supermarkets and hypermarkets continue to be the dominant distribution channels, leveraging their extensive reach and accessibility. However, online retail channels are experiencing exponential growth, fueled by increasing internet penetration and the undeniable convenience of home delivery, offering a significant challenge to traditional brick-and-mortar stores. Furthermore, the rise of subscription boxes and specialized online retailers catering to organic baby food needs further contributes to this segment's expansion.

- Leading Regions: Germany, France, UK. Drivers include high health consciousness, robust retail infrastructure, strong disposable incomes, and increasing government support for organic agriculture.

- Leading Segments (Product Type): Prepared Baby Food (xx% market share in 2025), followed by Milk Formula and Dried Baby Food. Growth in this segment is driven by innovation in product formats and flavors catering to evolving infant dietary needs.

- Leading Segments (Distribution Channel): Supermarkets/Hypermarkets (xx% market share in 2025), with Online Retail Channels demonstrating the fastest growth due to increased consumer convenience and targeted marketing strategies.

Europe Organic Baby Food Market Product Landscape

The organic baby food market offers a diverse product range, including milk formula, prepared meals, and dried foods. Product innovation focuses on enhancing nutritional value, convenience, and sustainability. Unique selling propositions include organic certification, allergen-free options, and innovative packaging designs. Technological advancements, such as advanced preservation techniques and sustainable packaging materials, are shaping the product landscape.

Key Drivers, Barriers & Challenges in Europe Organic Baby Food Market

Key Drivers:

- Growing health consciousness among parents.

- Rising disposable incomes in key European markets.

- Stringent regulations promoting organic food production.

- Increasing preference for natural and sustainable products.

Challenges & Restraints:

- Higher production costs associated with organic farming.

- Fluctuations in the prices of raw materials.

- Intense competition from conventional baby food brands.

- Potential supply chain disruptions affecting organic ingredient availability. (estimated impact on market growth: xx%)

Emerging Opportunities in Europe Organic Baby Food Market

- Growing demand for specialized organic baby food catering to specific dietary needs (e.g., allergies).

- Expansion into niche markets with unique product offerings (e.g., plant-based options).

- Leveraging e-commerce platforms to expand market reach and enhance customer experience.

- Development of sustainable packaging solutions to address environmental concerns.

Growth Accelerators in the Europe Organic Baby Food Market Industry

Long-term growth will be accelerated by strategic partnerships between organic food producers and retailers, leading to wider product availability and stronger brand recognition. Technological breakthroughs in organic farming and food processing techniques will further improve efficiency and reduce costs. Expansion into new markets and the introduction of innovative products catering to evolving consumer preferences will also significantly contribute to sustained market growth.

Key Players Shaping the Europe Organic Baby Food Market Market

- Nestle SA

- Plum Organics

- Little Tummy

- Deva Nutrition

- SPAR Austria

- Abbott Laboratories

- Danone SA

- Lebenswert

- HiPP UK Ltd

- Hero Group

- Holle baby food AG

Notable Milestones in Europe Organic Baby Food Market Sector

- July 2022: Organix launches 29 new products and two new ranges, expanding their product portfolio and addressing diverse consumer preferences.

- June 2021: SPAR Austria launches a new range of organic baby food, highlighting the increasing interest from major retailers in catering to the growing demand.

- January 2021: Hero Group acquires Baby Gourmet, signifying strategic consolidation within the market and potentially influencing future market dynamics.

- [Add more recent milestones here - Year: Company/Brand - Action taken]

In-Depth Europe Organic Baby Food Market Outlook

The European organic baby food market holds significant future potential, driven by consistently rising consumer demand for premium, healthy, and sustainably produced products. Strategic investments in research and development, coupled with effective marketing campaigns highlighting the benefits of organic baby food, will further solidify market growth. Companies that successfully adapt to evolving consumer preferences and leverage technological advancements will be best positioned for long-term success in this competitive but lucrative market.

Europe Organic Baby Food Market Segmentation

-

1. product Type

- 1.1. Milk Formula

- 1.2. Prepared Baby Food

- 1.3. Dried Baby Food

-

2. Distibution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Channels

- 2.5. Other Distribution Channels

Europe Organic Baby Food Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Organic Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference For Breastfeeding Alternatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by product Type

- 5.1.1. Milk Formula

- 5.1.2. Prepared Baby Food

- 5.1.3. Dried Baby Food

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Channels

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product Type

- 6. Germany Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Plum Organics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Little Tummy

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Deva Nutrition

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SPAR Austria*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Abbott Laboratories

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Lebenswert

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 HiPP UK Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hero Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Holle baby food AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Organic Baby Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Organic Baby Food Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Organic Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Organic Baby Food Market Revenue Million Forecast, by product Type 2019 & 2032

- Table 3: Europe Organic Baby Food Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 4: Europe Organic Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Organic Baby Food Market Revenue Million Forecast, by product Type 2019 & 2032

- Table 14: Europe Organic Baby Food Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 15: Europe Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Organic Baby Food Market?

The projected CAGR is approximately 9.60%.

2. Which companies are prominent players in the Europe Organic Baby Food Market?

Key companies in the market include Nestle SA, Plum Organics, Little Tummy, Deva Nutrition, SPAR Austria*List Not Exhaustive, Abbott Laboratories, Danone SA, Lebenswert, HiPP UK Ltd, Hero Group, Holle baby food AG.

3. What are the main segments of the Europe Organic Baby Food Market?

The market segments include product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Preference For Breastfeeding Alternatives.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In July 2022, The United Kingdom-based organic baby and toddler food brand, Organix unveiled 29 new products and two new ranges namely Baby Meals and Organix Kids and announced that these will be introduced initially in Asda and the Organix Online Shop. It also announced that it will bring further additions to its current finger food and snack ranges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Organic Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Organic Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Organic Baby Food Market?

To stay informed about further developments, trends, and reports in the Europe Organic Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence