Key Insights

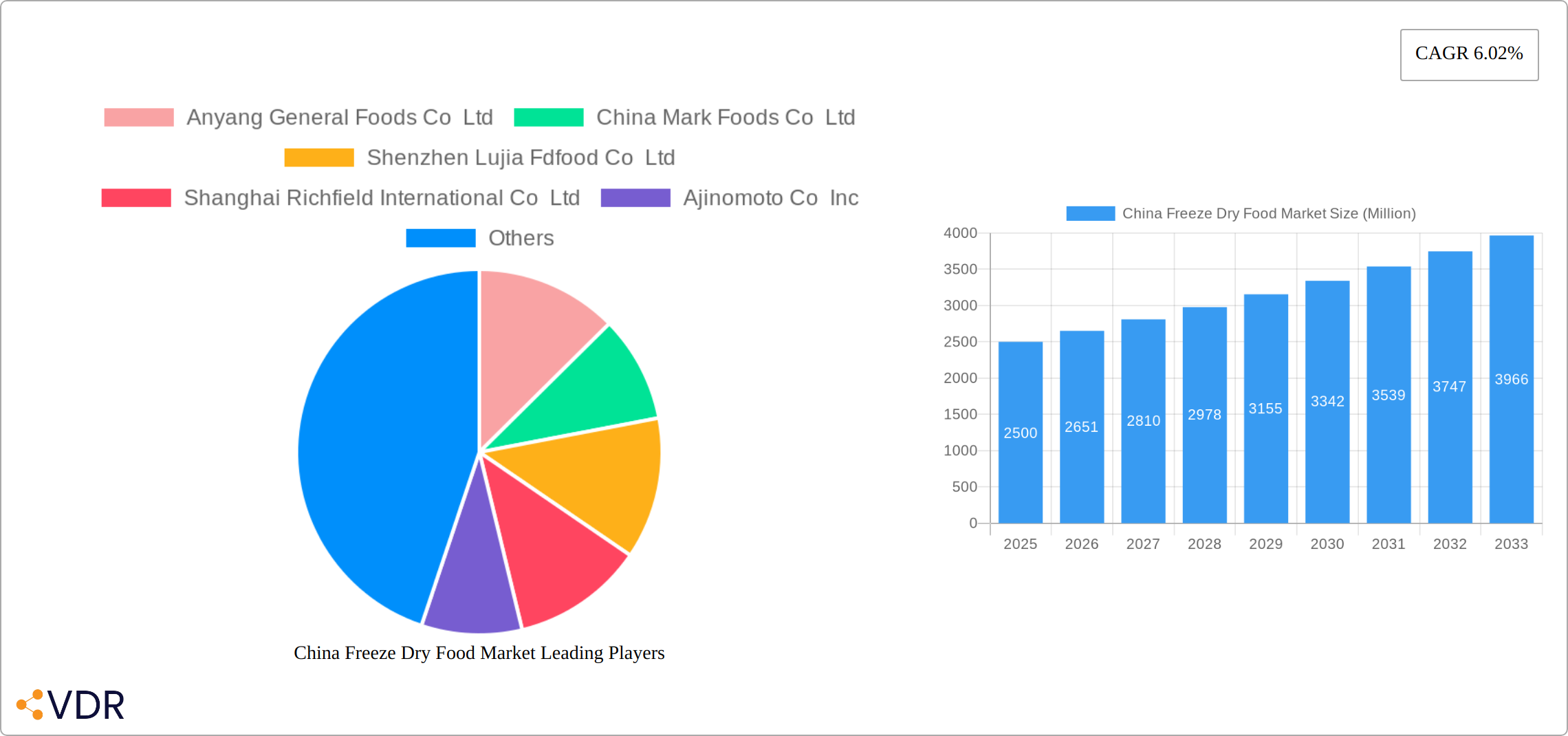

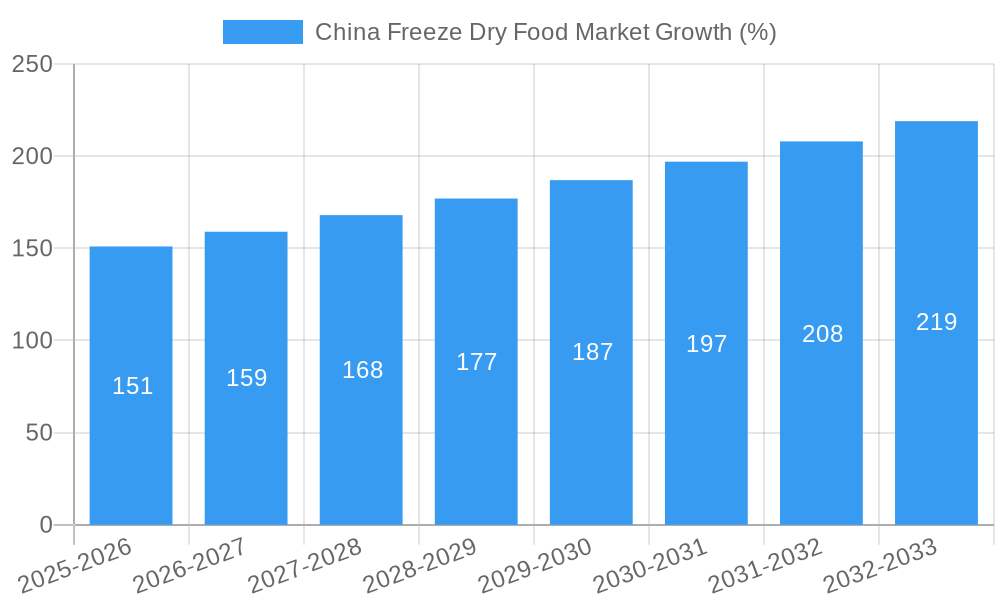

The China freeze-dried food market presents a compelling investment opportunity, exhibiting robust growth projected to continue over the next decade. With a Compound Annual Growth Rate (CAGR) of 6.02% from 2019 to 2024, the market's value likely exceeded several billion USD by 2024, considering the significant market size and the presence of major players like Ajinomoto and Fonterra. This expansion is fueled by several key drivers. Increasing consumer demand for convenient, healthy, and long-shelf-life food products is a primary factor. The rising popularity of ready-to-eat meals, particularly among younger demographics and busy professionals, is significantly boosting market growth. Furthermore, advancements in freeze-drying technology, leading to improved product quality and reduced production costs, contribute to the market's expansion. The growing food processing industry in China, with its increasing adoption of advanced preservation techniques, also plays a crucial role. The diverse product segments, including freeze-dried fruits, vegetables, meats, and dairy, cater to a wide range of consumer preferences and dietary needs, further fueling market expansion. The significant presence of established companies such as Anyang General Foods, China Mark Foods, and Ajinomoto underscores the market’s maturity and potential for further growth.

However, challenges remain. While the market demonstrates significant potential, fluctuating raw material prices and potential supply chain disruptions could impact profitability. Furthermore, the competitive landscape is intensifying, requiring companies to innovate and differentiate their product offerings to maintain a competitive edge. Regulatory changes related to food safety and labeling could also pose challenges. Despite these restraints, the overall growth trajectory remains positive, driven by the sustained demand for convenient and high-quality food options in a rapidly developing market. The focus on health and wellness, coupled with the continuous evolution of freeze-drying technology, suggests a promising future for the China freeze-dried food market. The market segmentation, with strong representation across various product types and end-users (foodservice, processed food manufacturers, retail, and institutions), indicates a diverse and robust market structure poised for continued growth.

China Freeze Dry Food Market: A Comprehensive Market Report (2019-2033)

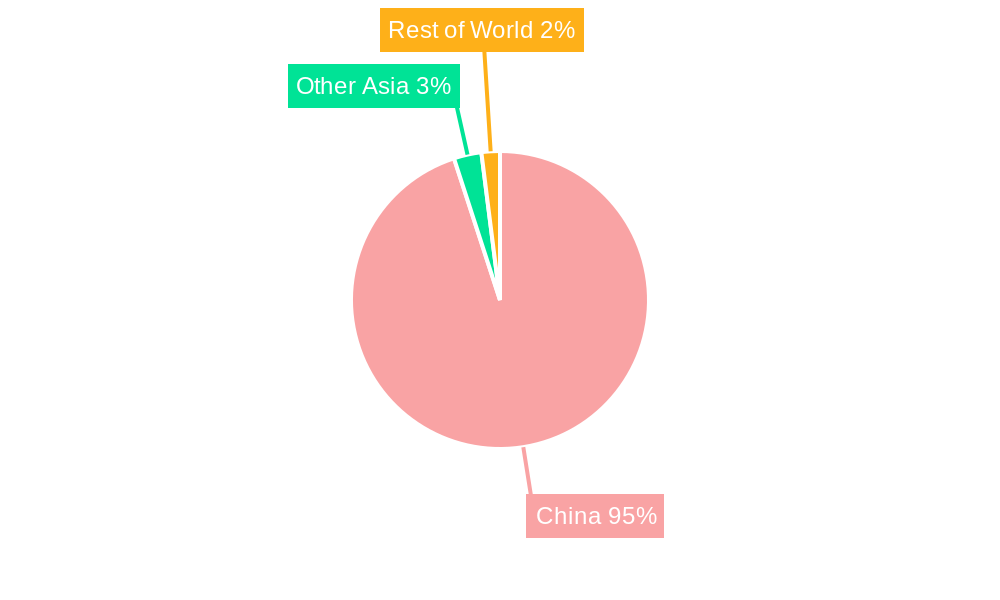

This comprehensive report provides a detailed analysis of the burgeoning China freeze-dried food market, offering invaluable insights for industry professionals, investors, and stakeholders. With a focus on market dynamics, growth trends, and key players, this report equips readers with the knowledge needed to navigate this rapidly evolving landscape. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is segmented by product type (freeze-dried fruits, vegetables & herbs, tea & coffee, dairy products, meat & seafood, other) and end-user (foodservice, processed food manufacturers, retail, institutions). The market size is presented in million units.

China Freeze Dry Food Market Market Dynamics & Structure

The China freeze-dried food market exhibits a moderately concentrated structure, featuring a blend of established large-scale manufacturers and a dynamic landscape of agile regional and niche players. This dynamic is further shaped by a relentless pursuit of technological innovation, with a significant focus on enhancing the efficiency and sustainability of freeze-drying processes, improving long-term preservation capabilities, and developing advanced, eco-friendly packaging solutions. Navigating the market also necessitates adherence to a robust regulatory framework, emphasizing stringent food safety standards and transparent labeling requirements, which are paramount for consumer trust and market access. The market faces ongoing competition from well-established, more budget-friendly alternatives like canned and frozen foods, particularly in price-sensitive segments. However, a powerful growth impetus comes from the increasing demand from health-conscious consumers, who are actively seeking nutrient-dense, convenient, and minimally processed food options. Mergers and acquisitions (M&A) activity is observed to be moderate, driven by strategic objectives aimed at consolidating market share, diversifying product portfolios, and leveraging synergistic advantages.

- Market Concentration: Moderately concentrated, with top 5 players estimated to hold approximately 45-55% of the market share in 2024.

- Technological Innovation: Key developments include the adoption of energy-efficient freeze-drying technologies, advancements in cryogenic preservation for enhanced nutrient retention, and the integration of sustainable and recyclable packaging materials.

- Regulatory Framework: Characterized by increasingly strict national and provincial food safety regulations and comprehensive labeling requirements, including detailed ingredient lists and nutritional information.

- Competitive Substitutes: Canned and frozen foods continue to offer significant competition, especially in segments where affordability and long shelf life are primary consumer considerations.

- End-User Demographics: The burgeoning middle class and rising disposable incomes are powerful drivers, fueling demand for premium, convenient, and health-oriented food choices.

- M&A Trends: Moderate M&A activity, with strategic acquisitions focused on gaining market access, expanding product offerings (e.g., into fruits, vegetables, dairy, and ready-to-eat meals), and achieving vertical integration. Approximately 10-15 significant M&A deals were observed between 2019 and 2024.

China Freeze Dry Food Market Growth Trends & Insights

The China freeze-dried food market exhibits robust growth, driven by several factors. Increased consumer preference for convenient, healthy, and long-shelf-life food products fuels market expansion. Technological advancements in freeze-drying techniques enhance product quality and efficiency, contributing to market growth. Changing lifestyles and rising urbanization further contribute to the market's expansion, with a significant increase in demand from food service and processed food manufacturers. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. Market penetration is currently at xx% and is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in China Freeze Dry Food Market

The coastal regions of China, particularly Guangdong, Jiangsu, and Zhejiang provinces, represent the dominant segments due to high population density, robust infrastructure, and advanced processing facilities. The freeze-dried fruit segment leads in terms of market share, followed by freeze-dried vegetables and herbs, driven by rising health consciousness and demand for convenient snacks. Food service and processed food manufacturers constitute the largest end-user segment.

- Key Drivers:

- Economic Growth: Rising disposable incomes and a growing middle class fuel demand.

- Infrastructure Development: Advanced logistics and cold chain infrastructure support the market.

- Government Policies: Support for food processing and agricultural modernization aids growth.

- Dominant Segments:

- Product Type: Freeze-dried fruits (xx% market share in 2024), followed by Freeze-dried Vegetables and Herbs (xx%).

- End-User: Food service (xx% market share in 2024), followed by Processed Food Manufacturers (xx%).

China Freeze Dry Food Market Product Landscape

Innovation in freeze-dried food products is focused on enhancing taste, texture, and nutritional value. Advancements in freeze-drying technology result in products with improved color, flavor, and aroma retention. New product applications are constantly emerging, with freeze-dried ingredients increasingly used in ready-to-eat meals, snacks, and functional foods. The emphasis is on providing convenient, nutritious, and appealing products that cater to diverse consumer needs and preferences. Unique selling propositions often revolve around high nutritional value and extended shelf life.

Key Drivers, Barriers & Challenges in China Freeze Dry Food Market

Key Drivers: The market's growth is propelled by several converging factors. A primary driver is the escalating consumer demand for convenient and healthy food options, aligning with modern lifestyles and a growing awareness of nutritional benefits. Coupled with this is the increase in disposable incomes across urban and rural areas, allowing consumers to opt for premium food products. Significant advancements in freeze-drying techniques, leading to improved product quality and cost-effectiveness, are also crucial. Furthermore, supportive government initiatives aimed at modernizing the agricultural sector and enhancing the food processing industry provide a conducive environment for market expansion.

Key Challenges: Despite the positive outlook, the market faces several hurdles. The high initial investment costs associated with acquiring and maintaining state-of-the-art freeze-drying equipment can present a substantial barrier to entry for small and medium-sized enterprises (SMEs). Robust competition from established substitutes such as canned and frozen foods, which often have lower price points, remains a persistent challenge. Ensuring consistent product quality and preventing degradation throughout the supply chain, from production to storage and transportation, requires meticulous attention and specialized infrastructure. Maintaining a resilient and efficient supply chain can also be a challenge, particularly in the face of unpredictable events like adverse weather conditions, logistical disruptions, or global supply chain volatility.

Emerging Opportunities in China Freeze Dry Food Market

Untapped markets in rural areas and the expansion into niche segments, such as organic and specialty freeze-dried foods, present significant growth opportunities. Innovation in product formats, such as ready-to-eat meals and functional foods containing freeze-dried ingredients, holds considerable potential. Evolving consumer preferences towards healthier and more convenient food solutions create promising opportunities for businesses to meet unmet market needs.

Growth Accelerators in the China Freeze Dry Food Market Industry

Technological breakthroughs in freeze-drying, leading to improved efficiency and reduced costs, are significant growth catalysts. Strategic partnerships between food manufacturers, ingredient suppliers, and technology providers will enhance innovation and market penetration. Expansion into new markets, both domestically and internationally, presents significant opportunities for growth.

Key Players Shaping the China Freeze Dry Food Market Market

- Anyang General Foods Co Ltd

- China Mark Foods Co Ltd

- Shenzhen Lujia Fdfood Co Ltd

- Shanghai Richfield International Co Ltd

- Ajinomoto Co Inc (with its Chinese operations)

- Zhengzhou Donsen Foods Co Ltd

- Fonterra Co-operative Group Limited (focusing on dairy ingredients)

- Tianjin Sai Yu Food Co Ltd

- Lixing Group (Fujian Lixing Foods Co Ltd)

- Kerry Group PLC (with significant presence in Chinese food industry)

- Chaucer Foods Ltd (supplying various freeze-dried ingredients)

Notable Milestones in China Freeze Dry Food Market Sector

- May 2022: Fonterra strategically launched a comprehensive online platform for its dairy ingredients across Asia, with a notable inclusion of its range of freeze-dried dairy products for the Chinese market.

- December 2021: Fujian Lixing Foods Co Ltd significantly bolstered its production capabilities by completing the expansion of its Phase IV Freeze-Dried Production Workshop, marking a substantial increase in its output capacity.

- April 2021: Kerry Group strategically expanded its footprint within the Chinese food sector by acquiring Jining Natural Group, enhancing its market reach and product diversification.

In-Depth China Freeze Dry Food Market Market Outlook

The China freeze-dried food market is on a trajectory for sustained and robust growth, underpinned by a confluence of powerful trends. Continuous technological advancements are not only improving the quality and variety of freeze-dried products but also making them more accessible. The ever-increasing consumer demand for healthier, convenient, and high-quality food options is a significant market catalyst. Furthermore, supportive government policies that encourage innovation, food safety, and agricultural modernization are creating a favorable ecosystem for expansion. Strategic investments in research and development, alongside a concerted effort to expand into new product categories (such as gourmet ingredients, specialized pet food, and functional foods) and explore untapped geographic markets within China, are expected to further accelerate market growth. The long-term outlook for the China freeze-dried food market is overwhelmingly positive, presenting substantial and attractive opportunities for both established industry leaders seeking to consolidate their positions and for innovative new entrants aiming to capture emerging market segments.

China Freeze Dry Food Market Segmentation

-

1. Product Type

- 1.1. Freeze-dried Fruits

- 1.2. Freeze-dried Vegetables and Herbs

- 1.3. Freeze-dried Tea and Coffee

- 1.4. Freeze-dried Dairy Products

- 1.5. Freeze-dried Meat and Seafood

- 1.6. Other Freeze-dried Food

-

2. End Users

- 2.1. Foodservice

- 2.2. Processed Food Manufacturers

- 2.3. Retail

- 2.4. Institutions

China Freeze Dry Food Market Segmentation By Geography

- 1. China

China Freeze Dry Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Foods

- 3.3. Market Restrains

- 3.3.1. High Production Costs

- 3.4. Market Trends

- 3.4.1. Rise of online shopping has made freeze-dried foods more accessible to consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Freeze Dry Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Freeze-dried Fruits

- 5.1.2. Freeze-dried Vegetables and Herbs

- 5.1.3. Freeze-dried Tea and Coffee

- 5.1.4. Freeze-dried Dairy Products

- 5.1.5. Freeze-dried Meat and Seafood

- 5.1.6. Other Freeze-dried Food

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Foodservice

- 5.2.2. Processed Food Manufacturers

- 5.2.3. Retail

- 5.2.4. Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Anyang General Foods Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Mark Foods Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shenzhen Lujia Fdfood Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shanghai Richfield International Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Co Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zhengzhou Donsen Foods Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fonterra Co-operative Group Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tianjin Sai Yu Food Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lixing Group (Fujian Lixing Foods Co Ltd)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Chaucer Foods Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Anyang General Foods Co Ltd

List of Figures

- Figure 1: China Freeze Dry Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Freeze Dry Food Market Share (%) by Company 2024

List of Tables

- Table 1: China Freeze Dry Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Freeze Dry Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: China Freeze Dry Food Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 4: China Freeze Dry Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Freeze Dry Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Freeze Dry Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: China Freeze Dry Food Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 8: China Freeze Dry Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Freeze Dry Food Market?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the China Freeze Dry Food Market?

Key companies in the market include Anyang General Foods Co Ltd, China Mark Foods Co Ltd, Shenzhen Lujia Fdfood Co Ltd, Shanghai Richfield International Co Ltd, Ajinomoto Co Inc, Zhengzhou Donsen Foods Co Ltd, Fonterra Co-operative Group Limited, Tianjin Sai Yu Food Co Ltd, Lixing Group (Fujian Lixing Foods Co Ltd), Kerry Group PLC, Chaucer Foods Ltd.

3. What are the main segments of the China Freeze Dry Food Market?

The market segments include Product Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Foods.

6. What are the notable trends driving market growth?

Rise of online shopping has made freeze-dried foods more accessible to consumers.

7. Are there any restraints impacting market growth?

High Production Costs.

8. Can you provide examples of recent developments in the market?

In May 2022: Fonterra announced the launch of an online platform for dairy ingredients across Asia and a few other regions for the convenience of their ingredients customers to purchase the products, from milk powder to specialty dairy proteins including its freeze dried-products such as SureStart BifidoB HN019.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Freeze Dry Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Freeze Dry Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Freeze Dry Food Market?

To stay informed about further developments, trends, and reports in the China Freeze Dry Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence