Key Insights

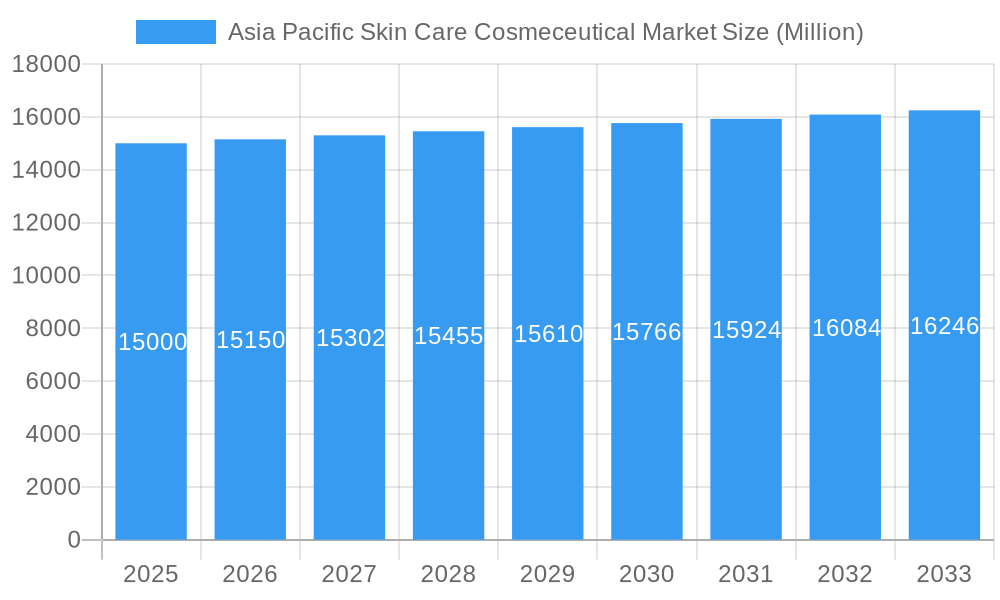

The Asia Pacific skincare cosmeceutical market is projected to experience robust expansion, driven by escalating disposable incomes in key economies such as China, India, and South Korea. Growing consumer awareness regarding skincare benefits, coupled with a demand for premium, high-efficacy products, is significantly boosting market traction. The skincare segment demonstrably leads within the cosmeceutical category, outperforming hair, lip, and oral care. E-commerce channels are witnessing accelerated growth, propelled by increasing internet penetration and widespread online shopping adoption across the region. Anticipated CAGR: 4.1%. Market Size: 12576.8 million. Base Year: 2024.

Asia Pacific Skin Care Cosmeceutical Market Market Size (In Billion)

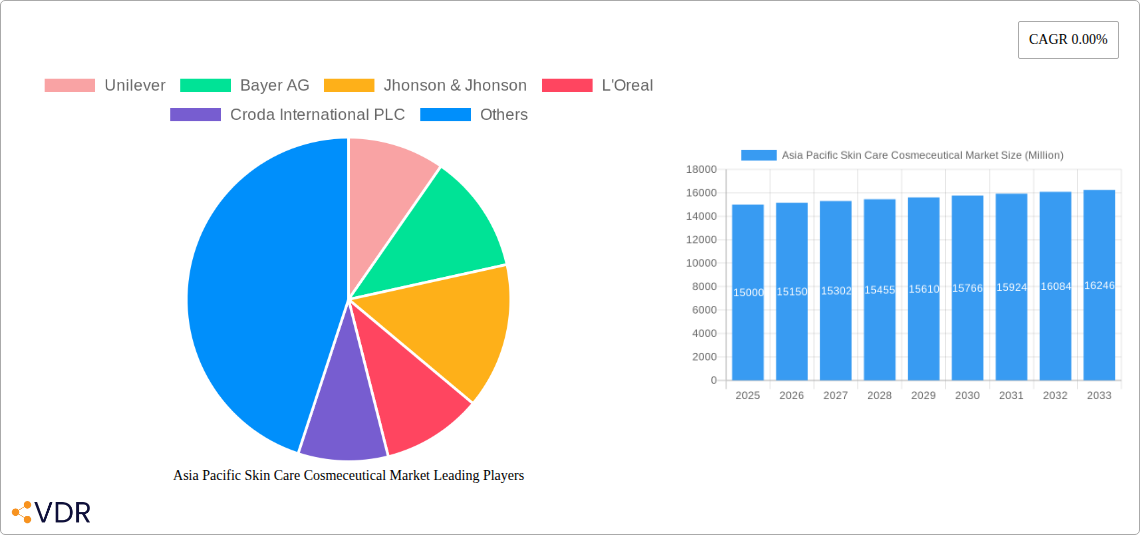

Despite potential regulatory hurdles and varying consumer comprehension of cosmeceutical benefits, strategic market players like Unilever, L'Oreal, and Johnson & Johnson are poised to leverage market opportunities. Product innovation, strategic alliances, and targeted expansion in emerging Asia Pacific markets will be critical. Growth will be particularly prominent in economies with expanding middle classes and advanced e-commerce infrastructures. Navigating regulatory frameworks, bridging consumer education gaps, and building trust in cosmeceutical efficacy through strong branding and transparent communication are imperative for successful market penetration. A focus on unique solutions, natural and sustainable ingredients, and personalized consumer experiences will be key to maintaining a competitive edge in this dynamic sector.

Asia Pacific Skin Care Cosmeceutical Market Company Market Share

Asia Pacific Skin Care Cosmeceutical Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific skin care cosmeceutical market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The report meticulously examines market dynamics, growth trends, dominant segments, and key players, equipping readers with the knowledge needed to navigate this dynamic and rapidly evolving market. The market is segmented by distribution channels (Hypermarkets and Supermarkets, Convenience Stores, Online, Specialty Stores, Others) and product type (Skin Care, Hair Care, Lip Care, Oral Care, Others). Key players analyzed include Unilever, Bayer AG, Johnson & Johnson, L'Oréal, Croda International PLC, Procter & Gamble, Clarins Group, Revlon Inc, and Henkel AG & Company KGaA, with the list not being exhaustive. The total market value is predicted to reach xx Million units by 2033.

Asia Pacific Skin Care Cosmeceutical Market Dynamics & Structure

The Asia Pacific skin care cosmeceutical market is characterized by a moderately concentrated structure with several multinational corporations and regional players vying for market share. Technological innovation, driven by advancements in active ingredients, delivery systems, and formulation technologies, is a key driver of growth. Stringent regulatory frameworks, particularly concerning ingredient safety and labeling, impact market dynamics. The market also faces competition from conventional skincare products and herbal remedies. The increasing disposable incomes and a rising awareness of skincare among the young population fuel market demand. M&A activity has been moderate in recent years, with a total of xx deals recorded between 2019 and 2024, signifying strategic consolidation within the industry.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on advanced delivery systems (e.g., liposomes, nanotechnology) and personalized skincare solutions.

- Regulatory Framework: Stringent regulations regarding ingredient safety and efficacy claims, varying across countries.

- Competitive Substitutes: Conventional skincare products, herbal remedies, and home remedies pose competition.

- End-User Demographics: Growth driven by the rising middle class, increasing disposable incomes, and a growing awareness of skincare benefits across all age groups, with a particular focus on millennials and Gen Z.

- M&A Trends: Strategic acquisitions and mergers to enhance product portfolios and expand market reach.

Asia Pacific Skin Care Cosmeceutical Market Growth Trends & Insights

The Asia Pacific skin care cosmeceutical market experienced significant growth between 2019 and 2024, driven by increasing consumer awareness, rising disposable incomes, and the adoption of technologically advanced products. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. This growth is anticipated to continue during the forecast period (2025-2033), with a projected CAGR of xx%, reaching xx Million units by 2033. Key factors contributing to this growth include increased adoption of online channels, the rise of personalized skincare, and the growing preference for natural and organic ingredients. The market penetration of cosmeceuticals is currently at xx%, but is expected to increase substantially due to increasing consumer awareness and product innovation. Technological disruptions, such as AI-powered skincare analysis and personalized formulations, are further accelerating market expansion. Changing consumer preferences towards natural and sustainable products are also influencing market growth and brand choices.

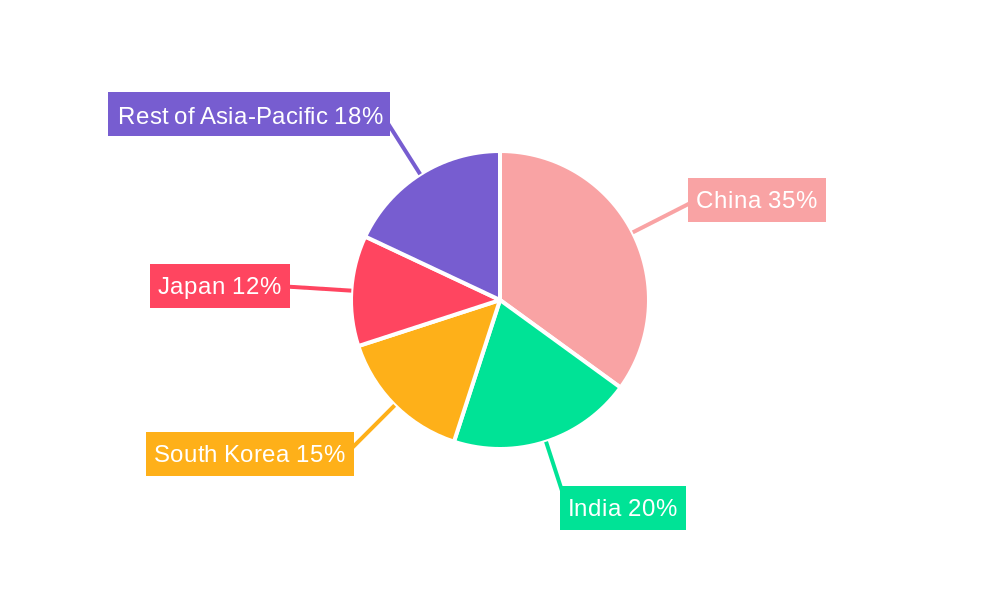

Dominant Regions, Countries, or Segments in Asia Pacific Skin Care Cosmeceutical Market

The leading segment is the Skin Care, within the product type category holding approximately xx% market share in 2024. Within the distribution channels segment, Online sales are experiencing rapid growth, projected to reach xx Million units by 2033, driven by increasing internet penetration and the convenience of e-commerce platforms. China, Japan, South Korea, and Australia are the dominant countries driving the market's growth, together accounting for approximately xx% of the total market value.

Key Drivers:

- China: Rapid economic growth, expanding middle class, and increasing demand for premium skincare products.

- Japan: Well-established skincare market, high consumer spending on beauty and personal care products.

- South Korea: Global leader in cosmetic innovation, known for its advanced skincare technology.

- Australia: High per capita expenditure on personal care products and growing awareness of cosmeceuticals.

- Online Sales: Convenience, wider product selection, and targeted marketing campaigns.

Dominance Factors:

- Strong consumer demand driven by rising disposable incomes and increasing awareness of skincare.

- Advanced technological innovation and product development in key regions like South Korea.

- Well-established distribution networks and strong retail presence in major markets.

Asia Pacific Skin Care Cosmeceutical Market Product Landscape

The Asia Pacific cosmeceutical market showcases innovative products such as serums with advanced delivery systems, customized skincare formulations based on individual skin profiles, and products incorporating natural and organic ingredients. These products highlight unique selling propositions like targeted efficacy, personalized solutions, and sustainable formulations. Technological advancements include the use of bio-engineered ingredients, nanotechnology for enhanced penetration, and smart packaging for improved product preservation and user experience.

Key Drivers, Barriers & Challenges in Asia Pacific Skin Care Cosmeceutical Market

Key Drivers: Rising disposable incomes across many APAC countries, increasing awareness of skincare benefits among consumers, technological advancements leading to more effective products, and growing online retail presence. Government support for the beauty and personal care industry in several APAC nations is another catalyst.

Key Challenges: Strict regulations related to ingredient safety and efficacy claims across different countries, intense competition from established brands and emerging players leading to price pressure, and supply chain disruptions impacting product availability and cost. Counterfeit products also represent a significant challenge, impacting brand reputation and consumer trust.

Emerging Opportunities in Asia Pacific Skin Care Cosmeceutical Market

Untapped markets in Southeast Asia present significant growth opportunities. The increasing demand for personalized skincare solutions and natural/organic products creates a fertile ground for innovation. Expansion into niche segments, such as men's skincare and specialized treatments for specific skin concerns, offers further opportunities. Leveraging digital marketing and e-commerce platforms are key to expanding reach and engaging consumers.

Growth Accelerators in the Asia Pacific Skin Care Cosmeceutical Market Industry

Technological breakthroughs in ingredient development and delivery systems, strategic partnerships between cosmeceutical companies and research institutions, and successful market expansion into emerging markets are major growth catalysts. Investment in digital marketing and personalized customer experiences will also fuel market expansion.

Key Players Shaping the Asia Pacific Skin Care Cosmeceutical Market Market

- Unilever

- Bayer AG

- Johnson & Johnson

- L'Oréal

- Croda International PLC

- Procter & Gamble

- Clarins Group

- Revlon Inc

- Henkel AG & Company KGaA

Notable Milestones in Asia Pacific Skin Care Cosmeceutical Market Sector

- 2020: Launch of several new cosmeceutical products incorporating AI-powered personalization features.

- 2021: Increased investment in research and development by several key players focusing on sustainable and natural ingredients.

- 2022: Several mergers and acquisitions aimed at expanding market reach and product portfolios.

- 2023: Significant growth in online sales driven by the increasing popularity of e-commerce platforms.

In-Depth Asia Pacific Skin Care Cosmeceutical Market Outlook

The Asia Pacific skin care cosmeceutical market is poised for sustained growth, driven by ongoing innovation, expanding consumer base, and increasing preference for premium skincare products. Strategic partnerships, focused investments in research and development, and effective market expansion strategies will be crucial in capitalizing on this growth potential. The market is expected to witness substantial expansion in emerging markets, further accelerating its overall growth trajectory.

Asia Pacific Skin Care Cosmeceutical Market Segmentation

-

1. Product Type

-

1.1. Skin Care

- 1.1.1. Anti-Aging

- 1.1.2. Anti-Acne

- 1.1.3. Sun Protection

- 1.1.4. Moisturizers

- 1.1.5. Others

-

1.2. Hair Care

- 1.2.1. Shampoos and Conditioners

- 1.2.2. Hair Colorants and Dyes

- 1.3. Lip Care

- 1.4. Oral Care

-

1.1. Skin Care

-

2. Distribution Channels

- 2.1. Hypermarkets and Supermarkets

- 2.2. Convenience Stores

- 2.3. Online

- 2.4. Speciality Stores

- 2.5. Others

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. South Korea

- 3.1.6. Vietnam

- 3.1.7. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia Pacific Skin Care Cosmeceutical Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. South Korea

- 1.6. Vietnam

- 1.7. Rest of Asia Pacific

Asia Pacific Skin Care Cosmeceutical Market Regional Market Share

Geographic Coverage of Asia Pacific Skin Care Cosmeceutical Market

Asia Pacific Skin Care Cosmeceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Skin Care Segment Holds a Leading Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Skin Care Cosmeceutical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Skin Care

- 5.1.1.1. Anti-Aging

- 5.1.1.2. Anti-Acne

- 5.1.1.3. Sun Protection

- 5.1.1.4. Moisturizers

- 5.1.1.5. Others

- 5.1.2. Hair Care

- 5.1.2.1. Shampoos and Conditioners

- 5.1.2.2. Hair Colorants and Dyes

- 5.1.3. Lip Care

- 5.1.4. Oral Care

- 5.1.1. Skin Care

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.2.1. Hypermarkets and Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online

- 5.2.4. Speciality Stores

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. South Korea

- 5.3.1.6. Vietnam

- 5.3.1.7. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Unilever

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jhonson & Jhonson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 L'Oreal

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Croda International PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Procter and Gamble

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Clarins Group*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Revlon Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henkel AG & Company KGaA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Unilever

List of Figures

- Figure 1: Asia Pacific Skin Care Cosmeceutical Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Skin Care Cosmeceutical Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 3: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Distribution Channels 2020 & 2033

- Table 7: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Skin Care Cosmeceutical Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Skin Care Cosmeceutical Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Skin Care Cosmeceutical Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: India Asia Pacific Skin Care Cosmeceutical Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Australia Asia Pacific Skin Care Cosmeceutical Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia Pacific Skin Care Cosmeceutical Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Asia Pacific Skin Care Cosmeceutical Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Asia Pacific Skin Care Cosmeceutical Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Skin Care Cosmeceutical Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Asia Pacific Skin Care Cosmeceutical Market?

Key companies in the market include Unilever, Bayer AG, Jhonson & Jhonson, L'Oreal, Croda International PLC, Procter and Gamble, Clarins Group*List Not Exhaustive, Revlon Inc, Henkel AG & Company KGaA.

3. What are the main segments of the Asia Pacific Skin Care Cosmeceutical Market?

The market segments include Product Type, Distribution Channels, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12576.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Skin Care Segment Holds a Leading Share.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Skin Care Cosmeceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Skin Care Cosmeceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Skin Care Cosmeceutical Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Skin Care Cosmeceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence