Key Insights

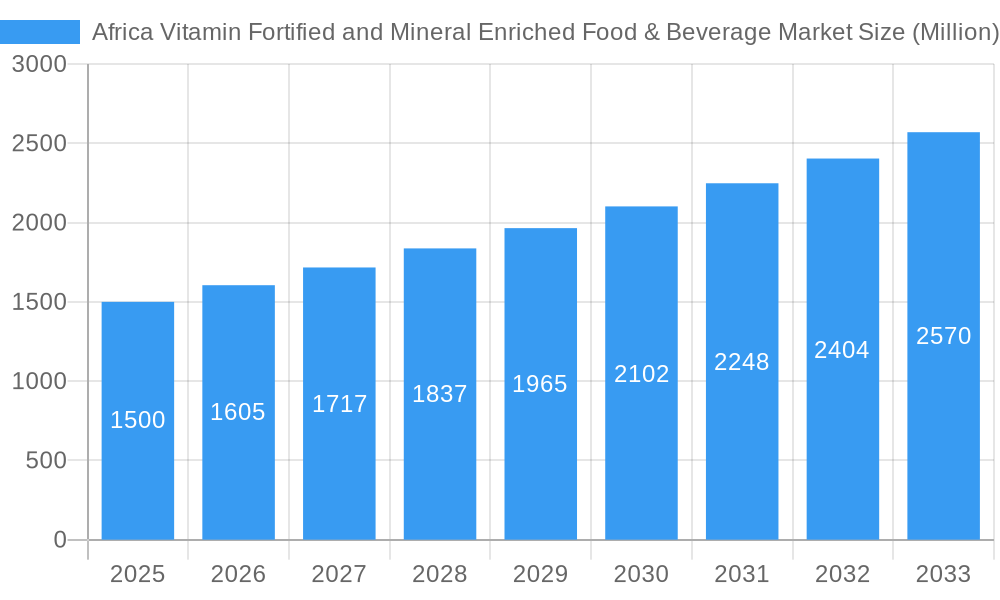

The African vitamin and mineral-fortified food and beverage market is poised for substantial expansion, driven by heightened health awareness, increasing disposable incomes, and a growing understanding of the role of nutrition in combating micronutrient deficiencies. With a projected CAGR of 7.12% from the base year 2024, the market is estimated at 5.77 billion and is anticipated to maintain this upward trajectory through the forecast period (2025-2033). Key segments include cereal-based products, dairy, beverages, and infant formulas, with distribution primarily through supermarkets/hypermarkets and online retail. The persistent prevalence of malnutrition, especially among vulnerable populations, is a significant demand driver. Government initiatives focused on public health and food fortification further accelerate market growth. Leading companies such as Nestle, Kellogg's, and PepsiCo are actively engaged, leveraging their established brands and distribution to secure market share. However, challenges persist, including infrastructural inconsistencies, variable consumer awareness, and affordability limitations impacting purchasing power.

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Market Size (In Billion)

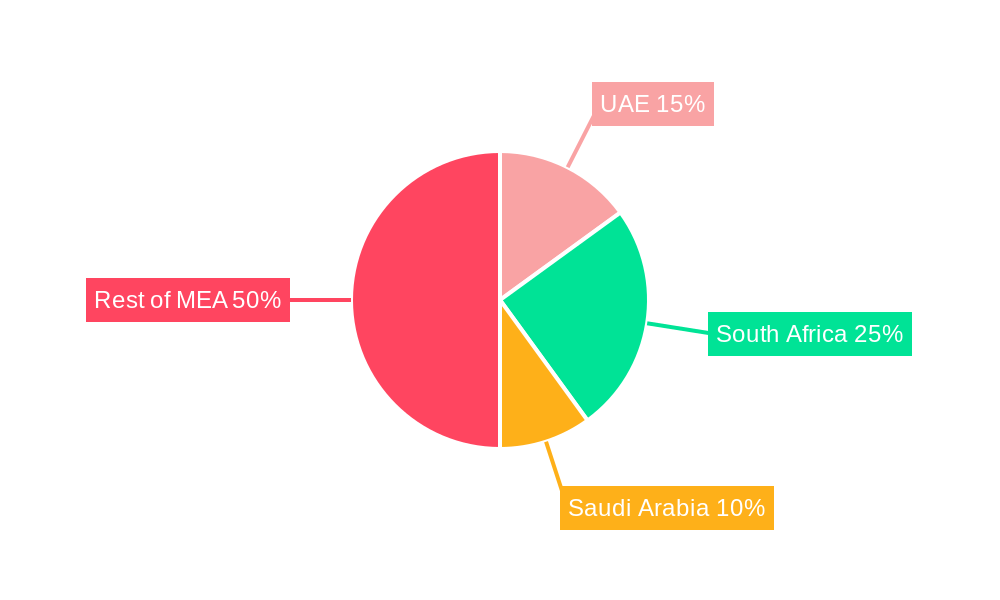

The Middle East and Africa region, with key markets in the UAE, South Africa, and Saudi Arabia, presents significant growth potential. Urbanization, evolving lifestyles, and changing dietary patterns are fueling demand for convenient, nutritious, and fortified food and beverage options. While granular data for specific African sub-regions may be limited, projected growth, considering economic development and health initiatives, indicates a robust market expansion. The increasing adoption of online retail channels offers expanded reach and accessibility. Strategic approaches focusing on affordable, culturally appropriate fortified products and collaboration with local distributors will be critical for successful market penetration and sustained growth across the diverse African continent.

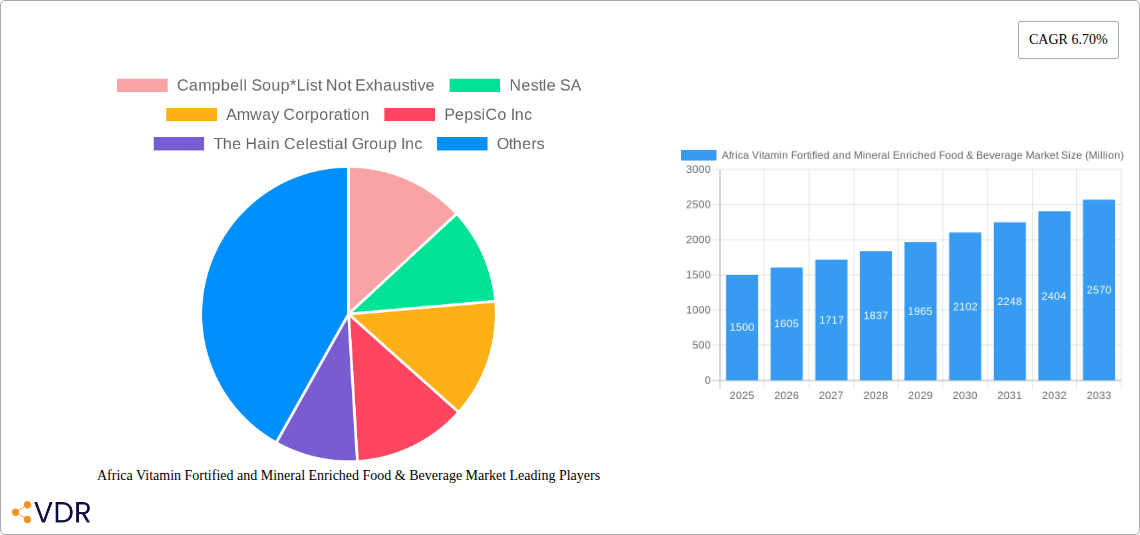

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Company Market Share

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market, offering crucial insights for industry professionals, investors, and stakeholders. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, growth trends, dominant segments, and key players, forecasting market evolution from 2025 to 2033. The market is segmented by product type (Cereal based products, Dairy Products, Beverages, Infant Formulas, Others) and application (Supermarket/Hypermarket, Convenience Stores, Pharmacy/Drug Store, Online Retail Store, Others). The report is valued at xx Million units.

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Market Dynamics & Structure

This section delves into the intricate structure of the African vitamin-fortified and mineral-enriched food and beverage market. We analyze market concentration, revealing the dominance of key players and the presence of smaller, niche competitors. Technological advancements, such as improved fortification methods and packaging innovations, are scrutinized for their impact on market growth. The regulatory landscape, encompassing food safety standards and labeling requirements across different African nations, is thoroughly examined. The report assesses competitive pressures from product substitutes, examines end-user demographics (age, income, location), and evaluates the influence of mergers and acquisitions (M&A) activities on market consolidation.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few large multinational companies holding significant market share, while numerous smaller regional players cater to specific needs. xx% market share is held by the top 5 players.

- Technological Innovation: Advancements in fortification technologies are driving efficiency and improving product quality, fostering market expansion.

- Regulatory Framework: Varied regulations across African nations pose challenges for standardization and market entry, but also create opportunities for tailored product offerings.

- Competitive Substitutes: Traditional, unfortified foods and beverages pose a competitive threat, while functional foods are emerging as substitutes.

- End-User Demographics: Growing urban populations, rising disposable incomes, and increased health awareness among consumers are key drivers of market growth.

- M&A Trends: A moderate number of M&A deals are observed, indicating strategic consolidation within the market. The total deal volume between 2019 and 2024 was xx Million units.

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Growth Trends & Insights

This section provides a comprehensive analysis of the market’s growth trajectory using various data points and insights from industry experts. We detail the market size evolution from 2019 to 2024 and project its expansion until 2033. The report quantifies the Compound Annual Growth Rate (CAGR) and market penetration rates, showcasing the market’s impressive growth potential. Furthermore, the influence of technological disruptions, such as e-commerce penetration and changing consumer preferences towards healthier options, is evaluated. The impact of these factors on consumer behavior and purchasing patterns is meticulously analyzed. Specific regional differences and growth disparities are highlighted, providing a nuanced perspective on the market's development. The analysis incorporates data points to support each conclusion.

Dominant Regions, Countries, or Segments in Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market

This section identifies the leading regions, countries, and product/application segments within the African vitamin-fortified and mineral-enriched food and beverage market. We analyze the factors driving growth in these dominant areas. Key drivers such as economic policies promoting food fortification, improvements in infrastructure facilitating distribution, and rising consumer awareness of nutritional deficiencies are discussed. The market share and growth potential of each dominant region/country/segment are analyzed, revealing potential investment opportunities.

- Leading Regions: [Insert region(s) with highest market share and growth potential and reasons - e.g., South Africa, Nigeria due to large population and economic growth]

- Leading Countries: [Insert specific countries and justification - e.g., Kenya showing strong growth due to government initiatives]

- Leading Segments (Product Type): [Insert leading segment and justification - e.g., Beverages have the largest market share due to high consumption]

- Leading Segments (Application): [Insert leading segment and justification - e.g., Supermarket/Hypermarkets due to high accessibility and visibility].

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Product Landscape

The African market showcases a diverse range of vitamin-fortified and mineral-enriched products. Innovations focus on enhanced taste, improved nutrient bioavailability, and convenient packaging formats tailored to the local consumer preferences. Products are designed to meet specific nutritional deficiencies prevalent in the region. Technological advancements, such as advanced fortification techniques and functional food ingredients, enhance product quality and appeal. Unique selling propositions include tailored blends targeting specific demographics and health conditions.

Key Drivers, Barriers & Challenges in Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market

Key Drivers: The market is propelled by several factors, including increased awareness of malnutrition and micronutrient deficiencies, government initiatives promoting food fortification, and growing disposable incomes enabling higher spending on nutritious foods. Technological advancements, such as improved fortification processes, also contribute significantly.

Challenges and Restraints: Key challenges include inconsistent regulatory frameworks across different countries, high production costs, limited access to technology and infrastructure in some regions, and consumer resistance to potentially altered taste and texture. Supply chain disruptions due to poor infrastructure pose further challenges, resulting in xx% increase in prices in 2024.

Emerging Opportunities in Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market

Significant opportunities exist in untapped rural markets, where nutritional deficiencies are prevalent but access to fortified foods is limited. The development of innovative product formulations catering to specific cultural preferences and dietary habits presents another opportunity. E-commerce expansion offers a platform for reaching consumers beyond traditional retail channels.

Growth Accelerators in the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Industry

Long-term growth will be propelled by sustained investments in research and development, leading to more innovative and effective fortification technologies. Strategic partnerships between multinational companies and local producers can help expand market reach and adapt products to local needs. Government support through policies and funding can further stimulate market expansion.

Key Players Shaping the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Market

- Campbell Soup

- Nestle SA

- Amway Corporation

- PepsiCo Inc

- The Hain Celestial Group Inc

- Abbott

- The Coca-Cola Company

- Kellogg Company

Notable Milestones in Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Sector

- 2020: Launch of a new fortified cereal by Nestle SA in Nigeria targeting children.

- 2022: Government of Kenya implements new regulations on mandatory fortification of staple foods.

- 2023: PepsiCo Inc. invests in a new production facility in South Africa for fortified beverages.

In-Depth Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Market Outlook

The Africa vitamin-fortified and mineral-enriched food and beverage market is poised for robust growth, driven by increasing health awareness, supportive government policies, and technological advancements. Strategic partnerships, innovative product development, and expansion into untapped markets present significant opportunities for companies. The market's future hinges on addressing challenges related to infrastructure, affordability, and regulatory consistency, but its inherent growth potential remains considerable.

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Segmentation

-

1. Product Type

- 1.1. Cereal based products

- 1.2. Dairy Products

- 1.3. Beverages

- 1.4. Infant Formulas

- 1.5. Others

-

2. Application

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Pharmacy/Drug Store

- 2.4. Online Retail Store

- 2.5. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Nigeria

- 3.3. Egypt

- 3.4. Rest of Africa

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Egypt

- 4. Rest of Africa

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Regional Market Share

Geographic Coverage of Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market

Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Ingredient fortified Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal based products

- 5.1.2. Dairy Products

- 5.1.3. Beverages

- 5.1.4. Infant Formulas

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacy/Drug Store

- 5.2.4. Online Retail Store

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Nigeria

- 5.3.3. Egypt

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Egypt

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cereal based products

- 6.1.2. Dairy Products

- 6.1.3. Beverages

- 6.1.4. Infant Formulas

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacy/Drug Store

- 6.2.4. Online Retail Store

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Nigeria

- 6.3.3. Egypt

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Nigeria Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cereal based products

- 7.1.2. Dairy Products

- 7.1.3. Beverages

- 7.1.4. Infant Formulas

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacy/Drug Store

- 7.2.4. Online Retail Store

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Nigeria

- 7.3.3. Egypt

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Egypt Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cereal based products

- 8.1.2. Dairy Products

- 8.1.3. Beverages

- 8.1.4. Infant Formulas

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacy/Drug Store

- 8.2.4. Online Retail Store

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Nigeria

- 8.3.3. Egypt

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Africa Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cereal based products

- 9.1.2. Dairy Products

- 9.1.3. Beverages

- 9.1.4. Infant Formulas

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacy/Drug Store

- 9.2.4. Online Retail Store

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Nigeria

- 9.3.3. Egypt

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Campbell Soup*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nestle SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amway Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PepsiCo Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Hain Celestial Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abbott

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Coca-Cola Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kellogg Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Campbell Soup*List Not Exhaustive

List of Figures

- Figure 1: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Application 2020 & 2033

- Table 5: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Application 2020 & 2033

- Table 13: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Application 2020 & 2033

- Table 21: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Application 2020 & 2033

- Table 29: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 35: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Application 2020 & 2033

- Table 37: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market?

Key companies in the market include Campbell Soup*List Not Exhaustive, Nestle SA, Amway Corporation, PepsiCo Inc, The Hain Celestial Group Inc, Abbott, The Coca-Cola Company, Kellogg Company.

3. What are the main segments of the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Growing Demand for Functional Ingredient fortified Food.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market?

To stay informed about further developments, trends, and reports in the Africa Vitamin Fortified and Mineral Enriched Food & Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence