Key Insights

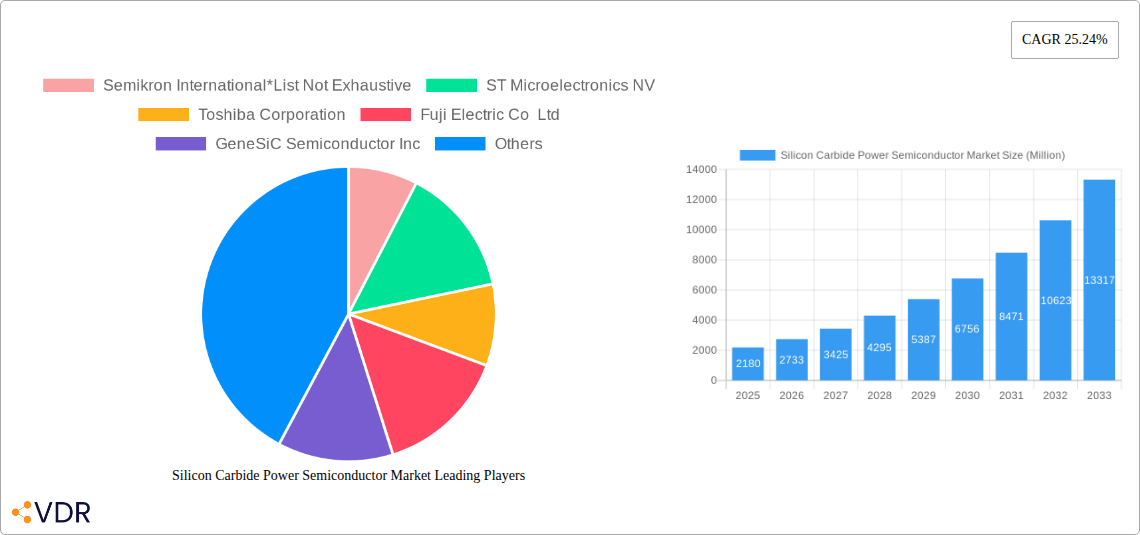

The global Silicon Carbide (SiC) Power Semiconductor Market is poised for remarkable expansion, with a current estimated market size of $2.18 billion in 2025 and projected to reach substantial figures by 2033. This surge is primarily driven by the accelerating adoption of electric vehicles (xEVs) and the rapid build-out of EV charging infrastructure. The inherent advantages of SiC, such as higher efficiency, increased power density, and superior thermal performance compared to traditional silicon-based semiconductors, make it an indispensable component in modern power electronics. Beyond the automotive sector, the market is witnessing significant growth in power applications, including renewable energy generation (PV and wind power systems), industrial motor drives, and uninterruptible power supply (UPS) systems, all of which demand enhanced energy efficiency and reliability. The IT and telecommunication sectors are also contributing to this growth, leveraging SiC for more efficient power management in data centers and advanced networking equipment.

Silicon Carbide Power Semiconductor Market Market Size (In Billion)

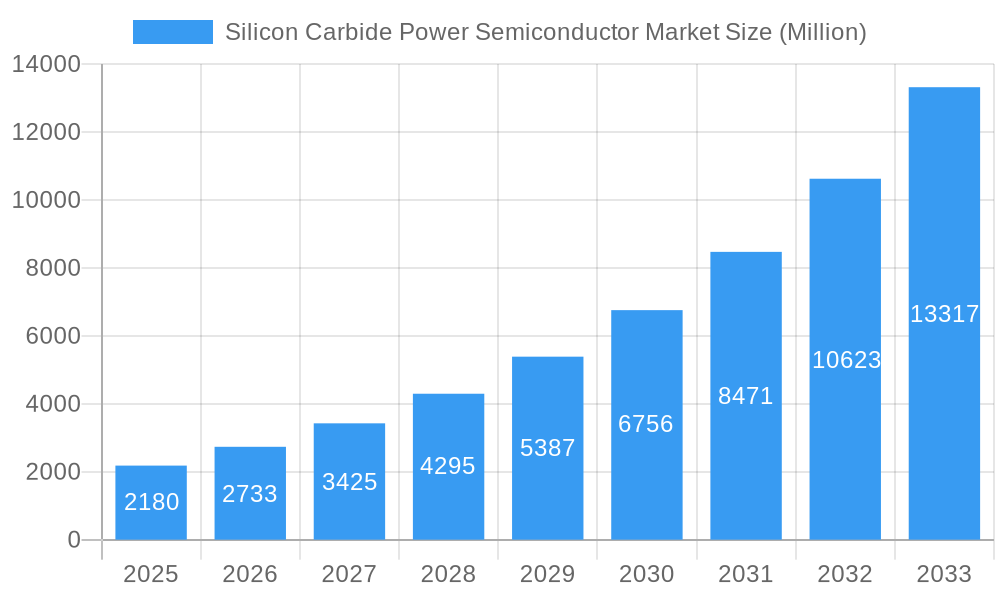

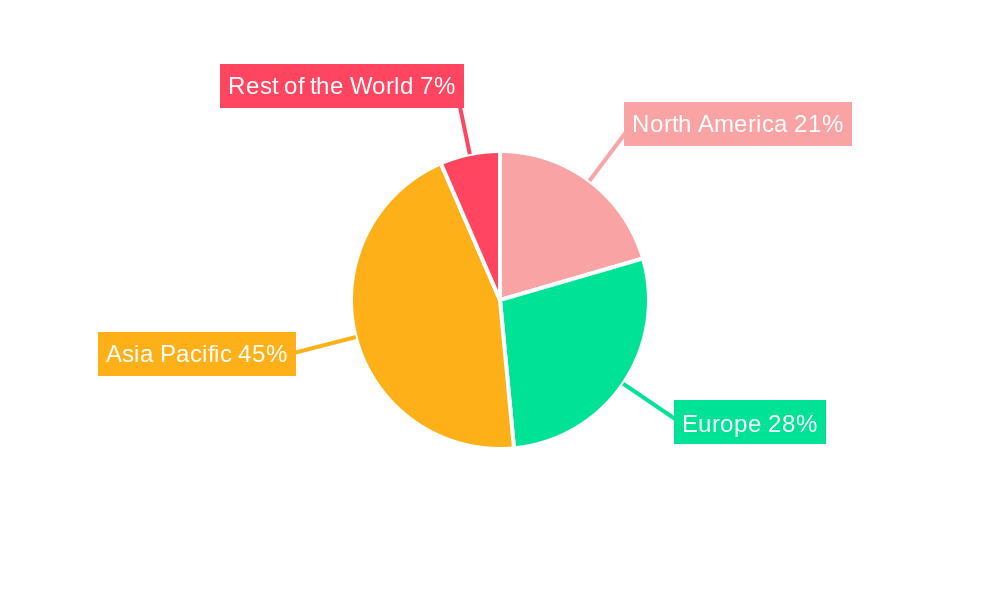

The market's impressive Compound Annual Growth Rate (CAGR) of 25.24% underscores the transformative impact of SiC technology across various industries. This high growth is fueled by a confluence of factors, including stringent government regulations promoting energy efficiency and emissions reduction, coupled with increasing consumer demand for sustainable and high-performance electronic devices. Key players like Infineon Technologies AG, STMicroelectronics NV, and ON Semiconductor Corporation are heavily investing in research and development, expanding production capacities, and forging strategic partnerships to capture market share. Emerging trends include the development of advanced SiC MOSFETs and diodes with even higher voltage and current ratings, as well as the integration of SiC devices into more compact and sophisticated power modules. While the market is robust, potential restraints could include the relatively higher cost of SiC raw materials and manufacturing complexities, though these are steadily being addressed through technological advancements and economies of scale. The Asia Pacific region is anticipated to lead in market dominance due to its strong manufacturing base and significant investments in electric mobility and renewable energy projects.

Silicon Carbide Power Semiconductor Market Company Market Share

Unlocking the Future of Power: Silicon Carbide Power Semiconductor Market Report (2019-2033)

Dive deep into the rapidly expanding Silicon Carbide (SiC) Power Semiconductor Market with this comprehensive report. Explore pivotal industry developments, growth trajectories, and key player strategies. This report is essential for stakeholders seeking to understand and capitalize on the surging demand for high-efficiency, high-performance power electronics in automotive, telecommunication, power, and industrial sectors.

Silicon Carbide Power Semiconductor Market Market Dynamics & Structure

The Silicon Carbide (SiC) Power Semiconductor Market is characterized by a moderate to high concentration, driven by significant technological innovation and substantial capital investment. Key players are continually pushing the boundaries of performance and efficiency, with R&D efforts focused on improving device reliability, reducing manufacturing costs, and developing next-generation SiC materials. Regulatory frameworks, particularly those promoting energy efficiency and emission reduction, play a crucial role in accelerating SiC adoption across various end-user industries. While SiC offers superior performance over traditional silicon-based semiconductors, competitive product substitutes, primarily advanced silicon IGBTs and emerging wide-bandgap materials, exist but often fall short in key performance metrics for demanding applications. End-user demographics are shifting dramatically, with the automotive sector, especially electric vehicles (xEVs) and EV charging infrastructure, emerging as a dominant consumer. Mergers and acquisitions (M&A) are prevalent as larger companies seek to integrate SiC capabilities and secure market share. The market is poised for significant growth, fueled by government initiatives and increasing consumer demand for sustainable and efficient technologies.

- Market Concentration: Dominated by a few key players, with increasing strategic partnerships and M&A activities.

- Technological Innovation: Driven by the pursuit of higher voltage, higher current, improved thermal management, and reduced on-resistance in SiC devices.

- Regulatory Frameworks: Strong influence from environmental regulations promoting energy efficiency and electrification.

- Competitive Product Substitutes: Advanced silicon IGBTs and other wide-bandgap materials pose competition, but SiC often leads in performance for high-power applications.

- End-User Demographics: A significant shift towards the automotive sector (xEVs and charging infrastructure) and renewable energy.

- M&A Trends: Active consolidation and strategic alliances to gain competitive advantage and expand product portfolios.

Silicon Carbide Power Semiconductor Market Growth Trends & Insights

The Silicon Carbide Power Semiconductor Market is experiencing exponential growth, projecting a significant upward trajectory in market size and adoption rates from 2019 to 2033. This expansion is underpinned by transformative technological disruptions, primarily the inherent advantages of SiC over silicon, including higher breakdown voltage, faster switching speeds, lower on-resistance, and superior thermal conductivity. These benefits translate directly into enhanced energy efficiency, reduced system size and weight, and improved reliability, making SiC indispensable for next-generation power electronics. Consumer behavior shifts are also profoundly influencing market dynamics, with a growing global consciousness towards sustainability and electrification driving demand for electric vehicles (xEVs), renewable energy solutions like solar and wind power, and energy-efficient power supplies. The market penetration of SiC devices is steadily increasing across all major end-user segments.

The projected Compound Annual Growth Rate (CAGR) for the SiC Power Semiconductor Market is expected to be substantial, reflecting the rapid adoption across diverse applications. The automotive sector, particularly for electric vehicles (xEVs) and their associated charging infrastructure, is a primary demand driver. The need for higher efficiency and faster charging in EVs directly fuels the demand for SiC components in onboard chargers, inverters, and DC-DC converters. Furthermore, the burgeoning renewable energy sector, including photovoltaic (PV) systems and wind turbines, benefits immensely from SiC's ability to handle higher power densities and operate efficiently under varying conditions, contributing significantly to market growth.

The IT and Telecommunication industry is also witnessing increased adoption of SiC for power supply units (PSUs) and data center applications, where energy efficiency and reduced cooling requirements are paramount. Industrial applications, such as motor drives and power grids, are increasingly leveraging SiC for improved performance and cost savings through enhanced energy efficiency. The overall market evolution is characterized by continuous innovation, leading to the development of more robust, cost-effective, and higher-performing SiC power modules and discrete devices. The shift from traditional silicon-based power electronics to SiC is not merely an incremental improvement but a fundamental technological leap, enabling the development of more advanced and sustainable power systems. This comprehensive market outlook predicts sustained high growth, driven by technological superiority, environmental imperatives, and evolving consumer preferences for cleaner and more efficient energy solutions.

Dominant Regions, Countries, or Segments in Silicon Carbide Power Semiconductor Market

The Automotive (xEVs and EV Charging Infrastructure) segment is unequivocally the dominant force driving growth in the Silicon Carbide (SiC) Power Semiconductor Market. This supremacy is fueled by a confluence of accelerating global trends, including stringent emission regulations, government incentives for electric vehicle adoption, and a significant shift in consumer preferences towards sustainable transportation. The transition to electric mobility necessitates the widespread deployment of high-performance power electronics capable of efficient energy conversion and management. SiC's inherent advantages—higher efficiency, reduced power losses, smaller form factors, and enhanced thermal performance—make it the material of choice for critical EV components such as inverters, onboard chargers (OBCs), DC-DC converters, and increasingly, battery management systems.

The expansion of EV charging infrastructure, from residential charging stations to public fast-charging networks, further amplifies the demand for SiC power devices. These systems require robust and efficient power converters to handle high voltages and currents, where SiC excels. Countries that are at the forefront of EV adoption, such as China, the United States, and various European nations (Germany, Norway, France), are consequently major markets for SiC power semiconductors within the automotive domain. Supportive government policies, including subsidies for EV purchases, investments in charging infrastructure, and ambitious targets for phasing out internal combustion engine vehicles, are creating a fertile ground for SiC market expansion in this segment. The market share within the automotive segment is substantial and projected to grow at an accelerated pace, outpacing other end-user industries.

Beyond the automotive sector, the Power (Power Supply, UPS, PV, Wind etc.) segment represents another significant growth driver, although currently secondary to automotive. The global push towards renewable energy sources like solar (PV) and wind power necessitates highly efficient and reliable power conversion systems to integrate these intermittent sources into the grid. SiC devices enable higher conversion efficiencies in inverters for solar panels and wind turbines, thereby maximizing energy yield and reducing operational costs. Uninterruptible Power Supplies (UPS) also benefit from SiC's efficiency and reliability, especially in critical infrastructure like data centers and hospitals, where power continuity is paramount. The ability of SiC to handle higher power densities and temperatures leads to more compact and efficient UPS systems.

The IT and Telecommunication segment is also increasingly adopting SiC for high-efficiency power supplies in servers and base stations. As data consumption and processing demand continue to surge, the energy footprint of data centers becomes a critical concern. SiC-based power supplies offer significant energy savings, lower heat generation, and a smaller footprint, leading to reduced operational expenditures and environmental impact. Similarly, industrial applications, particularly motor drives, are recognizing the benefits of SiC for improved energy efficiency, faster response times, and enhanced motor control, contributing to a broader adoption across various industrial machinery. While these segments are experiencing robust growth, the sheer volume and rapid advancement within the automotive electrification trend position it as the primary engine of the SiC Power Semiconductor Market for the foreseeable future.

Silicon Carbide Power Semiconductor Market Product Landscape

The Silicon Carbide (SiC) Power Semiconductor Market is defined by continuous product innovation, focusing on enhancing device performance, reliability, and cost-effectiveness. Key product categories include SiC MOSFETs and SiC diodes (Schottky and PN junction), available in various voltage and current ratings suitable for diverse applications. Recent advancements have led to the introduction of higher voltage devices (e.g., 1200V, 1700V, and beyond), improved on-resistance (Rds(on)) for lower conduction losses, and faster switching speeds to minimize switching losses. These innovations enable smaller, lighter, and more energy-efficient power electronic systems. Applications span from electric vehicles (xEVs) and their charging infrastructure, renewable energy systems (PV inverters, wind turbines), industrial motor drives, and high-efficiency power supplies for IT and telecommunication equipment, to uninterruptible power supplies (UPS). Unique selling propositions revolve around superior thermal management capabilities, enabling operation at higher junction temperatures, and reduced system-level costs through smaller passive components and improved overall efficiency.

Key Drivers, Barriers & Challenges in Silicon Carbide Power Semiconductor Market

The Silicon Carbide Power Semiconductor Market is propelled by several key drivers. Technological superiority is paramount, with SiC offering significantly higher efficiency, faster switching speeds, and better thermal performance compared to silicon. The global push for electrification, particularly in the automotive sector for electric vehicles (xEVs) and the expansion of EV charging infrastructure, creates immense demand. Increasing focus on energy efficiency and sustainability across all industries, driven by environmental concerns and regulatory mandates, further bolsters SiC adoption. Government incentives and policies promoting renewable energy and electric mobility act as significant catalysts.

Key barriers and challenges include high manufacturing costs associated with SiC wafer production and device fabrication, which leads to higher device pricing compared to silicon. Supply chain constraints, particularly for high-quality SiC wafers, can limit production volumes and increase lead times. Reliability concerns, though diminishing with advancements, have historically been a hurdle, requiring extensive qualification and testing for mission-critical applications. Limited skilled workforce trained in SiC device design and application engineering can also pose a challenge. Competition from advanced silicon technologies and other wide-bandgap materials, while often not directly comparable in all metrics, presents a competitive landscape.

Emerging Opportunities in Silicon Carbide Power Semiconductor Market

Emerging opportunities in the Silicon Carbide Power Semiconductor Market are vast and diverse. The continued exponential growth of the electric vehicle (EV) market presents a sustained demand for SiC in xEV powertrains, charging systems, and battery management. The expansion of 5G infrastructure and data centers creates opportunities for high-efficiency power supplies utilizing SiC. The increasing adoption of renewable energy sources, including advanced solar power systems and grid stabilization technologies, will require more robust and efficient SiC components. Furthermore, emerging applications such as electric aircraft, industrial automation, and advanced motor drives are opening new frontiers for SiC technology. Innovations in SiC module integration and packaging also present significant opportunities for system-level optimization and cost reduction, making SiC more accessible to a wider range of applications.

Growth Accelerators in the Silicon Carbide Power Semiconductor Market Industry

Several key growth accelerators are shaping the long-term trajectory of the Silicon Carbide Power Semiconductor Market. Continuous technological advancements leading to improved device performance, higher reliability, and reduced manufacturing costs are fundamental. Strategic partnerships and collaborations between SiC device manufacturers, system integrators, and end-users are crucial for accelerating product development and market adoption. Expansion of manufacturing capacity by key players to meet growing demand and address supply chain bottlenecks will be a significant accelerator. Government policies and incentives that favor electrification, renewable energy, and energy efficiency will continue to drive market growth. Finally, increasing consumer and industrial demand for higher efficiency and sustainability across all sectors will create a persistent pull for SiC-based solutions.

Key Players Shaping the Silicon Carbide Power Semiconductor Market Market

- Semikron International

- ST Microelectronics NV

- Toshiba Corporation

- Fuji Electric Co Ltd

- GeneSiC Semiconductor Inc

- Mitsubishi Electric Corporation

- UnitedSiC

- Microsemi Corporation

- Infineon Technologies AG

- ON Semiconductor Corporation

- Danfoss A/S

Notable Milestones in Silicon Carbide Power Semiconductor Market Sector

- July 2022 - SemiQ announced the launch of its 2nd Generation Silicon Carbide power switch, a 1200V 80mΩ SiCMOSFET, expanding its portfolio of SiC power devices. The new MOSFET complements the company's existing SiC rectifiers at 650V, 1200V, and 1700V, which bring high efficiency to high-performance applications like electric vehicles.

- May 2022 - STMicroelectronics revealed its partnership with Semikron for supplying silicon carbide (SiC) technology for the eMPack electric-vehicle (EV) power modules provided by the company.

- May 2022 - Microchip launched the SiC-based Fully Integrated Precise Time Scale System for smart transportation infrastructure. The Precise Time Scale System (PTSS) is a fully integrated system capable of providing timing accuracies comparable to the world's best national laboratories.

- April 2021 - ON Semiconductor of Phoenix, Arizona, has introduced new automotive (AECQ101) and industrial-grade next-generation 1200V silicon carbide (SiC) diodes, which are suitable for high-power applications such as EV charging stations and solar inverters, uninterruptible power supplies (UPS), EV on-board chargers (OBC), and EV DC-DC converters.

- February 2021 - ON Semiconductor, one of the pioneers in energy-efficient innovations, has introduced a new line of 650 V silicon carbide (SiC) MOSFET devices for demanding applications requiring high power density, efficiency, and reliability. Designers will achieve significantly better performance in applications such as electric vehicles (EV) on-board chargers (OBC), solar inverters, server power supply units (PSU), telecoms, and uninterruptible power supplies (UPS) by replacing existing silicon switching technologies with the new SiC devices.

In-Depth Silicon Carbide Power Semiconductor Market Market Outlook

The Silicon Carbide Power Semiconductor Market is poised for sustained high growth, driven by the relentless pursuit of energy efficiency and electrification across key sectors. The automotive industry's unwavering commitment to electric mobility, coupled with expanding EV charging infrastructure, represents a critical growth accelerator. Continued innovation in SiC device technology, focusing on cost reduction, performance enhancement, and reliability improvements, will further unlock new application possibilities. Strategic collaborations and increased manufacturing capacity are expected to address supply chain challenges and meet the escalating demand. Government support for clean energy initiatives and electrification policies will continue to create a favorable market environment. Emerging applications in areas like electric aviation and advanced industrial automation are set to broaden the market's scope, cementing SiC's position as a foundational technology for the future of power electronics.

Silicon Carbide Power Semiconductor Market Segmentation

-

1. End-user Industry

- 1.1. Automotive (xEVs and EV Charging Infrastructure)

- 1.2. IT and Telecommunication

- 1.3. Power (Power Supply, UPS, PV, Wind etc.)

- 1.4. Industrial (Motor drives)

- 1.5. Other En

Silicon Carbide Power Semiconductor Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia Pacific

Silicon Carbide Power Semiconductor Market Regional Market Share

Geographic Coverage of Silicon Carbide Power Semiconductor Market

Silicon Carbide Power Semiconductor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Demand for Consumer Electronics and Wireless Communications; Growing Demand for Energy-Efficient Battery-Powered Portable Devices

- 3.3. Market Restrains

- 3.3.1. Rising Metal Prices Impacting Component Production Costs

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silicon Carbide Power Semiconductor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Automotive (xEVs and EV Charging Infrastructure)

- 5.1.2. IT and Telecommunication

- 5.1.3. Power (Power Supply, UPS, PV, Wind etc.)

- 5.1.4. Industrial (Motor drives)

- 5.1.5. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Americas Silicon Carbide Power Semiconductor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Automotive (xEVs and EV Charging Infrastructure)

- 6.1.2. IT and Telecommunication

- 6.1.3. Power (Power Supply, UPS, PV, Wind etc.)

- 6.1.4. Industrial (Motor drives)

- 6.1.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Silicon Carbide Power Semiconductor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Automotive (xEVs and EV Charging Infrastructure)

- 7.1.2. IT and Telecommunication

- 7.1.3. Power (Power Supply, UPS, PV, Wind etc.)

- 7.1.4. Industrial (Motor drives)

- 7.1.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Silicon Carbide Power Semiconductor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Automotive (xEVs and EV Charging Infrastructure)

- 8.1.2. IT and Telecommunication

- 8.1.3. Power (Power Supply, UPS, PV, Wind etc.)

- 8.1.4. Industrial (Motor drives)

- 8.1.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Semikron International*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ST Microelectronics NV

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Toshiba Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Fuji Electric Co Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 GeneSiC Semiconductor Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Mitsubishi Electric Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 UnitedSiC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Microsemi Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Infineon technologies AG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 ON Semiconductor Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Danfoss A/S

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Semikron International*List Not Exhaustive

List of Figures

- Figure 1: Global Silicon Carbide Power Semiconductor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Americas Silicon Carbide Power Semiconductor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: Americas Silicon Carbide Power Semiconductor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Americas Silicon Carbide Power Semiconductor Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Americas Silicon Carbide Power Semiconductor Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Silicon Carbide Power Semiconductor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe Silicon Carbide Power Semiconductor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Silicon Carbide Power Semiconductor Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Silicon Carbide Power Semiconductor Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Silicon Carbide Power Semiconductor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Silicon Carbide Power Semiconductor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Silicon Carbide Power Semiconductor Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Silicon Carbide Power Semiconductor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Silicon Carbide Power Semiconductor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicon Carbide Power Semiconductor Market?

The projected CAGR is approximately 25.24%.

2. Which companies are prominent players in the Silicon Carbide Power Semiconductor Market?

Key companies in the market include Semikron International*List Not Exhaustive, ST Microelectronics NV, Toshiba Corporation, Fuji Electric Co Ltd, GeneSiC Semiconductor Inc, Mitsubishi Electric Corporation, UnitedSiC, Microsemi Corporation, Infineon technologies AG, ON Semiconductor Corporation, Danfoss A/S.

3. What are the main segments of the Silicon Carbide Power Semiconductor Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Demand for Consumer Electronics and Wireless Communications; Growing Demand for Energy-Efficient Battery-Powered Portable Devices.

6. What are the notable trends driving market growth?

Automotive Industry is Expected to Register Significant Growth.

7. Are there any restraints impacting market growth?

Rising Metal Prices Impacting Component Production Costs.

8. Can you provide examples of recent developments in the market?

July 2022 - SemiQ announced the launch of its 2nd Generation Silicon Carbide power switch, a 1200V 80mΩ SiCMOSFET, expanding its portfolio of SiCpower devices. The new MOSFET complements the company's existing SiCrectifiers at 650V, 1200V, and 1700V, which bring high efficiency to high-performance applications like electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silicon Carbide Power Semiconductor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silicon Carbide Power Semiconductor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silicon Carbide Power Semiconductor Market?

To stay informed about further developments, trends, and reports in the Silicon Carbide Power Semiconductor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence