Key Insights

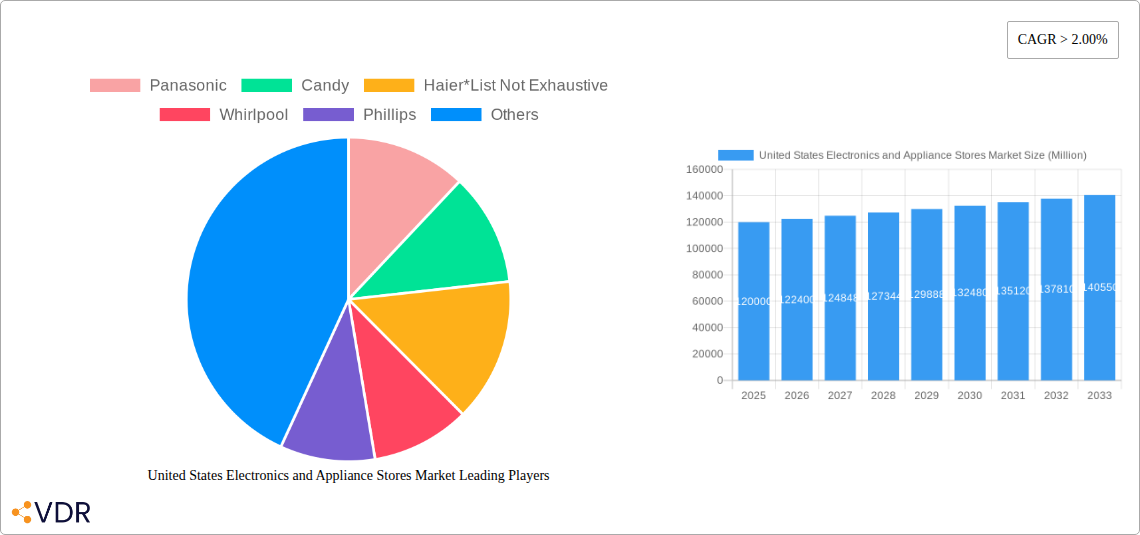

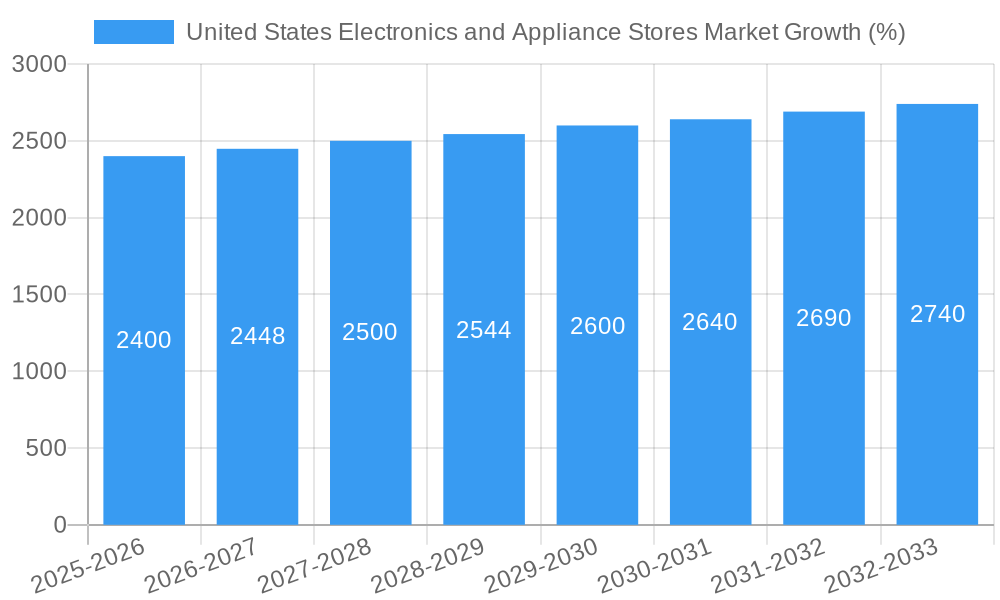

The United States electronics and appliance stores market exhibits robust growth potential, driven by increasing disposable incomes, a preference for technologically advanced appliances, and the expanding e-commerce sector. The market's compound annual growth rate (CAGR) exceeding 2.00% indicates a steady upward trajectory, with significant opportunities for both established players like Panasonic, Whirlpool, and Samsung, and emerging brands seeking market share. The market segmentation reveals a dynamic landscape, with hardware suppliers, security stores, and consumer electronics stores competing for consumer attention across various retail models. Retail chains enjoy economies of scale, while independent retailers often offer personalized service and niche product selections. The rise of online channels presents both challenges and opportunities, forcing traditional brick-and-mortar stores to adapt their strategies and integrate seamless omnichannel experiences to remain competitive. Exclusive retailers and showrooms cater to high-end consumers seeking premium brands and specialized support, while inclusive retailers and dealers provide a broader range of products and price points, appealing to a wider consumer base. While specific market size data for the US is unavailable, assuming a global market size of $XX million and factoring in the significant US consumer electronics market, a reasonable estimate for the US market size in 2025 could be placed in the range of $100 Billion to $150 Billion USD, depending on the definition of the scope of the industry. This estimate accounts for the strong US consumer market and its substantial contribution to global electronics sales.

Growth in the coming years will be influenced by factors such as technological advancements in appliances (smart home integration, energy efficiency), evolving consumer preferences towards premium features and sustainable products, and the ongoing expansion of e-commerce platforms. However, challenges remain, including supply chain disruptions, potential economic slowdowns, and increased competition from online marketplaces offering competitive pricing and convenient delivery options. Market players are responding to these dynamics by investing in digital transformation, improving customer service, enhancing supply chain resilience, and focusing on niche market segments to maintain a competitive edge. The market will likely see continued consolidation as larger retailers acquire smaller players and the lines between online and offline retail continue to blur, resulting in a more integrated and dynamic market environment.

This comprehensive report provides a detailed analysis of the United States Electronics and Appliance Stores Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete understanding of the market's historical performance, current state, and future trajectory. The market is segmented by Type (Hardware Supplier, Security Stores, Consumer Electronic Stores), Ownership (Retail Chain, Independent Retailer), and Type of Store (Exclusive Retailers/showroom, Inclusive Retailers/Dealers Store, Online). The total market size is projected to reach xx million units by 2033.

United States Electronics and Appliance Stores Market Dynamics & Structure

The US electronics and appliance stores market exhibits a moderately concentrated structure, with key players such as Whirlpool, Panasonic, and Haier holding significant market share. Technological innovation, particularly in smart home appliances and energy-efficient solutions, is a primary growth driver. Stringent regulatory frameworks concerning energy consumption and product safety influence market dynamics. The market also faces competition from online retailers and alternative product categories offering similar functionalities. M&A activity has been significant, with notable acquisitions shaping the competitive landscape.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Smart home integration, energy efficiency improvements, and advanced features are driving premium segment growth.

- Regulatory Landscape: Compliance with energy efficiency standards (e.g., Energy Star) and safety regulations impacts product development and pricing.

- Competitive Substitutes: Online retailers and direct-to-consumer brands pose a growing competitive threat.

- M&A Activity: The acquisition of InSinkErator by Whirlpool in 2022 exemplifies the consolidation trend in the market. The number of M&A deals in the sector averaged xx per year during the historical period.

- End-User Demographics: Millennials and Gen Z demonstrate a higher adoption rate of smart appliances and online purchasing channels.

United States Electronics and Appliance Stores Market Growth Trends & Insights

The US electronics and appliance stores market experienced a CAGR of xx% during the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and a preference for technologically advanced appliances. The market is expected to maintain a healthy growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration of smart appliances is increasing rapidly, particularly within the premium segment. Technological disruptions, such as the rise of IoT (Internet of Things) connected devices and the integration of AI functionalities, are fundamentally reshaping consumer preferences and purchasing behaviors. Consumers increasingly value energy efficiency, sustainability, and convenience, impacting product demand. The market size in 2024 was estimated at xx million units.

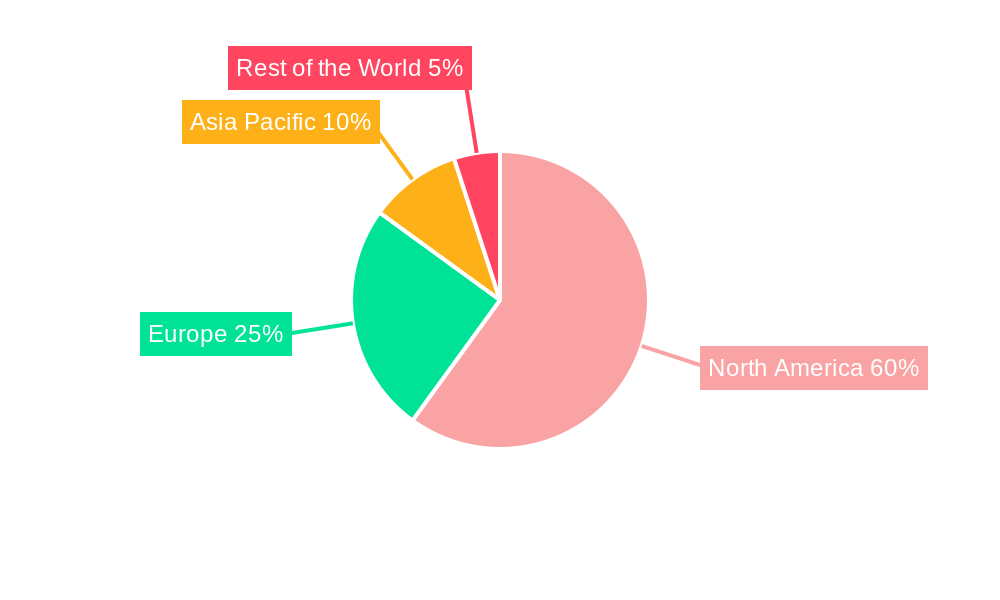

Dominant Regions, Countries, or Segments in United States Electronics and Appliance Stores Market

The Northeast and West Coast regions of the United States demonstrate the highest market share within the United States Electronics and Appliance Stores Market. This dominance is attributed to higher disposable incomes, greater adoption of advanced technologies, and a stronger presence of major retail chains. The Consumer Electronic Stores segment exhibits the fastest growth rate, fueled by the increasing demand for smart home devices and entertainment systems. Online sales are showing significant growth, changing the overall retail landscape.

- Key Drivers: Higher disposable incomes, robust retail infrastructure, and early adoption of new technologies in the Northeast and West Coast regions.

- Dominance Factors: Concentration of major retail chains, affluent consumer base, and advanced infrastructure.

- Growth Potential: Expanding adoption of smart home technologies and increasing online penetration offer significant growth prospects in all segments.

United States Electronics and Appliance Stores Market Product Landscape

The market showcases a diverse product range, encompassing traditional appliances (refrigerators, washing machines, ovens), consumer electronics (televisions, audio systems), and smart home devices (smart speakers, smart lighting). Key product innovations include energy-efficient models, improved connectivity features, and AI-powered functionalities (like GE Appliances' Flavorly™ AI). These innovations enhance user experience, convenience, and energy savings, creating strong unique selling propositions and driving premiumization trends.

Key Drivers, Barriers & Challenges in United States Electronics and Appliance Stores Market

Key Drivers:

- Rising disposable incomes and consumer spending power.

- Growing preference for technologically advanced and energy-efficient appliances.

- Increased adoption of smart home technology and IoT devices.

Challenges & Restraints:

- Supply chain disruptions impacting product availability and pricing.

- Intense competition from online retailers and direct-to-consumer brands.

- Increasing regulatory scrutiny concerning energy efficiency and product safety. This results in higher manufacturing costs and potentially limits market expansion in certain segments.

Emerging Opportunities in United States Electronics and Appliance Stores Market

- Growth in the smart home market presents significant opportunities for integrating appliances and electronics into centralized control systems.

- The increasing demand for sustainable and energy-efficient products opens avenues for eco-friendly appliance development and marketing.

- Expanding into underserved rural markets offers untapped growth potential.

Growth Accelerators in the United States Electronics and Appliance Stores Market Industry

Strategic partnerships between appliance manufacturers and technology providers (like GE Appliances and Google Cloud) accelerate innovation and enhance consumer experience. Technological breakthroughs in AI, IoT, and energy efficiency continuously drive product development and market expansion. Retailers are investing heavily in their online presence and omnichannel strategies to cater to evolving consumer preferences.

Key Players Shaping the United States Electronics and Appliance Stores Market Market

Notable Milestones in United States Electronics and Appliance Stores Market Sector

- August 2023: GE Appliances and Google Cloud partner to integrate generative AI into the SmartHQ app, enhancing consumer experiences.

- November 2022: Whirlpool acquires InSinkErator, expanding its portfolio in kitchen and waste disposal solutions.

- February 2022: Mitsubishi Electric Corporation acquires CPT, strengthening its UPS business in North America.

In-Depth United States Electronics and Appliance Stores Market Market Outlook

The US electronics and appliance stores market is poised for robust growth in the coming years, driven by technological advancements, increasing consumer spending, and the expansion of e-commerce. Strategic partnerships, investments in R&D, and the development of innovative products and services will shape the competitive landscape and unlock significant market opportunities. The integration of AI and IoT will become increasingly important in driving market growth, creating smarter, more connected, and energy-efficient appliances and enhancing the overall consumer experience.

United States Electronics and Appliance Stores Market Segmentation

-

1. Type

- 1.1. Hardware Supplier

- 1.2. Security Stores

- 1.3. Consumer Electronic Store

-

2. Ownership

- 2.1. Retail Chain

- 2.2. Independent Retailer

-

3. Type of Store

- 3.1. Exclusive Retailers/showroom

- 3.2. Inclusive Retailers/Dealers Store

- 3.3. Online

United States Electronics and Appliance Stores Market Segmentation By Geography

- 1. United States

United States Electronics and Appliance Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Innovation in LED Display; Increased Applications for Digital Signage

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware Supplier

- 5.1.2. Security Stores

- 5.1.3. Consumer Electronic Store

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Retail Chain

- 5.2.2. Independent Retailer

- 5.3. Market Analysis, Insights and Forecast - by Type of Store

- 5.3.1. Exclusive Retailers/showroom

- 5.3.2. Inclusive Retailers/Dealers Store

- 5.3.3. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of the World United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panasonic

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Candy

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Haier*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Whirlpool

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Phillips

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bosch

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toshiba

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hitachi Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GE Appliance

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Panasonic

List of Figures

- Figure 1: United States Electronics and Appliance Stores Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Electronics and Appliance Stores Market Share (%) by Company 2024

List of Tables

- Table 1: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 4: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type of Store 2019 & 2032

- Table 5: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 16: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type of Store 2019 & 2032

- Table 17: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electronics and Appliance Stores Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the United States Electronics and Appliance Stores Market?

Key companies in the market include Panasonic, Candy, Haier*List Not Exhaustive, Whirlpool, Phillips, Bosch, Toshiba, Hitachi Limited, GE Appliance.

3. What are the main segments of the United States Electronics and Appliance Stores Market?

The market segments include Type, Ownership, Type of Store.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Innovation in LED Display; Increased Applications for Digital Signage.

6. What are the notable trends driving market growth?

AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

In August 2023, GE Appliances, a Haier company, and Google Cloud expanded their partnership to enhance and personalize consumer experiences with generative AI. GE Appliances’ SmartHQ consumer app will use Google Cloud’s generative AI platform, Vertex AI, to offer users the ability to generate custom recipes based on the food in their kitchen with its new feature called Flavorly™ AI.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electronics and Appliance Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electronics and Appliance Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electronics and Appliance Stores Market?

To stay informed about further developments, trends, and reports in the United States Electronics and Appliance Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence