Key Insights

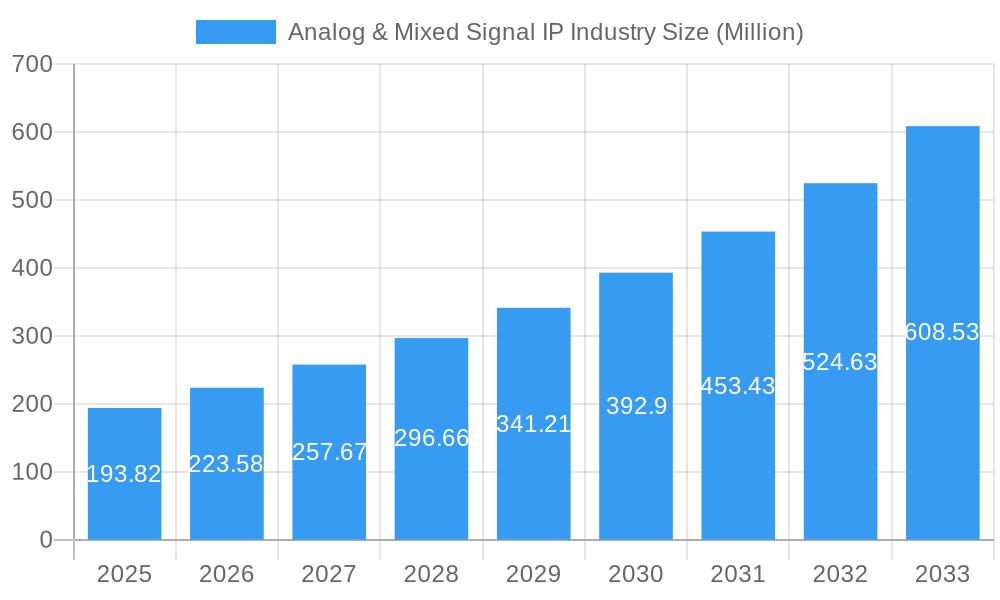

The Analog & Mixed Signal (AMS) IP market is experiencing robust growth, projected to reach $193.82 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.17% from 2025 to 2033. This expansion is driven primarily by the increasing demand for advanced features in consumer electronics, particularly smartphones and wearables, which require sophisticated power management and high-performance analog components. The automotive industry's transition towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is another significant growth catalyst, requiring highly integrated and reliable AMS IP for powertrain control, sensor integration, and safety systems. Furthermore, the burgeoning telecommunications sector, with its focus on 5G and beyond, necessitates high-speed, low-power AMS solutions for efficient data processing and signal transmission. The market is segmented by product type (A2D and D2A converters, power management modules, RF components, and other products), end-user industry (consumer electronics, telecommunications, automotive, industrial, and others), and IP design type (firm/soft IP and hard IP). This segmentation reflects the diverse applications of AMS IP across various technological domains. Leading companies like Xilinx, Renesas, and Synopsys are actively shaping the market through innovation and strategic acquisitions.

Analog & Mixed Signal IP Industry Market Size (In Million)

The geographical distribution of the AMS IP market is fairly diverse, with North America and Asia Pacific anticipated to be the leading regions throughout the forecast period. Strong technological advancements and a robust electronics manufacturing base in these regions will continue to drive demand. However, emerging economies in Asia Pacific and other regions are also expected to exhibit significant growth, fueled by increasing investments in infrastructure and technological advancements. The key restraints to market growth include the complexity of designing and verifying AMS IP, the high cost of development, and the need for specialized expertise. Despite these challenges, the ongoing technological advancements and increasing demand from diverse end-user industries are expected to propel significant growth in the AMS IP market over the coming years, reinforcing its strategic importance in various technology sectors.

Analog & Mixed Signal IP Industry Company Market Share

Analog & Mixed Signal IP Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Analog & Mixed Signal IP industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategists seeking to navigate this dynamic market. The market is segmented by Product (A2D and D2A Converter, Power Management Modules, RF, Other Products), End-user Industry (Consumer Electronics, Telecommunication, Automotive, Industrial, Other End-user Industries), and Design (Firm/Soft IP, Hard IP). Key players analyzed include Xilinx Inc, Renesas Electronics Corporation, Silicon Creations LLC, Synopsys Inc, Cadence Design Systems Inc, VeriSilicon Holdings Co Ltd, Analog Devices Inc, Maxim Integrated Products Inc, Texas Instruments Limited, ARM Holdings PLC, and Intel Corporation. The report projects a total market value of xx Million units by 2033.

Analog & Mixed Signal IP Industry Market Dynamics & Structure

The Analog & Mixed Signal IP market is characterized by moderate concentration, with a few dominant players alongside numerous smaller specialized firms. Technological innovation, particularly in areas like 5G, AI, and IoT, is a primary growth driver. Stringent regulatory frameworks concerning data security and power efficiency influence product development and adoption. Competitive substitutes include software-defined solutions and FPGA-based implementations. The end-user demographics are diverse, encompassing consumer electronics, automotive, telecommunications, and industrial sectors. M&A activity has been notable, with several strategic acquisitions aiming to expand product portfolios and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation Drivers: 5G deployment, AI advancements, IoT expansion, and increasing demand for high-performance computing.

- Regulatory Frameworks: Compliance with industry standards (e.g., automotive safety standards) and data privacy regulations.

- Competitive Product Substitutes: Software-defined radio, FPGA-based solutions, and open-source IP cores.

- End-User Demographics: Shifting consumer preferences towards energy efficiency, enhanced performance, and compact device sizes.

- M&A Trends: xx major mergers and acquisitions recorded between 2019 and 2024, focusing on expanding product offerings and technological expertise. A projected xx deals in the forecast period.

Analog & Mixed Signal IP Industry Growth Trends & Insights

The Analog & Mixed Signal IP market experienced robust growth between 2019 and 2024, driven by increasing demand across various end-user industries. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. This growth trajectory is expected to continue, albeit at a moderated pace, throughout the forecast period (2025-2033). The adoption rate of advanced Analog & Mixed Signal IP solutions is increasing steadily, particularly within the automotive and telecommunications sectors. Technological disruptions, such as the rise of 5G and the increasing sophistication of AI applications, create new opportunities while simultaneously challenging existing players to adapt and innovate. Consumer behavior shifts, such as the increasing demand for high-bandwidth connectivity and energy-efficient devices, further drive market growth. The projected CAGR for 2025-2033 is xx%, resulting in a market size of xx Million units by 2033.

Dominant Regions, Countries, or Segments in Analog & Mixed Signal IP Industry

North America and Asia-Pacific currently dominate the Analog & Mixed Signal IP market, driven by robust technological advancements and substantial investments in R&D. Within product segments, RF and power management modules are leading the growth due to increased demand from 5G and IoT applications. The automotive industry displays considerable potential in both regions, while the consumer electronics sector is a significant driver in Asia-Pacific. Within design categories, hard IP dominates, reflecting the demand for high-performance and reliable solutions. However, firm/soft IP is experiencing increasing adoption due to cost and time-to-market advantages.

- Key Drivers (North America): Strong R&D investments, presence of major industry players, established infrastructure, and government support.

- Key Drivers (Asia-Pacific): Rapid technological advancements, increasing consumer electronics manufacturing, and expanding telecommunication infrastructure.

- Dominant Product Segment: RF and Power Management Modules (due to 5G and IoT growth).

- Dominant End-User Industry: Automotive and Telecommunications (high growth potential and technological demand).

- Dominant Design Category: Hard IP (reliability and performance).

Analog & Mixed Signal IP Industry Product Landscape

The Analog & Mixed Signal IP product landscape is characterized by continuous innovation, focusing on enhancing performance, reducing power consumption, and integrating advanced functionalities. Recent advancements include highly integrated solutions with advanced process nodes, resulting in smaller form factors and improved efficiency. Unique selling propositions include superior noise performance, improved linearity, and increased bandwidth. Technological advancements involve integrating AI capabilities and employing advanced packaging techniques.

Key Drivers, Barriers & Challenges in Analog & Mixed Signal IP Industry

Key Drivers:

- Growing demand for high-bandwidth applications (5G, IoT)

- Increased adoption of advanced driver-assistance systems (ADAS) in automotive

- Rising need for energy-efficient solutions across various sectors

Challenges & Restraints:

- High development costs and design complexity

- Intense competition from established and emerging players

- Supply chain disruptions and component shortages impacting production (estimated to impact market growth by xx% in 2026).

- Stringent regulatory requirements and certifications (estimated to increase development time by an average of xx months).

Emerging Opportunities in Analog & Mixed Signal IP Industry

- Expanding applications in healthcare and wearable technology.

- Growing demand for high-precision sensors and actuators in industrial automation.

- Emergence of new materials and processes leading to enhanced performance and cost reductions.

Growth Accelerators in the Analog & Mixed Signal IP Industry

Long-term growth in the Analog & Mixed Signal IP industry will be driven by technological breakthroughs in areas like advanced process nodes, new materials, and innovative circuit architectures. Strategic partnerships between IP providers and system integrators will play a crucial role. Expanding into untapped markets, such as medical devices and aerospace, will present significant opportunities.

Key Players Shaping the Analog & Mixed Signal IP Market

Notable Milestones in Analog & Mixed Signal IP Industry Sector

- August 2020: Silicon Creations' SerDes technology deployed in an 8K digital TV SoC by NovatekMicroelectronics Corp. This highlighted the growing demand for high-bandwidth solutions in consumer electronics.

- February 2020: Marvell and Analog Devices announced a collaboration to develop 5G base station solutions, indicating the strategic importance of partnerships in the 5G ecosystem.

In-Depth Analog & Mixed Signal IP Industry Market Outlook

The future of the Analog & Mixed Signal IP market appears bright, propelled by the continued growth of high-bandwidth applications and the increasing demand for energy-efficient solutions. Strategic partnerships, technological advancements, and expansion into emerging markets will be key to success. The market is poised for substantial growth in the coming years, presenting significant opportunities for both established and emerging players.

Analog & Mixed Signal IP Industry Segmentation

-

1. Design

- 1.1. Firm/Soft IP

- 1.2. Hard IP

-

2. Product

- 2.1. A2D and D2A Converter

- 2.2. Power Management Modules

- 2.3. RF

- 2.4. Other Products

-

3. End-user Industry

- 3.1. Consumer Electronics

- 3.2. Telecommunication

- 3.3. Automotive

- 3.4. Industrial

- 3.5. Other End-user Industries

Analog & Mixed Signal IP Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Analog & Mixed Signal IP Industry Regional Market Share

Geographic Coverage of Analog & Mixed Signal IP Industry

Analog & Mixed Signal IP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Reusability of AMS Block; Growing Prevalence of Wireless Communications

- 3.3. Market Restrains

- 3.3.1. Complexity and Sensitivity of Analog/Mixed-Signal (AMS) design

- 3.4. Market Trends

- 3.4.1. Telecommunication is Expected Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Analog & Mixed Signal IP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Design

- 5.1.1. Firm/Soft IP

- 5.1.2. Hard IP

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. A2D and D2A Converter

- 5.2.2. Power Management Modules

- 5.2.3. RF

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Electronics

- 5.3.2. Telecommunication

- 5.3.3. Automotive

- 5.3.4. Industrial

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Design

- 6. North America Analog & Mixed Signal IP Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Design

- 6.1.1. Firm/Soft IP

- 6.1.2. Hard IP

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. A2D and D2A Converter

- 6.2.2. Power Management Modules

- 6.2.3. RF

- 6.2.4. Other Products

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Consumer Electronics

- 6.3.2. Telecommunication

- 6.3.3. Automotive

- 6.3.4. Industrial

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Design

- 7. Europe Analog & Mixed Signal IP Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Design

- 7.1.1. Firm/Soft IP

- 7.1.2. Hard IP

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. A2D and D2A Converter

- 7.2.2. Power Management Modules

- 7.2.3. RF

- 7.2.4. Other Products

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Consumer Electronics

- 7.3.2. Telecommunication

- 7.3.3. Automotive

- 7.3.4. Industrial

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Design

- 8. Asia Pacific Analog & Mixed Signal IP Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Design

- 8.1.1. Firm/Soft IP

- 8.1.2. Hard IP

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. A2D and D2A Converter

- 8.2.2. Power Management Modules

- 8.2.3. RF

- 8.2.4. Other Products

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Consumer Electronics

- 8.3.2. Telecommunication

- 8.3.3. Automotive

- 8.3.4. Industrial

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Design

- 9. Latin America Analog & Mixed Signal IP Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Design

- 9.1.1. Firm/Soft IP

- 9.1.2. Hard IP

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. A2D and D2A Converter

- 9.2.2. Power Management Modules

- 9.2.3. RF

- 9.2.4. Other Products

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Consumer Electronics

- 9.3.2. Telecommunication

- 9.3.3. Automotive

- 9.3.4. Industrial

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Design

- 10. Middle East Analog & Mixed Signal IP Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Design

- 10.1.1. Firm/Soft IP

- 10.1.2. Hard IP

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. A2D and D2A Converter

- 10.2.2. Power Management Modules

- 10.2.3. RF

- 10.2.4. Other Products

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Consumer Electronics

- 10.3.2. Telecommunication

- 10.3.3. Automotive

- 10.3.4. Industrial

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Design

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Xilinx Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renesas Electronics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Silicon Creations LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Synopsys Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cadence Design Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VeriSilicon Holdings Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Analog Devices Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maxim Integrated Products Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Limite

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ARM Holdings PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Intel Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Xilinx Inc

List of Figures

- Figure 1: Global Analog & Mixed Signal IP Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Analog & Mixed Signal IP Industry Revenue (Million), by Design 2025 & 2033

- Figure 3: North America Analog & Mixed Signal IP Industry Revenue Share (%), by Design 2025 & 2033

- Figure 4: North America Analog & Mixed Signal IP Industry Revenue (Million), by Product 2025 & 2033

- Figure 5: North America Analog & Mixed Signal IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Analog & Mixed Signal IP Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Analog & Mixed Signal IP Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Analog & Mixed Signal IP Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Analog & Mixed Signal IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Analog & Mixed Signal IP Industry Revenue (Million), by Design 2025 & 2033

- Figure 11: Europe Analog & Mixed Signal IP Industry Revenue Share (%), by Design 2025 & 2033

- Figure 12: Europe Analog & Mixed Signal IP Industry Revenue (Million), by Product 2025 & 2033

- Figure 13: Europe Analog & Mixed Signal IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Analog & Mixed Signal IP Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Analog & Mixed Signal IP Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Analog & Mixed Signal IP Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Analog & Mixed Signal IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Analog & Mixed Signal IP Industry Revenue (Million), by Design 2025 & 2033

- Figure 19: Asia Pacific Analog & Mixed Signal IP Industry Revenue Share (%), by Design 2025 & 2033

- Figure 20: Asia Pacific Analog & Mixed Signal IP Industry Revenue (Million), by Product 2025 & 2033

- Figure 21: Asia Pacific Analog & Mixed Signal IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Asia Pacific Analog & Mixed Signal IP Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Analog & Mixed Signal IP Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Analog & Mixed Signal IP Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Analog & Mixed Signal IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Analog & Mixed Signal IP Industry Revenue (Million), by Design 2025 & 2033

- Figure 27: Latin America Analog & Mixed Signal IP Industry Revenue Share (%), by Design 2025 & 2033

- Figure 28: Latin America Analog & Mixed Signal IP Industry Revenue (Million), by Product 2025 & 2033

- Figure 29: Latin America Analog & Mixed Signal IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Latin America Analog & Mixed Signal IP Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Analog & Mixed Signal IP Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Analog & Mixed Signal IP Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Analog & Mixed Signal IP Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Analog & Mixed Signal IP Industry Revenue (Million), by Design 2025 & 2033

- Figure 35: Middle East Analog & Mixed Signal IP Industry Revenue Share (%), by Design 2025 & 2033

- Figure 36: Middle East Analog & Mixed Signal IP Industry Revenue (Million), by Product 2025 & 2033

- Figure 37: Middle East Analog & Mixed Signal IP Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Middle East Analog & Mixed Signal IP Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East Analog & Mixed Signal IP Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East Analog & Mixed Signal IP Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Analog & Mixed Signal IP Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Design 2020 & 2033

- Table 2: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Design 2020 & 2033

- Table 6: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Design 2020 & 2033

- Table 10: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Design 2020 & 2033

- Table 14: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 15: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Design 2020 & 2033

- Table 18: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 19: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Design 2020 & 2033

- Table 22: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Analog & Mixed Signal IP Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog & Mixed Signal IP Industry?

The projected CAGR is approximately 15.17%.

2. Which companies are prominent players in the Analog & Mixed Signal IP Industry?

Key companies in the market include Xilinx Inc, Renesas Electronics Corporation, Silicon Creations LLC, Synopsys Inc, Cadence Design Systems Inc, VeriSilicon Holdings Co Ltd, Analog Devices Inc, Maxim Integrated Products Inc, Texas Instruments Limite, ARM Holdings PLC, Intel Corporation.

3. What are the main segments of the Analog & Mixed Signal IP Industry?

The market segments include Design, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 193.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Reusability of AMS Block; Growing Prevalence of Wireless Communications.

6. What are the notable trends driving market growth?

Telecommunication is Expected Hold a Significant Share.

7. Are there any restraints impacting market growth?

Complexity and Sensitivity of Analog/Mixed-Signal (AMS) design.

8. Can you provide examples of recent developments in the market?

August 2020 - The SerDes Technology of Silicon Creations was deployed as a V-by-One HS receiver in an SoC designed by NovatekMicroelectronics Corp. for an 8K digital TV application. The company designed the frame-rate converter SoC on TSMC's 12nm process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Analog & Mixed Signal IP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Analog & Mixed Signal IP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Analog & Mixed Signal IP Industry?

To stay informed about further developments, trends, and reports in the Analog & Mixed Signal IP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence