Key Insights

The Global General Purpose Analog IC Market is projected to reach $102.52 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 10.2%. This significant growth is propelled by the essential role of analog integrated circuits across diverse industries, including consumer electronics, automotive, industrial automation, and telecommunications. The fundamental requirement for signal conditioning, amplification, and conversion in all electronic devices ensures the market's sustained expansion. Key growth catalysts include the proliferation of the Internet of Things (IoT), the widespread deployment of 5G technology, and the advancement of automotive driver-assistance systems (ADAS). Additionally, the increasing integration of analog functionalities into System-on-Chip (SoC) designs and the continuous pursuit of miniaturization and power efficiency in electronic devices are shaping product innovation and market demand. The Asia-Pacific region is anticipated to lead market growth, driven by its strong manufacturing capabilities and rapid technological adoption.

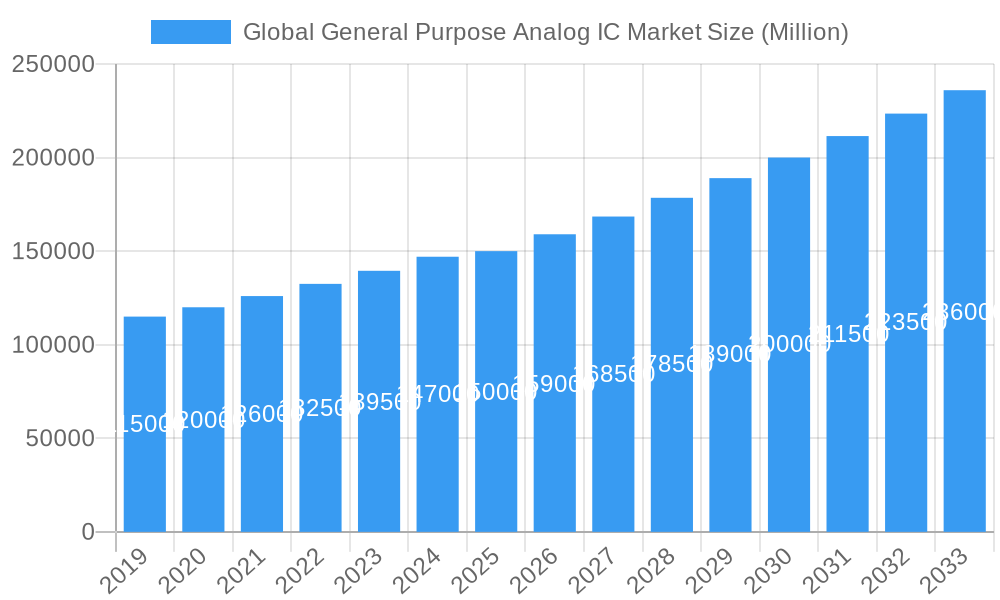

Global General Purpose Analog IC Market Market Size (In Billion)

The market is forecasted to experience a CAGR of approximately 6.5% during the study period of 2019-2033, indicating a consistent and substantial upward trend. This sustained growth will be supported by ongoing innovation in high-performance amplifiers, precise voltage regulators, and advanced mixed-signal ICs. The automotive sector's increasing reliance on sophisticated electronic systems, alongside the continuous evolution of smart home devices and wearable technology, will further fuel demand. Industrial applications, such as smart grids and advanced sensor networks, are also significant contributors. Despite a competitive landscape featuring established and emerging players, the fundamental and escalating need for analog solutions ensures a dynamic and expanding market for general-purpose analog ICs throughout the forecast period.

Global General Purpose Analog IC Market Company Market Share

This report provides a comprehensive analysis of the Global General Purpose Analog IC Market, covering key market dynamics, growth trends, regional insights, product segmentation, drivers, opportunities, and leading market participants. Spanning the forecast period of 2019–2033, with a base year of 2025, this research offers critical intelligence for stakeholders aiming to leverage opportunities within this vital segment of the semiconductor industry. Gain strategic advantages through detailed market forecasts and insights into the evolving landscape of interface, power management, signal conversion, and amplifier/comparator applications.

Global General Purpose Analog IC Market Market Dynamics & Structure

The global general-purpose analog IC market exhibits a moderately concentrated structure, with leading players such as Texas Instruments, Analog Devices, Infineon Technologies, STMicroelectronics, and Onsemi holding significant market shares. Technological innovation remains a primary driver, fueled by the increasing sophistication of consumer electronics, automotive systems, industrial automation, and communication infrastructure. The demand for higher performance, lower power consumption, and enhanced functionality in analog ICs continuously pushes research and development efforts. Regulatory frameworks, particularly concerning environmental standards and semiconductor manufacturing practices, influence production and material sourcing. Competitive product substitutes, while present in niche applications, are often outpaced by the cost-effectiveness and integrated capabilities of general-purpose analog ICs. End-user demographics are broadening, with a growing demand from emerging economies and an aging population requiring more advanced medical devices. Mergers and acquisition (M&A) trends are evident as companies seek to expand their product portfolios, acquire new technologies, and consolidate market presence. The market has seen approximately 15-20 M&A deals annually in the historical period, indicating a strategic consolidation phase. Barriers to innovation include the high cost of R&D, stringent qualification processes for critical applications like automotive and medical, and the long product lifecycle of some established devices.

Global General Purpose Analog IC Market Growth Trends & Insights

The global general-purpose analog IC market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year 2025 through 2033. This sustained growth trajectory is underpinned by several key trends. Firstly, the relentless proliferation of the Internet of Things (IoT) devices, from smart home appliances to industrial sensors, necessitates a continuous supply of analog ICs for signal conditioning, power management, and connectivity. The adoption rate of analog ICs in these burgeoning applications is expected to reach over 70% by 2028. Secondly, the automotive sector is a major growth engine, with the increasing electrification of vehicles, advanced driver-assistance systems (ADAS), and in-car infotainment demanding sophisticated analog solutions for battery management, sensor interfaces, and audio amplification. The market penetration of analog ICs in new automotive models is projected to exceed 90% by 2030. Technological disruptions, such as the advancement in analog-to-digital converter (ADC) and digital-to-analog converter (DAC) technologies, enabling higher resolution and faster conversion rates, are further fueling demand. Consumer behavior shifts towards more integrated and intelligent devices also play a crucial role, pushing manufacturers to incorporate advanced analog functionalities. The market size, estimated at approximately USD 65,000 million units in 2025, is anticipated to reach over USD 105,000 million units by 2033. Furthermore, the growing demand for high-performance computing and data centers requires efficient power management ICs and high-speed signal processing capabilities, areas where general-purpose analog ICs excel. The ongoing miniaturization of electronic devices also pressures analog IC manufacturers to deliver smaller, more power-efficient components without compromising on performance.

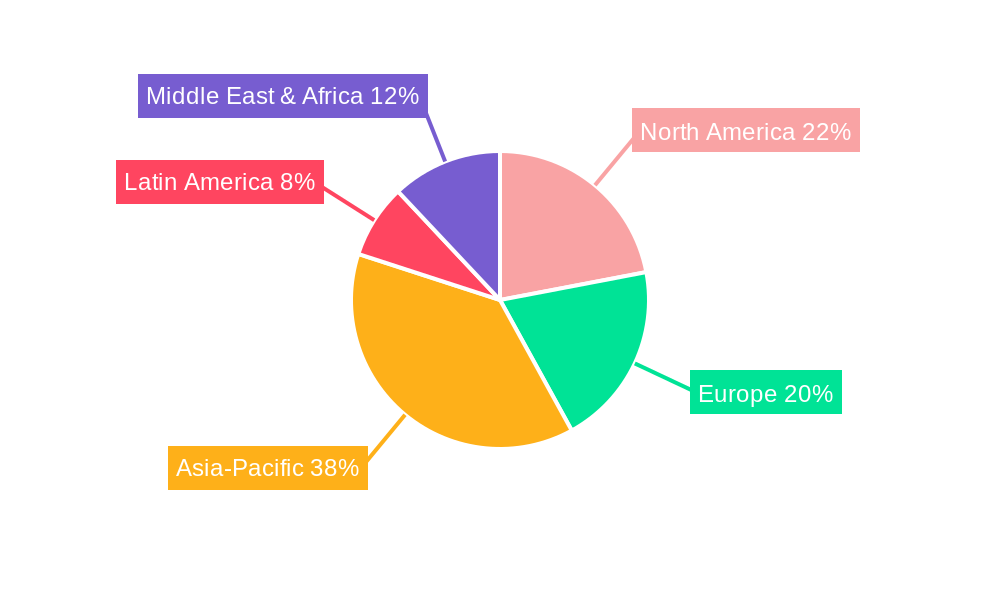

Dominant Regions, Countries, or Segments in Global General Purpose Analog IC Market

Asia Pacific stands out as the dominant region in the global general-purpose analog IC market, driven by its robust manufacturing capabilities, the presence of major electronics assembly hubs, and an ever-increasing domestic demand for consumer electronics, automotive, and industrial products. Countries like China, Taiwan, South Korea, and Japan are at the forefront of this dominance, contributing significantly to both production and consumption. China, in particular, is a powerhouse, not only as a major consumer but also as a rapidly developing hub for semiconductor design and manufacturing. The market share of Asia Pacific in the global general-purpose analog IC market is estimated to be around 45% in 2025, with a projected growth potential exceeding 7% CAGR during the forecast period.

Among the application segments, Power Management is emerging as the most significant growth driver. This is directly attributable to the exponential rise in demand for energy-efficient solutions across all sectors.

- Power Management: This segment is witnessing an unprecedented surge due to the global focus on energy conservation, the proliferation of portable electronics, and the electrification of transportation. The increasing complexity of power delivery in modern electronic systems, from smartphones to electric vehicles, necessitates advanced power management ICs, including voltage regulators, DC-DC converters, and battery chargers. Market share for this segment is estimated at 30% in 2025, projected to reach over 35% by 2033.

- Interface ICs: As connectivity becomes paramount in the digital age, interface ICs, such as serializers/deserializers, USB controllers, and Ethernet PHYs, are crucial for seamless data transfer between different components and systems. The growth in IoT and advanced communication networks fuels demand in this area.

- Signal Conversion (ADC/DAC): High-resolution and high-speed analog-to-digital converters (ADCs) and digital-to-analog converters (DACs) are essential for accurate data acquisition and signal processing in applications ranging from medical imaging to industrial automation and high-fidelity audio.

- Amplifier/Comparator: These fundamental analog building blocks remain indispensable across virtually all electronic circuits for signal amplification and comparison, experiencing steady growth with the expansion of end-user industries.

Economic policies in Asia Pacific, such as government incentives for semiconductor manufacturing and R&D, coupled with substantial investments in infrastructure, further solidify the region's leadership. The presence of major electronics manufacturers and their expanding supply chains in the region also create a concentrated demand for general-purpose analog ICs.

Global General Purpose Analog IC Market Product Landscape

The product landscape of the global general-purpose analog IC market is characterized by a constant stream of innovations focused on enhanced performance, miniaturization, and improved power efficiency. Key product types include a wide array of voltage regulators, current sensors, operational amplifiers, comparators, data converters (ADCs and DACs), and interface ICs. Manufacturers are increasingly emphasizing the integration of multiple functionalities into single chips, leading to System-in-Package (SiP) solutions and compact designs. For instance, advanced power management ICs are now incorporating sophisticated digital control features, while high-speed ADCs are achieving higher sampling rates and greater resolution, enabling more precise signal acquisition. The focus on specific applications like automotive, industrial IoT, and consumer electronics drives the development of specialized variants, though general-purpose components maintain a broad appeal due to their versatility and cost-effectiveness. Unique selling propositions often revolve around ultra-low power consumption for battery-operated devices, high precision for measurement applications, and robust performance in harsh environmental conditions.

Key Drivers, Barriers & Challenges in Global General Purpose Analog IC Market

Key Drivers:

- Ubiquitous Demand from Emerging Technologies: The explosion of IoT devices, 5G infrastructure, electric vehicles (EVs), and advanced medical equipment directly fuels the demand for general-purpose analog ICs. These technologies require efficient power management, precise signal conditioning, and reliable data conversion.

- Miniaturization and Increased Functionality: Consumer demand for smaller, more powerful, and feature-rich electronic devices compels manufacturers to develop smaller, more integrated analog ICs with enhanced performance characteristics.

- Growth in Automotive and Industrial Automation: The increasing sophistication of automotive systems (ADAS, infotainment, electrification) and the drive towards Industry 4.0 in manufacturing environments necessitate a wide range of analog components for sensing, control, and communication.

- Cost-Effectiveness and Versatility: General-purpose analog ICs offer a compelling balance of performance and cost, making them the preferred choice for a broad spectrum of applications where highly specialized components are not required.

Barriers & Challenges:

- Supply Chain Volatility and Geopolitical Risks: The semiconductor industry, including analog ICs, is susceptible to disruptions in raw material sourcing, manufacturing capacity constraints, and geopolitical tensions impacting global trade. The estimated impact of such disruptions can lead to price increases of 10-20% and lead time extensions of 2-6 months.

- Intense Competition and Price Pressure: The market is highly competitive, with numerous players vying for market share, leading to significant price pressure, especially for mature product categories.

- Increasing R&D Costs and Technological Complexity: Developing cutting-edge analog ICs requires substantial investment in research and development, posing a challenge for smaller companies. The increasing complexity of analog design also requires highly skilled engineering talent.

- Regulatory Compliance and Environmental Standards: Adhering to evolving environmental regulations and international compliance standards adds to manufacturing costs and complexity.

Emerging Opportunities in Global General Purpose Analog IC Market

Emerging opportunities within the global general-purpose analog IC market are significantly influenced by the ongoing digital transformation and the push for sustainable technologies. The expansion of the electric vehicle (EV) market presents a substantial opportunity for advanced analog ICs used in battery management systems (BMS), onboard chargers, and powertrain control. Furthermore, the increasing adoption of renewable energy sources like solar and wind power drives demand for analog ICs in power conversion and grid management systems. The growing healthcare sector, with its focus on remote patient monitoring and wearable health devices, also creates a demand for low-power, high-precision analog components. The development of next-generation communication networks beyond 5G, such as 6G, will necessitate new analog solutions for higher frequencies and increased data throughput. The increasing adoption of AI and machine learning in edge computing applications also opens avenues for specialized analog ICs that can efficiently process data at the source.

Growth Accelerators in the Global General Purpose Analog IC Market Industry

Several key catalysts are accelerating the growth of the global general-purpose analog IC market. The rapid advancements in materials science and fabrication technologies are enabling the development of smaller, faster, and more power-efficient analog components. Strategic partnerships between analog IC manufacturers and system integrators or original equipment manufacturers (OEMs) are crucial for co-development and faster market penetration, ensuring that new analog solutions meet specific application needs. Furthermore, the increasing trend towards system-on-chip (SoC) integration, where analog and digital functionalities are combined on a single die, although often leading to specialized ICs, also drives innovation in the core analog building blocks that find their way into general-purpose offerings. Market expansion strategies targeting developing economies, where the adoption of electronics is rapidly growing, represent another significant growth accelerator.

Key Players Shaping the Global General Purpose Analog IC Market Market

- Onsemi

- Analog Devices

- Infineon Technologies

- Microchip Technology Inc

- NXP Semiconductors

- STMicroelectronics

- Skywork Solutions Inc

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Maxim Integrated Products Inc

- Taiwan Semiconductor

Notable Milestones in Global General Purpose Analog IC Market Sector

- November 2021: Texas Instruments announced its plans to begin construction of its new 300-millimeter semiconductor wafer fabrication plants (or "fabs") in Sherman, Texas. The company's analog and embedded processing 300-mm fabs at the Sherman site are part of its long-term capacity planning to continue to strengthen its manufacturing and technology competitive advantage. This move signals a significant investment in increasing manufacturing capacity for critical analog components, aiming to address long-term demand and secure supply chains.

- 2022: Analog Devices completed its acquisition of Maxim Integrated Products, a move that significantly consolidated the analog IC market, expanding Analog Devices' product portfolio and market reach in key sectors like automotive and industrial.

- 2023: Infineon Technologies announced advancements in its silicon carbide (SiC) and gallium nitride (GaN) power semiconductor technologies, which, while often used in specialized high-power applications, are also influencing the development of more efficient and compact general-purpose power management ICs.

In-Depth Global General Purpose Analog IC Market Market Outlook

The future outlook for the global general-purpose analog IC market is exceptionally bright, driven by an enduring and expanding demand across a multitude of burgeoning technologies. Growth accelerators such as the ongoing digital transformation, the push for electrification in transportation and energy sectors, and the relentless pursuit of smarter, more connected devices will continue to propel the market forward. Strategic investments in advanced manufacturing capabilities, like those announced by Texas Instruments, are crucial for meeting future demand and ensuring supply chain resilience. The innovation in analog design, focusing on miniaturization, enhanced power efficiency, and higher integration levels, will further unlock new application possibilities. Emerging markets represent significant untapped potential, and as their economies develop, the adoption of electronic devices will naturally increase, creating a substantial customer base for general-purpose analog ICs. The synergistic effect of technological breakthroughs and strategic market expansion will ensure that this vital segment of the semiconductor industry remains a cornerstone of technological advancement for years to come.

Global General Purpose Analog IC Market Segmentation

-

1. Application

- 1.1. Interface

- 1.2. Power Management

- 1.3. Signal Conversion

- 1.4. Amplifier/Comparator

Global General Purpose Analog IC Market Segmentation By Geography

- 1. North America

- 2. Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Global General Purpose Analog IC Market Regional Market Share

Geographic Coverage of Global General Purpose Analog IC Market

Global General Purpose Analog IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in fabrication techniques; Increasing end-user applications; Advancements in Internet of Things and Artificial Intelligence

- 3.3. Market Restrains

- 3.3.1. Design Complexity and high costs; Increasing popularity of application specific analog Ics

- 3.4. Market Trends

- 3.4.1. Increasing Factory Automation is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Interface

- 5.1.2. Power Management

- 5.1.3. Signal Conversion

- 5.1.4. Amplifier/Comparator

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Interface

- 6.1.2. Power Management

- 6.1.3. Signal Conversion

- 6.1.4. Amplifier/Comparator

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Interface

- 7.1.2. Power Management

- 7.1.3. Signal Conversion

- 7.1.4. Amplifier/Comparator

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Interface

- 8.1.2. Power Management

- 8.1.3. Signal Conversion

- 8.1.4. Amplifier/Comparator

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Interface

- 9.1.2. Power Management

- 9.1.3. Signal Conversion

- 9.1.4. Amplifier/Comparator

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Onsemi

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Analog Devices

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Infenion Technologies*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Microchip Technology Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NXP Semiconductors

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STMicroelectronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Skywork Solutions Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Renesas Electronics Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Texas Instruments Incorporated

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Maxim Integrated Products Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Taiwan Semiconductor

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Onsemi

List of Figures

- Figure 1: Global Global General Purpose Analog IC Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Rest of the World Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global General Purpose Analog IC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global General Purpose Analog IC Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Global General Purpose Analog IC Market?

Key companies in the market include Onsemi, Analog Devices, Infenion Technologies*List Not Exhaustive, Microchip Technology Inc, NXP Semiconductors, STMicroelectronics, Skywork Solutions Inc, Renesas Electronics Corporation, Texas Instruments Incorporated, Maxim Integrated Products Inc, Taiwan Semiconductor.

3. What are the main segments of the Global General Purpose Analog IC Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 102.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Advancements in fabrication techniques; Increasing end-user applications; Advancements in Internet of Things and Artificial Intelligence.

6. What are the notable trends driving market growth?

Increasing Factory Automation is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Design Complexity and high costs; Increasing popularity of application specific analog Ics.

8. Can you provide examples of recent developments in the market?

November 2021 - Texas Instruments announced its plans to begin construction of its new 300-millimeter semiconductor wafer fabrication plants (or "fabs") in Sherman, Texas. The company's analog and embedded processing 300-mm fabs at the Sherman site are part of its long-term capacity planning to continue to strengthen its manufacturing and technology competitive advantage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global General Purpose Analog IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global General Purpose Analog IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global General Purpose Analog IC Market?

To stay informed about further developments, trends, and reports in the Global General Purpose Analog IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence