Key Insights

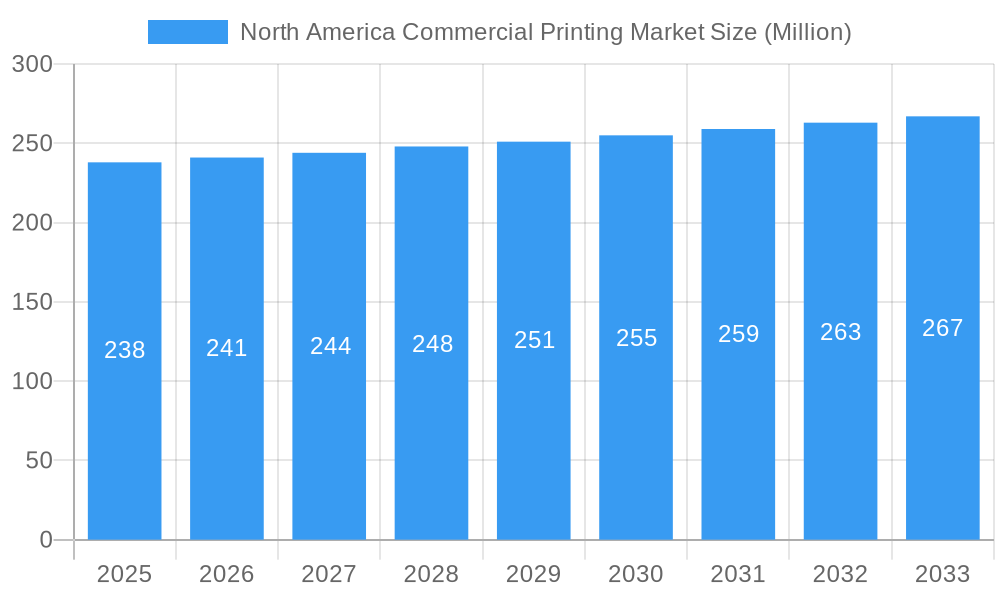

The North American commercial printing market, valued at $238 million in 2025, is projected to experience moderate growth, driven primarily by the increasing demand for personalized marketing materials and packaging solutions. While the Compound Annual Growth Rate (CAGR) of 1.27% suggests a relatively stable market, several factors contribute to this projection. The rise of e-commerce fuels the need for high-quality product packaging, pushing demand for specialized printing services. Simultaneously, businesses continue to invest in targeted marketing campaigns, further driving demand for printed materials like brochures, flyers, and direct mail pieces. Sustainability concerns are also impacting the industry, with a growing emphasis on eco-friendly inks, substrates, and printing processes. This trend, while initially posing challenges for some printers, presents opportunities for those adopting sustainable practices, attracting environmentally conscious clients. Despite the growth drivers, the market faces restraints such as the ongoing digitalization of marketing and communication, leading to decreased reliance on traditional print media for some applications. Competition from lower-cost international printers also presents a challenge. However, the North American market maintains a strong position due to its focus on specialized printing, quick turnaround times, and a robust network of established players. The market's segmentation includes various specialized areas like packaging printing, label printing, and commercial printing services, each responding differently to market forces and presenting diverse growth opportunities.

North America Commercial Printing Market Market Size (In Million)

The leading players in the North American commercial printing market, including Amcor, Graphic Packaging International, and others, are actively adapting to the evolving landscape through strategic acquisitions, technological investments, and the development of innovative printing solutions. Their ability to incorporate sustainable practices and cater to the growing demand for personalized and high-quality print products will be crucial in determining their success in the coming years. The forecast period of 2025-2033 anticipates a continuous but moderate expansion of the market, reflecting a balance between growth drivers and market restraints. Successful companies will leverage their established infrastructure, expertise, and technological capabilities to navigate the competitive dynamics and capitalize on emerging opportunities presented by evolving consumer preferences and market demands.

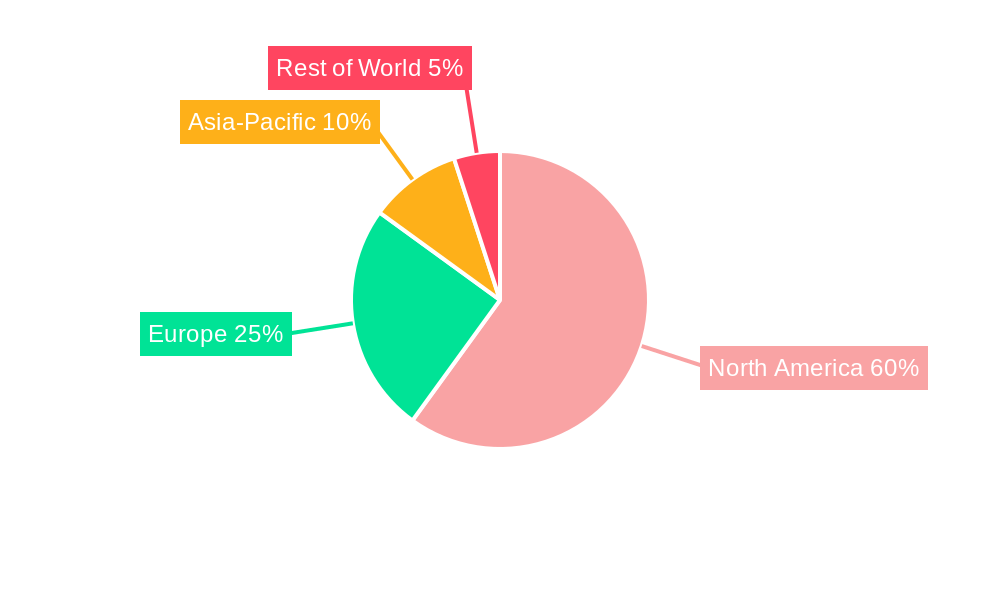

North America Commercial Printing Market Company Market Share

North America Commercial Printing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America commercial printing market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking a deep understanding of this dynamic sector.

North America Commercial Printing Market Market Dynamics & Structure

The North American commercial printing market is characterized by moderate concentration, with a few large players and numerous smaller firms. Technological innovation, particularly in digital printing and sustainable materials, is a major driver. Regulatory frameworks concerning environmental impact and data privacy significantly influence market operations. Competitive pressures from alternative printing technologies and digital marketing necessitate continuous adaptation. End-user demographics, including shifts in consumer preferences and industry-specific needs (e.g., packaging, publishing), greatly influence demand. The market has witnessed a moderate level of M&A activity in recent years, with larger companies seeking to expand their market share and service offerings.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong push towards digital printing, automation, and personalized solutions. Barrier to entry: High capital investment in advanced equipment.

- Regulatory Framework: Stringent environmental regulations impacting material choices and waste management. Data privacy laws influencing data handling practices.

- Competitive Substitutes: Digital marketing, e-books, and other digital alternatives pose competitive pressure.

- End-User Demographics: Growth driven by packaging, labels, and specialized printing segments.

- M&A Trends: Moderate activity, focusing on expansion into new technologies and geographic markets. xx M&A deals recorded between 2019 and 2024.

North America Commercial Printing Market Growth Trends & Insights

The North American commercial printing market experienced a CAGR of xx% during the historical period (2019-2024). The market size in 2024 was estimated at $xx million. This growth is attributed to increasing demand for customized packaging, particularly in the food and beverage, pharmaceutical, and consumer goods sectors. Technological advancements, such as the adoption of digital printing and inkjet technology, significantly improve production efficiency and turnaround times. Changes in consumer behavior, with a rising demand for personalized and sustainable products, are also driving market expansion. The market is anticipated to reach $xx million by 2033, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration of digital printing technologies is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in North America Commercial Printing Market

The Northeastern United States and California currently lead the North American commercial printing market, owing to their high population density, established industrial infrastructure, and significant presence of major companies. These regions benefit from advanced technological infrastructure and skilled labor, facilitating higher production efficiency. The packaging segment dominates market share due to the growth of e-commerce and consumer demand for attractively packaged goods.

- Key Drivers for Northeastern US and California:

- Strong industrial base and established supply chains.

- High concentration of key players.

- Advanced infrastructure and skilled labor.

- High demand from various end-use sectors.

- Market Share: Northeastern US accounts for approximately xx%, while California holds approximately xx% of the market share.

- Growth Potential: Continued growth expected, driven by increasing demand for specialized printing services and sustainable packaging.

North America Commercial Printing Market Product Landscape

The product landscape is diverse, encompassing a range of printing technologies (offset, digital, flexographic, screen printing), materials (paper, plastic films, textiles), and applications (packaging, labels, marketing collateral, books). Recent innovations focus on high-speed digital printing, personalized printing solutions, and sustainable materials. Unique selling propositions include faster turnaround times, cost-effectiveness, enhanced customization options, and environmentally friendly materials.

Key Drivers, Barriers & Challenges in North America Commercial Printing Market

Key Drivers:

- Increasing demand for customized packaging solutions.

- Growth of e-commerce and online retail.

- Technological advancements in digital printing and automation.

- Rising demand for sustainable and eco-friendly printing.

Challenges and Restraints:

- Intense competition from alternative printing technologies.

- Fluctuations in raw material prices and supply chain disruptions.

- Environmental regulations and sustainability concerns.

- Increasing labor costs and skill gaps. The impact of these factors has resulted in a xx% reduction in profit margins for some firms.

Emerging Opportunities in North America Commercial Printing Market

- Growth in personalized and on-demand printing.

- Expansion into niche market segments such as 3D printing and specialized packaging.

- Increasing demand for sustainable and eco-friendly printing solutions.

- Opportunities in the pharmaceutical and healthcare sectors for specialized packaging.

Growth Accelerators in the North America Commercial Printing Market Industry

Long-term growth is fueled by technological breakthroughs in digital printing, material science, and automation. Strategic partnerships between print providers and technology companies enhance efficiency and innovation. Market expansion into untapped segments and geographic regions will further drive industry growth. The adoption of Industry 4.0 principles enhances supply chain optimization and real-time data analysis.

Key Players Shaping the North America Commercial Printing Market Market

- C-P Flexible Packaging Inc

- Amcor Group

- Graphic Packaging International

- American Packaging Corporation

- Resource Label Group LLC

- Weber Packaging Solution

- Advanced Labelworx Inc

- Multi-colour Corporation

- OMNI Systems Inc

- Quad (formerly known as Quad/Graphics)

- Vistaprint (Cimpress PLC)

- R R Donnelley & Sons Company

- Deluxe Corporation

- Taylor Corporation

- LSC Communications LLC

- 4over LLC

- JPS Books + Logistics

- Cober Solutions

- CJ Graphics Inc

- Hemlock Printers Ltd *List Not Exhaustive

Notable Milestones in North America Commercial Printing Market Sector

- May 2024: American Packaging Corporation expands operations with a new digital printing unit in Wisconsin, boosting flexible packaging capacity.

- February 2024: Resource Label Group LLC launches RLG Healthcare, focusing on pharmaceutical and healthcare packaging solutions.

In-Depth North America Commercial Printing Market Market Outlook

The North American commercial printing market presents significant growth opportunities driven by ongoing technological advancements, expanding e-commerce, and increasing demand for customized packaging. Strategic investments in digital printing technologies, sustainable materials, and automation will be crucial for success. Companies focused on providing value-added services, including personalized solutions and efficient supply chain management, are poised for strong growth in the coming years.

North America Commercial Printing Market Segmentation

-

1. Technology

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Others (Electrophotography and Letterpress)

-

2. Application

- 2.1. Direct Mail

- 2.2. Books & Stationery

- 2.3. Business Forms & Cards

- 2.4. Tickets (Lottery, others)

- 2.5. Advertis

- 2.6. Transactional Print

- 2.7. Security

- 2.8. Labels

- 2.9. Packaging (Paper & Other Packaging)

- 2.10. Other Applications

-

3. North America Commercial Printing Growth Analysis

- 3.1. Factors Responsible for Growth Projections

- 3.2. Key Segm

- 3.3. Labels I

-

4. Printing Industry Supply Landscape

- 4.1. Printing

- 4.2. Inks & Toners

- 4.3. Printing Equipment

- 4.4. Print Components - Printheads, etc.

- 4.5. Printing Services in North America

North America Commercial Printing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Commercial Printing Market Regional Market Share

Geographic Coverage of North America Commercial Printing Market

North America Commercial Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth

- 3.3. Market Restrains

- 3.3.1. Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth

- 3.4. Market Trends

- 3.4.1. Packaging Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Others (Electrophotography and Letterpress)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Direct Mail

- 5.2.2. Books & Stationery

- 5.2.3. Business Forms & Cards

- 5.2.4. Tickets (Lottery, others)

- 5.2.5. Advertis

- 5.2.6. Transactional Print

- 5.2.7. Security

- 5.2.8. Labels

- 5.2.9. Packaging (Paper & Other Packaging)

- 5.2.10. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by North America Commercial Printing Growth Analysis

- 5.3.1. Factors Responsible for Growth Projections

- 5.3.2. Key Segm

- 5.3.3. Labels I

- 5.4. Market Analysis, Insights and Forecast - by Printing Industry Supply Landscape

- 5.4.1. Printing

- 5.4.2. Inks & Toners

- 5.4.3. Printing Equipment

- 5.4.4. Print Components - Printheads, etc.

- 5.4.5. Printing Services in North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 C-P Flexible Packaging Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Graphic Packaging International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Packaging Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Resource Label Group LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Weber Packaging Solution

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanced Labelworx Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Multi-colour Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OMNI Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Quad (formerly known as Quad/Graphics)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vistaprint (Cimpress PLC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 R R Donnelley & Sons Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Deluxe Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Taylor Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 LSC Communications LLC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 4over LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 JPS Books + Logistics

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Cober Solutions

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 CJ Graphics Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Hemlock Printers Ltd*List Not Exhaustive 7 2 Sustainability Trends in the North American Printing Industr

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 C-P Flexible Packaging Inc

List of Figures

- Figure 1: North America Commercial Printing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Commercial Printing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: North America Commercial Printing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 3: North America Commercial Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Commercial Printing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: North America Commercial Printing Market Revenue Million Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 6: North America Commercial Printing Market Volume Billion Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 7: North America Commercial Printing Market Revenue Million Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 8: North America Commercial Printing Market Volume Billion Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 9: North America Commercial Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: North America Commercial Printing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: North America Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: North America Commercial Printing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 13: North America Commercial Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North America Commercial Printing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: North America Commercial Printing Market Revenue Million Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 16: North America Commercial Printing Market Volume Billion Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 17: North America Commercial Printing Market Revenue Million Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 18: North America Commercial Printing Market Volume Billion Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 19: North America Commercial Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: North America Commercial Printing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canada North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Mexico North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Commercial Printing Market?

The projected CAGR is approximately 1.27%.

2. Which companies are prominent players in the North America Commercial Printing Market?

Key companies in the market include C-P Flexible Packaging Inc, Amcor Group, Graphic Packaging International, American Packaging Corporation, Resource Label Group LLC, Weber Packaging Solution, Advanced Labelworx Inc, Multi-colour Corporation, OMNI Systems Inc, Quad (formerly known as Quad/Graphics), Vistaprint (Cimpress PLC), R R Donnelley & Sons Company, Deluxe Corporation, Taylor Corporation, LSC Communications LLC, 4over LLC, JPS Books + Logistics, Cober Solutions, CJ Graphics Inc, Hemlock Printers Ltd*List Not Exhaustive 7 2 Sustainability Trends in the North American Printing Industr.

3. What are the main segments of the North America Commercial Printing Market?

The market segments include Technology, Application, North America Commercial Printing Growth Analysis, Printing Industry Supply Landscape.

4. Can you provide details about the market size?

The market size is estimated to be USD 238 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth.

6. What are the notable trends driving market growth?

Packaging Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth.

8. Can you provide examples of recent developments in the market?

May 2024: The American Packaging Corporation expanded its operations by opening a second production unit for digitally printed flexible packaging at its Wisconsin Center of Excellence. The company invested in this new unit's packaging equipment and service capabilities, including digital printing, laminating, registered coating, and pouch-making machinery. APC established a rapid response library of stocked packaging materials designed to fulfill orders within 15 days or less.February 2024: Resource Label Group LLC (RLG) announced the formation of a specialty pharmaceutical and healthcare packaging division named RLG Healthcare. The formation of RLG Healthcare is expected to help the company offer packaging solutions such as labels, inserts, cartons, and others for the pharmaceutical and healthcare sector in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Commercial Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Commercial Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Commercial Printing Market?

To stay informed about further developments, trends, and reports in the North America Commercial Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence