Key Insights

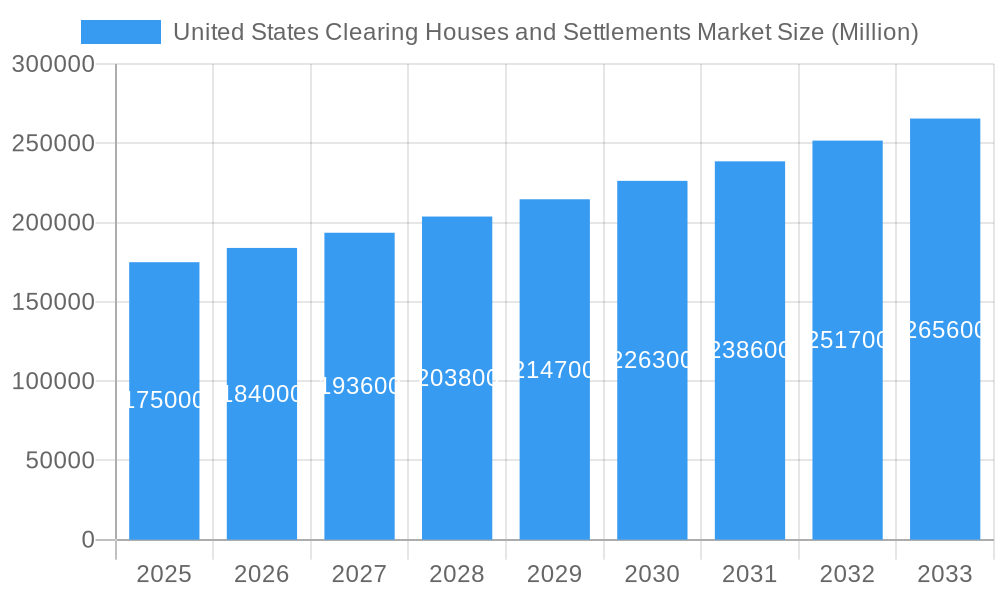

The United States Clearing Houses and Settlements market is projected for substantial growth, driven by a compound annual growth rate (CAGR) of 5%. The market size was valued at $6.75 billion in the base year 2024 and is expected to experience a significant upward trend through 2033. This expansion is fueled by the escalating volume and intricacy of financial transactions, necessitating advanced and dependable clearing and settlement infrastructures. Furthermore, regulatory mandates focused on bolstering market stability and mitigating systemic risks are stimulating demand for sophisticated clearing house solutions. Innovations in technology, including the integration of distributed ledger technology and advanced analytics, are enhancing operational efficiency and process optimization, thereby contributing to market momentum.

United States Clearing Houses and Settlements Market Market Size (In Billion)

Despite a strong growth outlook, the market encounters certain limitations. High upfront investments for infrastructure modernization and technology adoption, alongside continuous regulatory compliance expenditures, present considerable challenges. Cybersecurity vulnerabilities and the potential for operational disruptions remain critical concerns. Market segmentation is anticipated to encompass diverse asset classes (equities, fixed income, derivatives), client segments (institutional, retail), and clearing house models (central counterparty clearing houses, bilateral clearing). Key market participants, including prominent exchanges, offer comprehensive clearing and settlement services. Market concentration is expected within major U.S. financial centers, with emerging opportunities in developing financial hubs.

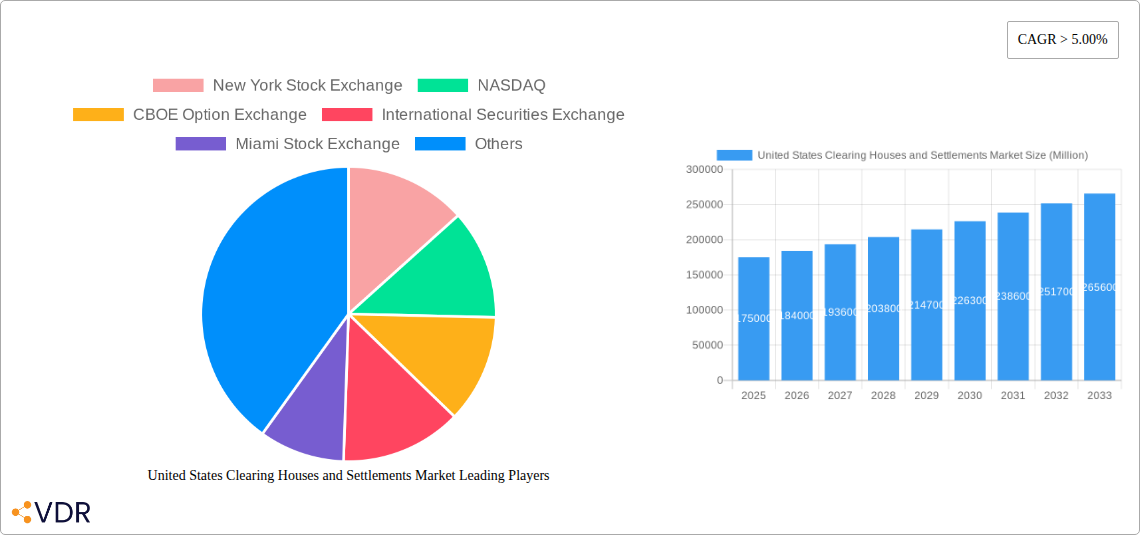

United States Clearing Houses and Settlements Market Company Market Share

United States Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Clearing Houses and Settlements Market, encompassing market dynamics, growth trends, regional analysis, product landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for investors, industry professionals, and strategists seeking to understand and capitalize on opportunities within this crucial financial sector. The parent market is the broader US financial services market, while the child market focuses specifically on clearing houses and settlement services.

Keywords: United States Clearing Houses, Settlements Market, Financial Services, Clearing House, Securities Settlement, Market Analysis, Market Size, Market Growth, Regulatory Framework, Technological Innovation, NYSE, NASDAQ, CBOE, MIAX, Market Share, Investment Opportunities, Fintech, Systemic Risk

United States Clearing Houses and Settlements Market Dynamics & Structure

The US clearing houses and settlements market is characterized by a concentrated structure, dominated by established players like the New York Stock Exchange, NASDAQ, and CBOE Option Exchange. However, the landscape is evolving with increased technological innovation and regulatory shifts. The market's concentration is approximately xx%, with the top 5 players holding xx%. Mergers and acquisitions (M&A) activity has been moderate, with xx deals recorded in the past five years, driven by the pursuit of economies of scale and technological capabilities.

- Market Concentration: Highly concentrated, with significant market share held by major exchanges.

- Technological Innovation: Driven by advancements in distributed ledger technology (DLT), AI, and automation, aiming to enhance efficiency and security. However, adoption faces barriers, such as legacy infrastructure and data integration challenges.

- Regulatory Framework: Stringent regulations, including those related to risk management, capital requirements, and cybersecurity, significantly impact market operations and compliance costs. Recent changes have pushed for increased clearing house usage, aiming to reduce systemic risk.

- Competitive Product Substitutes: Limited direct substitutes but innovative fintech solutions are emerging which might change the competitive landscape

- End-User Demographics: Primarily institutional investors, broker-dealers, and financial institutions. Increasingly sophisticated needs and demands for advanced services.

- M&A Trends: Strategic acquisitions are common in pursuit of technology, geographic expansion, or market share gains.

United States Clearing Houses and Settlements Market Growth Trends & Insights

The United States clearing houses and settlements market has demonstrated robust growth, fueled by escalating trading volumes across various asset classes and a dynamic regulatory landscape. The market size experienced a significant expansion, growing from an estimated $XX million in 2019 to $XX million in 2024, achieving a Compound Annual Growth Rate (CAGR) of XX%. Looking ahead, the market is poised for continued expansion, with projections indicating a XX% CAGR from 2025 to 2033, ultimately reaching an estimated $XX million by 2033. Key growth catalysts include rapid technological advancements, notably the increasing adoption of Distributed Ledger Technology (DLT) and sophisticated automation solutions, which are instrumental in enhancing operational efficiency and dramatically reducing settlement times. Evolving consumer behavior, characterized by a heightened demand for faster, more transparent, and secure settlement processes, is also a significant influencer shaping market dynamics. The market penetration, currently standing at approximately XX%, is anticipated to rise to XX% by 2033.

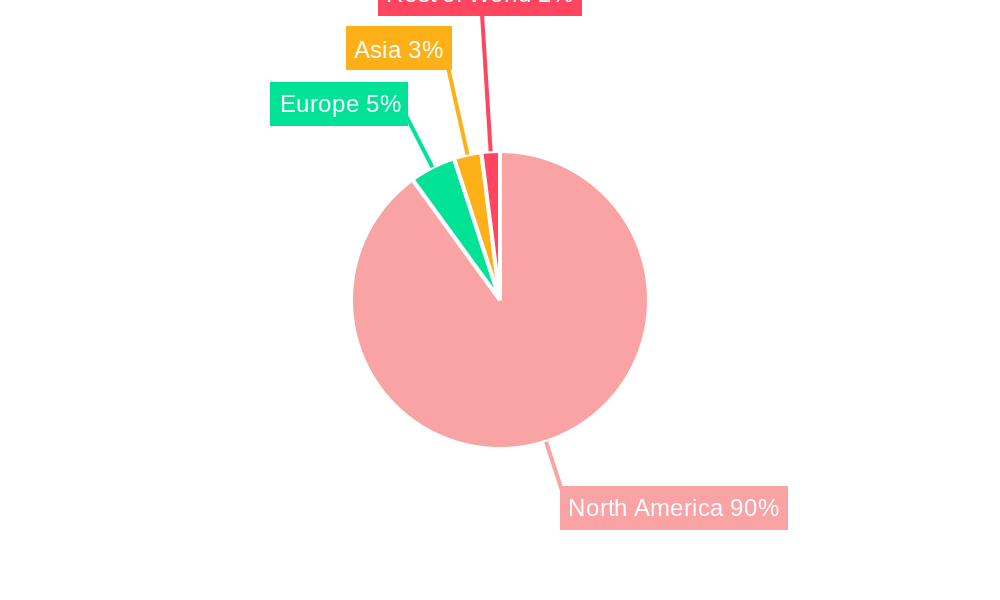

Dominant Regions, Countries, or Segments in United States Clearing Houses and Settlements Market

The New York metropolitan area continues to solidify its position as the dominant hub for clearing houses and settlements in the United States. This leadership is attributed to its deeply entrenched financial infrastructure, the significant concentration of major market participants, and its strategic role in global finance. Prominent entities like the New York Stock Exchange (NYSE) and NASDAQ are central to this dominance, collectively holding approximately XX% of the market share. The region benefits from supportive economic policies, unparalleled access to capital markets, and a highly skilled financial workforce, all contributing to its preeminence. While New York leads, other regions such as Chicago and California are also experiencing notable growth. This expansion is largely driven by the burgeoning fintech sector and an increasing demand for specialized clearing and settlement services catering to diverse financial instruments.

- Key Drivers of Regional Dominance:

- Established and sophisticated financial infrastructure.

- High concentration of leading financial institutions and trading platforms.

- A supportive and evolving regulatory environment conducive to financial innovation.

- Proximity to substantial capital pools and a highly skilled talent base.

- Factors Contributing to Market Concentration:

- Exceptional trading volumes facilitated by major stock exchanges located within these regions.

- Mature and robust infrastructure for efficient settlement services.

- The presence and influence of globally recognized financial institutions.

United States Clearing Houses and Settlements Market Product Landscape

The product and service landscape within the United States clearing houses and settlements market is diverse, offering a comprehensive suite of solutions designed to cater to a wide array of asset classes, including equities, derivatives, fixed income, and emerging asset types. A significant trend is the continuous evolution of these offerings, driven by technological innovation. This has led to the development and widespread adoption of advanced solutions such as highly automated clearing platforms and real-time settlement systems. These innovations are specifically engineered to amplify operational efficiency, mitigate risks, and substantially reduce associated operational costs. The unique selling propositions (USPs) for these services typically revolve around critical factors such as speed of execution, robust security protocols, cost-effectiveness, and seamless integration capabilities with existing trading and back-office systems.

Key Drivers, Barriers & Challenges in United States Clearing Houses and Settlements Market

Key Drivers:

The United States clearing houses and settlements market is propelled by several powerful forces. Foremost among these are the continuously increasing trading volumes across financial markets, coupled with regulatory mandates that increasingly favor and encourage the utilization of central clearing houses to enhance systemic stability. Technological advancements are also a paramount driver, facilitating faster, more secure, and more efficient settlement processes. A notable recent development is the introduction of new regulations in December 2023, specifically designed to reduce systemic risk within the substantial $26 trillion US Treasury market, acting as a significant impetus for market growth. Furthermore, the escalating adoption of cutting-edge technologies such as Distributed Ledger Technology (DLT) and Artificial Intelligence (AI) is proving to be a transformative catalyst, unlocking new efficiencies and possibilities within the market.

Key Challenges and Restraints:

Despite the positive growth trajectory, the market faces significant hurdles. The substantial cost associated with implementing and integrating new technologies can be a considerable barrier, particularly for smaller institutions. Stringent and evolving regulatory compliance requirements demand continuous investment and adaptation. The ever-present threat of cyber-attacks poses a significant risk to the integrity and security of clearing and settlement systems, necessitating robust cybersecurity measures. These factors collectively can constrain market expansion and impact the profitability of clearing house operations. Additionally, intensifying competition, particularly from innovative fintech companies offering agile and specialized solutions, presents a dynamic challenge. Lastly, supply chain disruptions can have ripple effects, potentially impacting the stability and efficiency of critical market infrastructure.

Emerging Opportunities in United States Clearing Houses and Settlements Market

Emerging opportunities include the expansion of services into new asset classes, such as cryptocurrencies and digital assets, and the adoption of innovative technologies, such as DLT and AI. Untapped markets exist in underserved segments of the financial market, with room for greater accessibility of financial services. The growing demand for enhanced cybersecurity measures also creates opportunities for specialized security solutions within the sector.

Growth Accelerators in the United States Clearing Houses and Settlements Market Industry

Long-term growth will be accelerated by strategic partnerships between established players and fintech companies, driving innovation and adoption of new technologies. Expansion into international markets, particularly within developed economies, can increase market reach and customer base. Technological breakthroughs, such as improved DLT and AI solutions, will create efficiency gains and expand market capacity.

Key Players Shaping the United States Clearing Houses and Settlements Market Market

- New York Stock Exchange (NYSE) - A cornerstone of US financial markets, providing comprehensive clearing and settlement services.

- NASDAQ - Known for its technology-focused exchange, it also offers vital clearing and settlement infrastructure.

- CBOE Option Exchange - A major player in the derivatives market, offering specialized clearing and settlement for options.

- International Securities Exchange (ISE) - Another key exchange participant, contributing to the derivatives clearing ecosystem.

- Miami Stock Exchange - An emerging player contributing to regional market activity.

- National Stock Exchange - A significant participant in US equity trading and related services.

- Philadelphia Stock Exchange - A historically important exchange with ongoing clearing and settlement operations.

- List Not Exhaustive - This list represents some of the prominent entities, and the market includes numerous other specialized service providers and financial institutions.

Notable Milestones in United States Clearing Houses and Settlements Market Sector

- December 2023: Miami International Holdings, Inc. introduces MIAX Sapphire, a new physical trading floor and electronic exchange in Miami, expanding options trading capacity.

- December 2023: New regulations from Wall Street regulators mandate increased clearing house usage to reduce systemic risk in the US Treasury market.

In-Depth United States Clearing Houses and Settlements Market Market Outlook

The future of the US clearing houses and settlements market is bright, driven by the continued growth of trading volumes, technological advancements, and regulatory changes. Strategic partnerships and innovative product development will drive market expansion. Opportunities exist in the adoption of new technologies like DLT and AI, opening new avenues for efficiency gains, increased security, and expanded market access. The market's long-term potential is significant, with continued growth expected over the forecast period.

United States Clearing Houses and Settlements Market Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

United States Clearing Houses and Settlements Market Segmentation By Geography

- 1. United States

United States Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of United States Clearing Houses and Settlements Market

United States Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital Assets and Digitalization is Expected to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 New York Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NASDAQ

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBOE Option Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Securities Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miami Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philadelphia Stock Exchange*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 New York Stock Exchange

List of Figures

- Figure 1: United States Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Clearing Houses and Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 3: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 5: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 6: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Clearing Houses and Settlements Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Clearing Houses and Settlements Market?

Key companies in the market include New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, Philadelphia Stock Exchange*List Not Exhaustive.

3. What are the main segments of the United States Clearing Houses and Settlements Market?

The market segments include Type of Market, Financial Instruments.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.75 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital Assets and Digitalization is Expected to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Miami International Holdings, Inc. has introduced new MIAX Sapphire, physical trading floor located in Miami's Wynwood district. The new MIAX Sapphire exchange, which will run both an electronic exchange and a physical trading floor, will be MIAX's fourth national securities exchange for U.S. multi-listed options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the United States Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence