Key Insights

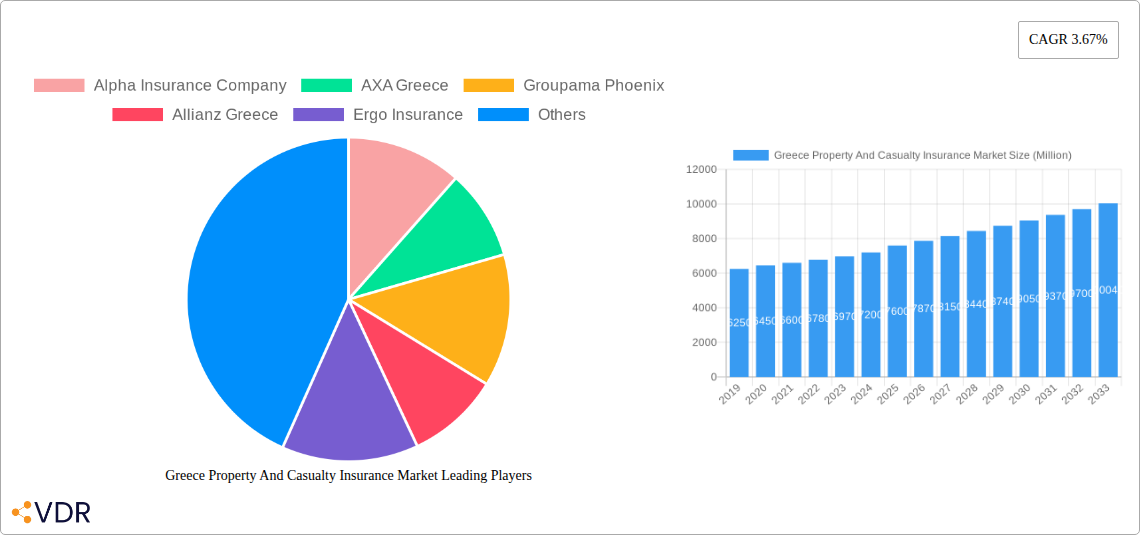

The Greece Property and Casualty (P&C) Insurance Market is poised for steady growth, projected to reach a market size of USD 7,600 million by 2025. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 3.67% during the study period of 2019-2033. The market's robustness is driven by several key factors, including increasing property ownership and a growing awareness of the need for comprehensive insurance coverage against unforeseen events. The P&C sector encompasses essential insurance types such as Home and Motor insurance, catering to a wide spectrum of individual and commercial needs. The "Other Insurance" category likely includes specialized coverages like professional indemnity, marine, and aviation insurance, which are vital for Greece's diverse economic landscape.

Greece Property And Casualty Insurance Market Market Size (In Billion)

Distribution channels are a crucial element in this market's dynamics. While direct sales are significant, the role of intermediaries like agencies and brokers is paramount in reaching a broader customer base and offering tailored solutions. Emerging trends point towards a greater adoption of digital platforms for policy management and claims processing, enhancing customer experience and operational efficiency. However, the market faces certain restraints, potentially including economic fluctuations, evolving regulatory landscapes, and competitive pricing pressures from a consolidated list of key players. Companies such as Alpha Insurance Company, AXA Greece, Groupama Phoenix, Allianz Greece, Ergo Insurance, and NN Hellas are actively shaping the market, with established entities like Ethniki Hellenic General Insurance Company and Interamerican Greece holding significant market positions. The continued development of innovative insurance products and the leveraging of technology will be critical for sustained growth and competitive advantage in the coming years.

Greece Property And Casualty Insurance Market Company Market Share

This comprehensive report offers an in-depth analysis of the Greece Property and Casualty Insurance Market, projecting its trajectory from 2019 to 2033, with a detailed focus on the 2025 base and estimated year. We explore critical market dynamics, growth trends, dominant segments, product innovations, and the strategic landscape shaped by key players. This report is essential for insurance providers, reinsurers, brokers, investors, and industry stakeholders seeking to understand and capitalize on the evolving Greek insurance sector, including parent and child market insights.

Greece Property And Casualty Insurance Market Market Dynamics & Structure

The Greece Property and Casualty Insurance Market is characterized by a moderate level of market concentration, with a few dominant players holding significant market share. Technological innovation is emerging as a key driver, with advancements in AI, data analytics, and InsurTech solutions enhancing operational efficiency and customer experience. The regulatory framework, governed by Solvency II and national insurance laws, continues to shape market practices, emphasizing financial stability and consumer protection. Competitive product substitutes are limited within the core P&C offerings, but innovative bundled products and value-added services are gaining traction. End-user demographics are evolving, with a growing demand for digitalized services and personalized insurance solutions from a younger, tech-savvy population. Mergers and Acquisitions (M&A) trends are evident, as companies seek to consolidate market presence, achieve economies of scale, and expand their product portfolios. For instance, the European Reliance and Allianz Greece joint venture signifies a strategic move towards enhanced market penetration.

- Market Concentration: Dominated by a mix of local and international insurers.

- Technological Drivers: AI-powered claims processing, telematics for motor insurance, and digital distribution platforms.

- Regulatory Framework: Adherence to EU directives and Hellenic Bank and Insurance Company supervision.

- Competitive Landscape: Differentiation through enhanced customer service, specialized products, and digital offerings.

- End-User Demographics: Increasing demand for online policy management, mobile accessibility, and transparent pricing.

- M&A Trends: Consolidations for market share growth and diversification of offerings.

Greece Property And Casualty Insurance Market Growth Trends & Insights

The Greece Property and Casualty Insurance Market is poised for significant growth, driven by an increasing awareness of insurance as a necessity for safeguarding assets and mitigating risks. The market size evolution is influenced by economic recovery and a growing disposable income that allows for greater insurance penetration. Adoption rates for digital insurance platforms are accelerating, reflecting a shift in consumer preferences towards convenience and speed. Technological disruptions, such as the integration of IoT devices in home insurance and advanced analytics for risk assessment, are reshaping product offerings and pricing strategies. Consumer behavior shifts are evident, with a growing emphasis on proactive risk management, personalized policy options, and a demand for seamless digital interactions throughout the customer journey, from purchase to claims settlement. The Greek insurance sector is witnessing a steady increase in the uptake of specialized insurance products catering to specific needs.

- Market Size Evolution: Projected to expand by a CAGR of XX% from 2019-2033.

- Adoption Rates: Increasing adoption of online purchasing and self-service portals.

- Technological Disruptions: Impact of InsurTech startups and legacy insurer digital transformation.

- Consumer Behavior Shifts: Preference for bundled policies, parametric insurance, and proactive risk mitigation services.

- Market Penetration: Expected to reach XX% by 2033.

Dominant Regions, Countries, or Segments in Greece Property And Casualty Insurance Market

The Motor Insurance segment is a dominant force within the Greece Property and Casualty Insurance Market, driven by mandatory coverage requirements and the high volume of vehicle ownership across the country. This segment benefits significantly from economic policies that encourage vehicle usage and infrastructure development that supports transportation networks. The Direct Distribution Channel is also emerging as a key growth driver, propelled by technological advancements that enable online sales and direct customer engagement, bypassing traditional intermediaries. This channel offers greater cost efficiency and a streamlined customer experience. Within the Home Insurance segment, increased awareness of natural disaster risks and a desire for asset protection are contributing to steady growth. The Agency and Broker channels, however, continue to play a vital role, particularly for complex insurance needs and for reaching a broader customer base, reflecting a balanced distribution strategy within the Greek insurance market.

- Dominant Insurance Type: Motor Insurance, accounting for approximately XX% of the market share.

- Key Drivers: Compulsory third-party liability, increasing vehicle fleet, and adoption of telematics for premium discounts.

- Dominant Distribution Channel: Direct Channel, with growing influence from online platforms and mobile apps.

- Key Drivers: Cost-effectiveness, customer convenience, and enhanced digital customer journeys.

- Growth Potential in Home Insurance: Driven by increased property ownership and awareness of seismic and weather-related risks.

- Role of Agencies and Brokers: Crucial for providing expert advice and catering to specialized insurance needs.

- Other Insurance Segments: Significant growth in business insurance and travel insurance due to economic recovery and increased tourism.

Greece Property And Casualty Insurance Market Product Landscape

The Greece Property and Casualty Insurance Market is witnessing a wave of product innovations designed to meet evolving consumer demands and leverage technological advancements. Smart home insurance policies, integrated with IoT devices to monitor and prevent potential damages, are gaining traction. Motor insurance is increasingly incorporating telematics-based pricing, rewarding safe driving behavior. We are also observing the development of more flexible and customizable insurance products, allowing policyholders to tailor coverage to their specific needs. Performance metrics are improving through advanced risk assessment tools and streamlined claims processing, leading to greater customer satisfaction and reduced operational costs for insurers.

Key Drivers, Barriers & Challenges in Greece Property And Casualty Insurance Market

Key Drivers:

- Economic Recovery: A strengthening Greek economy bolsters disposable income, enabling more consumers to purchase insurance.

- Regulatory Support: Favorable regulatory environments and a focus on consumer protection encourage market growth.

- Technological Advigoration: InsurTech adoption enhances efficiency, customer experience, and product innovation.

- Increased Risk Awareness: Growing understanding of the importance of insurance for asset protection against natural disasters and unforeseen events.

- Growing Tourism and Business Sector: Expansion in these sectors drives demand for specialized business and travel insurance.

Barriers & Challenges:

- Economic Instability: Past economic downturns have impacted purchasing power and trust in financial services.

- Regulatory Hurdles: Navigating complex and evolving regulatory frameworks can be challenging for new entrants.

- Competition: Intense competition among established players and new InsurTech startups.

- Cybersecurity Risks: Increasing digital operations expose insurers to sophisticated cyber threats.

- Fraudulent Claims: Managing and mitigating fraudulent claims remains a persistent challenge.

- Limited Digital Literacy in Certain Demographics: Some segments of the population may still prefer traditional service models.

Emerging Opportunities in Greece Property And Casualty Insurance Market

Emerging opportunities in the Greece Property and Casualty Insurance Market lie in the development of parametric insurance products, particularly for climate-related events, offering swift payouts based on pre-defined triggers. The growing demand for personalized insurance solutions presents an avenue for data-driven product customization. The untapped market potential in micro-insurance for small businesses and underserved populations is significant. Furthermore, the integration of insurance with other services, such as property management or mobility solutions, offers innovative cross-selling opportunities. The rise of the sharing economy also necessitates new insurance models.

Growth Accelerators in the Greece Property And Casualty Insurance Market Industry

The Greece Property and Casualty Insurance Market is experiencing significant growth acceleration driven by robust technological breakthroughs, including advanced AI for risk underwriting and fraud detection, and blockchain for secure and transparent claims processing. Strategic partnerships between traditional insurers and InsurTech startups are fostering innovation and expanding market reach. Furthermore, market expansion strategies focused on catering to specific niche markets and developing specialized insurance products for emerging industries, such as renewable energy or e-commerce, are acting as crucial growth catalysts. The increasing focus on sustainable and ESG-compliant insurance products is also a notable accelerator.

Key Players Shaping the Greece Property And Casualty Insurance Market Market

- Alpha Insurance Company

- AXA Greece

- Groupama Phoenix

- Allianz Greece

- Ergo Insurance

- HDI-Gerling Greece Insurance

- NN Hellas

- Piraeus Insurance

- Eurobank Insurance

- MetLife Greece Insurance Company

- Ethniki Hellenic General Insurance Company

- Interamerican Greece

- Zurich Insurance

Notable Milestones in Greece Property And Casualty Insurance Market Sector

- December 2022: European Reliance and Allianz Greece announced the formation of an Executive Committee (ExCom) to oversee their joint expansion journey and facilitate the effective integration of the two companies.

- February 2022: The European Commission unconditionally cleared the acquisition of Ethniki Hellenic General Insurance Company S.A. of Greece by CVC Capital Partners SICAV FIS S.A. of Luxemburg.

In-Depth Greece Property And Casualty Insurance Market Market Outlook

The future outlook for the Greece Property and Casualty Insurance Market is exceptionally promising, fueled by continued technological adoption, a robust regulatory environment, and evolving consumer needs. Growth accelerators such as InsurTech integration, strategic alliances, and the development of niche insurance products will continue to propel market expansion. The increasing demand for digital-first insurance experiences, coupled with a growing awareness of risk management, positions the Greek insurance sector for sustained growth and innovation throughout the forecast period. Strategic opportunities abound for insurers who can effectively leverage data analytics to personalize offerings and enhance customer engagement.

Greece Property And Casualty Insurance Market Segmentation

-

1. Insurance type

- 1.1. Home

- 1.2. Motor

- 1.3. Other In

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Brokers

- 2.4. Other Distribution Channels

Greece Property And Casualty Insurance Market Segmentation By Geography

- 1. Greece

Greece Property And Casualty Insurance Market Regional Market Share

Geographic Coverage of Greece Property And Casualty Insurance Market

Greece Property And Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Technological Advancements are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece Property And Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Home

- 5.1.2. Motor

- 5.1.3. Other In

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Brokers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpha Insurance Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AXA Greece

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Groupama Phoenix

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Allianz Greece

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ergo Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HDI-Gerling Greece Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NN Hellas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Piraeus Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eurobank Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MetLife Greece Insurance Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ethniki Hellenic General Insurance Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Interamerican Greece

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Zurich Insurance

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Alpha Insurance Company

List of Figures

- Figure 1: Greece Property And Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Greece Property And Casualty Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Greece Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 2: Greece Property And Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Greece Property And Casualty Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Greece Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 5: Greece Property And Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Greece Property And Casualty Insurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece Property And Casualty Insurance Market?

The projected CAGR is approximately 3.67%.

2. Which companies are prominent players in the Greece Property And Casualty Insurance Market?

Key companies in the market include Alpha Insurance Company, AXA Greece, Groupama Phoenix, Allianz Greece, Ergo Insurance, HDI-Gerling Greece Insurance, NN Hellas, Piraeus Insurance, Eurobank Insurance, MetLife Greece Insurance Company**List Not Exhaustive, Ethniki Hellenic General Insurance Company, Interamerican Greece, Zurich Insurance.

3. What are the main segments of the Greece Property And Casualty Insurance Market?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Technological Advancements are Driving the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

December 2022: European Reliance and Allianz Greece announced the formation of an Executive Committee (ExCom) to oversee their joint expansion journey and facilitate the effective integration of the two companies. The composition of the ExCom members has been carefully chosen with the primary goal of ensuring a seamless integration process..

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece Property And Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece Property And Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece Property And Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Greece Property And Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence