Key Insights

The UAE Health and Medical Insurance Market is poised for significant expansion, projected to reach a substantial market size of $10.51 billion by the end of the study period, driven by a robust Compound Annual Growth Rate (CAGR) of 12.38%. This impressive growth trajectory is fueled by a confluence of compelling market drivers, including increasing healthcare expenditure, rising chronic disease prevalence, and a growing awareness of preventive healthcare measures among the UAE population. The mandatory health insurance regulations implemented across various Emirates continue to be a cornerstone of this market's expansion, ensuring a consistent demand for both individual and group health insurance policies. Furthermore, the UAE's commitment to developing world-class healthcare infrastructure and attracting medical tourism indirectly boosts the health insurance sector, as more individuals seek comprehensive coverage for advanced medical treatments.

UAE Health and Medical Insurance Market Market Size (In Million)

The market's segmentation reveals a dynamic landscape. Single/Individual Health Insurance is expected to witness strong uptake as more residents prioritize personal financial security against escalating medical costs. Simultaneously, Group Health Insurance remains a vital segment, driven by employers seeking to provide competitive benefits to their workforce, a key factor in talent acquisition and retention. On the provider side, both Public/Social Health Insurance and Private Health Insurance play crucial roles, catering to diverse demographic needs. Distribution channels are also evolving, with a notable surge in Online Sales capabilities, complementing traditional channels like Agents, Brokers, and Banks. Leading players such as DAMAN Health Insurance, AXA Gulf Insurance, and Orient Insurance are actively innovating and expanding their offerings to capture a larger share of this burgeoning market, while also navigating challenges such as increasing claims and the need for advanced technological integration in policy management and claims processing.

UAE Health and Medical Insurance Market Company Market Share

This in-depth report provides a comprehensive analysis of the UAE Health and Medical Insurance Market, offering critical insights into its dynamics, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. We delve into market size evolution, technological disruptions, consumer behavior shifts, regulatory frameworks, and competitive landscapes. Essential for insurers, reinsurers, brokers, and healthcare providers, this report analyzes key market segments, including Single/Individual Health Insurance and Group Health Insurance, as well as Public/Social Health Insurance and Private Health Insurance providers. Distribution channels such as Agents, Brokers, Banks, and Online Sales are meticulously examined. Gain a competitive edge with our detailed examination of market drivers, barriers, emerging opportunities, and growth accelerators.

UAE Health and Medical Insurance Market Dynamics & Structure

The UAE Health and Medical Insurance Market is characterized by a dynamic interplay of regulatory advancements, technological innovation, and evolving consumer needs. Market concentration is influenced by a robust presence of both local and international players, with key entities like Orient Insurance, Emirates Insurance Company, DAMAN Health Insurance, Alliance Insurance, Islamic Arab Insurance Company, Oman Insurance Company, AXA Gulf Insurance, Abu Dhabi National Insurance Company, Ras Al Khaimah National Insurance Company, and Al Buhaira National Insurance Company actively shaping the competitive landscape. Technological innovation is a significant driver, with insurtech solutions transforming policy management, claims processing, and customer engagement. Regulatory frameworks, particularly those mandated by the UAE government, play a crucial role in ensuring market stability and consumer protection, influencing product development and pricing strategies. Competitive product substitutes are emerging, driven by innovation in digital health solutions and preventative care offerings. End-user demographics, a growing and increasingly health-conscious population, are a primary force behind market demand. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate market share, expand their service offerings, and enhance operational efficiencies.

- Market Concentration: Moderately concentrated with a mix of established large insurers and emerging specialized providers.

- Technological Innovation Drivers: Insurtech adoption for customer onboarding, claims automation, and personalized health programs; AI for risk assessment and fraud detection.

- Regulatory Frameworks: Mandatory health insurance regulations in various Emirates, focusing on comprehensive coverage and affordability.

- Competitive Product Substitutes: Telehealth services, corporate wellness programs, and preventative health screening packages.

- End-User Demographics: Growing expatriate population, aging demographics, and increasing awareness of health and wellness.

- M&A Trends: Strategic partnerships and acquisitions to gain market share and diversify product portfolios, with an estimated xx M&A deals in the historical period.

UAE Health and Medical Insurance Market Growth Trends & Insights

The UAE Health and Medical Insurance Market is poised for substantial growth, driven by a confluence of economic, demographic, and technological factors. The market size has seen consistent expansion throughout the historical period (2019–2024), fueled by increasing healthcare expenditure and mandatory insurance mandates. Adoption rates of comprehensive health insurance policies are on an upward trend, reflecting a growing understanding of the importance of financial protection against medical expenses. Technological disruptions, particularly the integration of artificial intelligence, big data analytics, and blockchain, are revolutionizing the insurance value chain, leading to enhanced operational efficiencies, personalized customer experiences, and innovative product designs. Consumer behavior shifts are evident, with a greater demand for digital-first insurance solutions, preventative health services, and customized plans that cater to individual needs and preferences. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, with the market size estimated to reach USD XXXX Million by 2033. This growth is underpinned by increasing health awareness, a rising incidence of lifestyle-related diseases, and government initiatives promoting universal healthcare access. The penetration of health insurance is expected to rise from XX% in 2025 to XX% by 2033, indicating significant untapped potential. Insurers are increasingly focusing on value-added services, such as wellness programs and chronic disease management, to differentiate themselves and foster long-term customer loyalty. The robust economic growth of the UAE, coupled with a strong emphasis on public health infrastructure development, further solidifies the positive growth outlook for the health and medical insurance sector.

Dominant Regions, Countries, or Segments in UAE Health and Medical Insurance Market

The UAE Health and Medical Insurance Market exhibits dominance across various segments, with Private Health Insurance emerging as the most significant contributor to market growth. This dominance is propelled by the region's robust economy, a substantial expatriate population requiring employer-sponsored or individual health coverage, and a high standard of private healthcare facilities. Within the provider segment, Private Health Insurance accounts for an estimated XX% of the total market share, followed by Public/Social Health Insurance which, while growing, is primarily driven by governmental initiatives for specific demographics.

Analyzing product types, Group Health Insurance holds a commanding position, driven by corporate mandates and the desire of employers to provide comprehensive benefits to their workforce. This segment contributes approximately XX% to the overall market. Single/Individual Health Insurance, while smaller, is experiencing rapid growth due to increasing health consciousness among individuals and the availability of more flexible and tailored policy options.

In terms of distribution channels, Brokers and Agents continue to be dominant, leveraging their expertise and extensive networks to reach a broad customer base. They collectively account for an estimated XX% of the distribution. However, Online Sales are rapidly gaining traction, particularly among younger demographics, driven by the convenience and transparency offered by digital platforms, and are projected to capture a significant market share of XX% by 2033.

- Dominant Provider Segment: Private Health Insurance (estimated XX% market share)

- Key Drivers: High quality of private healthcare, mandatory employer coverage, growing demand for specialized medical treatments.

- Dominant Product Type: Group Health Insurance (estimated XX% market share)

- Key Drivers: Corporate benefits mandates, employee retention strategies, comprehensive coverage needs of businesses.

- Dominant Distribution Channel: Agents and Brokers (estimated XX% combined market share)

- Key Drivers: Established relationships, personalized advice, complexity of insurance products.

- Fastest Growing Distribution Channel: Online Sales (projected XX% market share by 2033)

- Key Drivers: Convenience, speed, accessibility, digital-savvy consumer base.

UAE Health and Medical Insurance Market Product Landscape

The UAE Health and Medical Insurance Market product landscape is characterized by an increasing diversification and innovation to meet the evolving needs of consumers and businesses. Insurers are offering a wide array of plans, from comprehensive medical coverage encompassing hospitalization, outpatient services, and emergency care, to specialized policies for critical illnesses and maternity benefits. A notable trend is the integration of preventative healthcare services and wellness programs into standard health insurance packages, encouraging policyholders to adopt healthier lifestyles and reduce long-term healthcare costs. The unique selling propositions often revolve around extensive provider networks, seamless claims processing, and flexible premium options. Technological advancements are enabling personalized product offerings, with data analytics being used to tailor coverage based on individual risk profiles and health needs. The introduction of digital health platforms and telemedicine services as part of insurance plans is another significant product innovation, providing policyholders with convenient access to medical consultations and health management tools.

Key Drivers, Barriers & Challenges in UAE Health and Medical Insurance Market

Key Drivers:

- Government Mandates: Compulsory health insurance laws in key Emirates are a primary growth driver, ensuring a baseline of coverage for residents.

- Rising Healthcare Costs: Escalating medical expenses due to advanced treatments and an aging population necessitate robust health insurance.

- Increased Health Awareness: Growing public consciousness about health and wellness promotes the adoption of insurance for financial security.

- Economic Growth and Population Expansion: A strong economy and a steadily growing population, especially expatriates, fuel demand for health insurance.

- Technological Advancements: Insurtech innovations enhance efficiency, customer experience, and product development.

Barriers & Challenges:

- Regulatory Compliance and Complexity: Navigating diverse regulatory requirements across different Emirates can be complex for insurers.

- Fraudulent Claims: The persistence of fraudulent claims poses a significant financial challenge, impacting profitability.

- Price Sensitivity and Affordability: Balancing comprehensive coverage with affordable premiums remains a key challenge, especially for lower-income segments.

- Competition and Market Saturation: An increasingly competitive market demands continuous innovation and efficient cost management to maintain market share.

- Provider Network Management: Ensuring access to a quality and cost-effective network of healthcare providers can be challenging.

Emerging Opportunities in UAE Health and Medical Insurance Market

Emerging opportunities in the UAE Health and Medical Insurance Market lie in the untapped potential of specific demographic segments and the burgeoning demand for specialized health services. The growing awareness and destigmatization of mental health present a significant opportunity for insurers to develop and offer dedicated mental wellness plans, potentially in partnership with online counseling platforms, similar to the strategic alignment seen between Dubai National Insurance (DNI) and Takalam. Furthermore, the increasing prevalence of chronic diseases like diabetes and cardiovascular conditions is creating a demand for specialized insurance products focused on chronic disease management and long-term care. The expanding elderly population also presents an opportunity for tailored health insurance solutions catering to geriatric care needs. Leveraging data analytics and AI, insurers can also develop highly personalized insurance products and preventative health programs, thereby enhancing customer engagement and reducing long-term healthcare liabilities. The focus on preventative healthcare and wellness is a strong emerging trend, creating avenues for innovative product design and service integration.

Growth Accelerators in the UAE Health and Medical Insurance Market Industry

Several catalysts are accelerating the growth of the UAE Health and Medical Insurance Market. Technological breakthroughs, particularly in insurtech, are enabling enhanced customer experience through digital platforms for policy management, claims submission, and virtual consultations. Strategic partnerships between insurance providers and technology firms, as exemplified by Turtlefin's collaboration with The Continental Group, are crucial for streamlining operations and expanding distribution networks. Furthermore, the government's continued commitment to enhancing the healthcare ecosystem and promoting health tourism indirectly boosts the demand for comprehensive medical insurance. The increasing focus on preventative care and wellness programs by insurers, incentivizing healthier lifestyles, is also a significant growth accelerator, fostering a more proactive approach to health management among policyholders. The continuous influx of expatriates seeking employment in the UAE also fuels demand for employer-sponsored health insurance, a key segment of the market.

Key Players Shaping the UAE Health and Medical Insurance Market Market

- Orient Insurance

- Emirates Insurance Company

- DAMAN Health Insurance

- Alliance Insurance

- Islamic Arab Insurance Company

- Oman Insurance Company

- AXA Gulf Insurance

- Abu Dhabi National Insurance Company

- Ras Al Khaimah National Insurance Company

- Al Buhaira National Insurance Company

- Dubai Islamic Insurance and Reinsurance Co

- Al Ain Al Ahilia Insurance Company

Notable Milestones in UAE Health and Medical Insurance Market Sector

- January 2023: Dubai National Insurance (DNI) partnered with Takalam, an online counseling platform, to offer mental well-being services as part of DNI packages, enhancing access to mental health professionals and solutions.

- December 2022: Turtlefin, an insurtech platform, announced a partnership with The Continental Group, a UAE insurance intermediary, to provide its software-as-a-service platform, enabling seamless proposal customization and information access for distribution teams.

In-Depth UAE Health and Medical Insurance Market Market Outlook

The future outlook for the UAE Health and Medical Insurance Market is highly promising, driven by sustained economic development, a growing and health-conscious population, and a supportive regulatory environment. Growth accelerators such as the increasing adoption of insurtech solutions, strategic partnerships aimed at enhancing service delivery, and a stronger emphasis on preventative healthcare will continue to propel the market forward. The market is expected to witness further innovation in product development, with a greater focus on personalized plans, telemedicine integration, and comprehensive wellness programs. The continued expansion of private healthcare infrastructure and the government's commitment to universal healthcare access will further solidify the demand for health insurance. Stakeholders can anticipate significant opportunities in segments catering to specialized medical needs, chronic disease management, and mental well-being. The strategic integration of technology and customer-centric approaches will be paramount for insurers aiming to capture a larger share of this dynamic and evolving market.

UAE Health and Medical Insurance Market Segmentation

-

1. Product Type

- 1.1. Single/Individual Health Insurance

- 1.2. Group Health Insurance

-

2. Provider

- 2.1. Public/ Social Health Insurance

- 2.2. Private Health Insurance

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Brokers

- 3.3. Banks

- 3.4. Online Sales

- 3.5. Other Distribution Channels

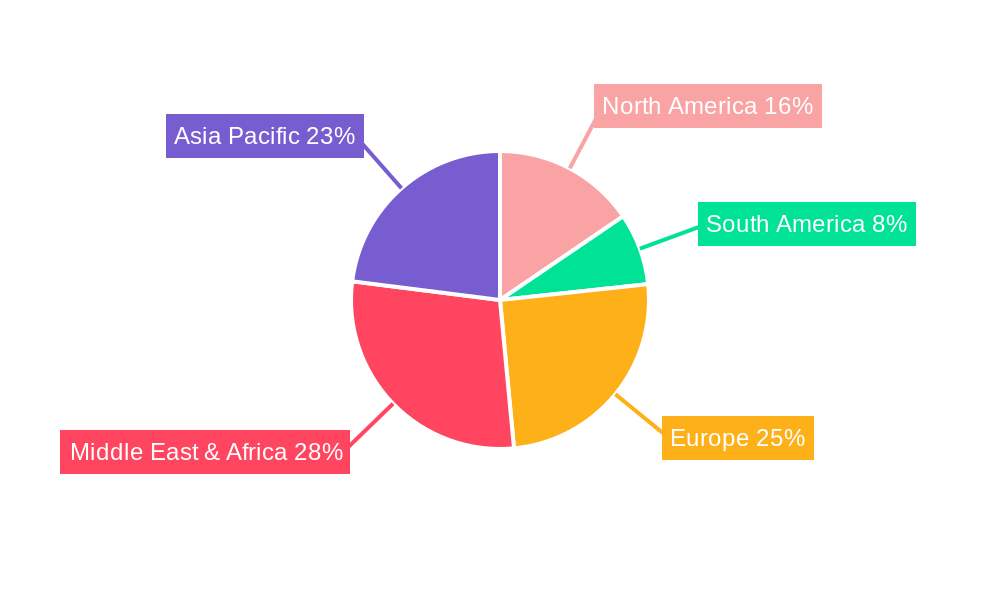

UAE Health and Medical Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Health and Medical Insurance Market Regional Market Share

Geographic Coverage of UAE Health and Medical Insurance Market

UAE Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. National Insurance Companies are Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Single/Individual Health Insurance

- 5.1.2. Group Health Insurance

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Public/ Social Health Insurance

- 5.2.2. Private Health Insurance

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Brokers

- 5.3.3. Banks

- 5.3.4. Online Sales

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Single/Individual Health Insurance

- 6.1.2. Group Health Insurance

- 6.2. Market Analysis, Insights and Forecast - by Provider

- 6.2.1. Public/ Social Health Insurance

- 6.2.2. Private Health Insurance

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Agents

- 6.3.2. Brokers

- 6.3.3. Banks

- 6.3.4. Online Sales

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Single/Individual Health Insurance

- 7.1.2. Group Health Insurance

- 7.2. Market Analysis, Insights and Forecast - by Provider

- 7.2.1. Public/ Social Health Insurance

- 7.2.2. Private Health Insurance

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Agents

- 7.3.2. Brokers

- 7.3.3. Banks

- 7.3.4. Online Sales

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Single/Individual Health Insurance

- 8.1.2. Group Health Insurance

- 8.2. Market Analysis, Insights and Forecast - by Provider

- 8.2.1. Public/ Social Health Insurance

- 8.2.2. Private Health Insurance

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Agents

- 8.3.2. Brokers

- 8.3.3. Banks

- 8.3.4. Online Sales

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Single/Individual Health Insurance

- 9.1.2. Group Health Insurance

- 9.2. Market Analysis, Insights and Forecast - by Provider

- 9.2.1. Public/ Social Health Insurance

- 9.2.2. Private Health Insurance

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Agents

- 9.3.2. Brokers

- 9.3.3. Banks

- 9.3.4. Online Sales

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UAE Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Single/Individual Health Insurance

- 10.1.2. Group Health Insurance

- 10.2. Market Analysis, Insights and Forecast - by Provider

- 10.2.1. Public/ Social Health Insurance

- 10.2.2. Private Health Insurance

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Agents

- 10.3.2. Brokers

- 10.3.3. Banks

- 10.3.4. Online Sales

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Orient Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emirates Insurance Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DAMAN Health Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alliance Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Islamic Arab Insurance Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oman Insurance Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA Gulf Insurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abu Dhabi National Insurance Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ras Al Khaimah National Insurance Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Buhaira National Insurance Company**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dubai Islamic Insurance and Reinsurance Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Al Ain Al Ahilia Insurance Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Orient Insurance

List of Figures

- Figure 1: Global UAE Health and Medical Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 5: North America UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 6: North America UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 13: South America UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 14: South America UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 21: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 22: Europe UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 29: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 30: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Provider 2025 & 2033

- Figure 37: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 38: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific UAE Health and Medical Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Health and Medical Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 3: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 7: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 14: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 21: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 34: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 44: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global UAE Health and Medical Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Health and Medical Insurance Market?

The projected CAGR is approximately 12.38%.

2. Which companies are prominent players in the UAE Health and Medical Insurance Market?

Key companies in the market include Orient Insurance, Emirates Insurance Company, DAMAN Health Insurance, Alliance Insurance, Islamic Arab Insurance Company, Oman Insurance Company, AXA Gulf Insurance, Abu Dhabi National Insurance Company, Ras Al Khaimah National Insurance Company, Al Buhaira National Insurance Company**List Not Exhaustive, Dubai Islamic Insurance and Reinsurance Co, Al Ain Al Ahilia Insurance Company.

3. What are the main segments of the UAE Health and Medical Insurance Market?

The market segments include Product Type, Provider, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

National Insurance Companies are Dominating the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

January 2023: Dubai National Insurance (DNI), an Insurance company in the UAE, has entered into a strategic partnership with Takalam, a UAE-based online counseling platform for mental well-being. With this partnership, individuals, as part of their DNI package, will be offered private and easy access to mental health professionals, tools, and solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the UAE Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence