Key Insights

The North America metal cleaning chemicals market is experiencing robust growth, driven by expanding automotive, aerospace, and electronics sectors. With a projected Compound Annual Growth Rate (CAGR) of 4.9% from a base year of 2024, the market is poised for significant expansion. Key growth drivers include increasing regulatory emphasis on environmental sustainability, fostering demand for eco-friendly aqueous-based and low-hazard cleaning solutions. Furthermore, the growing complexity of metal components in high-tech applications necessitates specialized, high-performance cleaning agents such as surfactants, corrosion inhibitors, and chelating agents. The market is segmented by form (aqueous, solvent), type (acidic, basic, neutral), functional additives, and end-user industries, with transportation, electronics, and pharmaceuticals as key segments. Intense competition exists between multinational corporations and specialized regional players. Estimates suggest the market size, currently at 15.1 billion, will continue to grow, offering substantial opportunities for companies innovating in sustainable and high-performance metal cleaning solutions.

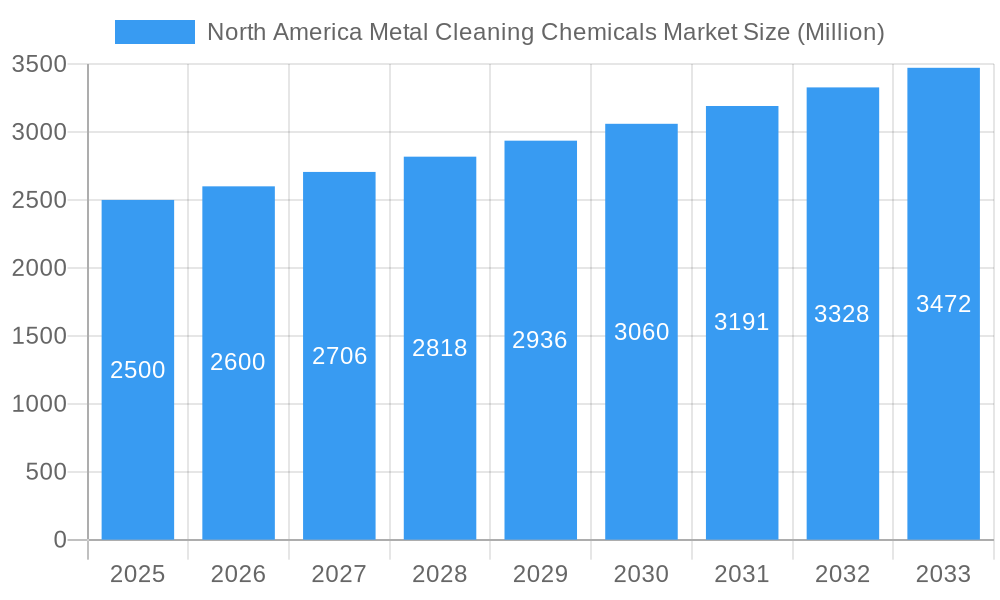

North America Metal Cleaning Chemicals Market Market Size (In Billion)

Looking ahead to 2033, sustained market growth is anticipated, supported by ongoing technological advancements, stringent environmental regulations, and consistent manufacturing sector expansion. Demand for specialized cleaning chemicals for diverse metal types and applications will continue to drive innovation. Companies prioritizing sustainable and efficient cleaning technologies, alongside robust customer relationships and effective distribution, are strategically positioned for market leadership. The increasing focus on reducing water consumption and waste will further stimulate innovation in cleaning chemical technology.

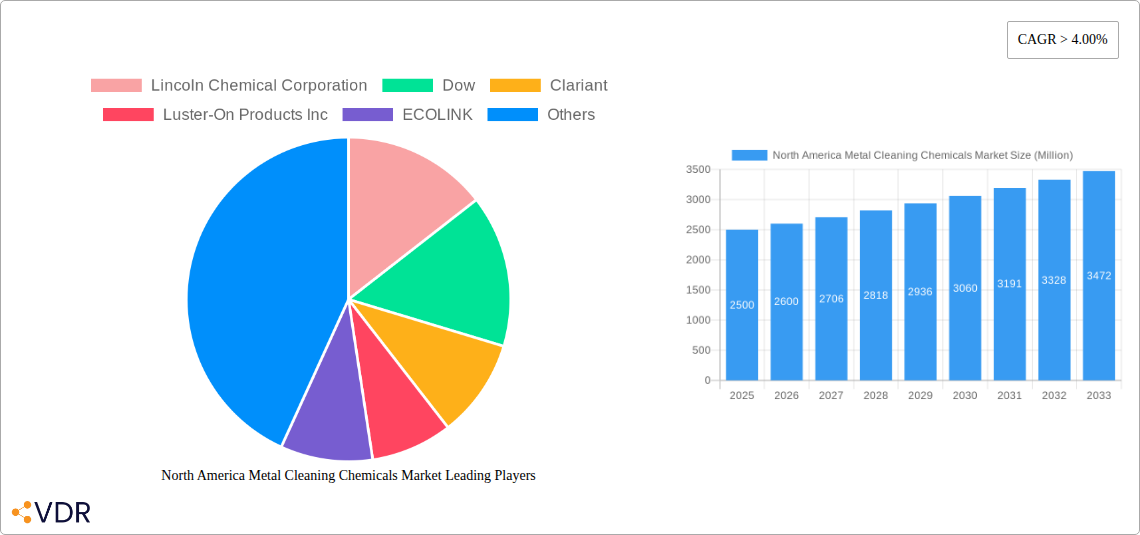

North America Metal Cleaning Chemicals Market Company Market Share

North America Metal Cleaning Chemicals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America metal cleaning chemicals market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking a detailed understanding of this dynamic market. Market values are presented in million units.

North America Metal Cleaning Chemicals Market Dynamics & Structure

The North American metal cleaning chemicals market is a complex landscape shaped by several interacting factors. Market concentration is moderate, with several large players and numerous smaller, specialized companies competing. Technological innovation is a significant driver, with continuous efforts to develop more efficient, environmentally friendly, and specialized cleaning solutions. Stringent environmental regulations are impacting the market, pushing for the adoption of sustainable cleaning agents. The market also faces competition from alternative cleaning methods and technologies. End-user demographics, particularly the growth of the automotive, electronics, and pharmaceutical industries, significantly influence market demand. The report analyzes M&A activities, revealing xx M&A deals in the past five years, with an average deal value of xx million.

- Market Concentration: Moderate, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Driven by the need for higher efficiency, sustainability, and specialized cleaning solutions.

- Regulatory Framework: Stringent environmental regulations drive adoption of eco-friendly solutions.

- Competitive Substitutes: Alternative cleaning methods and technologies pose some competition.

- End-User Demographics: Growth in automotive, electronics, and pharmaceuticals fuels market demand.

- M&A Trends: xx M&A deals over the past 5 years, indicating consolidation and strategic expansion within the industry. Significant deals include the acquisition of Atotech by MKS Instruments (August 2022) and Coventya Holding SAS by Element Solutions Inc. (September 2021). Innovation barriers include high R&D costs and stringent regulatory approvals.

North America Metal Cleaning Chemicals Market Growth Trends & Insights

The North America metal cleaning chemicals market exhibits robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). Market size is estimated at xx million in 2025 and is expected to reach xx million by 2033. This growth is driven by factors including increasing industrialization, technological advancements in metal cleaning solutions, and growing demand from various end-user industries. The adoption rate of advanced cleaning technologies, such as ultrasonic cleaning and electropolishing, is steadily increasing. Consumer behavior shifts toward environmentally conscious products are also influencing market trends. Specific growth segments include applications in renewable energy and high-precision electronics manufacturing.

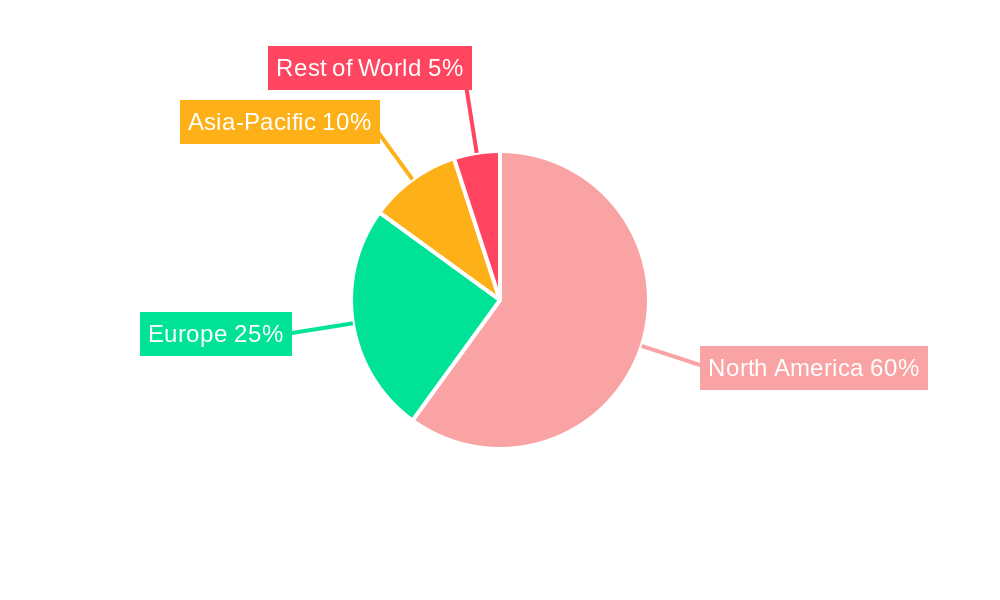

Dominant Regions, Countries, or Segments in North America Metal Cleaning Chemicals Market

The market is geographically diverse, with significant variations in growth rates and market share across regions and countries. The xx region currently holds the largest market share, driven by a robust manufacturing base and high demand from the automotive and electronics industries. The United States dominates the North American market followed by Canada and Mexico. Within the segment breakdown, aqueous-based cleaning chemicals currently hold the largest market share (xx%), followed by solvent-based chemicals (xx%). Acidic cleaning chemicals represent the largest type segment (xx%), driven by their effectiveness in removing various contaminants. Surfactants are the most widely used functional additive (xx%), owing to their cleaning and emulsifying properties. The transportation end-user industry currently consumes the largest volume of metal cleaning chemicals (xx%), reflecting the significant use in automotive manufacturing and maintenance.

- Key Regional Drivers: Strong manufacturing sectors, supportive government policies, and growing end-user industries.

- Country-Specific Factors: High industrial output in the US, rising manufacturing in Mexico, and specific regulatory environments in Canada influence market dynamics.

- Segment-Specific Drivers: The dominance of Aqueous formulations stems from cost-effectiveness and versatility; the prevalence of acidic chemicals reflects their efficacy; and the high consumption of surfactants reflects their critical role in cleaning efficiency.

North America Metal Cleaning Chemicals Market Product Landscape

The metal cleaning chemicals market features a range of products tailored to specific applications and metal types. Innovation focuses on developing eco-friendly, high-efficiency formulations that minimize environmental impact and improve cleaning performance. Unique selling propositions include enhanced cleaning power, reduced environmental footprint, and improved worker safety. Advancements in formulation chemistry, such as the use of biodegradable surfactants and corrosion inhibitors, are driving market growth. Specialized cleaning agents for niche applications, such as aerospace components or medical devices, are also gaining traction.

Key Drivers, Barriers & Challenges in North America Metal Cleaning Chemicals Market

Key Drivers:

- Increasing industrial activity and manufacturing across multiple sectors.

- Demand for advanced cleaning solutions driven by stricter quality standards.

- Growing adoption of environmentally friendly cleaning chemicals.

Challenges & Restraints:

- Fluctuations in raw material prices impacting production costs. Estimated impact: xx% increase in prices over the next 5 years.

- Stringent environmental regulations requiring compliance and continuous innovation.

- Intense competition and pricing pressures amongst market players.

Emerging Opportunities in North America Metal Cleaning Chemicals Market

The North America metal cleaning chemicals market is poised for significant growth driven by emerging opportunities across diverse sectors. A key area of expansion lies in the renewable energy sector, with increasing demand for specialized cleaning solutions in solar panel manufacturing and the essential maintenance of wind turbine infrastructure. Concurrently, a strong global push towards sustainable industrial practices is fueling the demand for biodegradable, less toxic, and environmentally responsible cleaning agents. Beyond these macro trends, the market is witnessing lucrative possibilities in niche sectors such as the fast-evolving electronics industry and the highly regulated aerospace sector. Furthermore, the development of customized formulations tailored to the specific properties of various metal types presents a distinct advantage for market players. The nascent yet promising field of additive manufacturing and 3D printing is also opening new avenues for innovative metal cleaning applications.

Growth Accelerators in the North America Metal Cleaning Chemicals Market Industry

The North America metal cleaning chemicals market is experiencing accelerated growth fueled by a combination of technological innovation and strategic industry initiatives. Significant advancements in formulation science and application methodologies, particularly the integration of automated cleaning systems, are enhancing efficiency and driving adoption. The market is also witnessing a surge in growth through strategic partnerships and collaborations between leading chemical manufacturers and key end-user industries, fostering synergistic development and market penetration. Geographic expansion into untapped regions within North America and the diversification of product portfolios to cater to new and evolving end-user sectors are critical growth strategies. Moreover, government initiatives and increasing regulatory emphasis on promoting sustainable industrial practices across the continent are acting as powerful long-term catalysts, accelerating the adoption of eco-friendly and responsible metal cleaning solutions.

Key Players Shaping the North America Metal Cleaning Chemicals Market Market

- Lincoln Chemical Corporation

- Dow

- Clariant

- Luster-On Products Inc

- ECOLINK

- Eastman Chemical Company

- Delstar Metal Finishing Inc

- Royal Chemical Company

- Nouryon

- Rochester Midland Corp

- Evonik Industries

- Chautauqua Chemical Company

- Spartan Chemical Company Inc

- Crest Chemicals

- 3M

- Hubbard-Hall

- Stepan Company

- KYZEN CORPORATION

- Dober

- Quaker Chemical Corporation

- BASF SE

Notable Milestones in North America Metal Cleaning Chemicals Market Sector

- August 2022: MKS Instruments significantly bolstered its presence in the global metal cleaning market with its strategic acquisition of Atotech, a prominent player in surface finishing and metal cleaning technologies.

- September 2021: Element Solutions Inc. expanded its market reach and capabilities within North America and across various end markets through its acquisition of Coventya Holding SAS, a global leader in specialty chemicals for metal finishing.

In-Depth North America Metal Cleaning Chemicals Market Outlook

The North America metal cleaning chemicals market is poised for continued growth, driven by technological innovations, increasing industrialization, and the growing adoption of sustainable practices. Strategic partnerships and expansion into new applications and markets will present significant opportunities for key players. The market's future potential is substantial, offering attractive returns for investors and promising long-term growth for industry stakeholders. The focus on sustainability, increased automation and specialized cleaning solutions will drive further market differentiation and expansion.

North America Metal Cleaning Chemicals Market Segmentation

-

1. Form

- 1.1. Aqueous

- 1.2. Solvent

-

2. Type

- 2.1. Acidic

- 2.2. Basic

- 2.3. Neutral

-

3. Functional Additives

- 3.1. Surfactants

- 3.2. Corrosion Inhibitors

- 3.3. Chelating Agents

- 3.4. PH Regulators

-

4. End-user Industries

- 4.1. Transportation

- 4.2. Electrical and Electronics

- 4.3. Chemical and Pharmaceutical

- 4.4. Oil and Gas

- 4.5. Other End-user Industries

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

North America Metal Cleaning Chemicals Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Metal Cleaning Chemicals Market Regional Market Share

Geographic Coverage of North America Metal Cleaning Chemicals Market

North America Metal Cleaning Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Environment Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Aqueous

- 5.1.2. Solvent

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Acidic

- 5.2.2. Basic

- 5.2.3. Neutral

- 5.3. Market Analysis, Insights and Forecast - by Functional Additives

- 5.3.1. Surfactants

- 5.3.2. Corrosion Inhibitors

- 5.3.3. Chelating Agents

- 5.3.4. PH Regulators

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. Transportation

- 5.4.2. Electrical and Electronics

- 5.4.3. Chemical and Pharmaceutical

- 5.4.4. Oil and Gas

- 5.4.5. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United States North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Aqueous

- 6.1.2. Solvent

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Acidic

- 6.2.2. Basic

- 6.2.3. Neutral

- 6.3. Market Analysis, Insights and Forecast - by Functional Additives

- 6.3.1. Surfactants

- 6.3.2. Corrosion Inhibitors

- 6.3.3. Chelating Agents

- 6.3.4. PH Regulators

- 6.4. Market Analysis, Insights and Forecast - by End-user Industries

- 6.4.1. Transportation

- 6.4.2. Electrical and Electronics

- 6.4.3. Chemical and Pharmaceutical

- 6.4.4. Oil and Gas

- 6.4.5. Other End-user Industries

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Canada North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Aqueous

- 7.1.2. Solvent

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Acidic

- 7.2.2. Basic

- 7.2.3. Neutral

- 7.3. Market Analysis, Insights and Forecast - by Functional Additives

- 7.3.1. Surfactants

- 7.3.2. Corrosion Inhibitors

- 7.3.3. Chelating Agents

- 7.3.4. PH Regulators

- 7.4. Market Analysis, Insights and Forecast - by End-user Industries

- 7.4.1. Transportation

- 7.4.2. Electrical and Electronics

- 7.4.3. Chemical and Pharmaceutical

- 7.4.4. Oil and Gas

- 7.4.5. Other End-user Industries

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Mexico North America Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Aqueous

- 8.1.2. Solvent

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Acidic

- 8.2.2. Basic

- 8.2.3. Neutral

- 8.3. Market Analysis, Insights and Forecast - by Functional Additives

- 8.3.1. Surfactants

- 8.3.2. Corrosion Inhibitors

- 8.3.3. Chelating Agents

- 8.3.4. PH Regulators

- 8.4. Market Analysis, Insights and Forecast - by End-user Industries

- 8.4.1. Transportation

- 8.4.2. Electrical and Electronics

- 8.4.3. Chemical and Pharmaceutical

- 8.4.4. Oil and Gas

- 8.4.5. Other End-user Industries

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Lincoln Chemical Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Dow

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Clariant

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Luster-On Products Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 ECOLINK

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Eastman Chemical Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Delstar Metal Finishing Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Royal Chemical Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nouryon

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Rochester Midland Corp

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Evonik industries

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Chautauqua Chemical Company

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Spartan Chemical Company Inc

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Crest Chemicals

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 3M

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 Hubbard-Hall

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 Stepan Company*List Not Exhaustive

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 KYZEN CORPORATION

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.19 Dober

- 9.2.19.1. Overview

- 9.2.19.2. Products

- 9.2.19.3. SWOT Analysis

- 9.2.19.4. Recent Developments

- 9.2.19.5. Financials (Based on Availability)

- 9.2.20 Quaker Chemical Corporation

- 9.2.20.1. Overview

- 9.2.20.2. Products

- 9.2.20.3. SWOT Analysis

- 9.2.20.4. Recent Developments

- 9.2.20.5. Financials (Based on Availability)

- 9.2.21 BASF SE

- 9.2.21.1. Overview

- 9.2.21.2. Products

- 9.2.21.3. SWOT Analysis

- 9.2.21.4. Recent Developments

- 9.2.21.5. Financials (Based on Availability)

- 9.2.1 Lincoln Chemical Corporation

List of Figures

- Figure 1: North America Metal Cleaning Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Metal Cleaning Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 4: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 5: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 8: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 9: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 10: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 11: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 14: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 16: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 17: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 20: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 21: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 22: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 23: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: North America Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Metal Cleaning Chemicals Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the North America Metal Cleaning Chemicals Market?

Key companies in the market include Lincoln Chemical Corporation, Dow, Clariant, Luster-On Products Inc, ECOLINK, Eastman Chemical Company, Delstar Metal Finishing Inc, Royal Chemical Company, Nouryon, Rochester Midland Corp, Evonik industries, Chautauqua Chemical Company, Spartan Chemical Company Inc, Crest Chemicals, 3M, Hubbard-Hall, Stepan Company*List Not Exhaustive, KYZEN CORPORATION, Dober, Quaker Chemical Corporation, BASF SE.

3. What are the main segments of the North America Metal Cleaning Chemicals Market?

The market segments include Form, Type, Functional Additives, End-user Industries, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries.

6. What are the notable trends driving market growth?

Increasing Usage in the Transportation Industry.

7. Are there any restraints impacting market growth?

Stringent Environment Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: MKS Instruments completed the acquisition of Atotech, a global player in producing surface treatment and processing chemicals for various metals. The acquisition may strengthen the position of MKS Instruments in the metal cleaning market across the world, including North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Metal Cleaning Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Metal Cleaning Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Metal Cleaning Chemicals Market?

To stay informed about further developments, trends, and reports in the North America Metal Cleaning Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence