Key Insights

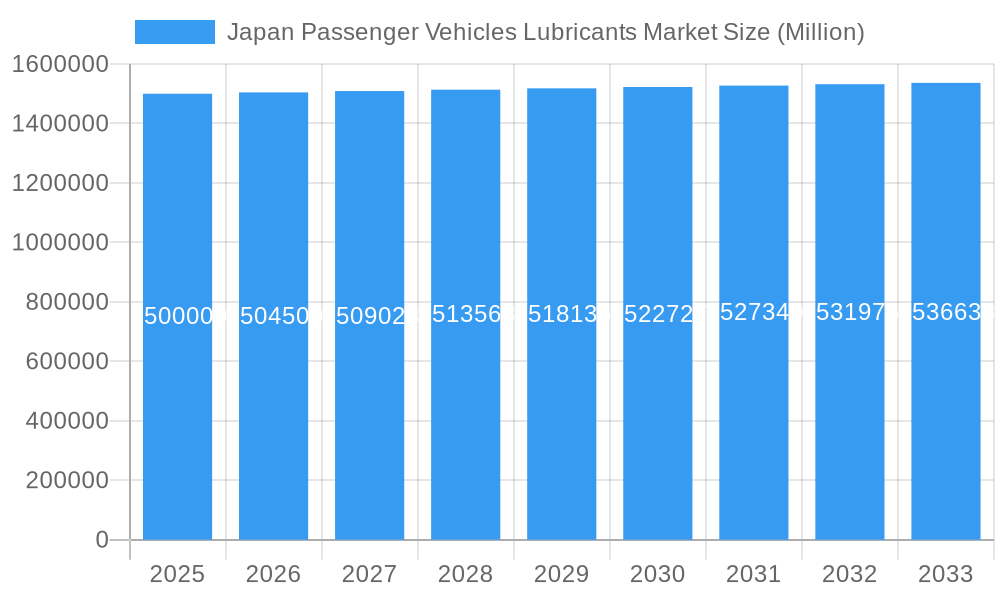

The Japan Passenger Vehicles Lubricants Market is projected to reach a market size of 250.27 million by the base year 2025, exhibiting a CAGR of 0.34%. This mature market's steady growth is driven by the substantial existing passenger vehicle fleet, the imperative for regular maintenance to ensure vehicle longevity and optimal performance, and the increasing adoption of advanced engine technologies requiring specialized, high-performance lubricants. Consumer emphasis on vehicle upkeep and maximizing automotive investment lifespan underpins this robust demand. Key trends include a growing preference for synthetic and semi-synthetic engine oils offering superior protection and efficiency, and demand for specialized transmission fluids supporting evolving gearbox technologies.

Japan Passenger Vehicles Lubricants Market Market Size (In Million)

Longer vehicle lifespans and the gradual shift towards electric vehicles (EVs) with different lubrication needs present long-term challenges. However, the continued prevalence of internal combustion engine (ICE) vehicles ensures sustained demand for lubricants. The market segments include Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils, with Engine Oils anticipated to dominate due to frequent replacement cycles. Major global and domestic players, including ExxonMobil Corporation, BP PLC (Castrol), ENEOS Corporation, and Royal Dutch Shell Plc, compete through product innovation, strategic partnerships, and brand recognition within Japan's established automotive industry and discerning consumer base.

Japan Passenger Vehicles Lubricants Market Company Market Share

Japan Passenger Vehicles Lubricants Market Analysis: Size, Growth Drivers, and Forecast. Comprehensive insights into market size, CAGR, and segmentation (Engine Oils, Greases, Hydraulic Fluids, Transmission & Gear Oils). Explore key trends, competitive landscape, and strategies of leading players such as ENEOS Corporation, ExxonMobil, and BP PLC (Castrol) for the Japan automotive aftermarket.

Japan Passenger Vehicles Lubricants Market Market Dynamics & Structure

The Japan passenger vehicles lubricants market is characterized by a mature yet evolving landscape, driven by stringent performance standards and a high-density vehicle parc. Market concentration is notable, with major integrated oil companies and specialized lubricant manufacturers holding significant shares. Technological innovation is a key driver, spurred by the transition towards electric vehicles (EVs) and the demand for higher fuel efficiency in internal combustion engine (ICE) vehicles. Regulatory frameworks, particularly those related to emissions and environmental impact, continuously shape product development and adoption. Competitive product substitutes, while limited in core lubricant functions, emerge in the form of advanced additive technologies and extended drain interval formulations. End-user demographics are shifting, with an aging vehicle population in some segments and a growing interest in advanced, eco-friendly lubricants among a discerning consumer base. Mergers and acquisitions (M&A) trends, though less frequent in the lubricant sector compared to broader energy markets, focus on consolidating specialized offerings or expanding geographical reach. The market is poised for transformation as the automotive industry navigates electrification and sustainability goals.

- Market Concentration: Dominated by a few key players, but with space for specialized niche providers.

- Technological Innovation Drivers: EV fluid development, high-performance engine oils for fuel efficiency, and sustainable lubricant formulations.

- Regulatory Frameworks: Increasingly stringent emissions standards and environmental protection mandates.

- Competitive Product Substitutes: Advanced additive packages, synthetic blends, and bio-based lubricant alternatives.

- End-User Demographics: Shifting preferences towards premium, eco-friendly, and high-performance lubricants.

- M&A Trends: Focus on acquiring innovative technologies and expanding product portfolios, particularly for EV fluids.

Japan Passenger Vehicles Lubricants Market Growth Trends & Insights

The Japan passenger vehicles lubricants market is experiencing a nuanced growth trajectory, influenced by a confluence of technological advancements, evolving consumer preferences, and the overarching shift in automotive propulsion systems. The market size evolution is a story of resilience and adaptation. While the demand for traditional engine oils for internal combustion engine (ICE) vehicles remains substantial, its growth rate is tempered by the accelerating adoption of electric vehicles (EVs). However, the burgeoning EV segment is simultaneously creating new avenues for growth with specialized e-fluids, including e-gear oils, e-coolants, and e-greases, representing a significant emerging opportunity. Adoption rates for synthetic and semi-synthetic lubricants continue to climb, driven by their superior performance characteristics, such as enhanced protection, extended drain intervals, and improved fuel efficiency. Technological disruptions, particularly in battery technology and powertrain design for EVs, necessitate the development of novel lubricant formulations capable of managing thermal stress, electrical conductivity, and material compatibility within these advanced systems. Consumer behavior shifts are becoming increasingly apparent, with a segment of Japanese car owners prioritizing product quality, brand reputation, and environmental sustainability in their lubricant choices. The increasing awareness of the importance of proper lubrication for vehicle longevity and optimal performance also contributes to sustained demand. The report meticulously forecasts market penetration for various lubricant types, including the significant uptick expected for EV-specific fluids. The overall market is projected to witness a compound annual growth rate (CAGR) of approximately xx% from 2019 to 2033, with the base year of 2025 setting a benchmark for estimated growth in the subsequent forecast period. This growth will be increasingly bifurcated, with steady but slower growth in ICE lubricants and a rapid expansion in the EV lubricants segment.

Dominant Regions, Countries, or Segments in Japan Passenger Vehicles Lubricants Market

Within the Japan passenger vehicles lubricants market, Engine Oils stand out as the unequivocally dominant segment driving market growth. This dominance is not a static phenomenon but is sustained by several interconnected factors, including the sheer volume of passenger vehicles still powered by internal combustion engines, the critical role engine oil plays in vehicle performance and longevity, and the ongoing demand for maintenance and replacement. The installed base of ICE vehicles in Japan, despite the increasing penetration of hybrids and EVs, remains substantial, ensuring a continuous need for high-quality engine oils. Furthermore, advancements in engine technology, such as turbocharging and direct injection, necessitate the use of more sophisticated engine oils offering superior protection against wear, deposit formation, and oxidation.

- Engine Oils: This segment accounts for the largest market share, estimated to be around 70-75% of the total passenger vehicles lubricants market in Japan. Key drivers include:

- Large ICE Vehicle Parc: A significant number of passenger cars still rely on internal combustion engines, requiring regular engine oil changes.

- Technological Advancements in Engines: Modern engines demand high-performance lubricants for optimal efficiency and protection.

- Extended Drain Intervals: Formulations offering longer service life contribute to consistent demand.

- Brand Loyalty and OEM Recommendations: Established brands and manufacturer specifications heavily influence consumer choices.

- Transmission & Gear Oils: This segment holds the second-largest share, approximately 15-20%. The increasing complexity of transmissions, including dual-clutch transmissions (DCTs) and continuously variable transmissions (CVTs), drives demand for specialized gear oils that ensure smooth operation and durability.

- Greases: Representing around 5-8% of the market, greases are essential for various automotive components like bearings, chassis points, and suspension systems. Their demand is linked to vehicle production and maintenance needs.

- Hydraulic Fluids: These fluids, typically used in power steering systems and convertible tops, constitute a smaller but important segment, around 2-5% of the market. The increasing prevalence of electric power steering (EPS) systems is leading to a gradual decline in demand for traditional hydraulic fluids in this specific application.

The dominance of engine oils is further bolstered by economic policies that support the automotive industry and infrastructure development that facilitates vehicle usage. Despite the rise of EVs, the sheer scale of the existing ICE fleet ensures that engine oils will remain the cornerstone of the Japanese passenger vehicles lubricants market for the foreseeable future. The growth potential within the engine oil segment is shifting towards premium synthetic formulations and those offering enhanced fuel economy and environmental benefits.

Japan Passenger Vehicles Lubricants Market Product Landscape

The product landscape of the Japan passenger vehicles lubricants market is defined by continuous innovation aimed at meeting evolving vehicle technologies and consumer demands. Engine oils remain the flagship category, with formulations increasingly emphasizing synthetic bases for superior thermal stability, wear protection, and fuel efficiency. The market is witnessing a growing availability of low-viscosity engine oils, designed to minimize friction and enhance fuel economy in modern, smaller displacement engines. For the burgeoning electric vehicle sector, a new generation of specialized fluids is emerging. This includes e-gear oils designed for the unique demands of electric drivetrains, e-coolants engineered for efficient battery thermal management, and specialized e-greases for EV component lubrication. These advanced products are crucial for ensuring the optimal performance, longevity, and safety of electric vehicles.

Key Drivers, Barriers & Challenges in Japan Passenger Vehicles Lubricants Market

Key Drivers:

- Technological Advancements: The development of high-performance synthetic engine oils for improved fuel efficiency and engine protection continues to be a major driver. The rapid evolution of electric vehicle (EV) technology is creating substantial demand for specialized EV fluids (e-fluids) such as e-gear oils and e-coolants.

- Stringent Emission Standards: Ever-tightening environmental regulations push manufacturers to develop lubricants that reduce emissions and improve fuel economy, directly impacting product development and consumer choices.

- Growing Vehicle Parc: Despite the shift towards electrification, the sheer number of passenger vehicles in Japan necessitates ongoing lubricant demand for maintenance and replacement.

- Consumer Demand for Premium Products: A segment of Japanese consumers is willing to pay a premium for high-quality, advanced lubricants that offer extended drain intervals and superior protection for their vehicles.

Barriers & Challenges:

- Maturing ICE Vehicle Market: The gradual decline in new ICE vehicle sales and the increasing adoption of EVs will inevitably lead to a long-term reduction in the demand for traditional engine oils.

- High Cost of Advanced Lubricants: The development and production of highly specialized synthetic and EV fluids can result in higher price points, potentially limiting adoption among price-sensitive consumers.

- Complex Regulatory Landscape: Navigating the evolving environmental and safety regulations in Japan requires significant investment in R&D and product compliance.

- Supply Chain Disruptions: Global geopolitical events and economic volatility can impact the availability and cost of raw materials, posing a challenge to consistent production and pricing.

- Intense Competition: The market is highly competitive, with both global players and established domestic manufacturers vying for market share, leading to pressure on profit margins.

Emerging Opportunities in Japan Passenger Vehicles Lubricants Market

The Japan passenger vehicles lubricants market presents significant emerging opportunities, primarily driven by the ongoing transition towards electric and hybrid vehicles. The development and widespread adoption of specialized EV Fluids (e-fluids), encompassing e-gear oils, e-coolants, and e-greases, represent a substantial growth area. As EV manufacturers expand their model offerings and consumers embrace electric mobility, the demand for these highly engineered lubricants designed to manage thermal challenges, electrical conductivity, and lubrication needs specific to EV powertrains will escalate. Furthermore, the growing emphasis on sustainability and eco-friendly products opens doors for bio-based lubricants and formulations with reduced environmental impact. The demand for high-performance synthetic lubricants that offer extended drain intervals and superior fuel efficiency for remaining ICE vehicles will continue to be a significant, albeit more mature, opportunity. Strategic partnerships between lubricant manufacturers and EV component suppliers or automotive OEMs are crucial for co-developing and validating these new fluid technologies, ensuring market readiness and adoption.

Growth Accelerators in the Japan Passenger Vehicles Lubricants Market Industry

Several key catalysts are accelerating growth in the Japan passenger vehicles lubricants market. The rapid advancement and increasing adoption of electric and hybrid vehicles are fundamentally reshaping the demand for specialized EV fluids, creating new product categories and expanding market share. Strategic partnerships and collaborations between lubricant manufacturers and automotive OEMs, particularly those focused on EV development, are crucial for accelerating the development and market penetration of next-generation fluids. Furthermore, ongoing investment in research and development by leading companies to create more efficient, environmentally friendly, and high-performance lubricants for both ICE and EV applications acts as a significant growth accelerator. Market expansion strategies, including focusing on aftermarket services and the development of innovative distribution channels, also contribute to sustained growth.

Key Players Shaping the Japan Passenger Vehicles Lubricants Market Market

- ExxonMobil Corporation

- BP PLC (Castrol)

- ENEOS Corporation

- Cosmo Energy Holdings Co Ltd

- Motul

- Royal Dutch Shell Plc

- Idemitsu Kosan Co Ltd

- Wako Chemical Co Lt

- Royal Purple (REDTREE Co Ltd)

- AKT Japan Co Ltd (TAKUMI Motor Oil)

Notable Milestones in Japan Passenger Vehicles Lubricants Market Sector

- April 2021: Motul launched two engine oils, namely CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, specifically for classic cars manufactured between the 1970s and 2000s, catering to the niche market of vintage vehicle enthusiasts.

- March 2021: Castrol announced the launch of Castrol ON, a dedicated range of e-fluids including e-gear oils, e-coolants, and e-greases, specifically designed to meet the unique lubrication and thermal management needs of electric vehicles, signaling a strong commitment to the EV segment.

- March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year global business cooperation agreement with a new focus on clean energy and carbon reduction, underscoring the strategic importance of partnerships in addressing evolving automotive industry challenges, including the development of cleaner mobility solutions.

In-Depth Japan Passenger Vehicles Lubricants Market Market Outlook

The Japan passenger vehicles lubricants market outlook is shaped by a compelling blend of transformative technological shifts and sustained demand for vehicular mobility. Growth accelerators like the burgeoning electric vehicle sector, with its burgeoning need for specialized EV fluids, and the continuous pursuit of enhanced fuel efficiency in internal combustion engines will propel the market forward. Strategic alliances between lubricant providers and automotive manufacturers, coupled with significant investments in innovative research and development, are poised to unlock new product categories and optimize performance. The market is expected to see a dynamic evolution, with a gradual shift in product mix towards advanced synthetic formulations and an exponential rise in the demand for e-fluids designed for next-generation electric drivetrains. Stakeholders who can adapt to these technological imperatives and cater to the evolving preferences for sustainability and performance will be well-positioned to capitalize on the significant future market potential.

Japan Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Japan Passenger Vehicles Lubricants Market Segmentation By Geography

- 1. Japan

Japan Passenger Vehicles Lubricants Market Regional Market Share

Geographic Coverage of Japan Passenger Vehicles Lubricants Market

Japan Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for the Paper and Plastics Packaging Industry; Increasing Demand from the Building and Construction Industry

- 3.3. Market Restrains

- 3.3.1. Cyclic Nature of Mining Industry; Other Restraints

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP PLC (Castrol)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ENEOS Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cosmo Energy Holdings Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Motul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Idemitsu Kosan Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wako Chemical Co Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal Purple (REDTREE Co Ltd)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AKT Japan Co Ltd (TAKUMI Motor Oil)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Japan Passenger Vehicles Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan Passenger Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Passenger Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Japan Passenger Vehicles Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Japan Passenger Vehicles Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Japan Passenger Vehicles Lubricants Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Japan Passenger Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Japan Passenger Vehicles Lubricants Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 7: Japan Passenger Vehicles Lubricants Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Japan Passenger Vehicles Lubricants Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 0.34%.

2. Which companies are prominent players in the Japan Passenger Vehicles Lubricants Market?

Key companies in the market include ExxonMobil Corporation, BP PLC (Castrol), ENEOS Corporation, Cosmo Energy Holdings Co Ltd, Motul, Royal Dutch Shell Plc, Idemitsu Kosan Co Ltd, Wako Chemical Co Lt, Royal Purple (REDTREE Co Ltd), AKT Japan Co Ltd (TAKUMI Motor Oil).

3. What are the main segments of the Japan Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 250.27 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for the Paper and Plastics Packaging Industry; Increasing Demand from the Building and Construction Industry.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

Cyclic Nature of Mining Industry; Other Restraints.

8. Can you provide examples of recent developments in the market?

April 2021: Motul launched two engine oils, namely CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, for classic cars manufactured between the 1970s and 2000s.March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year global business cooperation agreement, with a new focus on clean energy and carbon reduction, to help Hyundai continue its transformation as a Smart Mobility Solution Provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Japan Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence