Key Insights

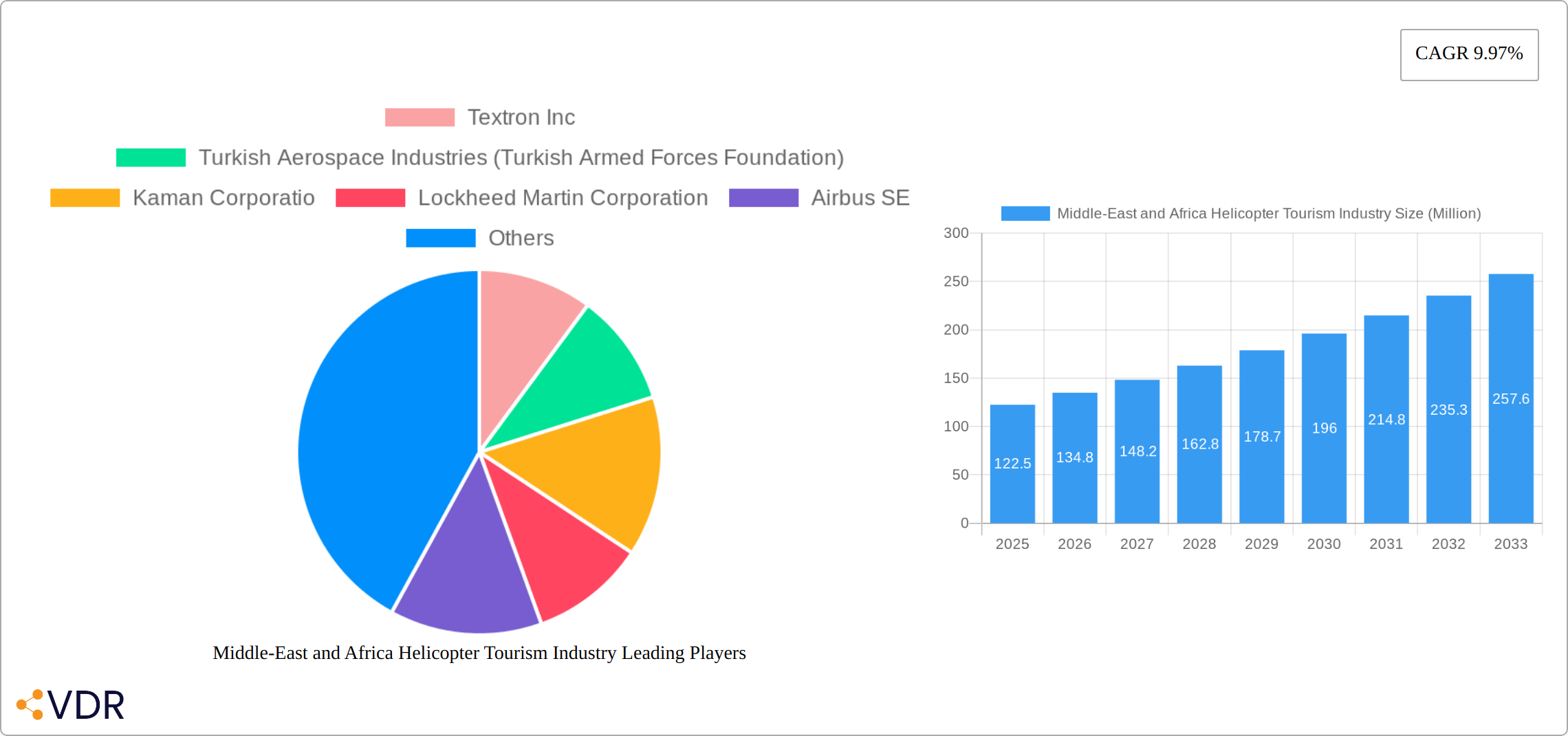

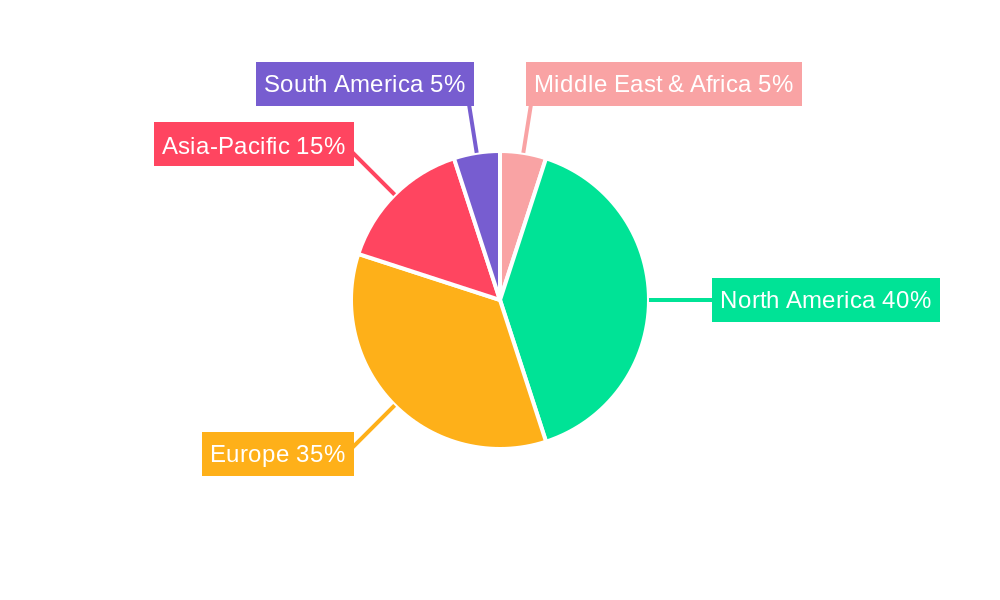

The Middle East and Africa helicopter tourism market, while currently smaller than other regions, exhibits significant growth potential. The market's 9.97% CAGR (2019-2033) suggests a robust expansion, driven by increasing disposable incomes in key tourism destinations, improved infrastructure in some areas facilitating easier access to remote and scenic locations, and a rising demand for unique and luxurious travel experiences. While specific data for the Middle East and Africa region is unavailable, we can extrapolate from the global market size of $2.45 billion (2025) and apply regional factors to estimate a plausible value. Considering the region's nascent stage of development in helicopter tourism compared to more mature markets in Europe or North America, a reasonable estimation places the Middle East and Africa market share at approximately 5% of the global market in 2025, resulting in a regional market size of roughly $122.5 million. This figure is anticipated to grow significantly over the forecast period (2025-2033), driven by ongoing tourism infrastructure developments and the growing popularity of adventure and luxury travel within the region.

However, several factors could restrain growth. These include safety concerns associated with helicopter travel, high operational costs potentially limiting accessibility for a broad segment of the population, and regulatory hurdles in certain countries. The market is segmented by application (civil and commercial vs. military) and engine type (single-engine vs. multi-engine), with the civil and commercial segments likely to dominate the tourism sector. Major players such as Textron Inc., Airbus SE, and The Boeing Company, alongside regional operators, will play a crucial role in shaping this market's trajectory. Strategic investments in safety standards and sustainable practices will be essential for the long-term viability and responsible growth of the industry.

Middle-East and Africa Helicopter Tourism Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa helicopter tourism industry, offering crucial insights for investors, industry professionals, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers a granular view of market dynamics, growth trends, and future opportunities. The report segments the market by application (Civil & Commercial, Military) and number of engines (Single-Engine, Multi-Engine), providing a detailed understanding of each segment's contribution to the overall market. Key players analyzed include Textron Inc, Turkish Aerospace Industries, Kaman Corporation, Lockheed Martin Corporation, Airbus SE, Robinson Helicopter Company Inc, MD Helicopters LLC, Rostec State Corporation, Leonardo S.p.A, and The Boeing Company. The total market size is projected at xx Million by 2033.

Middle-East and Africa Helicopter Tourism Industry Market Dynamics & Structure

The Middle East and Africa helicopter tourism market is characterized by moderate concentration, with key players holding significant market share, but also witnessing emergence of smaller regional operators. Technological innovation, particularly in areas like autonomous flight systems and enhanced safety features, are key drivers. Regulatory frameworks vary across the region, impacting operational costs and market access. Competition from alternative tourism options (e.g., private jets) exists, although the unique experience offered by helicopter tours remains a significant differentiator. End-user demographics are skewed towards high-net-worth individuals and luxury travel segments. M&A activity has been relatively low in recent years (xx deals in the last 5 years), but is expected to increase with market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on autonomous systems, safety enhancements, and fuel efficiency are major drivers.

- Regulatory Framework: Varied across countries, impacting operational costs and entry barriers.

- Competitive Substitutes: Private jets and other luxury travel options pose competition.

- End-User Demographics: Primarily high-net-worth individuals and luxury travel segments.

- M&A Activity: Relatively low historically, with potential for increased consolidation.

Middle-East and Africa Helicopter Tourism Industry Growth Trends & Insights

The Middle East and Africa helicopter tourism market is on an upward trajectory, demonstrating robust growth driven by several compelling factors. During the historical period (2019-2024), the market is estimated to have experienced a Compound Annual Growth Rate (CAGR) of approximately **10-12%**, reaching a market size of **USD 800-900 Million in 2024**. This expansion is significantly fueled by the burgeoning tourism sectors across key destinations like the UAE, Saudi Arabia, Egypt, and South Africa, coupled with a notable increase in disposable incomes among target demographics. The allure of unique, awe-inspiring experiences, such as aerial city tours, wildlife spotting safaris, and access to remote, exclusive locations, is a primary demand generator. Furthermore, ongoing technological advancements are playing a crucial role; innovations in rotorcraft design are leading to enhanced safety features, quieter operations, and more efficient fuel consumption, thereby reducing operational costs and making helicopter tourism more accessible. Consumer preferences are increasingly leaning towards personalized and curated travel experiences, boosting the demand for bespoke helicopter tours and premium packages. Despite its growing popularity, market penetration remains relatively nascent across many parts of the region, presenting substantial untapped growth potential. The forecast period (2025-2033) projects an accelerated CAGR of **13-15%**, with the market anticipated to reach an estimated size of **USD 2.5 - 3.0 Billion by 2033**. This sustained growth is expected to be further propelled by significant infrastructure development, particularly in tourist hubs, and proactive governmental initiatives aimed at bolstering the tourism industry and attracting investment.

Dominant Regions, Countries, or Segments in Middle-East and Africa Helicopter Tourism Industry

The UAE, South Africa, and Egypt are currently leading the Middle East and Africa helicopter tourism market. The Civil & Commercial segment dominates the application sector (xx% market share), driven by increasing demand for sightseeing tours, private charters, and emergency medical services. Within the number of engines, the Multi-Engine segment holds a significant portion (xx% market share) due to higher passenger capacity and longer-range capabilities.

- Key Drivers:

- UAE: Strong tourism infrastructure, favorable regulatory environment, and high disposable incomes.

- South Africa: Thriving tourism sector, diverse landscapes suitable for helicopter tours, and government initiatives to promote tourism.

- Egypt: Ancient historical sites, appealing natural landscapes, and increasing investment in tourism infrastructure.

- Civil & Commercial Segment: Increasing demand for sightseeing tours, private charters, and emergency medical services.

- Multi-Engine Segment: Higher passenger capacity, longer range, and enhanced safety features.

Middle-East and Africa Helicopter Tourism Industry Product Landscape

The product landscape within the Middle East and Africa helicopter tourism market is diverse and continuously evolving to meet varied customer needs and preferences. Operators utilize a spectrum of aircraft, ranging from nimble, lightweight single-engine helicopters, perfect for intimate scenic flights over iconic landmarks or natural wonders, to more spacious, multi-engine models designed for group excursions, corporate transfers, and specialized photographic or filming missions. A significant focus of recent innovation is on enhancing the passenger experience through advancements such as advanced noise reduction technologies for a more comfortable flight, state-of-the-art safety features including advanced avionics and redundant systems, and improved fuel efficiency to manage operating costs. The unique selling propositions that differentiate operators often include meticulously crafted, customized tour packages that cater to specific interests, offering unparalleled personalized service, and providing exclusive access to otherwise inaccessible or breathtaking locations. Cutting-edge technological integrations, such as sophisticated flight control systems, advanced GPS navigation, and in-flight entertainment options, are continually elevating the overall quality and memorability of the helicopter tourism experience.

Key Drivers, Barriers & Challenges in Middle-East and Africa Helicopter Tourism Industry

Key Drivers: The Middle East and Africa helicopter tourism industry is propelled by several powerful forces. A primary driver is the robust growth of the tourism sector across the region, marked by increased international arrivals and a strong domestic travel market. This is complemented by rising disposable incomes, enabling a larger segment of the population to afford luxury travel experiences. The inherent demand for unique and exclusive experiences, which helicopter tours perfectly fulfill, is a significant catalyst. Supportive government initiatives aimed at promoting tourism and developing infrastructure are creating a more favorable business environment. Furthermore, continuous technological advancements in aviation are enhancing safety, efficiency, and the overall appeal of helicopter operations.

Key Challenges: Despite the positive outlook, the industry faces notable hurdles. High operational costs, including aircraft maintenance, fuel, and pilot salaries, remain a significant barrier. Stringent and often complex regulatory requirements across different countries can impede market entry and expansion. Persistent safety concerns, although mitigated by technological advancements and rigorous training, can still deter potential customers. Infrastructure limitations, particularly in remote tourist destinations, can affect accessibility and operational feasibility. The industry also faces competition from other luxury tourism options. Supply chain disruptions, affecting the availability of parts and specialized services, can also significantly impact operational continuity and costs, potentially affecting growth by an estimated **5-8%** in the next five years if not effectively managed.

Emerging Opportunities in Middle-East and Africa Helicopter Tourism Industry

Untapped markets in several African countries present substantial growth potential. Eco-tourism initiatives focusing on sustainable practices could attract environmentally conscious tourists. The integration of virtual reality and augmented reality technologies can enhance the tourist experience. Developing customized packages catering to niche interests (e.g., wildlife viewing, historical site tours) will also drive growth.

Growth Accelerators in the Middle-East and Africa Helicopter Tourism Industry Industry

Several factors are poised to significantly accelerate the growth of the helicopter tourism industry in the Middle East and Africa. Technological advancements are at the forefront, with the exploration and adoption of autonomous flight systems and the emerging potential of electric and hybrid-electric propulsion promising to reduce operational costs, enhance sustainability, and potentially increase operational flexibility. Strategic partnerships and collaborations between helicopter operators, luxury hotel chains, tour operators, and destination management companies are crucial for expanding market reach, co-creating unique packages, and accessing broader customer bases. Governmental support, including investment in tourism infrastructure such as helipads and related facilities, alongside the implementation of favorable and streamlined regulatory frameworks, will create an even more conducive and attractive business environment for investment and expansion. Furthermore, the increasing trend towards experiential travel and the desire for unique, Instagrammable moments will continue to fuel demand for helicopter-based adventures.

Key Players Shaping the Middle-East and Africa Helicopter Tourism Industry Market

- Textron Inc

- Turkish Aerospace Industries (Turkish Armed Forces Foundation)

- Kaman Corporation

- Lockheed Martin Corporation

- Airbus SE

- Robinson Helicopter Company Inc

- MD Helicopters LLC

- Rostec State Corporation

- Leonardo S.p.A

- The Boeing Company

Notable Milestones in Middle-East and Africa Helicopter Tourism Industry Sector

- November 2023: The UAE’s Strategic Development Fund announced significant plans to independently develop the VRT500 and VRT300 co-axial light helicopters. This strategic move underscores a growing regional commitment to fostering indigenous helicopter technology and manufacturing capabilities, which could lead to more localized and cost-effective solutions for the burgeoning helicopter tourism sector in the future.

- January 2023: The US Army awarded Boeing a substantial USD 426 million contract for 12 CH-47F Chinooks destined for the Egyptian Air Force. While primarily a military procurement, such significant investments in advanced helicopter technology within the region can often have a trickle-down effect, potentially paving the way for future commercial applications, including enhanced capabilities for heavy-lift or long-range tourist transport.

- Late 2023/Early 2024: Several key tourism hubs in Saudi Arabia, particularly those developing new giga-projects like NEOM and Red Sea Global, have seen increased investment in and development of helipad infrastructure, signaling a proactive approach to integrating helicopter tourism as a premium transport and sightseeing option for visitors to these emerging destinations.

- Ongoing 2023-2024: A surge in partnerships between helicopter tour operators and luxury safari lodges in South Africa and Botswana has been observed. These collaborations are enhancing the wildlife viewing experience by offering exclusive aerial perspectives of wildlife migrations and vast game reserves, directly catering to the high-end adventure tourism market.

In-Depth Middle-East and Africa Helicopter Tourism Industry Market Outlook

The Middle East and Africa helicopter tourism market exhibits strong potential for growth in the coming years. Continued infrastructure development, rising disposable incomes, and technological advancements will be primary drivers. Strategic partnerships and innovative business models focusing on sustainability and niche tourism segments will be crucial for success. The market is poised for significant expansion, especially in underserved regions, presenting considerable opportunities for investors and industry players.

Middle-East and Africa Helicopter Tourism Industry Segmentation

-

1. Application

- 1.1. Civil And Commercial

- 1.2. Military

-

2. Number of Engines

- 2.1. Single-Engine

- 2.2. Multi-Engine

-

3. Geography

-

3.1. Middle-East and Africa

- 3.1.1. Saudi Arabia

- 3.1.2. United Arab Emirates

- 3.1.3. Israel

- 3.1.4. Qatar

- 3.1.5. Egypt

- 3.1.6. Turkey

- 3.1.7. Rest of Middle-East and Africa

-

3.1. Middle-East and Africa

Middle-East and Africa Helicopter Tourism Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Egypt

- 1.6. Turkey

- 1.7. Rest of Middle East and Africa

Middle-East and Africa Helicopter Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Segment to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil And Commercial

- 5.1.2. Military

- 5.2. Market Analysis, Insights and Forecast - by Number of Engines

- 5.2.1. Single-Engine

- 5.2.2. Multi-Engine

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East and Africa

- 5.3.1.1. Saudi Arabia

- 5.3.1.2. United Arab Emirates

- 5.3.1.3. Israel

- 5.3.1.4. Qatar

- 5.3.1.5. Egypt

- 5.3.1.6. Turkey

- 5.3.1.7. Rest of Middle-East and Africa

- 5.3.1. Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Textron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Turkish Aerospace Industries (Turkish Armed Forces Foundation)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kaman Corporatio

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Lockheed Martin Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Airbus SE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Robinson Helicopter Company Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MD Helicopters LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rostec State Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Leonardo S p A

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 The Boeing Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Textron Inc

List of Figures

- Figure 1: Middle-East and Africa Helicopter Tourism Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Helicopter Tourism Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Number of Engines 2019 & 2032

- Table 4: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Number of Engines 2019 & 2032

- Table 15: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Egypt Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Turkey Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Middle East and Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Helicopter Tourism Industry?

The projected CAGR is approximately 9.97%.

2. Which companies are prominent players in the Middle-East and Africa Helicopter Tourism Industry?

Key companies in the market include Textron Inc, Turkish Aerospace Industries (Turkish Armed Forces Foundation), Kaman Corporatio, Lockheed Martin Corporation, Airbus SE, Robinson Helicopter Company Inc, MD Helicopters LLC, Rostec State Corporation, Leonardo S p A, The Boeing Company.

3. What are the main segments of the Middle-East and Africa Helicopter Tourism Industry?

The market segments include Application, Number of Engines, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Segment to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2023: The UAE’s Strategic Development Fund announced that it had planned to independently develop the VRT500 and VRT300 co-axial light helicopters after the invasion of Ukraine by Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Helicopter Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Helicopter Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Helicopter Tourism Industry?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Helicopter Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence