Key Insights

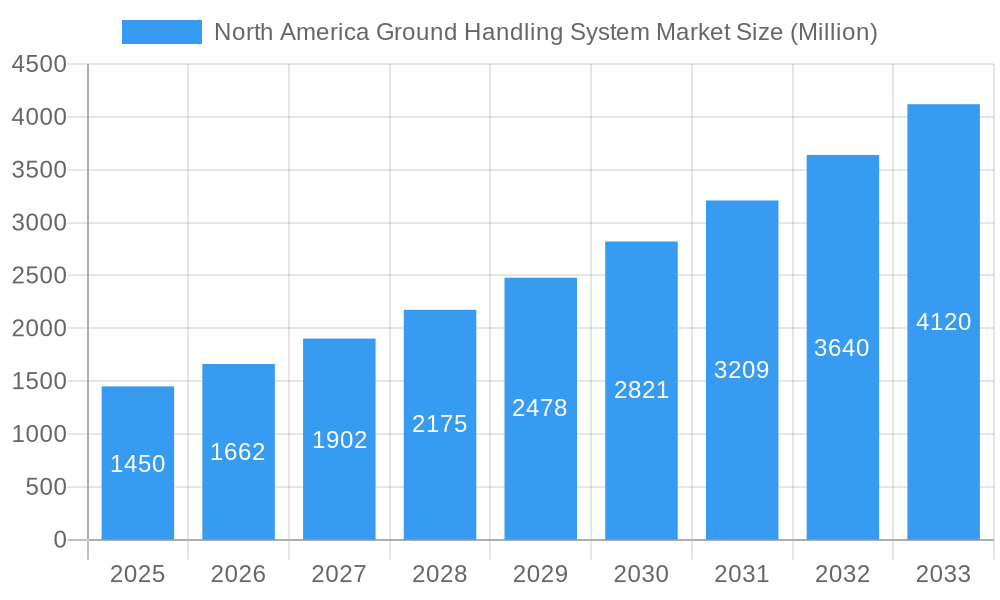

The North America Ground Handling System Market is poised for significant expansion, projected to reach a market size of USD 1.45 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 14.70% throughout the forecast period of 2025-2033. This remarkable growth is underpinned by several key factors. The increasing volume of air traffic globally, coupled with the continuous modernization of airport infrastructure across North America, necessitates advanced and efficient ground handling solutions. The demand for enhanced safety, reduced turnaround times, and improved operational efficiency at airports are primary catalysts. Furthermore, the growing emphasis on sustainable aviation practices is spurring the adoption of electric and hybrid ground support equipment (GSE), which aligns with environmental regulations and operational cost savings. Technological advancements in automation, AI-powered diagnostics, and IoT integration are further revolutionizing ground handling operations, leading to greater accuracy and reduced human error. Key market segments, including production, consumption, import/export, and price trends, are all expected to witness substantial activity. Production is set to escalate to meet rising demand, while consumption will be fueled by airports and ground handling service providers. Import and export activities will remain dynamic as regions specialize in certain technologies and manufacturing capabilities. Price trends will likely reflect a balance between technological innovation, material costs, and competitive market forces.

North America Ground Handling System Market Market Size (In Billion)

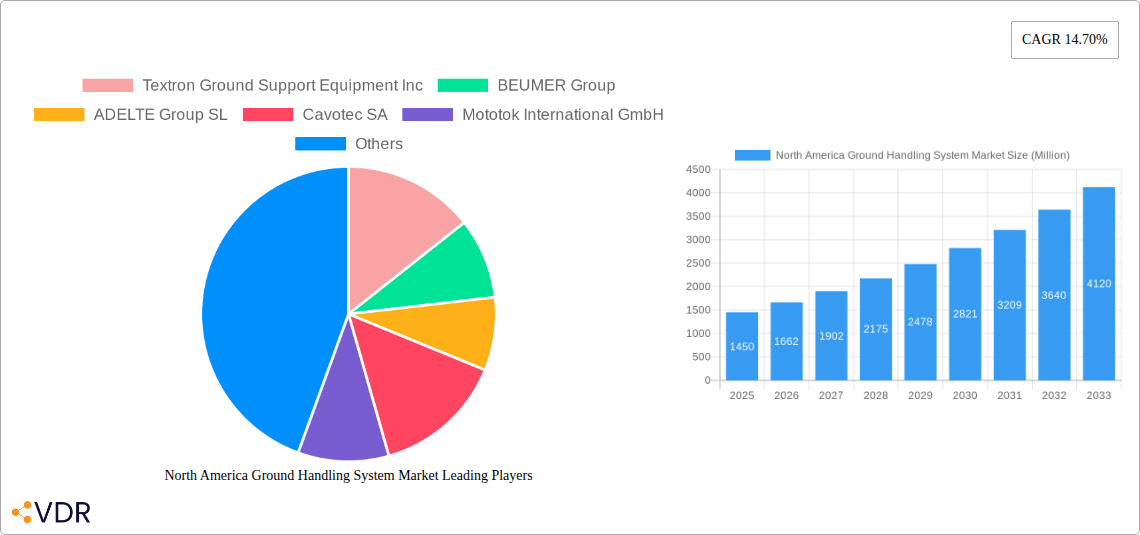

The competitive landscape of the North America Ground Handling System Market is characterized by the presence of established global players and emerging innovators. Companies such as Textron Ground Support Equipment Inc., BEUMER Group, ADELTE Group SL, Cavotec SA, Mototok International GmbH, JBT Corporation, and ALVES are actively contributing to market dynamics through product development, strategic collaborations, and mergers and acquisitions. Innovation in areas like automated baggage handling, advanced boarding bridges, and efficient aircraft tugs is critical for market participants to maintain a competitive edge. The market is witnessing a discernible shift towards integrated solutions that offer comprehensive ground support services, encompassing everything from passenger boarding to aircraft maintenance support. Future growth will be heavily influenced by the ability of these companies to adapt to evolving airport operational needs, stringent safety standards, and the global push towards decarbonization within the aviation sector. The continued investment in airport infrastructure and the recovery of air travel post-pandemic are expected to further accelerate the adoption of sophisticated ground handling systems, making North America a pivotal region for this market.

North America Ground Handling System Market Company Market Share

Unlock critical insights into the North America ground handling system market, a vital sector supporting air travel operations. This in-depth report provides a granular analysis of market dynamics, growth trends, regional dominance, product innovations, key players, and future opportunities. Covering the period from 2019–2033, with a base and estimated year of 2025, this report is essential for stakeholders seeking to navigate and capitalize on this evolving industry. We delve into both parent and child markets, offering a holistic view of the ground support equipment and services landscape. All values are presented in Million units.

North America Ground Handling System Market Market Dynamics & Structure

The North America ground handling system market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Technological innovation is a key driver, fueled by the demand for increased efficiency, safety, and sustainability in airport operations. Regulatory frameworks, established by aviation authorities like the FAA and Transport Canada, dictate stringent safety standards and operational protocols, influencing system design and adoption. Competitive product substitutes, ranging from traditional diesel-powered equipment to emerging electric and autonomous solutions, are constantly challenging existing market paradigms. End-user demographics, primarily airports, airlines, and third-party ground handlers, influence demand based on traffic volume, fleet size, and operational needs. Mergers and acquisitions (M&A) trends are also shaping the landscape, with companies consolidating to enhance their product portfolios and expand their geographical reach. For instance, the market has witnessed XX M&A deals in the historical period (2019-2024), indicating a drive for consolidation and synergy. Innovation barriers primarily stem from high R&D costs, long product development cycles, and the need for extensive testing and certification within the aviation industry.

- Market Concentration: Dominated by key players, with a XX% market share held by the top 5 companies.

- Technological Innovation Drivers: Demand for automation, electrification, AI-powered solutions, and enhanced safety features.

- Regulatory Frameworks: FAA and Transport Canada mandates on safety, emissions, and operational efficiency.

- Competitive Substitutes: Electric Ground Power Units (E-GPUs), autonomous baggage tractors, advanced fleet management software.

- End-User Demographics: Major airports (e.g., Hartsfield-Jackson Atlanta International Airport, O'Hare International Airport), large airline carriers, and specialized ground handling service providers.

- M&A Trends: Consolidation to achieve economies of scale, expand service offerings, and gain market access.

- Innovation Barriers: High capital investment, rigorous certification processes, and the need for extensive infrastructure upgrades.

North America Ground Handling System Market Growth Trends & Insights

The North America ground handling system market is poised for robust growth, driven by an increasing global air passenger and cargo traffic. The market size is projected to evolve from approximately $XX million in 2019 to an estimated $XX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates for advanced ground handling equipment are steadily rising, influenced by the imperative to optimize turnaround times and reduce operational costs. Technological disruptions, such as the integration of IoT for real-time monitoring and predictive maintenance of ground support equipment (GSE), are transforming operational paradigms. Consumer behavior shifts, characterized by airlines’ increasing focus on passenger experience and on-time performance, directly translate to a demand for highly reliable and efficient ground handling services and systems. The gradual shift towards electric and eco-friendly ground support equipment is also a significant trend, driven by environmental regulations and corporate sustainability initiatives. Furthermore, the growing emphasis on digital transformation within the aviation sector is accelerating the adoption of advanced software solutions for fleet management, operational planning, and data analytics. This digital integration is not only enhancing efficiency but also providing valuable insights for strategic decision-making. The expansion of air cargo operations, particularly in response to e-commerce growth, is creating additional demand for specialized ground handling systems and infrastructure at airports across North America. The ongoing modernization of airport infrastructure across the region also plays a pivotal role in driving the demand for new and advanced ground handling systems that can seamlessly integrate with the latest airport technologies.

Dominant Regions, Countries, or Segments in North America Ground Handling System Market

The United States consistently emerges as the dominant region in the North America ground handling system market, driven by its extensive air travel network, high passenger and cargo volumes, and the presence of major airline hubs.

- Production Analysis: The U.S. leads in the manufacturing of advanced ground handling equipment, with a significant number of key manufacturers headquartered in the country. This dominance is attributed to robust industrial infrastructure, access to skilled labor, and strong R&D capabilities. Production output is estimated at XX million units annually, with a projected growth of XX% by 2033.

- Consumption Analysis: The U.S. accounts for the largest share of consumption due to the sheer number of active airports and the high frequency of aircraft movements. Major airports like Hartsfield-Jackson Atlanta International Airport and Los Angeles International Airport are significant consumers of ground handling systems. Consumption volume is anticipated to reach XX million units by 2033.

- Import Market Analysis (Value & Volume): While the U.S. is a net exporter of ground handling systems, there are significant imports of specialized components and niche equipment from international markets. The import market value is estimated at $XX million in 2025, with a volume of XX million units. Canada, while smaller, also contributes to the import market, particularly for specialized GSE.

- Export Market Analysis (Value & Volume): The U.S. is a major exporter of ground handling systems, particularly to Latin America and other regions. The export market value is projected to be $XX million in 2025, with a volume of XX million units, reflecting the global demand for American-made aviation technology.

- Price Trend Analysis: Price trends are influenced by raw material costs, technological advancements, and supply chain dynamics. The average price for a unit of ground handling equipment is expected to see a moderate increase of XX% from 2025 to 2033. Fluctuations in energy prices also impact the operational costs of ground handling services, indirectly influencing equipment demand and pricing.

- Industry Developments: The ongoing investments in airport infrastructure and the increasing focus on operational efficiency by airlines are key drivers for the North American market. For instance, the development of smart airport technologies is creating a demand for integrated and automated ground handling solutions, further solidifying the region's dominance.

North America Ground Handling System Market Product Landscape

The product landscape of the North America ground handling system market is diverse, encompassing a wide array of essential equipment and services. Innovations are heavily focused on enhancing operational efficiency, safety, and environmental sustainability. Key product categories include self-propelled tow tractors, pushback tractors, de-icing systems, cargo loaders, passenger boarding bridges, and ground power units (GPUs). The market is witnessing a significant trend towards electrification, with battery-powered GSE becoming increasingly prevalent to reduce emissions and noise pollution at airports. Autonomous technologies are also being explored and piloted for baggage handling and towing operations, promising to revolutionize turnaround times. Performance metrics are meticulously tracked, including fuel efficiency, maintenance intervals, payload capacity, and operational uptime. The unique selling proposition of leading products often lies in their advanced automation features, robust build quality, and integration capabilities with airport IT systems.

Key Drivers, Barriers & Challenges in North America Ground Handling System Market

Key Drivers:

- Increasing Air Traffic: The consistent growth in passenger and cargo volumes necessitates more efficient and advanced ground handling operations.

- Technological Advancements: Innovations in automation, electrification, and data analytics are driving demand for modern GSE.

- Focus on Operational Efficiency: Airlines and airports are keen on reducing turnaround times and operational costs, pushing for faster and more reliable ground handling.

- Sustainability Initiatives: Growing environmental concerns and regulatory pressures are accelerating the adoption of eco-friendly ground support equipment.

- Airport Modernization Projects: Significant investments in airport infrastructure upgrades worldwide are creating opportunities for new GSE deployment.

Barriers & Challenges:

- High Capital Investment: The upfront cost of advanced ground handling systems can be substantial, posing a barrier for smaller operators.

- Regulatory Hurdles: Stringent safety regulations and certification processes can lengthen product development and deployment timelines.

- Infrastructure Limitations: Existing airport infrastructure may not always be compatible with new technologies, requiring significant upgrades.

- Skilled Labor Shortage: A lack of trained personnel to operate and maintain complex, technologically advanced GSE can hinder adoption.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components, leading to production delays and price volatility.

- Competitive Pressures: Intense competition among GSE manufacturers and service providers can lead to price wars and reduced profit margins.

Emerging Opportunities in North America Ground Handling System Market

Emerging opportunities in the North America ground handling system market lie in the burgeoning demand for electric and autonomous ground support equipment (GSE). As airports strive for greater sustainability and operational efficiency, the adoption of battery-powered GSE, from tugs to loaders, is set to surge. The development of intelligent, data-driven solutions for fleet management and predictive maintenance presents another significant avenue. Furthermore, the expansion of cargo operations, fueled by e-commerce, is creating a need for specialized and automated cargo handling systems. Untapped markets in smaller regional airports seeking to upgrade their capabilities also represent growth potential. Evolving consumer preferences for faster and more seamless travel experiences are indirectly driving demand for optimized ground handling processes and technologies.

Growth Accelerators in the North America Ground Handling System Market Industry

Growth accelerators in the North America ground handling system market are multifaceted. Technological breakthroughs, particularly in battery technology and AI for autonomous operations, are significantly enhancing the capabilities and appeal of ground support equipment. Strategic partnerships between GSE manufacturers, airlines, and airport authorities are crucial for developing tailored solutions and ensuring seamless integration into existing airport ecosystems. Market expansion strategies, including the development of comprehensive after-sales service and maintenance networks, are vital for building customer trust and loyalty. The increasing emphasis on digitalization and data analytics within the aviation sector is also a powerful growth accelerator, enabling better operational planning, resource allocation, and overall efficiency in ground handling operations.

Key Players Shaping the North America Ground Handling System Market Market

- Textron Ground Support Equipment Inc

- BEUMER Group

- ADELTE Group SL

- Cavotec SA

- Mototok International GmbH

- JBT Corporation

- ALVES

Notable Milestones in North America Ground Handling System Market Sector

- October 2021: Swissport opened its latest air cargo warehouse at Halifax Stanfield International Airport, expanding its local offering with a 370 sq. meters facility.

- November 2021: Swissport Canada entered into a three-year partnership with Sunwing Airlines to provide comprehensive airport ground services at Toronto Pearson International Airport, including baggage handling, check-in assistance, gate services, and aircraft handling on the apron.

In-Depth North America Ground Handling System Market Market Outlook

The future outlook for the North America ground handling system market is exceptionally promising, driven by a confluence of accelerating factors. The continued global rebound in air travel, coupled with the persistent growth of air cargo, will sustain and amplify demand for efficient and advanced ground support equipment. Investments in smart airport technologies and sustainable aviation practices will further propel the adoption of electric and autonomous GSE. Strategic collaborations and innovative product development will be key to unlocking untapped market segments and addressing the evolving needs of airlines and airports. The market is set for significant expansion, offering substantial opportunities for stakeholders to innovate and lead in shaping the future of aviation ground operations.

North America Ground Handling System Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Ground Handling System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Ground Handling System Market Regional Market Share

Geographic Coverage of North America Ground Handling System Market

North America Ground Handling System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Anticipated Rebound In Passenger Traffic And The Growth In Airline Fleets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Ground Handling System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Ground Support Equipment Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BEUMER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADELTE Group SL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cavotec SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mototok International GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JBT Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALVES

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Textron Ground Support Equipment Inc

List of Figures

- Figure 1: North America Ground Handling System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Ground Handling System Market Share (%) by Company 2025

List of Tables

- Table 1: North America Ground Handling System Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Ground Handling System Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Ground Handling System Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Ground Handling System Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Ground Handling System Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Ground Handling System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Ground Handling System Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Ground Handling System Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Ground Handling System Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Ground Handling System Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Ground Handling System Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Ground Handling System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Ground Handling System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Ground Handling System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Ground Handling System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Ground Handling System Market?

The projected CAGR is approximately 14.70%.

2. Which companies are prominent players in the North America Ground Handling System Market?

Key companies in the market include Textron Ground Support Equipment Inc, BEUMER Group, ADELTE Group SL, Cavotec SA, Mototok International GmbH, JBT Corporation, ALVES.

3. What are the main segments of the North America Ground Handling System Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.45 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Anticipated Rebound In Passenger Traffic And The Growth In Airline Fleets.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2021, Swissport opened three new air cargo warehouses at Montréal-Mirabel International Airport, Edmonton International Airport, and Halifax Stanfield International Airport. The latest air cargo warehouse was opened in October 2021 at Halifax Stanfield International Airport with an area of 370 sq. meters that will complement its local offering in passenger services with air cargo handling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Ground Handling System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Ground Handling System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Ground Handling System Market?

To stay informed about further developments, trends, and reports in the North America Ground Handling System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence