Key Insights

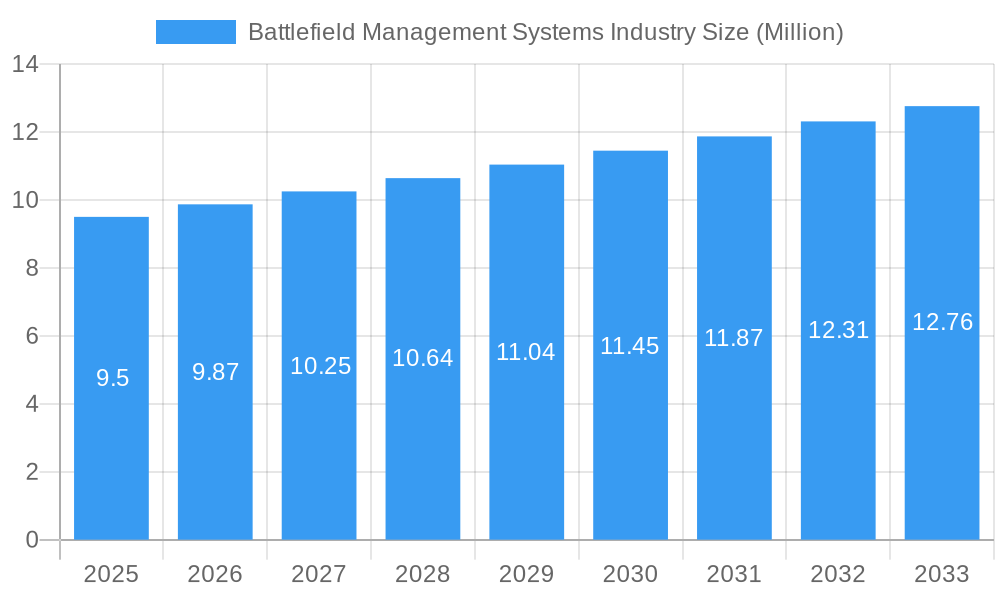

The Battlefield Management Systems (BMS) market is poised for significant expansion, projected to reach approximately USD 11.09 million by the end of the study period. This growth is underpinned by a steady Compound Annual Growth Rate (CAGR) of 3.83% throughout the forecast period of 2025-2033. The escalating global defense spending, driven by the need for enhanced situational awareness, real-time data sharing, and improved command and control capabilities, serves as a primary catalyst for this market's ascent. Modern warfare increasingly relies on integrated digital solutions to streamline operations, reduce collateral damage, and improve soldier safety. Consequently, the demand for sophisticated Navigation Systems, robust Communication and Networking Systems, efficient Command and Control Systems, and advanced Weapon Systems is expected to surge. Key players like THALE, L3Harris Technologies Inc., General Dynamics Corporation, and BAE Systems plc are actively investing in research and development to offer cutting-edge BMS solutions that cater to the evolving needs of the Army, Air Force, and Navy. The increasing adoption of cloud computing, artificial intelligence, and secure data transmission technologies will further propel market innovation and adoption.

Battlefield Management Systems Industry Market Size (In Million)

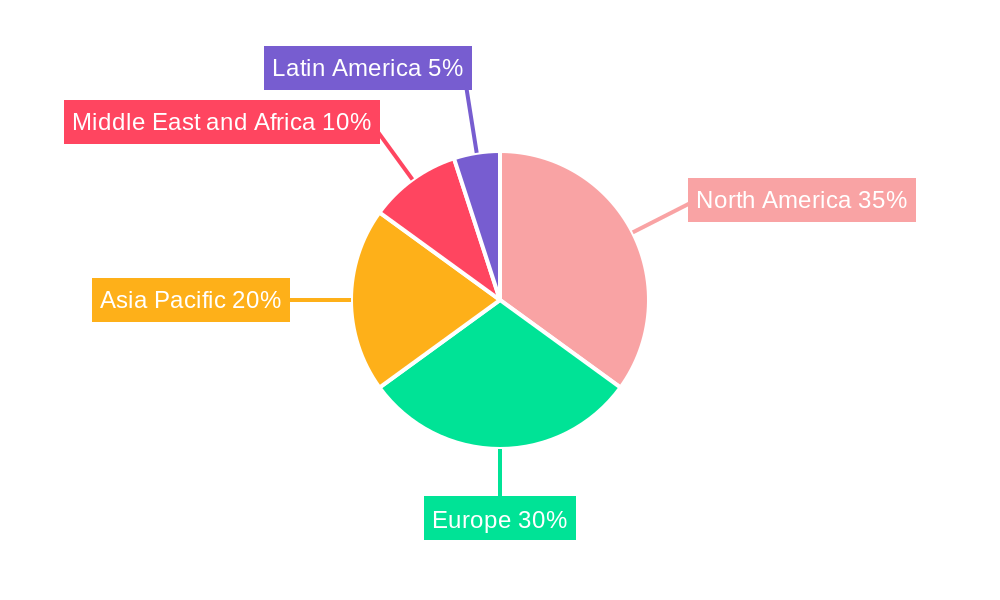

The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at expanding market reach and technological prowess. Geographically, North America and Europe are anticipated to remain dominant markets, owing to substantial defense budgets and the presence of leading defense contractors. However, the Asia Pacific region, particularly China and India, is exhibiting rapid growth due to modernization initiatives within their armed forces and increasing geopolitical tensions. Emerging trends such as the integration of unmanned systems, cyber warfare capabilities, and advanced sensor fusion within BMS platforms are shaping the future trajectory of the market. While the market presents robust growth opportunities, challenges such as high initial investment costs, data security concerns, and the need for interoperability across diverse systems may pose constraints to immediate widespread adoption. Nevertheless, the undeniable strategic advantage offered by effective BMS solutions ensures sustained demand and continued market development.

Battlefield Management Systems Industry Company Market Share

Report Description: Battlefield Management Systems Industry Market Analysis 2025-2033

This comprehensive report offers an in-depth analysis of the global Battlefield Management Systems (BMS) industry, providing crucial insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the competitive environment. Covering the study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving battlefield technology sector. We present all quantitative values in million units.

Battlefield Management Systems Industry Market Dynamics & Structure

The Battlefield Management Systems (BMS) industry is characterized by a moderately concentrated market structure, driven by substantial R&D investments and high entry barriers due to stringent defense procurement processes and technological complexity. Key players like THALE, L3Harris Technologies Inc, General Dynamics Corporation, Rheinmetall AG, Kongsberg Gruppen ASA, Elbit Systems Ltd, RTX Corporation, ASELSAN A S, Leonardo DRS Inc (Leonardo S p A), BAE Systems plc, Indra Sistemas S A, and Saab AB dominate a significant portion of the market share, estimated at 65-70%. Technological innovation remains the primary growth driver, fueled by advancements in artificial intelligence (AI), sensor fusion, secure communication protocols, and data analytics, all crucial for enhancing situational awareness and operational efficiency.

- Market Concentration: Dominated by a few large defense contractors with extensive integrated capabilities.

- Technological Innovation Drivers: AI, C5ISR integration, cyber resilience, advanced sensor technology, drone integration.

- Regulatory Frameworks: Stringent export controls, defense procurement regulations, interoperability standards.

- Competitive Product Substitutes: While direct substitutes are limited, modular and adaptable C4ISR solutions offer partial alternatives for specific functions.

- End-User Demographics: Primarily government defense forces (Army, Air Force, Navy) with varying modernization priorities.

- M&A Trends: Strategic acquisitions to gain access to niche technologies or expand geographic reach, with an estimated 5-8 significant M&A deals annually during the historical period, indicating consolidation and integration efforts.

Battlefield Management Systems Industry Growth Trends & Insights

The global Battlefield Management Systems (BMS) market is poised for substantial expansion, driven by escalating geopolitical tensions, the increasing adoption of digital warfare capabilities, and ongoing military modernization programs across key nations. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 8.5% to 9.2% between 2025 and 2033. This growth is propelled by a paradigm shift towards networked warfare, where seamless information exchange and enhanced situational awareness are paramount for achieving battlefield superiority. The integration of AI and machine learning into BMS platforms is revolutionizing decision-making processes, enabling real-time threat assessment and optimized resource allocation.

The adoption rate of advanced BMS solutions is accelerating, particularly within the Army segment, which is expected to command a market share of approximately 45-50% by 2033. This dominance is attributed to the Army's extensive need for ground troop coordination, vehicle integration, and persistent surveillance. The Air Force and Navy segments are also exhibiting strong growth, driven by the demand for integrated air and missile defense systems, maritime surveillance, and joint operational capabilities. Technological disruptions, such as the proliferation of unmanned aerial vehicles (UAVs) and the development of counter-drone technologies, are creating new avenues for BMS integration and demanding more sophisticated command and control functionalities.

Consumer behavior, in this context referring to defense procurement agencies, is increasingly focused on interoperability, cybersecurity, and life-cycle support. There is a growing preference for modular, scalable, and upgradeable BMS solutions that can adapt to rapidly evolving threats and technological advancements. The increasing emphasis on network-centric warfare and the need for enhanced data fusion from various sensors are critical factors influencing market penetration. Furthermore, the growing defense budgets in emerging economies and the continuous requirement for replacing aging military hardware are significant tailwinds for market growth. The penetration of advanced BMS within the total defense technology spending is estimated to increase from 12% in 2024 to 18% by 2033.

Dominant Regions, Countries, or Segments in Battlefield Management Systems Industry

The global Battlefield Management Systems (BMS) market is significantly influenced by the strategic priorities and defense spending of major global powers, with North America and Europe emerging as the dominant regions. Within these regions, the United States and several key European nations, including the United Kingdom, Germany, and France, are the primary drivers of market growth. The Army segment is consistently the largest end-user, accounting for an estimated 48% of the global market share in 2025, due to its extensive operational requirements for ground troop coordination, vehicle integration, and real-time battlefield intelligence.

- North America: Driven by the US Department of Defense's continuous investment in modernizing its forces, enhancing interoperability across its services, and developing advanced C4ISR capabilities. The emphasis on network-centric warfare and the integration of AI in battlefield operations further fuels demand. The US alone is expected to represent over 30% of the global BMS market by 2033.

- Europe: Characterized by significant defense spending from countries like Germany, the UK, and France, spurred by evolving geopolitical landscapes and the need for collective security. Investments in next-generation combat vehicles, joint operational capabilities, and digital battlefield solutions are key growth factors. The European market is projected to grow at a CAGR of 8.8% during the forecast period.

- Dominant Segment - Command and Control Systems: This segment is a cornerstone of BMS, providing the critical infrastructure for decision-making and operational management. Its market share is estimated to be around 35-40% of the total BMS market, highlighting its central role in integrating all battlefield elements. Advancements in AI-driven C2 systems are particularly driving innovation and demand.

- Key Drivers:

- Economic Policies: Increased defense budgets, government incentives for indigenous defense manufacturing.

- Infrastructure: Robust technological infrastructure supporting advanced communication and data processing.

- Geopolitical Factors: Regional conflicts, increasing security concerns, and the need for enhanced national defense capabilities.

- Technological Advancements: Rapid development and integration of AI, IoT, and advanced sensor technologies.

- Interoperability Initiatives: Mandates and programs aimed at improving seamless communication between different military branches and allied forces.

The Command and Control Systems segment is also a key driver of growth due to its foundational role in integrating various battlefield components. As military operations become more complex and data-intensive, the need for sophisticated C2 systems that can process vast amounts of information in real-time is paramount. The Army end-user segment’s dominance stems from its broad application of BMS across infantry, armored units, artillery, and logistics.

Battlefield Management Systems Industry Product Landscape

The Battlefield Management Systems (BMS) product landscape is characterized by continuous innovation, focusing on enhanced connectivity, data fusion, and AI-driven decision support. Key product developments include advanced situational awareness displays, secure networking solutions, and integrated sensor platforms that provide real-time battlefield intelligence. Applications span from dismounted soldier systems to complex vehicle-mounted and airborne command centers, all aimed at improving operational efficiency and survivability. Unique selling propositions revolve around superior cybersecurity, interoperability with existing and future systems, and the ability to provide commanders with actionable insights derived from vast datasets. Technological advancements are heavily focused on miniaturization, power efficiency, and ruggedization for extreme operating environments.

Key Drivers, Barriers & Challenges in Battlefield Management Systems Industry

Key Drivers:

- Rising Geopolitical Tensions: Increasing global conflicts and defense spending by nations worldwide.

- Technological Advancements: Integration of AI, IoT, advanced sensors, and secure communication networks.

- Military Modernization Programs: Ongoing efforts by armed forces to upgrade legacy systems with advanced battlefield management capabilities.

- Demand for Network-Centric Warfare: The imperative for seamless information flow and enhanced situational awareness.

Barriers & Challenges:

- High Development and Procurement Costs: The significant financial investment required for R&D and acquiring advanced BMS.

- Interoperability Issues: Challenges in ensuring seamless communication and data exchange between diverse legacy and new systems.

- Cybersecurity Threats: The constant risk of cyberattacks targeting critical battlefield information and command systems, with an estimated annual cost of cyber breaches in the defense sector reaching hundreds of millions of dollars globally.

- Stringent Regulatory and Export Controls: Complex approval processes and international restrictions on defense technology transfers.

- Long Procurement Cycles: Lengthy defense procurement timelines can delay the adoption of cutting-edge technologies.

Emerging Opportunities in Battlefield Management Systems Industry

Emerging opportunities in the Battlefield Management Systems (BMS) industry are significantly driven by the integration of artificial intelligence and machine learning for predictive analytics and autonomous operations. The growing demand for drone swarm management systems and their seamless integration into existing BMS platforms presents a substantial growth avenue. Furthermore, the focus on cyber resilience and the development of secure, encrypted communication networks for contested environments offer significant potential. The increasing adoption of cloud-based solutions and edge computing for real-time data processing in the field also represents a key emerging trend, promising enhanced flexibility and scalability. The market for modular and open architecture BMS solutions, enabling easier upgrades and integration, is also set to expand.

Growth Accelerators in the Battlefield Management Systems Industry Industry

The Battlefield Management Systems (BMS) industry is experiencing significant growth acceleration driven by the strategic imperative for military forces worldwide to enhance their combat effectiveness through digitalization and network-centric operations. Key accelerators include the continuous advancements in AI and machine learning, which are enabling sophisticated data analytics, predictive capabilities, and improved decision support for commanders. The ongoing global emphasis on modernizing defense infrastructure and replacing aging military hardware with state-of-the-art systems also fuels demand. Furthermore, strategic partnerships between technology providers and defense contractors, aimed at co-developing integrated solutions and expanding market reach, are crucial growth catalysts. The increasing adoption of cloud and edge computing technologies for real-time data processing and enhanced battlefield connectivity is also a significant accelerator.

Key Players Shaping the Battlefield Management Systems Industry Market

- THALE

- L3Harris Technologies Inc

- General Dynamics Corporation

- Rheinmetall AG

- Kongsberg Gruppen ASA

- Elbit Systems Ltd

- RTX Corporation

- ASELSAN A S

- Leonardo DRS Inc (Leonardo S p A)

- BAE Systems plc

- Indra Sistemas S A

- Saab AB

Notable Milestones in Battlefield Management Systems Industry Sector

- 2020: L3Harris Technologies awarded a significant contract for advanced communication systems for the US Army's Network Modernization program.

- 2021: BAE Systems launched a new generation of integrated soldier systems enhancing dismounted soldier situational awareness.

- 2022: Rheinmetall AG announced the integration of AI-powered targeting and navigation systems into its armored vehicle platforms.

- 2022: Kongsberg Gruppen ASA secured a contract for advanced naval combat management systems, emphasizing interoperability.

- 2023: THALE showcased its latest generation of secure battlefield communication and networking solutions at a major defense exhibition.

- 2023: Elbit Systems Ltd announced the successful integration of unmanned aerial vehicle (UAV) control capabilities within its BMS.

- 2024: RTX Corporation highlighted advancements in multi-domain command and control systems for joint operations.

- 2024: ASELSAN A S demonstrated its enhanced electronic warfare and cyber defense capabilities integrated into battlefield management.

In-Depth Battlefield Management Systems Industry Market Outlook

The future of the Battlefield Management Systems (BMS) market appears exceptionally promising, driven by an unwavering commitment to advancing military capabilities in an increasingly complex global security environment. Growth accelerators like the relentless pursuit of AI-driven intelligence, enhanced cybersecurity, and seamless multi-domain integration will continue to shape the industry. The market is expected to witness further consolidation through strategic mergers and acquisitions, fostering innovation and creating more robust, end-to-end solutions. The demand for modular, scalable, and adaptable BMS platforms that can evolve with emerging threats will remain a dominant trend. Opportunities for expansion into emerging defense markets and the development of specialized BMS for niche applications, such as urban warfare and information warfare, are also anticipated to drive significant future growth.

Battlefield Management Systems Industry Segmentation

-

1. System

- 1.1. Navigation Systems

- 1.2. Communication and Networking Systems

- 1.3. Command and Control Systems

- 1.4. Weapon Systems

-

2. End User

- 2.1. Army

- 2.2. Air Force

- 2.3. Navy

Battlefield Management Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Battlefield Management Systems Industry Regional Market Share

Geographic Coverage of Battlefield Management Systems Industry

Battlefield Management Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Army Segment To Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Battlefield Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System

- 5.1.1. Navigation Systems

- 5.1.2. Communication and Networking Systems

- 5.1.3. Command and Control Systems

- 5.1.4. Weapon Systems

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Army

- 5.2.2. Air Force

- 5.2.3. Navy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by System

- 6. North America Battlefield Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System

- 6.1.1. Navigation Systems

- 6.1.2. Communication and Networking Systems

- 6.1.3. Command and Control Systems

- 6.1.4. Weapon Systems

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Army

- 6.2.2. Air Force

- 6.2.3. Navy

- 6.1. Market Analysis, Insights and Forecast - by System

- 7. Europe Battlefield Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System

- 7.1.1. Navigation Systems

- 7.1.2. Communication and Networking Systems

- 7.1.3. Command and Control Systems

- 7.1.4. Weapon Systems

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Army

- 7.2.2. Air Force

- 7.2.3. Navy

- 7.1. Market Analysis, Insights and Forecast - by System

- 8. Asia Pacific Battlefield Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System

- 8.1.1. Navigation Systems

- 8.1.2. Communication and Networking Systems

- 8.1.3. Command and Control Systems

- 8.1.4. Weapon Systems

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Army

- 8.2.2. Air Force

- 8.2.3. Navy

- 8.1. Market Analysis, Insights and Forecast - by System

- 9. Latin America Battlefield Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System

- 9.1.1. Navigation Systems

- 9.1.2. Communication and Networking Systems

- 9.1.3. Command and Control Systems

- 9.1.4. Weapon Systems

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Army

- 9.2.2. Air Force

- 9.2.3. Navy

- 9.1. Market Analysis, Insights and Forecast - by System

- 10. Middle East and Africa Battlefield Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by System

- 10.1.1. Navigation Systems

- 10.1.2. Communication and Networking Systems

- 10.1.3. Command and Control Systems

- 10.1.4. Weapon Systems

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Army

- 10.2.2. Air Force

- 10.2.3. Navy

- 10.1. Market Analysis, Insights and Forecast - by System

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L3Harris Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rheinmetall AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kongsberg Gruppen ASA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elbit Systems Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ASELSAN A S

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leonardo DRS Inc (Leonardo S p A )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BAE Systems plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Indra Sistemas S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Saab AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 THALE

List of Figures

- Figure 1: Global Battlefield Management Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Battlefield Management Systems Industry Revenue (Million), by System 2025 & 2033

- Figure 3: North America Battlefield Management Systems Industry Revenue Share (%), by System 2025 & 2033

- Figure 4: North America Battlefield Management Systems Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Battlefield Management Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Battlefield Management Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Battlefield Management Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Battlefield Management Systems Industry Revenue (Million), by System 2025 & 2033

- Figure 9: Europe Battlefield Management Systems Industry Revenue Share (%), by System 2025 & 2033

- Figure 10: Europe Battlefield Management Systems Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Battlefield Management Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Battlefield Management Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Battlefield Management Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Battlefield Management Systems Industry Revenue (Million), by System 2025 & 2033

- Figure 15: Asia Pacific Battlefield Management Systems Industry Revenue Share (%), by System 2025 & 2033

- Figure 16: Asia Pacific Battlefield Management Systems Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Battlefield Management Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Battlefield Management Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Battlefield Management Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Battlefield Management Systems Industry Revenue (Million), by System 2025 & 2033

- Figure 21: Latin America Battlefield Management Systems Industry Revenue Share (%), by System 2025 & 2033

- Figure 22: Latin America Battlefield Management Systems Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Latin America Battlefield Management Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Battlefield Management Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Battlefield Management Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Battlefield Management Systems Industry Revenue (Million), by System 2025 & 2033

- Figure 27: Middle East and Africa Battlefield Management Systems Industry Revenue Share (%), by System 2025 & 2033

- Figure 28: Middle East and Africa Battlefield Management Systems Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Battlefield Management Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Battlefield Management Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Battlefield Management Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Battlefield Management Systems Industry Revenue Million Forecast, by System 2020 & 2033

- Table 2: Global Battlefield Management Systems Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Battlefield Management Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Battlefield Management Systems Industry Revenue Million Forecast, by System 2020 & 2033

- Table 5: Global Battlefield Management Systems Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Battlefield Management Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Battlefield Management Systems Industry Revenue Million Forecast, by System 2020 & 2033

- Table 10: Global Battlefield Management Systems Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Global Battlefield Management Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Battlefield Management Systems Industry Revenue Million Forecast, by System 2020 & 2033

- Table 17: Global Battlefield Management Systems Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Battlefield Management Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Battlefield Management Systems Industry Revenue Million Forecast, by System 2020 & 2033

- Table 25: Global Battlefield Management Systems Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Battlefield Management Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Battlefield Management Systems Industry Revenue Million Forecast, by System 2020 & 2033

- Table 30: Global Battlefield Management Systems Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 31: Global Battlefield Management Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Israel Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Battlefield Management Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Battlefield Management Systems Industry?

The projected CAGR is approximately 3.83%.

2. Which companies are prominent players in the Battlefield Management Systems Industry?

Key companies in the market include THALE, L3Harris Technologies Inc, General Dynamics Corporation, Rheinmetall AG, Kongsberg Gruppen ASA, Elbit Systems Ltd, RTX Corporation, ASELSAN A S, Leonardo DRS Inc (Leonardo S p A ), BAE Systems plc, Indra Sistemas S A, Saab AB.

3. What are the main segments of the Battlefield Management Systems Industry?

The market segments include System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.09 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Army Segment To Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Battlefield Management Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Battlefield Management Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Battlefield Management Systems Industry?

To stay informed about further developments, trends, and reports in the Battlefield Management Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence