Key Insights

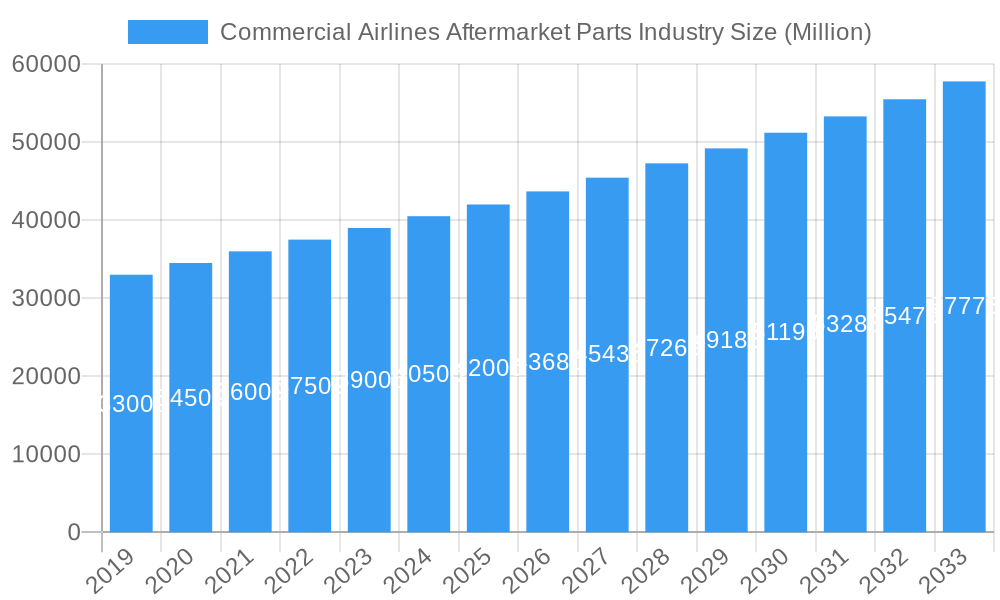

The global Commercial Airlines Aftermarket Parts industry is poised for robust growth, projected to exceed a market size of \$40 billion by 2025 and sustain a Compound Annual Growth Rate (CAGR) of over 4.00% through 2033. This expansion is primarily fueled by the escalating global air travel demand, driving increased utilization of commercial aircraft fleets and consequently, a higher need for maintenance, repair, and overhaul (MRO) activities. Key growth drivers include the aging global aircraft fleet, necessitating regular part replacements and upgrades to maintain airworthiness and operational efficiency. Furthermore, advancements in aviation technology are leading to the development of more sophisticated and durable aftermarket parts, offering airlines cost-effective alternatives to original equipment manufacturer (OEM) parts. The industry is also benefiting from a growing trend towards outsourcing MRO services, allowing airlines to focus on core operations while specialized providers manage parts procurement and maintenance. The "Other Component Types" segment, encompassing systems like avionics, hydraulics, and pneumatics, is expected to witness significant growth due to their critical role in modern aircraft functionality and increasing complexity.

Commercial Airlines Aftermarket Parts Industry Market Size (In Billion)

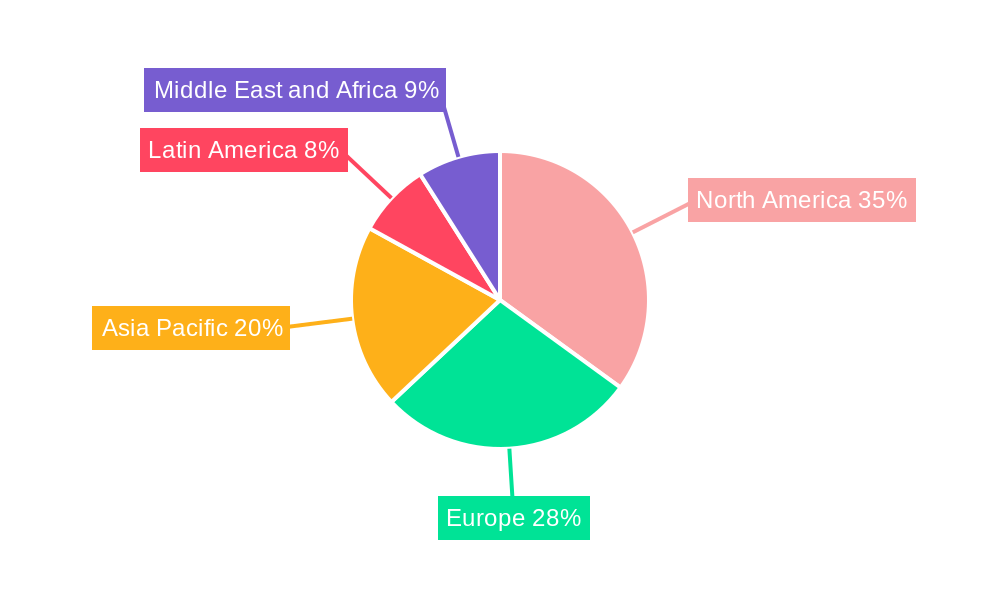

Despite the positive outlook, the industry faces certain restraints. The stringent regulatory environment and the need for rigorous certification processes for aftermarket parts can lead to extended lead times and increased costs. Additionally, the high initial investment required for advanced manufacturing technologies and the constant threat of counterfeit parts entering the supply chain pose significant challenges. However, these are being mitigated by enhanced traceability solutions and a growing emphasis on certified and reliable aftermarket suppliers. The "Rotable Replacement Parts" segment is particularly critical, as these components offer airlines the flexibility of immediate replacement, minimizing aircraft downtime and maximizing revenue generation. Geographically, North America is anticipated to maintain its leading position, driven by a mature aviation market and a high concentration of MRO facilities. The Asia Pacific region, however, is expected to exhibit the fastest growth, propelled by the rapid expansion of low-cost carriers and the increasing demand for air travel in emerging economies. Major players like Honeywell International Inc., Collins Aerospace, and General Electric Company are actively investing in R&D and expanding their service networks to capture market share.

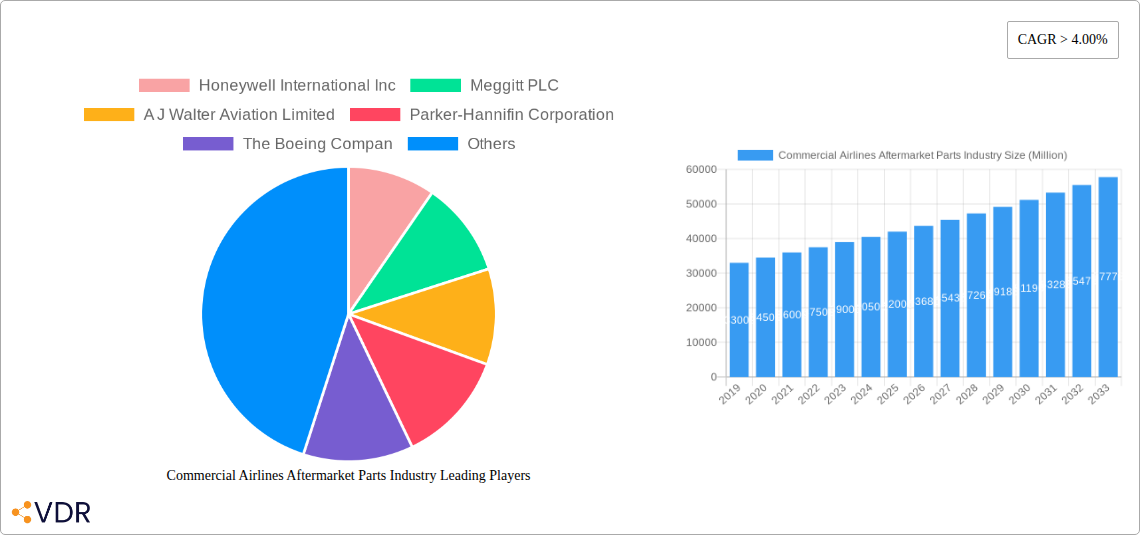

Commercial Airlines Aftermarket Parts Industry Company Market Share

Comprehensive Report: Commercial Airlines Aftermarket Parts Industry – Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth market research report provides an exhaustive analysis of the global Commercial Airlines Aftermarket Parts Industry. Covering the study period from 2019 to 2033, with a base year of 2025, this report offers critical insights into market size, growth drivers, competitive landscape, and future projections. It dissects the parent market of commercial aviation and its crucial child market of aftermarket parts, offering a holistic view for industry stakeholders. With a focus on MRO parts and rotable replacement parts across airframe, engine, interior, and other component types, this report equips you with actionable intelligence to navigate this dynamic sector.

Commercial Airlines Aftermarket Parts Industry Market Dynamics & Structure

The Commercial Airlines Aftermarket Parts Industry exhibits a moderately concentrated market structure, with a few key players holding significant market shares, interspersed with a larger number of specialized suppliers. Technological innovation is a paramount driver, fueled by the constant need for enhanced aircraft performance, fuel efficiency, and passenger safety. Stringent regulatory frameworks from bodies like the FAA and EASA significantly influence product development, certification, and maintenance practices, creating high barriers to entry but also ensuring a baseline of quality and safety. Competitive product substitutes, particularly in the form of certified used parts and advanced repair solutions, pose a growing challenge to new part manufacturers. End-user demographics are shifting, with an increasing demand for cost-effective solutions from emerging low-cost carriers and a continued emphasis on reliability from established legacy airlines. Mergers and acquisitions (M&A) are actively shaping the landscape as companies seek to expand their product portfolios, geographic reach, and MRO capabilities. For instance, the consolidation within the aerospace manufacturing sector has led to a greater integration of aftermarket services within original equipment manufacturers (OEMs).

- Market Concentration: Moderate, with key OEMs and large MRO providers dominating significant portions.

- Technological Innovation: Driven by demand for fuel efficiency, sustainability, and advanced diagnostics.

- Regulatory Frameworks: FAA, EASA, and other aviation authorities impose strict standards.

- Competitive Substitutes: Certified used parts, advanced repair technologies, and alternative material solutions.

- End-User Demographics: Diverse, from budget-conscious low-cost carriers to premium full-service airlines.

- M&A Trends: Strategic acquisitions to gain market share, technological capabilities, and integrated service offerings.

Commercial Airlines Aftermarket Parts Industry Growth Trends & Insights

The Commercial Airlines Aftermarket Parts Industry is poised for robust growth, driven by an expanding global air travel fleet and an increasing emphasis on extending the operational life of existing aircraft. The market size evolution is directly correlated with the number of commercial aircraft in operation and their maintenance requirements. Adoption rates for advanced MRO technologies, such as predictive maintenance powered by AI and IoT, are steadily increasing, leading to a higher demand for specialized aftermarket components and services. Technological disruptions, including the integration of additive manufacturing (3D printing) for complex parts and the development of sustainable aviation materials, are reshaping the product landscape. Consumer behavior shifts are also evident, with airlines prioritizing cost optimization without compromising safety, leading to a greater demand for lifecycle cost management solutions and flexible MRO agreements. The global commercial airline fleet is projected to expand significantly over the forecast period, necessitating a continuous supply of aftermarket parts for maintenance, repair, and overhaul operations. This expansion, coupled with the aging of existing fleets, creates a substantial and growing demand for a wide array of aftermarket components.

The CAGR for the Commercial Airlines Aftermarket Parts Industry is projected to be approximately 6.8% during the forecast period (2025-2033). Market penetration of advanced MRO solutions is expected to rise by 25% by 2033. The increasing average age of commercial aircraft, currently around 12 years, further amplifies the need for continuous and comprehensive aftermarket support, driving demand for both routine maintenance and component replacements. Furthermore, the growth in air cargo operations, accelerated by e-commerce, is adding another layer of demand to the aftermarket sector. The increasing complexity of modern aircraft systems also necessitates specialized expertise and parts, creating opportunities for niche players and technology providers. Airlines are increasingly looking to outsource their MRO operations to specialized providers, thereby boosting the aftermarket services segment. The focus on sustainability within the aviation industry is also a significant trend, driving demand for parts and materials that contribute to fuel efficiency and reduced environmental impact.

Dominant Regions, Countries, or Segments in Commercial Airlines Aftermarket Parts Industry

The North America region currently dominates the Commercial Airlines Aftermarket Parts Industry, driven by the presence of a large and mature commercial airline fleet, significant MRO infrastructure, and a high concentration of leading aerospace manufacturers and service providers. The United States, in particular, stands out as a critical market due to its extensive airline network, substantial defense aerospace sector that often cross-pollinates into commercial applications, and a well-established regulatory environment. Key drivers include robust economic policies supporting the aviation sector, advanced technological adoption, and a sophisticated MRO ecosystem.

Within the Component Type segment, Engine aftermarket parts represent a substantial portion of the market value and volume. Engines are the most complex and high-value components of an aircraft, requiring frequent and specialized maintenance, repair, and overhaul. This necessitates a continuous supply of genuine or certified MRO Parts and Rotable Replacement Parts. The demand for engine aftermarket services is further propelled by engine health monitoring, performance restoration, and the increasing adoption of more fuel-efficient and technologically advanced engine designs that require specialized support.

- Dominant Region: North America, specifically the United States.

- Key Drivers: Large existing fleet, advanced MRO capabilities, strong regulatory support, presence of major OEMs and MRO providers.

- Market Share: Estimated at 35% of the global market.

- Growth Potential: Steady growth driven by fleet modernization and maintenance needs.

- Dominant Segment (Component Type): Engine.

- Key Drivers: High complexity, frequent maintenance requirements, significant cost of replacement, technological advancements.

- Market Share: Estimated at 40% of the aftermarket parts market.

- Growth Potential: Strong, driven by new engine technologies and extended engine life programs.

- Dominant Segment (Parts): MRO Parts.

- Key Drivers: Routine maintenance, repairs, and overhauls.

- Market Share: Accounts for a significant portion due to the continuous nature of MRO activities.

- Growth Potential: Stable and consistent, tied to overall fleet utilization.

Commercial Airlines Aftermarket Parts Industry Product Landscape

The Commercial Airlines Aftermarket Parts Industry product landscape is characterized by an increasing sophistication in material science, manufacturing techniques, and digital integration. Innovations in airframe components focus on lightweight yet durable materials, aerodynamic enhancements, and structural health monitoring systems. Engine aftermarket parts see advancements in turbine blade technology, fuel efficiency upgrades, and emission reduction solutions, often supported by sophisticated diagnostics. Interior components are evolving with passenger comfort, connectivity, and cabin safety in mind, incorporating advanced materials and integrated electronic systems. The application of additive manufacturing is revolutionizing the production of complex, custom-fit parts, reducing lead times and inventory costs. Performance metrics are increasingly tied to reliability, lifespan, cost-effectiveness, and compliance with stringent aviation safety standards.

Key Drivers, Barriers & Challenges in Commercial Airlines Aftermarket Parts Industry

Key Drivers:

- Growing Global Air Travel Demand: Increased passenger and cargo traffic necessitates a larger and more active commercial aircraft fleet, directly driving aftermarket demand.

- Fleet Expansion and Aging Aircraft: The continuous delivery of new aircraft and the sustained operation of older fleets both require substantial aftermarket support for maintenance and repair.

- Technological Advancements: Innovations in materials, manufacturing, and diagnostics lead to new and improved aftermarket solutions, driving upgrades and replacements.

- Focus on Cost Optimization and Efficiency: Airlines seek to extend aircraft lifespan and reduce operational costs, leading to higher demand for MRO services and cost-effective parts.

- Stringent Regulatory Compliance: Aviation safety regulations mandate the use of certified parts and rigorous maintenance, ensuring a steady demand for compliant aftermarket solutions.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical events, natural disasters, and raw material shortages can disrupt the production and delivery of critical aftermarket parts, leading to significant delays and cost increases. For example, a single component shortage can ground an aircraft for extended periods.

- Counterfeit Parts: The presence of counterfeit or uncertified parts in the market poses a significant safety risk and a reputational challenge for the industry, requiring robust traceability and verification processes.

- Skilled Labor Shortage: A growing deficit in skilled aviation maintenance technicians and engineers can hamper MRO capabilities and slow down repair processes.

- Economic Volatility and Airline Financial Health: Downturns in the global economy can impact airline profitability, potentially leading to reduced maintenance spending and deferred part replacements.

- Intellectual Property and Licensing Issues: Navigating intellectual property rights for aftermarket parts, especially for older aircraft, can be complex and lead to legal challenges.

Emerging Opportunities in Commercial Airlines Aftermarket Parts Industry

Emerging opportunities within the Commercial Airlines Aftermarket Parts Industry are centered on sustainability, digital transformation, and specialized services. The drive for greener aviation is creating demand for parts manufactured with recycled or sustainable materials, as well as components that enhance fuel efficiency. The widespread adoption of digital technologies, including AI-powered predictive maintenance, blockchain for enhanced part traceability, and augmented reality for maintenance procedures, presents significant opportunities for service providers and parts manufacturers offering integrated digital solutions. Furthermore, the increasing focus on lifecycle management and comprehensive support packages, rather than just individual part sales, is opening avenues for value-added services and long-term partnerships with airlines. The growth of the ultra-long-range and wide-body aircraft segments also presents a specific niche for specialized aftermarket support.

Growth Accelerators in the Commercial Airlines Aftermarket Parts Industry Industry

Several catalysts are accelerating growth in the Commercial Airlines Aftermarket Parts Industry. Technological breakthroughs, such as advancements in composite material repair and the increasing feasibility of 3D printing for metallic and polymer parts, are enhancing repair capabilities and reducing lead times. Strategic partnerships between OEMs, MRO providers, and technology firms are fostering innovation and creating integrated service offerings that cater to complex airline needs. For instance, collaborations on developing digital twin technologies for engine components are improving performance monitoring and predictive maintenance. Market expansion strategies, including the increasing focus on emerging aviation markets in Asia-Pacific and Latin America, are opening up new revenue streams and customer bases. The continuous drive for fleet modernization and the subsequent retirement of older aircraft also create a demand for specialized parts and support for transition phases.

Key Players Shaping the Commercial Airlines Aftermarket Parts Industry Market

- Honeywell International Inc

- Meggitt PLC

- A J Walter Aviation Limited

- Parker-Hannifin Corporation

- The Boeing Company

- GKN Aerospace (Melrose Industries)

- Moog Inc

- Aventure International Aviation Services

- Bombardier Inc

- Collins Aerospace (Raytheon Technologies Corporation)

- General Electric Company

Notable Milestones in Commercial Airlines Aftermarket Parts Industry Sector

- May 2022: Boeing and Airline MRO Parts (AMP) signed a Tailored Parts Package (TPP) agreement. This strategic alliance makes Boeing a supplier for AMP's parts business and designates Boeing as a Platinum Supplier, enhancing parts availability and supply chain efficiency.

- February 2022: Chilean low-cost operator SKY signed an agreement with Airbus for Flight Hour Services (FHS)-Components for its A320 fleet. This agreement signifies a shift towards integrated component management and servicing directly from the manufacturer, optimizing operational costs and ensuring component availability for SKY.

In-Depth Commercial Airlines Aftermarket Parts Industry Market Outlook

The Commercial Airlines Aftermarket Parts Industry is set for sustained and robust growth, driven by the accelerating demand for air travel and the continuous need to maintain and operate a diverse global fleet. Growth accelerators like technological advancements in sustainable materials and additive manufacturing, coupled with strategic partnerships that foster integrated MRO solutions, are creating a more efficient and responsive aftermarket ecosystem. The ongoing digital transformation, including the pervasive use of AI for predictive maintenance and advanced data analytics for lifecycle management, will further optimize operations and reduce costs for airlines. Emerging opportunities in specialized support for new aircraft types and expanding into underdeveloped aviation markets present significant avenues for future expansion. The industry's outlook is positive, emphasizing a future where comprehensive support, technological integration, and sustainability are paramount for success.

Commercial Airlines Aftermarket Parts Industry Segmentation

-

1. Component Type

- 1.1. Airframe

- 1.2. Engine

- 1.3. Interior

- 1.4. Other Component Types

-

2. Parts

- 2.1. MRO Parts

- 2.2. Rotable Replacement Parts

Commercial Airlines Aftermarket Parts Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Commercial Airlines Aftermarket Parts Industry Regional Market Share

Geographic Coverage of Commercial Airlines Aftermarket Parts Industry

Commercial Airlines Aftermarket Parts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Narrow-body Segment Expected to Witness the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Airframe

- 5.1.2. Engine

- 5.1.3. Interior

- 5.1.4. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by Parts

- 5.2.1. MRO Parts

- 5.2.2. Rotable Replacement Parts

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Airframe

- 6.1.2. Engine

- 6.1.3. Interior

- 6.1.4. Other Component Types

- 6.2. Market Analysis, Insights and Forecast - by Parts

- 6.2.1. MRO Parts

- 6.2.2. Rotable Replacement Parts

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Airframe

- 7.1.2. Engine

- 7.1.3. Interior

- 7.1.4. Other Component Types

- 7.2. Market Analysis, Insights and Forecast - by Parts

- 7.2.1. MRO Parts

- 7.2.2. Rotable Replacement Parts

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Airframe

- 8.1.2. Engine

- 8.1.3. Interior

- 8.1.4. Other Component Types

- 8.2. Market Analysis, Insights and Forecast - by Parts

- 8.2.1. MRO Parts

- 8.2.2. Rotable Replacement Parts

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Latin America Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Airframe

- 9.1.2. Engine

- 9.1.3. Interior

- 9.1.4. Other Component Types

- 9.2. Market Analysis, Insights and Forecast - by Parts

- 9.2.1. MRO Parts

- 9.2.2. Rotable Replacement Parts

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Middle East and Africa Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component Type

- 10.1.1. Airframe

- 10.1.2. Engine

- 10.1.3. Interior

- 10.1.4. Other Component Types

- 10.2. Market Analysis, Insights and Forecast - by Parts

- 10.2.1. MRO Parts

- 10.2.2. Rotable Replacement Parts

- 10.1. Market Analysis, Insights and Forecast - by Component Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Meggitt PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A J Walter Aviation Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Parker-Hannifin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GKN Aerospace (Melrose Industries)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Moog Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aventure International Aviation Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Collins Aerospace (Raytheon Technologies Corporation)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 General Electric Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Commercial Airlines Aftermarket Parts Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 3: North America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 5: North America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 6: North America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 9: Europe Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 11: Europe Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 12: Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 15: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 17: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 18: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 21: Latin America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 22: Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 23: Latin America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 24: Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 27: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 28: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 29: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 30: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 2: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 3: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 5: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 6: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 10: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 11: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 18: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 19: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 26: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 27: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 32: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 33: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Egypt Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Airlines Aftermarket Parts Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Commercial Airlines Aftermarket Parts Industry?

Key companies in the market include Honeywell International Inc, Meggitt PLC, A J Walter Aviation Limited, Parker-Hannifin Corporation, The Boeing Compan, GKN Aerospace (Melrose Industries), Moog Inc, Aventure International Aviation Services, Bombardier Inc, Collins Aerospace (Raytheon Technologies Corporation), General Electric Company.

3. What are the main segments of the Commercial Airlines Aftermarket Parts Industry?

The market segments include Component Type, Parts.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Narrow-body Segment Expected to Witness the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: Boeing and Airline MRO Parts (AMP) signed a Tailored Parts Package (TPP) agreement that makes Boeing a supplier for AMP's parts business and identifies the former as a Platinum Supplier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Airlines Aftermarket Parts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Airlines Aftermarket Parts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Airlines Aftermarket Parts Industry?

To stay informed about further developments, trends, and reports in the Commercial Airlines Aftermarket Parts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence