Key Insights

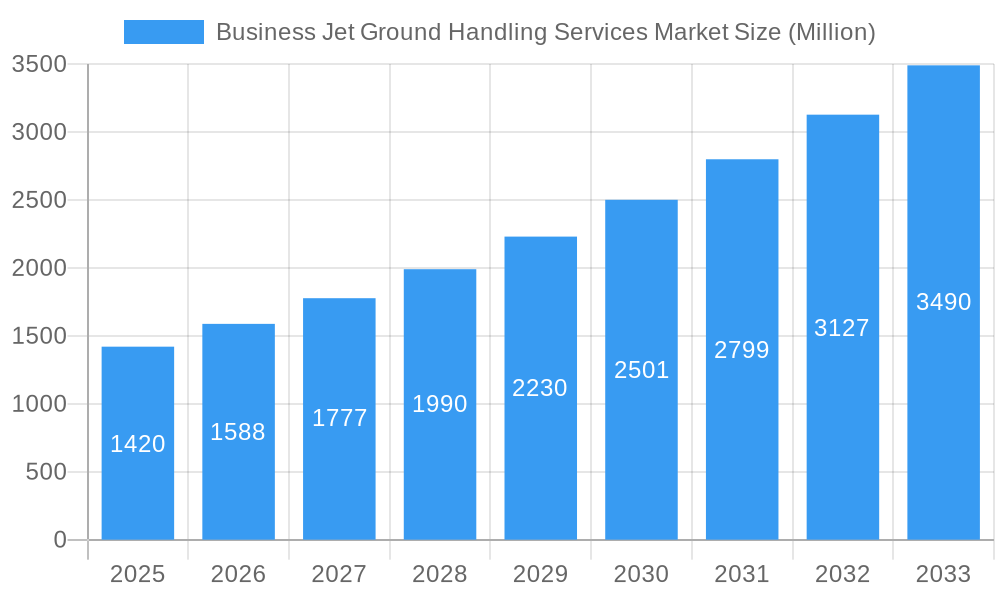

The global Business Jet Ground Handling Services market is projected for substantial growth, with a current estimated market size of approximately $1.42 billion in 2025. This upward trajectory is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.87% throughout the forecast period of 2025-2033. This robust expansion is primarily driven by the increasing global demand for business aviation, including a rising number of high-net-worth individuals and corporations investing in private jets for enhanced flexibility, efficiency, and privacy. The expansion of airport infrastructure to better accommodate business aviation traffic, coupled with advancements in technology for smoother and faster ground operations, are also key contributors. Furthermore, the growing trend of outsourcing ground handling services by business jet operators, seeking specialized expertise and cost-effectiveness, plays a significant role in market dynamics.

Business Jet Ground Handling Services Market Market Size (In Billion)

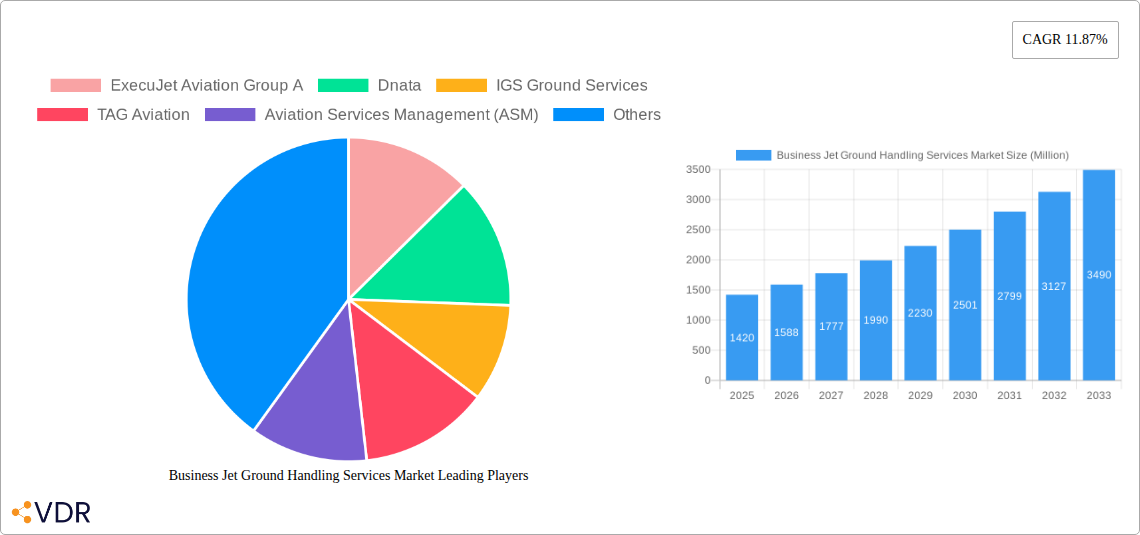

The market is segmented into critical areas of operation, including Aircraft Handling, Passenger Handling, and Cargo and Baggage Handling. Aircraft handling services, encompassing a range of technical and operational support for aircraft on the ground, are expected to see consistent demand. Passenger handling, focusing on creating a seamless and luxurious experience for business jet occupants, is becoming increasingly sophisticated and a key differentiator. Cargo and baggage handling, while perhaps a smaller segment for business jets compared to commercial aviation, remains essential for efficient operations. Key players such as Dnata, Signature Aviation Limited, and ExecuJet Aviation Group are actively shaping the market through strategic expansions, technological integrations, and a focus on premium customer service. Geographically, North America and Europe are anticipated to maintain their dominant market shares due to established business aviation hubs and a mature market for private jet services. However, the Asia Pacific region is poised for significant growth, driven by economic expansion and an increasing adoption of business aviation in emerging economies.

Business Jet Ground Handling Services Market Company Market Share

This in-depth report provides a detailed analysis of the global Business Jet Ground Handling Services market, encompassing a comprehensive study from 2019 to 2033, with a base and estimated year of 2025. It examines key market dynamics, growth trends, regional dominance, product innovations, driving forces, challenges, and emerging opportunities shaping this vital sector of the aviation industry. The report offers actionable insights for stakeholders, including private jet operators, FBOs, service providers, and investors, to navigate the evolving landscape and capitalize on future growth prospects. The report analyzes the parent market for Business Jet Ground Handling Services, and also dives into child markets, offering a granular view of specific service categories.

Business Jet Ground Handling Services Market Market Dynamics & Structure

The Business Jet Ground Handling Services market is characterized by a moderately concentrated structure, with leading global players holding significant market share. Technological innovation is a key driver, particularly in areas like automation, sustainable ground power units (GPUs), and advanced baggage handling systems, aiming to enhance efficiency and reduce turnaround times for business jets. Regulatory frameworks, though evolving to promote safety and environmental standards, can sometimes pose barriers to entry for smaller operators. Competitive product substitutes are limited in core ground handling functions, but advancements in aircraft design and operational efficiency indirectly impact demand for certain services. End-user demographics are diverse, ranging from ultra-high-net-worth individuals to corporate flight departments, all prioritizing speed, discretion, and premium service. Mergers and acquisitions (M&A) are a notable trend as larger entities seek to expand their global footprint and service offerings. For instance, recent M&A activities indicate a push towards consolidation, with key players acquiring smaller regional FBOs to strengthen their network. The market is projected to witness a CAGR of approximately 6.2% during the forecast period.

- Market Concentration: Moderate, with a few key global players dominating.

- Technological Innovation Drivers: Automation, sustainability (e.g., electric GPUs), advanced safety systems.

- Regulatory Frameworks: Focus on safety, security, and environmental compliance.

- Competitive Product Substitutes: Limited for core handling, but indirect impact from aircraft operational efficiency.

- End-User Demographics: High-net-worth individuals, corporate flight departments, charter operators.

- M&A Trends: Consolidation and global network expansion are prominent.

Business Jet Ground Handling Services Market Growth Trends & Insights

The global Business Jet Ground Handling Services market is poised for substantial growth, driven by an increasing volume of business aviation movements and a rising demand for premium, seamless service experiences. The market size, estimated to be around USD 12,000 million in 2025, is projected to expand significantly by 2033. Adoption rates for advanced technologies, such as AI-powered operational management and advanced data analytics for predictive maintenance of ground support equipment (GSE), are on the rise. These advancements are critical in optimizing turnaround times and enhancing operational efficiency. Technological disruptions, including the integration of digital platforms for flight planning and service booking, are transforming how services are procured and delivered. Consumer behavior shifts are leaning towards a greater emphasis on personalized services, contactless solutions, and environmentally conscious operations. The CAGR of 6.2% reflects a robust expansion trajectory, fueled by economic growth in emerging markets and the continued importance of business aviation for global connectivity. The market penetration of specialized business jet ground handling services is expected to deepen as operators seek to differentiate themselves through superior service quality.

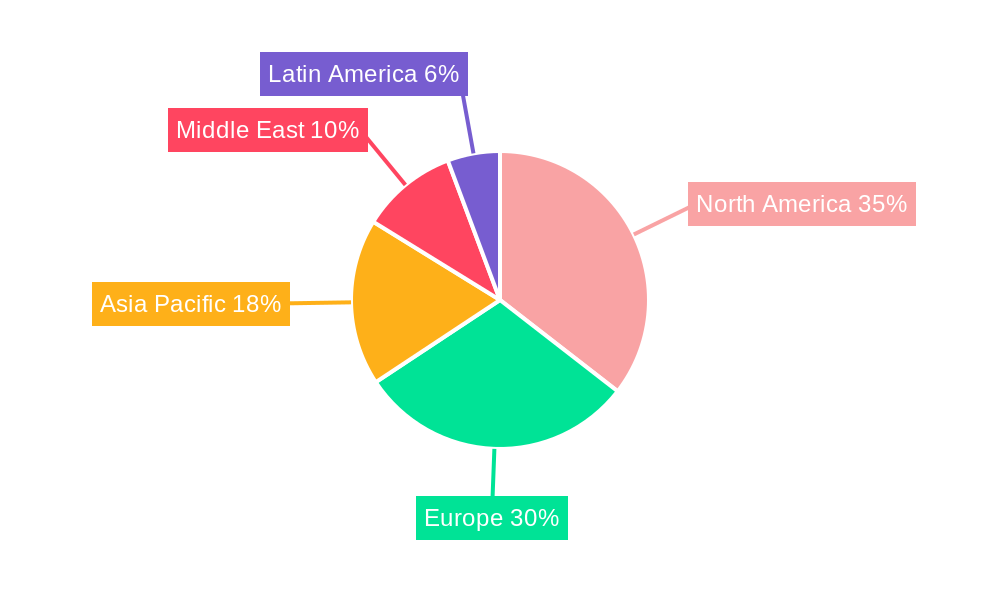

Dominant Regions, Countries, or Segments in Business Jet Ground Handling Services Market

The North America region stands as the dominant force in the Business Jet Ground Handling Services market, largely attributed to its mature business aviation infrastructure, extensive network of airports catering to private jets, and a strong economic foundation that supports high levels of business travel. Within North America, the United States represents the largest and most influential market. Key drivers include robust economic policies that favor business aviation, significant investments in airport infrastructure, and a high concentration of corporate headquarters and affluent individuals. The market share within North America is substantial, estimated to be over 40% of the global market.

- Dominant Region: North America

- Dominant Country: United States

- Key Drivers:

- Economic Policies: Favorable business environment and tax incentives.

- Infrastructure: Extensive network of FBOs and dedicated business jet terminals.

- Demand: High volume of corporate and private flight operations.

- Technological Adoption: Early and widespread adoption of advanced ground handling technologies.

- Regulatory Support: Well-established regulatory framework for business aviation.

The growth potential in North America remains significant, albeit with a maturing market. Emerging markets in Asia Pacific and the Middle East are showing accelerated growth rates, driven by expanding economies and increasing adoption of business aviation.

Business Jet Ground Handling Services Market Product Landscape

The product landscape of Business Jet Ground Handling Services is defined by a spectrum of essential offerings designed to ensure the efficient and safe operation of business jets. These include comprehensive aircraft handling services encompassing marshalling, towing, and parking, alongside meticulous passenger handling services such as VIP lounge access, concierge services, and expedited customs and immigration processing. Cargo and baggage handling are also crucial, focusing on discreet and secure transfer of luggage and freight. Innovations are consistently being introduced to enhance service delivery, such as the implementation of digital check-in systems, advanced GPU technologies for reduced emissions, and specialized cleaning and detailing services that cater to the high standards of business jet owners. The performance metrics revolve around turnaround time, safety protocols, and customer satisfaction.

Key Drivers, Barriers & Challenges in Business Jet Ground Handling Services Market

The Business Jet Ground Handling Services market is propelled by several key drivers, including the sustained growth of global business aviation, the increasing complexity of aircraft operations necessitating expert handling, and the rising demand for premium passenger experiences. Technological advancements in GSE and digital platforms further enhance operational efficiency and service quality.

- Key Drivers:

- Growing business aviation fleet.

- Demand for expedited turnaround times.

- Emphasis on passenger comfort and convenience.

- Advancements in ground support equipment.

- Increasing globalization of business operations.

Conversely, the market faces significant barriers and challenges. Stringent regulatory compliance, the high capital investment required for modern GSE, and a shortage of skilled ground handling personnel can impede growth. Intense competition among service providers also puts pressure on pricing and margins. Supply chain disruptions for essential equipment and parts can lead to operational delays.

- Key Barriers & Challenges:

- Strict regulatory compliance and evolving safety standards.

- High capital expenditure for advanced GSE.

- Shortage of skilled and trained ground handling personnel.

- Intense price competition among service providers.

- Vulnerability to global economic downturns impacting business travel.

Emerging Opportunities in Business Jet Ground Handling Services Market

Emerging opportunities in the Business Jet Ground Handling Services market lie in the expansion of sustainable ground handling solutions, including the adoption of electric GSE and environmentally friendly de-icing fluids. The growing demand for integrated digital platforms that offer end-to-end service management, from flight booking to post-flight reporting, presents a significant avenue for growth. Furthermore, the development of specialized services for emerging aircraft types, such as eVTOLs and supersonic business jets, will create new market niches. Untapped markets in developing economies with a burgeoning business aviation sector also represent substantial opportunities for service providers.

Growth Accelerators in the Business Jet Ground Handling Services Market Industry

Growth accelerators in the Business Jet Ground Handling Services industry are primarily driven by technological innovation and strategic partnerships. The development and adoption of advanced IT systems for seamless flight planning, resource allocation, and customer communication are crucial. Strategic partnerships between ground handlers, FBOs, and aircraft manufacturers can lead to integrated service packages and enhanced customer loyalty. Furthermore, market expansion strategies, including the establishment of new FBOs in high-demand locations and the acquisition of smaller regional players, will catalyze long-term growth. The continuous drive for operational excellence and cost efficiency will also fuel sustained expansion.

Key Players Shaping the Business Jet Ground Handling Services Market Market

- ExecuJet Aviation Group

- Dnata

- IGS Ground Services

- TAG Aviation

- Aviation Services Management (ASM)

- Jet Aviation AG

- Signature Aviation Limited

- Atlantic Aviation

- RoyalJet LLC

- World Fuel Services Corporation

- Dassault Falcon Service

- Universal Weather and Aviation LLC

Notable Milestones in Business Jet Ground Handling Services Market Sector

- August 2023: Menzies, a ground handling operator at the Entebbe International Airport in Uganda, acquired new ground handling equipment worth USD 1 million, enhancing its operational capabilities.

- April 2022: Airpro announced an investment of EUR 4 million to procure four Elephant e-BETA de-icers from Vestergaard Company. The equipment, delivered by winter 2022 and operated at Helsinki Airport, positions Airpro as the first ground-handling company in Finland to deploy electric de-icing services.

- April 2022: Amsterdam Airport Schiphol approved digital declarations to streamline the cargo chain with the welcomed implementation of Automated Nomination, ensuring import cargo is automatically assigned to the correct forwarder before physical arrival at the airport.

In-Depth Business Jet Ground Handling Services Market Market Outlook

The outlook for the Business Jet Ground Handling Services market is exceptionally positive, underpinned by continued advancements in technology and a growing global reliance on business aviation. Growth accelerators like the widespread adoption of sustainable GSE and AI-driven operational optimization are setting new industry standards. Strategic collaborations between key industry players are expected to foster greater efficiency and expanded service offerings, thereby enhancing customer satisfaction and driving market penetration. The increasing focus on personalized and bespoke services, coupled with the expansion into underserved geographical regions, will further fuel the market's robust trajectory. These factors collectively point towards a dynamic and expanding market with significant future potential and strategic opportunities for innovation and investment. The projected market size is estimated to reach USD 20,000 million by 2033.

Business Jet Ground Handling Services Market Segmentation

-

1. Type

- 1.1. Aircraft Handling

- 1.2. Passenger Handling

- 1.3. Cargo and Baggage Handling

Business Jet Ground Handling Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Business Jet Ground Handling Services Market Regional Market Share

Geographic Coverage of Business Jet Ground Handling Services Market

Business Jet Ground Handling Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Aircraft Handling Services to Dominate the Market During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Aircraft Handling

- 5.1.2. Passenger Handling

- 5.1.3. Cargo and Baggage Handling

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Aircraft Handling

- 6.1.2. Passenger Handling

- 6.1.3. Cargo and Baggage Handling

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Aircraft Handling

- 7.1.2. Passenger Handling

- 7.1.3. Cargo and Baggage Handling

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Aircraft Handling

- 8.1.2. Passenger Handling

- 8.1.3. Cargo and Baggage Handling

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Aircraft Handling

- 9.1.2. Passenger Handling

- 9.1.3. Cargo and Baggage Handling

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Business Jet Ground Handling Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Aircraft Handling

- 10.1.2. Passenger Handling

- 10.1.3. Cargo and Baggage Handling

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ExecuJet Aviation Group A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dnata

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IGS Ground Services

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TAG Aviation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aviation Services Management (ASM)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jet Aviation AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Signature Aviation Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlantic Aviation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RoyalJet LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 World Fuel Services Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dassault Falcon Service

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Universal Weather and Aviation LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ExecuJet Aviation Group A

List of Figures

- Figure 1: Global Business Jet Ground Handling Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Business Jet Ground Handling Services Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East Business Jet Ground Handling Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East Business Jet Ground Handling Services Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East Business Jet Ground Handling Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Business Jet Ground Handling Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Jet Ground Handling Services Market?

The projected CAGR is approximately 11.87%.

2. Which companies are prominent players in the Business Jet Ground Handling Services Market?

Key companies in the market include ExecuJet Aviation Group A, Dnata, IGS Ground Services, TAG Aviation, Aviation Services Management (ASM), Jet Aviation AG, Signature Aviation Limited, Atlantic Aviation, RoyalJet LLC, World Fuel Services Corporation, Dassault Falcon Service, Universal Weather and Aviation LLC.

3. What are the main segments of the Business Jet Ground Handling Services Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Aircraft Handling Services to Dominate the Market During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: Menzies, a ground handling operator at the Entebbe International Airport in Uganda acquired new ground handling equipment worth USD 1 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Jet Ground Handling Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Jet Ground Handling Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Jet Ground Handling Services Market?

To stay informed about further developments, trends, and reports in the Business Jet Ground Handling Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence