Key Insights

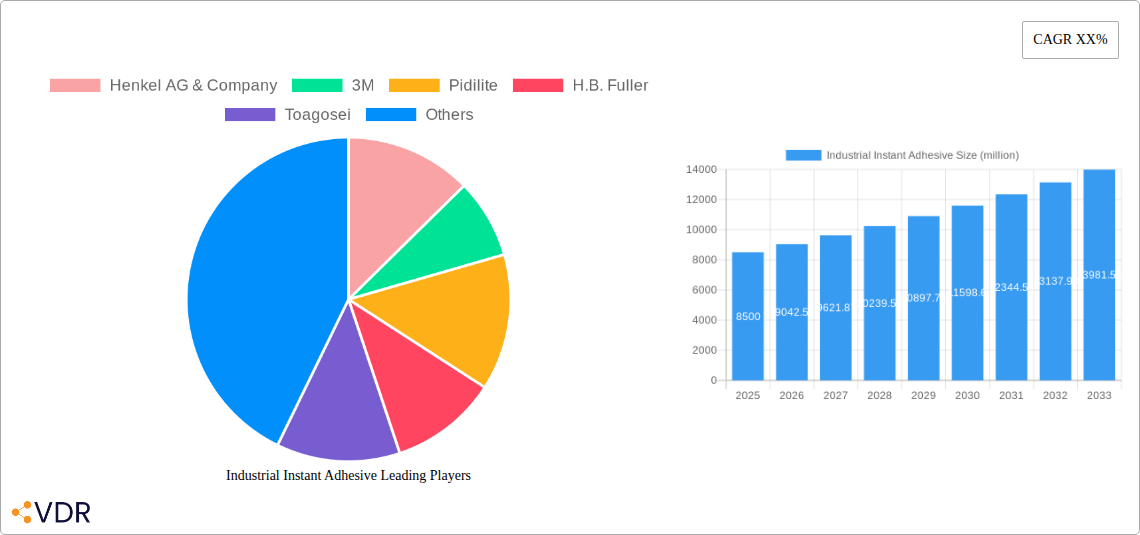

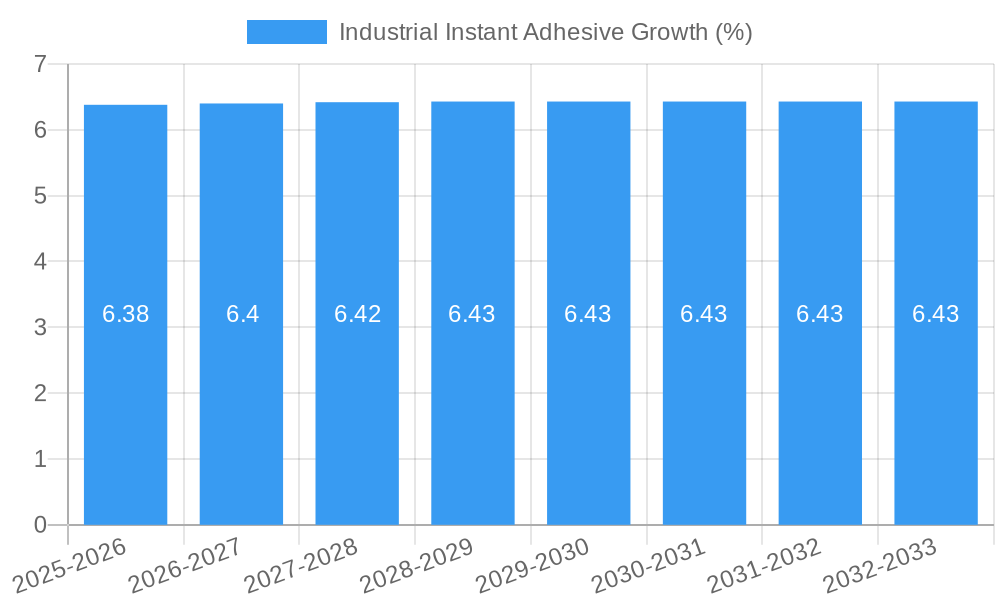

The global Industrial Instant Adhesives market is poised for substantial expansion, projected to reach a market size of approximately $8.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% expected throughout the forecast period of 2025-2033. This significant growth is primarily fueled by the increasing demand for rapid assembly and efficient manufacturing processes across diverse industries. Key drivers include the automotive sector's adoption of lightweight materials and advanced assembly techniques, the electronics industry's need for high-performance bonding solutions for intricate components, and the booming construction industry's requirement for quick-setting and durable adhesives. Furthermore, the rising adoption of automation in manufacturing lines amplifies the utility of instant adhesives, enabling faster production cycles and reduced labor costs. Innovations in adhesive formulations, such as improved temperature resistance, enhanced flexibility, and faster curing times, are also contributing to market buoyancy, allowing for their application in more demanding environments and specialized uses.

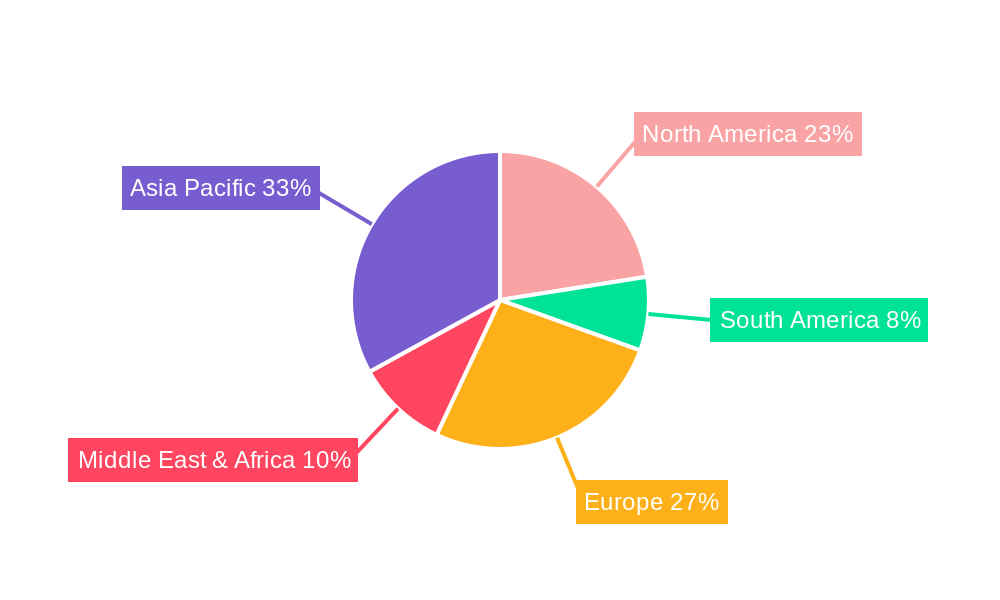

The market is characterized by a dynamic competitive landscape with major global players like Henkel AG & Company, 3M, and Pidilite actively investing in research and development to introduce novel products that cater to evolving industry needs. The market segmentation reveals that Cyanoacrylate Instant Adhesives and Epoxy-based Instant Adhesives are the dominant types, each serving distinct application requirements. While the industrial segment is the largest consumer, significant growth is also anticipated in the business and household sectors, driven by the convenience and effectiveness of instant bonding solutions. Geographically, the Asia Pacific region, particularly China and India, is emerging as a key growth engine due to its expanding manufacturing base and increasing industrialization. However, market restraints such as stringent environmental regulations regarding volatile organic compounds (VOCs) in some formulations and the availability of alternative joining methods could pose challenges. Nevertheless, the inherent advantages of instant adhesives in terms of speed, strength, and versatility ensure their continued prominence and growth trajectory in the global market.

Industrial Instant Adhesive Market: A Comprehensive Report (2019-2033)

This in-depth report offers a panoramic view of the global Industrial Instant Adhesive market, providing critical insights into its dynamics, growth trajectory, and future outlook. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this study is an indispensable resource for industry stakeholders, investors, and decision-makers seeking to navigate this rapidly evolving sector. We meticulously analyze market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and mergers & acquisitions (M&A) trends, alongside market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. The report further delves into dominant regions, countries, and segments, offering a detailed exploration of the product landscape, key drivers, barriers, challenges, emerging opportunities, and growth accelerators.

Industrial Instant Adhesive Market Dynamics & Structure

The Industrial Instant Adhesive market exhibits a moderate level of concentration, with key players like Henkel AG & Company, 3M, Pidilite, and H.B. Fuller holding significant market shares. Technological innovation is a primary driver, fueled by continuous research and development into enhanced bond strength, faster curing times, and improved resistance to environmental factors. Regulatory frameworks, particularly concerning environmental impact and product safety, play a crucial role in shaping product development and market entry strategies. Competitive product substitutes, such as traditional mechanical fasteners and other adhesive types, present a constant challenge, necessitating superior performance and cost-effectiveness from instant adhesives. End-user demographics are increasingly sophisticated, demanding tailored solutions for diverse industrial applications. M&A trends are active, with strategic acquisitions aimed at expanding product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Moderate, with a few dominant players and a fragmented landscape of smaller manufacturers.

- Technological Innovation: Driven by advancements in polymer science, formulation chemistry, and application technologies.

- Regulatory Frameworks: Influenced by evolving environmental regulations and safety standards for industrial chemicals.

- Competitive Product Substitutes: Mechanical fasteners, two-part adhesives, and other bonding solutions.

- End-User Demographics: Diversified across industries with specific performance and application requirements.

- M&A Trends: Characterized by strategic consolidation and acquisition of niche technologies or market access.

Industrial Instant Adhesive Growth Trends & Insights

The global Industrial Instant Adhesive market is projected for robust expansion, driven by a confluence of factors that are reshaping its trajectory. The market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, reaching an estimated value of USD 7,500 million units by the end of the forecast period. This growth is underpinned by increasing adoption rates across a multitude of industries, spurred by the inherent advantages of instant adhesives: rapid assembly, lightweighting capabilities, and enhanced design flexibility. Technological disruptions, such as the development of low-odor, low-blooming cyanoacrylates and advanced epoxy formulations with superior impact resistance, are significantly influencing market penetration. Consumer behavior shifts are also playing a pivotal role, with industries prioritizing efficiency, automation, and sustainable manufacturing practices. The demand for high-performance bonding solutions in sectors like automotive, electronics, and medical devices is creating substantial growth opportunities. Furthermore, the growing emphasis on reducing manufacturing costs and improving product durability is leading to a greater reliance on advanced adhesive technologies. The inherent benefits of instant adhesives, including their ability to bond dissimilar materials and their ease of application, are key factors driving their widespread adoption. The market penetration is expected to rise from an estimated 35% of the total adhesive market in 2025 to over 45% by 2033.

Dominant Regions, Countries, or Segments in Industrial Instant Adhesive

The Industry application segment stands as the dominant force driving growth within the Industrial Instant Adhesive market. This segment, encompassing a vast array of manufacturing and assembly operations, consistently demands high-performance, rapid-curing bonding solutions. Within this broad application, specific sub-sectors are particularly influential.

Key Drivers of Dominance in the Industry Segment:

- Automotive Manufacturing: The automotive industry is a significant consumer, utilizing instant adhesives for interior trim, component assembly, and lightweighting initiatives. The demand for fuel efficiency and advanced vehicle features necessitates strong, reliable bonding that instant adhesives provide, with an estimated market share of 25% within the industry application.

- Electronics Assembly: The miniaturization and complexity of electronic devices require precise and fast bonding. Instant adhesives are crucial for securing components, encapsulating sensitive parts, and ensuring the integrity of printed circuit boards (PCBs), contributing approximately 20% to the industry segment's demand.

- Medical Device Manufacturing: Stringent quality and safety standards in the medical field are met by specialized instant adhesives used in assembling catheters, diagnostic equipment, and other disposable and reusable devices. This sector accounts for around 15% of the industry application's consumption.

- General Industrial Assembly: This broad category includes everything from appliance manufacturing to furniture production, where the speed and efficiency of instant adhesives translate directly into cost savings and increased output. This sub-segment holds an approximate 22% market share.

- Aerospace: While demanding highly specialized formulations, the aerospace industry's need for lightweight, high-strength bonds in non-critical applications provides a growing avenue for instant adhesives, representing about 8% of the industry segment.

- Other Industrial Applications: This residual category, including sectors like sporting goods and consumer electronics, contributes the remaining 10% to the industry segment's dominance.

The Cyanoacrylate Instant Adhesives type also plays a pivotal role in this dominance, being the most widely used category due to their rapid cure times, high bond strength, and versatility across various substrates. Their estimated market share within the instant adhesive types is around 70%, with Epoxy-based Instant Adhesives following at approximately 25%, offering greater strength and environmental resistance for more demanding applications.

Industrial Instant Adhesive Product Landscape

The Industrial Instant Adhesive product landscape is characterized by continuous innovation aimed at expanding application capabilities and improving performance metrics. Manufacturers are developing specialized formulations to address niche industrial needs, such as high-temperature resistance, increased flexibility, and enhanced impact strength. Cyanoacrylate-based adhesives remain dominant due to their rapid curing properties, while epoxy-based options offer superior strength and durability for more demanding applications. Advancements in low-odor and low-blooming formulations are enhancing user experience and expanding their use in sensitive environments. Unique selling propositions often revolve around specific bond strengths (e.g., tensile strength up to 30 MPa), cure speeds (e.g., fixtures in under 10 seconds), and resistance to chemicals, moisture, and extreme temperatures.

Key Drivers, Barriers & Challenges in Industrial Instant Adhesive

Key Drivers:

- Technological Advancements: Development of specialized formulations for demanding applications, faster curing, and improved environmental resistance.

- Efficiency and Cost Savings: Rapid assembly times and reduced labor requirements directly translate into operational cost reductions for manufacturers.

- Lightweighting Initiatives: The ability to bond dissimilar materials without heavy fasteners facilitates the creation of lighter, more fuel-efficient products in industries like automotive and aerospace.

- Growing Demand in Emerging Economies: Industrialization and manufacturing growth in developing regions are spurring the demand for advanced adhesives.

Key Barriers & Challenges:

- Substrate Limitations: Certain materials, such as plastics with low surface energy, can be challenging to bond effectively without specialized primers.

- Environmental Concerns: Some traditional formulations contain volatile organic compounds (VOCs), leading to regulatory scrutiny and a push for more sustainable alternatives.

- Shelf Life and Storage Conditions: Instant adhesives can have limited shelf lives and require specific storage conditions to maintain optimal performance, impacting supply chain logistics.

- Competitive Pressure: The presence of alternative joining methods and a broad spectrum of adhesive types creates intense competition, demanding continuous product differentiation and competitive pricing.

- Supply Chain Disruptions: Global events and geopolitical factors can impact the availability and cost of raw materials, affecting production and pricing of industrial instant adhesives.

Emerging Opportunities in Industrial Instant Adhesive

Emerging opportunities in the Industrial Instant Adhesive market lie in the development of bio-based and sustainable adhesive formulations, responding to increasing environmental regulations and consumer demand for eco-friendly products. The expanding use of 3D printing in various industries presents a significant opportunity for specialized instant adhesives that can effectively bond printed materials. Furthermore, the integration of smart functionalities, such as self-healing or conductive properties, into instant adhesives could unlock novel applications in advanced manufacturing and electronics. Untapped markets in developing regions with nascent manufacturing sectors also represent a substantial growth avenue.

Growth Accelerators in the Industrial Instant Adhesive Industry

Several catalysts are accelerating the growth of the Industrial Instant Adhesive industry. Technological breakthroughs in polymer science are enabling the creation of adhesives with unprecedented strength-to-weight ratios and environmental resilience. Strategic partnerships between adhesive manufacturers and end-users are fostering co-development of tailor-made solutions, driving innovation and market penetration. Market expansion strategies, including geographical diversification into high-growth regions and targeted marketing efforts towards emerging industrial sectors, are also significant growth accelerators. The increasing trend towards automation in manufacturing further boosts the demand for fast-curing, reliable bonding solutions.

Key Players Shaping the Industrial Instant Adhesive Market

- Henkel AG & Company

- 3M

- Pidilite

- H.B. Fuller

- Toagosei

- Franklin International

- Huntsman Corporation

- Illinois Tool Works Incorporation (ITW)

- Delo Industrial Adhesives

- Bostik SA

- Sika AG

- RPM

- Permabond

- Parson Adhesives

- Loxeal Engineering Adhesives

Notable Milestones in Industrial Instant Adhesive Sector

- 2020: Launch of next-generation cyanoacrylate formulations with significantly reduced odor and blooming, enhancing worker safety and application versatility.

- 2021: Introduction of high-strength, impact-resistant epoxy-based instant adhesives specifically designed for demanding automotive sub-assembly applications.

- 2022: Strategic acquisition of a specialized primer manufacturer by a major adhesive player, aiming to improve bonding performance on difficult-to-bond plastics.

- 2023: Development of UV-curable instant adhesives offering extremely fast fixture times for high-volume electronics assembly lines.

- 2024: Increased focus on developing partially bio-based instant adhesives to meet growing sustainability demands in consumer goods manufacturing.

In-Depth Industrial Instant Adhesive Market Outlook

The future outlook for the Industrial Instant Adhesive market remains exceptionally bright, fueled by ongoing innovation and increasing adoption across diverse industries. Growth accelerators such as advancements in material science, strategic collaborations, and aggressive market expansion strategies will continue to propel the sector forward. The trend towards lightweighting, automation, and sustainable manufacturing practices will further solidify the indispensable role of instant adhesives. Emerging opportunities in advanced electronics, medical devices, and renewable energy sectors present significant untapped potential. Stakeholders can anticipate continued market expansion driven by both incremental improvements in existing technologies and disruptive innovations that redefine bonding capabilities, ensuring substantial future market potential.

Industrial Instant Adhesive Segmentation

-

1. Application

- 1.1. Industry

- 1.2. Business

- 1.3. Household

- 1.4. Other

-

2. Types

- 2.1. Cyanoacrylate Instant Adhesives

- 2.2. Epoxy-based Instant Adhesive

Industrial Instant Adhesive Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Industrial Instant Adhesive REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Instant Adhesive Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industry

- 5.1.2. Business

- 5.1.3. Household

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cyanoacrylate Instant Adhesives

- 5.2.2. Epoxy-based Instant Adhesive

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial Instant Adhesive Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industry

- 6.1.2. Business

- 6.1.3. Household

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cyanoacrylate Instant Adhesives

- 6.2.2. Epoxy-based Instant Adhesive

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Industrial Instant Adhesive Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industry

- 7.1.2. Business

- 7.1.3. Household

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cyanoacrylate Instant Adhesives

- 7.2.2. Epoxy-based Instant Adhesive

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Industrial Instant Adhesive Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industry

- 8.1.2. Business

- 8.1.3. Household

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cyanoacrylate Instant Adhesives

- 8.2.2. Epoxy-based Instant Adhesive

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Industrial Instant Adhesive Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industry

- 9.1.2. Business

- 9.1.3. Household

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cyanoacrylate Instant Adhesives

- 9.2.2. Epoxy-based Instant Adhesive

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Industrial Instant Adhesive Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industry

- 10.1.2. Business

- 10.1.3. Household

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cyanoacrylate Instant Adhesives

- 10.2.2. Epoxy-based Instant Adhesive

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 3M

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pidilite

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 H.B. Fuller

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toagosei

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Franklin International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Huntsman Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Illinois Tool Works Incorporation (ITW)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delo Industrial Adhesives

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bostik SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sika AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RPM

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Permabond

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Parson Adhesives

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Loxeal Engineering Adhesives

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Company

List of Figures

- Figure 1: Global Industrial Instant Adhesive Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Instant Adhesive Revenue (million), by Application 2024 & 2032

- Figure 3: North America Industrial Instant Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Industrial Instant Adhesive Revenue (million), by Types 2024 & 2032

- Figure 5: North America Industrial Instant Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Industrial Instant Adhesive Revenue (million), by Country 2024 & 2032

- Figure 7: North America Industrial Instant Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Industrial Instant Adhesive Revenue (million), by Application 2024 & 2032

- Figure 9: South America Industrial Instant Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Industrial Instant Adhesive Revenue (million), by Types 2024 & 2032

- Figure 11: South America Industrial Instant Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Industrial Instant Adhesive Revenue (million), by Country 2024 & 2032

- Figure 13: South America Industrial Instant Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Industrial Instant Adhesive Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Industrial Instant Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Industrial Instant Adhesive Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Industrial Instant Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Industrial Instant Adhesive Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Industrial Instant Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Industrial Instant Adhesive Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Industrial Instant Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Industrial Instant Adhesive Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Industrial Instant Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Industrial Instant Adhesive Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Industrial Instant Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Industrial Instant Adhesive Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Industrial Instant Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Industrial Instant Adhesive Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Industrial Instant Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Industrial Instant Adhesive Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Industrial Instant Adhesive Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Instant Adhesive Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Instant Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Industrial Instant Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Industrial Instant Adhesive Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Instant Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Industrial Instant Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Industrial Instant Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Instant Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Industrial Instant Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Industrial Instant Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Industrial Instant Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Industrial Instant Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Industrial Instant Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Industrial Instant Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Industrial Instant Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Industrial Instant Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Industrial Instant Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Industrial Instant Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Industrial Instant Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Industrial Instant Adhesive Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Instant Adhesive?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Industrial Instant Adhesive?

Key companies in the market include Henkel AG & Company, 3M, Pidilite, H.B. Fuller, Toagosei, Franklin International, Huntsman Corporation, Illinois Tool Works Incorporation (ITW), Delo Industrial Adhesives, Bostik SA, Sika AG, RPM, Permabond, Parson Adhesives, Loxeal Engineering Adhesives.

3. What are the main segments of the Industrial Instant Adhesive?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Instant Adhesive," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Instant Adhesive report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Instant Adhesive?

To stay informed about further developments, trends, and reports in the Industrial Instant Adhesive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence