Key Insights

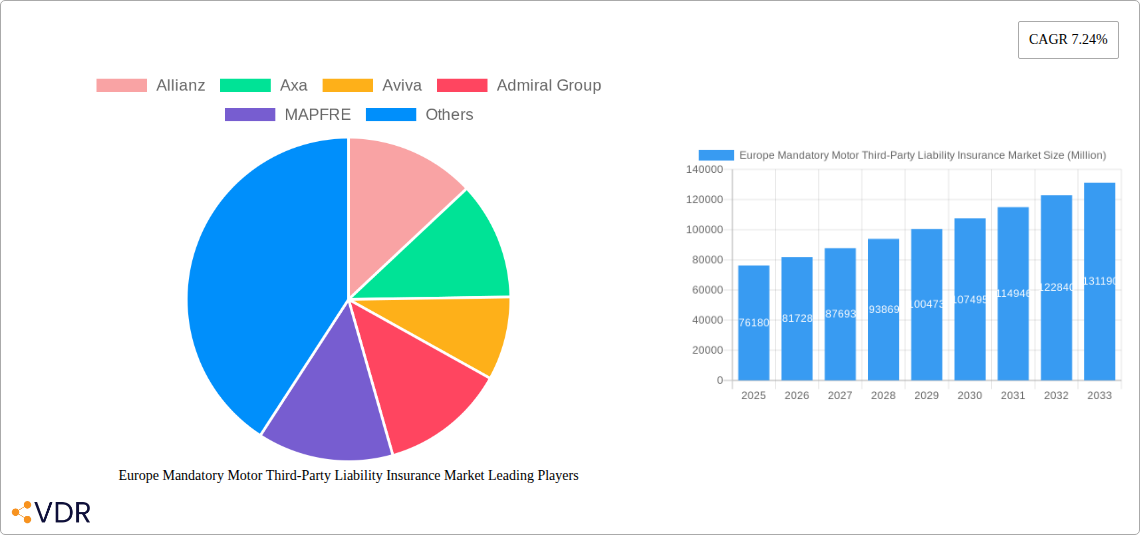

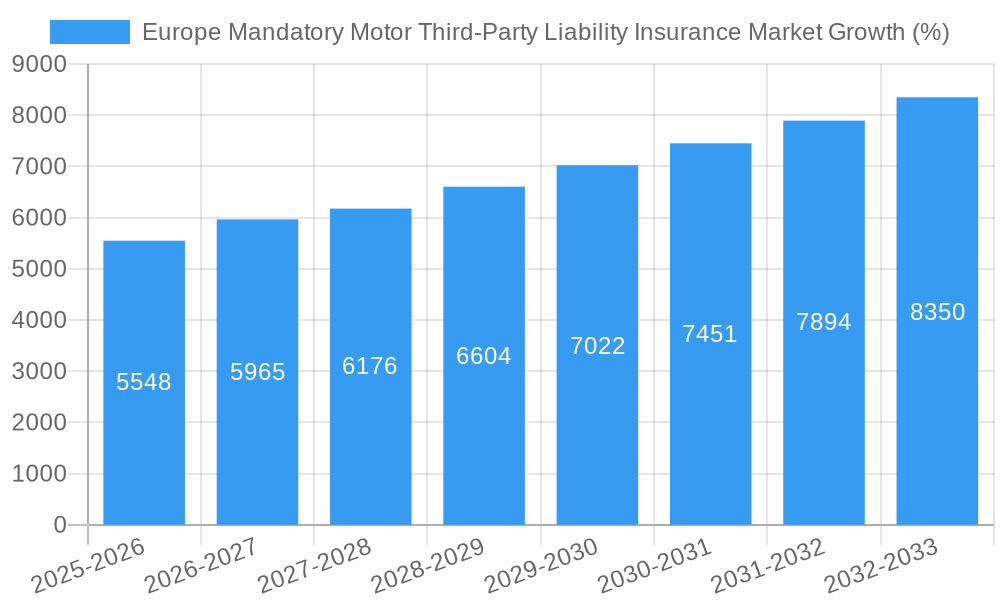

The European Mandatory Motor Third-Party Liability Insurance market, valued at €76.18 billion in 2025, is projected to experience robust growth, driven by increasing vehicle ownership, stricter government regulations enforcing comprehensive insurance coverage, and a rising awareness of personal liability. The market's Compound Annual Growth Rate (CAGR) of 7.24% from 2025 to 2033 indicates a significant expansion, with the market expected to surpass €130 billion by 2033. Key drivers include expanding urban populations leading to higher vehicle density, the increasing severity and frequency of road accidents necessitating higher insurance payouts, and evolving insurance product offerings integrating digital technologies and personalized risk assessment. The competitive landscape is shaped by established players such as Allianz, AXA, Aviva, and others, who are constantly innovating to offer competitive pricing and comprehensive coverage. However, factors like economic downturns, fluctuating fuel prices impacting vehicle usage, and increasing operational costs for insurance companies could present challenges to market growth.

Segmentation within the market is likely diverse, encompassing different vehicle types (cars, commercial vehicles, etc.), customer demographics (age, driving history), and geographic regions within Europe. While specific segment data isn't available, a reasonable assumption is a higher proportion of the market being driven by passenger vehicle insurance due to higher ownership numbers. Further regional variations will likely exist reflecting differences in vehicle ownership rates, regulatory frameworks, and economic conditions across individual European countries. The forecast period (2025-2033) indicates a continued upward trajectory, with sustained growth spurred by long-term trends in urbanization, technological advancement in risk management, and the evolving insurance landscape within the European Union. This positive outlook presents substantial opportunities for established players and new entrants alike to leverage the expanding market.

Europe Mandatory Motor Third-Party Liability Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Mandatory Motor Third-Party Liability Insurance Market, encompassing market dynamics, growth trends, regional analysis, competitive landscape, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, and uses 2025 as the base year. The market is segmented by various factors (specific segments will be detailed in the full report). This report is essential for insurance professionals, investors, and policymakers seeking a deep understanding of this crucial sector. The market size is estimated to be xx Million in 2025.

Europe Mandatory Motor Third-Party Liability Insurance Market Market Dynamics & Structure

The European mandatory motor third-party liability insurance market is characterized by a complex interplay of factors. Market concentration is relatively high, with several large players dominating the landscape. Technological innovation, driven by the adoption of telematics and data analytics, is reshaping underwriting and claims processes. Stringent regulatory frameworks, varying across European nations, significantly influence market operations. The presence of competitive substitutes, such as alternative risk transfer mechanisms, exerts pressure on traditional insurers. End-user demographics, particularly the rising number of vehicle owners and increasing awareness of insurance needs, fuel market growth. Finally, M&A activity, as evidenced by recent deals like Allianz's acquisition of Tua Assicurazioni and Aviva's acquisition of AIG Life UK, reflects consolidation trends and strategic expansion within the sector.

- Market Concentration: High, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Telematics, AI-powered claims processing, and personalized risk assessment driving efficiency and cost reduction.

- Regulatory Frameworks: Differing regulations across European countries create complexities for market participants.

- Competitive Substitutes: Alternative risk-sharing mechanisms pose challenges to traditional insurance models.

- End-User Demographics: Growing vehicle ownership and evolving consumer preferences influencing demand.

- M&A Trends: Significant M&A activity indicates industry consolidation and expansion strategies. In 2024 alone, deal value totaled approximately EUR 733 Million.

Europe Mandatory Motor Third-Party Liability Insurance Market Growth Trends & Insights

The European mandatory motor third-party liability insurance market has experienced consistent growth throughout the historical period (2019-2024). Driven by factors such as rising vehicle ownership, increasing urbanization, and stricter regulatory compliance, the market is projected to maintain a steady growth trajectory during the forecast period (2025-2033). Technological disruptions, such as the introduction of usage-based insurance (UBI) and telematics-enabled risk assessment, are significantly altering market dynamics, leading to greater efficiency and personalized pricing. Consumer behavior shifts, including the increasing adoption of online insurance platforms and the growing demand for personalized insurance products, further influence market growth. The CAGR during the forecast period is estimated to be xx%. Market penetration is expected to reach xx% by 2033.

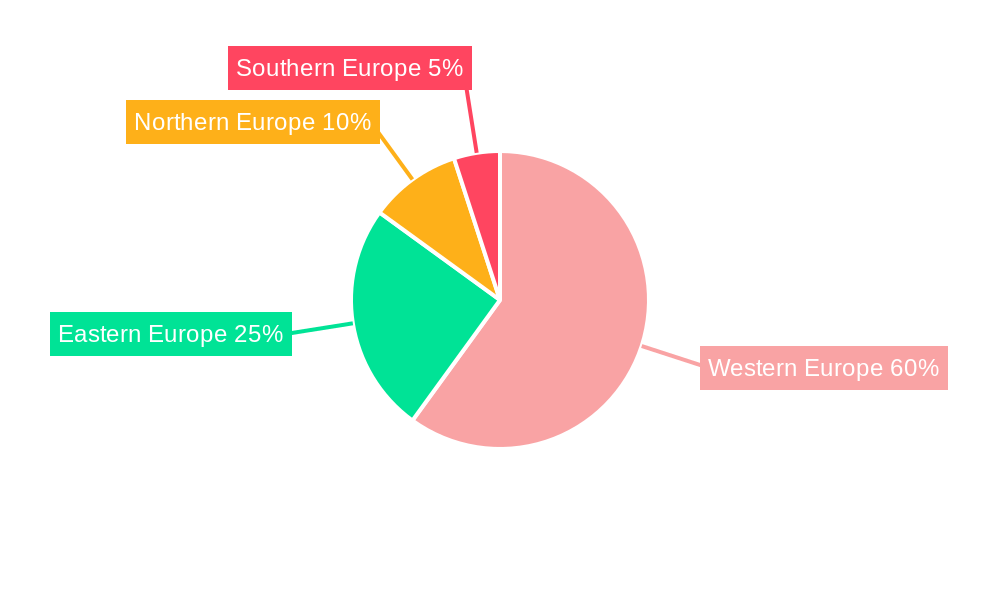

Dominant Regions, Countries, or Segments in Europe Mandatory Motor Third-Party Liability Insurance Market

Western European countries, particularly Germany, France, and the UK, constitute the largest segment of the European mandatory motor third-party liability insurance market. Their high vehicle ownership rates, robust economies, and well-established insurance sectors contribute to their dominance. However, significant growth potential exists in Central and Eastern European countries, where increasing vehicle ownership and rising disposable incomes drive demand for insurance products.

- Key Drivers in Western Europe: High vehicle ownership, strong economies, developed insurance infrastructure.

- Growth Potential in Central and Eastern Europe: Rising vehicle ownership, increasing disposable incomes, expanding insurance penetration.

- Market Share: Germany holds approximately xx% of the market in 2025, followed by France with xx% and the UK with xx%.

Europe Mandatory Motor Third-Party Liability Insurance Market Product Landscape

The product landscape is evolving rapidly, with a shift towards more sophisticated and personalized offerings. Insurers are incorporating telematics data to offer usage-based insurance (UBI) products, providing tailored premiums based on driving behavior. The integration of advanced analytics enables more accurate risk assessment, reducing costs and improving underwriting efficiency. Furthermore, the increasing use of digital platforms simplifies the insurance purchasing process, enhancing customer experience. This evolution drives customer acquisition and retention for insurers.

Key Drivers, Barriers & Challenges in Europe Mandatory Motor Third-Party Liability Insurance Market

Key Drivers:

- Rising vehicle ownership and usage

- Increasing urbanization and traffic density

- Stringent regulatory requirements

- Growing awareness of insurance importance

Challenges and Restraints:

- Intense competition among insurers

- Economic downturns impacting consumer spending on insurance

- Regulatory complexities and varying compliance requirements across countries

- Fraudulent claims and rising operational costs

Emerging Opportunities in Europe Mandatory Motor Third-Party Liability Insurance Market

- Expansion into untapped markets in Central and Eastern Europe

- Development of innovative insurance products using telematics and AI

- Adoption of digital distribution channels for enhanced customer experience

- Partnerships with technology companies to leverage data and analytics

Growth Accelerators in the Europe Mandatory Motor Third-Party Liability Insurance Market Industry

The market's long-term growth will be accelerated by the continued adoption of telematics, the development of AI-driven risk assessment models, and strategic mergers and acquisitions. Expanding into emerging markets and providing personalized insurance solutions will also be key drivers of growth.

Key Players Shaping the Europe Mandatory Motor Third-Party Liability Insurance Market Market

- Allianz

- Axa

- Aviva

- Admiral Group

- MAPFRE

- Chubb Limited

- Generali Group

- BaFin

- Ergo Insurance

- SCOR

- List Not Exhaustive

Notable Milestones in Europe Mandatory Motor Third-Party Liability Insurance Market Sector

- April 2024: Aviva PLC acquires AIG Life Limited for EUR 453 million.

- March 2024: Allianz acquires Tua Assicurazioni for EUR 280 million.

In-Depth Europe Mandatory Motor Third-Party Liability Insurance Market Market Outlook

The European mandatory motor third-party liability insurance market presents significant growth potential driven by technological advancements, expanding insurance penetration, and increasing vehicle ownership across the region. Strategic partnerships, innovative product development, and effective risk management strategies will be crucial for success in this dynamic market. The continued adoption of telematics and AI-powered solutions will further enhance efficiency, allowing insurers to offer more tailored and cost-effective products to consumers.

Europe Mandatory Motor Third-Party Liability Insurance Market Segmentation

-

1. Type

- 1.1. Bodily Injury Liability

- 1.2. Property Damage Liability

-

2. Distribution Channel

- 2.1. Independent Agents/Brokers

- 2.2. Direct Sales

- 2.3. Banks

-

3. Application

- 3.1. Personal

- 3.2. Commercial

Europe Mandatory Motor Third-Party Liability Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Mandatory Motor Third-Party Liability Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Ownership

- 3.3. Market Restrains

- 3.3.1. Increasing Vehicle Ownership

- 3.4. Market Trends

- 3.4.1. Increasing Number of Vehicles on the Road to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Mandatory Motor Third-Party Liability Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bodily Injury Liability

- 5.1.2. Property Damage Liability

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Independent Agents/Brokers

- 5.2.2. Direct Sales

- 5.2.3. Banks

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Allianz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aviva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Admiral Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAPFRE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Generali Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BaFin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ergo Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SCOR**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Allianz

List of Figures

- Figure 1: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Mandatory Motor Third-Party Liability Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 9: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 17: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: United Kingdom Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: France Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Spain Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Netherlands Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Netherlands Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Belgium Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Belgium Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Sweden Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Sweden Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Norway Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Norway Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Poland Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Poland Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Denmark Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Denmark Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Mandatory Motor Third-Party Liability Insurance Market?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the Europe Mandatory Motor Third-Party Liability Insurance Market?

Key companies in the market include Allianz, Axa, Aviva, Admiral Group, MAPFRE, Chubb Limited, Generali Group, BaFin, Ergo Insurance, SCOR**List Not Exhaustive.

3. What are the main segments of the Europe Mandatory Motor Third-Party Liability Insurance Market?

The market segments include Type, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Ownership.

6. What are the notable trends driving market growth?

Increasing Number of Vehicles on the Road to Drive Market Growth.

7. Are there any restraints impacting market growth?

Increasing Vehicle Ownership.

8. Can you provide examples of recent developments in the market?

April 2024: Aviva PLC ("Aviva") announced the acquisition of AIG Life Limited ("AIG Life UK") from Corebridge Financial Inc., a subsidiary of American International Group Inc. After receiving all requisite approvals, the acquisition was finalized for EUR 453 million (USD 497.95 million).March 2024: Allianz finalized its acquisition of Tua Assicurazioni in Italy. Allianz SpA confirmed the successful acquisition of Tua Assicurazioni SpA from Assicurazioni Generali SpA. The deal was sealed for EUR 280 million (USD 307.78 million). Tua Assicurazioni boasts a robust property and casualty (P/C) insurance portfolio, generating approximately EUR 280 million (USD 307.78 million) in gross written premiums in 2022. Notably, this was largely facilitated through its extensive network of nearly 500 agents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Mandatory Motor Third-Party Liability Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Mandatory Motor Third-Party Liability Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Mandatory Motor Third-Party Liability Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Mandatory Motor Third-Party Liability Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence