Key Insights

The European capital market exchange ecosystem is a dynamic and complex landscape experiencing robust growth, driven by escalating cross-border investments, technological advancements, and evolving regulatory frameworks. The market is projected to reach a size of 151.36 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.8%. This expansion is attributed to the increasing adoption of digital trading platforms, enhancing liquidity and accessibility. Furthermore, the European Union's commitment to financial market integration and regulatory harmonization, including initiatives to boost transparency and reduce fragmentation, is a significant catalyst for market growth. The rising volume of initial public offerings (IPOs) and other capital-raising activities also contributes to this upward trajectory.

Europe Capital Market Exchange Ecosystem Market Size (In Million)

However, the ecosystem navigates several restraints. Geopolitical uncertainties, particularly those affecting specific regions, can induce volatility and diminish investor confidence. The ongoing ramifications of Brexit on cross-border transactions and regulatory structures add to market complexities. Competition from other global financial hubs and the imperative for continuous investment in infrastructure and cybersecurity measures present additional challenges. The market is segmented across diverse asset classes, trading mechanisms, and exchange tiers, with prominent players like Euronext, Nasdaq Nordic, and the London Stock Exchange underscoring the competitive and varied nature of this ecosystem. Projections for the forecast period (2025-2033) anticipate sustained expansion, contingent upon the interplay of these growth drivers and restraints.

Europe Capital Market Exchange Ecosystem Company Market Share

Europe Capital Market Exchange Ecosystem Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Capital Market Exchange Ecosystem, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report utilizes a robust methodology to forecast market growth from 2025 to 2033, providing invaluable insights for industry professionals, investors, and strategic decision-makers. The analysis considers various segments and parent-child market relationships within this dynamic landscape.

Keywords: Europe Capital Market Exchange, Stock Exchange, Euronext, Nasdaq Nordic, London Stock Exchange, Frankfurt Stock Exchange, SIX Swiss Exchange, Market Size, Market Share, Growth Forecast, M&A, Regulatory Landscape, Technological Innovation, Investment Opportunities, Capital Markets, Trading Platforms, Financial Markets, European Union, Fintech

Europe Capital Market Exchange Ecosystem Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the European capital market exchange ecosystem. The market is characterized by a moderately concentrated structure, with several major players holding significant market share. However, the emergence of fintech companies and increased competition are influencing market dynamics.

Market Concentration:

- The top five exchanges (London Stock Exchange, Euronext, Deutsche Börse (Frankfurt Stock Exchange), SIX Swiss Exchange, and Nasdaq Nordic) collectively account for approximately xx% of the total trading volume in 2025.

- Smaller exchanges such as the Hamburg Stock Exchange, Italian Stock Exchange, Budapest Stock Exchange and others contribute to the remaining market share. The Ukrainian Exchange's performance is currently impacted by geopolitical factors.

- Market share fluctuates annually based on macroeconomic factors and market events.

Technological Innovation Drivers:

- High-frequency trading (HFT) technologies continue to improve execution speed and efficiency.

- Blockchain technology and distributed ledger technology (DLT) are explored for increased transparency and security.

- Artificial intelligence (AI) and machine learning (ML) are being implemented for risk management and algorithmic trading.

Regulatory Frameworks:

- The changing regulatory environment in Europe, driven by MiFID II and other directives, shapes the market landscape.

- Regulatory compliance costs significantly impact smaller exchanges more than larger ones.

- Compliance pressures drive technological adoption and innovation.

Competitive Product Substitutes:

- Alternative trading venues (ATVs) and OTC markets provide some competition.

- The rise of decentralized finance (DeFi) poses a potential long-term threat, though adoption within mainstream capital markets remains relatively low.

End-User Demographics:

- Institutional investors (e.g., mutual funds, hedge funds) represent the majority of trading volume.

- Retail investors are increasingly active through online brokerage platforms.

M&A Trends:

- The historical period (2019-2024) witnessed xx M&A deals in the European capital market exchange sector, totaling approximately xx Million in value.

- The forecast period (2025-2033) is expected to see an increase in M&A activity due to consolidation and expansion strategies, but the exact volume remains difficult to predict given market volatility (estimated xx Million in value).

Europe Capital Market Exchange Ecosystem Growth Trends & Insights

The European capital market exchange ecosystem witnessed robust growth during the historical period (2019-2024), driven primarily by increased trading activity, technological advancements, and favorable regulatory frameworks. The market size expanded from xx Million in 2019 to xx Million in 2024, representing a CAGR of xx%. The growth was not uniform across all markets. The impact of the COVID-19 pandemic initially increased volatility but eventually led to a surge in trading activity, impacting the overall growth rate during 2020-2021.

Market penetration of online trading platforms has steadily increased, reflecting the changing preferences of retail investors. The forecast period (2025-2033) is projected to exhibit a CAGR of xx%, driven by factors such as increasing digitalization, the rise of fintech, and growing participation from institutional investors. Geopolitical events can however influence the overall market size and CAGR significantly. Technological disruptions, such as the adoption of blockchain and AI, will continue to reshape the market landscape, creating new opportunities while simultaneously presenting challenges for established players. Changes in consumer behavior, such as increased adoption of mobile trading and demand for personalized investment solutions, influence future market dynamics.

Dominant Regions, Countries, or Segments in Europe Capital Market Exchange Ecosystem

The United Kingdom, Germany, and France represent the dominant regions within the European capital market exchange ecosystem, accounting for approximately xx% of the total market share in 2025. This dominance is attributable to several factors including:

- Mature Financial Infrastructure: These countries possess well-established financial infrastructure, including robust regulatory frameworks, advanced technological capabilities, and a deep pool of skilled professionals.

- Economic Strength: Strong economies attract a higher volume of trading activity and investment.

- Large Investor Base: A significant concentration of institutional and retail investors drives trading volume.

Key Drivers:

- Favorable Regulatory Environment: Supportive government policies and regulations promote the growth of the capital market.

- Strong Economic Growth: Economic stability and growth contribute to increased investment and trading activity.

- Technological Advancements: Adoption of innovative technologies enhances efficiency and attracts market participation.

Growth Potential:

While the UK, Germany, and France are currently dominant, other regions possess considerable growth potential. Central and Eastern European countries exhibit significant growth prospects, but regulatory frameworks and infrastructure development play critical roles.

Europe Capital Market Exchange Ecosystem Product Landscape

The product landscape encompasses a range of trading platforms, data analytics tools, and risk management solutions. Innovation focuses on enhancing trading speed and efficiency, improving data analysis capabilities, and developing sophisticated risk management tools. Many exchanges offer differentiated services, including specialized market segments for specific asset classes, advanced order routing systems, and customized data feeds. The unique selling propositions often center on speed of execution, data accuracy, technological integration, and client service. Key advancements include improved algorithms for algorithmic trading, enhanced data security protocols, and integration of artificial intelligence for fraud detection and regulatory compliance.

Key Drivers, Barriers & Challenges in Europe Capital Market Exchange Ecosystem

Key Drivers:

- Technological advancements, such as high-frequency trading and AI-powered analytics, are streamlining operations and improving efficiency.

- Increased regulatory scrutiny and compliance requirements drive innovation in risk management and data security.

- The rising demand for ESG (environmental, social, and governance) investing is creating new market opportunities.

Key Challenges and Restraints:

- Regulatory hurdles and compliance costs create significant barriers to entry for smaller firms.

- Increased competition from alternative trading venues and fintech firms pose significant competitive pressures.

- Cybersecurity threats and data breaches are a growing concern for exchanges. The estimated cost of cybersecurity breaches is xx Million annually across the European market.

Emerging Opportunities in Europe Capital Market Exchange Ecosystem

Emerging opportunities include the growth of:

- Sustainable and responsible investment (SRI) markets which has increased by xx% between 2020-2024

- Digital asset trading platforms and integration of blockchain technology.

- Expansion into underserved markets in Central and Eastern Europe.

Growth Accelerators in the Europe Capital Market Exchange Ecosystem Industry

Long-term growth will be driven by increased digitalization, strategic partnerships between exchanges and fintech companies, and expansion into new markets. Technological advancements, particularly in AI and blockchain, offer substantial opportunities for enhancing trading platforms and reducing operational costs. Strategic alliances allow exchanges to leverage new technologies and expand their reach. Furthermore, initiatives to encourage SME listing and improving access for small and medium-sized businesses should enhance overall market growth.

Key Players Shaping the Europe Capital Market Exchange Ecosystem Market

- Euronext

- Nasdaq Nordic

- London Stock Exchange

- Hamburg Stock Exchange

- Frankfurt Stock Exchange

- Italian Stock Exchange

- SIX Swiss Exchange

- Budapest Stock Exchange

- Moscow Exchange

- Ukrainian Exchange

Notable Milestones in Europe Capital Market Exchange Ecosystem Sector

- October 2023: Euronext introduced a new VaR-based margin methodology on the Euronext Milan equities, ETF, and financial derivatives markets, enhancing risk management.

- March 2023: Innovate UK and the London Stock Exchange partnered to improve financial access for innovative businesses, unlocking EUR 6 trillion in long-term capital for UK innovation.

In-Depth Europe Capital Market Exchange Ecosystem Market Outlook

The future of the European capital market exchange ecosystem is bright, driven by technological innovation, increased regulatory clarity, and the growing demand for efficient and transparent trading platforms. The market is expected to continue its expansion, particularly in the areas of digital assets, sustainable investing, and expansion into underserved markets. Strategic partnerships and acquisitions will further shape the market landscape, leading to increased consolidation and the emergence of dominant players. The focus on improving regulatory frameworks and enhancing technological infrastructure will be crucial for sustained long-term growth, presenting significant opportunities for investors and industry participants.

Europe Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Europe Capital Market Exchange Ecosystem Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

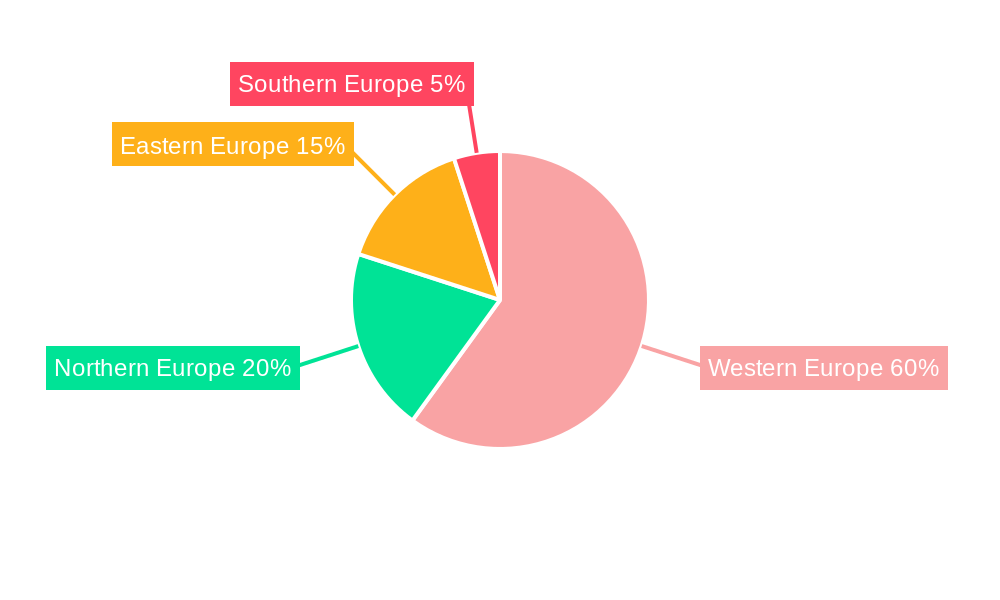

Europe Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Europe Capital Market Exchange Ecosystem

Europe Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Significance of Primary Market in European Capital Market Exchange Ecosystem

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Euronext

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nasdaq Nordic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 London Stock Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hamburg Stock Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frankfurt Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Italian Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIX Swiss Exchange

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Budapest Stock Exchange

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Moscow Exchange

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ukrainian Exchange**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Euronext

List of Figures

- Figure 1: Europe Capital Market Exchange Ecosystem Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 2: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 3: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 4: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 6: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 7: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 8: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Capital Market Exchange Ecosystem?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Europe Capital Market Exchange Ecosystem?

Key companies in the market include Euronext, Nasdaq Nordic, London Stock Exchange, Hamburg Stock Exchange, Frankfurt Stock Exchange, Italian Stock Exchange, SIX Swiss Exchange, Budapest Stock Exchange, Moscow Exchange, Ukrainian Exchange**List Not Exhaustive.

3. What are the main segments of the Europe Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Instruments, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.36 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Significance of Primary Market in European Capital Market Exchange Ecosystem.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Euronext introduced a new VaR-based margin methodology on the Euronext Milan equities, ETF and financial derivatives markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Europe Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence