Key Insights

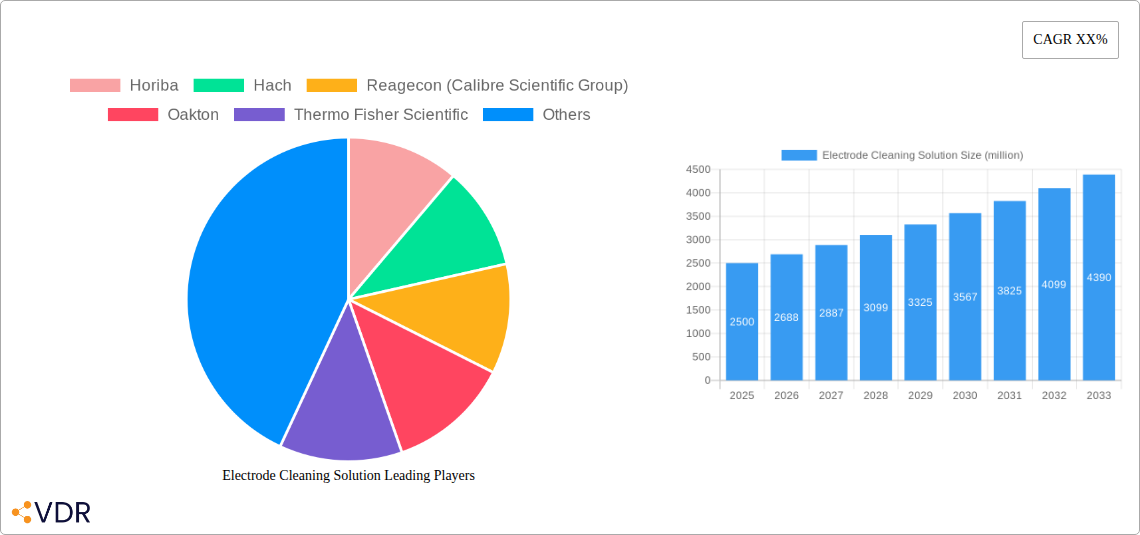

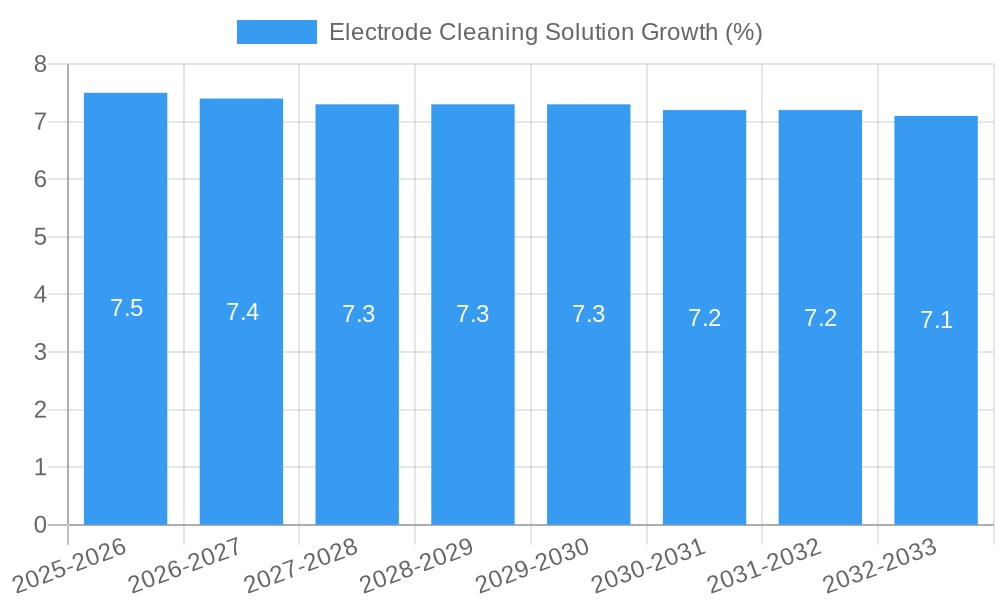

The global Electrode Cleaning Solution market is poised for robust expansion, projected to reach an estimated market size of approximately $2,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 7.5% between 2025 and 2033. This significant growth is underpinned by escalating demand across critical sectors such as medical devices and electronic products, where electrode integrity is paramount for accurate diagnostics and reliable performance. The medical industry, in particular, is a key driver, fueled by the increasing adoption of advanced diagnostic equipment and the continuous need for sterile and functional electrodes in patient monitoring and laboratory testing. Similarly, the burgeoning electronics sector, with its rapid innovation cycles and growing production volumes, necessitates effective electrode cleaning solutions to ensure product quality and longevity. The market is segmented into Organic Electrode Cleaning Solutions and Inorganic Electrode Cleaning Solutions, with organic variants likely experiencing higher demand due to their specialized properties and effectiveness in specific applications.

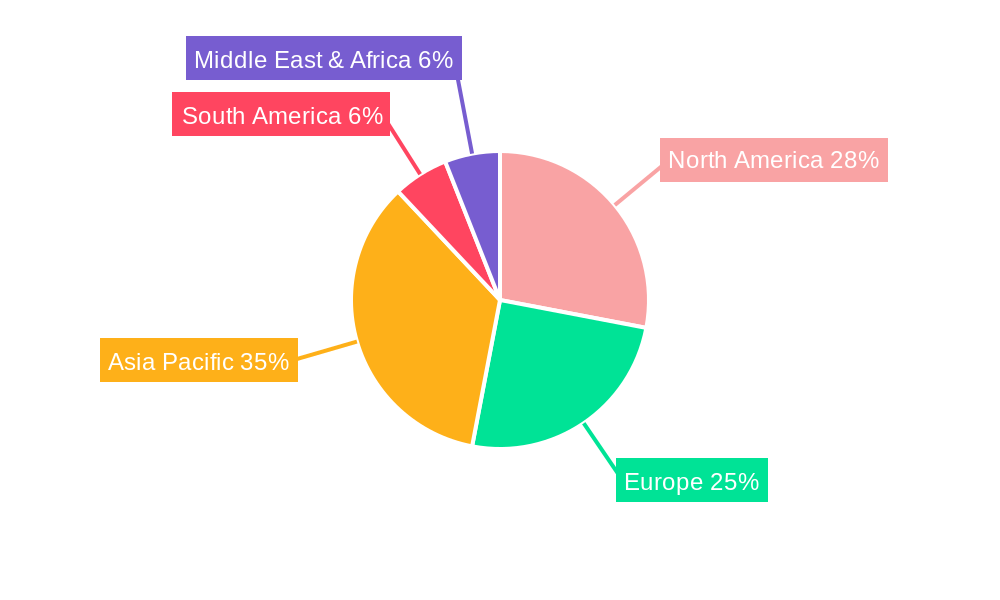

The market is further shaped by several influential drivers, including stringent quality control mandates in healthcare and manufacturing, coupled with ongoing technological advancements in electrode materials and cleaning methodologies. Innovations leading to faster, more efficient, and environmentally friendly cleaning solutions are expected to gain traction. However, the market also faces certain restraints, such as the high cost of specialized cleaning formulations and potential regulatory hurdles in specific regions, which could impede widespread adoption. Key players like Thermo Fisher Scientific, Mettler Toledo, and MilliporeSigma are at the forefront, investing in research and development to introduce novel products that address these challenges and capitalize on emerging opportunities. Regional dynamics indicate that Asia Pacific, particularly China and India, is expected to witness substantial growth owing to its expanding manufacturing base and increasing healthcare investments. North America and Europe, with their established industries and high technological adoption rates, will continue to be significant markets.

Electrode Cleaning Solution Market: Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Electrode Cleaning Solution market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, growth accelerators, and a detailed outlook. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and navigate this evolving market.

Electrode Cleaning Solution Market Dynamics & Structure

The global Electrode Cleaning Solution market is characterized by a moderate to high degree of market concentration, with key players like Mettler Toledo, Thermo Fisher Scientific, and Hach holding significant market shares. Technological innovation is a primary driver, fueled by the increasing demand for highly accurate and reliable electrochemical measurements across various industries. Stringent regulatory frameworks, particularly in the medical and environmental monitoring sectors, mandate the use of certified and effective cleaning solutions, further shaping market dynamics. Competitive product substitutes, such as advanced electrode materials and in-situ cleaning technologies, present a constant challenge, pushing manufacturers to innovate and differentiate their offerings. End-user demographics are shifting towards research and development institutions, quality control laboratories, and industrial process monitoring, all requiring precise and consistent electrode performance. Mergers and acquisitions (M&A) are a notable trend, with larger companies acquiring smaller, specialized players to expand their product portfolios and geographical reach. For instance, the acquisition of Reagecon by Calibre Scientific Group exemplifies this consolidation. Barriers to innovation include the high cost of R&D, complex validation processes for new formulations, and the need for extensive testing to meet specific application requirements.

Electrode Cleaning Solution Growth Trends & Insights

The global Electrode Cleaning Solution market is poised for robust growth, driven by escalating demand across diverse applications. The market size is projected to witness a substantial evolution, expanding from approximately $XXX million in 2019 to an estimated $XXX million by 2033. The Compound Annual Growth Rate (CAGR) over the forecast period is anticipated to be around XX%, signifying consistent and strong expansion. Adoption rates for advanced cleaning solutions are increasing as industries recognize the direct correlation between electrode cleanliness and measurement accuracy, leading to reduced downtime and improved operational efficiency. Technological disruptions are emerging in the form of eco-friendly and biodegradable cleaning formulations, addressing growing environmental concerns. Furthermore, the development of automated cleaning systems integrated with electrode maintenance protocols is enhancing user convenience and performance. Consumer behavior is shifting towards a preference for specialized cleaning solutions tailored to specific electrode types and applications, moving away from generic alternatives. Market penetration is expected to deepen in sectors like pharmaceuticals, food and beverage quality control, and advanced materials research, where precise electrochemical analysis is critical. The growing emphasis on data integrity and regulatory compliance in these fields further underpins the demand for reliable electrode maintenance.

Dominant Regions, Countries, or Segments in Electrode Cleaning Solution

The Medical application segment is projected to be the dominant force driving growth in the global Electrode Cleaning Solution market. This dominance is underpinned by several critical factors. The burgeoning healthcare industry, with its ever-increasing need for accurate diagnostic and analytical testing, directly translates into higher demand for reliable electrode performance in medical devices and laboratory equipment. Stringent quality control and regulatory compliance within the pharmaceutical and biotechnology sectors, for example, necessitate the use of premium electrode cleaning solutions to ensure the integrity of research and production processes. The market share for electrode cleaning solutions in the medical sector is estimated to be around XX% of the total market value in 2025, with a projected growth potential of XX% over the forecast period. Key drivers include the continuous development of novel diagnostic tools, the expansion of personalized medicine initiatives, and the rising prevalence of chronic diseases requiring extensive monitoring. Furthermore, government initiatives promoting healthcare infrastructure development and increased investment in medical research and development are further accelerating adoption.

In terms of specific countries, North America, particularly the United States, is expected to lead market growth. This is attributed to its advanced research infrastructure, high concentration of pharmaceutical and biotechnology companies, and a strong emphasis on innovation in the healthcare and electronics sectors. The presence of major research institutions and well-established manufacturing hubs for electronic products further bolsters demand.

Analyzing by Type, the Organic Electrode Cleaning Solution segment is anticipated to witness significant expansion, driven by its efficacy in cleaning a wider range of organic contaminants often encountered in complex analytical matrices, particularly within the medical and advanced electronics industries.

Electrode Cleaning Solution Product Landscape

The Electrode Cleaning Solution market is witnessing a wave of product innovations focused on enhanced efficacy, broader compatibility, and environmental sustainability. Manufacturers are developing advanced formulations designed to tackle specific contaminants encountered in medical diagnostics, electronics manufacturing, and environmental testing. Unique selling propositions often revolve around faster cleaning times, extended electrode lifespan, and reduced chemical usage. For example, new organic cleaning solutions are emerging that effectively remove protein fouling in biosensors without damaging sensitive electrode materials. Similarly, inorganic cleaning solutions are being refined for use in high-purity electronic component manufacturing, ensuring minimal residue and optimal conductivity. Technological advancements include the incorporation of biodegradable components and the development of concentrated formulas that reduce shipping weight and waste.

Key Drivers, Barriers & Challenges in Electrode Cleaning Solution

Key Drivers:

- Growing demand for accurate electrochemical measurements: Industries like healthcare, pharmaceuticals, and environmental monitoring rely heavily on precise readings, making electrode maintenance critical.

- Technological advancements in sensor technology: The development of more sensitive and sophisticated electrodes necessitates specialized cleaning solutions to maintain their performance.

- Increasing regulatory stringency: Strict quality control and compliance standards in various sectors mandate the use of effective and validated cleaning agents.

- Expansion of end-user industries: Growth in medical devices, electronics manufacturing, and R&D activities directly fuels the demand for electrode cleaning solutions.

Key Barriers & Challenges:

- High R&D costs and validation complexities: Developing new formulations and obtaining necessary certifications can be time-consuming and expensive.

- Availability of cheaper, less specialized alternatives: The presence of generic cleaning agents can pose a competitive challenge, particularly in price-sensitive markets.

- Supply chain disruptions and raw material price volatility: Global events can impact the availability and cost of essential chemical components.

- Environmental regulations regarding chemical disposal: Increasingly stringent rules for chemical waste management can add to operational costs for users.

- Limited awareness of specialized solutions in emerging markets: Educating potential users about the benefits of advanced cleaning solutions remains a challenge.

Emerging Opportunities in Electrode Cleaning Solution

Emerging opportunities in the Electrode Cleaning Solution market lie in the development of highly specialized, application-specific formulations. The increasing use of microfluidics and lab-on-a-chip devices in medical diagnostics presents a niche for ultra-gentle yet effective cleaning solutions. The burgeoning field of renewable energy, particularly in battery research and development, requires specialized electrode cleaning agents for testing and maintenance. Furthermore, the growing trend towards portable and field-deployable analytical instruments is creating a demand for robust, all-in-one cleaning kits that are easy to use and store. Untapped markets in developing economies, coupled with a rising awareness of the importance of accurate scientific measurements, offer significant growth potential. The development of smart cleaning solutions that can self-assess electrode condition and recommend appropriate cleaning protocols also represents an exciting avenue.

Growth Accelerators in the Electrode Cleaning Solution Industry

Long-term growth in the Electrode Cleaning Solution industry will be significantly accelerated by continuous technological breakthroughs in material science, leading to the development of more effective and environmentally friendly cleaning agents. Strategic partnerships between solution manufacturers and electrode producers will foster synergistic innovation, ensuring cleaning solutions are perfectly optimized for emerging electrode technologies. Market expansion strategies targeting underserved regions and nascent industries, such as advanced agriculture and sustainable manufacturing, will unlock new revenue streams. The increasing adoption of Industry 4.0 principles, including automation and data analytics, will drive demand for integrated electrode maintenance and cleaning systems. Furthermore, a growing emphasis on sustainability and green chemistry within the broader chemical industry will push innovation towards biodegradable and less hazardous cleaning formulations, creating a competitive advantage for forward-thinking companies.

Key Players Shaping the Electrode Cleaning Solution Market

- Horiba

- Hach

- Reagecon (Calibre Scientific Group)

- Oakton

- Thermo Fisher Scientific

- Hamilton

- Hanna Instruments

- Mettler Toledo

- MilliporeSigma

- Milwaukee Instruments

- TRUEscience

- RICCA

- Green Air Products, Inc

- Adwa Instruments

- Bante Instruments

Notable Milestones in Electrode Cleaning Solution Sector

- 2019: Increased focus on biodegradable cleaning formulations in response to growing environmental regulations.

- 2020: Introduction of advanced, multi-component cleaning solutions for complex biosensor applications.

- 2021: Expansion of Reagecon by Calibre Scientific Group, signifying industry consolidation.

- 2022: Development of automated cleaning systems for high-throughput laboratory environments.

- 2023: Rise in demand for specialized cleaning solutions for the growing electric vehicle battery research sector.

- 2024: Emergence of novel cleaning agents designed for microfluidic devices in point-of-care diagnostics.

In-Depth Electrode Cleaning Solution Market Outlook

The future outlook for the Electrode Cleaning Solution market is exceptionally positive, fueled by sustained innovation and expanding application frontiers. Growth accelerators, including advancements in electrochemical sensor technology and the persistent drive for higher analytical accuracy in critical industries, will continue to propel demand. Strategic opportunities exist in the development of intelligent cleaning systems integrated with IoT capabilities, offering real-time monitoring and predictive maintenance for electrodes. Market expansion into emerging economies and niche applications like advanced materials science and agri-tech will create new avenues for growth. The increasing emphasis on sustainable chemical practices will further incentivize the development and adoption of eco-friendly cleaning solutions, positioning companies with a strong R&D focus in this area for significant success. Overall, the market is set for consistent expansion, driven by its indispensable role in ensuring the reliability and accuracy of electrochemical measurements across a wide spectrum of scientific and industrial endeavors.

Electrode Cleaning Solution Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Electronic Product

- 1.3. Other

-

2. Types

- 2.1. Organic Electrode Cleaning Solution

- 2.2. Inorganic Electrode Cleaning Solution

Electrode Cleaning Solution Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electrode Cleaning Solution REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrode Cleaning Solution Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Electronic Product

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Organic Electrode Cleaning Solution

- 5.2.2. Inorganic Electrode Cleaning Solution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electrode Cleaning Solution Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Electronic Product

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Organic Electrode Cleaning Solution

- 6.2.2. Inorganic Electrode Cleaning Solution

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electrode Cleaning Solution Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Electronic Product

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Organic Electrode Cleaning Solution

- 7.2.2. Inorganic Electrode Cleaning Solution

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electrode Cleaning Solution Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Electronic Product

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Organic Electrode Cleaning Solution

- 8.2.2. Inorganic Electrode Cleaning Solution

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electrode Cleaning Solution Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Electronic Product

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Organic Electrode Cleaning Solution

- 9.2.2. Inorganic Electrode Cleaning Solution

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electrode Cleaning Solution Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. Electronic Product

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Organic Electrode Cleaning Solution

- 10.2.2. Inorganic Electrode Cleaning Solution

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Horiba

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hach

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Reagecon (Calibre Scientific Group)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oakton

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hamilton

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hanna Instruments

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mettler Toledo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MilliporeSigma

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Milwaukee Instruments

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TRUEscience

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RICCA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Green Air Products

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Adwa Instruments

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bante Instruments

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Horiba

List of Figures

- Figure 1: Global Electrode Cleaning Solution Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Electrode Cleaning Solution Revenue (million), by Application 2024 & 2032

- Figure 3: North America Electrode Cleaning Solution Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Electrode Cleaning Solution Revenue (million), by Types 2024 & 2032

- Figure 5: North America Electrode Cleaning Solution Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Electrode Cleaning Solution Revenue (million), by Country 2024 & 2032

- Figure 7: North America Electrode Cleaning Solution Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Electrode Cleaning Solution Revenue (million), by Application 2024 & 2032

- Figure 9: South America Electrode Cleaning Solution Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Electrode Cleaning Solution Revenue (million), by Types 2024 & 2032

- Figure 11: South America Electrode Cleaning Solution Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Electrode Cleaning Solution Revenue (million), by Country 2024 & 2032

- Figure 13: South America Electrode Cleaning Solution Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Electrode Cleaning Solution Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Electrode Cleaning Solution Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Electrode Cleaning Solution Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Electrode Cleaning Solution Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Electrode Cleaning Solution Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Electrode Cleaning Solution Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Electrode Cleaning Solution Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Electrode Cleaning Solution Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Electrode Cleaning Solution Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Electrode Cleaning Solution Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Electrode Cleaning Solution Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Electrode Cleaning Solution Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Electrode Cleaning Solution Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Electrode Cleaning Solution Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Electrode Cleaning Solution Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Electrode Cleaning Solution Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Electrode Cleaning Solution Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Electrode Cleaning Solution Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electrode Cleaning Solution Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electrode Cleaning Solution Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Electrode Cleaning Solution Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Electrode Cleaning Solution Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Electrode Cleaning Solution Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Electrode Cleaning Solution Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Electrode Cleaning Solution Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Electrode Cleaning Solution Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Electrode Cleaning Solution Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Electrode Cleaning Solution Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Electrode Cleaning Solution Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Electrode Cleaning Solution Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Electrode Cleaning Solution Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Electrode Cleaning Solution Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Electrode Cleaning Solution Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Electrode Cleaning Solution Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Electrode Cleaning Solution Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Electrode Cleaning Solution Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Electrode Cleaning Solution Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Electrode Cleaning Solution Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrode Cleaning Solution?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Electrode Cleaning Solution?

Key companies in the market include Horiba, Hach, Reagecon (Calibre Scientific Group), Oakton, Thermo Fisher Scientific, Hamilton, Hanna Instruments, Mettler Toledo, MilliporeSigma, Milwaukee Instruments, TRUEscience, RICCA, Green Air Products, Inc, Adwa Instruments, Bante Instruments.

3. What are the main segments of the Electrode Cleaning Solution?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrode Cleaning Solution," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrode Cleaning Solution report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrode Cleaning Solution?

To stay informed about further developments, trends, and reports in the Electrode Cleaning Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence