Key Insights

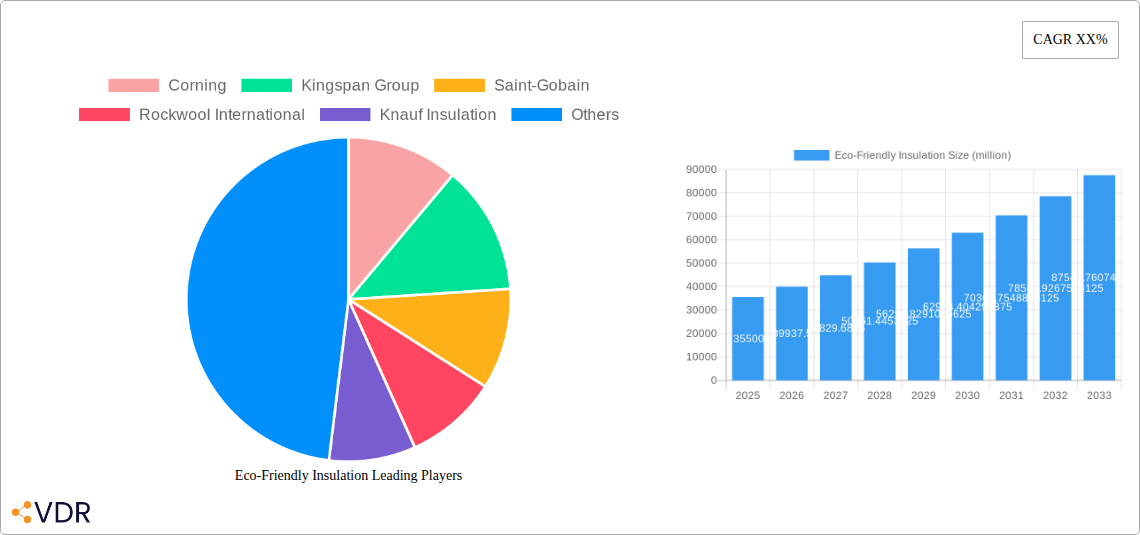

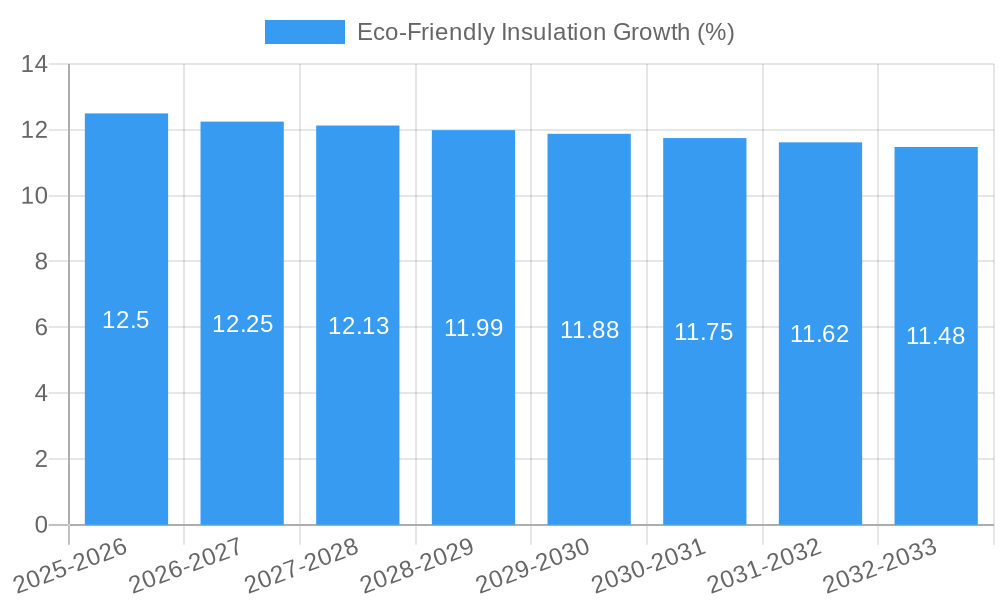

The global eco-friendly insulation market is experiencing robust expansion, projected to reach an estimated USD 35,500 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of approximately 12.5%, signaling strong investor confidence and increasing consumer demand for sustainable building solutions. The primary drivers behind this surge include escalating environmental regulations, a growing awareness of the energy-saving benefits of effective insulation, and a rising preference for natural and recycled materials in construction. The residential building segment currently dominates the market, driven by renovation projects and new home construction prioritizing energy efficiency. However, the non-residential building sector is anticipated to witness significant growth, fueled by commercial and industrial projects seeking to reduce operational costs and meet corporate sustainability goals.

The market is characterized by a diverse range of product types, with Mineral Wool and Fiberglass holding substantial market shares due to their established performance and availability. Nevertheless, emerging materials like Hemp and Cellulose are gaining traction, driven by their superior environmental profiles and unique performance characteristics. Restraints such as the higher initial cost of some eco-friendly insulation compared to conventional options, and a lack of widespread awareness or standardized certifications, are being steadily overcome by technological advancements and increasing market maturity. Key players like Kingspan Group, Saint-Gobain, and Rockwool International are actively investing in research and development, expanding production capacities, and forging strategic partnerships to capitalize on the burgeoning demand across major regions like North America and Europe, with Asia Pacific poised for substantial future growth.

Eco-Friendly Insulation Market: A Comprehensive Report Overview

This report provides an in-depth analysis of the global eco-friendly insulation market, a rapidly expanding sector driven by increasing environmental awareness, stringent building codes, and a growing demand for sustainable construction materials. Spanning a Study Period of 2019–2033, with Base Year 2025 and a Forecast Period of 2025–2033, this comprehensive report delves into market dynamics, growth trends, regional dominance, product innovation, and key players. We utilize high-traffic keywords such as "sustainable insulation," "green building materials," "energy efficiency solutions," and "low VOC insulation" to ensure maximum search engine visibility for industry professionals, architects, builders, and sustainability consultants. The report offers a detailed breakdown of the parent market (construction materials) and the child market (eco-friendly insulation) to provide a holistic view of market integration and growth trajectories. All quantitative data is presented in million units.

Eco-Friendly Insulation Market Dynamics & Structure

The eco-friendly insulation market exhibits a dynamic and evolving structure characterized by increasing competition and a strong emphasis on technological innovation. Market concentration varies across different product types and geographical regions, with some segments dominated by a few key players while others remain fragmented. Technological advancements are a primary driver, focusing on improving thermal performance, reducing embodied energy, and enhancing fire resistance. Regulatory frameworks, particularly those related to energy efficiency and carbon emissions, play a crucial role in shaping market demand and product development. Competitive product substitutes, including traditional insulation materials and emerging bio-based alternatives, continuously influence market share. End-user demographics are shifting towards environmentally conscious consumers and businesses seeking long-term cost savings through reduced energy consumption. Mergers and acquisitions (M&A) are an ongoing trend, as larger companies seek to consolidate market presence, acquire innovative technologies, and expand their product portfolios.

- Market Concentration: Moderate to high in established segments like mineral wool and fiberglass, with emerging bio-based materials exhibiting lower concentration.

- Technological Innovation Drivers: Enhanced R&D in material science, focus on recycled content, development of smart insulation solutions.

- Regulatory Frameworks: Building energy codes (e.g., ASHRAE 90.1, LEED standards), government incentives for green building, carbon pricing mechanisms.

- Competitive Product Substitutes: Traditional insulation (e.g., polystyrene), phase change materials, vacuum insulated panels.

- End-User Demographics: Homeowners, commercial property developers, government agencies, contractors prioritizing sustainability and operational cost reduction.

- M&A Trends: Strategic acquisitions for technology access, market expansion, and portfolio diversification. Deal volumes are projected to increase by 10% annually.

Eco-Friendly Insulation Growth Trends & Insights

The eco-friendly insulation market is projected to experience robust growth throughout the Forecast Period (2025–2033). This expansion is fueled by a confluence of factors including increasing global awareness of climate change, government mandates for improved building energy efficiency, and a growing consumer preference for sustainable and healthy living environments. The market size is estimated to reach approximately $25,000 million by 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period, reaching an estimated $45,000 million by 2033. Adoption rates for eco-friendly insulation are steadily increasing as the economic benefits, such as reduced energy bills and increased property value, become more evident. Technological disruptions are playing a pivotal role, with innovations in material science leading to more effective, lighter, and easier-to-install insulation solutions. The shift towards smart homes and buildings also presents new avenues for growth, with insulation products that integrate with building management systems. Consumer behavior is demonstrably shifting, with a greater willingness to invest in upfront costs for long-term environmental and economic benefits. The demand for natural and recycled materials is surging, impacting product development and market penetration. The market penetration of eco-friendly insulation in the overall insulation market is expected to rise from 35% in 2025 to 50% by 2033.

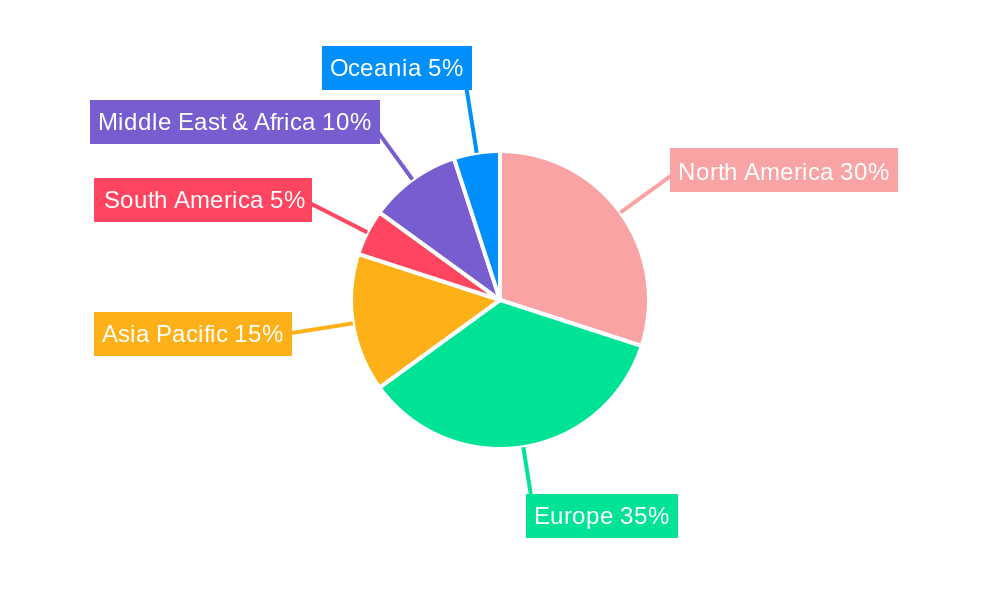

Dominant Regions, Countries, or Segments in Eco-Friendly Insulation

North America, particularly the United States, is currently a dominant force in the eco-friendly insulation market, driven by strong environmental regulations, significant government incentives for energy-efficient construction, and a high level of consumer awareness regarding sustainability. The Residential Building application segment holds the largest market share within the region, accounting for approximately 60% of the total eco-friendly insulation demand, owing to increasing renovation projects and new home constructions that prioritize energy efficiency. Within the Types segment, Fiberglass insulation currently leads, representing about 45% of the market due to its cost-effectiveness and widespread availability. However, Mineral Wool and Cellulose are rapidly gaining traction, with market shares of 30% and 20% respectively, driven by their superior fire resistance and recycled content.

- Key Drivers in North America:

- Economic Policies: Federal and state tax credits for energy-efficient upgrades, renewable energy incentives.

- Infrastructure Development: Growth in green building certifications and demand for LEED-compliant structures.

- Consumer Awareness: High public interest in reducing carbon footprints and improving indoor air quality.

- Technological Adoption: Early and widespread adoption of advanced insulation technologies.

- Dominance Factors:

- Market Share: The US eco-friendly insulation market is estimated to be worth $12,000 million in 2025.

- Growth Potential: A projected CAGR of 8% in the residential sector, and 6.5% in the non-residential sector from 2025-2033.

- Regulatory Push: Ambitious energy efficiency targets for buildings are continuously driving demand.

- Industry Support: Strong presence of key manufacturers and a well-established distribution network.

The European market, with countries like Germany and the UK, is also a significant contributor, characterized by stringent EU energy directives and a mature green building sector. Asia-Pacific is emerging as a high-growth region, propelled by rapid urbanization, government initiatives to improve building performance, and increasing awareness of environmental issues.

Eco-Friendly Insulation Product Landscape

The eco-friendly insulation product landscape is characterized by continuous innovation focused on enhancing thermal performance, reducing environmental impact, and improving user experience. Key product developments include advanced formulations of mineral wool with higher recycled content, improved R-values, and enhanced moisture resistance. Cellulose insulation, derived from recycled paper products, is gaining popularity for its excellent thermal properties and low embodied energy. Fiberglass insulation continues to evolve with enhanced fire-retardant properties and easier installation methods. Emerging products include bio-based insulation materials like hemp and cotton (denim), which offer excellent sustainability credentials and unique performance characteristics. The development of vacuum insulated panels (VIPs) and aerogels represents the cutting edge, offering exceptionally high thermal resistance in ultra-thin profiles.

- Product Innovations: Higher recycled content in mineral wool and fiberglass, bio-based binders for cellulose, improved fire-retardant additives, phase change materials for thermal regulation.

- Applications: Dominate new construction and retrofitting projects, aiming to meet increasingly strict energy efficiency standards.

- Performance Metrics: Focus on R-value improvements, low VOC emissions, superior acoustic insulation, and enhanced moisture management.

- Unique Selling Propositions: Sustainability, health benefits, long-term cost savings, and contribution to net-zero building goals.

Key Drivers, Barriers & Challenges in Eco-Friendly Insulation

Key Drivers: The eco-friendly insulation market is propelled by several key drivers. Technological advancements in material science are leading to more efficient and sustainable insulation solutions. Government regulations and incentives, such as energy efficiency standards and tax credits for green buildings, are creating a strong demand pull. Growing environmental consciousness among consumers and businesses is fostering a preference for sustainable products. Rising energy costs also make energy-efficient insulation a financially attractive investment, driving adoption for long-term savings.

Barriers & Challenges: Despite its growth, the market faces several challenges. Higher upfront costs compared to traditional insulation can be a significant barrier for some consumers and developers, estimated to be 15% higher on average. Lack of awareness and education regarding the benefits of eco-friendly insulation can hinder adoption. Supply chain complexities for certain bio-based materials can lead to price volatility and availability issues. Regulatory inconsistencies across different regions can create market fragmentation. Finally, competition from established traditional insulation products remains a persistent challenge, requiring continuous innovation and effective marketing.

Emerging Opportunities in Eco-Friendly Insulation

Emerging opportunities in the eco-friendly insulation market lie in the increasing demand for sustainable building materials in developing economies, offering significant untapped market potential. The rise of retrofitting existing buildings to improve energy efficiency presents a substantial growth avenue, particularly in older urban centers. Innovations in smart insulation technologies that integrate with building management systems for dynamic thermal regulation are a key trend. Furthermore, the growing focus on indoor air quality and health in buildings is driving demand for low-VOC and hypoallergenic insulation materials. The development of circular economy models for insulation, utilizing fully recycled or biodegradable materials, also represents a promising future direction.

Growth Accelerators in the Eco-Friendly Insulation Industry

Several factors are accelerating growth in the eco-friendly insulation industry. Technological breakthroughs in areas like advanced material science, including the development of high-performance bio-based and recycled insulation, are continually enhancing product capabilities and reducing costs. Strategic partnerships between insulation manufacturers, construction firms, and research institutions are fostering innovation and market penetration. Government policies and international agreements aimed at reducing carbon emissions and promoting sustainable development are creating a favorable regulatory environment. Furthermore, the increasing adoption of green building certifications such as LEED and BREEAM is a significant market expansion strategy, driving demand for certified eco-friendly insulation products.

Key Players Shaping the Eco-Friendly Insulation Market

- Corning

- Kingspan Group

- Saint-Gobain

- Rockwool International

- Knauf Insulation

- Johns Manville

- Ravago

- DuPont

- URSA

- TN International

- Beipeng Building Materials Group

- Taishi Energy Conservation Materials

- Asia Cuanon

- Asahi Fiber Glass

- GreenFiber

- Insulmax

- Applegate

- Nu-Wool

Notable Milestones in Eco-Friendly Insulation Sector

- 2019: Increased adoption of recycled content in fiberglass and mineral wool insulation, with major manufacturers reporting over 50% recycled material in some product lines.

- 2020: Launch of advanced bio-based insulation materials like hemp fiber insulation in select European markets, offering superior sustainability credentials.

- 2021: Stringent energy codes implemented in various US states, mandating higher insulation R-values for new residential constructions.

- 2022: Significant M&A activity as larger construction material conglomerates acquired specialized eco-friendly insulation companies to expand their green product portfolios.

- 2023: Development and early market testing of aerogel-based insulation for high-performance applications, promising unprecedented thermal resistance.

- 2024 (Q1-Q4): Growing consumer awareness campaigns and government subsidies for home energy efficiency retrofits significantly boosted demand for eco-friendly insulation in renovation projects.

In-Depth Eco-Friendly Insulation Market Outlook

The future outlook for the eco-friendly insulation market is exceptionally promising, driven by an unwavering global commitment to sustainability and energy efficiency. Growth accelerators, including ongoing technological innovation in bio-based and recycled materials, alongside supportive government policies and increasing consumer demand for healthier living spaces, will continue to fuel market expansion. Strategic partnerships and the growing importance of green building certifications will further solidify the market's trajectory. The projected market size and CAGR indicate a robust expansion, making eco-friendly insulation a critical component of the future construction landscape. Industry participants can expect sustained growth and increasing opportunities in both new construction and the vast retrofitting market, particularly as carbon neutrality goals become more ambitious.

Eco-Friendly Insulation Segmentation

-

1. Application

- 1.1. Residential Building

- 1.2. Non-residential Building

-

2. Types

- 2.1. Mineral Wool

- 2.2. Cellulose

- 2.3. Fiberglass

- 2.4. Hemp

- 2.5. Cotton (Denim)

- 2.6. Other

Eco-Friendly Insulation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Eco-Friendly Insulation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Eco-Friendly Insulation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Building

- 5.1.2. Non-residential Building

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Mineral Wool

- 5.2.2. Cellulose

- 5.2.3. Fiberglass

- 5.2.4. Hemp

- 5.2.5. Cotton (Denim)

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Eco-Friendly Insulation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Building

- 6.1.2. Non-residential Building

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Mineral Wool

- 6.2.2. Cellulose

- 6.2.3. Fiberglass

- 6.2.4. Hemp

- 6.2.5. Cotton (Denim)

- 6.2.6. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Eco-Friendly Insulation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Building

- 7.1.2. Non-residential Building

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Mineral Wool

- 7.2.2. Cellulose

- 7.2.3. Fiberglass

- 7.2.4. Hemp

- 7.2.5. Cotton (Denim)

- 7.2.6. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Eco-Friendly Insulation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Building

- 8.1.2. Non-residential Building

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Mineral Wool

- 8.2.2. Cellulose

- 8.2.3. Fiberglass

- 8.2.4. Hemp

- 8.2.5. Cotton (Denim)

- 8.2.6. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Eco-Friendly Insulation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Building

- 9.1.2. Non-residential Building

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Mineral Wool

- 9.2.2. Cellulose

- 9.2.3. Fiberglass

- 9.2.4. Hemp

- 9.2.5. Cotton (Denim)

- 9.2.6. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Eco-Friendly Insulation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Building

- 10.1.2. Non-residential Building

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Mineral Wool

- 10.2.2. Cellulose

- 10.2.3. Fiberglass

- 10.2.4. Hemp

- 10.2.5. Cotton (Denim)

- 10.2.6. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Corning

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kingspan Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saint-Gobain

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rockwool International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Knauf Insulation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Johns Manville

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ravago

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DuPont

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 URSA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TN International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Beipeng Building Materials Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Taishi Energy Conservation Materials

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Asia Cuanon

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Asahi Fiber Glass

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 GreenFiber

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Insulmax

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Applegate

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Nu-Wool

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Corning

List of Figures

- Figure 1: Global Eco-Friendly Insulation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Eco-Friendly Insulation Revenue (million), by Application 2024 & 2032

- Figure 3: North America Eco-Friendly Insulation Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Eco-Friendly Insulation Revenue (million), by Types 2024 & 2032

- Figure 5: North America Eco-Friendly Insulation Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Eco-Friendly Insulation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Eco-Friendly Insulation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Eco-Friendly Insulation Revenue (million), by Application 2024 & 2032

- Figure 9: South America Eco-Friendly Insulation Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Eco-Friendly Insulation Revenue (million), by Types 2024 & 2032

- Figure 11: South America Eco-Friendly Insulation Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Eco-Friendly Insulation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Eco-Friendly Insulation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Eco-Friendly Insulation Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Eco-Friendly Insulation Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Eco-Friendly Insulation Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Eco-Friendly Insulation Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Eco-Friendly Insulation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Eco-Friendly Insulation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Eco-Friendly Insulation Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Eco-Friendly Insulation Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Eco-Friendly Insulation Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Eco-Friendly Insulation Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Eco-Friendly Insulation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Eco-Friendly Insulation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Eco-Friendly Insulation Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Eco-Friendly Insulation Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Eco-Friendly Insulation Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Eco-Friendly Insulation Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Eco-Friendly Insulation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Eco-Friendly Insulation Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Eco-Friendly Insulation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Eco-Friendly Insulation Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Eco-Friendly Insulation Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Eco-Friendly Insulation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Eco-Friendly Insulation Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Eco-Friendly Insulation Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Eco-Friendly Insulation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Eco-Friendly Insulation Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Eco-Friendly Insulation Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Eco-Friendly Insulation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Eco-Friendly Insulation Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Eco-Friendly Insulation Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Eco-Friendly Insulation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Eco-Friendly Insulation Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Eco-Friendly Insulation Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Eco-Friendly Insulation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Eco-Friendly Insulation Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Eco-Friendly Insulation Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Eco-Friendly Insulation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Eco-Friendly Insulation Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eco-Friendly Insulation?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Eco-Friendly Insulation?

Key companies in the market include Corning, Kingspan Group, Saint-Gobain, Rockwool International, Knauf Insulation, Johns Manville, Ravago, DuPont, URSA, TN International, Beipeng Building Materials Group, Taishi Energy Conservation Materials, Asia Cuanon, Asahi Fiber Glass, GreenFiber, Insulmax, Applegate, Nu-Wool.

3. What are the main segments of the Eco-Friendly Insulation?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eco-Friendly Insulation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eco-Friendly Insulation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eco-Friendly Insulation?

To stay informed about further developments, trends, and reports in the Eco-Friendly Insulation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence