Key Insights

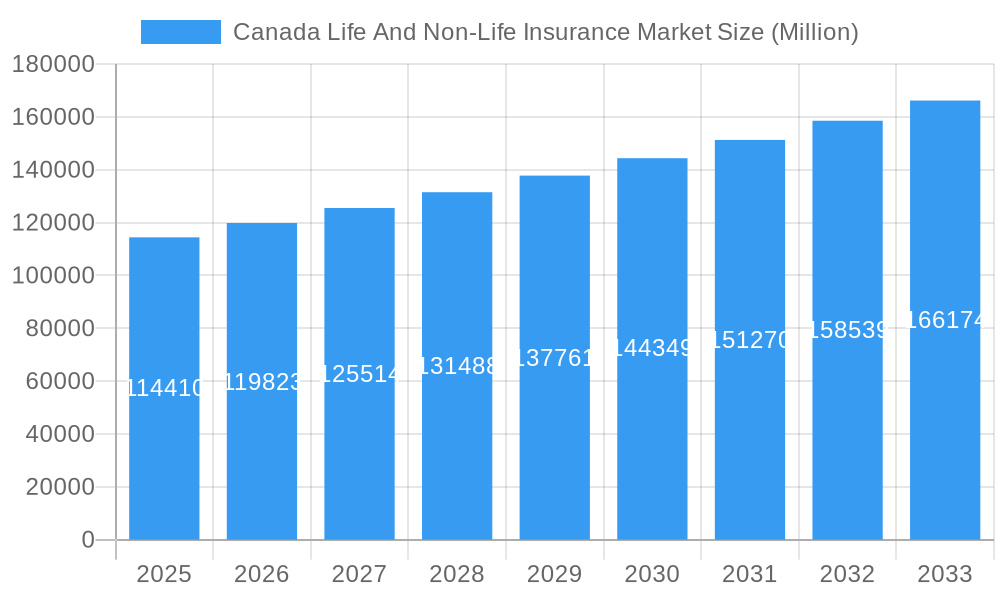

The Canadian life and non-life insurance market, valued at $114.41 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.67% from 2025 to 2033. This growth is fueled by several key factors. An aging population necessitates increased demand for life insurance products, particularly long-term care and annuity solutions. Furthermore, rising awareness of financial security and protection against unforeseen events drives demand for both life and non-life insurance policies. The increasing adoption of digital technologies, including online insurance platforms and automated underwriting processes, enhances accessibility and efficiency within the sector. Government regulations aimed at ensuring consumer protection and market stability also play a crucial role in shaping market dynamics. Competitive intensity among established players like Intact Financial Corporation, Manulife, Sun Life Financial, and Great-West Lifeco, along with the presence of regional insurers, fosters innovation and pricing strategies. However, challenges such as fluctuating interest rates and the increasing complexity of insurance products may influence market growth trajectory.

Canada Life And Non-Life Insurance Market Market Size (In Billion)

The forecast period (2025-2033) anticipates consistent growth driven by continued demographic shifts and evolving consumer preferences. The market segmentation (data not provided) will likely influence the growth trajectory within specific product categories, such as individual life insurance, group life insurance, property insurance, auto insurance, and others. The presence of a diversified landscape of companies suggests a healthy level of competition and potential for consolidation or strategic partnerships in the coming years. Analysis of regional data (not provided) would provide a more nuanced understanding of growth patterns across Canada. To better project future market values, granular data on specific product segments and their respective growth rates would be beneficial.

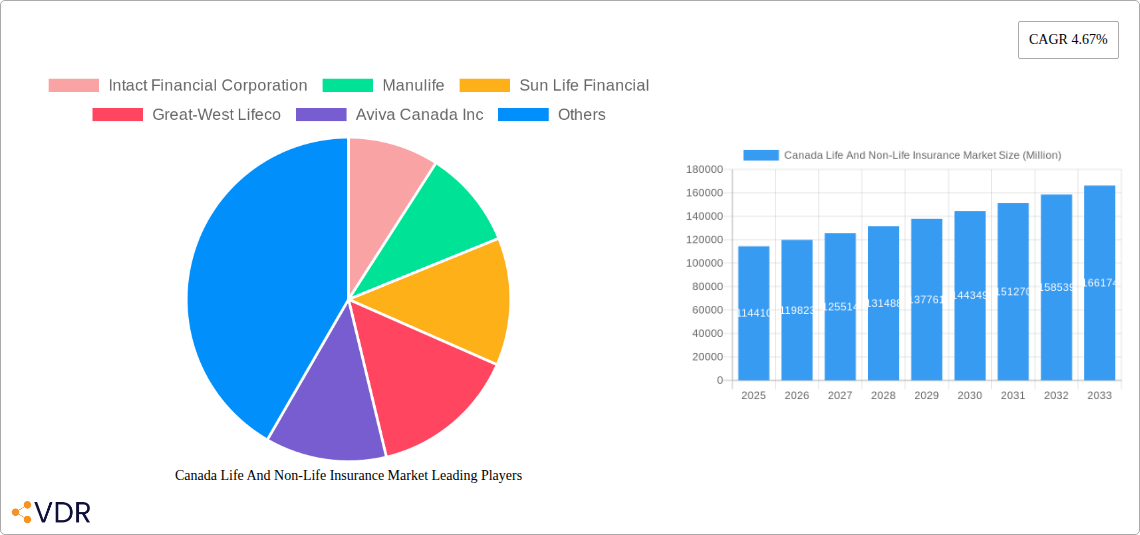

Canada Life And Non-Life Insurance Market Company Market Share

Canada Life and Non-Life Insurance Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canadian life and non-life insurance market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast extending to 2033. This report is crucial for insurance professionals, investors, and anyone seeking to understand the complexities and future of this vital sector. Market values are presented in millions of units.

Canada Life And Non-Life Insurance Market Dynamics & Structure

This section analyzes the Canadian life and non-life insurance market's competitive landscape, regulatory environment, and technological influences. The market is characterized by a relatively concentrated structure, with a few dominant players controlling a significant share. However, smaller insurers and brokers play important roles in specific niches.

Market Concentration: Intact Financial Corporation, Manulife, Sun Life Financial, and Great-West Lifeco dominate the market, holding a combined xx% market share in 2024. The remaining share is distributed among numerous regional and niche players like Aviva Canada Inc, Co-Operators Group Limited, Canada Life Assurance Company, Northbridge Financial Corporation, RBC Insurance Holdings Inc, and Industrial Alliance Insurance. Further analysis reveals a moderate level of market concentration in the parent market and a more fragmented landscape in specific child markets like commercial lines and specialized insurance products.

Technological Innovation: Insurtech is significantly impacting the industry, driving efficiency and enhancing customer experience through digital platforms, AI-powered underwriting, and personalized products. However, barriers to entry, such as regulatory hurdles and data security concerns, moderate the speed of innovation.

Regulatory Framework: The Office of the Superintendent of Financial Institutions (OSFI) plays a critical role in regulating the industry, ensuring solvency and consumer protection. Regulatory changes and compliance requirements pose both challenges and opportunities for market players.

Competitive Product Substitutes: The increasing availability of alternative financial products and investment options presents competition for life and non-life insurance products. These alternatives offer certain advantages regarding flexibility and accessibility.

End-User Demographics: Canada's aging population and growing awareness of risk management are key drivers for life insurance demand. In the non-life segment, shifts in urban development, climate change patterns, and evolving consumer risk perceptions influence demand.

M&A Trends: The insurance sector has witnessed a notable increase in mergers and acquisitions (M&A) activity in recent years, exemplified by recent deals such as Westland's acquisition of Gateway Insurance and StoneRidge's acquisition of Safeway Insurance. These M&A activities reflect industry consolidation and expansion strategies. An estimated xx M&A deals occurred in the period 2019-2024, with an average deal value of xx million.

Canada Life And Non-Life Insurance Market Growth Trends & Insights

The Canadian life and non-life insurance market is expected to exhibit steady growth over the forecast period (2025-2033). The market size, which stood at xx million in 2024, is projected to reach xx million by 2033, representing a CAGR of xx%. This growth is driven by several factors, including increasing disposable incomes, rising awareness of insurance products, and the impact of technological advancements. Market penetration in certain segments, particularly in areas with lower insurance awareness, offers opportunities for future growth. Technological disruptions, specifically the rising adoption of digital platforms and the integration of artificial intelligence, are transforming the industry's operations and customer interactions. Changing consumer preferences, particularly toward greater personalization and seamless digital experiences, necessitate adaptations in product offerings and customer service strategies. The growth pattern also reflects the macroeconomic conditions, population growth rates, and regulatory reforms affecting the insurance sector during the historical and forecast periods.

Dominant Regions, Countries, or Segments in Canada Life And Non-Life Insurance Market

Ontario and Quebec represent the largest segments of the Canadian life and non-life insurance market, accounting for xx% and xx% of the total market value in 2024, respectively. This dominance stems from higher population density, greater economic activity, and a more developed insurance market infrastructure. The growth in these regions is anticipated to be moderately higher than the national average over the coming years. However, the Western provinces, driven by economic growth and increasing population, are also showing a potential for accelerated expansion.

Key Drivers in Ontario and Quebec:

- High population density and strong economic activity.

- Well-established insurance infrastructure and distribution networks.

- Increased awareness of insurance products and risk management practices.

- Favorable government policies and regulations.

Growth Potential in Western Provinces:

- Increasing population and economic expansion.

- Opportunities for market penetration in underinsured segments.

- Investment in new infrastructure and technological advancements.

The market segments showing strong growth include commercial lines and specialized insurance products, reflecting economic activity and changing consumer risk profiles.

Canada Life And Non-Life Insurance Market Product Landscape

The Canadian insurance market offers a diverse range of products, including traditional life insurance (term, whole, universal), health insurance, auto insurance, home insurance, and commercial lines. Recent years have witnessed the introduction of innovative products, leveraging technology to offer customized coverage, bundled packages, and improved customer service. For example, some insurers now offer telematics-based auto insurance, rewarding safe driving behavior with lower premiums. Furthermore, the integration of AI and machine learning is enhancing risk assessment and fraud detection, improving the efficiency and accuracy of underwriting processes.

Key Drivers, Barriers & Challenges in Canada Life And Non-Life Insurance Market

Key Drivers: Increased awareness of risk management, an aging population driving demand for life insurance, and economic growth fueling demand for various insurance products are key drivers. Furthermore, technological advancements are enhancing operational efficiencies and improving customer experiences.

Key Challenges: Intense competition among established players and new entrants, fluctuating interest rates impacting investment returns, and evolving regulatory landscapes pose significant challenges. Supply chain disruptions, particularly in the claims processing arena, can also impact efficiency and customer satisfaction. Additionally, the need for robust cybersecurity measures in the face of evolving cyber threats represents a considerable challenge to insurers. The increasing frequency and severity of climate-related events like severe weather are also pushing up claims costs.

Emerging Opportunities in Canada Life And Non-Life Insurance Market

Untapped markets in rural and underserved communities, particularly among specific demographic segments, present significant opportunities. The development of innovative products addressing specific consumer needs, including personalized coverage based on lifestyle data and bundled insurance solutions, offers further expansion potential. Increased utilization of telematics and data analytics to offer tailored premiums and enhance customer engagement is another expanding area.

Growth Accelerators in the Canada Life And Non-Life Insurance Market Industry

Technological advancements, strategic partnerships, and international collaborations are major growth accelerators. Insurtech solutions are driving efficiency gains and product innovation, while strategic alliances are broadening market reach and product offerings. Government support for the insurance sector can further spur growth.

Key Players Shaping the Canada Life And Non-Life Insurance Market Market

- Intact Financial Corporation

- Manulife

- Sun Life Financial

- Great-West Lifeco

- Aviva Canada Inc

- Co-Operators Group Limited

- Canada Life Assurance Company

- Northbridge Financial Corporation

- RBC Insurance Holdings Inc

- Industrial Alliance Insurance

Notable Milestones in Canada Life And Non-Life Insurance Market Sector

- January 2024: Manulife and Aeroplan launch a multi-year agreement incentivizing healthy lifestyles for Manulife Group Benefits members. This initiative enhances customer engagement and positions Manulife as a leader in health and wellness.

- December 2023: Westland Insurance's acquisition of Gateway Insurance Group, Hutcheson, Reynolds, and Caswell Insurance expands its P&C operations, significantly increasing its presence in Ontario and Atlantic Canada. This consolidates market share in key geographic areas.

- November 2022: StoneRidge Insurance Brokers acquire Safeway Insurance, broadening their product portfolio and customer base significantly. This move increases competition in the market and expands consumer choices.

In-Depth Canada Life And Non-Life Insurance Market Market Outlook

The Canadian life and non-life insurance market is poised for continued growth, driven by technological innovations, strategic partnerships, and evolving consumer preferences. Opportunities exist in untapped markets, product diversification, and improved customer experiences. The market is expected to witness increased consolidation through M&A activity, shaping a more concentrated yet dynamic landscape. The long-term outlook remains positive, with significant potential for growth and innovation.

Canada Life And Non-Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Rest of Non-life Insurances

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Canada Life And Non-Life Insurance Market Segmentation By Geography

- 1. Canada

Canada Life And Non-Life Insurance Market Regional Market Share

Geographic Coverage of Canada Life And Non-Life Insurance Market

Canada Life And Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mandatory Insurance Requirements for Automobiles and Certain Life Insurance Policies; Increased Consumer Spending Capacity and Willingness to Invest in Insurance Products

- 3.3. Market Restrains

- 3.3.1. Mandatory Insurance Requirements for Automobiles and Certain Life Insurance Policies; Increased Consumer Spending Capacity and Willingness to Invest in Insurance Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand Motor Insurance Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Life And Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Rest of Non-life Insurances

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intact Financial Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Manulife

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sun Life Financial

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Great-West Lifeco

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aviva Canada Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Co-Operators Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canada Life Assurance Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northbridge Financial Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 RBC Insurance Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Industrial Alliance Insurance**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intact Financial Corporation

List of Figures

- Figure 1: Canada Life And Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Life And Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Life And Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Canada Life And Non-Life Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Canada Life And Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Canada Life And Non-Life Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Canada Life And Non-Life Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Canada Life And Non-Life Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Canada Life And Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: Canada Life And Non-Life Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 9: Canada Life And Non-Life Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Canada Life And Non-Life Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Canada Life And Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Canada Life And Non-Life Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Life And Non-Life Insurance Market?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the Canada Life And Non-Life Insurance Market?

Key companies in the market include Intact Financial Corporation, Manulife, Sun Life Financial, Great-West Lifeco, Aviva Canada Inc, Co-Operators Group Limited, Canada Life Assurance Company, Northbridge Financial Corporation, RBC Insurance Holdings Inc, Industrial Alliance Insurance**List Not Exhaustive.

3. What are the main segments of the Canada Life And Non-Life Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 114.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Mandatory Insurance Requirements for Automobiles and Certain Life Insurance Policies; Increased Consumer Spending Capacity and Willingness to Invest in Insurance Products.

6. What are the notable trends driving market growth?

Increasing Demand Motor Insurance Driving the Market.

7. Are there any restraints impacting market growth?

Mandatory Insurance Requirements for Automobiles and Certain Life Insurance Policies; Increased Consumer Spending Capacity and Willingness to Invest in Insurance Products.

8. Can you provide examples of recent developments in the market?

January 2024: Manulife and Aeroplan, an Air Canada-owned loyalty program, launched a new multi-year agreement that will allow Manulife Group Benefits members to accrue Aeroplan points for participating in activities and behaviors that promote health and well-being.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Life And Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Life And Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Life And Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Canada Life And Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence