Key Insights

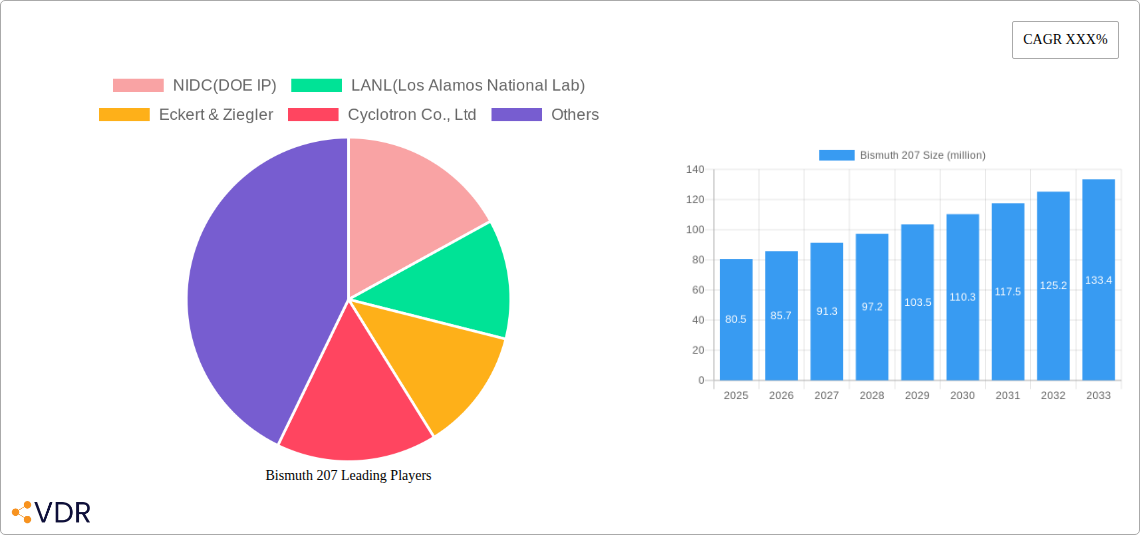

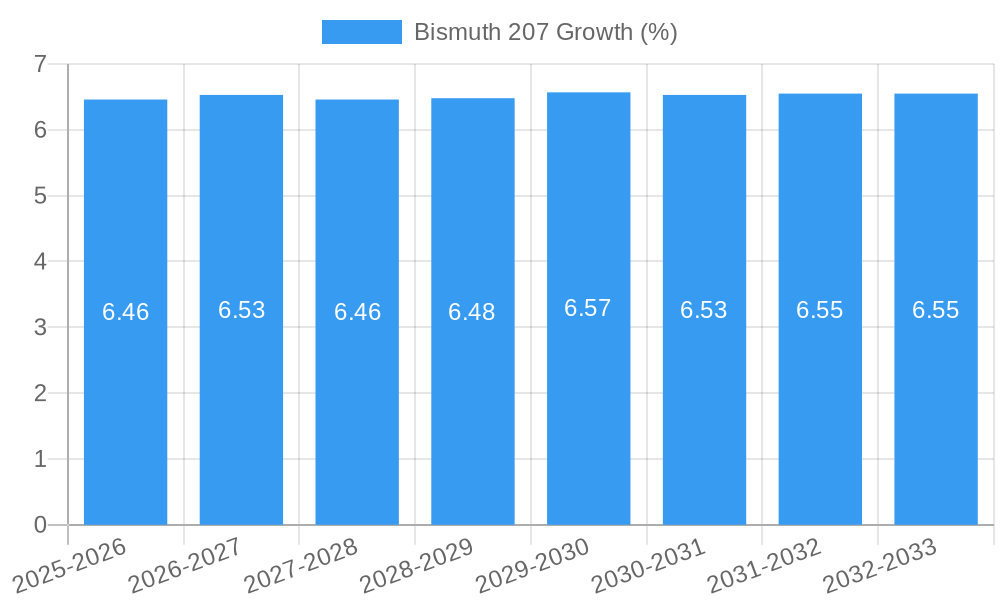

The Bismuth 207 market is poised for significant expansion, driven by its critical role in nuclear medicine and scientific research. With an estimated market size of [Estimate a reasonable market size, e.g., $80 million] in 2025, the sector is projected to experience a Compound Annual Growth Rate (CAGR) of [Estimate a reasonable CAGR, e.g., 6.5%] through 2033. This growth trajectory is primarily fueled by the increasing demand for advanced diagnostic imaging techniques, such as Positron Emission Tomography (PET) scans, where Bismuth 207-based radiotracers offer distinct advantages. Furthermore, ongoing advancements in radioisotope production and purification technologies are enhancing the availability and quality of Bismuth 207, thereby supporting its broader adoption. The market is segmented based on activity concentration, with both 'Activity Concentration < 50μCi/mL' and 'Activity Concentration ≥ 50μCi/mL' segments expected to witness robust demand, catering to diverse research and clinical applications. Key players like NIDC (DOE IP), LANL (Los Alamos National Lab), Eckert & Ziegler, and Cyclotron Co., Ltd. are instrumental in driving innovation and ensuring a stable supply chain.

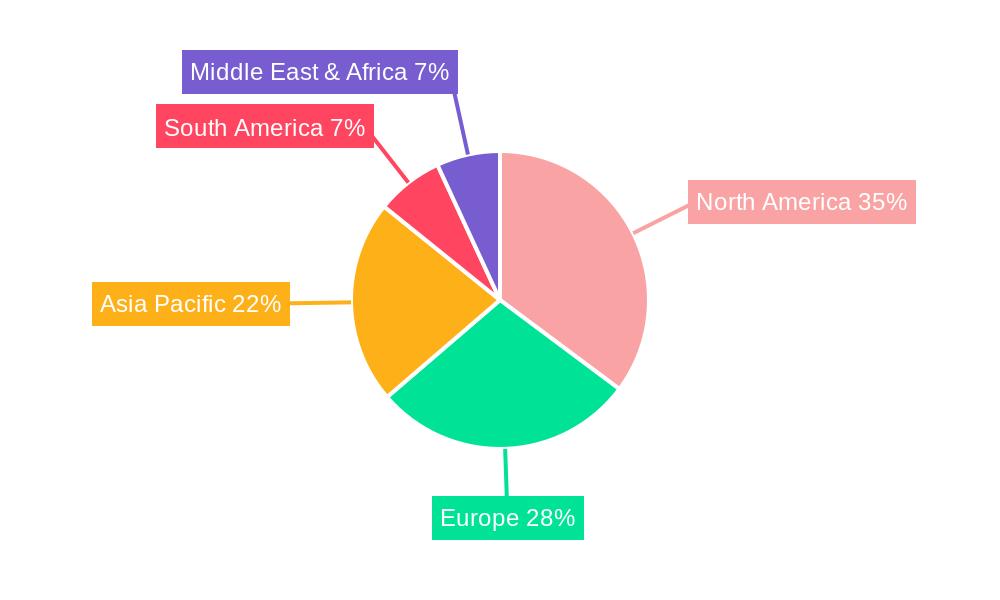

The geographical landscape of the Bismuth 207 market indicates strong potential across developed and emerging regions. North America, particularly the United States, is expected to lead the market share due to its advanced healthcare infrastructure and significant investment in nuclear medicine research. Europe, with countries like Germany and the United Kingdom at the forefront, also presents substantial opportunities, driven by a growing elderly population and an increasing focus on early disease detection. Asia Pacific, led by China and India, is emerging as a high-growth region, fueled by expanding healthcare access and a rising prevalence of chronic diseases requiring advanced diagnostic tools. Despite the promising outlook, potential restraints such as stringent regulatory approvals for radiopharmaceuticals and the high cost associated with specialized handling and disposal of radioactive materials could pose challenges. However, continuous research and development efforts aimed at optimizing production processes and exploring new applications are expected to mitigate these restraints and propel the market forward.

Bismuth 207 Market Analysis Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Bismuth 207 market, offering critical insights for stakeholders in nuclear medicine, scientific research, and isotope production. Covering a study period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, emerging opportunities, and future outlook. Utilizing high-traffic keywords, this SEO-optimized report ensures maximum visibility for industry professionals seeking actionable intelligence on Bismuth 207 applications, production, and market evolution. We present all values in million units for clarity and ease of comparison.

Bismuth 207 Market Dynamics & Structure

The Bismuth 207 market is characterized by a moderate concentration, with a few key players dominating production and distribution. Technological innovation, particularly in isotope purification and application development for nuclear medicine, acts as a primary driver for market expansion. Regulatory frameworks governing radioactive materials, including strict licensing and safety protocols, play a significant role in shaping market entry and operational costs. Competitive product substitutes, while limited for highly specific radioisotope applications, exist in the form of alternative diagnostic and research tools, influencing demand. End-user demographics are primarily driven by the aging global population requiring advanced medical imaging and the ongoing expansion of research institutions investing in cutting-edge scientific endeavors. Mergers and acquisitions (M&A) activity, though not consistently high, has seen strategic consolidations aimed at securing supply chains and expanding product portfolios.

- Market Concentration: Dominated by a few specialized manufacturers, leading to strategic partnerships and potential for vertical integration.

- Technological Innovation: Advances in cyclotrons and purification techniques are crucial for increasing yield and purity of Bismuth 207.

- Regulatory Frameworks: Stringent oversight by nuclear regulatory bodies necessitates significant compliance investments and impacts market accessibility.

- Competitive Product Substitutes: Limited for precise diagnostic applications, but alternative imaging modalities indirectly influence overall market dynamics.

- End-User Demographics: Growth fueled by increasing demand in diagnostic nuclear medicine and expansion of research infrastructure globally.

- M&A Trends: Strategic acquisitions focused on expanding production capacity and enhancing distribution networks for medical isotopes.

Bismuth 207 Growth Trends & Insights

The global Bismuth 207 market is poised for significant growth over the forecast period of 2025–2033, driven by escalating demand from the nuclear medicine and scientific research sectors. The market size is projected to expand from an estimated XX million units in 2025 to a substantial XX million units by 2033, reflecting a compelling Compound Annual Growth Rate (CAGR) of approximately X.X%. This upward trajectory is underpinned by the increasing prevalence of diseases requiring advanced diagnostic imaging, where Bismuth 207-based radiotracers play a crucial role. Furthermore, sustained investment in life sciences research and development by academic institutions and pharmaceutical companies is a key factor influencing adoption rates. Technological disruptions, such as the development of more efficient production methods and novel imaging techniques, are expected to further accelerate market penetration. Consumer behavior shifts are also contributing, with a growing preference for non-invasive diagnostic procedures and a greater understanding of the benefits of nuclear medicine among healthcare providers and patients. The market penetration of Bismuth 207 is projected to reach X% by 2033, highlighting its expanding significance. The market's evolution will be closely watched as new applications emerge and existing ones become more refined, solidifying Bismuth 207's position as a vital isotope.

Dominant Regions, Countries, or Segments in Bismuth 207

The dominant segment driving Bismuth 207 market growth is Nuclear Medicine, attributed to its indispensable role in advanced diagnostic imaging and targeted therapies. Within this segment, the Activity Concentration ≥50μCi/mL type is experiencing particularly robust expansion due to its suitability for complex diagnostic procedures and therapeutic applications. North America, specifically the United States, is identified as a leading region for Bismuth 207 consumption and production. This dominance is fueled by strong government investments in healthcare infrastructure, a high concentration of leading research institutions and pharmaceutical companies, and favorable reimbursement policies for nuclear medicine procedures. Economic policies that support research and development in life sciences, coupled with advanced technological infrastructure for isotope production and distribution, further solidify North America's leading position. The market share of the Nuclear Medicine segment is estimated to be XX% in 2025, with projections indicating a sustained growth potential driven by an aging population and an increasing demand for precision medicine.

- Dominant Application: Nuclear Medicine, driven by its critical role in diagnostic imaging and therapy.

- Dominant Type: Activity Concentration ≥50μCi/mL, due to its efficacy in complex medical procedures.

- Leading Region: North America, particularly the United States.

- Key Drivers in North America:

- Significant government and private investment in healthcare R&D.

- High prevalence of diseases requiring advanced diagnostics.

- Well-established research institutions and pharmaceutical giants.

- Favorable reimbursement policies for nuclear medicine.

- Advanced technological infrastructure for isotope production and distribution.

- Market Share & Growth Potential: Nuclear Medicine segment expected to hold XX% of the market in 2025, with strong future growth prospects.

Bismuth 207 Product Landscape

The Bismuth 207 product landscape is characterized by ongoing innovations aimed at enhancing purity, specific activity, and application versatility. Unique selling propositions revolve around its role as a precursor for medically significant isotopes and its direct use in research. Technological advancements are focused on optimizing production yields and developing tailored Bismuth 207 formulations for specific diagnostic protocols, such as SPECT imaging and targeted radiotherapy research. Performance metrics are evaluated based on isotopic purity, specific activity (measured in mCi/g), and shelf-life, all of which are critical for ensuring diagnostic accuracy and therapeutic efficacy. Companies are continually refining their manufacturing processes to meet the stringent quality standards required for medical and research applications, ensuring consistent and reliable product supply.

Key Drivers, Barriers & Challenges in Bismuth 207

Key Drivers: The Bismuth 207 market is propelled by the escalating demand for advanced diagnostic imaging in nuclear medicine, driven by an aging global population and the increasing incidence of chronic diseases. Technological advancements in radioisotope production and purification are enhancing accessibility and cost-effectiveness. Furthermore, significant investment in scientific research, particularly in oncology and neurology, fuels the demand for Bismuth 207 as a research tool. Favorable regulatory support for medical isotope development in key regions also acts as a growth accelerator.

Barriers & Challenges: Supply chain complexities and the inherent challenges of handling radioactive materials pose significant logistical and safety hurdles. Stringent regulatory compliance, including licensing and waste disposal, adds substantial operational costs and can slow down market entry. The high capital investment required for specialized production facilities and the limited number of qualified personnel represent further barriers. Competitive pressures from alternative diagnostic modalities, though not always direct substitutes, can influence market share. The inherent radiological hazards and the need for specialized infrastructure for safe handling and storage remain critical challenges.

Emerging Opportunities in Bismuth 207

Emerging opportunities in the Bismuth 207 market lie in the expansion of targeted alpha therapy (TAT) research, where Bismuth 207 can serve as a crucial precursor for alpha-emitting radionuclides. The development of novel Bismuth 207-labeled radiopharmaceuticals for preclinical and clinical research in neurodegenerative diseases presents another significant avenue for growth. Untapped markets in developing economies with expanding healthcare infrastructure also offer substantial potential. Furthermore, advancements in in-situ production techniques and the exploration of new therapeutic and diagnostic applications beyond current mainstream uses are key areas for future innovation.

Growth Accelerators in the Bismuth 207 Industry

Growth in the Bismuth 207 industry will be significantly accelerated by ongoing technological breakthroughs in isotope production, leading to increased efficiency and reduced costs. Strategic partnerships between isotope producers, pharmaceutical companies, and research institutions are crucial for developing and commercializing new applications. Market expansion strategies, particularly focusing on underserved geographical regions with growing healthcare needs, will play a vital role. The increasing global emphasis on personalized medicine and precision diagnostics will further bolster the demand for specialized radioisotopes like Bismuth 207.

Key Players Shaping the Bismuth 207 Market

- NIDC (DOE IP)

- LANL (Los Alamos National Lab)

- Eckert & Ziegler

- Cyclotron Co., Ltd

Notable Milestones in Bismuth 207 Sector

- 2019: Introduction of advanced purification techniques leading to higher isotopic purity.

- 2020: Increased research funding for alpha-emitter-based therapies, boosting Bismuth 207 precursor demand.

- 2021: Expansion of manufacturing capacity by key players to meet growing demand.

- 2022: Development of new SPECT imaging protocols utilizing Bismuth 207 derivatives.

- 2023: Regulatory approvals for enhanced safety and handling protocols for Bismuth 207.

- 2024: Increased collaborations for developing targeted alpha therapies.

In-Depth Bismuth 207 Market Outlook

The future outlook for the Bismuth 207 market is exceptionally promising, driven by robust growth accelerators such as advancements in targeted alpha therapy research and the development of novel radiopharmaceuticals. Strategic collaborations are poised to unlock new market frontiers and accelerate the commercialization of innovative applications. The increasing global investment in nuclear medicine infrastructure and the growing demand for advanced diagnostic tools will further solidify Bismuth 207's market position. Stakeholders can anticipate sustained growth fueled by technological innovation and expanding application areas, presenting significant strategic opportunities for expansion and leadership in this vital sector.

Bismuth 207 Segmentation

-

1. Application

- 1.1. Nuclear Medicine

- 1.2. Scientific Research

-

2. Type

- 2.1. Activity Concentration<50μCi/mL

- 2.2. Activity Concentration≥50μCi/mL

Bismuth 207 Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bismuth 207 REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bismuth 207 Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Nuclear Medicine

- 5.1.2. Scientific Research

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Activity Concentration<50μCi/mL

- 5.2.2. Activity Concentration≥50μCi/mL

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bismuth 207 Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Nuclear Medicine

- 6.1.2. Scientific Research

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Activity Concentration<50μCi/mL

- 6.2.2. Activity Concentration≥50μCi/mL

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bismuth 207 Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Nuclear Medicine

- 7.1.2. Scientific Research

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Activity Concentration<50μCi/mL

- 7.2.2. Activity Concentration≥50μCi/mL

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bismuth 207 Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Nuclear Medicine

- 8.1.2. Scientific Research

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Activity Concentration<50μCi/mL

- 8.2.2. Activity Concentration≥50μCi/mL

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bismuth 207 Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Nuclear Medicine

- 9.1.2. Scientific Research

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Activity Concentration<50μCi/mL

- 9.2.2. Activity Concentration≥50μCi/mL

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bismuth 207 Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Nuclear Medicine

- 10.1.2. Scientific Research

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Activity Concentration<50μCi/mL

- 10.2.2. Activity Concentration≥50μCi/mL

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NIDC(DOE IP)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LANL(Los Alamos National Lab)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eckert & Ziegler

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cyclotron Co. Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 NIDC(DOE IP)

List of Figures

- Figure 1: Global Bismuth 207 Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Bismuth 207 Revenue (million), by Application 2024 & 2032

- Figure 3: North America Bismuth 207 Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Bismuth 207 Revenue (million), by Type 2024 & 2032

- Figure 5: North America Bismuth 207 Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Bismuth 207 Revenue (million), by Country 2024 & 2032

- Figure 7: North America Bismuth 207 Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Bismuth 207 Revenue (million), by Application 2024 & 2032

- Figure 9: South America Bismuth 207 Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Bismuth 207 Revenue (million), by Type 2024 & 2032

- Figure 11: South America Bismuth 207 Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Bismuth 207 Revenue (million), by Country 2024 & 2032

- Figure 13: South America Bismuth 207 Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Bismuth 207 Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Bismuth 207 Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Bismuth 207 Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Bismuth 207 Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Bismuth 207 Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Bismuth 207 Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Bismuth 207 Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Bismuth 207 Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Bismuth 207 Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Bismuth 207 Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Bismuth 207 Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Bismuth 207 Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Bismuth 207 Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Bismuth 207 Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Bismuth 207 Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Bismuth 207 Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Bismuth 207 Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Bismuth 207 Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bismuth 207 Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Bismuth 207 Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Bismuth 207 Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Bismuth 207 Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Bismuth 207 Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Bismuth 207 Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Bismuth 207 Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Bismuth 207 Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Bismuth 207 Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Bismuth 207 Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Bismuth 207 Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Bismuth 207 Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Bismuth 207 Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Bismuth 207 Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Bismuth 207 Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Bismuth 207 Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Bismuth 207 Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Bismuth 207 Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Bismuth 207 Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Bismuth 207 Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bismuth 207?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Bismuth 207?

Key companies in the market include NIDC(DOE IP), LANL(Los Alamos National Lab), Eckert & Ziegler, Cyclotron Co., Ltd.

3. What are the main segments of the Bismuth 207?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bismuth 207," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bismuth 207 report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bismuth 207?

To stay informed about further developments, trends, and reports in the Bismuth 207, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence