Key Insights

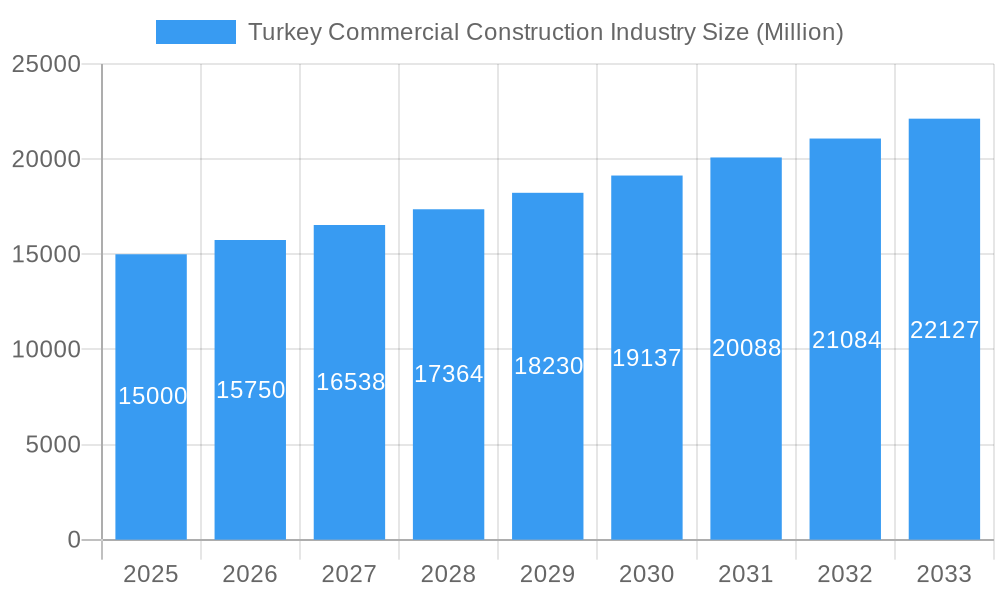

Turkey's commercial construction sector is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 3%. The market size was valued at $1488065 million in the base year 2025 and is expected to grow substantially through 2033. This robust growth is propelled by key factors including substantial investments in hospitality infrastructure driven by Turkey's thriving tourism industry, and increased demand for modern office spaces due to a growing urban population. Government-led infrastructure development and urban renewal initiatives further bolster market expansion. While economic volatility and material cost fluctuations present challenges, the sustained investment from major construction firms like Rönesans Holding, ENKA İnsaat, and Yapı Merkezi Holding ensures a positive long-term outlook. The industry's segmentation across Office Building, Retail, Hospitality, Institutional, and Other construction types underscores its dynamic nature and diverse growth drivers.

Turkey Commercial Construction Industry Market Size (In Million)

The market's substantial value in 2025, estimated at $1488065 million, reflects the combined contributions of its diverse segments. Strategic investments by leading companies, coupled with Turkey's economic growth, support a sustained positive market trajectory. Future research focusing on specific regional dynamics within Turkey could uncover additional growth opportunities, complementing the current focus on national-level data.

Turkey Commercial Construction Industry Company Market Share

Turkey Commercial Construction Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report delivers an in-depth analysis of the Turkey Commercial Construction Industry, encompassing market dynamics, growth trends, key players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report provides valuable insights for industry professionals, investors, and policymakers seeking to navigate this dynamic market. Market values are presented in million units.

Turkey Commercial Construction Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory factors shaping the Turkish commercial construction market. The market is characterized by a mix of large conglomerates and smaller specialized firms, resulting in a moderately concentrated market structure. While precise market share data for individual players remains proprietary, key players such as Rönesans Holding, Albayrak Group, and ENKA İnsaat hold significant influence.

- Market Concentration: Moderately concentrated, with a few major players dominating certain segments. Market share data will be detailed in the full report.

- Technological Innovation: Adoption of Building Information Modeling (BIM), prefabrication, and sustainable construction practices are gradually increasing but face challenges due to initial investment costs and a skills gap.

- Regulatory Framework: Government regulations concerning building codes, permits, and environmental standards significantly impact project timelines and costs. Recent amendments focusing on sustainability and earthquake resistance are driving innovation.

- Competitive Product Substitutes: Limited direct substitutes exist, though the market faces indirect competition from alternative real estate asset classes (e.g., industrial spaces).

- End-User Demographics: Demand is driven by a growing population, urbanization, and increasing commercial activity, particularly in major cities like Istanbul and Ankara.

- M&A Trends: The frequency of mergers and acquisitions in this sector is moderate, with strategic partnerships playing a crucial role in accessing new technologies and expanding market reach. The full report details specific M&A activities and quantifies the deal volume.

Turkey Commercial Construction Industry Growth Trends & Insights

The Turkish commercial construction market experienced fluctuating growth during the historical period (2019-2024) due to macroeconomic factors and global events. However, a positive growth trajectory is projected for the forecast period (2025-2033), driven by government infrastructure investments and sustained demand from various sectors. The full report leverages proprietary data and sophisticated forecasting models (XXX) to project a Compound Annual Growth Rate (CAGR) and market penetration rate. Technological disruptions, such as the adoption of BIM and sustainable building technologies, are expected to reshape the industry landscape, with market adoption rates to be presented. Consumer behavior shifts, including a growing preference for green buildings and technologically advanced spaces, will influence construction trends.

Dominant Regions, Countries, or Segments in Turkey Commercial Construction Industry

Istanbul and Ankara remain the dominant regions due to high population density, economic activity, and substantial infrastructure projects. While data regarding precise segmental contribution remains proprietary, the hospitality and institutional segments are anticipated to witness robust growth, driven by increased tourism and government spending on healthcare and education infrastructure.

- Key Drivers:

- Strong government investment in infrastructure projects.

- Growing tourism sector fueling hospitality construction.

- Increased government spending in healthcare and education.

- Rapid urbanization and population growth.

- Dominance Factors: High concentration of commercial activity, robust local government support, and strategic location. The full report details market share and growth potential for each segment and region.

Turkey Commercial Construction Industry Product Landscape

The product landscape is characterized by a diverse range of buildings, encompassing office buildings, retail spaces, hotels, hospitals, and educational institutions. Innovative building materials, construction techniques, and sustainable designs are increasingly being adopted to enhance energy efficiency and reduce environmental impact. The market is witnessing the incorporation of smart building technologies, enhancing functionality and operational efficiency. Unique selling propositions (USPs) include environmentally conscious construction and integration of smart building technologies.

Key Drivers, Barriers & Challenges in Turkey Commercial Construction Industry

Key Drivers:

- Government investments in large-scale infrastructure projects.

- Rising tourism and increased demand for hospitality infrastructure.

- Growing urbanization and the need for more commercial spaces.

Challenges & Restraints:

- Fluctuations in the Turkish Lira, impacting import costs and project budgets.

- Supply chain disruptions and material price volatility.

- Regulatory hurdles and bureaucratic delays.

- Competition from established and new players.

Emerging Opportunities in Turkey Commercial Construction Industry

- Growing demand for sustainable and green buildings.

- Expansion of smart city initiatives creating opportunities in technology-integrated buildings.

- Increased focus on resilient infrastructure to withstand natural disasters.

Growth Accelerators in the Turkey Commercial Construction Industry Industry

Technological advancements, especially in sustainable materials and prefabrication, alongside government support for green initiatives, are key growth catalysts. Strategic partnerships between domestic and international firms are driving innovation and expanding access to finance, facilitating the development of large-scale projects.

Key Players Shaping the Turkey Commercial Construction Industry Market

- Rönesans Holding

- Albayrak Group

- Yapı Merkezi Holding

- Sinpas GYO İstanbul Sarayları

- ENKA İnsaat ve Sanayi A S

- YDA Group

- Umut Construction Tourism Industry ve Tic Inc

- Yenigün Construction

- GAP Insaat

- Zorlu Group

Notable Milestones in Turkey Commercial Construction Industry Sector

- December 2022: EBRD provides a USD 79.5 million loan to Rönesans Holding for hospital infrastructure investment. This signifies increased foreign investment in the healthcare construction segment.

- August 2022: Commencement of a new stadium construction in Ankara, a USD 0.24 billion project funded by public funds. This underscores government commitment to infrastructure development.

- June 13, 2022: A consortium of Yıldızlar Grup and ASL İnşaat secured the Ankara stadium contract, highlighting the collaborative approach in major infrastructure projects.

In-Depth Turkey Commercial Construction Industry Market Outlook

The Turkish commercial construction market is poised for sustained growth, driven by a confluence of factors including increasing urbanization, government investment in infrastructure, and a growing tourism sector. Strategic opportunities lie in sustainable construction practices, adoption of smart building technologies, and public-private partnerships that will further accelerate market expansion in the coming years. The full report will provide detailed forecasts, identifying areas of highest growth potential and strategic guidance for players seeking to capitalize on this dynamic market.

Turkey Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Others

Turkey Commercial Construction Industry Segmentation By Geography

- 1. Turkey

Turkey Commercial Construction Industry Regional Market Share

Geographic Coverage of Turkey Commercial Construction Industry

Turkey Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Office Space Demand Fuelling the Market Growth of Commercial Construction; Growing Retail Sector to Support the Market Development in the Turkey

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labour in the Construction Industry; Complex architectural designs or unique project requirements can pose restraints.

- 3.4. Market Trends

- 3.4.1. Office Space Demand Fuelling the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Commercial Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rönesans Holding

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Albayrak Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yapı Merkezi Holding

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinpas GYO İstanbul Sarayları**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENKA İnsaat ve Sanayi A S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 YDA Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Umut Construction Tourism Industry ve Tic Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yenigün Construction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GAP Insaat

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zorlu Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rönesans Holding

List of Figures

- Figure 1: Turkey Commercial Construction Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Turkey Commercial Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Turkey Commercial Construction Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Turkey Commercial Construction Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Turkey Commercial Construction Industry Revenue million Forecast, by Type 2020 & 2033

- Table 4: Turkey Commercial Construction Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Commercial Construction Industry?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Turkey Commercial Construction Industry?

Key companies in the market include Rönesans Holding, Albayrak Group, Yapı Merkezi Holding, Sinpas GYO İstanbul Sarayları**List Not Exhaustive, ENKA İnsaat ve Sanayi A S, YDA Group, Umut Construction Tourism Industry ve Tic Inc, Yenigün Construction, GAP Insaat, Zorlu Group.

3. What are the main segments of the Turkey Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1488065 million as of 2022.

5. What are some drivers contributing to market growth?

Office Space Demand Fuelling the Market Growth of Commercial Construction; Growing Retail Sector to Support the Market Development in the Turkey.

6. What are the notable trends driving market growth?

Office Space Demand Fuelling the Market Growth.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labour in the Construction Industry; Complex architectural designs or unique project requirements can pose restraints..

8. Can you provide examples of recent developments in the market?

December 2022: The European Bank for Reconstruction and Development (EBRD) will provide a long-term convertible loan of EUR 75 million (USD 79.5 million) to a subsidiary of Turkey's Ronesans Holding for hospital infrastructure investment. Ronesans Saglik Yatirim, the unit of the conglomerate that runs hospitals, will undertake to complete the newly acquired hospital project in their portfolio. Rönesans currently has five operational hospital projects in progress, with a combined construction area of 3.2 million m2 and a total capacity of 7,100 beds. Once all of these projects have been completed, Rönesans will reach a total capacity of 9,000 beds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Turkey Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence