Key Insights

The China luxury residential real estate market, valued at $146.25 billion in 2025, is projected to experience robust growth, fueled by a compound annual growth rate (CAGR) of 6.28% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a burgeoning high-net-worth individual (HNWI) population in major Chinese cities like Beijing, Shanghai, and Shenzhen, coupled with increasing disposable incomes and a preference for opulent lifestyles, significantly boosts demand for luxury properties. Secondly, the ongoing urbanization trend continues to reshape China's landscape, attracting both domestic and international investors to prime locations offering exclusive amenities and prestige. Finally, government initiatives focused on sustainable urban development and improved infrastructure in key cities further contribute to the attractiveness of the luxury residential sector. Competition within the market is intense, with prominent players like Evergrande, R&F Properties, and China Vanke vying for market share. While the segment comprising villas and landed houses currently dominates, apartments and condominiums in strategic locations are also witnessing strong demand, representing a significant growth opportunity.

China Luxury Residential Real Estate Market Market Size (In Billion)

However, the market faces certain challenges. Fluctuations in the national economy and stringent government regulations aimed at curbing speculative investment in real estate can impact growth trajectory. Moreover, the rising cost of construction materials and land acquisition presents an ongoing constraint. Furthermore, preferences for luxury amenities and features are constantly evolving, requiring developers to adapt to shifting consumer tastes. Despite these hurdles, the long-term outlook for the China luxury residential market remains positive, particularly considering the continued growth of China's economy and the increasing affluence of its population. The market is poised for continued expansion, albeit at a potentially moderated pace influenced by economic conditions and government policies. Strategic location, innovative designs, and sustainable development practices will be crucial for success in this competitive landscape.

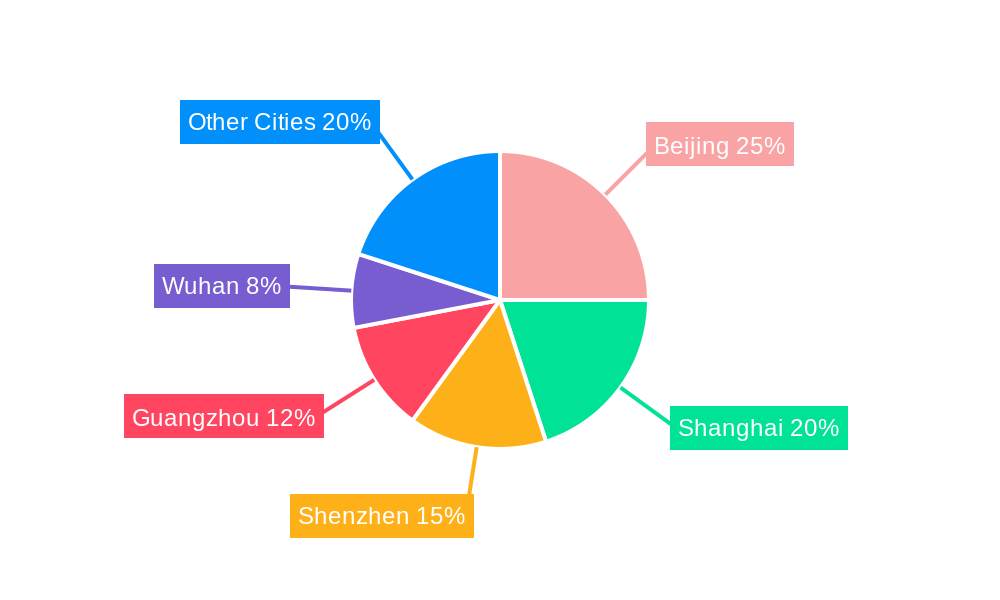

China Luxury Residential Real Estate Market Company Market Share

China Luxury Residential Real Estate Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China luxury residential real estate market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for investors, developers, and industry professionals seeking to navigate this dynamic and lucrative market segment.

Keywords: China luxury real estate, luxury residential market China, high-end residential properties China, China real estate market analysis, luxury villas China, luxury apartments China, Beijing luxury real estate, Shanghai luxury property, Shenzhen luxury homes, Guangzhou luxury condos, Chinese luxury property market trends, real estate investment China, China property market forecast.

China Luxury Residential Real Estate Market Dynamics & Structure

The China luxury residential real estate market is characterized by high concentration among a few major players, significant technological innovation, a complex regulatory framework, and increasing competition from alternative investment options. The market is segmented by property type (villas and landed houses; apartments and condominiums) and by city (Beijing, Shanghai, Shenzhen, Guangzhou, Wuhan, and other cities).

Market Concentration: A few large developers, including Evergrande Real Estate Group Limited, R&F Properties, China State Construction Engineering Corporation, Poly Real Estate Group Co, and Longfor Properties Co Ltd, dominate the market, holding xx% of the total market share in 2024. However, smaller boutique developers and international players like Christie's International Real Estate are also increasing their presence.

Technological Innovation: Technological advancements, such as smart home integration, virtual reality property tours, and data-driven marketing, are transforming the luxury segment. However, high implementation costs and a lack of standardized technologies present barriers to widespread adoption.

Regulatory Frameworks: Government regulations, including those related to land use, foreign investment, and environmental protection, significantly influence market dynamics. Recent policy shifts have aimed to curb excessive speculation and promote sustainable development.

Competitive Product Substitutes: High-net-worth individuals have various investment alternatives including art, private equity, and international real estate, thereby increasing competition for luxury residential property.

End-User Demographics: The target demographic consists primarily of high-net-worth individuals, including entrepreneurs, executives, and celebrities. Their preferences are evolving towards sustainable, technologically advanced, and aesthetically unique properties.

M&A Trends: The number of M&A deals in the luxury residential segment fluctuated between xx and xx million deals in the historical period (2019-2024), reflecting market volatility and investor sentiment. Consolidation amongst developers is expected to continue.

China Luxury Residential Real Estate Market Growth Trends & Insights

The China luxury residential real estate market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. Market size reached xx million units in 2024. This growth is primarily fueled by rising disposable incomes among the affluent population, increasing urbanization, and a preference for high-quality living spaces. However, government interventions aimed at curbing property speculation led to market corrections in certain periods.

Technological disruptions, particularly in smart home technology and personalized design, are accelerating market adoption rates. Consumer behavior shifts towards sustainability, wellness-focused design, and unique architectural styles are also shaping the market. The forecast period (2025-2033) projects continued growth, although at a moderated pace, with an expected CAGR of xx%, leading to a market size of xx million units by 2033. This moderation reflects a more stable policy environment and a maturing market.

Dominant Regions, Countries, or Segments in China Luxury Residential Real Estate Market

Tier-1 cities, particularly Beijing, Shanghai, Shenzhen, and Guangzhou, continue to dominate the luxury residential market. These cities boast established infrastructure, strong economic activity, and a high concentration of high-net-worth individuals. However, other cities are experiencing growth as well, particularly those with developing high-speed rail links and improving infrastructure.

Beijing: Strong government presence, large pool of high-income residents, historical significance, and limited land supply contribute to high prices and strong demand.

Shanghai: Known for its international business environment, luxury lifestyle amenities, and iconic architecture, Shanghai remains a prime location for luxury properties.

Shenzhen: Rapid economic growth, thriving tech sector, and modern infrastructure make Shenzhen an attractive destination for the affluent.

Guangzhou: A large population, expanding commercial sector, and relatively more affordable pricing (compared to Beijing and Shanghai) drive the luxury housing market in Guangzhou.

Villas and Landed Houses: This segment consistently commands premium pricing due to scarcity, exclusivity, and prestige associated with detached properties in prime locations.

Apartments and Condominiums: Modern high-rise apartments with premium amenities are becoming increasingly popular in urban centers. The market is driven by convenience, sophisticated building designs and integrated services.

Key growth drivers include government initiatives supporting infrastructure development, favorable economic policies that encourage foreign investment, and improved access to financing for luxury property development. While tier-1 cities maintain market dominance, secondary cities offer promising growth potential due to improving infrastructure and a relatively lower entry cost for developers.

China Luxury Residential Real Estate Market Product Landscape

The luxury residential sector offers a diverse range of products, ranging from traditional high-end villas with extensive gardens to modern, technologically advanced apartments equipped with smart home systems and bespoke design elements. Innovation focuses on enhancing security, sustainability, energy efficiency, and personalization to meet the discerning preferences of high-net-worth individuals. Unique selling propositions include exclusive amenities, personalized services, prime locations, and exceptional craftsmanship.

Key Drivers, Barriers & Challenges in China Luxury Residential Real Estate Market

Key Drivers: Rising disposable incomes amongst the affluent, urbanization, and government investments in infrastructure are major growth drivers. Strong demand from both domestic and international high-net-worth individuals further propels market expansion. Technological advancements contribute to enhanced product offerings and streamlined sales processes.

Key Challenges: Stringent regulatory policies aimed at curbing property speculation, supply chain disruptions, limited land availability in prime urban areas, and competition from alternative investment options pose significant challenges. These can lead to price volatility and reduced investor confidence. The impact of these challenges is estimated to affect the market by xx% in the near future.

Emerging Opportunities in China Luxury Residential Real Estate Market

Emerging opportunities include the growth of secondary luxury markets beyond the Tier-1 cities, increasing demand for sustainable and eco-friendly properties, and the rise of integrated lifestyle developments incorporating luxury residential components alongside wellness facilities, retail spaces, and entertainment options. Furthermore, the integration of technology, such as smart home systems, is shaping future opportunities in the sector.

Growth Accelerators in the China Luxury Residential Real Estate Market Industry

Technological breakthroughs in building materials, design, and smart home integration are key growth accelerators. Strategic partnerships between international and domestic developers are also driving market expansion. The increasing focus on sustainability and wellness-focused design further adds to the growth. Government policies supporting sustainable urban development and foreign investment will continue to play a significant role.

Key Players Shaping the China Luxury Residential Real Estate Market Market

- Evergrande Real Estate Group Limited

- R&F Properties

- China State Construction Engineering Corporation

- Poly Real Estate Group Co

- Longfor Properties Co Ltd

- Christie's International Real Estate

- China Vanke Co

- 4321 Property

- China Merchants Property Development Co Ltd

- LuxuryEstate (List Not Exhaustive)

Notable Milestones in China Luxury Residential Real Estate Market Sector

- November 2022: China’s largest lenders pledged USD 162 billion in credit to property developers, signaling a shift in government policy towards supporting the sector.

- December 2022: A joint venture secured land rights for a high-end residential project in Shanghai’s Yangpu district, indicating continued investment in the luxury segment.

In-Depth China Luxury Residential Real Estate Market Market Outlook

The China luxury residential real estate market is projected to experience steady growth throughout the forecast period (2025-2033), driven by sustained economic growth, increasing urbanization, and evolving consumer preferences. Strategic opportunities lie in developing sustainable, technologically advanced properties in both primary and secondary cities, capitalizing on the growing demand for premium living spaces. Further, focusing on niche segments and personalized services will be vital for success in the increasingly competitive luxury market.

China Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Beijing

- 2.2. Wuhan

- 2.3. Shanghai

- 2.4. Shenzhen

- 2.5. Guangzhou

- 2.6. Other Cities

China Luxury Residential Real Estate Market Segmentation By Geography

- 1. China

China Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of China Luxury Residential Real Estate Market

China Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Higher incomes support4.; Massive industry change

- 3.3. Market Restrains

- 3.3.1. 4.; High imbalance in population versus real estate index

- 3.4. Market Trends

- 3.4.1. Growth of urbanization driving luxury residential real estate market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Beijing

- 5.2.2. Wuhan

- 5.2.3. Shanghai

- 5.2.4. Shenzhen

- 5.2.5. Guangzhou

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Evergrande Real Estate Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 R&F Properties

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China State Construction Engineering Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Poly Real Estate Group Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Longfor Properties Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Christie's International Real Estate

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Vanke Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4321 Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Merchants Property Development Co Ltd**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LuxuryEstate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Evergrande Real Estate Group Limited

List of Figures

- Figure 1: China Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: China Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Luxury Residential Real Estate Market Revenue Million Forecast, by Cities 2020 & 2033

- Table 3: China Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Luxury Residential Real Estate Market Revenue Million Forecast, by Cities 2020 & 2033

- Table 6: China Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Luxury Residential Real Estate Market?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the China Luxury Residential Real Estate Market?

Key companies in the market include Evergrande Real Estate Group Limited, R&F Properties, China State Construction Engineering Corporation, Poly Real Estate Group Co, Longfor Properties Co Ltd, Christie's International Real Estate, China Vanke Co, 4321 Property, China Merchants Property Development Co Ltd**List Not Exhaustive, LuxuryEstate.

3. What are the main segments of the China Luxury Residential Real Estate Market?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.25 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Higher incomes support4.; Massive industry change.

6. What are the notable trends driving market growth?

Growth of urbanization driving luxury residential real estate market.

7. Are there any restraints impacting market growth?

4.; High imbalance in population versus real estate index.

8. Can you provide examples of recent developments in the market?

December 2022: A joint venture led by Shui On Land has won the land-use rights to develop a residential project on a plot in Shanghai’s Yangpu district with a bid of RMB 2.38 billion (USD 340 million). The parties plan to develop the 16,993.8 square metre (182,920 square foot) parcel on Pingliang Street into a heritage preservation project incorporating a high-end, low-density residential community. A wholly owned subsidiary of Shui On holds 60% of the JV, with the remaining 40% held by state-owned developer Shanghai Yangshupu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the China Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence