Key Insights

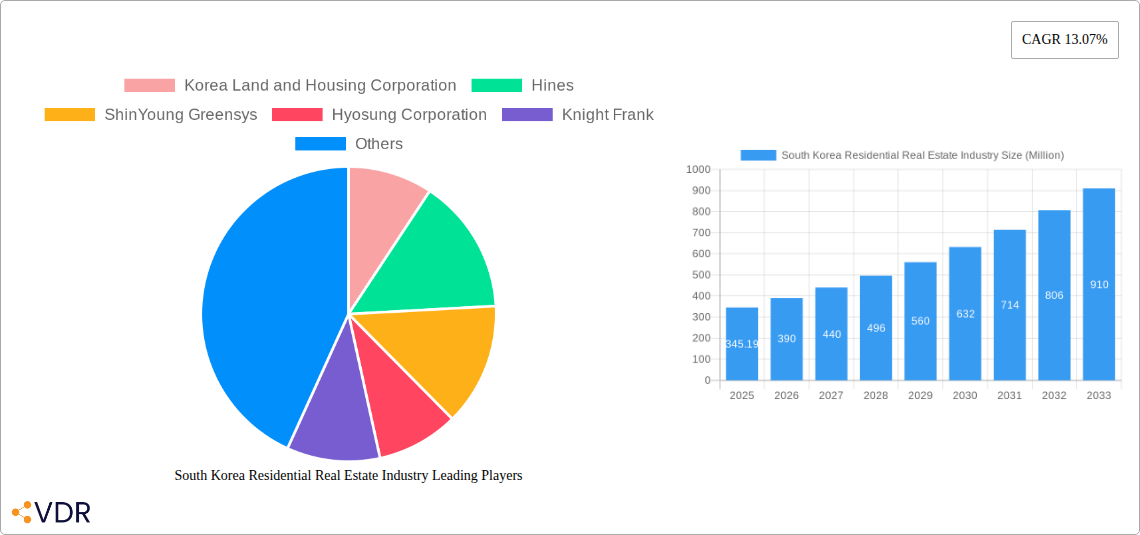

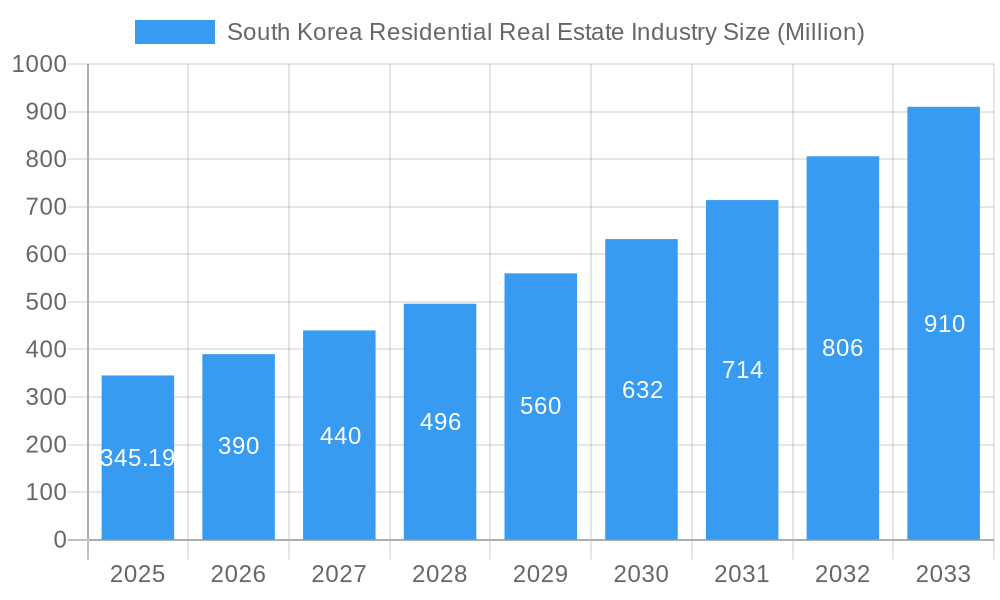

The South Korean residential real estate market, valued at $345.19 million in 2025, is projected to experience robust growth, driven by several key factors. A burgeoning population, particularly in urban centers like Seoul, coupled with rising disposable incomes and a preference for modern, comfortable housing are fueling demand. Government initiatives aimed at stimulating the construction sector and improving housing affordability, while potentially impacting market dynamics, also contribute to the overall growth trajectory. However, challenges persist. Land scarcity in prime locations and stringent building regulations can constrain supply, potentially leading to price fluctuations. Furthermore, fluctuations in interest rates and broader economic conditions could impact buyer sentiment and investment decisions. The market is segmented primarily by property type, with apartments and condominiums currently dominating market share due to their affordability and location accessibility. Landed houses and villas represent a more premium segment, catering to a wealthier demographic with a preference for larger living spaces. Key players include established developers like Korea Land and Housing Corporation, Hines, and Hyundai Development Company, alongside prominent local firms. The competitive landscape is characterized by a mix of large-scale developers and smaller, specialized builders, each targeting specific niches within the market.

South Korea Residential Real Estate Industry Market Size (In Million)

Looking ahead to 2033, the projected Compound Annual Growth Rate (CAGR) of 13.07% suggests substantial expansion. This growth is expected to be relatively consistent throughout the forecast period, although variations may occur based on economic cycles and policy changes. The market's performance will hinge on the delicate balance between meeting the rising demand for housing while mitigating potential constraints on supply. Strategic land use planning, efficient infrastructure development, and innovative construction techniques will be crucial in shaping the future trajectory of the South Korean residential real estate market. Ongoing monitoring of economic indicators and government policies will be essential for accurate forecasting and informed investment decisions.

South Korea Residential Real Estate Industry Company Market Share

South Korea Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the South Korea residential real estate market, covering the period 2019-2033. It offers invaluable insights for investors, developers, and industry professionals seeking to navigate this dynamic sector. The report utilizes a robust methodology incorporating historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. Key segments analyzed include Apartments and Condominiums and Landed Houses and Villas, providing granular data for strategic decision-making.

South Korea Residential Real Estate Industry Market Dynamics & Structure

The South Korean residential real estate market is characterized by a moderate level of market concentration, with a few large players like Korea Land and Housing Corporation, Hines, and Hyundai Development Company holding significant shares, estimated at approximately xx%. Technological innovation, while present, faces barriers such as stringent building codes and a preference for traditional construction methods. However, recent developments like GS E&C's XiGEIST modular housing division are starting to disrupt the status quo. The regulatory framework plays a crucial role, influencing land availability, construction permits, and financing options. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024, totaling xx Million USD. Consumer demographics show a growing demand for sustainable and technologically advanced housing solutions.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Technological Innovation: Slow adoption due to regulatory hurdles and preference for established methods.

- Regulatory Framework: Significant influence on land use, construction, and financing.

- M&A Activity: xx deals between 2019-2024, totaling xx Million USD.

- End-User Demographics: Shifting towards sustainable and technologically integrated housing.

South Korea Residential Real Estate Industry Growth Trends & Insights

The South Korean residential real estate market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by factors such as urbanization and increasing disposable incomes. However, the market faced challenges due to fluctuating interest rates and government policies aimed at curbing speculative investments. The forecast period (2025-2033) projects a more moderate CAGR of xx%, influenced by anticipated economic growth, infrastructural development, and changes in consumer preferences. Technological disruptions, such as modular construction and smart home technologies, are expected to gain momentum, though gradual adoption will be a factor. Consumer behavior is gradually shifting towards energy-efficient and sustainable homes. The total market size is projected to reach xx Million units by 2033.

Dominant Regions, Countries, or Segments in South Korea Residential Real Estate Industry

The Seoul Metropolitan Area remains the dominant region, accounting for xx% of the market share in 2024 due to high population density, robust economic activity, and well-developed infrastructure. Within the segments, Apartments and Condominiums continue to hold the largest market share (xx%), driven by affordability and convenience. Landed Houses and Villas represent a smaller but growing segment (xx%), appealing to high-net-worth individuals.

- Seoul Metropolitan Area Dominance: High population density, strong economy, and established infrastructure.

- Apartments and Condominiums: Largest segment (xx% market share) due to affordability and convenience.

- Landed Houses and Villas: Smaller but growing segment catering to high-net-worth individuals.

- Growth Drivers: Government investments in infrastructure and rising disposable incomes.

South Korea Residential Real Estate Industry Product Landscape

The South Korean residential real estate product landscape is evolving towards energy-efficient, technologically advanced, and environmentally sustainable options. Innovations include smart home technologies, sustainable building materials, and modular construction techniques, promising increased efficiency and reduced environmental impact. Key performance metrics include energy consumption, carbon footprint, and construction timelines.

Key Drivers, Barriers & Challenges in South Korea Residential Real Estate Industry

Key Drivers: Increasing urbanization, rising disposable incomes, government initiatives promoting affordable housing, and technological advancements in construction methods are key drivers.

Challenges: Stringent building regulations, land scarcity, high construction costs, and cyclical economic fluctuations represent significant challenges. Supply chain disruptions, particularly following the pandemic, also contributed to increased construction times and costs, impacting approximately xx% of projects.

Emerging Opportunities in South Korea Residential Real Estate Industry

Emerging opportunities lie in the increasing adoption of sustainable building practices, the integration of smart home technologies, and the growing demand for affordable housing solutions in secondary cities. Further growth opportunities exist in developing niche segments like senior living facilities and eco-friendly housing developments.

Growth Accelerators in the South Korea Residential Real Estate Industry Industry

Strategic partnerships between developers and technology companies, along with investments in sustainable infrastructure, are expected to accelerate market growth. Government support for affordable housing projects and the adoption of innovative construction technologies are also crucial catalysts.

Key Players Shaping the South Korea Residential Real Estate Industry Market

- Korea Land and Housing Corporation

- Hines

- ShinYoung Greensys

- Hyosung Corporation

- Knight Frank

- Booyoung Group

- Dongbu Corporation

- Daelim Corporation

- Hyundai Development Company

Notable Milestones in South Korea Residential Real Estate Industry Sector

- January 2023: Unveiling of Parkside Seoul, a large mixed-use development emphasizing sustainability and community amenities. This project signals a move towards more integrated and amenity-rich residential developments.

- April 2023: Launch of GS E&C's XiGEIST premium modular housing division, promising faster construction times and increased efficiency. This represents a significant technological disruption within the industry.

In-Depth South Korea Residential Real Estate Industry Market Outlook

The South Korea residential real estate market is poised for continued growth, driven by ongoing urbanization, improving living standards, and the adoption of innovative construction technologies. Strategic partnerships and investments in sustainable infrastructure present significant opportunities for both domestic and international players. The market's long-term prospects are positive, although careful consideration of regulatory changes and cyclical economic fluctuations remains essential.

South Korea Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Seoul

- 2.2. Other Locations

South Korea Residential Real Estate Industry Segmentation By Geography

- 1. Seoul

- 2. Other Locations

South Korea Residential Real Estate Industry Regional Market Share

Geographic Coverage of South Korea Residential Real Estate Industry

South Korea Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government's Plans to Supply New Homes

- 3.3. Market Restrains

- 3.3.1. Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Urbanization in the Country is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Seoul

- 5.2.2. Other Locations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Seoul

- 5.3.2. Other Locations

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Seoul South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Seoul

- 6.2.2. Other Locations

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Other Locations South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Seoul

- 7.2.2. Other Locations

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Korea Land and Housing Corporation

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Hines

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 ShinYoung Greensys

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Hyosung Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Knight Frank

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Booyoung Group

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Dongbu Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Daelim Corporation

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Hyundai Development Company

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.1 Korea Land and Housing Corporation

List of Figures

- Figure 1: South Korea Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South Korea Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Residential Real Estate Industry?

The projected CAGR is approximately 13.07%.

2. Which companies are prominent players in the South Korea Residential Real Estate Industry?

Key companies in the market include Korea Land and Housing Corporation, Hines, ShinYoung Greensys, Hyosung Corporation, Knight Frank, Booyoung Group, Dongbu Corporation, Daelim Corporation, Hyundai Development Company.

3. What are the main segments of the South Korea Residential Real Estate Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 345.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Government's Plans to Supply New Homes.

6. What are the notable trends driving market growth?

Urbanization in the Country is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

January 2023: International architecture office KPF has unveiled the design for Parkside Seoul, a new mixed-use neighborhood planned for the South Korean capital to complement the surrounding natural elements and pay homage to Yongsan Park. The 482,600 square meter development is composed of a layered exterior envelope encompassing various programs and public amenities to enhance the residents’ experience of space. Besides the residential units, the complex includes office and retail spaces, hospitality facilities, and public and green spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the South Korea Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence