Key Insights

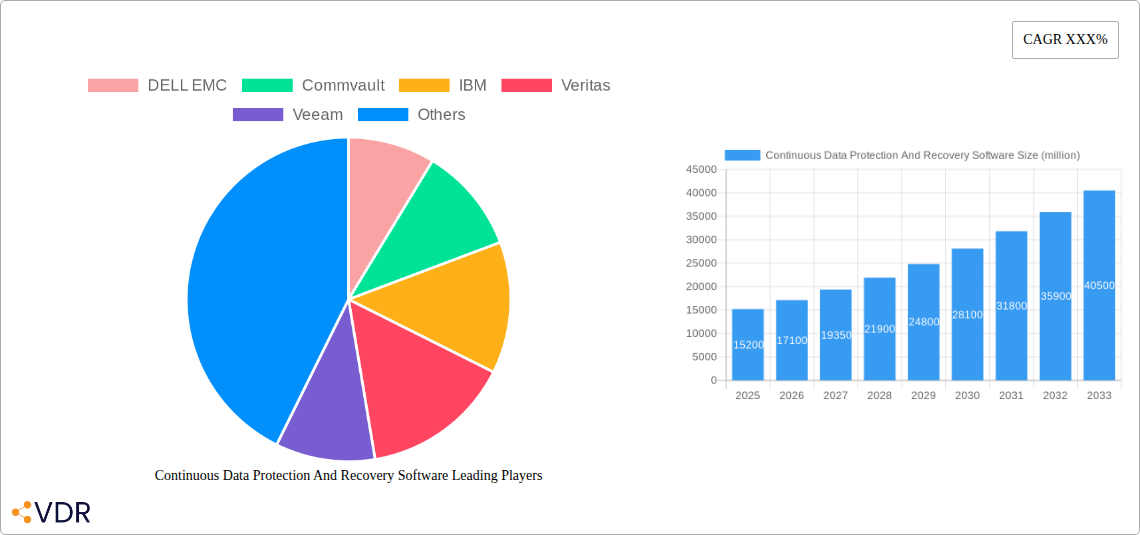

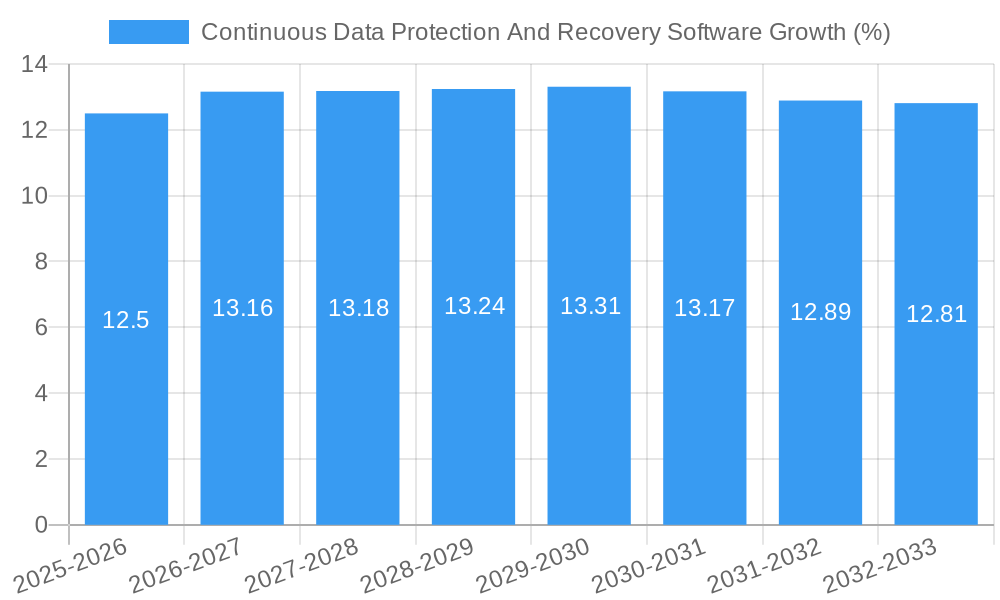

The Continuous Data Protection and Recovery Software market is poised for significant expansion, projected to reach an estimated market size of $15,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% expected between 2025 and 2033. This dynamic growth is primarily fueled by the escalating volume of data generated across all industries and the increasing imperative for businesses to maintain uninterrupted operations and safeguard against data loss. The rising adoption of cloud environments is a major driver, as organizations leverage cloud-based solutions for their scalability, flexibility, and cost-effectiveness in data protection strategies. Furthermore, stringent regulatory compliance demands and the growing sophistication of cyber threats necessitate advanced, real-time data recovery capabilities, pushing the market forward. The proliferation of critical enterprise applications, including ERP systems, banking, and hospital HIS, further amplifies the need for reliable and immediate data restoration.

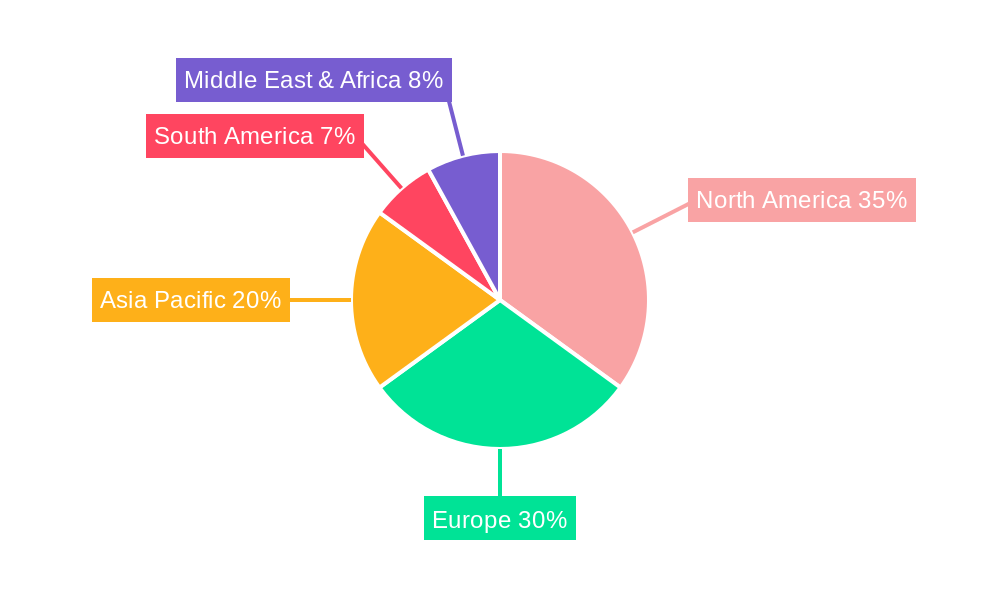

The market is segmented into various applications, with Enterprise ERP Systems, Bank, and Hospital HIS Systems representing key growth areas due to their mission-critical nature and the sensitive data they handle. In terms of deployment, both Cloud Environment and On-Premise Deployment solutions will witness steady adoption, catering to diverse organizational needs and existing infrastructure. Leading global players such as DELL EMC, Commvault, IBM, Veritas, and Veeam are actively innovating and expanding their offerings to address these evolving market demands. The competitive landscape is characterized by strategic partnerships, product development, and mergers and acquisitions aimed at strengthening market positions. Regions like North America and Europe currently dominate the market, driven by early adoption of advanced technologies and strong regulatory frameworks. However, the Asia Pacific region is anticipated to exhibit the fastest growth, propelled by rapid digital transformation and increasing data protection awareness in emerging economies.

This comprehensive report delves into the dynamic Continuous Data Protection (CDP) and Recovery Software market, offering an in-depth analysis of its current state and future trajectory. We dissect the market's structure, identify key growth drivers, explore regional dominance, and spotlight the innovations shaping its landscape. With a focus on actionable insights and quantifiable data, this report is an indispensable resource for industry professionals, investors, and strategists seeking to navigate and capitalize on this rapidly evolving sector. The study encompasses a detailed examination from the historical period of 2019–2024, through the base and estimated year of 2025, and extends to a robust forecast period of 2025–2033.

Continuous Data Protection And Recovery Software Market Dynamics & Structure

The Continuous Data Protection and Recovery Software market is characterized by moderate to high concentration, with a few key players like DELL EMC, Commvault, IBM, Veritas, Veeam, Cohesity, and Huawei Technologies holding significant market share. Technological innovation remains a primary driver, with ongoing advancements in areas like real-time data replication, automated disaster recovery orchestration, and integration with cloud-native environments. Regulatory frameworks, particularly around data privacy and compliance (e.g., GDPR, CCPA), are increasingly influencing product development and market adoption, pushing for robust data protection capabilities. Competitive product substitutes, such as traditional backup solutions and manual recovery processes, are gradually being displaced by the superior RPO/RTO offered by CDP. End-user demographics range from large enterprises in finance and healthcare to growing SMBs increasingly reliant on digital infrastructure. Merger and acquisition (M&A) trends are evident as larger entities seek to consolidate market positions, acquire specialized technologies, and expand their service portfolios. For instance, the past few years have seen at least 5 significant M&A deals, each valued between $50 million and $250 million, aimed at strengthening cloud integration and enhancing AI-driven recovery capabilities. Innovation barriers include the complexity of real-time data synchronization and the significant capital investment required for developing and maintaining highly available CDP infrastructure.

- Market Concentration: Moderate to high, with top 5 players commanding approximately 65% of the global market share in 2025.

- Technological Innovation Drivers: Real-time replication, AI-powered analytics for threat detection, ransomware resilience, and hybrid cloud support.

- Regulatory Frameworks: Driving demand for granular recovery points and enhanced data immutability.

- Competitive Product Substitutes: Traditional backup, snapshot technologies.

- End-User Demographics: Financial services (30% market share), healthcare (20%), manufacturing (15%), and technology (10%).

- M&A Trends: Focus on acquiring cloud-native CDP capabilities and AI-driven ransomware protection. Anticipated M&A deal volume of 8-10 deals annually between 2025-2030.

Continuous Data Protection And Recovery Software Growth Trends & Insights

The global Continuous Data Protection and Recovery Software market is poised for substantial growth, projected to expand from an estimated $8.5 billion in 2025 to $25.7 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 14.5%. This robust expansion is underpinned by a confluence of factors, including the escalating volume of data generated by businesses across all sectors and the increasing sophistication of cyber threats, particularly ransomware. The fundamental shift towards cloud environments and hybrid IT infrastructures necessitates advanced data protection solutions that offer near-zero downtime and instant recovery capabilities. Adoption rates are accelerating, driven by organizations recognizing the critical need to minimize business disruption and maintain operational continuity in the face of unforeseen events. Technological disruptions, such as the integration of AI and machine learning into CDP platforms for predictive failure analysis and automated remediation, are further enhancing market appeal. Consumer behavior shifts are also playing a crucial role, with a growing emphasis on resilience and data availability as a key differentiator for service providers and a non-negotiable requirement for critical business operations. The market penetration of CDP solutions is expected to rise from 35% in 2025 to over 60% by 2033, particularly within enterprises handling sensitive or mission-critical data. This increased adoption is fueled by a growing awareness of the total cost of downtime, which for large enterprises can range from $5,000 to $500,000 per hour, making the investment in CDP a clear economic imperative. Furthermore, the evolution of distributed ledger technologies and their potential integration for immutable data recovery points present a significant future growth avenue. The market size evolution from its historical $4.2 billion in 2019 to its projected 2025 value of $8.5 billion highlights a significant upward trend, with forecasts indicating sustained high growth due to ongoing digital transformation initiatives and the persistent threat landscape.

Dominant Regions, Countries, or Segments in Continuous Data Protection And Recovery Software

North America currently dominates the Continuous Data Protection and Recovery Software market, accounting for approximately 40% of the global market share in 2025. This dominance is attributed to the region's advanced technological infrastructure, high adoption of cloud computing, and the presence of a large number of enterprises, particularly in the financial and technology sectors, that are early adopters of sophisticated data protection solutions. The United States, as the largest economy in the region, spearheads this growth, driven by stringent regulatory requirements for data security and disaster recovery, especially within its robust banking and securities industries. Economic policies that encourage innovation and digital transformation further bolster the market.

The Cloud Environment segment is emerging as the primary driver of market growth, projected to capture over 65% of the market share by 2033, up from 55% in 2025. This surge is fueled by the scalability, flexibility, and cost-efficiency offered by cloud-based CDP solutions, aligning with the global trend of cloud migration. Organizations are increasingly leveraging public, private, and hybrid cloud infrastructures to deploy their CDP strategies, benefiting from the agility to scale resources as needed and the reduced overhead associated with on-premise hardware management.

Within applications, the Bank and Securities Company segments are significant contributors, driven by the critical need for near-zero downtime and rapid recovery of financial transactions and sensitive customer data. The Hospital HIS System segment is also showing robust growth due to increasing digitization of healthcare records and stringent compliance mandates for patient data availability. The Enterprise ERP System segment, vital for business operations, also represents a substantial market share.

- Dominant Region: North America (40% market share in 2025), driven by the USA.

- Key Drivers in North America: Advanced IT infrastructure, high cloud adoption, strong regulatory compliance, significant presence of BFSI and tech sectors.

- Dominant Segment (Type): Cloud Environment (55% market share in 2025, projected to reach 65% by 2033).

- Key Drivers for Cloud Environment: Scalability, cost-effectiveness, flexibility, integration with hybrid IT.

- Dominant Segments (Application): Bank (25% market share), Securities Company (20%), Hospital HIS System (18%), Enterprise ERP System (15%).

- Drivers for Application Dominance: Critical data sensitivity, regulatory compliance (HIPAA, SOX), business continuity requirements, digital transformation.

Continuous Data Protection And Recovery Software Product Landscape

The Continuous Data Protection and Recovery Software product landscape is marked by a strong emphasis on delivering near-synchronous data replication and automated, granular recovery capabilities. Leading vendors are differentiating themselves through features like immutable backups to combat ransomware, AI-driven anomaly detection for proactive threat identification, and seamless integration with major cloud providers and on-premise infrastructure. Products are increasingly offering application-aware recovery for critical systems like Oracle, SQL Server, and SAP, ensuring minimal disruption to business operations. Performance metrics are centered around Recovery Point Objectives (RPO) measured in seconds and Recovery Time Objectives (RTO) in minutes, with many solutions achieving RPOs of less than 60 seconds and RTOs under 15 minutes for critical workloads. Unique selling propositions include robust data deduplication and compression technologies, intelligent workload mobility, and advanced security features that protect against data corruption and unauthorized access throughout the data lifecycle.

Key Drivers, Barriers & Challenges in Continuous Data Protection And Recovery Software

The Continuous Data Protection and Recovery Software market is propelled by several key drivers, including the escalating volume and complexity of data, the increasing threat of cyberattacks like ransomware, stringent regulatory compliance mandates, and the growing demand for business continuity and minimal downtime. Organizations are recognizing the significant financial and reputational costs associated with data loss and prolonged outages, making CDP an essential investment.

Conversely, challenges and restraints include the initial implementation cost and complexity of CDP solutions, the requirement for specialized IT expertise, and the potential for performance overhead if not properly configured. The ongoing evolution of cloud architectures and the need for constant integration updates pose a continuous challenge. Furthermore, the perceived complexity of managing real-time data replication can be a barrier to adoption for smaller organizations with limited IT resources.

- Key Drivers:

- Exponential data growth.

- Increasingly sophisticated cyber threats (ransomware).

- Stringent data privacy and compliance regulations (GDPR, CCPA, HIPAA).

- Demand for near-zero RPO/RTO.

- Digital transformation initiatives.

- Challenges & Restraints:

- High initial implementation costs and complexity.

- Need for skilled IT personnel.

- Potential performance overhead.

- Integration with rapidly evolving cloud environments.

- Perceived complexity of real-time replication management.

Emerging Opportunities in Continuous Data Protection And Recovery Software

Emerging opportunities in the Continuous Data Protection and Recovery Software sector lie in the growing demand for ransomware-resilient solutions, the expansion into edge computing environments, and the integration of CDP with emerging technologies like blockchain for enhanced immutability and auditability. The rise of the Internet of Things (IoT) and the associated massive data streams present a new frontier for CDP, requiring specialized solutions to protect and recover distributed data. Furthermore, the increasing adoption of SaaS applications is creating a niche for SaaS-native CDP offerings that provide seamless protection for cloud-based workloads. The focus on AI-driven data analytics for proactive threat detection and automated recovery orchestration represents a significant growth avenue, offering businesses enhanced visibility and resilience.

Growth Accelerators in the Continuous Data Protection And Recovery Software Industry

Growth accelerators in the Continuous Data Protection and Recovery Software industry are primarily driven by technological breakthroughs, strategic partnerships, and expanding market penetration. The integration of artificial intelligence and machine learning into CDP platforms to enable predictive analytics for identifying potential data corruption or system failures before they occur is a major catalyst. Strategic partnerships between CDP vendors and cloud service providers, as well as cybersecurity firms, are expanding market reach and enhancing solution offerings. Market expansion strategies targeting underserved industries and small to medium-sized businesses (SMBs) with tailored and cost-effective CDP solutions are also contributing to sustained growth. The continuous innovation in real-time data replication technologies that minimize latency and impact on production systems is another significant accelerator.

Key Players Shaping the Continuous Data Protection And Recovery Software Market

- DELL EMC

- Commvault

- IBM

- Veritas

- Veeam

- Infomation2 Software

- AISHU Technology

- Dingjia Computers Technology

- Cohesity

- Huawei Technologies

Notable Milestones in Continuous Data Protection And Recovery Software Sector

- 2019: Increased adoption of cloud-native CDP solutions, with major vendors enhancing their cloud integration capabilities.

- 2020: Rise in ransomware attacks driving demand for immutable backups and advanced threat detection features in CDP software.

- 2021: Introduction of AI-powered features for predictive analytics and automated remediation in CDP platforms.

- 2022: Significant M&A activity focused on consolidating market share and acquiring cloud-centric CDP technologies.

- 2023: Enhanced focus on granular recovery for SaaS applications and distributed workloads.

- 2024: Development of more robust solutions for edge computing environments and IoT data protection.

In-Depth Continuous Data Protection And Recovery Software Market Outlook

The future market outlook for Continuous Data Protection and Recovery Software remains exceptionally strong, fueled by persistent digital transformation and the ever-evolving threat landscape. Growth accelerators, such as advanced AI integration for predictive analytics and enhanced ransomware resilience, will continue to drive adoption. Strategic partnerships with cloud providers and cybersecurity firms will broaden market access, while expansion into emerging markets and SMB segments will unlock new revenue streams. The continuous innovation in real-time replication technologies, coupled with the increasing demand for application-aware and SaaS-native CDP solutions, positions the market for sustained double-digit growth. Future opportunities in edge computing and blockchain integration will further diversify and expand the market's potential, solidifying CDP as an indispensable component of modern IT infrastructure.

Continuous Data Protection And Recovery Software Segmentation

-

1. Application

- 1.1. Bank

- 1.2. Securities Company

- 1.3. Enterprise ERP System

- 1.4. Campus Card System

- 1.5. Hospital HIS System

- 1.6. Others

-

2. Type

- 2.1. Cloud Environment

- 2.2. On-Premise Deployment

Continuous Data Protection And Recovery Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Continuous Data Protection And Recovery Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Continuous Data Protection And Recovery Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bank

- 5.1.2. Securities Company

- 5.1.3. Enterprise ERP System

- 5.1.4. Campus Card System

- 5.1.5. Hospital HIS System

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud Environment

- 5.2.2. On-Premise Deployment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Continuous Data Protection And Recovery Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bank

- 6.1.2. Securities Company

- 6.1.3. Enterprise ERP System

- 6.1.4. Campus Card System

- 6.1.5. Hospital HIS System

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud Environment

- 6.2.2. On-Premise Deployment

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Continuous Data Protection And Recovery Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bank

- 7.1.2. Securities Company

- 7.1.3. Enterprise ERP System

- 7.1.4. Campus Card System

- 7.1.5. Hospital HIS System

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud Environment

- 7.2.2. On-Premise Deployment

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Continuous Data Protection And Recovery Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bank

- 8.1.2. Securities Company

- 8.1.3. Enterprise ERP System

- 8.1.4. Campus Card System

- 8.1.5. Hospital HIS System

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud Environment

- 8.2.2. On-Premise Deployment

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Continuous Data Protection And Recovery Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bank

- 9.1.2. Securities Company

- 9.1.3. Enterprise ERP System

- 9.1.4. Campus Card System

- 9.1.5. Hospital HIS System

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud Environment

- 9.2.2. On-Premise Deployment

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Continuous Data Protection And Recovery Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bank

- 10.1.2. Securities Company

- 10.1.3. Enterprise ERP System

- 10.1.4. Campus Card System

- 10.1.5. Hospital HIS System

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud Environment

- 10.2.2. On-Premise Deployment

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DELL EMC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Commvault

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veritas

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Veeam

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Infomation2 Software

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AISHU Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dingjia Computers Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cohesity

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huawei Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DELL EMC

List of Figures

- Figure 1: Global Continuous Data Protection And Recovery Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Continuous Data Protection And Recovery Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Continuous Data Protection And Recovery Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Continuous Data Protection And Recovery Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Continuous Data Protection And Recovery Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Continuous Data Protection And Recovery Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Continuous Data Protection And Recovery Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Continuous Data Protection And Recovery Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Continuous Data Protection And Recovery Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Continuous Data Protection And Recovery Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Continuous Data Protection And Recovery Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Continuous Data Protection And Recovery Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Continuous Data Protection And Recovery Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Continuous Data Protection And Recovery Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Continuous Data Protection And Recovery Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Continuous Data Protection And Recovery Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Continuous Data Protection And Recovery Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Continuous Data Protection And Recovery Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Continuous Data Protection And Recovery Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Continuous Data Protection And Recovery Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Continuous Data Protection And Recovery Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Continuous Data Protection And Recovery Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Continuous Data Protection And Recovery Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Continuous Data Protection And Recovery Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Continuous Data Protection And Recovery Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Continuous Data Protection And Recovery Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Continuous Data Protection And Recovery Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Continuous Data Protection And Recovery Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Continuous Data Protection And Recovery Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Continuous Data Protection And Recovery Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Continuous Data Protection And Recovery Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Continuous Data Protection And Recovery Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Continuous Data Protection And Recovery Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Continuous Data Protection And Recovery Software?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Continuous Data Protection And Recovery Software?

Key companies in the market include DELL EMC, Commvault, IBM, Veritas, Veeam, Infomation2 Software, AISHU Technology, Dingjia Computers Technology, Cohesity, Huawei Technologies.

3. What are the main segments of the Continuous Data Protection And Recovery Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Continuous Data Protection And Recovery Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Continuous Data Protection And Recovery Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Continuous Data Protection And Recovery Software?

To stay informed about further developments, trends, and reports in the Continuous Data Protection And Recovery Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence