Key Insights

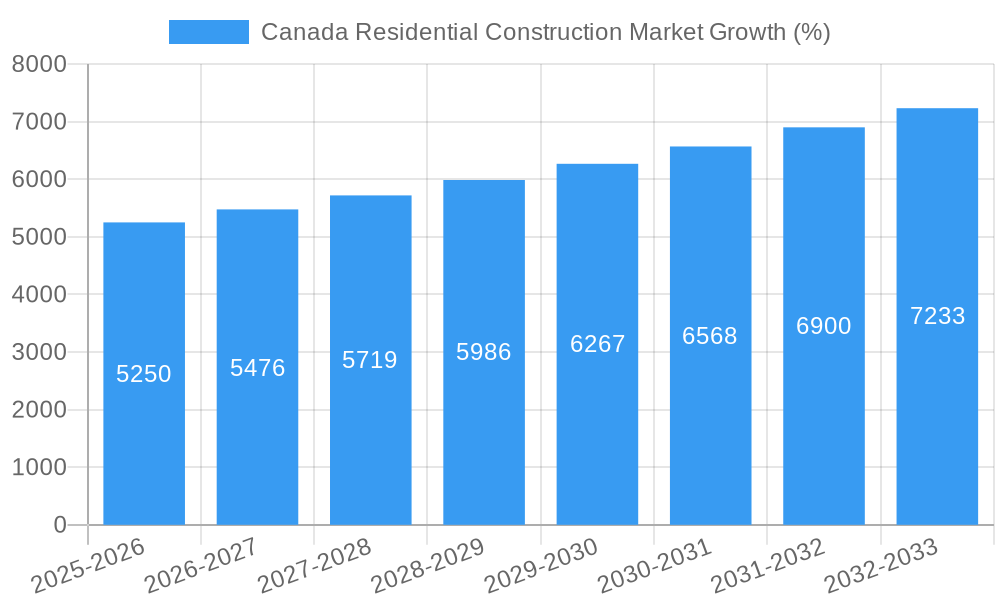

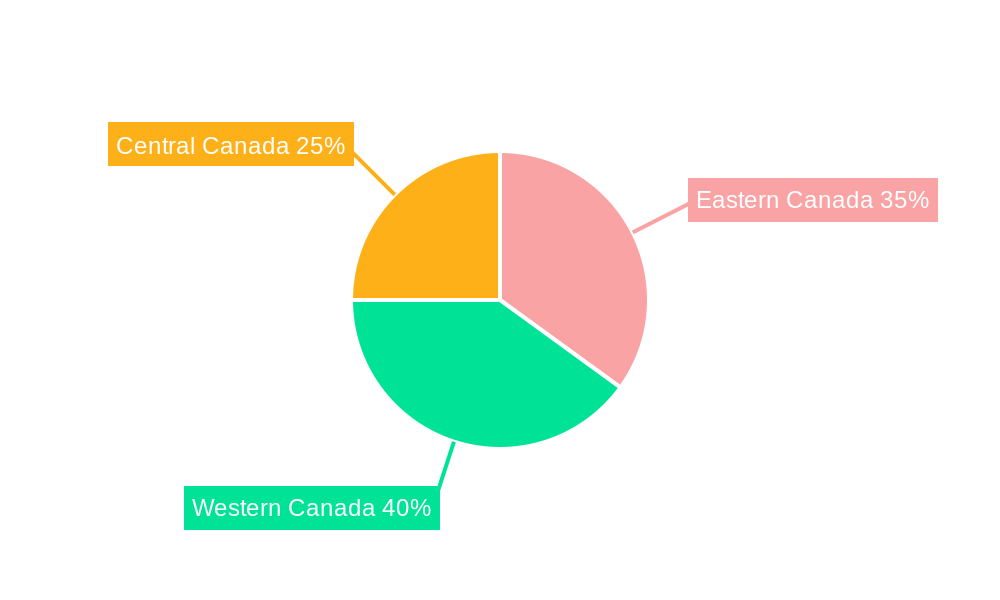

The Canada residential construction market, valued at approximately $100 billion CAD in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This expansion is fueled by several key factors. Firstly, a sustained increase in population, particularly in major urban centers like Toronto, Vancouver, and Calgary, is driving significant demand for new housing units. Secondly, favorable government policies aimed at stimulating housing construction, including mortgage incentives and infrastructure investments, are contributing to the market's dynamism. Furthermore, a robust economy and increasing household incomes are enabling greater affordability and purchasing power for prospective homeowners. The market is segmented by dwelling type (single-family and multi-family) and geographically across regions such as Eastern, Western, and Central Canada, with significant regional variations in growth rates reflecting differing demographic trends and local market conditions. Major players like PCL Construction, EllisDon, and Ledcor Group are actively shaping market dynamics through their project portfolios and construction expertise.

However, challenges persist. Rising material costs, particularly lumber and steel, coupled with skilled labor shortages, are placing upward pressure on construction costs and potentially impacting project timelines. Furthermore, stringent building codes and environmental regulations add complexity and expense to development projects. Despite these constraints, the long-term outlook remains positive, driven by sustained population growth and the ongoing need for affordable and sustainable housing solutions across Canada. The market is expected to see significant investment in multi-family dwellings in urban areas to address the increasing demand for rental units and condominium properties in densely populated regions. The continued focus on sustainable construction practices, such as green building certifications and energy-efficient designs, will further influence market growth and competition.

Canada Residential Construction Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Residential Construction Market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The report covers key market segments, including single-family and multi-family dwellings across major Canadian cities (Edmonton, Calgary, Toronto, Vancouver, Ottawa, Montreal, and Rest of Canada), offering valuable insights for industry professionals, investors, and stakeholders. The total market size is projected to reach xx Million units by 2033.

Canada Residential Construction Market Dynamics & Structure

The Canadian residential construction market is characterized by a moderately concentrated landscape, with a handful of large players and numerous smaller firms. Market share is dynamic, influenced by project wins, economic conditions, and M&A activity. Technological innovation, while present, faces barriers such as high upfront investment costs and the need for skilled labor. Regulatory frameworks, including building codes and environmental regulations, significantly impact construction practices and costs. Competitive product substitutes are limited, primarily focusing on different construction materials and techniques. End-user demographics, shifting towards smaller, more sustainable housing options in urban centers, are reshaping demand. M&A activity is moderate, driven by the pursuit of scale and geographic expansion.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share (2024).

- Technological Innovation: Adoption of Building Information Modeling (BIM) and prefabrication is increasing but slow due to cost and skills gaps.

- Regulatory Framework: Stringent building codes and environmental regulations influence project timelines and costs.

- Competitive Substitutes: Limited substitutes, primarily focusing on alternative materials (e.g., modular construction).

- End-User Demographics: Shifting preferences towards smaller, urban dwellings and sustainable building practices.

- M&A Activity: Moderate level of mergers and acquisitions, primarily for geographic expansion and market consolidation. Approx. xx M&A deals occurred between 2019-2024.

Canada Residential Construction Market Growth Trends & Insights

The Canadian residential construction market experienced significant growth during the historical period (2019-2024), driven by factors including population growth, urbanization, and low-interest rates. However, growth slowed in 2022 and 2023 due to increased interest rates and material cost inflation. The market is expected to recover gradually, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the increased adoption of modular construction and sustainable building materials, are gradually transforming the industry. Consumer behavior is shifting toward energy-efficient and environmentally friendly homes.

- Market Size Evolution: Steadily increased from xx Million units in 2019 to xx Million units in 2024; projected to reach xx Million units by 2033.

- Adoption Rates: Adoption of sustainable building materials and practices is increasing but faces challenges in affordability and widespread acceptance.

- Technological Disruptions: BIM and prefabrication are gaining traction, impacting efficiency and construction timelines.

- Consumer Behavior Shifts: Growing demand for energy-efficient and sustainable homes, influencing design and construction choices.

Dominant Regions, Countries, or Segments in Canada Residential Construction Market

Toronto, Vancouver, and Calgary are the dominant regions, driving market growth due to high population density, strong economic activity, and robust demand for housing. The multi-family segment is experiencing faster growth compared to the single-family segment, fueled by urbanization and affordability concerns.

- Toronto: High demand due to population growth and limited land availability; strong economic activity.

- Vancouver: Similar to Toronto, driven by high population density and limited land supply; significant investment in infrastructure.

- Calgary: Strong economic base, with an expanding population and demand for both single-family and multi-family dwellings.

- Multi-family Segment: Fastest-growing segment, driven by urbanization and affordability considerations.

- Single-family Segment: Growth is slower, influenced by rising land prices and affordability challenges.

Canada Residential Construction Market Product Landscape

The product landscape is diverse, ranging from traditional single-family homes to high-rise multi-family buildings. Innovations include the use of prefabricated components, sustainable building materials (e.g., cross-laminated timber), and smart home technologies. These advancements enhance efficiency, reduce construction time, and improve energy performance. Unique selling propositions focus on sustainable features, smart home integration, and customized designs.

Key Drivers, Barriers & Challenges in Canada Residential Construction Market

Key Drivers:

- Strong population growth and urbanization.

- Government incentives for affordable housing and green building.

- Increased demand for energy-efficient homes.

- Technological advancements.

Key Barriers & Challenges:

- Skilled labor shortages (estimated xx% shortage by 2025).

- Rising material costs (xx% increase since 2019).

- Supply chain disruptions (leading to xx% project delays on average).

- Regulatory complexities and permitting processes.

Emerging Opportunities in Canada Residential Construction Market

- Growing demand for sustainable and energy-efficient housing.

- Expansion of modular and prefabricated construction methods.

- Smart home technology integration.

- Development of affordable housing solutions.

Growth Accelerators in the Canada Residential Construction Market Industry

Continued population growth, government investments in infrastructure, and technological advancements are key accelerators. Strategic partnerships between developers, technology providers, and construction firms will facilitate innovation and efficiency improvements. Expansion into new markets and sustainable building initiatives will further fuel growth.

Key Players Shaping the Canada Residential Construction Market Market

- Clark Builders

- Taggart Group of Companies

- Magil Construction

- Buttcon Limited

- Pomerleau Incorporated

- EllisDon Corporation

- Maple Reinders Constructors Limited

- Dawson Wallace Construction Limited

- Urban One Builders

- Graham Construction

- Delnor Construction Limited

- Chandos Construction

- Broccolini

- Marco Group of Companies

- EBC Incorporated

- Turner Construction Company

- Ledcor Group of Companies

- Matheson Constructors

- PCL Construction

- Bird Construction Incorporated

Notable Milestones in Canada Residential Construction Market Sector

- September 2022: PCL Construction awarded Kindred Resort in Keystone, Colorado (USD 184 million mixed-use development). While outside of Canada, this showcases the capabilities and reach of a major Canadian player, impacting market perception and potential future projects.

- January 2023: PCL Construction broke ground on the Avant, a luxury residential community in Denver, Colorado. Again, this highlights the scope and ambition of major Canadian firms operating beyond national borders.

In-Depth Canada Residential Construction Market Market Outlook

The Canadian residential construction market presents significant long-term growth potential, driven by consistent population growth and ongoing urbanization. Strategic opportunities exist in sustainable building practices, technological adoption, and the development of innovative housing solutions. Addressing labor shortages and supply chain vulnerabilities will be crucial for maximizing market potential and maintaining sustainable growth.

Canada Residential Construction Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

-

2. Key City

- 2.1. Edmonton

- 2.2. Calgary

- 2.3. Toronto

- 2.4. Vancouver

- 2.5. Ottawa

- 2.6. Montreal

- 2.7. Rest Of Canada

Canada Residential Construction Market Segmentation By Geography

- 1. Canada

Canada Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets

- 3.3. Market Restrains

- 3.3.1. Shortage of Raw Materials

- 3.4. Market Trends

- 3.4.1. Drop in Building Permits Due to High Interest Rates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Key City

- 5.2.1. Edmonton

- 5.2.2. Calgary

- 5.2.3. Toronto

- 5.2.4. Vancouver

- 5.2.5. Ottawa

- 5.2.6. Montreal

- 5.2.7. Rest Of Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Eastern Canada Canada Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Clark Builders

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Taggart Group of Companies

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Magil Construction

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Buttcon Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Pomerleau Incorporated

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 EllisDon Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Maple Reinders Constructors Limited

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dawson Wallace Construction Limited

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Urban One Builders

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Graham Construction

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Delnor Construction Limited

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Chandos Construction

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Broccolini

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Marco Group of Companies

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 EBC Incorporated

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 Turner Construction Company

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 Ledcor Group of Companies

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 Matheson Constructors**List Not Exhaustive

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.19 PCL Construction

- 9.2.19.1. Overview

- 9.2.19.2. Products

- 9.2.19.3. SWOT Analysis

- 9.2.19.4. Recent Developments

- 9.2.19.5. Financials (Based on Availability)

- 9.2.20 Bird Construction Incorporated

- 9.2.20.1. Overview

- 9.2.20.2. Products

- 9.2.20.3. SWOT Analysis

- 9.2.20.4. Recent Developments

- 9.2.20.5. Financials (Based on Availability)

- 9.2.1 Clark Builders

List of Figures

- Figure 1: Canada Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Canada Residential Construction Market Revenue Million Forecast, by Key City 2019 & 2032

- Table 4: Canada Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Canada Residential Construction Market Revenue Million Forecast, by Key City 2019 & 2032

- Table 11: Canada Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Residential Construction Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Canada Residential Construction Market?

Key companies in the market include Clark Builders, Taggart Group of Companies, Magil Construction, Buttcon Limited, Pomerleau Incorporated, EllisDon Corporation, Maple Reinders Constructors Limited, Dawson Wallace Construction Limited, Urban One Builders, Graham Construction, Delnor Construction Limited, Chandos Construction, Broccolini, Marco Group of Companies, EBC Incorporated, Turner Construction Company, Ledcor Group of Companies, Matheson Constructors**List Not Exhaustive, PCL Construction, Bird Construction Incorporated.

3. What are the main segments of the Canada Residential Construction Market?

The market segments include Type, Key City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets.

6. What are the notable trends driving market growth?

Drop in Building Permits Due to High Interest Rates.

7. Are there any restraints impacting market growth?

Shortage of Raw Materials.

8. Can you provide examples of recent developments in the market?

September 2022: PCL Construction was awarded Kindred Resort - Keystone's first major development in River Run in 20 years. This USD 184 million, 321,000 square-foot mixed-use development, designed by OZ Architecture, will consist of 95 luxury ski-in/ski-out condominiums and a 107-key full-service hotel, all just steps away from the River Run Gondola at Keystone Ski Resort. The development also includes 25,000 square feet of commercial space for restaurants, retail, and amenities including a pool, spa, fitness center, ski club, and event space. Preliminary construction activities are underway to relocate utilities. Construction will continue year-round and is scheduled for completion in June 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Residential Construction Market?

To stay informed about further developments, trends, and reports in the Canada Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence