Key Insights

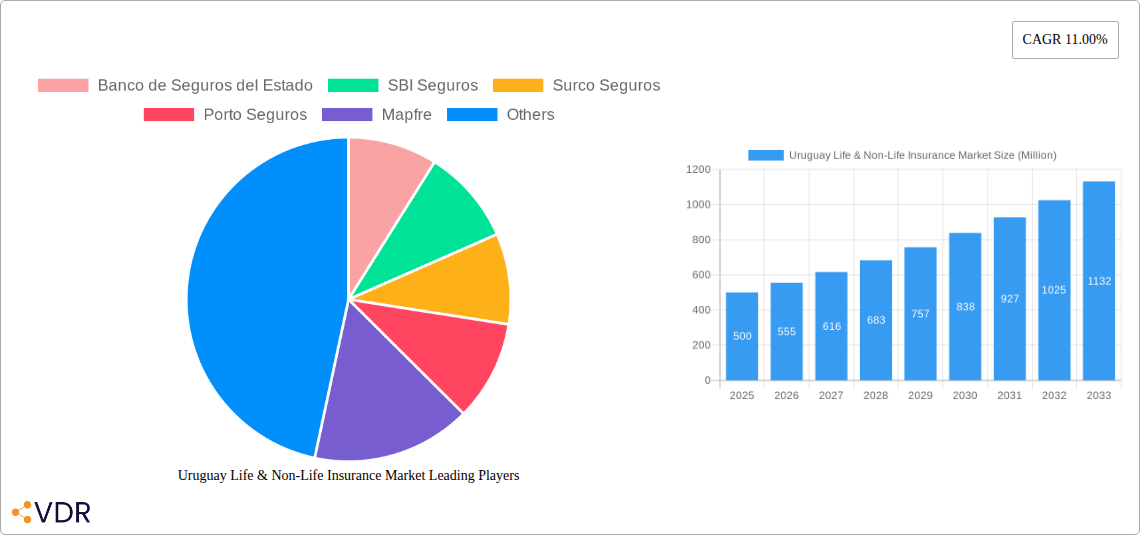

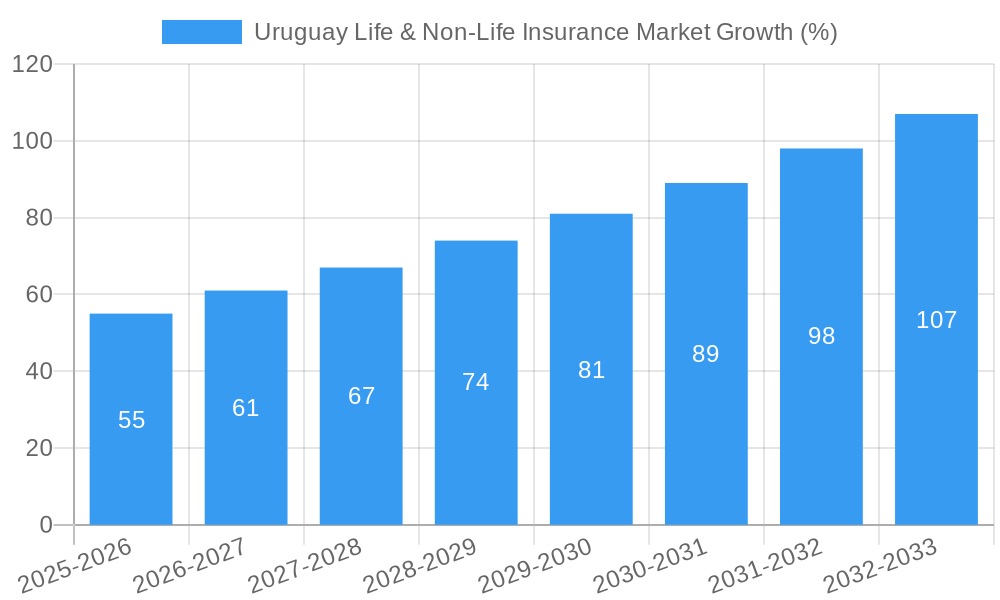

The Uruguayan life and non-life insurance market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 11%, presents a compelling investment opportunity. While precise market size figures for 2019-2024 are unavailable, extrapolating from the provided 2025 market size (let's assume a value of $500 million for illustrative purposes; this should be replaced with the actual value if available) and applying the 11% CAGR, we can project significant growth over the forecast period (2025-2033). This growth is driven by factors such as increasing awareness of insurance products, rising disposable incomes, and a growing middle class demanding financial security. Government initiatives promoting financial inclusion and regulatory reforms streamlining the insurance sector further contribute to this positive trajectory. Competitive dynamics are shaped by a mix of both local and international players, including Banco de Seguros del Estado, SBI Seguros, and Mapfre, each vying for market share with varied product offerings and distribution strategies. While the market faces potential restraints such as economic volatility and high inflation, the overall outlook remains positive, particularly in the non-life segment which is likely to benefit from increased infrastructure development and the expansion of the agricultural sector.

The projected market expansion is anticipated to be uneven across different segments, with health and motor insurance likely experiencing the highest growth. Challenges remain in improving insurance penetration rates, particularly in underserved rural areas. Further enhancing consumer trust and awareness of insurance benefits through targeted marketing campaigns and financial literacy programs is crucial for sustained market growth. The presence of established international players coupled with growing domestic insurers signals a dynamic competitive landscape. Proactive risk management strategies and innovative product development will be key success factors for insurers to thrive in this evolving market. Strategic partnerships and collaborations could play a significant role in penetrating new market segments and fostering wider financial inclusion within the Uruguayan population.

Uruguay Life & Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Uruguay Life & Non-Life Insurance Market, offering invaluable insights for industry professionals, investors, and strategic planners. The study covers the historical period (2019-2024), base year (2025), and forecasts the market's trajectory until 2033. Discover key market dynamics, growth trends, dominant segments, and emerging opportunities within the Uruguayan insurance landscape. The report analyzes both the parent market (Insurance Market in Uruguay) and its key child segments (Life Insurance and Non-Life Insurance). Market values are presented in millions.

Uruguay Life & Non-Life Insurance Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological influences shaping the Uruguayan insurance market. We examine market concentration, identifying key players like Banco de Seguros del Estado, SBI Seguros, and Mapfre, and assess their market share percentages. The report explores the impact of technological innovation, regulatory frameworks, and competitive substitutes on market growth. Further analysis includes:

- Market Concentration: Examining the dominance of key players and the level of competition. (e.g., Banco de Seguros del Estado holds xx% market share in 2025)

- Technological Innovation: Assessing the adoption of digital technologies (e.g., InsurTech) and their impact on efficiency and customer experience.

- Regulatory Framework: Analyzing the influence of government policies and regulations on market operations.

- Competitive Product Substitutes: Identifying alternative financial products and their impact on the insurance market.

- End-User Demographics: Examining the distribution of insurance policyholders across different age groups, income levels, and geographic locations.

- M&A Trends: Analyzing recent mergers and acquisitions, their impact on market structure, and future M&A predictions (e.g., xx M&A deals predicted for 2026-2028).

Uruguay Life & Non-Life Insurance Market Growth Trends & Insights

This section provides a detailed analysis of the market size evolution using proprietary data (XXX) from 2019 to 2033. We explore the factors driving market growth, including adoption rates, technological disruptions, and shifting consumer behavior. Key metrics like CAGR and market penetration are utilized to provide quantitative insights into market performance. The analysis will explore:

- Market size evolution (in millions) from 2019 to 2024 and projections until 2033.

- CAGR of the market during the forecast period (2025-2033).

- Market penetration rates for different insurance products (Life and Non-Life).

- Impact of technological disruptions, such as digital insurance platforms and AI-driven risk assessment.

- Analysis of changing consumer preferences and their influence on product demand.

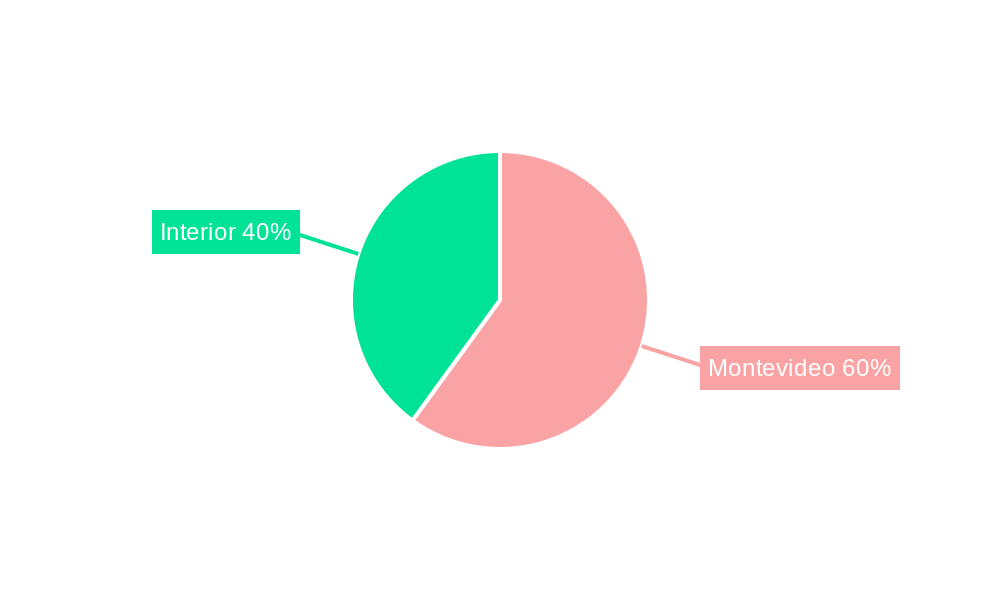

Dominant Regions, Countries, or Segments in Uruguay Life & Non-Life Insurance Market

This section identifies the leading regions or segments driving market growth within Uruguay. We analyze factors contributing to their dominance, including economic policies, infrastructure development, and population demographics. Key drivers and dominance factors will be detailed using both bullet points and paragraphs. Examples include:

- Montevideo's dominance: (e.g., Montevideo accounts for xx% of the market due to higher population density and economic activity.)

- Growth in rural areas: (e.g., Government initiatives aimed at increasing insurance penetration in rural areas are driving growth in these regions.)

- Life insurance vs. Non-Life: (e.g., The Non-life segment is projected to experience higher growth due to rising demand for motor and property insurance.)

Uruguay Life & Non-Life Insurance Market Product Landscape

This section describes the range of insurance products available in Uruguay, focusing on innovation and performance. We will analyze the unique selling propositions (USPs) of various products, highlighting technological advancements driving product differentiation.

Key Drivers, Barriers & Challenges in Uruguay Life & Non-Life Insurance Market

This section identifies key factors driving and hindering market growth. We analyze technological advancements, economic conditions, and policy-related factors. Challenges including supply chain disruptions, regulatory hurdles, and competitive pressures are examined, along with their quantifiable impacts on market dynamics.

Emerging Opportunities in Uruguay Life & Non-Life Insurance Market

This section highlights emerging opportunities in the Uruguayan insurance market, focusing on untapped markets, innovative applications, and evolving consumer preferences. This could include areas like microinsurance, specialized insurance products, or the growing adoption of digital insurance solutions.

Growth Accelerators in the Uruguay Life & Non-Life Insurance Market Industry

This section explores catalysts driving long-term growth, such as technological breakthroughs, strategic partnerships, and expansion strategies. Specific examples of these growth accelerators will be provided.

Key Players Shaping the Uruguay Life & Non-Life Insurance Market Market

- Banco de Seguros del Estado

- SBI Seguros

- Surco Seguros

- Porto Seguros

- Mapfre

- Sancor Seguros

- Berkley Uruguay Seguros

- Surety Insures SA

- FAR Insurance company SA

- State Insurance Bank

- CUTCSA Seguros SA

- HDI Seguros SA (List Not Exhaustive)

Notable Milestones in Uruguay Life & Non-Life Insurance Market Sector

- March 08, 2022: Banco de Seguros del Estado inaugurated its Río Branco Agency, expanding its reach and accessibility.

- November 09, 2022: SBI Seguros expanded its commercial risk portfolio by offering bail insurance, catering to a new customer segment.

In-Depth Uruguay Life & Non-Life Insurance Market Outlook

This section summarizes the growth accelerators discussed earlier, focusing on future market potential and strategic opportunities. It will emphasize the long-term prospects for the Uruguayan insurance market and outline potential avenues for sustained growth and profitability.

Uruguay Life & Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Other Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other distribution channels

Uruguay Life & Non-Life Insurance Market Segmentation By Geography

- 1. Uruguay

Uruguay Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Demand for Health Insurance in Uruguay

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uruguay Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Other Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other distribution channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uruguay

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Banco de Seguros del Estado

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SBI Seguros

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Surco Seguros

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Porto Seguros

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mapfre

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sancor Seguros

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berkley Uruguay Seguros

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Surety Insures SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FAR Insurance company SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 State Insurance Bank

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CUTCSA Seguros SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 HDI Seguros SA**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Banco de Seguros del Estado

List of Figures

- Figure 1: Uruguay Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uruguay Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 4: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 7: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uruguay Life & Non-Life Insurance Market?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Uruguay Life & Non-Life Insurance Market?

Key companies in the market include Banco de Seguros del Estado, SBI Seguros, Surco Seguros, Porto Seguros, Mapfre, Sancor Seguros, Berkley Uruguay Seguros, Surety Insures SA, FAR Insurance company SA, State Insurance Bank, CUTCSA Seguros SA, HDI Seguros SA**List Not Exhaustive.

3. What are the main segments of the Uruguay Life & Non-Life Insurance Market?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Demand for Health Insurance in Uruguay.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On March 08, 2022, Banco de Seguros del Estado in Río Branco Agency, located at Virrey Arredondo 930, Río Branco, Department of Cerro Largo, was inaugurated. The allocation of this Agency was given within the framework of a call for expressions of interest made by the BSE in July 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uruguay Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uruguay Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uruguay Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Uruguay Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence