Key Insights

The Bangladesh Vehicle Insurance Market is projected for robust expansion, forecasted to reach 956.71 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 11% from the base year 2025. This growth is propelled by increasing vehicle registrations, urbanization, and a heightened consumer understanding of insurance's significance. Supportive government regulations mandating insurance and efforts to bolster road safety are further stimulating market development. Despite these positive trends, challenges such as low penetration rates, influenced by affordability issues and limited awareness in rural areas, persist. Intense competition among established insurers necessitates strategic pricing, unique product offerings, and efficient distribution channels. Market segmentation typically encompasses diverse vehicle types and insurance policies, including third-party liability and comprehensive coverage. Overcoming these hurdles through targeted marketing, financial inclusion, and digital integration will be key to unlocking future growth potential.

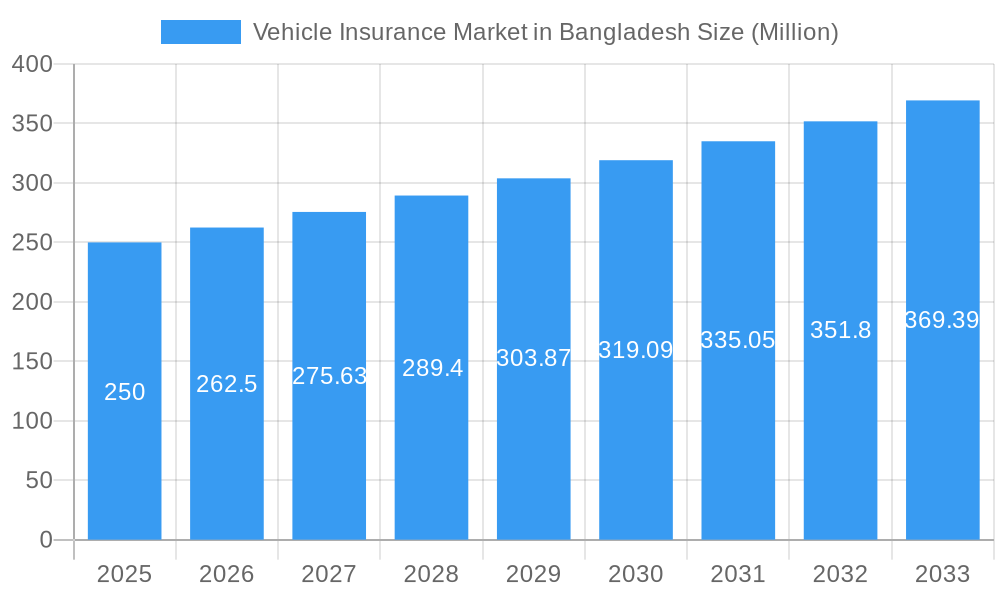

Vehicle Insurance Market in Bangladesh Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market expansion, potentially moderating slightly due to economic volatility and the saturation of accessible market segments. Significant untapped opportunities lie within rural demographics and lower-income segments, offering avenues for insurers adept at addressing affordability and awareness gaps. Developing innovative, needs-specific insurance products and implementing effective risk management strategies are vital for enduring success. Leading companies will prioritize superior customer service, streamlined claims processing, and technological advancements for enhanced risk assessment and fraud mitigation.

Vehicle Insurance Market in Bangladesh Company Market Share

Vehicle Insurance Market in Bangladesh: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vehicle Insurance Market in Bangladesh, offering valuable insights into market dynamics, growth trends, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the evolving landscape of the Bangladeshi vehicle insurance sector. The report analyzes both the parent market (Insurance in Bangladesh) and the child market (Vehicle Insurance), providing a granular view of market segmentation and growth drivers. Market size values are presented in Million Units.

Vehicle Insurance Market in Bangladesh Market Dynamics & Structure

This section analyzes the competitive landscape of the Bangladeshi vehicle insurance market, examining market concentration, technological advancements, regulatory influences, and market dynamics. The analysis considers factors influencing market growth and identifies key trends impacting the industry. The report delves into mergers & acquisitions (M&A) activity, exploring their impact on market share and competition.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few large players holding significant market share. The exact market share distribution is under analysis and will be included in the final report. xx% of the market is concentrated among the top 5 players.

- Technological Innovation: Adoption of telematics and digital platforms is gradually increasing, driving efficiency and customer engagement. However, limited digital infrastructure and digital literacy in certain regions remain barriers.

- Regulatory Framework: The Insurance Development and Regulatory Authority (IDRA) plays a crucial role in shaping market dynamics through regulations, such as the April 2023 solvency margin requirements. These regulations aim to enhance financial stability within the industry.

- Competitive Product Substitutes: Limited substitutes exist for comprehensive vehicle insurance policies, especially those offering third-party liability coverage.

- End-User Demographics: Growth is driven by increasing vehicle ownership, particularly in urban areas, and a rising middle class with higher disposable incomes.

- M&A Trends: Recent M&A activity has been moderate, with a focus on enhancing market reach and product diversification. The report will quantify M&A deal volumes during the historical period.

Vehicle Insurance Market in Bangladesh Growth Trends & Insights

This section provides a detailed analysis of the market's growth trajectory, utilizing data and insights to determine the Compound Annual Growth Rate (CAGR), market penetration rates, and key factors driving expansion. The analysis examines technological disruptions, evolving consumer preferences, and their impact on market dynamics.

[This section will contain a 600-word analysis, incorporating quantitative metrics (CAGR, market penetration, market size evolution over the study period, etc.) and qualitative insights into consumer behavior and technological trends. Specific data will be included in the final report].

Dominant Regions, Countries, or Segments in Vehicle Insurance Market in Bangladesh

This section pinpoints the leading regions, segments, or countries driving market expansion within Bangladesh. It examines factors contributing to their dominance, such as economic growth, infrastructural development, and specific government policies. Detailed market share breakdowns and growth potential assessments for each segment will be provided.

[This section will contain a 600-word analysis, including bullet points highlighting key drivers and paragraphs analyzing dominance factors, including market share and growth potential. Specific data will be included in the final report]

Vehicle Insurance Market in Bangladesh Product Landscape

The Bangladeshi vehicle insurance market offers a range of products, from basic third-party liability coverage to comprehensive policies encompassing various risks. Innovations include the incorporation of telematics for usage-based insurance and the expansion of online platforms for policy purchase and management. These advancements aim to enhance customer experience and provide more tailored coverage options.

Key Drivers, Barriers & Challenges in Vehicle Insurance Market in Bangladesh

Key Drivers:

- Growing vehicle ownership.

- Rising middle-class disposable incomes.

- Increased awareness of insurance benefits.

- Government initiatives to promote insurance penetration.

Challenges & Restraints:

- Limited insurance awareness in rural areas.

- High claim settlement processing time.

- Fraudulent claims and associated costs.

- Intense competition among existing players.

Emerging Opportunities in Vehicle Insurance Market in Bangladesh

- Expansion into underinsured rural markets.

- Development of innovative insurance products catering to specific consumer needs.

- Leveraging technology to improve customer service and claims processing.

- Strategic partnerships with banks and other financial institutions (as seen with the BRAC Bank and Green Delta Insurance bancassurance agreement).

Growth Accelerators in the Vehicle Insurance Market in Bangladesh Industry

The Bangladeshi vehicle insurance market is poised for sustained growth fueled by the expansion of the middle class, increasing vehicle ownership, and technological advancements. Government initiatives promoting financial inclusion and insurance awareness further accelerate market expansion. Strategic partnerships between insurers and banks, as well as the adoption of innovative product offerings, will play a significant role in shaping future growth trajectories.

Key Players Shaping the Vehicle Insurance Market in Bangladesh Market

- Eastern Insurance Company Ltd

- Rupali Insurance Company Ltd

- Phoenix Insurance Company Ltd

- Peoples Insurance Company Limited

- Asia Insurance Limited

- Sadharan Bima Corporation

- Bangladesh National Insurance Company Limited

- Pragati Insurance Limited

- Eastland Insurance Co Ltd

- Provati Insurance Company Limited

- List Not Exhaustive

Notable Milestones in Vehicle Insurance Market in Bangladesh Sector

- December 2023: BRAC Bank and Green Delta Insurance Company partnered to offer bancassurance services, expanding motor insurance access.

- April 2023: IDRA introduced new solvency margin regulations for non-life insurers, impacting financial stability and risk management.

In-Depth Vehicle Insurance Market in Bangladesh Market Outlook

The Bangladeshi vehicle insurance market presents significant growth potential driven by rising vehicle ownership, expanding middle class, and supportive regulatory measures. Strategic investments in technology, expansion into underserved markets, and innovative product development will be key success factors for insurers. The market is projected to exhibit considerable growth throughout the forecast period, presenting lucrative opportunities for both established and emerging players.

Vehicle Insurance Market in Bangladesh Segmentation

-

1. Product type

- 1.1. Third-Party

- 1.2. Comprehensive

- 1.3. Others

-

2. Distribution channel

- 2.1. Brokers

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

Vehicle Insurance Market in Bangladesh Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vehicle Insurance Market in Bangladesh Regional Market Share

Geographic Coverage of Vehicle Insurance Market in Bangladesh

Vehicle Insurance Market in Bangladesh REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in sales of motor vehicles driving motor insurance market; Innovative products in motor vehicles with differentiated insurance price

- 3.3. Market Restrains

- 3.3.1. Rise in sales of motor vehicles driving motor insurance market; Innovative products in motor vehicles with differentiated insurance price

- 3.4. Market Trends

- 3.4.1. Increase in Motor Vehicles Registration Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Insurance Market in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Third-Party

- 5.1.2. Comprehensive

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Brokers

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. North America Vehicle Insurance Market in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Third-Party

- 6.1.2. Comprehensive

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution channel

- 6.2.1. Brokers

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. South America Vehicle Insurance Market in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Third-Party

- 7.1.2. Comprehensive

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution channel

- 7.2.1. Brokers

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. Europe Vehicle Insurance Market in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Third-Party

- 8.1.2. Comprehensive

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution channel

- 8.2.1. Brokers

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Middle East & Africa Vehicle Insurance Market in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Third-Party

- 9.1.2. Comprehensive

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution channel

- 9.2.1. Brokers

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. Asia Pacific Vehicle Insurance Market in Bangladesh Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 10.1.1. Third-Party

- 10.1.2. Comprehensive

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution channel

- 10.2.1. Brokers

- 10.2.2. Agency

- 10.2.3. Banks

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eastern Insurance Company Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rupali Insurance Company Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Phonix Insurance Company Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Peoples Insurance Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Asia Insurance Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sadharan Bima Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bangladesh National Insurance Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pragati Insurance Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eastland Insurance Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Provati Insurance Company Limited**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Eastern Insurance Company Ltd

List of Figures

- Figure 1: Global Vehicle Insurance Market in Bangladesh Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Vehicle Insurance Market in Bangladesh Revenue (billion), by Product type 2025 & 2033

- Figure 3: North America Vehicle Insurance Market in Bangladesh Revenue Share (%), by Product type 2025 & 2033

- Figure 4: North America Vehicle Insurance Market in Bangladesh Revenue (billion), by Distribution channel 2025 & 2033

- Figure 5: North America Vehicle Insurance Market in Bangladesh Revenue Share (%), by Distribution channel 2025 & 2033

- Figure 6: North America Vehicle Insurance Market in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Vehicle Insurance Market in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Vehicle Insurance Market in Bangladesh Revenue (billion), by Product type 2025 & 2033

- Figure 9: South America Vehicle Insurance Market in Bangladesh Revenue Share (%), by Product type 2025 & 2033

- Figure 10: South America Vehicle Insurance Market in Bangladesh Revenue (billion), by Distribution channel 2025 & 2033

- Figure 11: South America Vehicle Insurance Market in Bangladesh Revenue Share (%), by Distribution channel 2025 & 2033

- Figure 12: South America Vehicle Insurance Market in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Vehicle Insurance Market in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Vehicle Insurance Market in Bangladesh Revenue (billion), by Product type 2025 & 2033

- Figure 15: Europe Vehicle Insurance Market in Bangladesh Revenue Share (%), by Product type 2025 & 2033

- Figure 16: Europe Vehicle Insurance Market in Bangladesh Revenue (billion), by Distribution channel 2025 & 2033

- Figure 17: Europe Vehicle Insurance Market in Bangladesh Revenue Share (%), by Distribution channel 2025 & 2033

- Figure 18: Europe Vehicle Insurance Market in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Vehicle Insurance Market in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Vehicle Insurance Market in Bangladesh Revenue (billion), by Product type 2025 & 2033

- Figure 21: Middle East & Africa Vehicle Insurance Market in Bangladesh Revenue Share (%), by Product type 2025 & 2033

- Figure 22: Middle East & Africa Vehicle Insurance Market in Bangladesh Revenue (billion), by Distribution channel 2025 & 2033

- Figure 23: Middle East & Africa Vehicle Insurance Market in Bangladesh Revenue Share (%), by Distribution channel 2025 & 2033

- Figure 24: Middle East & Africa Vehicle Insurance Market in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Vehicle Insurance Market in Bangladesh Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Vehicle Insurance Market in Bangladesh Revenue (billion), by Product type 2025 & 2033

- Figure 27: Asia Pacific Vehicle Insurance Market in Bangladesh Revenue Share (%), by Product type 2025 & 2033

- Figure 28: Asia Pacific Vehicle Insurance Market in Bangladesh Revenue (billion), by Distribution channel 2025 & 2033

- Figure 29: Asia Pacific Vehicle Insurance Market in Bangladesh Revenue Share (%), by Distribution channel 2025 & 2033

- Figure 30: Asia Pacific Vehicle Insurance Market in Bangladesh Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Vehicle Insurance Market in Bangladesh Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Product type 2020 & 2033

- Table 2: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 3: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Product type 2020 & 2033

- Table 5: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 6: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Product type 2020 & 2033

- Table 11: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 12: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Product type 2020 & 2033

- Table 17: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 18: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Product type 2020 & 2033

- Table 29: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 30: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Product type 2020 & 2033

- Table 38: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 39: Global Vehicle Insurance Market in Bangladesh Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Vehicle Insurance Market in Bangladesh Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Insurance Market in Bangladesh?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Vehicle Insurance Market in Bangladesh?

Key companies in the market include Eastern Insurance Company Ltd, Rupali Insurance Company Ltd, Phonix Insurance Company Ltd, Peoples Insurance Company Limited, Asia Insurance Limited, Sadharan Bima Corporation, Bangladesh National Insurance Company Limited, Pragati Insurance Limited, Eastland Insurance Co Ltd, Provati Insurance Company Limited**List Not Exhaustive.

3. What are the main segments of the Vehicle Insurance Market in Bangladesh?

The market segments include Product type, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 956.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in sales of motor vehicles driving motor insurance market; Innovative products in motor vehicles with differentiated insurance price.

6. What are the notable trends driving market growth?

Increase in Motor Vehicles Registration Driving the Market.

7. Are there any restraints impacting market growth?

Rise in sales of motor vehicles driving motor insurance market; Innovative products in motor vehicles with differentiated insurance price.

8. Can you provide examples of recent developments in the market?

In December 2023, To enhance financial services, BRAC Bank and Green Delta Insurance Company have inked a bancassurance agreement that will allow BRAC Bank clients to buy a variety of non-life insurance products including motor insurance from Green Delta Insurance directly through the bank.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Insurance Market in Bangladesh," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Insurance Market in Bangladesh report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Insurance Market in Bangladesh?

To stay informed about further developments, trends, and reports in the Vehicle Insurance Market in Bangladesh, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence