Key Insights

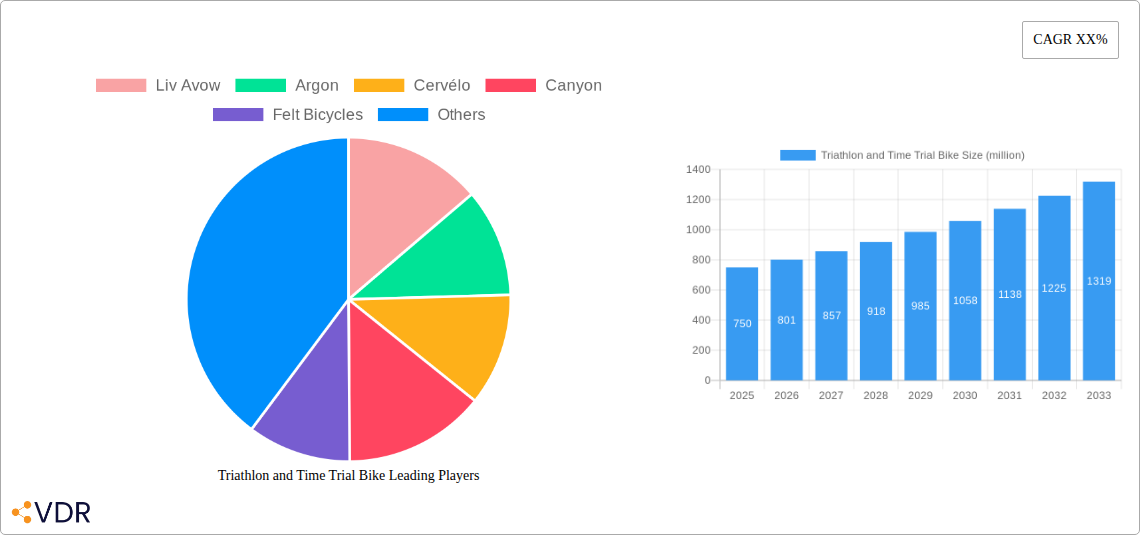

The global Triathlon and Time Trial Bike market is poised for significant expansion, projected to reach a robust market size of approximately USD 750 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 6.5% from 2025 to 2033. This substantial growth is fueled by a confluence of escalating participation in endurance sports, a rising disposable income enabling investment in high-performance equipment, and the increasing professionalization of cycling disciplines. The demand for specialized bikes that optimize aerodynamics and efficiency for speed is a primary driver. Furthermore, advancements in material science, particularly the wider adoption of carbon fiber, are leading to lighter, stronger, and more aerodynamic bike designs, catering to the evolving needs of competitive athletes and serious enthusiasts alike. The market is segmented into Online Sales and Offline Sales, with online channels experiencing accelerated growth due to convenience and wider product availability.

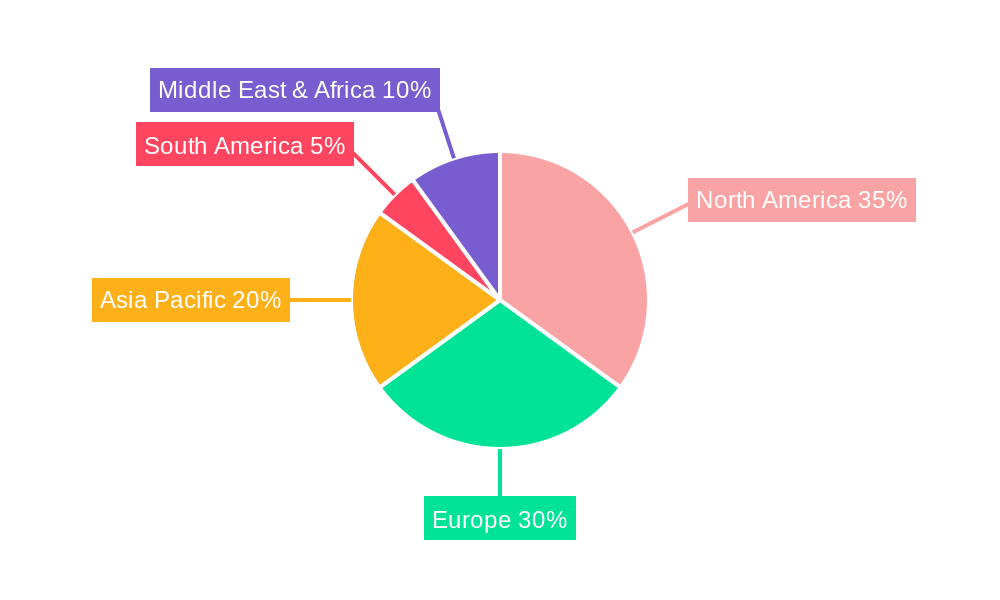

Key trends shaping the Triathlon and Time Trial Bike market include the continuous innovation in aerodynamic design, integrated components, and advanced gearing systems. Brands are heavily investing in research and development to shave off precious seconds for athletes. The rise of gravel racing and its crossover appeal is also indirectly boosting interest in performance cycling. However, the market faces certain restraints, including the high cost of these specialized bicycles, which can be a barrier for amateur participation. Additionally, the complexity of assembly and maintenance for advanced components may deter some consumers. Geographically, North America and Europe currently dominate the market, driven by established cycling cultures and high levels of disposable income. The Asia Pacific region, particularly China and Southeast Asian nations, is anticipated to witness the fastest growth due to increasing sports participation and economic development. Leading companies like Trek Bicycle Corporation, Specialized Bicycle Components, and Giant are at the forefront, constantly innovating to capture market share.

Here is a compelling, SEO-optimized report description for the Triathlon and Time Trial Bike market, incorporating high-traffic keywords, parent/child markets, and structured with the requested headings and details:

Report Title: Global Triathlon and Time Trial Bike Market Analysis: Growth, Trends, and Opportunities (2019–2033)

Report Description:

Dive deep into the dynamic global Triathlon Bike Market and Time Trial Bike Market with this comprehensive industry report. Spanning from 2019 to 2033, this analysis provides an unparalleled understanding of market dynamics, growth trends, regional dominance, product landscape, and key player strategies. Essential for industry professionals, manufacturers, investors, and cycling enthusiasts, this report leverages extensive data and expert insights to illuminate the future trajectory of the performance cycling sector. Explore market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends within the performance cycling equipment sector. Uncover critical insights into carbon fiber bike manufacturing, aluminum alloy bike technology, and the impact of online sales versus offline sales on market penetration.

Key Report Features:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Segments Analyzed: Application (Online Sales, Offline Sales), Types (Carbon Fiber Material, Aluminum Alloy Material, Others)

- Companies Covered: Liv Avow, Argon, Cervélo, Canyon, Felt Bicycles, Ventum, A2, Trek Bicycle Corporation, Quintana Roo, Giant, Specialized Bicycle Components, Wilier, Factor Bikes, RIBBLE, Cannondale, Orbea, Dimond Bikes, Squadcycles, LOOK, BMC

Triathlon and Time Trial Bike Market Dynamics & Structure

The global Triathlon and Time Trial Bike market is characterized by a moderately concentrated structure, with leading brands like Cervélo, Specialized Bicycle Components, and Trek Bicycle Corporation holding significant market share. Technological innovation, particularly in aerodynamics, frame materials like carbon fiber, and component integration, serves as a primary driver. Regulatory frameworks, primarily related to equipment safety and event standards, play a supporting role. Competitive product substitutes include high-end road bikes, which can sometimes bridge the gap for amateur athletes, though specialized time trial bikes and triathlon bikes offer distinct advantages. End-user demographics are predominantly affluent individuals aged 25-55 with a strong interest in endurance sports and cycling. Mergers & Acquisitions (M&A) activity, while not extremely high, involves strategic consolidations to expand product portfolios or gain access to new markets.

- Market Concentration: Moderate, with key players dominating a substantial portion of the high-performance segment.

- Technological Innovation Drivers: Advancements in aerodynamics, lightweight materials (especially advanced carbon fiber layups), electronic shifting systems, and integrated cockpits are paramount.

- Regulatory Frameworks: Primarily focused on UCI (Union Cycliste Internationale) regulations for time trials and specific triathlon federation guidelines.

- Competitive Product Substitutes: High-performance road bikes, while less specialized, can serve as an entry point for some athletes.

- End-User Demographics: Primarily male, aged 25-55, with disposable income, competitive aspirations, and an interest in personal bests and endurance events.

- M&A Trends: Strategic acquisitions by larger bicycle conglomerates to strengthen their presence in the performance cycling segment.

Triathlon and Time Trial Bike Growth Trends & Insights

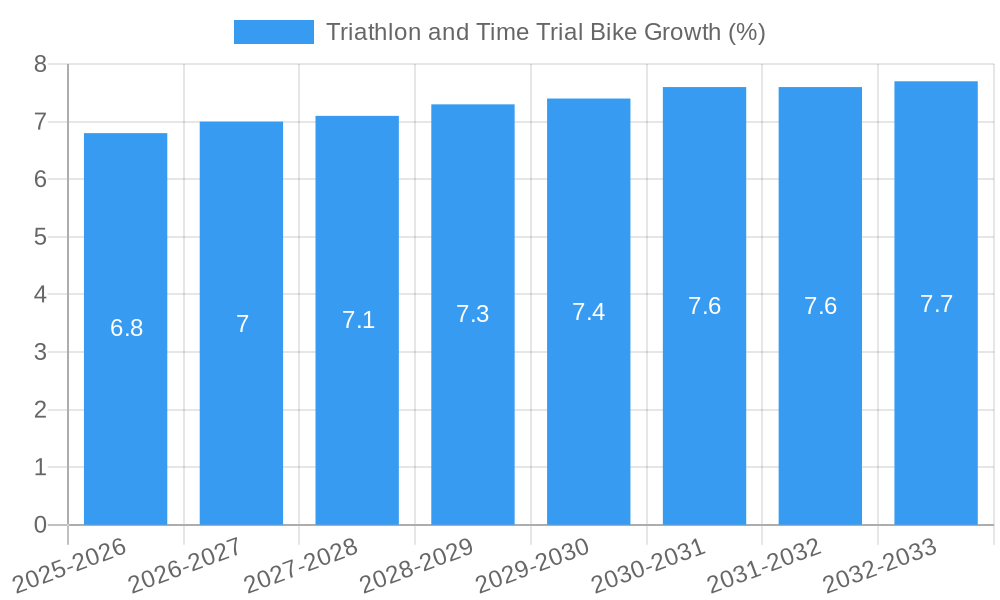

The Triathlon and Time Trial Bike Market is projected to experience robust growth, driven by an increasing global participation in endurance sports and a rising disposable income among key demographics. The market size is estimated to reach approximately $1,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% through 2033, reaching an estimated $2,500 million. Adoption rates for these specialized bikes are steadily increasing, fueled by greater accessibility through online sales channels and a growing awareness of the performance advantages they offer. Technological disruptions, such as advancements in aerodynamic design, lightweight carbon fiber construction, and integrated power meter technology, are transforming the product landscape and appealing to performance-oriented consumers. Consumer behavior shifts are evident, with a greater emphasis on data-driven training, personalized bike fits, and the pursuit of competitive excellence. The increasing popularity of Ironman events and national time trial championships further bolsters demand.

- Market Size Evolution: Expected to grow significantly from an estimated $1,500 million in 2025 to $2,500 million by 2033.

- CAGR: Projected at xx% during the forecast period (2025-2033).

- Adoption Rates: Steadily increasing due to growing participation in endurance sports and enhanced product accessibility.

- Technological Disruptions: Continuous innovation in aerodynamics, materials science (advanced carbon fiber), and electronic integration are key.

- Consumer Behavior Shifts: Growing demand for data integration (power meters, GPS), professional bike fitting services, and performance optimization.

- Market Penetration: Driven by a combination of direct-to-consumer sales and established dealer networks.

Dominant Regions, Countries, or Segments in Triathlon and Time Trial Bike

North America and Europe currently dominate the global Triathlon and Time Trial Bike Market. This dominance is attributed to several factors, including a mature cycling culture, a higher prevalence of competitive triathletes and time trialists, and robust economic conditions enabling higher spending on premium sporting equipment. The United States stands out as a leading country within North America, characterized by a large number of organized triathlons and time trial events, coupled with a strong presence of high-end cycling brands and retailers. In Europe, countries like Germany, United Kingdom, and France exhibit significant market share due to a well-established cycling infrastructure and a strong tradition of competitive cycling.

The Carbon Fiber Material segment is the primary driver within the "Types" segmentation, accounting for an estimated 80% of the market share in 2025. This is due to its superior strength-to-weight ratio, aerodynamic potential, and ability to be molded into complex, performance-enhancing shapes. Online Sales are rapidly gaining traction, projected to capture approximately 45% of the market share by 2025, driven by convenience, wider selection, and competitive pricing. However, Offline Sales through specialized bike shops remain crucial for brand experience, professional fitting, and after-sales service, holding an estimated 55% market share.

- Leading Region: North America and Europe.

- Leading Countries: United States, Germany, United Kingdom, France.

- Dominance Factors (Regions): Mature cycling culture, high disposable income, organized competitive events, established distribution networks.

- Dominant Segment (Types): Carbon Fiber Material (estimated 80% market share in 2025).

- Dominant Segment (Application): Offline Sales (estimated 55% market share in 2025), with Online Sales rapidly increasing.

- Growth Potential (Segments): Continued growth in online sales and increasing adoption of advanced carbon fiber technologies.

Triathlon and Time Trial Bike Product Landscape

The Triathlon and Time Trial Bike product landscape is defined by relentless innovation in aerodynamic efficiency and weight reduction. Leading manufacturers are pushing the boundaries with proprietary carbon fiber layups, advanced frame geometries optimized for rider positioning, and integrated component systems. Key performance metrics revolve around aerodynamic drag reduction, stiffness for power transfer, and rider comfort for extended durations. Brands like Cervélo, Specialized, and Trek are at the forefront, offering models with highly integrated cockpits, internal cable routing, and specialized hydration and storage solutions designed for race-day performance. The pursuit of marginal gains is a constant theme, with continuous refinement in wheel technology, drivetrain efficiency, and braking systems.

Key Drivers, Barriers & Challenges in Triathlon and Time Trial Bike

Key Drivers:

- Growing Popularity of Endurance Sports: The increasing participation in triathlons and time trials globally fuels demand.

- Technological Advancements: Innovations in aerodynamics, materials (carbon fiber), and components enhance performance and appeal.

- Rising Disposable Incomes: Increased consumer spending power in key demographics allows for investment in premium sporting goods.

- Performance Optimization: Athletes' continuous pursuit of personal bests drives the demand for specialized, high-performance equipment.

- Online Retail Expansion: Improved accessibility through e-commerce platforms broadens market reach.

Barriers & Challenges:

- High Price Point: The premium cost of specialized triathlon and time trial bikes limits accessibility for some consumers.

- Supply Chain Disruptions: Global manufacturing and logistics challenges can impact product availability and lead times.

- Economic Downturns: Recessions can reduce discretionary spending on high-value sporting goods.

- Intense Competition: A crowded market with established brands requires continuous innovation and effective marketing.

- Regulatory Constraints: Strict UCI rules for professional time trials can limit design freedom in certain categories.

Emerging Opportunities in Triathlon and Time Trial Bike

Emerging opportunities lie in the expansion of the e-triathlon bike market, integrating advanced electric assistance for training and accessible participation. The development of more accessible, yet still high-performance, entry-level time trial bikes can tap into a broader segment of aspiring athletes. Furthermore, the growing demand for personalized bike fitting services and custom component integration presents a significant opportunity for specialized retailers and manufacturers. There's also potential in leveraging augmented reality (AR) for virtual bike fitting and product demonstrations, enhancing the online shopping experience for performance cycling equipment.

Growth Accelerators in the Triathlon and Time Trial Bike Industry

Growth accelerators in the triathlon and time trial bike industry are primarily driven by ongoing technological breakthroughs in aerodynamic engineering and material science. Strategic partnerships between bike manufacturers, component suppliers (e.g., Shimano, SRAM), and sports apparel brands are crucial for creating integrated performance solutions. Market expansion into emerging economies with a growing middle class and increasing interest in fitness and competitive sports also serves as a significant growth catalyst. The rise of professional and amateur cycling influencers on social media platforms continues to inspire demand and showcase the latest product innovations.

Key Players Shaping the Triathlon and Time Trial Bike Market

- Liv Avow

- Argon

- Cervélo

- Canyon

- Felt Bicycles

- Ventum

- A2

- Trek Bicycle Corporation

- Quintana Roo

- Giant

- Specialized Bicycle Components

- Wilier

- Factor Bikes

- RIBBLE

- Cannondale

- Orbea

- Dimond Bikes

- Squadcycles

- LOOK

- BMC

Notable Milestones in Triathlon and Time Trial Bike Sector

- 2019: Cervélo launches the P5X, setting new benchmarks in aerodynamic integration and storage solutions.

- 2020: Specialized Bicycle Components introduces the S-Works Shiv Disc, incorporating disc brakes and advanced carbon fiber for enhanced performance.

- 2021: Trek Bicycle Corporation unveils the Speed Concept, featuring innovative aerodynamic tube shapes and integrated hydration systems.

- 2022: Canyon releases the Speedmax CFR, pushing the boundaries of adjustability and aerodynamics for elite athletes.

- 2023: Felt Bicycles launches new iterations of its IA series, focusing on modularity and rider-specific customization.

- 2024: Continued advancements in integrated power meter technology across major brands, offering athletes more precise training data.

In-Depth Triathlon and Time Trial Bike Market Outlook

The outlook for the Triathlon and Time Trial Bike Market is exceptionally positive, fueled by sustained growth in endurance sports participation and continuous technological innovation. Key growth accelerators include the increasing demand for aerodynamic efficiency, the ongoing refinement of lightweight carbon fiber materials, and the expansion of online sales channels, making these high-performance bikes more accessible globally. Strategic collaborations and the exploration of new market segments, particularly among amateur athletes seeking to improve their performance, will further propel the industry forward. The focus on data-driven training and personalized rider experiences will continue to shape product development and consumer preferences, ensuring a dynamic and expanding market.

Triathlon and Time Trial Bike Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Carbon Fiber Material

- 2.2. Aluminum Alloy Material

- 2.3. Others

Triathlon and Time Trial Bike Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Triathlon and Time Trial Bike REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Triathlon and Time Trial Bike Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Carbon Fiber Material

- 5.2.2. Aluminum Alloy Material

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Triathlon and Time Trial Bike Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Carbon Fiber Material

- 6.2.2. Aluminum Alloy Material

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Triathlon and Time Trial Bike Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Carbon Fiber Material

- 7.2.2. Aluminum Alloy Material

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Triathlon and Time Trial Bike Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Carbon Fiber Material

- 8.2.2. Aluminum Alloy Material

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Triathlon and Time Trial Bike Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Carbon Fiber Material

- 9.2.2. Aluminum Alloy Material

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Triathlon and Time Trial Bike Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Carbon Fiber Material

- 10.2.2. Aluminum Alloy Material

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Liv Avow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Argon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cervélo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Canyon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Felt Bicycles

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ventum

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A2

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trek Bicycle Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Quintana Roo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Giant

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Specialized Bicycle Components

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wilier

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Factor Bikes

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 RIBBLE

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Cannondale

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Orbea

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Dimond Bikes

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Squadcycles

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 LOOK

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 BMC

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Liv Avow

List of Figures

- Figure 1: Global Triathlon and Time Trial Bike Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Triathlon and Time Trial Bike Revenue (million), by Application 2024 & 2032

- Figure 3: North America Triathlon and Time Trial Bike Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Triathlon and Time Trial Bike Revenue (million), by Types 2024 & 2032

- Figure 5: North America Triathlon and Time Trial Bike Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Triathlon and Time Trial Bike Revenue (million), by Country 2024 & 2032

- Figure 7: North America Triathlon and Time Trial Bike Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Triathlon and Time Trial Bike Revenue (million), by Application 2024 & 2032

- Figure 9: South America Triathlon and Time Trial Bike Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Triathlon and Time Trial Bike Revenue (million), by Types 2024 & 2032

- Figure 11: South America Triathlon and Time Trial Bike Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Triathlon and Time Trial Bike Revenue (million), by Country 2024 & 2032

- Figure 13: South America Triathlon and Time Trial Bike Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Triathlon and Time Trial Bike Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Triathlon and Time Trial Bike Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Triathlon and Time Trial Bike Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Triathlon and Time Trial Bike Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Triathlon and Time Trial Bike Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Triathlon and Time Trial Bike Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Triathlon and Time Trial Bike Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Triathlon and Time Trial Bike Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Triathlon and Time Trial Bike Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Triathlon and Time Trial Bike Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Triathlon and Time Trial Bike Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Triathlon and Time Trial Bike Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Triathlon and Time Trial Bike Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Triathlon and Time Trial Bike Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Triathlon and Time Trial Bike Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Triathlon and Time Trial Bike Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Triathlon and Time Trial Bike Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Triathlon and Time Trial Bike Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Triathlon and Time Trial Bike Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Triathlon and Time Trial Bike Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Triathlon and Time Trial Bike Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Triathlon and Time Trial Bike Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Triathlon and Time Trial Bike Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Triathlon and Time Trial Bike Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Triathlon and Time Trial Bike Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Triathlon and Time Trial Bike Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Triathlon and Time Trial Bike Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Triathlon and Time Trial Bike Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Triathlon and Time Trial Bike Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Triathlon and Time Trial Bike Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Triathlon and Time Trial Bike Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Triathlon and Time Trial Bike Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Triathlon and Time Trial Bike Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Triathlon and Time Trial Bike Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Triathlon and Time Trial Bike Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Triathlon and Time Trial Bike Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Triathlon and Time Trial Bike Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Triathlon and Time Trial Bike Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Triathlon and Time Trial Bike?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Triathlon and Time Trial Bike?

Key companies in the market include Liv Avow, Argon, Cervélo, Canyon, Felt Bicycles, Ventum, A2, Trek Bicycle Corporation, Quintana Roo, Giant, Specialized Bicycle Components, Wilier, Factor Bikes, RIBBLE, Cannondale, Orbea, Dimond Bikes, Squadcycles, LOOK, BMC.

3. What are the main segments of the Triathlon and Time Trial Bike?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Triathlon and Time Trial Bike," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Triathlon and Time Trial Bike report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Triathlon and Time Trial Bike?

To stay informed about further developments, trends, and reports in the Triathlon and Time Trial Bike, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence