Key Insights

The Middle East and Africa athletic footwear market is poised for significant expansion, propelled by heightened health consciousness, growing disposable incomes, and a flourishing sports and fitness culture. The market, valued at 89.83 billion USD in its base year of 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 6.6% through 2033. This upward trajectory is driven by increased participation in sports like running and football, especially among youth. Furthermore, the expanding presence of global athletic brands and the rise of e-commerce are enhancing product accessibility. Evolving fitness trends, including marathon running and organized sports leagues, also contribute to market growth.

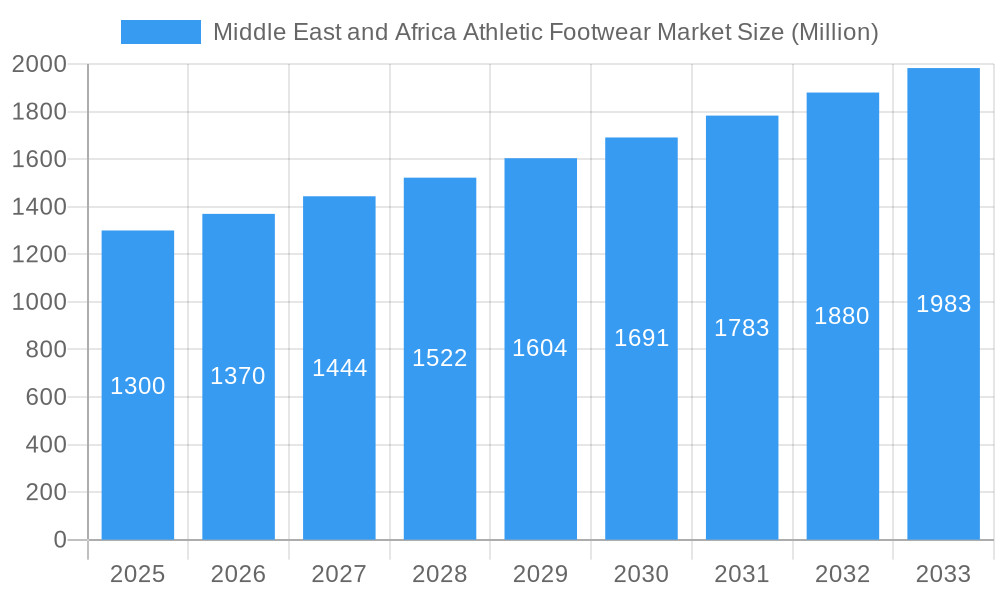

Middle East and Africa Athletic Footwear Market Market Size (In Billion)

Despite the positive outlook, the market faces several hurdles. Consumer price sensitivity in specific regions and the prevalence of counterfeit products pose significant challenges. Variations in infrastructure and economic stability across the region also impact market penetration and consumer purchasing power. To address these issues, brands are focusing on product line diversification, including affordable options, and strengthening supply chain management. Market segmentation by product type (running, sports, trekking), end-user (men, women, children), and distribution channel (online, offline) offers strategic opportunities for targeted marketing and expansion into niche segments.

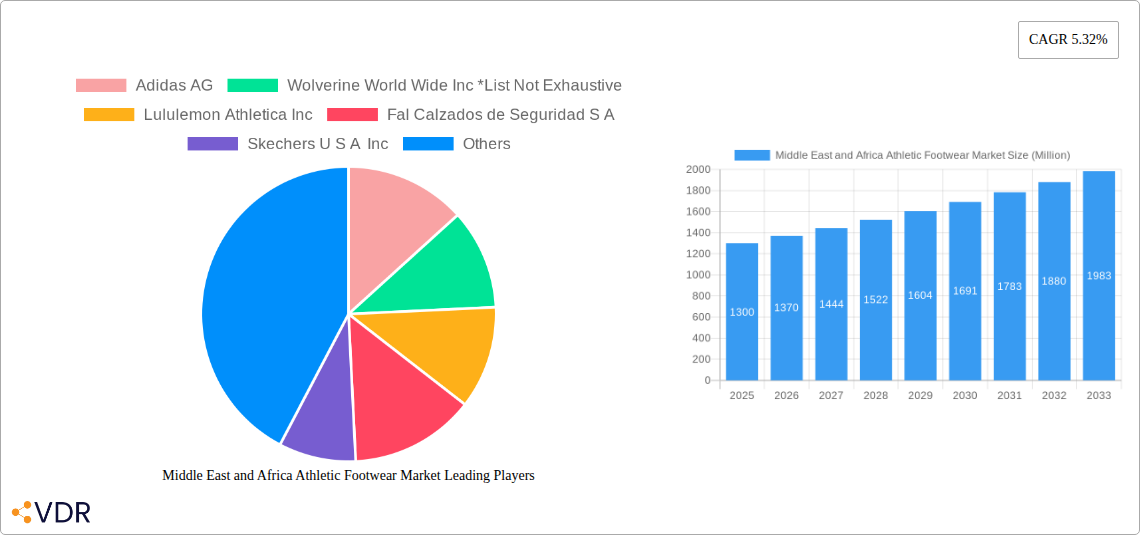

Middle East and Africa Athletic Footwear Market Company Market Share

Middle East and Africa Athletic Footwear Market Analysis and Forecast (2025-2033)

This report delivers a comprehensive analysis of the Middle East and Africa athletic footwear market from 2025 to 2033. It examines market dynamics, growth drivers, key segments, and major players, providing crucial insights for industry stakeholders. The analysis employs a robust methodology, utilizing historical data leading up to a 2025 base year and a forecast period concluding in 2033. Market values are presented in billions of USD.

Middle East and Africa Athletic Footwear Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and consumer trends within the Middle East and Africa region. The analysis incorporates quantitative data on market share, mergers and acquisitions (M&A) activity, and qualitative assessments of innovation barriers and other influencing factors. The athletic footwear market in MEA is characterized by a dynamic interplay of established international brands and regional players.

- Market Concentration: The market is moderately concentrated, with key players like Nike, Adidas, and Puma holding significant shares. However, the presence of regional brands and private labels contributes to competitive diversity. We estimate that the top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Technological advancements, such as the integration of smart sensors and personalized customization options in footwear, are driving market growth. However, high R&D costs and the need for specialized manufacturing capabilities present significant innovation barriers.

- Regulatory Framework: Varying regulatory standards across different countries within MEA can affect market access and distribution strategies. Compliance with these regulations presents a considerable challenge for both international and local players.

- Competitive Product Substitutes: The market faces competition from casual footwear and traditional sandals, particularly in price-sensitive segments. This requires manufacturers to differentiate their products through innovation, branding, and marketing.

- End-User Demographics: The MEA region's young and growing population, coupled with rising disposable incomes and increasing participation in sports and fitness activities, fuels the demand for athletic footwear. Significant growth is expected from the expanding middle class.

- M&A Trends: Consolidation through mergers and acquisitions is anticipated to increase as larger players seek to expand their market share and diversify their product portfolios. We project xx M&A deals within the forecast period.

Middle East and Africa Athletic Footwear Market Growth Trends & Insights

This section provides a comprehensive analysis of market size evolution, adoption rates, technological disruptions, and shifts in consumer preferences. The analysis utilizes a combination of quantitative metrics (such as CAGR and market penetration) and qualitative observations to provide a deep understanding of the market's trajectory. The MEA athletic footwear market experienced a CAGR of xx% during the historical period (2019-2024). This growth is projected to continue, driven by factors such as increasing urbanization, rising health consciousness, and the growing popularity of sports and fitness activities. Consumer preferences are evolving towards more technologically advanced and sustainable footwear. The increasing adoption of e-commerce channels also significantly influences the market's growth trajectory. We project a CAGR of xx% during the forecast period (2025-2033), with the market size reaching xx million units by 2033.

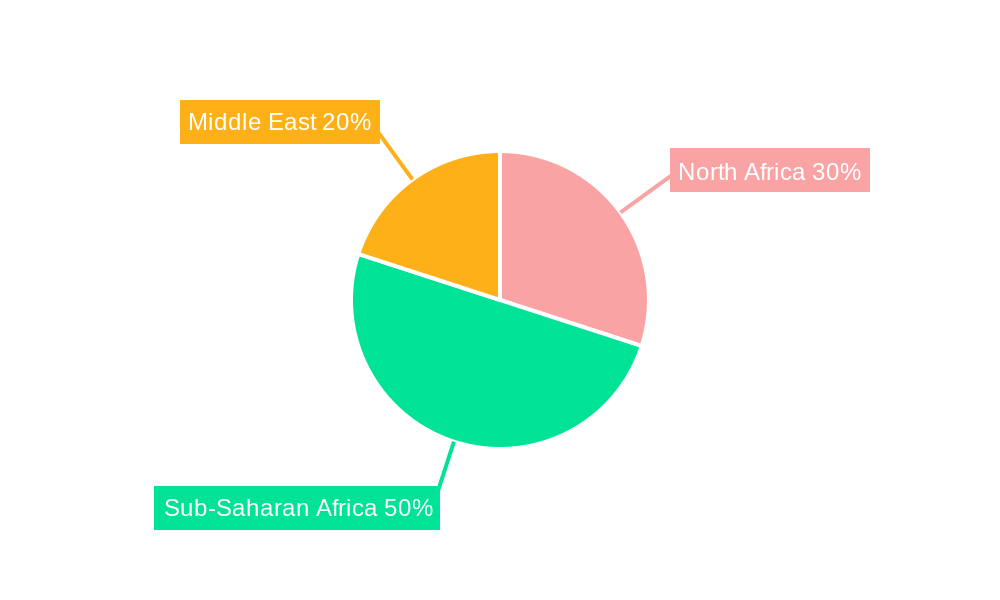

Dominant Regions, Countries, or Segments in Middle East and Africa Athletic Footwear Market

This section pinpoints the leading regions, countries, and segments within the MEA athletic footwear market, focusing on factors driving their growth. The analysis covers product types (Running Shoes, Sports Shoes, Trekking/Hiking Shoes, Other Product Types), end-users (Men, Women, Children), and distribution channels (Sports and Athletic Goods Stores, Supermarkets/Hypermarkets, Online Retail Stores, Other Distribution Channels).

- By Product Type: Sports shoes currently dominate the market, followed by running shoes. The trekking/hiking segment is experiencing steady growth due to increased tourism and outdoor activities.

- By End User: The men's segment holds the largest market share, followed by women's and children's segments. The children's segment is exhibiting faster growth due to increased participation in school sports and extracurricular activities.

- By Distribution Channel: Sports and athletic goods stores remain the primary distribution channel, but online retail stores are experiencing rapid growth, capturing a significant market share and changing the landscape of traditional retail.

The UAE and South Africa are currently leading regional markets, driven by strong economic growth, favorable demographics, and high consumer spending. However, other countries in the region, such as Egypt, Nigeria, and Kenya, are projected to show significant growth potential during the forecast period.

Middle East and Africa Athletic Footwear Market Product Landscape

The MEA athletic footwear market is witnessing significant product innovation, focusing on enhanced comfort, performance, and style. Manufacturers are incorporating advanced materials, such as breathable fabrics and responsive cushioning systems, to improve the functionality and appeal of their products. Sustainability is also becoming a key selling point, with several brands launching eco-friendly footwear options. Key innovations include specialized running shoes with integrated GPS trackers and smart insoles providing real-time feedback on running metrics.

Key Drivers, Barriers & Challenges in Middle East and Africa Athletic Footwear Market

Key Drivers: Rising disposable incomes, increasing health awareness, government initiatives promoting sports and fitness, and the burgeoning e-commerce sector are major drivers of market expansion. The increasing popularity of marathon events and fitness challenges further fuels market growth.

Key Challenges: Fluctuations in currency exchange rates, high import duties, counterfeit products, and the relatively underdeveloped supply chain infrastructure in certain regions are key challenges. Furthermore, competition from cheaper alternatives and evolving consumer preferences necessitate ongoing innovation and adaptation. We estimate that counterfeiting reduces revenue by xx% annually.

Emerging Opportunities in Middle East and Africa Athletic Footwear Market

Untapped markets in less-developed regions present substantial growth potential. Demand for affordable, high-quality footwear remains high, offering opportunities for local manufacturers and budget-friendly brands. Customization options, catering to individual preferences and needs, are gaining traction, presenting a lucrative niche. The rising popularity of e-sports also presents opportunities for specialized footwear tailored for this segment.

Growth Accelerators in the Middle East and Africa Athletic Footwear Market Industry

Technological advancements, strategic partnerships between international brands and regional distributors, and expansion into new markets will accelerate long-term growth. Investing in sustainable and ethical sourcing practices is becoming increasingly important, particularly among environmentally conscious consumers. Collaborations with sports celebrities and influencers significantly contribute to brand awareness and market reach.

Key Players Shaping the Middle East and Africa Athletic Footwear Market Market

- Adidas AG

- Wolverine World Wide Inc

- Lululemon Athletica Inc

- Fal Calzados de Seguridad S A

- Skechers U S A Inc

- Asics Corporation

- Puma SE

- Under Armour Inc

- Nike Inc

- New Balance Athletics Inc

Notable Milestones in Middle East and Africa Athletic Footwear Market Sector

- July 2021: Adidas opened its first women's-focused store in Dubai's Mall of the Emirates.

- June 2021: Adidas South Africa launched a 1000-square-meter flagship store in Sandton City.

- April 2021: Adidas Originals and Arwa Al Banawi collaborated on a new Forum sneaker launched exclusively in AlUla, Saudi Arabia.

In-Depth Middle East and Africa Athletic Footwear Market Market Outlook

The MEA athletic footwear market is poised for sustained growth, driven by favorable demographics, economic expansion, and increasing health consciousness. Strategic partnerships, technological advancements, and expansion into untapped markets will be crucial for capturing market share and achieving long-term success. The market offers significant potential for both established players and new entrants to capitalize on the region's dynamism and growing demand for athletic footwear.

Middle East and Africa Athletic Footwear Market Segmentation

-

1. Product Type

- 1.1. Running Shoes

- 1.2. Sports Shoes

- 1.3. Trekking/Hiking Shoes

- 1.4. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distibution Channel

- 3.1. Sports and Athletic Goods Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Rest of Middle-East and Africa

Middle East and Africa Athletic Footwear Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Athletic Footwear Market Regional Market Share

Geographic Coverage of Middle East and Africa Athletic Footwear Market

Middle East and Africa Athletic Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Demand for Athleisure Footwear; Aggressive Marketing by Brands

- 3.3. Market Restrains

- 3.3.1. Extensive Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Participation in Sports and Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Running Shoes

- 5.1.2. Sports Shoes

- 5.1.3. Trekking/Hiking Shoes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Sports and Athletic Goods Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle-East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. South Africa

- 5.5.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East and Africa Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Running Shoes

- 6.1.2. Sports Shoes

- 6.1.3. Trekking/Hiking Shoes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Sports and Athletic Goods Stores

- 6.3.2. Supermarkets/Hypermarkets

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. South Africa

- 6.4.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates Middle East and Africa Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Running Shoes

- 7.1.2. Sports Shoes

- 7.1.3. Trekking/Hiking Shoes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Sports and Athletic Goods Stores

- 7.3.2. Supermarkets/Hypermarkets

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. South Africa

- 7.4.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. South Africa Middle East and Africa Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Running Shoes

- 8.1.2. Sports Shoes

- 8.1.3. Trekking/Hiking Shoes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Sports and Athletic Goods Stores

- 8.3.2. Supermarkets/Hypermarkets

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. South Africa

- 8.4.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East and Africa Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Running Shoes

- 9.1.2. Sports Shoes

- 9.1.3. Trekking/Hiking Shoes

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. Sports and Athletic Goods Stores

- 9.3.2. Supermarkets/Hypermarkets

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. South Africa

- 9.4.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wolverine World Wide Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lululemon Athletica Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fal Calzados de Seguridad S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Skechers U S A Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Asics Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Puma SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Under Armour Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nike Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 New Balance Athletics Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Middle East and Africa Athletic Footwear Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Athletic Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 7: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Region 2020 & 2033

- Table 11: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 16: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 17: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 25: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 26: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 27: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by End User 2020 & 2033

- Table 34: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 35: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 36: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 37: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by End User 2020 & 2033

- Table 44: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by End User 2020 & 2033

- Table 45: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 46: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 47: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 49: Middle East and Africa Athletic Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Middle East and Africa Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Athletic Footwear Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Middle East and Africa Athletic Footwear Market?

Key companies in the market include Adidas AG, Wolverine World Wide Inc *List Not Exhaustive, Lululemon Athletica Inc, Fal Calzados de Seguridad S A, Skechers U S A Inc, Asics Corporation, Puma SE, Under Armour Inc, Nike Inc, New Balance Athletics Inc.

3. What are the main segments of the Middle East and Africa Athletic Footwear Market?

The market segments include Product Type, End User, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 89.83 billion as of 2022.

5. What are some drivers contributing to market growth?

Surging Demand for Athleisure Footwear; Aggressive Marketing by Brands.

6. What are the notable trends driving market growth?

Rising Participation in Sports and Fitness.

7. Are there any restraints impacting market growth?

Extensive Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In July 2021, Sports brand Adidas opened its first store dedicated to women consumers at the Mall of the Emirates in Dubai. The store features collections across sports and lifestyles, catering to shoppers of all shapes, sizes, and backgrounds, and includes exclusive launches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Athletic Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Athletic Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Athletic Footwear Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Athletic Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence