Key Insights

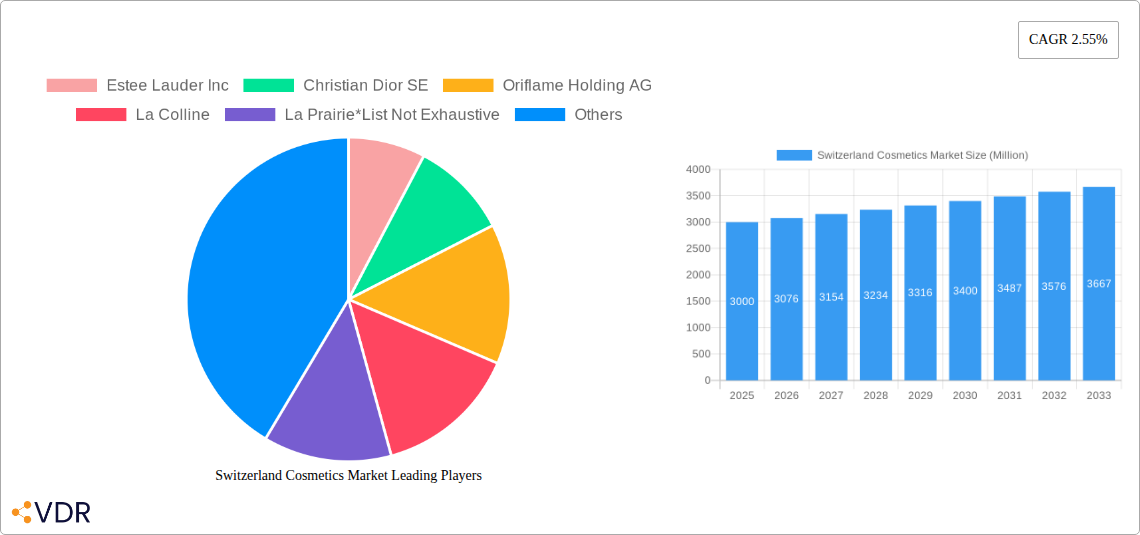

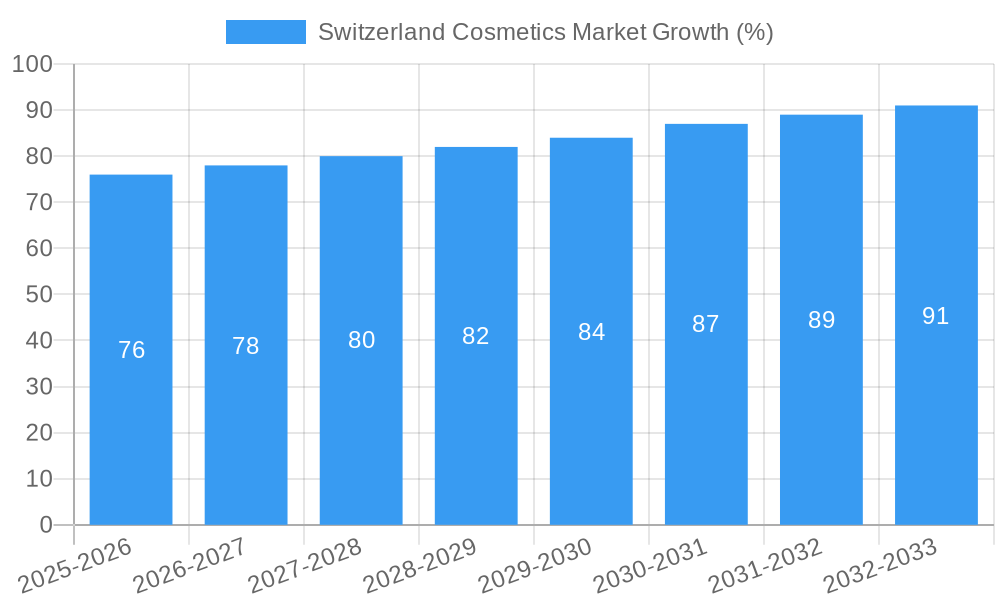

The Swiss cosmetics market, valued at approximately CHF 3 billion in 2025, is projected to exhibit steady growth, driven by increasing consumer spending on personal care and beauty products. A compound annual growth rate (CAGR) of 2.55% from 2025 to 2033 suggests a market size exceeding CHF 3.9 billion by 2033. This growth is fueled by several key factors. Firstly, the Swiss consumer base demonstrates a strong preference for premium and high-quality cosmetics, particularly within the skincare segment. This preference benefits luxury brands and drives higher average spending per capita. Secondly, the evolving consumer landscape embraces online retail channels significantly, contributing to the market expansion. Furthermore, a rising interest in natural and organic cosmetics presents a significant opportunity for brands focusing on sustainable and ethically sourced products. However, the market faces challenges such as economic fluctuations impacting consumer spending and intense competition from both domestic and international players. The market segmentation reveals a strong demand across all product types, with facial, eye, and lip color cosmetics leading the market. Specialist retail stores maintain a significant market share, although online retail is steadily gaining traction. Brands like Estee Lauder, L'Oreal, and Shiseido benefit from strong brand recognition and extensive distribution networks, while smaller, niche brands capitalize on growing consumer demand for specialized and personalized products.

The Swiss cosmetics market's future trajectory hinges on adapting to evolving consumer preferences and navigating the competitive landscape. Maintaining premium positioning while catering to growing demand for sustainable and ethical products will be crucial for success. Furthermore, leveraging digital channels effectively will be key for growth, considering the growing online presence of beauty consumers. The continued expansion of the premium segment indicates a robust market driven by consumers' willingness to invest in high-quality beauty solutions. Focusing on product innovation and targeted marketing strategies that resonate with the Swiss consumer will be vital for brands to thrive in this competitive yet lucrative market.

Switzerland Cosmetics Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Switzerland cosmetics market, covering the period 2019-2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and projects the market's trajectory from 2025 to 2033 (forecast period). Market values are presented in million units.

Switzerland Cosmetics Market Dynamics & Structure

The Swiss cosmetics market, valued at xx million in 2025, exhibits a moderately concentrated structure with a few dominant players and numerous smaller niche brands. Technological innovation, particularly in skincare formulations and sustainable packaging, is a key driver, alongside a strong regulatory framework emphasizing safety and transparency. The market faces competition from substitutes like natural remedies and homemade cosmetics, but premium brands maintain strong appeal due to Switzerland's high disposable income and consumer preference for quality. M&A activity is moderate, with a recorded xx deals in the historical period (2019-2024), primarily focused on expanding distribution networks and product portfolios. End-user demographics show a strong focus on the affluent segment, with a growing interest in personalized and sustainable products.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Focus on natural ingredients, sustainable packaging, and personalized skincare solutions.

- Regulatory Framework: Strict regulations regarding product safety and labeling.

- Competitive Substitutes: Natural remedies and DIY cosmetics pose a moderate competitive threat.

- End-User Demographics: Predominantly affluent consumers with high purchasing power.

- M&A Trends: Moderate activity, primarily driven by expansion and portfolio diversification.

Switzerland Cosmetics Market Growth Trends & Insights

The Swiss cosmetics market demonstrates consistent growth throughout the study period, fueled by increasing disposable incomes, evolving consumer preferences towards premium and specialized products, and the rise of e-commerce. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a projected value of xx million by 2033. The adoption rate of new technologies and innovative formulations remains high, reflecting consumer demand for efficacy and sophistication. Consumer behavior is shifting towards more personalized and sustainable choices, driving demand for customizable products and eco-friendly packaging. The Premium segment is expected to be the leading driver of market growth, fueled by a growing emphasis on high-quality products and luxury experiences.

Dominant Regions, Countries, or Segments in Switzerland Cosmetics Market

The Swiss cosmetics market shows robust growth across various segments, with the premium category, specialist retail stores, and skincare products leading the charge. Urban centers like Zurich, Geneva, and Basel drive significant market share due to higher consumer spending and accessibility to diverse product offerings.

- Category: Premium segment exhibiting faster growth than mass market due to high disposable incomes and preference for high-quality products.

- Distribution Channel: Specialist retail stores hold a dominant position due to their curated product offerings and expert advice, followed by online retail channels, showing significant growth potential.

- Type: Skincare products (including Facial Color Cosmetics, Eye Color Cosmetics, and Lip Color Cosmetics) represent the largest segment, driven by health-conscious consumers seeking high-quality products.

The dominance of specialist retail stores is attributed to their ability to offer personalized advice and a curated selection of premium products. Online channels are rapidly gaining traction, driven by convenience and increased access to a wider range of brands. The premium segment's strong performance reflects Switzerland's affluent consumer base and focus on quality and luxury.

Switzerland Cosmetics Market Product Landscape

The Swiss cosmetics market showcases constant innovation in product formulations, particularly in skincare, where active ingredients derived from natural sources, advanced delivery systems, and personalized solutions are gaining traction. The emphasis is on efficacy, safety, and luxury experience. Unique selling propositions often center on Swiss heritage, natural ingredients, advanced technology, and sustainable practices. Technological advancements include AI-powered skin analysis tools and personalized skincare regimens.

Key Drivers, Barriers & Challenges in Switzerland Cosmetics Market

Key Drivers:

- High disposable incomes and a strong preference for premium products.

- Growing awareness of skincare and beauty routines.

- Rise of e-commerce and online beauty retail.

- Emphasis on natural and sustainable ingredients.

Key Barriers & Challenges:

- Stringent regulatory environment, increasing compliance costs.

- Intense competition from both established and emerging brands.

- Supply chain disruptions impacting product availability and pricing.

- Fluctuations in the global economic climate impacting consumer spending.

Emerging Opportunities in Switzerland Cosmetics Market

- Growing demand for personalized and customized cosmetic products.

- Increasing interest in sustainable and eco-friendly cosmetic brands.

- Expansion into niche segments, like men's grooming and natural cosmetics.

- Potential for growth in online retail and direct-to-consumer (DTC) channels.

Growth Accelerators in the Switzerland Cosmetics Market Industry

Long-term growth in the Swiss cosmetics market is expected to be fueled by continuous innovation in product formulations and packaging, strategic partnerships between brands and retailers, and an expanding online presence. Market expansion strategies targeting younger demographics and incorporating digital marketing techniques will further accelerate growth.

Key Players Shaping the Switzerland Cosmetics Market Market

- Estee Lauder Inc

- Christian Dior SE

- Oriflame Holding AG

- La Colline

- La Prairie

- JACQUELINE PIOTAZ

- LOreal S A

- Unilever plc

- Shiseido Co Ltd

- Amway GmbH

Notable Milestones in Switzerland Cosmetics Market Sector

- July 2022: Estee Lauder Companies (ELC) expands its distribution network with a new distribution center in Galgenen, Switzerland, enhancing its global travel retail business.

- October 2021: La Prairie launches its "Skin Caviar Nighttime Oil," expanding its product portfolio and targeting consumer demand for innovative skincare solutions.

In-Depth Switzerland Cosmetics Market Market Outlook

The Swiss cosmetics market exhibits promising long-term growth potential, driven by affluent consumers' persistent demand for premium and innovative products. Strategic opportunities lie in leveraging digital marketing to reach younger demographics, investing in sustainable packaging, and fostering partnerships to enhance distribution networks. The focus on personalized experiences and a commitment to incorporating advanced technologies will be critical for success in this dynamic market.

Switzerland Cosmetics Market Segmentation

-

1. Type

- 1.1. Facial Color Cosmetics

- 1.2. Eye Color Cosmetics

- 1.3. Lip Color Cosmetics

- 1.4. Nail Color Cosmetics

- 1.5. Hair Coloring and Styling Products

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Specialist Retail Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Convenience/Grocery Stores

- 3.4. Online Retail Channels

- 3.5. Other Distribution Channels

Switzerland Cosmetics Market Segmentation By Geography

- 1. Switzerland

Switzerland Cosmetics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation

- 3.3. Market Restrains

- 3.3.1. Product Misrepresentation and Counterfeit Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Natural and Organic Beauty Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Cosmetics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facial Color Cosmetics

- 5.1.2. Eye Color Cosmetics

- 5.1.3. Lip Color Cosmetics

- 5.1.4. Nail Color Cosmetics

- 5.1.5. Hair Coloring and Styling Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialist Retail Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Convenience/Grocery Stores

- 5.3.4. Online Retail Channels

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Estee Lauder Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christian Dior SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oriflame Holding AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 La Colline

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 La Prairie*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JACQUELINE PIOTAZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LOreal S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Unilever plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shiseido Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amway GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Estee Lauder Inc

List of Figures

- Figure 1: Switzerland Cosmetics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Cosmetics Market Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Cosmetics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Cosmetics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Switzerland Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Switzerland Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Switzerland Cosmetics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Switzerland Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Switzerland Cosmetics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Switzerland Cosmetics Market Revenue Million Forecast, by Category 2019 & 2032

- Table 9: Switzerland Cosmetics Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: Switzerland Cosmetics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Cosmetics Market?

The projected CAGR is approximately 2.55%.

2. Which companies are prominent players in the Switzerland Cosmetics Market?

Key companies in the market include Estee Lauder Inc, Christian Dior SE, Oriflame Holding AG, La Colline, La Prairie*List Not Exhaustive, JACQUELINE PIOTAZ, LOreal S A, Unilever plc, Shiseido Co Ltd, Amway GmbH.

3. What are the main segments of the Switzerland Cosmetics Market?

The market segments include Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation.

6. What are the notable trends driving market growth?

Increasing Demand for Natural and Organic Beauty Products.

7. Are there any restraints impacting market growth?

Product Misrepresentation and Counterfeit Concerns.

8. Can you provide examples of recent developments in the market?

July 2022: Estee Lauder Companies (ELC) expanded its distribution network by opening a new distribution center in Galgenen, Switzerland. As per the company's claim, the expansion of the distribution network will help accommodate the growth of its global travel retail business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Cosmetics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Cosmetics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Cosmetics Market?

To stay informed about further developments, trends, and reports in the Switzerland Cosmetics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence