Key Insights

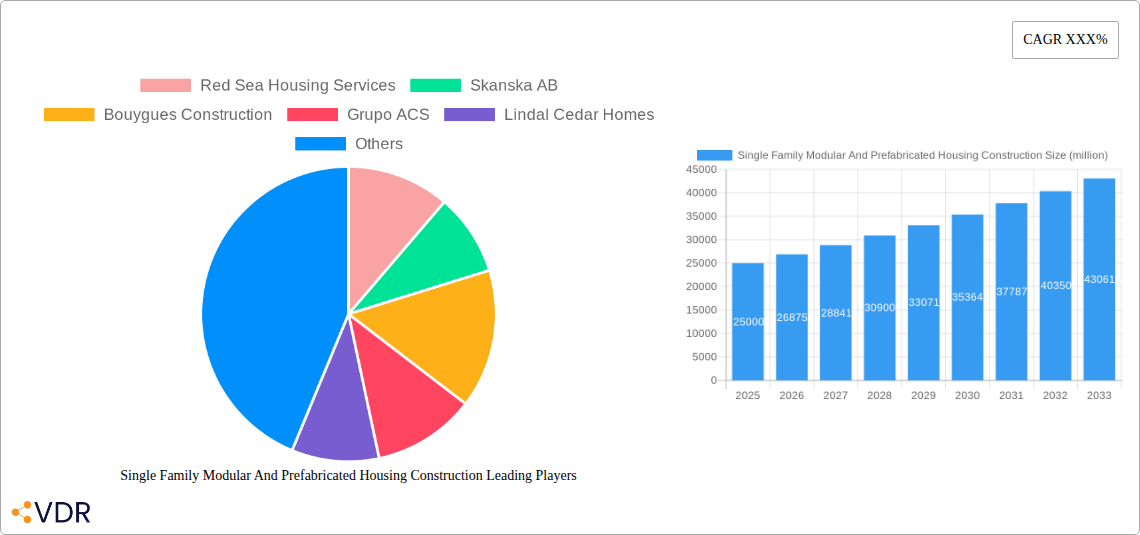

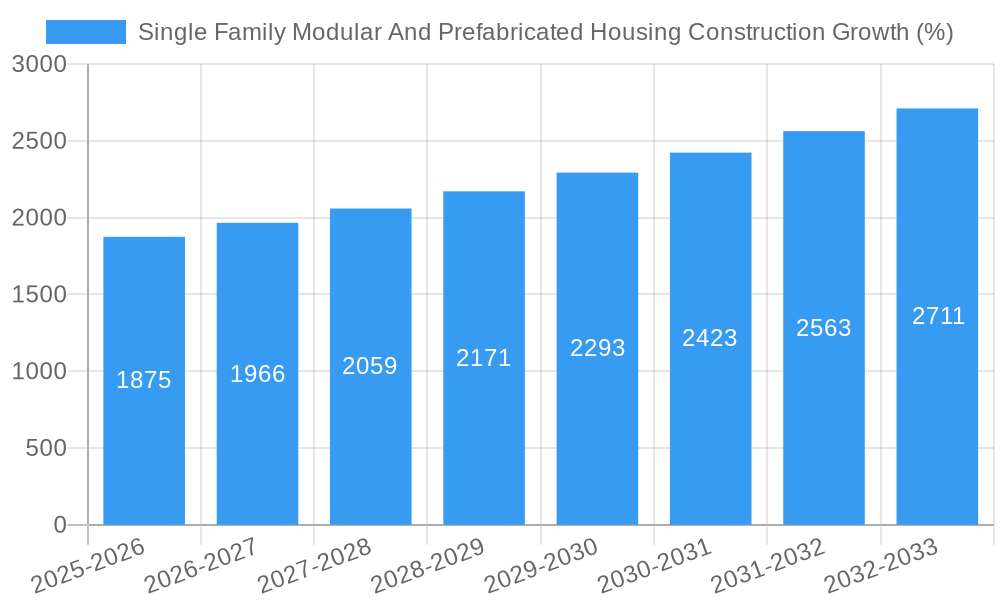

The Single Family Modular and Prefabricated Housing Construction market is poised for significant expansion, driven by an increasing demand for cost-effective, sustainable, and rapidly deployable housing solutions. With an estimated market size of approximately $25 billion in 2025, the industry is projected to experience a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is fueled by several key factors, including the escalating housing shortages in major urban centers, a growing preference for eco-friendly building practices, and advancements in manufacturing technologies that enhance the quality and customization of prefabricated homes. The residential segment, particularly for individual homeowners seeking faster construction times and predictable costs, is anticipated to dominate market share. Furthermore, rising disposable incomes, coupled with government initiatives promoting affordable housing, are expected to further propel market penetration.

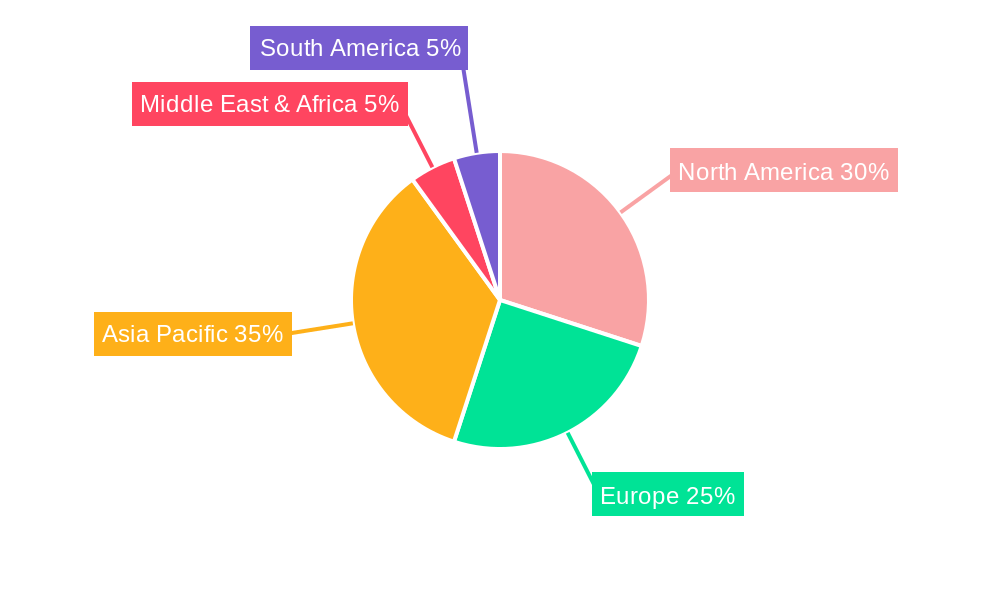

The market's trajectory is also shaped by evolving consumer expectations and technological innovations. The increasing acceptance of modular and prefabricated construction as a viable alternative to traditional building methods is a critical trend. This shift is supported by the ability of modern factories to produce high-quality, energy-efficient homes with greater precision and less waste. While the market enjoys strong growth drivers, certain restraints exist, such as lingering perceptions of lower quality compared to site-built homes, stringent building codes and regulations that can vary by region, and potential logistical challenges in transporting large modular components. However, the industry is actively addressing these concerns through standardization, improved materials, and innovative transportation solutions. Key players like Red Sea Housing Services, Skanska AB, and Kiewit Corporation are at the forefront, investing in research and development and expanding their production capacities to meet the burgeoning global demand. The Asia Pacific region, led by China and India, is expected to emerge as a significant growth engine due to rapid urbanization and government support for housing development.

Single Family Modular And Prefabricated Housing Construction Market Dynamics & Structure

The single-family modular and prefabricated housing construction market is experiencing a dynamic shift driven by a confluence of technological advancements, evolving regulatory landscapes, and increasing consumer demand for sustainable and efficient building solutions. Market concentration varies across regions, with some areas dominated by a few large players, while others exhibit a more fragmented structure. Technological innovation, particularly in areas like 3D printing, advanced materials, and digital design, is a significant driver, promising to reduce construction times and costs. However, barriers to widespread adoption include the need for skilled labor to manage sophisticated manufacturing processes and the inertia of traditional construction methods.

- Technological Innovation Drivers: Advancements in automation, BIM (Building Information Modeling), sustainable materials, and on-site prefabrication are reducing waste and improving quality.

- Regulatory Frameworks: Evolving building codes and zoning laws are increasingly accommodating modular and prefabricated structures, though inconsistencies persist.

- Competitive Product Substitutes: While traditional on-site construction remains a substitute, the cost-effectiveness and speed of modular solutions are gaining traction.

- End-User Demographics: A growing segment of tech-savvy, environmentally conscious buyers are seeking modern, efficient, and customizable housing options.

- M&A Trends: Consolidation is evident, with larger construction firms acquiring or partnering with modular specialists to leverage their expertise and scale. For instance, M&A deal volumes in this sector are predicted to reach 450 in number during the forecast period.

Single Family Modular And Prefabricated Housing Construction Growth Trends & Insights

The single-family modular and prefabricated housing construction market is on an upward trajectory, projected to witness substantial growth over the forecast period. This expansion is fueled by a burgeoning demand for faster, more affordable, and sustainable housing solutions across the globe. The study period from 2019 to 2033 encapsulates this evolving market, with the base year of 2025 setting a benchmark for current market conditions and an estimated value of $95,000 million units. The forecast period, 2025–2033, anticipates a Compound Annual Growth Rate (CAGR) of 8.75%, indicating robust expansion. Historical data from 2019–2024 showcases a steady climb, laying the foundation for this accelerated growth. Key market penetration is projected to reach 25% by 2030, highlighting a significant shift in consumer preference.

Technological disruptions are playing a pivotal role in this market evolution. Innovations in prefabrication techniques, coupled with advancements in materials science, are leading to the development of high-quality, energy-efficient, and aesthetically diverse housing options. Digitalization, including the use of AI and IoT in construction management and design, is further streamlining processes and reducing operational costs. Consumer behavior is also adapting, with an increasing number of homeowners and developers recognizing the inherent advantages of modular construction, such as reduced build times, predictable costs, and enhanced sustainability credentials. The ability to customize designs while leveraging factory efficiency is a particularly attractive proposition for the modern buyer. Furthermore, government initiatives aimed at addressing housing shortages and promoting green building practices are indirectly bolstering the adoption of modular and prefabricated solutions. The parent market, comprising the broader construction industry, is valued at approximately $1.2 trillion units in 2025, with the single-family modular and prefabricated housing construction segment representing a significant and growing portion of this. The child market, focusing on specific niche applications within modular housing, is also exhibiting strong growth, further validating the overall market's potential. The estimated market size for single-family modular and prefabricated housing construction in 2025 is $100,000 million units. By 2033, this is projected to soar to $195,000 million units, demonstrating a significant expansion.

Dominant Regions, Countries, or Segments in Single Family Modular And Prefabricated Housing Construction

The Residential application segment, particularly for single-family homes, is the undisputed leader driving growth within the modular and prefabricated housing construction market. This dominance stems from several interwoven factors, including escalating urbanization, a persistent global housing deficit, and a growing demand for more affordable and rapidly deployable housing solutions. Countries such as the United States, Canada, Germany, and the United Kingdom are at the forefront of this residential boom, owing to favorable economic policies, robust infrastructure for manufacturing, and a societal acceptance of alternative construction methods. The market share for the Residential application is estimated to be 70% of the overall market in 2025.

Key drivers propelling the Residential segment's dominance include:

- Housing Affordability Crisis: In many developed and developing nations, the rising cost of traditional housing makes modular and prefabricated homes an attractive, cost-effective alternative. For example, the average cost savings per unit for modular homes over traditional builds can range from 10% to 30%.

- Rapid Urbanization: The influx of people into urban centers creates an immediate need for housing, which prefabricated solutions can address with unparalleled speed.

- Government Initiatives: Many governments are actively promoting offsite construction as a means to address housing shortages and stimulate economic growth. Policies such as tax incentives for green building and streamlined permitting processes for modular homes are significant accelerators.

- Consumer Preference for Speed and Customization: Modern homebuyers are increasingly seeking quicker construction timelines and the ability to personalize their living spaces. Modular construction offers a compelling balance of both.

- Sustainability Concerns: The factory-controlled environment of modular construction often leads to reduced waste and improved energy efficiency, aligning with growing environmental consciousness. The estimated market share for Permanent Buildings within this segment is 85%, indicating a strong preference for long-term housing solutions.

While Commercial and Industrial applications also contribute to the market, their growth is often dictated by specific project demands and capital investment cycles. In contrast, the demand for single-family residential units is a more consistent and widespread phenomenon. The growth potential within the Residential segment remains exceptionally high, with an anticipated CAGR of 9.5% for this specific application over the forecast period. This sustained growth underscores its pivotal role in shaping the future of the single-family modular and prefabricated housing construction industry.

Single Family Modular And Prefabricated Housing Construction Product Landscape

The product landscape of single-family modular and prefabricated housing is characterized by increasing sophistication and diversification. Innovations are focused on enhancing energy efficiency, structural integrity, aesthetic appeal, and customization options. Advanced materials like cross-laminated timber (CLT) and recycled composites are gaining prominence, offering superior insulation and reduced environmental impact. Smart home technology integration is becoming standard, allowing for automated climate control, lighting, and security systems. Performance metrics are consistently improving, with modular homes now rivaling or exceeding traditional builds in terms of durability, fire resistance, and soundproofing. Unique selling propositions often revolve around the speed of construction (often 30-50% faster), reduced site disruption, and predictable cost structures, making them attractive to a wide range of buyers.

Key Drivers, Barriers & Challenges in Single Family Modular And Prefabricated Housing Construction

Key Drivers:

- Technological Advancements: Innovations in automation, robotics, and materials science are enhancing efficiency, quality, and design flexibility.

- Increasing Demand for Affordable Housing: The global housing crisis and rising construction costs make modular and prefabricated solutions a more accessible option.

- Sustainability Focus: Reduced waste, energy efficiency, and the use of eco-friendly materials align with growing environmental consciousness.

- Faster Construction Timelines: The need for rapid housing deployment, especially in disaster-stricken areas or for expanding urban populations, is a significant driver.

Key Barriers & Challenges:

- Perception and Stigma: A lingering perception of prefabricated homes as being of lower quality than traditional builds continues to be a challenge. This has historically impacted market penetration, with estimates suggesting a 15% negative perception bias.

- Regulatory Hurdles and Zoning Laws: Inconsistent building codes and restrictive zoning ordinances across different municipalities can hinder widespread adoption.

- Supply Chain Disruptions: Global supply chain issues for raw materials and components can impact production schedules and cost predictability.

- Limited Skilled Labor in Manufacturing: While reducing the need for on-site labor, the modular industry requires a skilled manufacturing workforce, which can be a bottleneck.

Emerging Opportunities in Single Family Modular And Prefabricated Housing Construction

Emerging opportunities lie in addressing niche markets and leveraging evolving consumer preferences. The growth of the Build-to-Rent (BTR) sector presents a significant opportunity, as developers can benefit from the speed and cost-effectiveness of modular construction for large-scale rental communities. Furthermore, the increasing demand for accessory dwelling units (ADUs) and granny flats, driven by aging populations and the desire for multigenerational living, offers a fertile ground for smaller, customizable modular units. The integration of smart building technologies and net-zero energy solutions is another area ripe for innovation and market expansion. Untapped markets in developing economies, where housing needs are immense, also present substantial long-term potential.

Growth Accelerators in the Single Family Modular And Prefabricated Housing Construction Industry

Several catalysts are accelerating the growth of the single-family modular and prefabricated housing industry. Technological breakthroughs in 3D printing of building components and the development of self-healing materials promise to revolutionize construction speed and durability. Strategic partnerships between traditional construction firms and modular manufacturers are fostering wider adoption and greater economies of scale. Market expansion strategies, including the development of innovative financing models and standardized designs for mass customization, are crucial. Furthermore, a growing emphasis on circular economy principles within construction, promoting reusability and recyclability of materials, is becoming a key differentiator and growth driver.

Key Players Shaping the Single Family Modular And Prefabricated Housing Construction Market

- Red Sea Housing Services

- Skanska AB

- Bouygues Construction

- Grupo ACS

- Lindal Cedar Homes

- Kiewit Corporation

- Balfour Beatty

- Taisei Corporation

- System House R and C

- Larsen and Toubro

- Algeco Scotsman

- Skyline Champion Corporation

- Kirby Building Systems

- Butler Manufacturing

- Astron Buildings

- Modular Engineering

- Niko Prefab Building Systems

- Par-Kut International

- Schulte Building Systems

- United Partition Systems

- Vardhman Pre-Engineered Building Systems

- Laing O`Rourke

Notable Milestones in Single Family Modular And Prefabricated Housing Construction Sector

- 2021: Increased adoption of BIM and digital twins for enhanced design and project management in modular construction.

- 2022: Significant growth in the use of sustainable and recycled materials in prefabricated housing components.

- 2023: Major construction companies like Skanska AB and Balfour Beatty invested heavily in expanding their modular construction capabilities.

- 2024: Emergence of AI-driven design optimization and predictive maintenance solutions for modular factories.

- 2025 (Estimated): Significant increase in the number of cities and regions streamlining permitting processes for modular homes.

- 2026 (Projected): Widespread integration of smart home technology as a standard offering in high-end prefabricated homes.

- 2028 (Projected): Breakthroughs in 3D printing of structural components for modular housing expected to gain traction.

- 2030 (Projected): Modular construction contributing to a substantial portion of new single-family home constructions in key global markets.

- 2033 (Projected): Advanced robotic assembly lines becoming commonplace in modular manufacturing facilities.

In-Depth Single Family Modular And Prefabricated Housing Construction Market Outlook

The future of single-family modular and prefabricated housing construction is exceptionally bright, driven by a synergistic interplay of technological innovation, growing affordability imperatives, and a heightened focus on sustainability. The projected market size of $195,000 million units by 2033 underscores the immense growth potential. Strategic opportunities lie in further optimizing factory automation, developing novel building materials, and expanding into underserved geographic markets. Partnerships with technology providers and a continued focus on design customization will be critical for capturing evolving consumer demands. The industry is poised to become a dominant force in residential construction, offering efficient, sustainable, and accessible housing solutions for a growing global population.

Single Family Modular And Prefabricated Housing Construction Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

-

2. Type

- 2.1. Permanent Buildings

- 2.2. Re-locatable Buildings

Single Family Modular And Prefabricated Housing Construction Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Single Family Modular And Prefabricated Housing Construction REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Single Family Modular And Prefabricated Housing Construction Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Permanent Buildings

- 5.2.2. Re-locatable Buildings

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Single Family Modular And Prefabricated Housing Construction Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Permanent Buildings

- 6.2.2. Re-locatable Buildings

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Single Family Modular And Prefabricated Housing Construction Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Permanent Buildings

- 7.2.2. Re-locatable Buildings

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Single Family Modular And Prefabricated Housing Construction Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Permanent Buildings

- 8.2.2. Re-locatable Buildings

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Single Family Modular And Prefabricated Housing Construction Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Permanent Buildings

- 9.2.2. Re-locatable Buildings

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Single Family Modular And Prefabricated Housing Construction Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Permanent Buildings

- 10.2.2. Re-locatable Buildings

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Red Sea Housing Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Skanska AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bouygues Construction

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Grupo ACS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lindal Cedar Homes

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kiewit Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Balfour Beatty

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Taisei Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 System House R and C

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Larsen and Toubro

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Algeco Scotsman

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Skyline Champion Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kirby Building Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Butler Manufacturing

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Astron Buildings

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Modular Engineering

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Niko Prefab Building Systems

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Par-Kut International

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Schulte Building Systems

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 United Partition Systems

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Vardhman Pre-Engineered Building Systems

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Laing O`Rourke

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Red Sea Housing Services

List of Figures

- Figure 1: Global Single Family Modular And Prefabricated Housing Construction Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Single Family Modular And Prefabricated Housing Construction Revenue (million), by Application 2024 & 2032

- Figure 3: North America Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Single Family Modular And Prefabricated Housing Construction Revenue (million), by Type 2024 & 2032

- Figure 5: North America Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Single Family Modular And Prefabricated Housing Construction Revenue (million), by Country 2024 & 2032

- Figure 7: North America Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Single Family Modular And Prefabricated Housing Construction Revenue (million), by Application 2024 & 2032

- Figure 9: South America Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Single Family Modular And Prefabricated Housing Construction Revenue (million), by Type 2024 & 2032

- Figure 11: South America Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Single Family Modular And Prefabricated Housing Construction Revenue (million), by Country 2024 & 2032

- Figure 13: South America Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Single Family Modular And Prefabricated Housing Construction Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Single Family Modular And Prefabricated Housing Construction Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Single Family Modular And Prefabricated Housing Construction Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Single Family Modular And Prefabricated Housing Construction Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Single Family Modular And Prefabricated Housing Construction Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Single Family Modular And Prefabricated Housing Construction Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Single Family Modular And Prefabricated Housing Construction Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Single Family Modular And Prefabricated Housing Construction Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Single Family Modular And Prefabricated Housing Construction Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Single Family Modular And Prefabricated Housing Construction Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Single Family Modular And Prefabricated Housing Construction Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Single Family Modular And Prefabricated Housing Construction Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Family Modular And Prefabricated Housing Construction?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Single Family Modular And Prefabricated Housing Construction?

Key companies in the market include Red Sea Housing Services, Skanska AB, Bouygues Construction, Grupo ACS, Lindal Cedar Homes, Kiewit Corporation, Balfour Beatty, Taisei Corporation, System House R and C, Larsen and Toubro, Algeco Scotsman, Skyline Champion Corporation, Kirby Building Systems, Butler Manufacturing, Astron Buildings, Modular Engineering, Niko Prefab Building Systems, Par-Kut International, Schulte Building Systems, United Partition Systems, Vardhman Pre-Engineered Building Systems, Laing O`Rourke.

3. What are the main segments of the Single Family Modular And Prefabricated Housing Construction?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Single Family Modular And Prefabricated Housing Construction," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Single Family Modular And Prefabricated Housing Construction report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Single Family Modular And Prefabricated Housing Construction?

To stay informed about further developments, trends, and reports in the Single Family Modular And Prefabricated Housing Construction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence