Key Insights

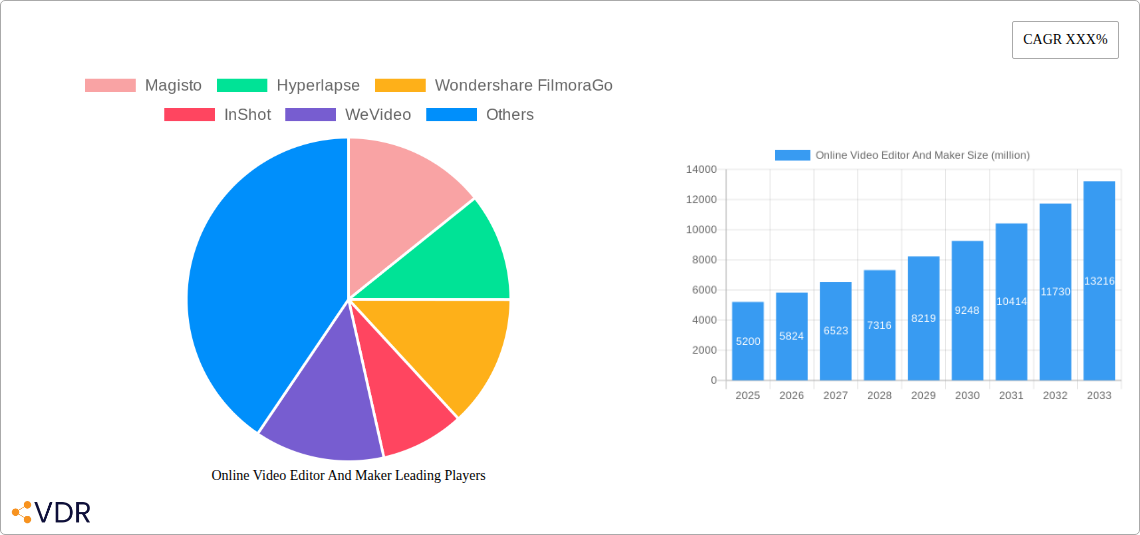

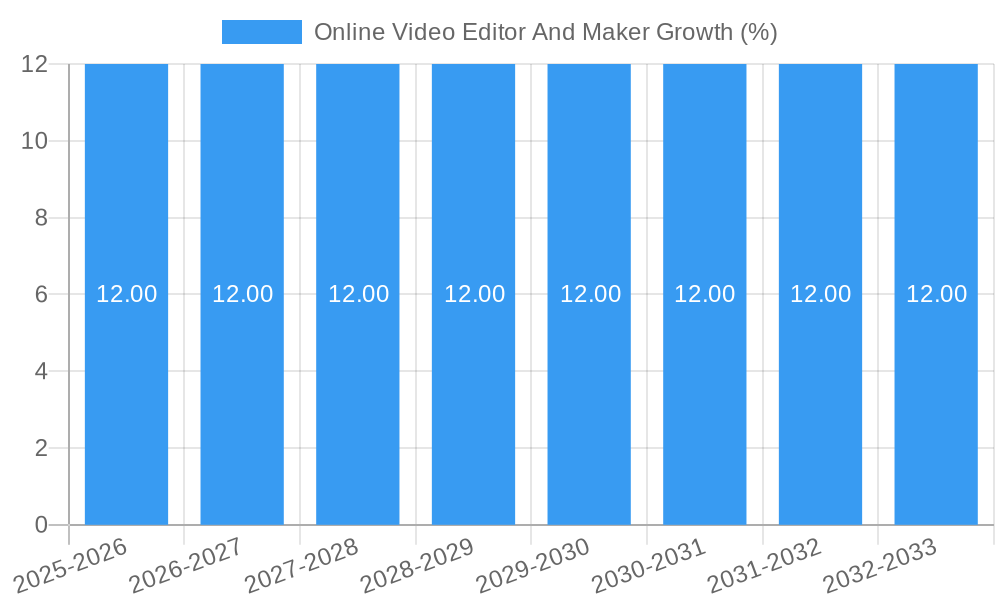

The Online Video Editor and Maker market is poised for substantial growth, driven by the increasing demand for user-friendly, accessible content creation tools. With an estimated market size of approximately $5.2 billion in 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of around 12%, reaching an estimated value of over $9.2 billion by 2033. This robust growth is fueled by the proliferation of social media platforms, the surge in short-form video content, and the growing need for businesses and individuals to create engaging visual narratives. The accessibility of cloud-based solutions, requiring no extensive software installation, further democratizes video editing, attracting a broader user base. Key applications are dominated by mobile phones and computers, reflecting the primary devices used for content consumption and creation today.

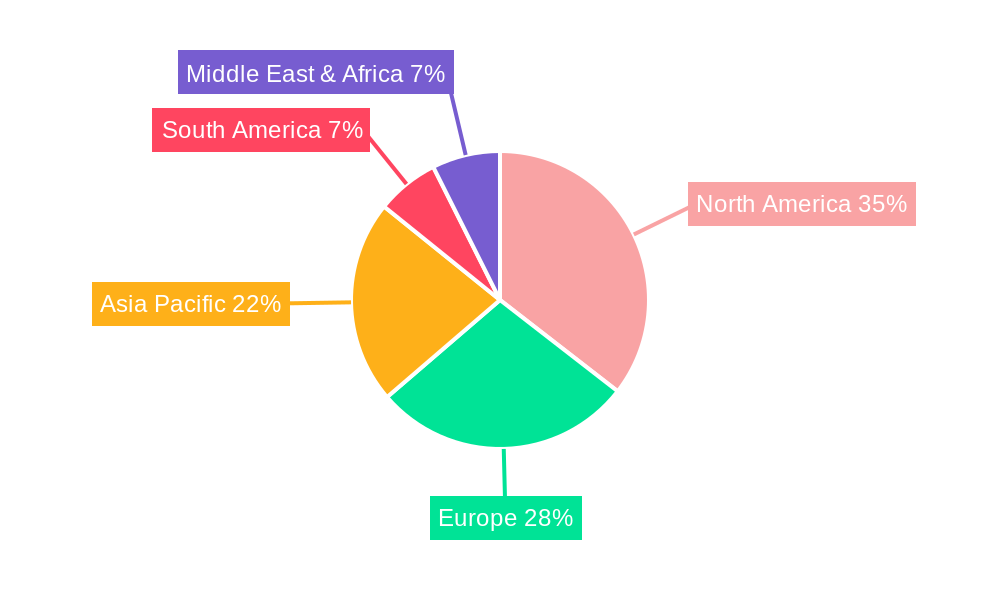

The market is segmented into both toll and free offerings, with a significant portion of users initially exploring free versions before upgrading to premium features for advanced functionalities. Major players like Magisto, Hyperlapse, Wondershare FilmoraGo, and Adobe Premiere Clip are continuously innovating, offering intuitive interfaces and powerful editing capabilities. However, the market also faces restraints such as increasing competition, the need for continuous software updates to keep pace with evolving technologies, and potential challenges in maintaining data security and privacy for cloud-based services. Geographically, North America and Europe are expected to lead the market, owing to early adoption rates and strong digital infrastructure. Asia Pacific, particularly China and India, presents a significant growth opportunity due to its vast user base and rapidly expanding digital economy.

Online Video Editor And Maker Market Dynamics & Structure

The global online video editor and maker market is characterized by a moderately fragmented structure, with key players like Adobe Premiere Clip, Wondershare FilmoraGo, and WeVideo holding significant market influence. Technological innovation remains a primary driver, fueled by advancements in AI-powered editing tools, cloud-based collaboration platforms, and increasingly sophisticated mobile editing capabilities. Regulatory frameworks are generally supportive, with a focus on data privacy and intellectual property rights, though varying by region. Competitive product substitutes include traditional desktop video editing software, though the accessibility and user-friendliness of online tools are steadily eroding this barrier. End-user demographics are diverse, encompassing individual content creators, social media influencers, small to medium-sized businesses (SMBs), and educational institutions. Mergers and acquisitions (M&A) are a notable trend, with larger software companies acquiring smaller, innovative startups to expand their feature sets and market reach. For instance, the acquisition of Magisto by Vimeo in 2019 significantly bolstered Vimeo's video creation capabilities.

- Market Concentration: Moderately fragmented with leading players.

- Technological Innovation: AI-powered editing, cloud collaboration, mobile optimization.

- Regulatory Frameworks: Supportive, with a focus on data privacy and IP rights.

- Competitive Substitutes: Traditional desktop software, though declining.

- End-User Demographics: Content creators, influencers, SMBs, educational institutions.

- M&A Trends: Active, with strategic acquisitions to enhance product offerings.

Online Video Editor And Maker Growth Trends & Insights

The online video editor and maker market is poised for robust growth, driven by the escalating demand for video content across all digital platforms. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033, expanding from an estimated market size of $XX million in 2025 to $XX million by 2033. This expansion is fueled by a burgeoning creator economy and the increasing adoption of video marketing strategies by businesses of all sizes. Mobile video editing applications, such as InShot, KineMaster, and VivaVideo, have witnessed phenomenal adoption rates, particularly among younger demographics and amateur content creators, owing to their intuitive interfaces and powerful features accessible directly from smartphones. The rise of short-form video content on platforms like TikTok and Instagram Reels has further accelerated the demand for quick, efficient, and mobile-friendly video editing solutions.

Technological disruptions are continuously reshaping the landscape. Features like automated video generation, AI-driven object tracking, and sophisticated color correction are becoming standard, lowering the barrier to entry for professional-quality video production. The shift towards cloud-based editing platforms is also a significant trend, enabling seamless collaboration among teams and access to projects from any device, irrespective of location. This accessibility is particularly beneficial for remote work environments and distributed creative teams. Consumer behavior is increasingly oriented towards visually engaging content, making video editing tools indispensable for individuals and organizations looking to capture audience attention. The penetration of online video editors is expected to reach XX% globally by 2033, indicating a substantial market opportunity. The increasing affordability of subscription-based models and the availability of free tiers for basic editing needs are also contributing to wider market adoption, democratizing video creation and empowering a new generation of digital storytellers.

Dominant Regions, Countries, or Segments in Online Video Editor And Maker

The North America region is currently the dominant force in the global online video editor and maker market, projected to hold a significant market share of XX% by 2025. This dominance is attributed to several converging factors: a highly developed digital infrastructure, a strong presence of tech-savvy early adopters, and a thriving content creation ecosystem. The United States, in particular, leads this charge, driven by its robust economy and a vast number of individual creators, influencers, and businesses that rely heavily on digital marketing and social media engagement. The high disposable income in the region supports the adoption of both paid and subscription-based video editing tools, contributing to the market value.

- North America's Dominance Factors:

- Economic Strength: High GDP and consumer spending power driving adoption of premium tools.

- Technological Infrastructure: Widespread high-speed internet access facilitating cloud-based editing.

- Content Creator Hub: Large population of YouTubers, social media influencers, and digital marketers.

- Early Adoption of Trends: Rapid uptake of new technologies and video formats.

The Application: Mobile Phone segment is a critical growth engine within the online video editor and maker market, expected to exhibit a CAGR of XX% during the forecast period. This surge is directly linked to the ubiquitous nature of smartphones and the increasing sophistication of mobile operating systems and hardware. Consumers are increasingly creating and editing videos on their mobile devices, driven by the convenience and immediacy it offers. Applications like PowerDirector, Splice, and Quik have capitalized on this trend by offering powerful yet user-friendly interfaces optimized for touchscreens. The ease with which users can capture, edit, and share video content directly from their phones has democratized video creation, making it accessible to a broader audience than ever before. The market penetration of mobile video editing is projected to reach XX% in this segment by 2033.

- Mobile Phone Application Drivers:

- Smartphone Penetration: Global ubiquity of smartphones.

- User-Friendly Interfaces: Intuitive design for on-the-go editing.

- Social Media Integration: Seamless sharing to platforms like Instagram, TikTok, and Facebook.

- Advancements in Mobile Technology: Improved camera capabilities and processing power.

Online Video Editor And Maker Product Landscape

The online video editor and maker market is witnessing continuous product innovation, with a focus on enhancing user experience and expanding creative possibilities. Recent developments include the integration of AI-driven features such as automatic scene detection, intelligent video stabilization, and advanced color grading tools. Companies are also prioritizing cloud-based collaboration features, enabling real-time co-editing and asset sharing among teams. Performance metrics are steadily improving, with faster rendering speeds and support for higher resolution video formats. Unique selling propositions often revolve around specialized tools for specific content types, such as social media templates or professional-grade effects. Companies like Blender offer powerful open-source solutions, while Adobe Premiere Clip provides seamless integration with Adobe's Creative Cloud suite.

Key Drivers, Barriers & Challenges in Online Video Editor And Maker

Key Drivers: The primary forces propelling the online video editor and maker market include the pervasive growth of video content consumption across social media, streaming platforms, and digital marketing channels. Technological advancements, particularly in AI and cloud computing, are democratizing professional-level video editing, making it accessible to a wider audience. The burgeoning creator economy and the increasing reliance of businesses on video for brand storytelling and customer engagement are also significant drivers.

- Technological Advancements: AI-powered editing, cloud accessibility, mobile optimization.

- Content Consumption Growth: Surging demand for video across platforms.

- Creator Economy Expansion: Rise of influencers and content creators.

- Business Adoption: Video as a core marketing and communication tool.

Key Barriers & Challenges: Despite the positive outlook, the market faces challenges such as intense competition, leading to price wars and pressure on profit margins. High initial development costs for advanced features and the need for continuous updates to keep pace with evolving technologies represent significant investment hurdles. Bandwidth limitations and potential latency issues in cloud-based editing can also hinder user experience. Furthermore, data security and privacy concerns for user-generated content can act as a restraint.

- Intense Competition: Price sensitivity and margin pressure.

- High Development Costs: Continuous investment in R&D.

- Technical Limitations: Bandwidth and latency issues.

- Data Security & Privacy: Concerns over user-generated content.

Emerging Opportunities in Online Video Editor And Maker

Emerging opportunities in the online video editor and maker market lie in the untapped potential of niche markets and the development of specialized tools. The growing demand for interactive video content, virtual and augmented reality (VR/AR) video editing, and personalized video creation presents significant avenues for innovation. Leveraging AI for automated content summarization and highlight generation for long-form videos is another promising area. Furthermore, the expansion of online video editing into educational technology (EdTech) for creating engaging learning materials and into e-commerce for product showcase videos offers substantial growth prospects.

Growth Accelerators in the Online Video Editor And Maker Industry

Long-term growth in the online video editor and maker industry will be significantly accelerated by breakthroughs in artificial intelligence, leading to more automated and intuitive editing experiences. Strategic partnerships between software providers and social media platforms will facilitate seamless integration and content distribution. The continued expansion of high-speed internet infrastructure globally will further boost the adoption of cloud-based solutions. Furthermore, market expansion into emerging economies and the development of highly localized editing tools will unlock new customer bases and drive sustained revenue growth.

Key Players Shaping the Online Video Editor And Maker Market

- Magisto

- Hyperlapse

- Wondershare FilmoraGo

- InShot

- WeVideo

- Splice

- Adobe Premiere Clip

- PicPlayPost

- Blender

- Lightworks

- Shotcut

- VSDC Free Video Editor

- Machete Video Editor Lite

- Avidemux

- HitFilm

- VideoShow

- PowerDirector

- Quik

- KineMaster

- VivaVideo

Notable Milestones in Online Video Editor And Maker Sector

- 2019: Vimeo acquires Magisto, strengthening its video creation suite.

- 2020: Significant surge in mobile video editing app downloads due to increased remote work and content creation.

- 2021: Introduction of AI-powered features like auto-reframing and smart object tracking in several leading editors.

- 2022: Rise of short-form video editing tools and templates catering to platforms like TikTok and Instagram Reels.

- 2023: Enhanced cloud collaboration features become standard, enabling real-time multi-user editing.

- 2024: Increased focus on sustainability in software development and user workflows.

In-Depth Online Video Editor And Maker Market Outlook

The future of the online video editor and maker market is exceptionally promising, driven by pervasive technological innovation and an ever-growing reliance on visual communication. Growth accelerators will continue to be fueled by AI advancements, leading to more sophisticated automated editing and content creation capabilities. Strategic alliances with key content distribution platforms will solidify market penetration, while expansion into underserved regions will unlock substantial new revenue streams. The ongoing evolution of consumer preferences towards more dynamic and engaging video formats will ensure a sustained demand for powerful yet accessible editing tools.

Online Video Editor And Maker Segmentation

-

1. Application

- 1.1. Mobile Phone

- 1.2. Computer

-

2. Type

- 2.1. Toll

- 2.2. Free

Online Video Editor And Maker Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Online Video Editor And Maker REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Video Editor And Maker Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Mobile Phone

- 5.1.2. Computer

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Toll

- 5.2.2. Free

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Online Video Editor And Maker Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Mobile Phone

- 6.1.2. Computer

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Toll

- 6.2.2. Free

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Online Video Editor And Maker Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Mobile Phone

- 7.1.2. Computer

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Toll

- 7.2.2. Free

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Online Video Editor And Maker Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Mobile Phone

- 8.1.2. Computer

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Toll

- 8.2.2. Free

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Online Video Editor And Maker Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Mobile Phone

- 9.1.2. Computer

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Toll

- 9.2.2. Free

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Online Video Editor And Maker Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Mobile Phone

- 10.1.2. Computer

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Toll

- 10.2.2. Free

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Magisto

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyperlapse

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wondershare FilmoraGo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 InShot

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 WeVideo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Splice

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adobe Premiere Clip

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PicPlayPost

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Blender

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lightworks

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shotcut

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 VSDC Free Video Editor

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Machete Video Editor Lite

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Avidemux

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HitFilm

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 VideoShow

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 PowerDirector

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Quik

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 KineMaster

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 VivaVideo

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Magisto

List of Figures

- Figure 1: Global Online Video Editor And Maker Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Online Video Editor And Maker Revenue (million), by Application 2024 & 2032

- Figure 3: North America Online Video Editor And Maker Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Online Video Editor And Maker Revenue (million), by Type 2024 & 2032

- Figure 5: North America Online Video Editor And Maker Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Online Video Editor And Maker Revenue (million), by Country 2024 & 2032

- Figure 7: North America Online Video Editor And Maker Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Online Video Editor And Maker Revenue (million), by Application 2024 & 2032

- Figure 9: South America Online Video Editor And Maker Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Online Video Editor And Maker Revenue (million), by Type 2024 & 2032

- Figure 11: South America Online Video Editor And Maker Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Online Video Editor And Maker Revenue (million), by Country 2024 & 2032

- Figure 13: South America Online Video Editor And Maker Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Online Video Editor And Maker Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Online Video Editor And Maker Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Online Video Editor And Maker Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Online Video Editor And Maker Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Online Video Editor And Maker Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Online Video Editor And Maker Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Online Video Editor And Maker Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Online Video Editor And Maker Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Online Video Editor And Maker Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Online Video Editor And Maker Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Online Video Editor And Maker Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Online Video Editor And Maker Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Online Video Editor And Maker Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Online Video Editor And Maker Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Online Video Editor And Maker Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Online Video Editor And Maker Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Online Video Editor And Maker Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Online Video Editor And Maker Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Video Editor And Maker Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Online Video Editor And Maker Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Online Video Editor And Maker Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Online Video Editor And Maker Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Online Video Editor And Maker Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Online Video Editor And Maker Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Online Video Editor And Maker Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Online Video Editor And Maker Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Online Video Editor And Maker Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Online Video Editor And Maker Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Online Video Editor And Maker Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Online Video Editor And Maker Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Online Video Editor And Maker Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Online Video Editor And Maker Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Online Video Editor And Maker Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Online Video Editor And Maker Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Online Video Editor And Maker Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Online Video Editor And Maker Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Online Video Editor And Maker Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Online Video Editor And Maker Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Video Editor And Maker?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Online Video Editor And Maker?

Key companies in the market include Magisto, Hyperlapse, Wondershare FilmoraGo, InShot, WeVideo, Splice, Adobe Premiere Clip, PicPlayPost, Blender, Lightworks, Shotcut, VSDC Free Video Editor, Machete Video Editor Lite, Avidemux, HitFilm, VideoShow, PowerDirector, Quik, KineMaster, VivaVideo.

3. What are the main segments of the Online Video Editor And Maker?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Video Editor And Maker," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Video Editor And Maker report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Video Editor And Maker?

To stay informed about further developments, trends, and reports in the Online Video Editor And Maker, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence