Key Insights

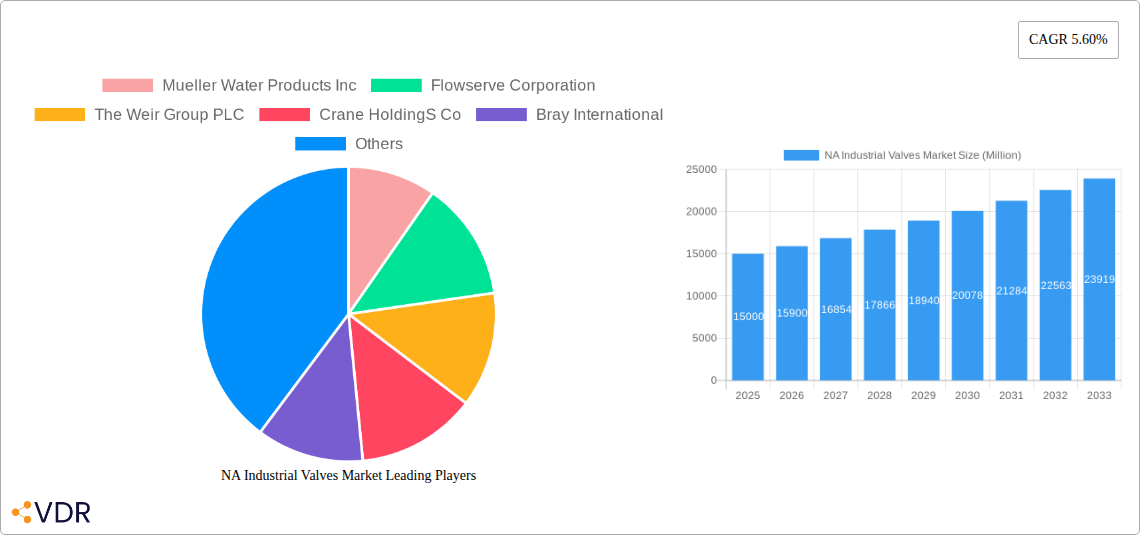

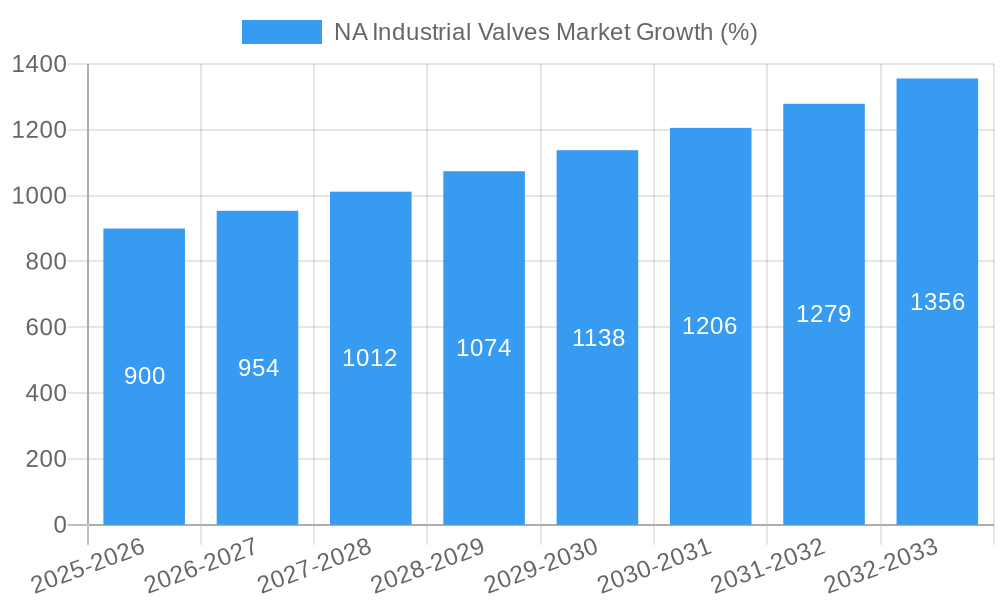

The North American industrial valves market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing investments in infrastructure development, particularly in water and wastewater management, and the burgeoning oil and gas sector. The market's Compound Annual Growth Rate (CAGR) of 5.60% from 2025 to 2033 signifies a considerable expansion, fueled by the rising demand for automation and advanced valve technologies across various industries. Key drivers include stringent environmental regulations prompting upgrades to existing valve infrastructure, the growing adoption of smart valves for improved efficiency and remote monitoring, and the increasing focus on process optimization and safety in industrial operations. Growth is further supported by the expanding chemical processing and food processing sectors. While the market faces potential restraints such as fluctuating raw material prices and potential supply chain disruptions, the overall positive outlook remains strong, particularly for segments like quarter-turn valves and ball valves, which are seeing widespread adoption due to their ease of use and durability. Geographic distribution shows North America maintaining a significant market share, with the United States as the primary driver of growth within the region. The consistent growth in industrial activity and the ongoing focus on upgrading aging infrastructure are poised to bolster this positive trajectory for the foreseeable future. Major players like Mueller Water Products Inc., Flowserve Corporation, and Emerson Electric Co. are actively shaping the market landscape through innovation and strategic acquisitions.

The competitive landscape is characterized by both established multinational corporations and specialized valve manufacturers. This dynamic competition is fostering innovation, leading to the development of more efficient, reliable, and sustainable valve solutions. Furthermore, the increasing integration of digital technologies, including IoT sensors and predictive maintenance capabilities, is further transforming the market. This trend towards smart valves is expected to significantly enhance operational efficiency and reduce downtime, thereby boosting the overall demand for advanced valve technologies. Continued investment in R&D, focusing on materials science and automation, will likely shape the trajectory of the market in the coming years. The expansion into niche applications, such as renewable energy and advanced manufacturing, also presents promising avenues for growth, reinforcing the optimistic outlook for the North American industrial valves market.

North America Industrial Valves Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America industrial valves market, encompassing market size, growth trends, competitive landscape, and future outlook. It delves into the intricacies of various segments, including product types (quarter-turn valves, multi-turn valves, etc.), applications (oil and gas, water management, etc.), and geographic regions (United States, Canada, Mexico). The report utilizes data from 2019-2024 (historical period), with estimations for 2025 (base and estimated year) and forecasts extending to 2033 (forecast period). This in-depth analysis is invaluable for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market. The total market value in 2025 is estimated at xx Million units.

NA Industrial Valves Market Market Dynamics & Structure

The North American industrial valves market is characterized by a moderately concentrated structure with a few dominant players and numerous smaller niche players. Technological innovation, particularly in smart valves and automation, is a key driver, alongside stringent regulatory frameworks aimed at improving safety and efficiency. Competitive pressures stem from both established players and new entrants offering innovative solutions. The market also witnesses significant M&A activity, as companies seek to expand their product portfolios and market reach. The estimated value of M&A deals in the past five years totaled approximately xx Million units.

- Market Concentration: The top five players hold an estimated xx% market share.

- Technological Innovation: Focus on smart valves, automation, and improved materials is driving growth.

- Regulatory Landscape: Compliance with safety and environmental standards influences market dynamics.

- Competitive Substitutes: Advances in alternative technologies pose a moderate competitive threat.

- End-User Demographics: The oil and gas, water & wastewater, and chemical sectors are major end-users.

- M&A Trends: Consolidation and expansion through acquisitions are prevalent strategies. Innovation barriers include high R&D costs and the need for specialized expertise.

NA Industrial Valves Market Growth Trends & Insights

The North American industrial valves market experienced significant growth between 2019 and 2024, driven by increasing industrial activity, infrastructure development, and investments in oil and gas extraction. This growth is expected to continue at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million units by 2033. Market penetration in key sectors, like water management and oil & gas, is also increasing due to ongoing modernization and expansion projects. Technological disruptions, such as the adoption of smart valves and digitalization, are further accelerating market expansion. Consumer behavior is shifting towards more sustainable and efficient valve solutions, demanding higher performance and lower maintenance. The overall adoption rate of advanced valve technologies is projected to rise from xx% in 2025 to xx% by 2033.

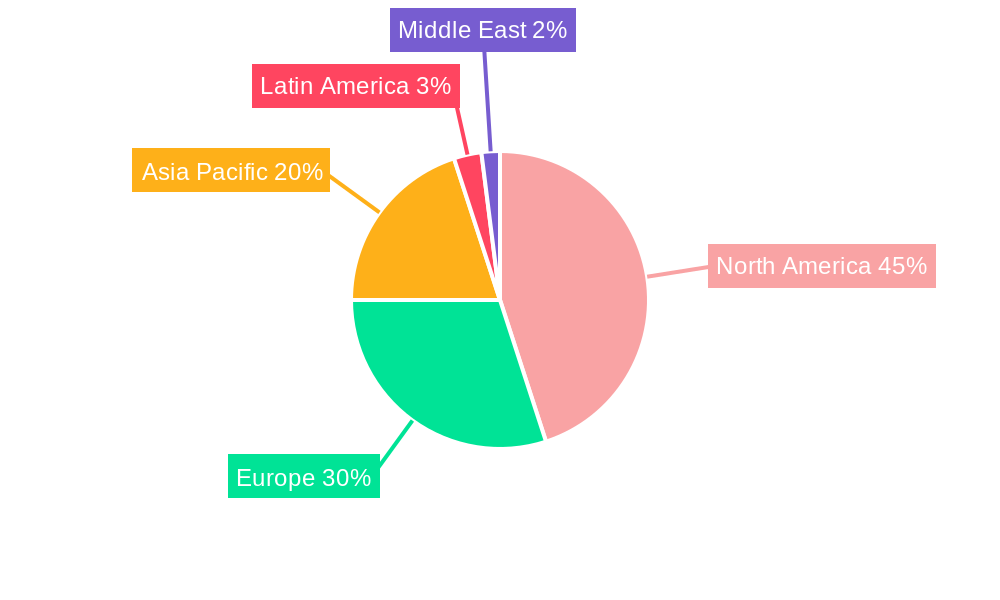

Dominant Regions, Countries, or Segments in NA Industrial Valves Market

The United States remains the dominant region, accounting for approximately xx% of the total market share in 2025, followed by Canada (xx%) and Mexico (xx%). Within the product segment, quarter-turn valves are the largest segment, holding xx% of the market, followed by multi-turn valves and other products. In terms of applications, the oil and gas sector dominates, representing xx% of the market due to the extensive use of valves in drilling, processing, and transportation. However, the water and wastewater management sector is experiencing rapid growth, driven by ongoing infrastructure investments.

- Key Drivers (United States): Robust industrial activity, significant infrastructure investments, and technological advancements.

- Key Drivers (Canada): Growing energy sector and investments in oil sands extraction.

- Key Drivers (Mexico): Expansion of the manufacturing and chemical industries.

- Dominant Segments: Quarter-turn valves due to their ease of operation and wide applications; Oil & Gas sector due to high demand in upstream and downstream operations; and The United States owing to its large industrial base.

NA Industrial Valves Market Product Landscape

The NA industrial valves market showcases a diverse product landscape, encompassing a wide range of valves categorized by type (globe, ball, butterfly, gate, plug, and others), and application. Recent innovations focus on enhancing efficiency, reducing maintenance requirements, and improving safety features. Smart valves with integrated sensors and remote monitoring capabilities are gaining traction, offering real-time data and predictive maintenance capabilities. These advanced features are coupled with improved materials for enhanced durability and corrosion resistance, resulting in a higher value proposition for end-users.

Key Drivers, Barriers & Challenges in NA Industrial Valves Market

Key Drivers: Growing industrialization, particularly in the energy and water sectors; Increasing demand for automation and smart technologies; Stringent environmental regulations driving the adoption of efficient and sustainable valves; Government investments in infrastructure development projects.

Key Challenges: Supply chain disruptions impacting raw material availability and pricing; Fluctuations in commodity prices influencing overall costs; Intense competition from both established players and new entrants; Regulatory compliance requirements requiring significant investments. The estimated impact of supply chain disruptions on market growth in 2024 was approximately xx% reduction.

Emerging Opportunities in NA Industrial Valves Market

Emerging opportunities exist in the development and adoption of smart valves, providing real-time monitoring and predictive maintenance. The integration of digital technologies, such as IoT and cloud computing, offers opportunities for optimizing valve performance and reducing operational costs. The growing demand for sustainable and eco-friendly valves presents another significant opportunity for manufacturers. Expansion into untapped markets, such as renewable energy and water treatment, also presents significant growth potential.

Growth Accelerators in the NA Industrial Valves Market Industry

Technological advancements, particularly in materials science and automation, are accelerating growth. Strategic partnerships and collaborations between valve manufacturers and technology providers are fostering innovation. Market expansion into new applications and regions, alongside increased investment in research and development, further fuels market expansion. The increasing adoption of digital twins and predictive maintenance strategies will play a significant role in enhancing operational efficiency and driving demand.

Key Players Shaping the NA Industrial Valves Market Market

- Mueller Water Products Inc

- Flowserve Corporation

- The Weir Group PLC

- Crane HoldingS Co

- Bray International

- Baker Hughes

- ALFA LAVAL AB

- Emerson Electric Co

- CIRCOR International Inc

- Apollo Valves

- ITT Inc

- Schlumberger Limited

- KITZ Corporation

- Trillium Flow Technologies

- Eaton Corporation

Notable Milestones in NA Industrial Valves Market Sector

- August 2022: FloWorks International LLC acquired Flotech Inc., expanding its product portfolio and distribution network.

- April 2022: Emerson launched a new three-way Series 090 valve, enhancing its miniature solenoid valve line and catering to the growing medical device market.

In-Depth NA Industrial Valves Market Market Outlook

The North American industrial valves market is poised for continued growth, driven by technological advancements, increasing industrial activity, and robust infrastructure investment. The focus on smart valves, digitalization, and sustainable solutions will shape future market dynamics. Strategic partnerships and collaborations will be crucial for navigating competitive pressures and capturing emerging opportunities within various market segments. The long-term outlook remains positive, presenting significant potential for both established players and new entrants.

NA Industrial Valves Market Segmentation

-

1. Type

- 1.1. Globe Valve

- 1.2. Ball Valve

- 1.3. Butterfly Valve

- 1.4. Gate Valve

- 1.5. Plug Valve

- 1.6. Other Types

-

2. Product

- 2.1. Quarter-turn Valve

- 2.2. Multi-turn Valve

- 2.3. Other Products

-

3. Application

- 3.1. Power

- 3.2. Water and Wastewater Management

- 3.3. Chemicals

- 3.4. Oil and Gas

- 3.5. Other

-

4. North America

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

NA Industrial Valves Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

NA Industrial Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Valves from Healthcare and Pharmaceuticals Industries due to COVID-19 pandemic.; Growing Demand from the Power Industry

- 3.3. Market Restrains

- 3.3.1 ; Lack of Common Platform for Zigbee

- 3.3.2 Profibus

- 3.3.3 and Ethernet

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Power Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. NA Industrial Valves Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Globe Valve

- 5.1.2. Ball Valve

- 5.1.3. Butterfly Valve

- 5.1.4. Gate Valve

- 5.1.5. Plug Valve

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Quarter-turn Valve

- 5.2.2. Multi-turn Valve

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Power

- 5.3.2. Water and Wastewater Management

- 5.3.3. Chemicals

- 5.3.4. Oil and Gas

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by North America

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America NA Industrial Valves Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Asia Pacific NA Industrial Valves Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Europe NA Industrial Valves Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America NA Industrial Valves Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East NA Industrial Valves Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mueller Water Products Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flowserve Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Weir Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crane HoldingS Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bray International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Hughes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ALFA LAVAL AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Emerson Electric Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CIRCOR International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apollo Valves

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ITT Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Schlumberger Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KITZ Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Trillium Flow Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Eaton Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Mueller Water Products Inc

List of Figures

- Figure 1: NA Industrial Valves Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: NA Industrial Valves Market Share (%) by Company 2024

List of Tables

- Table 1: NA Industrial Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: NA Industrial Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: NA Industrial Valves Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: NA Industrial Valves Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: NA Industrial Valves Market Revenue Million Forecast, by North America 2019 & 2032

- Table 6: NA Industrial Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: NA Industrial Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: NA Industrial Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: NA Industrial Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: NA Industrial Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: NA Industrial Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: NA Industrial Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: NA Industrial Valves Market Revenue Million Forecast, by Product 2019 & 2032

- Table 19: NA Industrial Valves Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: NA Industrial Valves Market Revenue Million Forecast, by North America 2019 & 2032

- Table 21: NA Industrial Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico NA Industrial Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Industrial Valves Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the NA Industrial Valves Market?

Key companies in the market include Mueller Water Products Inc, Flowserve Corporation, The Weir Group PLC, Crane HoldingS Co, Bray International, Baker Hughes, ALFA LAVAL AB, Emerson Electric Co, CIRCOR International Inc, Apollo Valves, ITT Inc, Schlumberger Limited, KITZ Corporation, Trillium Flow Technologies, Eaton Corporation.

3. What are the main segments of the NA Industrial Valves Market?

The market segments include Type, Product, Application, North America.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Valves from Healthcare and Pharmaceuticals Industries due to COVID-19 pandemic.; Growing Demand from the Power Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Power Industry.

7. Are there any restraints impacting market growth?

; Lack of Common Platform for Zigbee. Profibus. and Ethernet.

8. Can you provide examples of recent developments in the market?

August 2022 - FloWorks International LLC, a distribution platform for specialty flow control, announced that it had acquired Flotech Inc., a value-added distributor and servicer of industrial valves. The company's products include industrial and isolation valves, gate valves, globe valves, check valves, actuation and controls, safety and relief valves, and others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Industrial Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Industrial Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Industrial Valves Market?

To stay informed about further developments, trends, and reports in the NA Industrial Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence