Key Insights

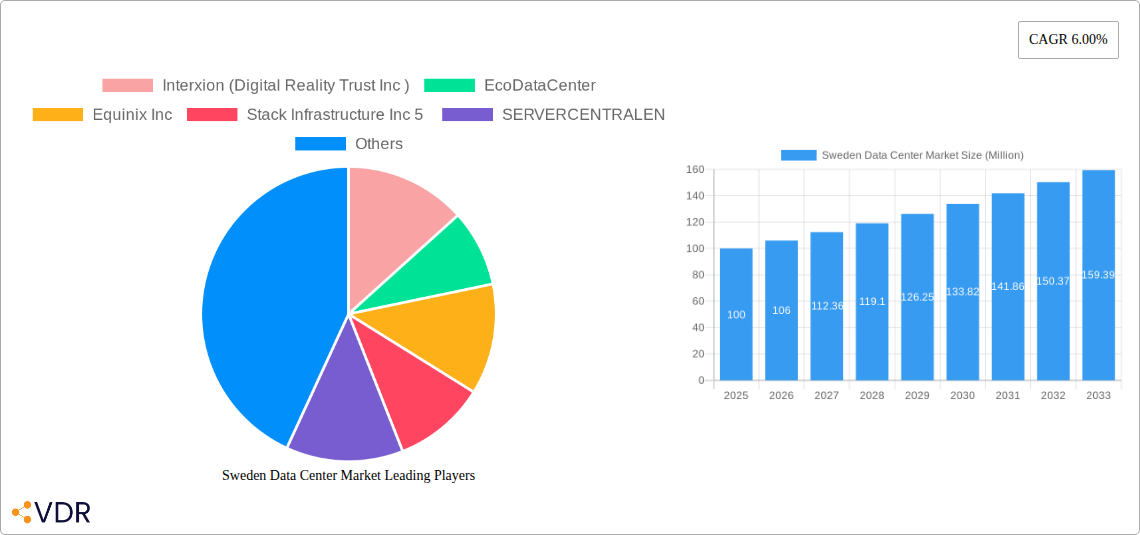

The Swedish data center market, valued at approximately €[Estimate based on market size XX and value unit Million. Assume XX is a reasonable number given the presence of major players like Equinix and Interxion. For example, if XX were 100, the value would be €100 Million in 2025], exhibits robust growth, projected at a CAGR of 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and digital services across various sectors, including finance, telecommunications, and government, necessitates substantial data storage and processing capabilities. Furthermore, stringent data privacy regulations in Sweden and the EU (GDPR) are driving companies to invest in local data center infrastructure to ensure compliance. The rise of edge computing, demanding low-latency data processing closer to end-users, also contributes to market growth. Stockholm, as a major tech hub, remains a key hotspot, attracting significant investments in data center capacity. Market segmentation reveals a diverse landscape, with varying sizes (small to massive) and tiers (Tier 1 to others) of data centers catering to diverse needs. The significant presence of both international players (Equinix, Interxion) and domestic providers (Bahnhof, ServerCentralen) indicates a competitive yet dynamic market environment.

However, challenges persist. Energy costs in Sweden, though relatively sustainable due to hydropower, still influence operational expenses. Competition among existing providers necessitates strategic investments in cutting-edge technology and efficient operations to maintain market share. Land availability in strategic locations like Stockholm might also pose a constraint on future expansion. The market's future growth trajectory hinges on the continued digital transformation of Swedish industries, government investment in digital infrastructure, and the successful management of energy costs and land acquisition challenges. Companies will need to focus on optimizing their facilities, providing sustainable solutions, and meeting the evolving demands of a increasingly connected world. The ongoing development of 5G networks and the increasing demand for high-speed internet connectivity are expected to further drive the demand for data center services in the coming years.

Sweden Data Center Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Sweden Data Center market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The analysis delves into various segments including Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1, Tier 2, Tier 3, Tier 4), Absorption (Utilized, Non-Utilized, Other End User), and key hotspots like Stockholm and the Rest of Sweden. The report is essential for industry professionals, investors, and stakeholders seeking to understand the current state and future trajectory of this rapidly evolving market.

Sweden Data Center Market Dynamics & Structure

The Swedish data center market exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with several key players competing alongside smaller, specialized providers. Technological innovation, particularly in areas like sustainable energy integration and edge computing, is a significant driver. The regulatory framework, while supportive of digital infrastructure development, presents challenges in navigating permitting and environmental compliance. Competitive product substitutes, such as cloud services, exert pressure on traditional colocation models. The end-user demographics are diverse, encompassing enterprises across various sectors, with a growing reliance on data-driven operations. M&A activity remains relatively active, with larger players seeking to consolidate their market positions.

- Market Concentration: Moderate, with a few dominant players and several smaller niche providers. xx% market share held by top 5 players in 2024.

- Technological Innovation: Strong focus on sustainability (renewable energy), edge computing, and improved network connectivity.

- Regulatory Framework: Supportive but complex, requiring careful navigation of permitting and environmental regulations.

- Competitive Substitutes: Cloud services pose a competitive threat to traditional colocation offerings.

- End-User Demographics: Diverse, including enterprises across various sectors (finance, telecommunications, healthcare).

- M&A Activity: Moderate level of mergers and acquisitions, driven by consolidation and expansion strategies. xx M&A deals in the period 2019-2024.

Sweden Data Center Market Growth Trends & Insights

The Sweden Data Center market has experienced significant growth over the historical period (2019-2024), driven by increasing digitalization across various sectors and robust demand for data storage and processing capacity. The market is expected to maintain a strong growth trajectory throughout the forecast period (2025-2033), fueled by ongoing digital transformation initiatives, the expansion of cloud services, and the rising adoption of data-intensive technologies like AI and IoT. Technological disruptions, such as the emergence of hyperscale data centers and advancements in energy-efficient cooling technologies, are reshaping the market landscape. Consumer behavior shifts towards greater reliance on digital services and data-driven decision-making further accelerate market growth. The CAGR for the market is estimated to be xx% during the forecast period. Market penetration is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Sweden Data Center Market

Stockholm is the undisputed dominant region in the Sweden data center market, accounting for the majority of existing capacity and new development projects. This dominance is attributed to factors such as superior infrastructure, skilled workforce, connectivity to major international networks, and proximity to key markets. Other regions are experiencing growth, but at a slower pace compared to Stockholm. Within the segments, large and mega data centers constitute the dominant share of the market due to economies of scale and growing demand from hyperscale cloud providers. Utilized absorption capacity significantly outpaces non-utilized capacity reflecting robust market demand.

- Key Drivers for Stockholm’s Dominance:

- Superior connectivity and network infrastructure.

- Highly skilled workforce.

- Proximity to major businesses and markets.

- Established ecosystem of supporting services.

- Growth Potential in Other Regions: Gradual expansion is expected in other regions driven by governmental incentives and investments in infrastructure.

- Dominant Segments: Large and Mega data centers, and Utilized Absorption.

Sweden Data Center Market Product Landscape

The Swedish data center market offers a diverse range of products and services, including colocation, managed services, cloud services, and specialized infrastructure solutions. Key product innovations focus on energy efficiency, scalability, and security. Data centers increasingly incorporate sustainable energy solutions (e.g., renewable energy sources) to reduce environmental impact and operational costs. Advancements in cooling technologies, virtualization, and automation are improving efficiency and reducing energy consumption. Unique selling propositions include high levels of security, network redundancy, and access to renewable energy.

Key Drivers, Barriers & Challenges in Sweden Data Center Market

Key Drivers: The increasing adoption of digital technologies across various sectors is a primary driver. Strong government support for digital infrastructure development and a commitment to sustainable energy further stimulate growth. The demand for high-capacity, reliable data storage and processing solutions fuels investment in new data center facilities.

Key Challenges: Securing sufficient power capacity to meet the rising demand for energy-intensive data centers presents a major hurdle. Land availability and permitting processes can also create delays and constraints. Competition from established players and the emergence of new entrants pose ongoing competitive pressure. The escalating cost of construction and energy creates challenges in maintaining cost-effectiveness.

Emerging Opportunities in Sweden Data Center Market

Edge computing deployments represent a substantial opportunity for growth. The increasing adoption of AI and machine learning is creating demand for advanced data processing infrastructure. Expansion into underserved regions beyond Stockholm presents a significant opportunity for data center providers. Focus on sustainable practices is attractive to environmentally conscious companies.

Growth Accelerators in the Sweden Data Center Market Industry

Strategic partnerships between data center operators, energy providers, and technology companies are accelerating market growth. Technological advancements in energy efficiency, cooling, and security enhance the appeal of data center services. Government initiatives to promote digitalization and sustainable infrastructure development significantly boost market expansion. Investments in new infrastructure and capacity expansion further contribute to the industry’s rapid growth.

Key Players Shaping the Sweden Data Center Market Market

- Interxion (Digital Reality Trust Inc)

- EcoDataCenter

- Equinix Inc

- Stack Infrastructure Inc

- SERVERCENTRALEN

- Inleed (Yelles AB)

- Hydro66 Svenska AB(Northern Data AG)

- Bahnhof

- Multigrid Solutions AB

- Conapto AB(Designrepublic se)

- High Sec Hosting HSDC AB

- Ember AB(S BARONS AB GROUP)

Notable Milestones in Sweden Data Center Market Sector

- March 2021: EcoDataCenter announces a SEK 1 billion (USD 102 million) investment in a new 15MW data center in Falun.

- February 2022: EcoDataCenter invests SEK 50 million (USD 4.79 million) to secure 80 MW of renewable energy for a data center.

- October 2022: Conapto and Fastpartner agree to build a 10,000-square-meter data center in southern Stockholm with a capacity of 8000 square meters and 20 MW of power.

In-Depth Sweden Data Center Market Market Outlook

The Sweden data center market is poised for sustained growth, driven by ongoing digital transformation, increasing demand for data storage and processing capacity, and the expansion of cloud computing services. Strategic investments in sustainable energy solutions and advanced technologies will be critical for maintaining competitiveness. The continued expansion of digital infrastructure across Sweden and the emergence of new applications will create ample opportunities for growth and innovation within this dynamic market. The market’s future potential is significant, offering substantial returns for investors and stakeholders who capitalize on emerging trends and strategic opportunities.

Sweden Data Center Market Segmentation

-

1. Hotspot

- 1.1. Stockholm

- 1.2. Rest of Sweden

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Sweden Data Center Market Segmentation By Geography

- 1. Sweden

Sweden Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Stockholm

- 5.1.2. Rest of Sweden

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Interxion (Digital Reality Trust Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EcoDataCenter

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Equinix Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stack Infrastructure Inc 5

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SERVERCENTRALEN

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inleed (Yelles AB)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hydro66 Svenska AB(Northern Data AG)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bahnhof

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Multigrid Solutions AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Conapto AB(Designrepublic se)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 High Sec Hosting HSDC AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ember AB(S BARONS AB GROUP)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Interxion (Digital Reality Trust Inc )

List of Figures

- Figure 1: Sweden Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Sweden Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Sweden Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Sweden Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Sweden Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Sweden Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Sweden Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Sweden Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Sweden Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Sweden Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Sweden Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Sweden Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Sweden Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Sweden Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Sweden Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Sweden Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Sweden Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Sweden Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Sweden Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Sweden Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Sweden Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Sweden Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Sweden Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Sweden Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Sweden Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Sweden Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Sweden Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Sweden Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Sweden Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Sweden Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Sweden Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Sweden Data Center Market?

Key companies in the market include Interxion (Digital Reality Trust Inc ), EcoDataCenter, Equinix Inc, Stack Infrastructure Inc 5 , SERVERCENTRALEN, Inleed (Yelles AB), Hydro66 Svenska AB(Northern Data AG), Bahnhof, Multigrid Solutions AB, Conapto AB(Designrepublic se), High Sec Hosting HSDC AB, Ember AB(S BARONS AB GROUP).

3. What are the main segments of the Sweden Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

October 2022: Conapto and the real estate firm Fastpartner have signed an agreement to construct a 10,000-square-meter data center building in southern Stockholm. This land can accommodate an 8000 square meter data center and 20 MW of power when fully built.February 2022: To complete the data center's power supply, EcoDataCenter invested about SEK 50 million(4.79 USD million) in a collaborative initiative with Ellevio and Falu Energi & Vatten. The facility's growth to its maximum capacity is made possible by secure access to 80 MW of renewable electricity.March 2021: EcoDataCenter plans to construct a second data center at its location in Falun, Sweden. The Swedish data center company revealed that it would spend SEK 1 billion (USD 102 million) on a new 15MW facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Data Center Market?

To stay informed about further developments, trends, and reports in the Sweden Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence