Key Insights

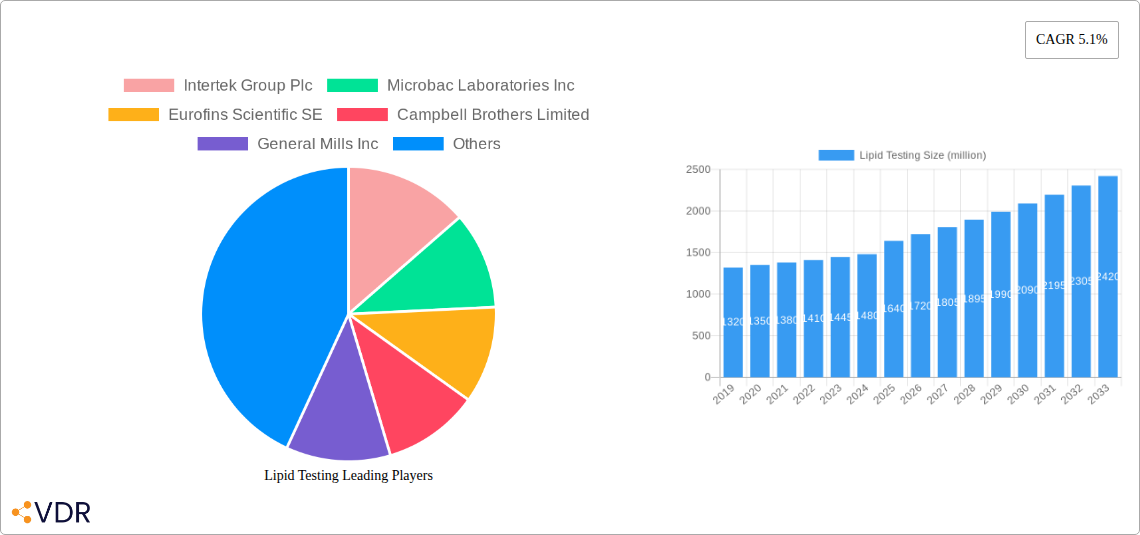

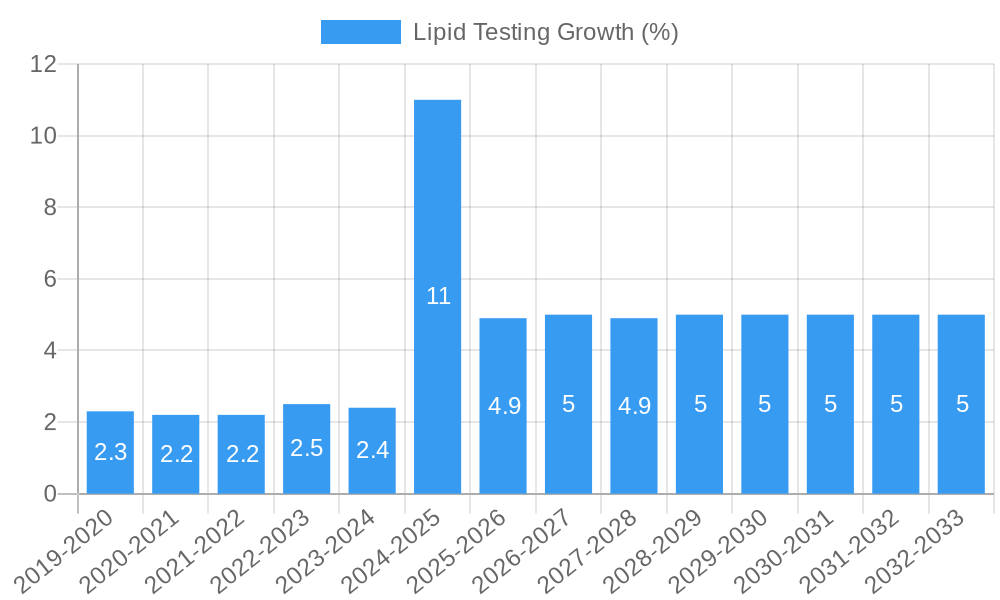

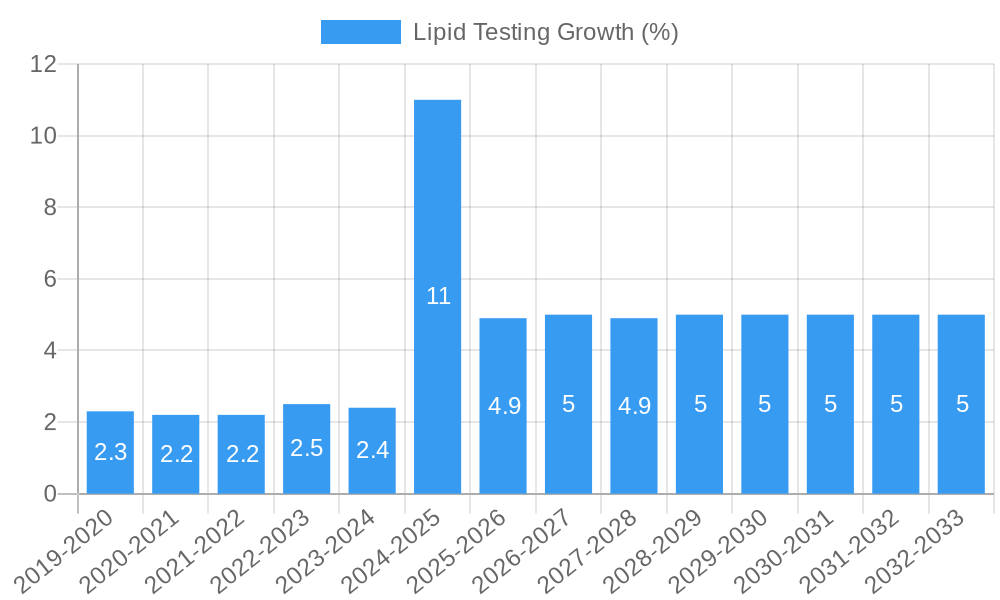

The global Lipid Testing market is poised for significant expansion, projected to reach an estimated USD 1640 million by 2025. Driven by a robust Compound Annual Growth Rate (CAGR) of 5.1% from 2019 to 2033, this growth trajectory underscores the increasing importance of lipid analysis across various industries. The primary impetus for this expansion stems from the escalating demand for accurate and reliable lipid profiling in the food and beverage sector, aimed at ensuring product quality, safety, and nutritional value. Simultaneously, the cosmetics industry's growing emphasis on skincare and anti-aging formulations, where lipid content plays a crucial role, is a notable driver. Advancements in analytical technologies, coupled with stringent regulatory frameworks promoting food safety and product efficacy, further bolster market expansion. The market benefits from companies prioritizing research and development to offer sophisticated and efficient lipid testing solutions.

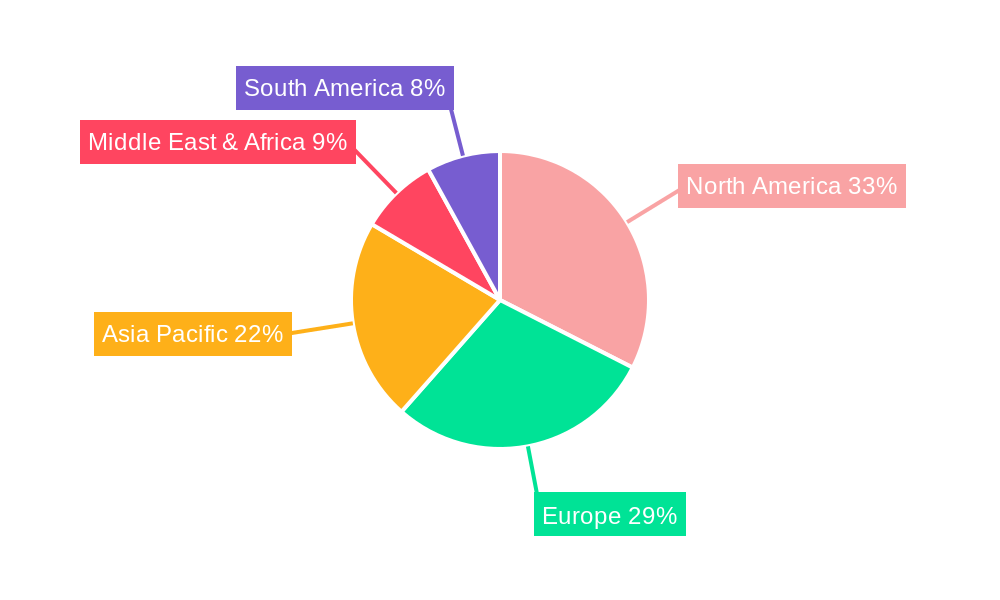

The Lipid Testing market is characterized by a dynamic landscape with emerging trends and established segments. The demand for both recent and traditional lipid testing methods is observed, reflecting the need for both cutting-edge scientific innovation and cost-effective established procedures. Geographically, North America and Europe are anticipated to dominate the market, owing to well-established healthcare and food industries and a strong focus on consumer safety. However, the Asia Pacific region is expected to witness the fastest growth, fueled by a burgeoning middle class, increasing disposable incomes, and a greater awareness of health and wellness. Key players like Eurofins Scientific, SGS SA, and Intertek Group are actively investing in expanding their service portfolios and geographical reach to capitalize on these opportunities. Challenges such as the high cost of advanced instrumentation and the need for skilled professionals in this specialized field are being addressed through technological advancements and training initiatives, ensuring sustained market development.

Comprehensive Lipid Testing Market Report: Trends, Opportunities, and Key Players

This in-depth report offers a thorough analysis of the global Lipid Testing market, providing critical insights for industry stakeholders. Spanning the study period of 2019–2033, with a base year of 2025, this report forecasts market evolution and highlights key drivers and challenges. It details market dynamics, growth trends, regional dominance, product innovations, and emerging opportunities, offering a strategic roadmap for navigating this dynamic sector.

Lipid Testing Market Dynamics & Structure

The global Lipid Testing market exhibits a moderately consolidated structure, characterized by a blend of established multinational corporations and specialized niche players. Market concentration is influenced by factors such as the high cost of advanced analytical instrumentation and the stringent regulatory requirements for accuracy and reliability. Technological innovation serves as a primary driver, with continuous advancements in techniques like gas chromatography-mass spectrometry (GC-MS), liquid chromatography (LC), and advanced spectroscopic methods enhancing sensitivity, specificity, and throughput. Regulatory frameworks, particularly those governing food safety and pharmaceutical quality control, play a pivotal role in shaping market demand and product development. Competitive product substitutes, while less prevalent in highly specialized analyses, exist in the form of simpler screening methods or in-house validation processes. End-user demographics are diverse, ranging from large food and beverage manufacturers and cosmetic companies to contract research organizations and academic institutions. Mergers and acquisitions (M&A) trends indicate strategic consolidation, with larger entities acquiring smaller, innovative firms to expand their service portfolios and geographical reach. For instance, in the historical period, there were approximately 20-30 M&A deals focusing on acquiring specialized lipid analysis capabilities. The market size for lipid testing services was estimated at $3,500 million in 2024.

- Market Concentration: Moderately consolidated with a few dominant players and several specialized providers.

- Technological Innovation Drivers: Advancements in chromatography, mass spectrometry, and automation are key.

- Regulatory Frameworks: Strict regulations in food safety (e.g., FDA, EFSA) and pharmaceuticals drive demand for accurate testing.

- Competitive Product Substitutes: Limited in specialized applications, but basic screening methods offer some alternatives.

- End-User Demographics: Broad, including Food & Beverages, Cosmetics, Pharma, and Academia.

- M&A Trends: Strategic acquisitions to gain market share and technological expertise.

Lipid Testing Growth Trends & Insights

The global Lipid Testing market is poised for robust growth, driven by increasing consumer awareness of health and wellness, stringent food safety regulations, and the expanding applications of lipid analysis in various industries. The market size for lipid testing is projected to grow from $3,500 million in 2024 to $6,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period (2025–2033). Adoption rates for advanced lipidomics technologies are steadily increasing as researchers and industries recognize their potential for uncovering complex biological pathways and identifying biomarkers for diseases. Technological disruptions, such as the miniaturization of analytical instruments and the development of high-throughput screening platforms, are making lipid testing more accessible and cost-effective. Consumer behavior shifts, including a growing demand for transparent labeling of nutritional content and the identification of specific fatty acid profiles in food products, are further fueling market expansion. The increasing focus on personalized nutrition and the development of functional foods and supplements also contribute significantly to this growth trajectory. The penetration of sophisticated lipid analysis techniques within the Food & Beverages segment is expected to reach 85% by 2033, while the Cosmetics Industries will see a penetration of 70%.

Dominant Regions, Countries, or Segments in Lipid Testing

The Food & Beverages segment stands as the dominant force driving growth in the global Lipid Testing market, attributed to its extensive reliance on quality control, nutritional analysis, and product development. This segment accounted for an estimated 55% of the total market revenue in 2024. Key drivers within this segment include escalating consumer demand for healthier food options, the need to comply with evolving food safety regulations globally, and the increasing popularity of fortified and functional foods. Countries with strong agricultural bases and significant food processing industries, such as the United States and China, are leading the charge in adopting advanced lipid testing methodologies. The economic policies supporting food safety initiatives and R&D in the food sector within these regions further bolster market expansion.

The Cosmetics Industries represent a significant and rapidly growing segment, driven by the demand for high-performance skincare and haircare products that leverage the benefits of specific lipids and fatty acids. Growth in this segment is further propelled by the rising trend of "clean beauty" and the need to ensure product safety and efficacy. Market share within the Cosmetics segment is projected to grow from 25% in 2024 to 35% by 2033. The adoption of Recent lipid testing methodologies, which offer greater precision and the ability to analyze complex lipid profiles, is accelerating across both segments. This includes techniques for identifying and quantifying specific fatty acids, phospholipids, and other lipid classes, crucial for understanding product stability, sensory properties, and biological activity. The regulatory landscape, particularly in Europe and North America, mandates rigorous testing for allergens and impurities, indirectly boosting the demand for sophisticated lipid analysis.

- Dominant Segment: Food & Beverages, accounting for approximately 55% of market revenue.

- Leading Countries: United States and China, due to strong food processing and regulatory frameworks.

- Growth Drivers in Food & Beverages: Consumer demand for healthy foods, food safety regulations, functional foods.

- Growing Segment: Cosmetics Industries, driven by clean beauty and product efficacy demands.

- Type Dominance: Increasing adoption of Recent lipid testing methods over Traditional ones.

- Market Share in Cosmetics: Projected to grow from 25% in 2024 to 35% by 2033.

Lipid Testing Product Landscape

The Lipid Testing product landscape is characterized by continuous innovation in analytical instrumentation and reagent development. High-performance liquid chromatography (HPLC) coupled with mass spectrometry (LC-MS) remains a cornerstone for comprehensive lipid profiling, offering unparalleled sensitivity and specificity in identifying and quantifying diverse lipid species. Innovations focus on increasing throughput, improving limit of detection (LOD), and enabling high-resolution analysis of complex lipidomes. Gas chromatography (GC) coupled with flame ionization detection (FID) or mass spectrometry (GC-MS) continues to be vital for the analysis of fatty acid composition and volatile lipids. Emerging technologies like matrix-assisted laser desorption/ionization mass spectrometry (MALDI-MS) and supercritical fluid chromatography (SFC) are gaining traction for their unique capabilities in lipid separation and analysis. These advancements enable detailed characterization of lipid structures, their metabolic pathways, and their functional roles, offering unique selling propositions in areas like nutritional science, pharmaceutical drug discovery, and advanced material development. The performance metrics of these instruments are continuously improving, with LODs reaching picomolar levels and analysis times reduced to minutes per sample.

Key Drivers, Barriers & Challenges in Lipid Testing

Key Drivers:

- Technological Advancements: Continuous innovation in analytical instrumentation (e.g., high-resolution MS, automated systems) enhances accuracy and efficiency.

- Growing Health & Wellness Awareness: Increased consumer demand for nutritional information and the role of lipids in health and disease drives testing needs.

- Stringent Food Safety & Quality Regulations: Mandates from bodies like the FDA and EFSA require rigorous lipid profiling for product safety and compliance.

- Expanding Applications in Pharma & Biotechnology: Lipidomics research for drug discovery, biomarker identification, and disease diagnostics.

- Growth in the Cosmetics Industry: Demand for specific lipid ingredients for product efficacy and safety.

Key Barriers & Challenges:

- High Cost of Advanced Instrumentation: Significant capital investment required for sophisticated analytical equipment limits adoption by smaller laboratories.

- Complexity of Lipidomics: The vast diversity of lipid species and the challenges in their extraction, separation, and identification require specialized expertise.

- Standardization of Methods: Lack of universally accepted standardized protocols across different labs can lead to variability in results.

- Skilled Workforce Shortage: A demand for highly trained personnel in lipid analysis can pose a recruitment challenge.

- Regulatory Hurdles for New Technologies: Gaining regulatory approval for novel testing methods can be time-consuming.

- Supply Chain Disruptions: Potential delays in the availability of specialized reagents and consumables can impact laboratory operations.

Emerging Opportunities in Lipid Testing

Emerging opportunities in the Lipid Testing market lie in the burgeoning field of personalized nutrition, where lipid profiling can inform tailored dietary recommendations based on an individual's unique metabolic makeup. The development of rapid, point-of-care lipid testing devices for clinical diagnostics and food safety screening presents a significant untapped market. Furthermore, the exploration of lipids in the context of the gut microbiome and its impact on human health opens new avenues for diagnostic and therapeutic lipid analysis. The growing interest in sustainable agriculture and the development of novel biofuels also presents opportunities for lipid characterization and optimization. The expansion of lipid testing into niche cosmetic applications, such as the development of hypoallergenic products and the authentication of natural ingredients, also signifies promising growth potential. The global market for lipid testing in these emerging areas is projected to grow by 15-20% annually.

Growth Accelerators in the Lipid Testing Industry

Several factors are accelerating long-term growth in the Lipid Testing industry. Technological breakthroughs in mass spectrometry, including ion mobility spectrometry-mass spectrometry (IMS-MS), are enhancing the speed and accuracy of lipid identification and quantification. Strategic partnerships between instrument manufacturers, software developers, and service providers are creating integrated solutions that streamline workflows and improve data analysis. Market expansion strategies, particularly into emerging economies with growing food and beverage sectors and increasing disposable incomes, are opening new revenue streams. The growing adoption of liquid biopsy techniques for cancer detection, where lipid biomarkers play a crucial role, is a significant growth accelerator in the clinical diagnostics space. Furthermore, the increasing investment in metabolomics research by pharmaceutical companies and academic institutions is directly translating into higher demand for advanced lipid testing services and technologies.

Key Players Shaping the Lipid Testing Market

- Intertek Group Plc

- Microbac Laboratories Inc

- Eurofins Scientific SE

- Campbell Brothers Limited

- General Mills Inc

- TUV Nord Group

- Bureau Veritas SA

- AsureQuality Limited

- ALS Limited

- NEOGEN Corporation

- Mérieux NutriSciences Corporation

- SGS SA

Notable Milestones in Lipid Testing Sector

- 2019: Launch of advanced high-resolution mass spectrometry systems capable of resolving isobaric lipids.

- 2020: Development of AI-powered software for automated lipid identification and annotation, significantly reducing analysis time.

- 2021: Increased investment in lipidomics research for COVID-19 related immune response studies.

- 2022: Introduction of portable lipid analysis devices for rapid on-site food safety testing.

- 2023: Major contract awarded to a leading lipid testing laboratory for a large-scale food safety surveillance program.

- 2024: Emergence of new lipid biomarkers for early detection of neurodegenerative diseases.

- 2025: Anticipated integration of ion mobility spectrometry with existing LC-MS platforms for enhanced lipid separation.

In-Depth Lipid Testing Market Outlook

The future outlook for the Lipid Testing market is exceptionally bright, driven by a confluence of sustained technological innovation, expanding applications, and evolving global demands. The increasing integration of artificial intelligence and machine learning in data analysis will further enhance the efficiency and predictive capabilities of lipidomics. Strategic collaborations between academic institutions and industry players will continue to drive fundamental research and its translation into practical applications, particularly in areas like precision medicine and advanced nutraceutical development. The global expansion of the food and beverage industry, coupled with a growing emphasis on sustainability and traceability, will ensure a consistent demand for robust lipid testing services. The market is expected to witness significant growth in the development of personalized health solutions, where lipid profiles will play a central role in diagnostics, preventative care, and therapeutic interventions, painting a picture of dynamic and sustained growth.

Lipid Testing Segmentation

-

1. Application

- 1.1. Food & Beverages

- 1.2. Cosmetics Industries

-

2. Type

- 2.1. Recent

- 2.2. Traditional

Lipid Testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lipid Testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lipid Testing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food & Beverages

- 5.1.2. Cosmetics Industries

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Recent

- 5.2.2. Traditional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Lipid Testing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food & Beverages

- 6.1.2. Cosmetics Industries

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Recent

- 6.2.2. Traditional

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Lipid Testing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food & Beverages

- 7.1.2. Cosmetics Industries

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Recent

- 7.2.2. Traditional

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Lipid Testing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food & Beverages

- 8.1.2. Cosmetics Industries

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Recent

- 8.2.2. Traditional

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Lipid Testing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food & Beverages

- 9.1.2. Cosmetics Industries

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Recent

- 9.2.2. Traditional

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Lipid Testing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food & Beverages

- 10.1.2. Cosmetics Industries

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Recent

- 10.2.2. Traditional

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intertek Group Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Microbac Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eurofins Scientific SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Campbell Brothers Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TUV Nord Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bureau Veritas SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AsureQuality Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ALS Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NEOGEN Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mérieux NutriSciences Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SGS SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Lipid Testing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Lipid Testing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Lipid Testing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Lipid Testing Revenue (million), by Type 2024 & 2032

- Figure 5: North America Lipid Testing Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Lipid Testing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Lipid Testing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Lipid Testing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Lipid Testing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Lipid Testing Revenue (million), by Type 2024 & 2032

- Figure 11: South America Lipid Testing Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Lipid Testing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Lipid Testing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lipid Testing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Lipid Testing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Lipid Testing Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Lipid Testing Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Lipid Testing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Lipid Testing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Lipid Testing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Lipid Testing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Lipid Testing Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Lipid Testing Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Lipid Testing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Lipid Testing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Lipid Testing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Lipid Testing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Lipid Testing Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Lipid Testing Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Lipid Testing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Lipid Testing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lipid Testing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lipid Testing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Lipid Testing Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Lipid Testing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Lipid Testing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Lipid Testing Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Lipid Testing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Lipid Testing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Lipid Testing Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Lipid Testing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Lipid Testing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Lipid Testing Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Lipid Testing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Lipid Testing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Lipid Testing Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Lipid Testing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Lipid Testing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Lipid Testing Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Lipid Testing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Lipid Testing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lipid Testing?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Lipid Testing?

Key companies in the market include Intertek Group Plc, Microbac Laboratories Inc, Eurofins Scientific SE, Campbell Brothers Limited, General Mills Inc, TUV Nord Group, Bureau Veritas SA, AsureQuality Limited, ALS Limited, NEOGEN Corporation, Mérieux NutriSciences Corporation, SGS SA.

3. What are the main segments of the Lipid Testing?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1640 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lipid Testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lipid Testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lipid Testing?

To stay informed about further developments, trends, and reports in the Lipid Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence