Key Insights

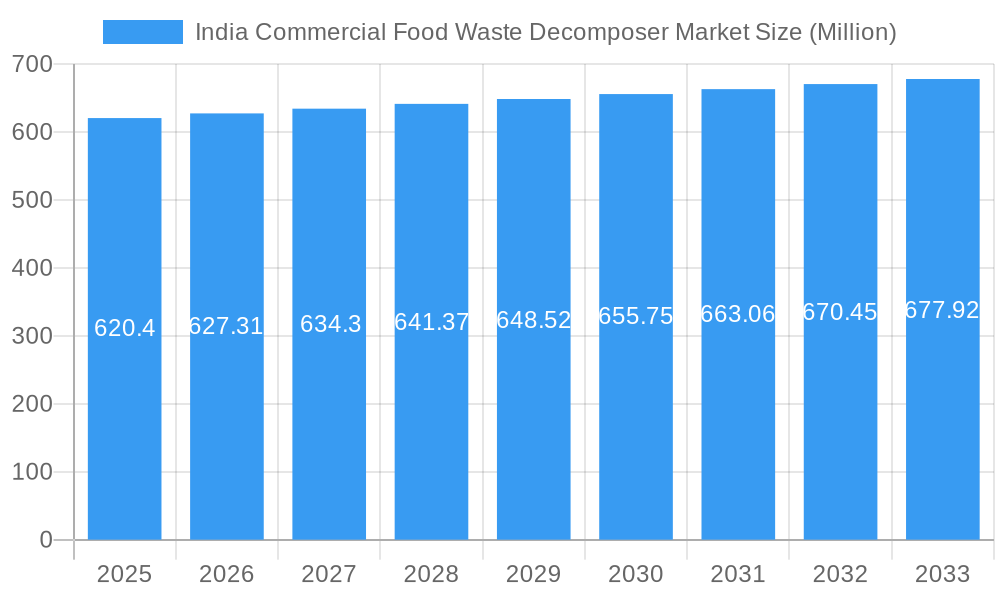

The India Commercial Food Waste Decomposer Market, valued at approximately ₹620.40 million in 2025, is projected to exhibit steady growth over the forecast period (2025-2033). A CAGR of 1.15% indicates a moderate expansion, driven by increasing awareness of sustainable waste management practices among commercial establishments, stringent government regulations aimed at reducing landfill waste, and the rising adoption of eco-friendly solutions within the hospitality, food processing, and retail sectors. The market's growth is further fueled by the increasing availability of technologically advanced decomposers offering efficient and hygienic waste processing, thereby minimizing operational costs and environmental impact. However, factors like high initial investment costs associated with advanced decomposer technologies and a lack of awareness among some commercial entities regarding the benefits of food waste decomposition could act as potential restraints. The market is segmented based on technology type (e.g., aerobic, anaerobic), capacity, and application (restaurants, hotels, supermarkets, etc.), with key players like Zigma Machinery & Equipment Solutions, Kings Industries, and others vying for market share through product innovation and strategic partnerships.

India Commercial Food Waste Decomposer Market Market Size (In Million)

The market's moderate growth reflects a gradual shift toward sustainable waste management. While the initial adoption rate may be moderate due to cost considerations, the long-term benefits, including reduced disposal costs, enhanced brand image associated with environmental responsibility, and compliance with regulations, are expected to drive wider market penetration in the coming years. Further growth could be stimulated by government incentives and subsidies promoting the adoption of commercial food waste decomposers. The competitive landscape is likely to remain dynamic, with existing players focusing on technological advancements, improved efficiency, and cost-effectiveness, alongside the potential entry of new players seeking to capitalize on this emerging market segment.

India Commercial Food Waste Decomposer Market Company Market Share

India Commercial Food Waste Decomposer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Commercial Food Waste Decomposer Market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The parent market is the broader Waste Management sector in India, while the child market focuses specifically on commercial food waste decomposition solutions. The market size is projected at xx Million units in 2025 and is expected to witness significant growth over the forecast period.

India Commercial Food Waste Decomposer Market Market Dynamics & Structure

The India Commercial Food Waste Decomposer market exhibits a moderately concentrated structure, with several key players commanding significant market shares. The market is experiencing robust growth fueled by several key factors. Technological advancements, particularly in enzymatic decomposition and anaerobic digestion, are continuously improving efficiency and reducing the overall cost of operation, thereby making these systems more appealing to businesses. Furthermore, stringent government regulations aimed at curbing waste generation and promoting sustainable practices are significantly boosting market expansion. While traditional waste disposal methods remain competitive substitutes, the escalating environmental awareness among businesses and consumers, coupled with the cost-effectiveness of decomposers, is driving a decisive shift towards adoption. The end-user segment is diverse, encompassing restaurants, hotels, hospitals, and food processing facilities, each with unique waste management needs and contributing substantially to market demand. Mergers and acquisitions (M&A) activity has been moderate but noticeable, with significant acquisitions such as Whirlpool Corporation's acquisition of InSinkErator in 2022 signaling a growing interest and potential for consolidation within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately [Insert Percentage]% market share in 2025. [Add data on market share evolution if available].

- Technological Innovation: Enzymatic decomposition and anaerobic digestion are leading innovations, enhancing efficiency, reducing costs, and broadening application possibilities. [Specify examples of specific technologies and their impact].

- Regulatory Framework: Supportive government initiatives promoting waste reduction and sustainable practices are creating a favorable environment for market expansion. [Mention specific policies or acts].

- Competitive Substitutes: Traditional methods like landfills and incineration remain competitive, but their environmental impact and associated costs are increasingly driving businesses toward decomposers. [Quantify the environmental impact comparison if data available].

- End-User Demographics: Restaurants ([Insert Percentage]% ), Hotels ([Insert Percentage]% ), Hospitals ([Insert Percentage]% ), and Food Processing ([Insert Percentage]% ) constitute the major end-user segments. [Provide further segmentation if available, e.g., by restaurant type or size].

- M&A Trends: Moderate but noteworthy activity, with Whirlpool's acquisition of InSinkErator illustrating industry consolidation. [Insert Number] M&A deals were recorded between 2019-2024. [Add details about the type of M&A deals and their impact on the market].

India Commercial Food Waste Decomposer Market Growth Trends & Insights

The India Commercial Food Waste Decomposer market exhibits a significant growth trajectory, driven by rising environmental concerns, stringent government regulations, and increasing adoption across various commercial sectors. The market size is projected to grow at a CAGR of xx% during the forecast period (2025-2033), expanding from xx Million units in 2025 to xx Million units by 2033. Technological advancements leading to more efficient and cost-effective decomposers are accelerating market penetration. Shifting consumer preferences towards eco-friendly waste management solutions further bolster market growth. The increasing urbanization and the growth of the food service industry are creating significant demand for efficient food waste management systems.

Dominant Regions, Countries, or Segments in India Commercial Food Waste Decomposer Market

The Indian commercial food waste decomposer market is predominantly driven by major metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai. These regions benefit from a higher density of commercial establishments, well-developed infrastructure supporting efficient waste management systems, and stricter environmental regulations enforcing sustainable practices. Government policies actively promoting sustainable waste management within these urban centers further incentivize the adoption of commercial food waste decomposers. The food service sector, encompassing restaurants, hotels, and catering businesses, stands out as a key driver, reflecting the significant volume of food waste generated within these establishments. Beyond these major cities, significant growth potential exists in rapidly developing Tier 2 and Tier 3 cities.

- Key Drivers:

- High concentration of commercial establishments and food businesses in major cities.

- Stringent environmental regulations and supportive government initiatives, including [mention specific policies and incentives].

- Growing awareness among businesses and consumers regarding sustainable waste management practices.

- Relatively well-developed infrastructure for waste collection and disposal in major urban areas.

- Dominance Factors: Market share is highest in major metropolitan areas due to the high concentration of commercial businesses. Growth potential, however, is significant in rapidly developing Tier 2 and Tier 3 cities due to increasing urbanization and economic activity.

India Commercial Food Waste Decomposer Market Product Landscape

The Indian Commercial Food Waste Decomposer market showcases a diverse range of products, including enzymatic decomposers, anaerobic digesters, and other innovative solutions tailored to meet the specific needs of various commercial establishments. These products vary significantly in terms of processing capacity, efficiency, automation levels, and overall cost. Key features driving adoption include automation for ease of use, efficient waste reduction capabilities, minimized environmental impact, and compliance with relevant environmental regulations. Ongoing technological advancements are continuously focusing on improving efficiency, reducing operational costs, enhancing hygiene protocols, and expanding functionalities. The unique selling propositions (USPs) for these products typically center around sustainability, cost savings, regulatory compliance, and the potential for revenue generation through by-product recovery (e.g., biogas).

Key Drivers, Barriers & Challenges in India Commercial Food Waste Decomposer Market

Key Drivers:

- Increasing environmental awareness and stringent government regulations are driving market growth.

- Rising urbanization and growth of the food service industry are creating substantial demand.

- Technological advancements are leading to more efficient and cost-effective decomposers.

Challenges & Restraints:

- High initial investment costs can hinder adoption, especially for smaller businesses.

- Lack of awareness about the benefits of food waste decomposers in certain regions.

- Complexities associated with waste collection and transportation can limit market penetration.

- Competition from traditional waste disposal methods remains significant.

Emerging Opportunities in India Commercial Food Waste Decomposer Market

Significant growth opportunities abound in expanding market penetration into Tier 2 and Tier 3 cities where awareness and adoption of sustainable waste management solutions remain relatively lower. Innovations in decentralized waste processing technologies, combined with effective integration into existing waste management infrastructure, present exciting prospects for market expansion. Government incentives and collaborative partnerships between manufacturers, waste management companies, and local authorities are crucial in accelerating adoption within these regions. The integration of food waste decomposers into comprehensive waste management systems that incorporate features like waste sorting and recycling presents a particularly significant opportunity for growth and value creation. [Add information on specific government initiatives or funding opportunities].

Growth Accelerators in the India Commercial Food Waste Decomposer Market Industry

Technological breakthroughs are pivotal in driving market growth, continuously enhancing efficiency, reducing costs, and expanding the applicability of food waste decomposers to a wider range of commercial settings. Strategic partnerships between manufacturers, waste management service providers, and government bodies are crucial for expanding market reach and promoting widespread adoption. The development and implementation of comprehensive market expansion strategies targeting underpenetrated regions and commercial sectors are essential for long-term, sustainable growth. [Mention specific examples of successful partnerships or technological advancements].

Key Players Shaping the India Commercial Food Waste Decomposer Market Market

- Zigma Machinery & Equipment Solutions

- Kings Industries

- Gurukrupa Enterprises

- Riteways Enviro Pvt Ltd

- Envipure Solution

- Vakratund Invention India Private Limited

- Reva Engineering Enterprises

- Ecopollutech Engineers

- Greenrich Grow India Private Limited

- Greenshield Enviro

- List Not Exhaustive

Notable Milestones in India Commercial Food Waste Decomposer Market Sector

- April 2022: Whirlpool Corporation acquired InSinkErator, expanding its presence in the food waste disposal market.

- September 2023: InSinkErator launched new garbage disposals, offering environmentally friendly solutions for commercial food waste management.

In-Depth India Commercial Food Waste Decomposer Market Market Outlook

The India Commercial Food Waste Decomposer Market is poised for substantial growth driven by escalating environmental concerns, supportive government policies, and continuous technological advancements. The market presents lucrative opportunities for companies that can offer cost-effective, efficient, and sustainable solutions. Strategic partnerships and market expansion strategies focused on untapped segments will be crucial for capturing a significant market share.

India Commercial Food Waste Decomposer Market Segmentation

-

1. Machine Type

- 1.1. Continuous Composters

- 1.2. Batch Composters

-

2. Application

- 2.1. Agricultural

- 2.2. Restaurants & Hotels

- 2.3. Food Processing Industries

-

3. Sales Channel

- 3.1. Direct Sales

- 3.2. Distributor

-

4. Capacity

- 4.1. Small-Scale

- 4.2. Medium-Scale

- 4.3. Large-Scale

India Commercial Food Waste Decomposer Market Segmentation By Geography

- 1. India

India Commercial Food Waste Decomposer Market Regional Market Share

Geographic Coverage of India Commercial Food Waste Decomposer Market

India Commercial Food Waste Decomposer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.3. Market Restrains

- 3.3.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.4. Market Trends

- 3.4.1. Growing Food Service Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Food Waste Decomposer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Continuous Composters

- 5.1.2. Batch Composters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Agricultural

- 5.2.2. Restaurants & Hotels

- 5.2.3. Food Processing Industries

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. Small-Scale

- 5.4.2. Medium-Scale

- 5.4.3. Large-Scale

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zigma Machinery & Equipment Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kings Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gurukrupa Enterprises

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Riteways Enviro Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Envipure Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vakratund Invention India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reva Engineering Enterprises

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ecopollutech Engineers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Greenrich Grow India Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greenshield Enviro**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zigma Machinery & Equipment Solutions

List of Figures

- Figure 1: India Commercial Food Waste Decomposer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Commercial Food Waste Decomposer Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 3: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 8: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 9: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Region 2020 & 2033

- Table 11: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 12: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 13: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 15: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 16: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 17: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 18: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 19: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Food Waste Decomposer Market?

The projected CAGR is approximately 1.15%.

2. Which companies are prominent players in the India Commercial Food Waste Decomposer Market?

Key companies in the market include Zigma Machinery & Equipment Solutions, Kings Industries, Gurukrupa Enterprises, Riteways Enviro Pvt Ltd, Envipure Solution, Vakratund Invention India Private Limited, Reva Engineering Enterprises, Ecopollutech Engineers, Greenrich Grow India Private Limited, Greenshield Enviro**List Not Exhaustive.

3. What are the main segments of the India Commercial Food Waste Decomposer Market?

The market segments include Machine Type, Application, Sales Channel, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 620.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

6. What are the notable trends driving market growth?

Growing Food Service Industry Drives the Market.

7. Are there any restraints impacting market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

8. Can you provide examples of recent developments in the market?

September 2023: InSinkErator introduced new garbage disposals in the market. The new garbage disposal aims to grind a variety of wastes quickly and provide environmentally friendly solutions for managing food waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Food Waste Decomposer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Food Waste Decomposer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Food Waste Decomposer Market?

To stay informed about further developments, trends, and reports in the India Commercial Food Waste Decomposer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence