Key Insights

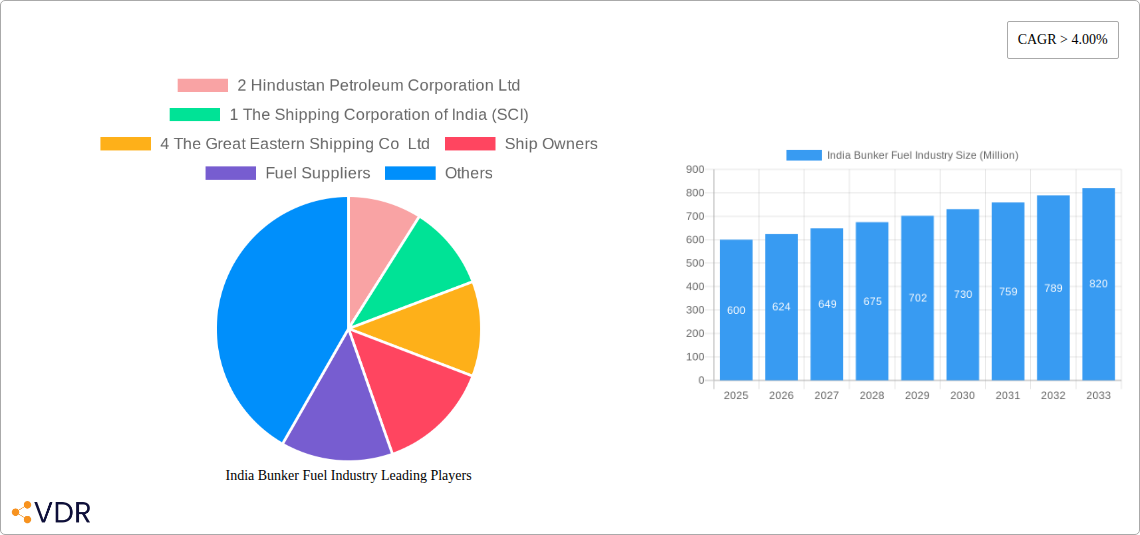

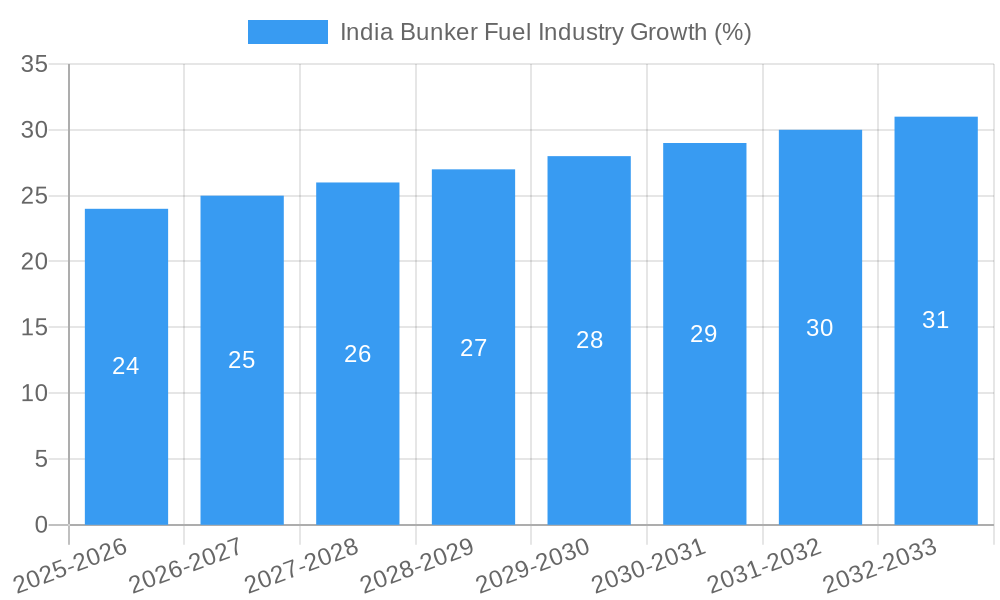

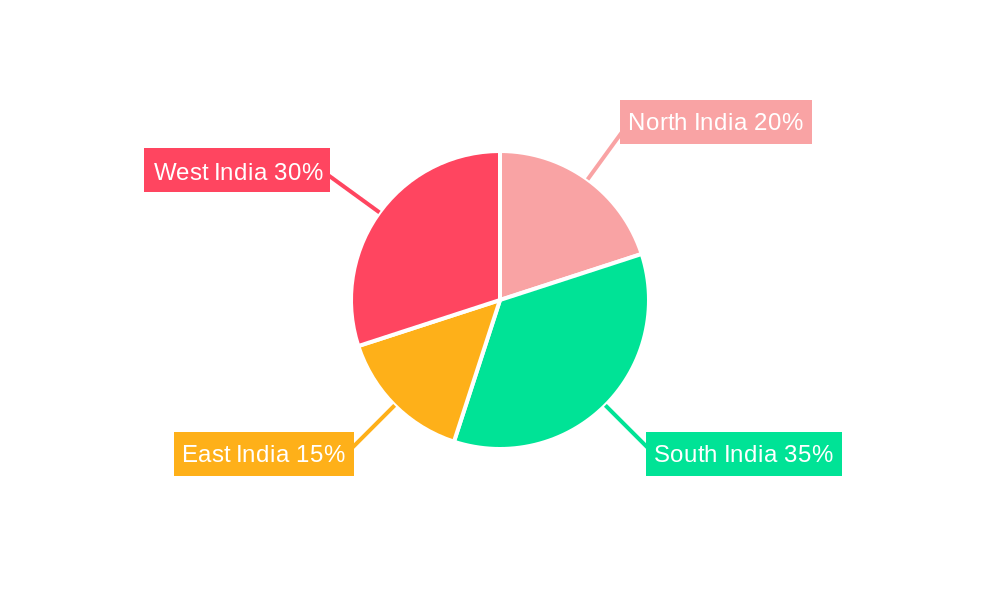

The India bunker fuel market, valued at approximately ₹50000 million (USD 600 million) in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. Firstly, India's burgeoning maritime trade and increasing containerization are fueling demand for bunker fuels. The growth of India's import and export activities, coupled with the expansion of its ports and shipping infrastructure, directly translates into higher fuel consumption. Secondly, the ongoing shift towards cleaner fuels like Very-low Sulfur Fuel Oil (VLSFO) due to stricter environmental regulations (IMO 2020) is also impacting market dynamics, although the High Sulfur Fuel Oil (HSFO) segment still holds significant share due to its cost-effectiveness for certain vessel types. The dominance of container ships and tankers in the vessel type segment further contributes to the overall market size. However, fluctuating crude oil prices and the potential for alternative fuel adoption (LNG, methanol) pose restraints on market growth. Regional variations exist, with coastal areas like South and West India exhibiting potentially higher growth due to concentrated port activity. Major players like Indian Oil Corporation, Bharat Petroleum, and Hindustan Petroleum dominate the fuel supply side, alongside significant shipping companies such as SCI and Great Eastern Shipping.

The competitive landscape is characterized by a mix of large state-owned enterprises and private players. While larger companies possess established infrastructure and distribution networks, smaller players are increasingly focusing on specialized services and niche segments. The market is likely to witness strategic partnerships and mergers & acquisitions to enhance market share and optimize supply chains. Looking ahead, the future of the Indian bunker fuel market will depend on the balance between continued growth in maritime trade, the implementation and enforcement of environmental regulations, and the eventual uptake of alternative marine fuels. Further research into specific fuel type consumption within each vessel category across different Indian regions would provide a more granular understanding of market segmentation and growth projections.

India Bunker Fuel Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the India Bunker Fuel industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a focus on key segments – Fuel Types (HSFO, VLSFO, MGO, Others) and Vessel Types (Containers, Tankers, General Cargo, Bulk Carriers, Others) – this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with 2025 as the base and estimated year.

India Bunker Fuel Industry Market Dynamics & Structure

This section analyzes the structure and dynamics of the Indian bunker fuel market, considering various factors impacting its evolution. The market is characterized by a moderately consolidated structure with key players such as Indian Oil Corporation Ltd, Bharat Petroleum Corporation Ltd, Hindustan Petroleum Corporation Ltd, and Adani Bunkering Private Limited holding significant market share. However, the presence of numerous smaller fuel suppliers and ship owners indicates a competitive landscape.

Market Concentration: The market exhibits moderate concentration, with the top 5 players accounting for approximately xx% of the market share in 2025. This is expected to shift slightly by 2033, with a projected xx% share for the top 5.

Technological Innovation: The industry is witnessing a gradual shift towards cleaner fuels like VLSFO and LNG, driven by stringent environmental regulations. Innovation is focused on improving fuel efficiency and reducing emissions. Barriers to innovation include high upfront investment costs for new technologies and the need for infrastructure upgrades.

Regulatory Framework: Indian maritime regulations are increasingly aligned with global standards, emphasizing emission control and safety. This necessitates continuous adaptation by industry players.

Competitive Product Substitutes: LNG is emerging as a significant substitute for traditional bunker fuels, presenting both opportunities and challenges for existing players.

End-User Demographics: The major end-users are diverse, encompassing large shipping companies like The Shipping Corporation of India (SCI), The Great Eastern Shipping Co Ltd, Essar Shipping Ltd, and Nautilus Shipping India Pvt Ltd, as well as smaller ship owners and operators.

M&A Trends: The past five years have witnessed xx M&A deals in the Indian bunker fuel sector, primarily focused on consolidation and expansion. These deals are expected to increase as the industry transitions to cleaner fuels.

India Bunker Fuel Industry Growth Trends & Insights

The Indian bunker fuel market exhibited a CAGR of xx% during 2019-2024. This growth is primarily driven by India's burgeoning maritime trade and the increasing demand for shipping services. The market is projected to register a CAGR of xx% between 2025 and 2033, reaching a market size of xx Million units by 2033. This projection considers the anticipated growth in India's economy and the rising volume of seaborne trade. Technological advancements, particularly the adoption of LNG as a bunker fuel, are expected to further fuel market expansion. However, factors like fluctuating crude oil prices and global economic uncertainties may influence growth trajectory. The market penetration of VLSFO is expected to increase significantly due to stringent environmental regulations. Consumer behavior is shifting towards cleaner and more efficient fuel options, leading to a higher demand for VLSFO and LNG.

Dominant Regions, Countries, or Segments in India Bunker Fuel Industry

The major ports in India, namely Mumbai, Kandla, and Chennai, dominate the bunker fuel market due to their high volume of shipping activities. Among fuel types, VLSFO is expected to witness the fastest growth due to environmental regulations and increasing adoption rates. Tankers and container vessels constitute the largest segment in terms of fuel consumption.

Key Drivers:

- Increasing Seaborne Trade: India's growing economy and global trade contribute significantly to increased fuel demand.

- Government Initiatives: Policy support for infrastructure development and cleaner fuels promotes market expansion.

- Technological Advancements: The adoption of more efficient and cleaner fuels is driving market growth.

Dominance Factors:

- High Volume of Shipping Activities: Major ports handle a significant portion of India's maritime trade.

- Stringent Environmental Regulations: The shift towards cleaner fuels is creating new market opportunities.

- Growth of Containerization: The increasing use of container ships drives demand for bunker fuel.

India Bunker Fuel Industry Product Landscape

The bunker fuel product landscape is evolving with a focus on cleaner and more efficient fuels. VLSFO is gaining popularity due to its low sulfur content, meeting stricter emission standards. LNG is emerging as a significant alternative, offering considerable environmental benefits. Product innovations focus on optimizing fuel efficiency, reducing emissions, and improving operational performance. Key features for differentiation include low sulfur content, reduced particulate matter emissions, and improved combustion efficiency.

Key Drivers, Barriers & Challenges in India Bunker Fuel Industry

Key Drivers:

- Increased maritime trade and economic growth

- Stringent environmental regulations pushing for cleaner fuels

- Government initiatives promoting infrastructure development

Challenges & Restraints:

- Fluctuating crude oil prices impacting fuel costs (estimated xx% impact on profitability in 2025)

- Infrastructure limitations in handling LNG bunkering (estimated to delay xx% of LNG adoption by 2030)

- High investment costs associated with cleaner fuel adoption

Emerging Opportunities in India Bunker Fuel Industry

- Growing demand for LNG bunkering fuels presents substantial growth opportunities.

- Expansion of port infrastructure and the development of new bunkering facilities create market expansion potential.

- Investment in research and development for next-generation biofuels provides a long-term sustainable path.

Growth Accelerators in the India Bunker Fuel Industry

The long-term growth trajectory of the Indian bunker fuel industry will be significantly influenced by strategic partnerships between fuel suppliers and shipping companies, focusing on optimizing supply chains and promoting cleaner fuel adoption. Technological breakthroughs in fuel efficiency and emissions reduction technologies will also play a key role.

Key Players Shaping the India Bunker Fuel Market

- Hindustan Petroleum Corporation Ltd

- The Shipping Corporation of India (SCI)

- The Great Eastern Shipping Co Ltd

- Ship Owners

- Fuel Suppliers

- Nautilus Shipping India Pvt Ltd

- Indian Oil Corporation Ltd

- Essar Shipping Ltd

- Bharat Petroleum Corporation Ltd

- Adani Bunkering Private Limited

- Greatship India Ltd

- Mediterranean Shipping Company

- Mangalore Refinery and Petrochemicals Ltd (MRPL)

Notable Milestones in India Bunker Fuel Industry Sector

- December 2022: AG&P and ADNOC signed an agreement for using an LNG carrier as a floating storage unit offshore India, signifying a significant step towards LNG bunkering infrastructure development.

- January 2022: LNG Alliance and New Mangalore Port Trust signed a cooperation agreement for developing India's first LNG bunkering facility, signaling a shift towards cleaner fuels.

In-Depth India Bunker Fuel Industry Market Outlook

The Indian bunker fuel market exhibits robust growth potential, driven by sustained economic expansion, increased maritime activity, and the imperative to adopt cleaner fuels. Strategic investments in port infrastructure and technological advancements in fuel efficiency and emission reduction will shape future market dynamics. The transition towards LNG and biofuels presents significant opportunities for industry players to capture market share and contribute to a sustainable maritime sector.

India Bunker Fuel Industry Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

India Bunker Fuel Industry Segmentation By Geography

- 1. India

India Bunker Fuel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Marine Transportation of Essential Commodities in South America4.; Supportive Policies for Cleaner Bunker Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Nature of Oil Market

- 3.4. Market Trends

- 3.4.1. Very Low Sulfur Fuel Oil (VLSFO) to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Bunker Fuel Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. North India India Bunker Fuel Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Bunker Fuel Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Bunker Fuel Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Bunker Fuel Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 2 Hindustan Petroleum Corporation Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 1 The Shipping Corporation of India (SCI)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 4 The Great Eastern Shipping Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ship Owners

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fuel Suppliers

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 6 Nautilus Shipping India Pvt Ltd *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 1 Indian Oil Corporation Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 2 Essar Shipping Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 3 Bharat Petroleum Corporation Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 4 Adani Bunkering Private Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 3 Greatship India Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 5 Mediterranean Shipping Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 5 Mangalore Refinery and Petrochemicals Ltd (MRPL)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 2 Hindustan Petroleum Corporation Ltd

List of Figures

- Figure 1: India Bunker Fuel Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Bunker Fuel Industry Share (%) by Company 2024

List of Tables

- Table 1: India Bunker Fuel Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Bunker Fuel Industry Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: India Bunker Fuel Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: India Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 5: India Bunker Fuel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 6: India Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 7: India Bunker Fuel Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Bunker Fuel Industry Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 9: India Bunker Fuel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 11: North India India Bunker Fuel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Bunker Fuel Industry Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 13: South India India Bunker Fuel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Bunker Fuel Industry Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 15: East India India Bunker Fuel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Bunker Fuel Industry Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 17: West India India Bunker Fuel Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Bunker Fuel Industry Volume (metric tonnes) Forecast, by Application 2019 & 2032

- Table 19: India Bunker Fuel Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: India Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2019 & 2032

- Table 21: India Bunker Fuel Industry Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 22: India Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2019 & 2032

- Table 23: India Bunker Fuel Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Bunker Fuel Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India Bunker Fuel Industry?

Key companies in the market include 2 Hindustan Petroleum Corporation Ltd, 1 The Shipping Corporation of India (SCI), 4 The Great Eastern Shipping Co Ltd, Ship Owners, Fuel Suppliers, 6 Nautilus Shipping India Pvt Ltd *List Not Exhaustive, 1 Indian Oil Corporation Ltd, 2 Essar Shipping Ltd, 3 Bharat Petroleum Corporation Ltd, 4 Adani Bunkering Private Limited, 3 Greatship India Ltd, 5 Mediterranean Shipping Company, 5 Mangalore Refinery and Petrochemicals Ltd (MRPL).

3. What are the main segments of the India Bunker Fuel Industry?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Marine Transportation of Essential Commodities in South America4.; Supportive Policies for Cleaner Bunker Fuel.

6. What are the notable trends driving market growth?

Very Low Sulfur Fuel Oil (VLSFO) to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Volatile Nature of Oil Market.

8. Can you provide examples of recent developments in the market?

December 2022: Atlantic Gulf & Pacific International Holdings (AG&P) and Abu Dhabi National Oil Company (ADNOC) signed an agreement to use its Ghasha liquefied natural gas (LNG) carrier as a floating storage unit offshore India. The carrier will be used at AG&P's LNG import terminal in India, which is expected to open in the second half of 2024, according to ADNOC Logistics and Services.The agreement is valid for 11 years and could be extended for four years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Bunker Fuel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Bunker Fuel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Bunker Fuel Industry?

To stay informed about further developments, trends, and reports in the India Bunker Fuel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence