Key Insights

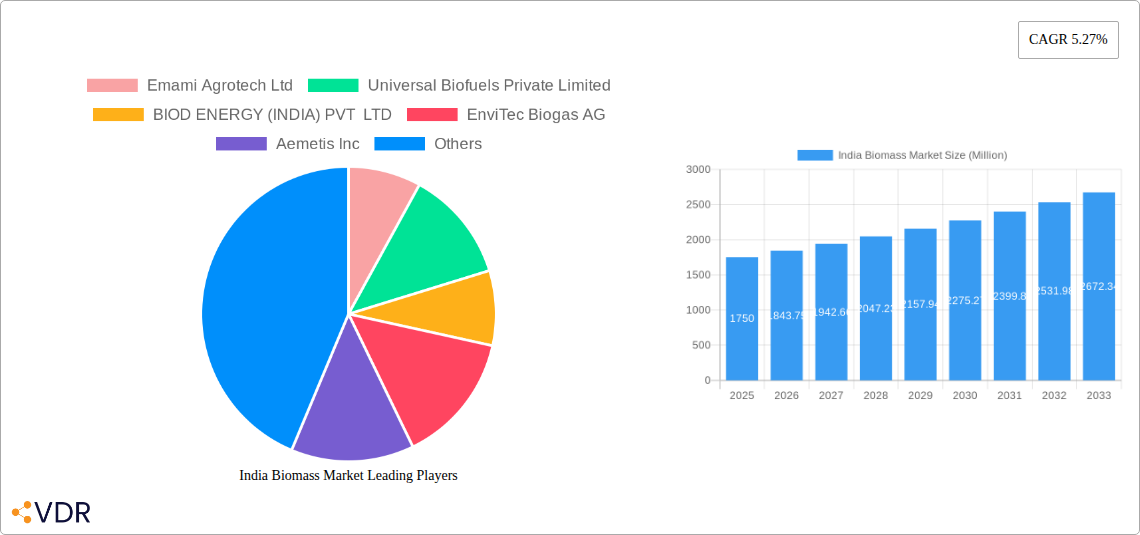

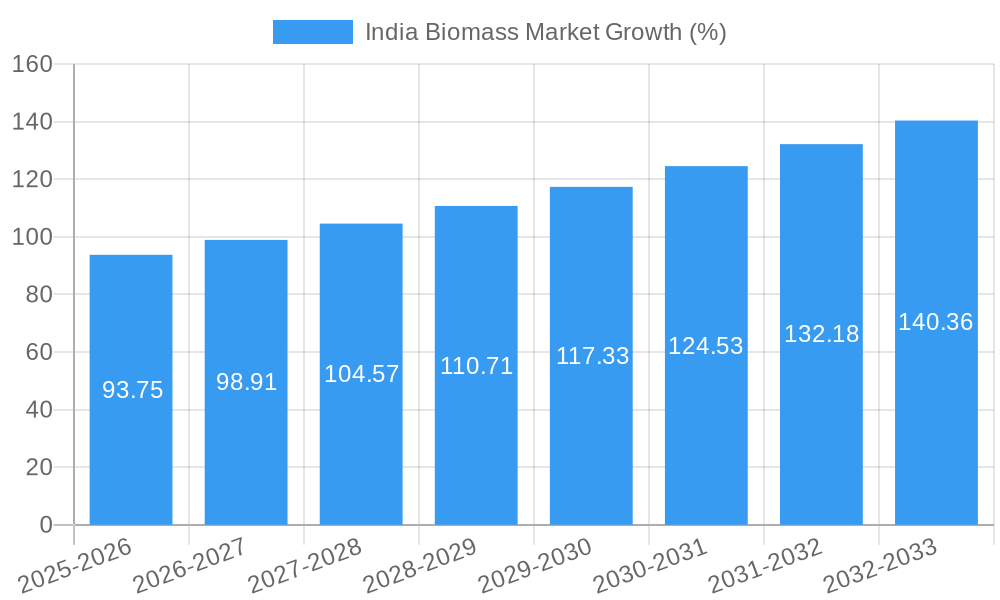

The India biomass market, exhibiting a Compound Annual Growth Rate (CAGR) of 5.27%, presents a significant investment opportunity. While the precise market size for 2025 isn't provided, considering a typical market size progression and the stated CAGR, a reasonable estimation for 2025 would place the market value between ₹1500-₹2000 million (assuming the "Million" unit refers to Indian Rupees). This growth is fueled by several key drivers. Firstly, the increasing emphasis on renewable energy sources in India's energy mix is driving demand for biomass as a sustainable alternative to fossil fuels. Government initiatives promoting bioenergy and waste-to-energy projects further bolster this trend. Secondly, the agricultural sector, a cornerstone of the Indian economy, generates substantial quantities of agricultural residues, providing a readily available biomass feedstock. Technological advancements in biomass conversion technologies, leading to improved efficiency and cost-effectiveness, also contribute to the market's expansion. However, challenges remain. These include inconsistent biomass supply due to seasonal variations in agricultural production, and the need for improved infrastructure to efficiently collect, transport and process biomass across diverse geographical locations. Moreover, overcoming technological limitations in certain biomass conversion methods and securing sufficient investment capital for large-scale projects present considerable restraints to faster market growth. The market is segmented by biomass type (agricultural residues, forestry residues, etc.), application (power generation, biofuels, etc.), and region. Key players in this market include Emami Agrotech Ltd, Universal Biofuels Private Limited, and BIOD ENERGY (INDIA) PVT LTD, among others, each contributing to the evolving landscape through their respective innovations and market strategies. The projected growth trajectory indicates a robust and expanding market with potential for further development in the coming years.

The forecast period (2025-2033) is expected to witness considerable expansion, particularly driven by advancements in technology and increased government support for sustainable energy initiatives. The market segmentation is likely to evolve, with a greater focus on specialized biomass applications and regional variations in demand. The market's success hinges on overcoming challenges related to consistent supply chains, improved infrastructure, and technological advancements in cost-effective conversion processes. Competition among existing and emerging players will likely intensify, leading to further innovation and market consolidation. Strategic partnerships between technology providers, biomass producers, and energy companies will be crucial for driving future growth and realizing the full potential of the India biomass market.

India Biomass Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India Biomass Market, encompassing its current state, future trajectory, and key players. With a focus on market dynamics, growth trends, and emerging opportunities, this report is an invaluable resource for industry professionals, investors, and policymakers seeking to understand and capitalize on this burgeoning sector. The report covers the parent market of renewable energy and the child market of biomass energy within India.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

India Biomass Market Dynamics & Structure

The Indian biomass market is characterized by a moderately concentrated structure with several key players vying for market share. Technological innovation, particularly in biomass gasification and pelletization, is a major driver. The regulatory landscape, including government incentives and sustainability standards, significantly influences market growth. Competition from fossil fuels and other renewable energy sources presents a challenge, while the increasing demand for sustainable energy solutions fuels market expansion. M&A activity is expected to increase as larger players consolidate their position and seek to expand their product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Significant advancements in biomass gasification, pelletization, and anaerobic digestion technologies are driving efficiency improvements and cost reductions.

- Regulatory Framework: Government initiatives promoting renewable energy adoption, such as the National Bioenergy Programme, are key growth catalysts. However, inconsistent policy implementation across states remains a challenge.

- Competitive Substitutes: Fossil fuels (coal, natural gas) and other renewable energy sources (solar, wind) pose significant competition.

- End-User Demographics: The primary end-users are power generation companies, industrial users, and residential consumers. The increasing awareness of environmental concerns is driving demand amongst residential consumers.

- M&A Trends: The number of M&A deals in the Indian biomass market is projected to increase to xx deals annually by 2033, driven by consolidation efforts among major players and entry of new players.

India Biomass Market Growth Trends & Insights

The Indian biomass market is experiencing significant growth, driven by increasing energy demand, government support for renewable energy, and rising environmental awareness. The market size is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period. Adoption rates are accelerating, particularly in rural areas where biomass is a readily available resource. Technological disruptions, such as advancements in biomass conversion technologies, are enhancing the efficiency and economic viability of biomass energy. Consumer behavior is shifting toward sustainable energy solutions, further boosting market growth. The penetration rate of biomass energy in the overall energy mix in India is predicted to rise from xx% in 2024 to xx% in 2033.

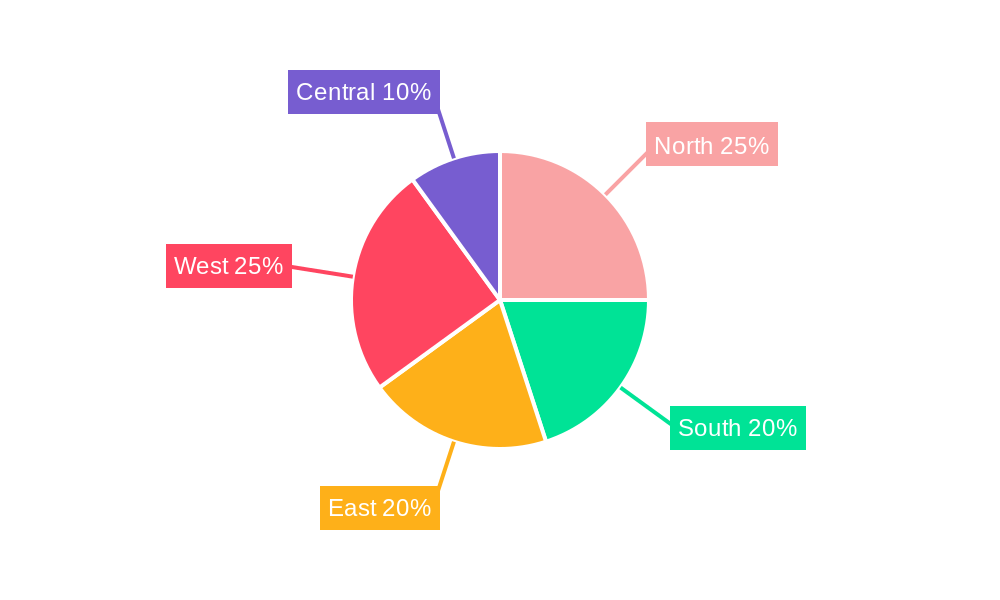

Dominant Regions, Countries, or Segments in India Biomass Market

The Northern and Western regions of India are currently dominating the biomass market due to favorable government policies, abundant biomass resources, and established infrastructure. Uttar Pradesh and Punjab, in particular, have emerged as significant hubs for biomass energy production.

- Key Drivers:

- Abundant biomass resources (agricultural residues, forestry waste)

- Supportive government policies and incentives

- Growing demand for renewable energy

- Development of robust infrastructure for biomass processing and distribution.

- Dominance Factors: Higher biomass availability, favorable government policies and initiatives, and substantial investments in biomass energy projects contribute to the dominance of these regions. Market share for the Northern region is estimated at xx% in 2024.

India Biomass Market Product Landscape

The Indian biomass market offers a diverse range of products, including biomass pellets, briquettes, biogas, and biofuels. Technological advancements have led to the development of high-efficiency biomass gasifiers and improved pellet production technologies. These advancements offer increased energy output and reduced emissions compared to traditional biomass utilization methods. The market is witnessing increasing focus on producing high-quality, standardized biomass products, which meet stringent quality standards and international certifications.

Key Drivers, Barriers & Challenges in India Biomass Market

Key Drivers:

- Increasing energy demand and the need for energy security.

- Government support and incentives for renewable energy adoption.

- Growing environmental concerns and the push for sustainable energy solutions.

- Abundant availability of biomass resources in India.

Challenges & Restraints:

- Inconsistent policy implementation across states.

- High initial investment costs for biomass energy projects.

- Lack of awareness and understanding of biomass energy technologies among consumers.

- Inefficient supply chains and logistical challenges in biomass transportation and handling. This results in approximately xx% of biomass being wasted annually.

Emerging Opportunities in India Biomass Market

- Untapped Markets: Expanding into rural and underserved areas with access to abundant biomass resources.

- Innovative Applications: Exploring new applications of biomass energy, such as in transportation and industrial heating.

- Evolving Consumer Preferences: Catering to the growing demand for sustainable and environmentally friendly energy options.

Growth Accelerators in the India Biomass Market Industry

Technological advancements in biomass conversion technologies, coupled with strategic partnerships between government agencies and private companies, are accelerating market growth. Expansion into new geographical markets and diversification into new applications will further propel market expansion. The government's push for achieving carbon neutrality further strengthens the market outlook.

Key Players Shaping the India Biomass Market Market

- Emami Agrotech Ltd

- Universal Biofuels Private Limited

- BIOD ENERGY (INDIA) PVT LTD

- EnviTec Biogas AG

- Aemetis Inc

- Monopoly Innovations Private Limited

- List Not Exhaustive

- List of Other Prominent Companies

- Market Ranking Analysis

Notable Milestones in India Biomass Market Sector

- November 2023: The Ministry of Power announced a benchmark price of INR 2.27/1,000 kcal (USD 0.027/1,000 kcal) for non-torrefied biomass pellets in Northern India (excluding NCR). This sets a price floor and standardizes the biomass pellet market.

- February 2023: Aranayak Fuel and Power launched a INR 50-crore (~USD 6 million) biomass-based green hydrogen plant, demonstrating the potential for biomass to be a feedstock for other clean energy technologies.

In-Depth India Biomass Market Market Outlook

The Indian biomass market is poised for robust growth over the next decade, driven by a confluence of factors including increasing energy demand, supportive government policies, technological advancements, and rising environmental consciousness. Strategic partnerships, investments in research and development, and expansion into new applications will shape the future landscape of this dynamic sector. The market is expected to witness considerable expansion, creating lucrative opportunities for investors and entrepreneurs.

India Biomass Market Segmentation

-

1. Feedstock

- 1.1. Agriculture Waste

- 1.2. Wood and Woody Residue

- 1.3. Solid Municipal Waste

- 1.4. Other Feedstocks

-

2. Application

- 2.1. Power Generation

- 2.2. Heating

- 2.3. Other Applications

India Biomass Market Segmentation By Geography

- 1. India

India Biomass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks

- 3.3. Market Restrains

- 3.3.1. 4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks

- 3.4. Market Trends

- 3.4.1. The Power Generation Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Biomass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Agriculture Waste

- 5.1.2. Wood and Woody Residue

- 5.1.3. Solid Municipal Waste

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation

- 5.2.2. Heating

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Emami Agrotech Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Universal Biofuels Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BIOD ENERGY (INDIA) PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnviTec Biogas AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aemetis Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Monopoly Innovations Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 1 *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Emami Agrotech Ltd

List of Figures

- Figure 1: India Biomass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Biomass Market Share (%) by Company 2024

List of Tables

- Table 1: India Biomass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Biomass Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 3: India Biomass Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Biomass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Biomass Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 6: India Biomass Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: India Biomass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Biomass Market?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the India Biomass Market?

Key companies in the market include Emami Agrotech Ltd, Universal Biofuels Private Limited, BIOD ENERGY (INDIA) PVT LTD, EnviTec Biogas AG, Aemetis Inc, Monopoly Innovations Private Limited, 1 *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi.

3. What are the main segments of the India Biomass Market?

The market segments include Feedstock, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks.

6. What are the notable trends driving market growth?

The Power Generation Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks.

8. Can you provide examples of recent developments in the market?

November 2023: The Ministry of Power in India announced a benchmark price of INR 2.27/1,000 kcal (USD 0.027/1,000 kcal) for non-torrefied biomass pellets, which is applicable to northern India, excluding the national capital region. The pellets should have a moisture content below 14 pc and a gross calorific value between 2,800 and 4,000 kcal/kg. The price excludes tax and transportation costs for goods and services.February 2023: Aranayak Fuel and Power, an Indian-based biomass company, broke the ground on its INR 50-crore (~USD 6 million), one tonne-per-day, biomass-based green hydrogen plant in the Mirzapur district of Uttar Pradesh. The company signed an MoU with the state government during the ‘global investors’ meet’ in Uttar Pradesh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Biomass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Biomass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Biomass Market?

To stay informed about further developments, trends, and reports in the India Biomass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence