Key Insights

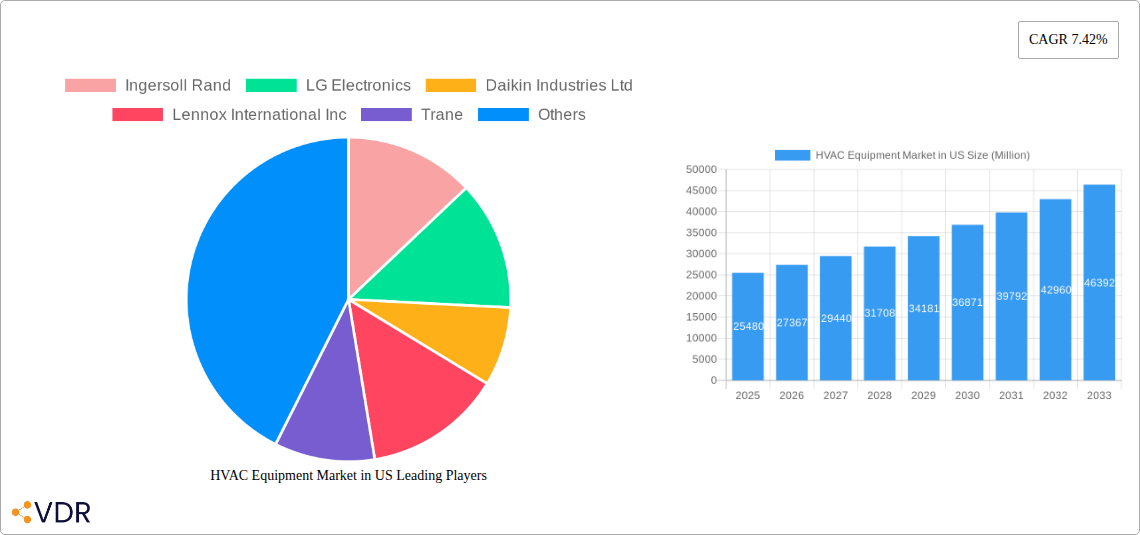

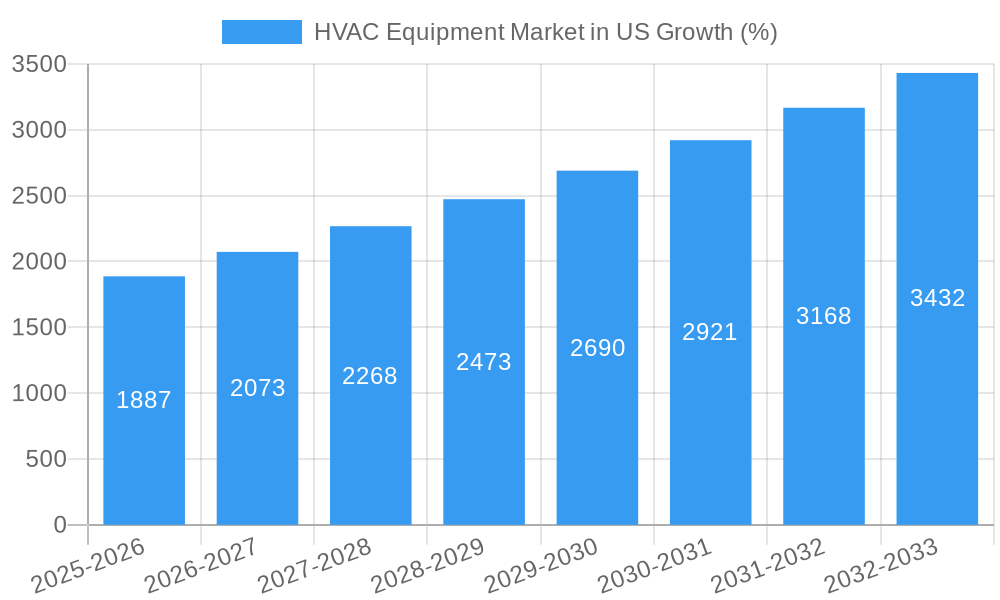

The US HVAC equipment market, valued at $25.48 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing urbanization and construction activities, particularly in the residential and commercial sectors, fuel demand for efficient climate control systems. Stringent energy efficiency regulations, coupled with rising consumer awareness of environmental sustainability, are further stimulating the adoption of energy-saving HVAC technologies like heat pumps and smart thermostats. The market is segmented by end-user (residential, commercial, industrial) and equipment type (air conditioning, chillers, heating, water heaters, ventilation). Commercial buildings are likely to show particularly strong growth given ongoing construction and renovation projects focused on energy efficiency. The industrial segment benefits from expanding manufacturing and logistics sectors requiring precise climate control in production and warehouse environments. Key players, including Ingersoll Rand, LG Electronics, Daikin, Lennox, Trane, Nortek, Mitsubishi Electric, Carrier, and Rheem, are engaged in intense competition, marked by product innovation, strategic partnerships, and mergers & acquisitions to gain market share. Technological advancements such as IoT integration, AI-driven optimization, and improved refrigerant technology continuously reshape the market landscape. While rising material costs and potential supply chain disruptions pose challenges, the overall growth trajectory remains positive, fueled by the long-term demand for efficient and sustainable climate control solutions.

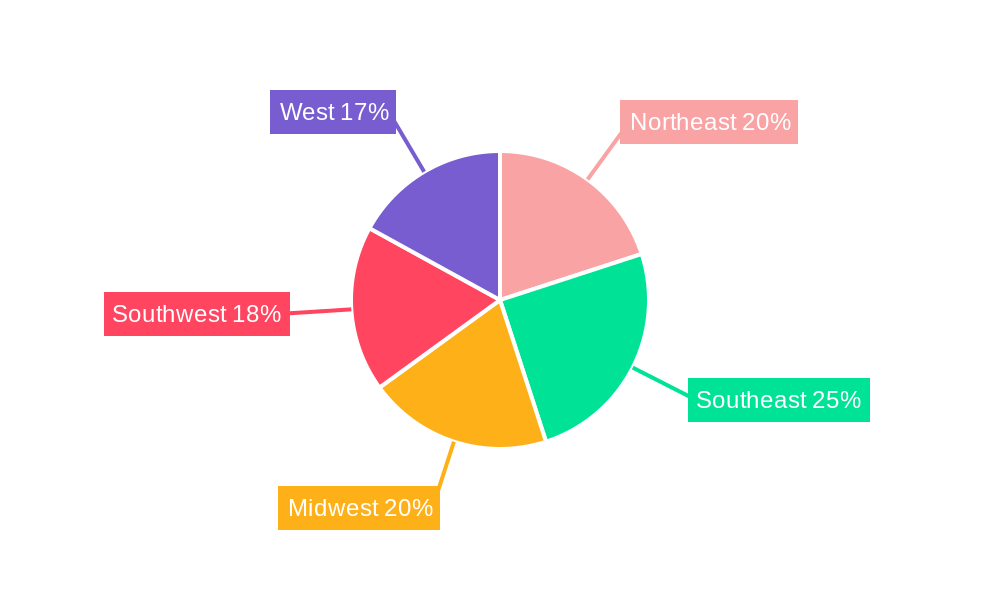

The forecast period (2025-2033) anticipates a continuation of this growth, with the CAGR of 7.42% suggesting a substantial market expansion. Regional variations within the US are expected, with the South and West potentially demonstrating higher growth rates due to climatic conditions and population increases. The residential segment's growth will be significantly influenced by new home construction and renovations, while the commercial sector’s expansion hinges on factors such as office space demand and retail development. Competition among established players will remain intense, prompting ongoing innovation in areas such as energy efficiency, smart home integration, and service offerings. This competitive environment is likely to benefit consumers through better product quality, greater choice, and potentially lower pricing in the long term. The market's future success hinges on addressing challenges related to skilled labor shortages for installation and maintenance, promoting sustainable refrigerant practices, and ensuring the continued development of energy-efficient technologies.

This comprehensive report provides an in-depth analysis of the HVAC equipment market in the US, covering market dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The US HVAC market is segmented by end-user (Residential, Commercial, Industrial) and equipment type (Air Conditioning, Chillers, Heating, Water Heaters (Electric and Gas), Ventilation). Total market value in 2025 is estimated at xx Million units.

HVAC Equipment Market in US Market Dynamics & Structure

The US HVAC equipment market is characterized by a moderately concentrated landscape, with major players like Carrier Global, Daikin Industries Ltd, and Lennox International Inc holding significant market share. Technological innovation, driven by energy efficiency mandates and sustainability concerns, is a key driver. Stringent regulatory frameworks, including energy codes and environmental regulations, shape product development and adoption. Competition from alternative technologies (e.g., geothermal heating and cooling) is emerging, while the market witnesses significant M&A activity, aiming to consolidate market share and expand product portfolios.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Focus on smart HVAC systems, IoT integration, and energy-efficient technologies.

- Regulatory Framework: Stringent energy efficiency standards and environmental regulations drive innovation.

- M&A Activity: Significant deal volume, averaging xx deals annually between 2019-2024, driven by consolidation and expansion strategies.

- End-User Demographics: Growing population and rising disposable incomes fuel demand, particularly in the residential sector.

- Innovation Barriers: High R&D costs and the complexity of integrating new technologies present challenges.

HVAC Equipment Market in US Growth Trends & Insights

The US HVAC equipment market experienced substantial growth during the historical period (2019-2024), driven by factors such as increasing urbanization, rising disposable incomes, and stringent building codes. The market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. Technological disruptions, such as the adoption of smart thermostats and energy-efficient HVAC systems, have significantly influenced market growth. Consumer behavior shifts toward sustainability and energy conservation further fuel demand for eco-friendly HVAC solutions. The forecast period (2025-2033) anticipates continued growth, driven by factors such as increasing demand for energy-efficient solutions, smart home technologies, and infrastructural development. The market is expected to reach xx million units by 2033, exhibiting a CAGR of xx%. Market penetration of smart HVAC systems is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in HVAC Equipment Market in US

The commercial sector is the largest segment in the US HVAC market, representing approximately xx% of the total market value in 2025, followed by residential (xx%) and industrial (xx%). Among equipment types, air conditioning systems dominate, accounting for xx% of the market. California, Texas, and Florida are leading states, driven by factors such as high temperatures, stringent building codes, and robust construction activity.

- Commercial Segment Drivers: Stringent energy efficiency standards in commercial buildings and the growth of commercial real estate.

- Residential Segment Drivers: Rising disposable incomes, increasing homeownership rates, and government incentives for energy-efficient home improvements.

- Industrial Segment Drivers: Growth in manufacturing and industrial activities, necessitating robust HVAC systems in industrial settings.

- Air Conditioning Dominance: High temperatures across vast parts of the US necessitate widespread air conditioning usage.

- Regional Differences: Climatic variations influence demand across different regions.

HVAC Equipment Market in US Product Landscape

The US HVAC market showcases a diverse product landscape featuring advancements in energy efficiency, smart functionalities, and innovative designs. Air conditioners now incorporate advanced technologies such as inverter compressors and variable refrigerant flow (VRF) systems for enhanced energy efficiency. Heating systems are increasingly incorporating smart controls and integration with renewable energy sources. Chillers offer improved energy efficiency and reduced environmental impact through advancements in compressor technology and refrigerant management. Ventilation systems emphasize improved air quality and energy recovery. Key features driving product adoption include advanced control systems, remote monitoring capabilities, and seamless integration with smart home ecosystems.

Key Drivers, Barriers & Challenges in HVAC Equipment Market in US

Key Drivers: Stringent environmental regulations promoting energy efficiency, increasing demand from commercial and residential sectors, and technological advancements leading to improved system efficiency and functionalities. Government incentives and tax credits for energy-efficient HVAC systems further boost market growth.

Key Challenges: Supply chain disruptions impacting raw material availability and production costs, fluctuations in energy prices affecting operational expenses, and the increasing complexity of HVAC systems challenging installation and maintenance. Intense competition among established players and the emergence of new technologies put downward pressure on pricing. Furthermore, skilled labor shortages hinder timely project completion and system maintenance.

Emerging Opportunities in HVAC Equipment Market in US

Emerging opportunities include growth in the smart home automation sector, increasing demand for energy-efficient and sustainable HVAC solutions, and expansion into underserved markets. Opportunities also exist in the development of HVAC systems tailored to specific building types and climate conditions. The integration of renewable energy sources and improved energy storage solutions offers further growth potential.

Growth Accelerators in the HVAC Equipment Market in US Industry

Technological advancements such as AI-driven energy management systems and the development of eco-friendly refrigerants are key growth catalysts. Strategic partnerships between HVAC manufacturers and technology companies can further accelerate market expansion. Government initiatives aimed at promoting energy efficiency and reducing carbon emissions also play a significant role in fueling market growth. The increasing adoption of building automation systems and the growing demand for smart HVAC solutions are also driving significant growth.

Key Players Shaping the HVAC Equipment Market in US Market

- Ingersoll Rand

- LG Electronics

- Daikin Industries Ltd

- Lennox International Inc

- Trane

- Nortek Air Solutions LLC

- Mitsubishi Electric

- Carrier Global

- Rheem Manufacturing Company

Notable Milestones in HVAC Equipment Market in US Sector

- September 2021: Carrier Transicold introduced two new Citimax unit lines for heavy-duty refrigerated trucks.

- January 2022: Daikin Applied introduced SiteLine Building Controls for optimizing HVAC performance and indoor air quality.

- February 2022: Carrier Global acquired Toshiba's stake in Toshiba Carrier Corporation, strengthening its position in the VRF market.

In-Depth HVAC Equipment Market in US Market Outlook

The US HVAC equipment market is poised for sustained growth over the forecast period, driven by technological advancements, increasing energy efficiency mandates, and a growing emphasis on sustainable building practices. Strategic partnerships and product innovation will play crucial roles in shaping future market dynamics. Expansion into niche markets and the development of innovative solutions tailored to specific consumer needs will present significant opportunities for growth. The focus on smart and interconnected systems, coupled with the increasing penetration of renewable energy integration, is expected to accelerate market growth in the coming years.

HVAC Equipment Market in US Segmentation

-

1. Type of Equipment

-

1.1. Air Conditioning Equipment

- 1.1.1. Unitary Air Conditioners

- 1.1.2. Room Air Conditioners

- 1.1.3. Packaged Terminal Air Conditioners

- 1.1.4. Chillers

-

1.2. Heating Equipment

- 1.2.1. Warm Air Furnace (Gas and Oil)

- 1.2.2. Boilers

- 1.2.3. Room and Zone Heating Equipment

- 1.2.4. Heat Pumps (Air-sourced and Geo-thermal)

-

1.3. Ventilation Equipment

- 1.3.1. Air Handling Units

- 1.3.2. Fan Coil Units

- 1.3.3. Building Humidifiers and Dehumidifiers

-

1.1. Air Conditioning Equipment

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

HVAC Equipment Market in US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

HVAC Equipment Market in US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement of Existing Equipment with Better Performing Onces; Supportive Government Regulations including Incentives for Saving Energy Through Tax Credit Programs.

- 3.3. Market Restrains

- 3.3.1. Rising Competition among key vendors to limit margins

- 3.4. Market Trends

- 3.4.1. Flourishing Energy and Construction Sectors Bodes well for the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Equipment

- 5.1.1. Air Conditioning Equipment

- 5.1.1.1. Unitary Air Conditioners

- 5.1.1.2. Room Air Conditioners

- 5.1.1.3. Packaged Terminal Air Conditioners

- 5.1.1.4. Chillers

- 5.1.2. Heating Equipment

- 5.1.2.1. Warm Air Furnace (Gas and Oil)

- 5.1.2.2. Boilers

- 5.1.2.3. Room and Zone Heating Equipment

- 5.1.2.4. Heat Pumps (Air-sourced and Geo-thermal)

- 5.1.3. Ventilation Equipment

- 5.1.3.1. Air Handling Units

- 5.1.3.2. Fan Coil Units

- 5.1.3.3. Building Humidifiers and Dehumidifiers

- 5.1.1. Air Conditioning Equipment

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Equipment

- 6. Northeast HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 7. Southeast HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 8. Midwest HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 9. Southwest HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 10. West HVAC Equipment Market in US Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ingersoll Rand

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daikin Industries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lennox International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trane

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nortek Air Solutions LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Carrier Global

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rheem Manufacturing Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Ingersoll Rand

List of Figures

- Figure 1: HVAC Equipment Market in US Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: HVAC Equipment Market in US Share (%) by Company 2024

List of Tables

- Table 1: HVAC Equipment Market in US Revenue Million Forecast, by Region 2019 & 2032

- Table 2: HVAC Equipment Market in US Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: HVAC Equipment Market in US Revenue Million Forecast, by Type of Equipment 2019 & 2032

- Table 4: HVAC Equipment Market in US Volume K Unit Forecast, by Type of Equipment 2019 & 2032

- Table 5: HVAC Equipment Market in US Revenue Million Forecast, by End User 2019 & 2032

- Table 6: HVAC Equipment Market in US Volume K Unit Forecast, by End User 2019 & 2032

- Table 7: HVAC Equipment Market in US Revenue Million Forecast, by Region 2019 & 2032

- Table 8: HVAC Equipment Market in US Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: HVAC Equipment Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 10: HVAC Equipment Market in US Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Northeast HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northeast HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Southeast HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Southeast HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Midwest HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Midwest HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Southwest HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Southwest HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: West HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: HVAC Equipment Market in US Revenue Million Forecast, by Type of Equipment 2019 & 2032

- Table 22: HVAC Equipment Market in US Volume K Unit Forecast, by Type of Equipment 2019 & 2032

- Table 23: HVAC Equipment Market in US Revenue Million Forecast, by End User 2019 & 2032

- Table 24: HVAC Equipment Market in US Volume K Unit Forecast, by End User 2019 & 2032

- Table 25: HVAC Equipment Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 26: HVAC Equipment Market in US Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: United States HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Canada HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Mexico HVAC Equipment Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico HVAC Equipment Market in US Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HVAC Equipment Market in US?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the HVAC Equipment Market in US?

Key companies in the market include Ingersoll Rand, LG Electronics, Daikin Industries Ltd, Lennox International Inc, Trane, Nortek Air Solutions LLC, Mitsubishi Electric, Carrier Global, Rheem Manufacturing Company.

3. What are the main segments of the HVAC Equipment Market in US?

The market segments include Type of Equipment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Replacement of Existing Equipment with Better Performing Onces; Supportive Government Regulations including Incentives for Saving Energy Through Tax Credit Programs..

6. What are the notable trends driving market growth?

Flourishing Energy and Construction Sectors Bodes well for the Market.

7. Are there any restraints impacting market growth?

Rising Competition among key vendors to limit margins.

8. Can you provide examples of recent developments in the market?

February 2022 - Carrier Global Corporation signed a binding agreement to acquire Toshiba Corporation's ownership stake in Toshiba Carrier Corporation (TCC), a joint venture with Carrier in variable refrigerant flow (VRF) and light commercial HVAC. Carrier's planned acquisition will strengthen its position in one of the fastest-growing HVAC segments, scale its global VRF product platform with leading and differentiated technology, and add a well-known brand to its portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HVAC Equipment Market in US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HVAC Equipment Market in US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HVAC Equipment Market in US?

To stay informed about further developments, trends, and reports in the HVAC Equipment Market in US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence