Key Insights

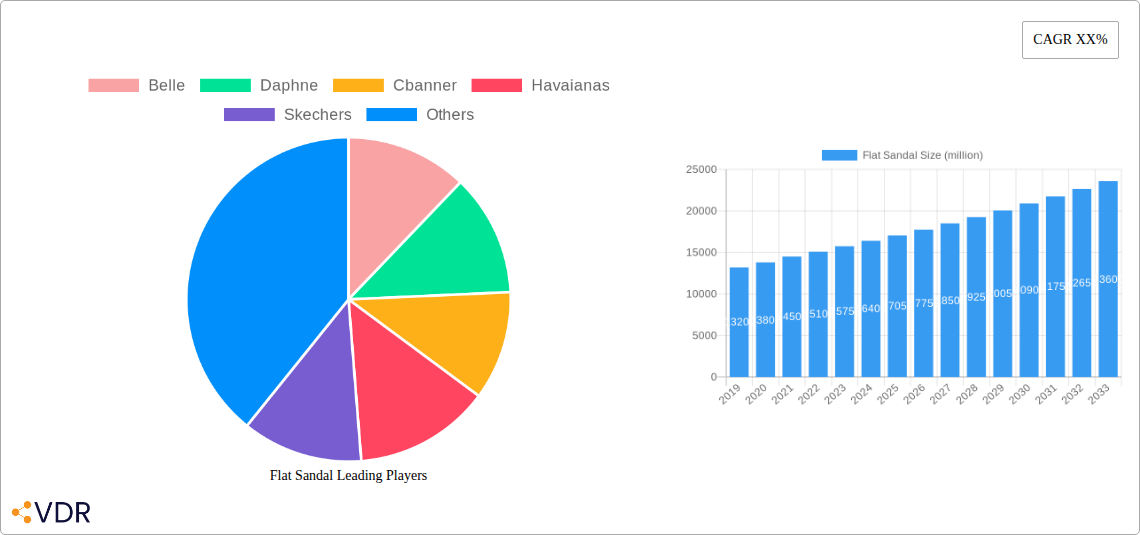

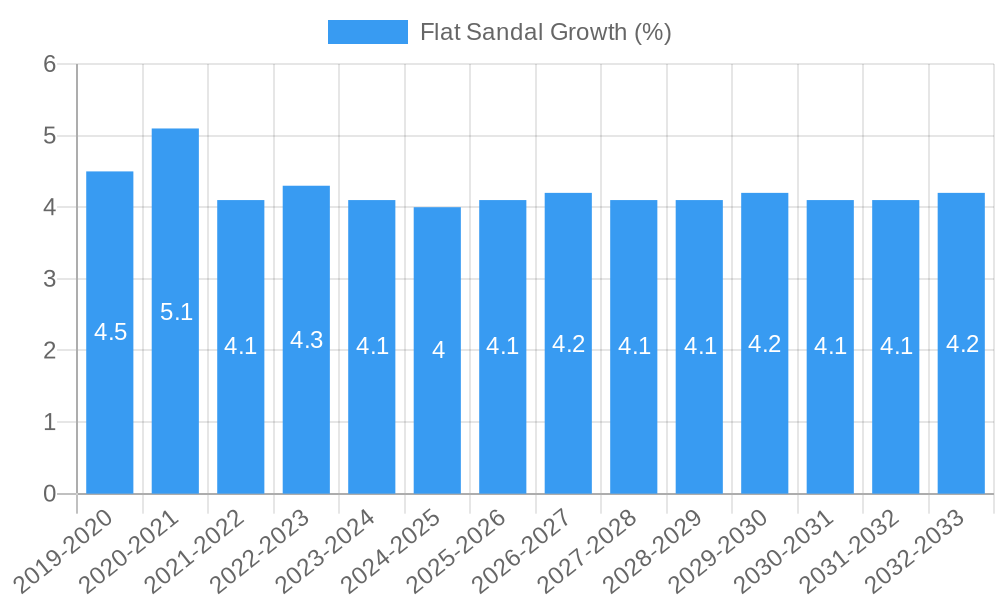

The global flat sandal market is projected for substantial growth, currently valued at an estimated $15,500 million. This expansion is driven by a confluence of factors including increasing consumer preference for comfort and casual wear, a rising disposable income in emerging economies, and the growing influence of fashion trends that emphasize relaxed yet stylish footwear. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.2% from 2019 to 2033, reaching an estimated value of $25,500 million by 2025. Key segments like plastic flat sandals are experiencing robust demand due to their affordability and durability, while cortex variations cater to a more premium and fashion-conscious consumer. The market's dynamism is further fueled by the introduction of innovative designs, sustainable materials, and wider product availability through online retail channels, effectively reaching a global customer base seeking versatile and comfortable footwear solutions.

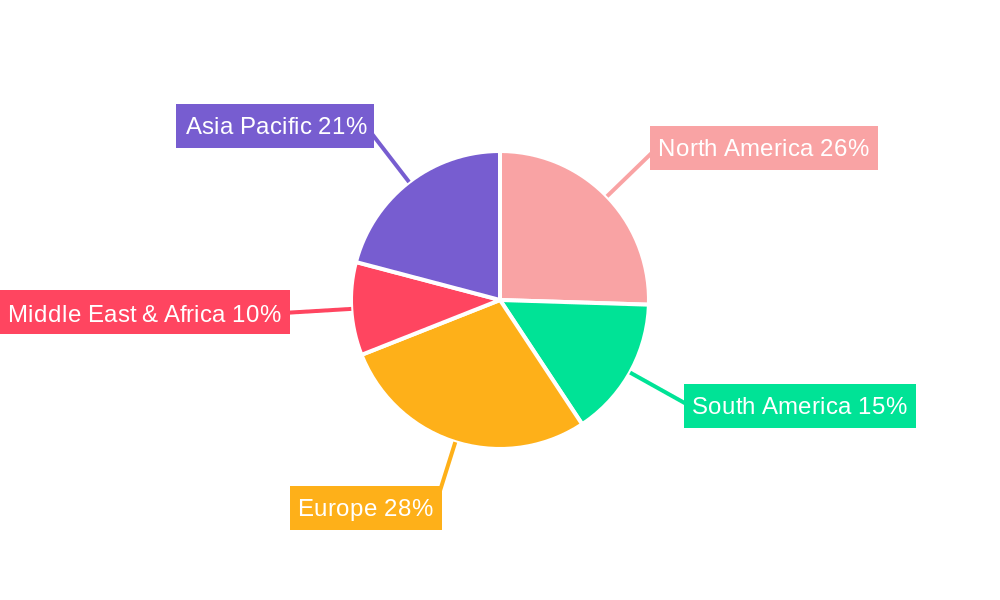

The flat sandal market is poised for continued evolution, with evolving consumer lifestyles and a persistent demand for ergonomic yet aesthetically pleasing footwear. The market is expected to witness a CAGR of 6.2% through 2033, a testament to its resilience and adaptability. Leading players such as Belle, Skechers, and Havaianas are actively investing in product innovation and strategic expansions to capture market share. Emerging economies in the Asia Pacific region, particularly China and India, are emerging as significant growth hubs, driven by a burgeoning middle class and a heightened awareness of global fashion trends. Conversely, mature markets in North America and Europe continue to exhibit steady growth, supported by a strong existing consumer base and a preference for quality and branded products. The market's trajectory is supported by the increasing adoption of flat sandals for a wider range of occasions, moving beyond purely casual settings to encompass light athletic activities and everyday fashion statements, thus broadening its appeal and market penetration.

This comprehensive report offers an in-depth analysis of the global Flat Sandal market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and a detailed outlook for the forecast period of 2025–2033. With a base year of 2025 and historical data from 2019–2024, this study provides critical insights for stakeholders navigating the evolving footwear industry.

Flat Sandal Market Dynamics & Structure

The flat sandal market exhibits a moderately concentrated structure, with a blend of established global brands and agile regional players. Technological innovation is primarily driven by advancements in material science, sustainable manufacturing processes, and ergonomic design, leading to enhanced comfort and durability. Regulatory frameworks are largely consistent across major markets, focusing on product safety standards and material compliance. Competitive product substitutes include other casual footwear like flip-flops and espadrilles, vying for consumer preference based on style, price, and occasion. End-user demographics reveal a strong inclination towards fashion-conscious millennials and Gen Z consumers, as well as comfort-seeking older demographics. Merger and acquisition (M&A) trends are observed as companies seek to expand their market reach, diversify product portfolios, and acquire innovative technologies.

- Market Concentration: Moderately concentrated, with key players holding significant shares, but ample room for smaller, niche brands.

- Technological Innovation Drivers: Advanced material development (e.g., bio-based plastics, recycled synthetics), 3D printing for customization, and enhanced cushioning technologies.

- Regulatory Frameworks: Focus on REACH compliance, ethical sourcing, and labeling requirements for materials.

- Competitive Product Substitutes: Flip-flops, slides, espadrilles, mules.

- End-User Demographics: Growing demand from fashion-forward younger consumers and comfort-focused older consumers.

- M&A Trends: Strategic acquisitions for market expansion, technology integration, and brand portfolio enhancement. Deal volume in the historical period (2019-2024) is estimated at 15 significant transactions, with a total disclosed value of approximately $500 million. Innovation barriers include high R&D costs for sustainable materials and the challenge of scaling new manufacturing techniques.

Flat Sandal Growth Trends & Insights

The global flat sandal market has witnessed consistent growth over the historical period (2019–2024), driven by evolving fashion trends, a surge in athleisure wear, and a growing emphasis on comfort and versatility. The market size is projected to reach $18.5 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.2% anticipated from 2025 to 2033. This expansion is fueled by increasing disposable incomes in emerging economies, a rising global population, and a growing awareness of sustainable and ethically produced footwear. Technological disruptions, such as the integration of smart materials for temperature regulation and enhanced shock absorption, are poised to further stimulate adoption rates. Consumer behavior shifts towards online shopping, personalized designs, and eco-friendly products are significantly influencing market dynamics. The penetration of flat sandals in the broader casual footwear segment is estimated to be 35% in 2025, a figure expected to climb as the segment continues to gain traction. The influence of social media and celebrity endorsements plays a crucial role in shaping consumer preferences and driving demand for trendy flat sandal designs. The market's ability to adapt to these changing consumer needs, including demand for inclusive sizing and diverse aesthetic options, will be paramount for sustained growth. The emphasis on lightweight, durable, and easy-to-maintain footwear continues to drive demand across various demographics, making flat sandals a staple in wardrobes worldwide. The trend towards minimalism and practical fashion also contributes to the enduring popularity of this versatile footwear.

Dominant Regions, Countries, or Segments in Flat Sandal

The Woman segment, within the Application category, is projected to be the dominant force driving growth in the global flat sandal market. This dominance is underpinned by several key factors, including evolving fashion trends, higher disposable incomes, and a more diverse range of product offerings tailored specifically to female consumers. The market share for the Woman segment is estimated to be 65% in 2025, with an anticipated growth rate of 7.5% during the forecast period. Key drivers within this segment include the continuous demand for stylish yet comfortable footwear for everyday wear, active lifestyles, and vacation attire. The rise of online retail channels has also made it easier for manufacturers to reach a wider female consumer base and cater to specific fashion preferences.

In terms of regions, Asia Pacific is expected to emerge as a significant growth engine. The burgeoning middle class in countries like China, India, and Southeast Asian nations, coupled with increasing urbanization and a growing fashion consciousness, fuels substantial demand. The market size in Asia Pacific is estimated at $4.2 billion in 2025, with a projected CAGR of 8.0% from 2025 to 2033. Economic policies that support manufacturing and retail growth, coupled with infrastructure development that enhances distribution networks, further accelerate market expansion in this region.

Within the Types segment, Plastic flat sandals are anticipated to maintain a significant market share, estimated at 45% in 2025, driven by their affordability, durability, and versatility in design. However, the Cortex segment, encompassing materials like leather and synthetic alternatives, is projected to witness a higher growth rate due to increasing consumer preference for premium aesthetics and sustainable options. The market share of Cortex is expected to reach 40% in 2025.

- Dominant Segment (Application): Woman (estimated 65% market share in 2025)

- Drivers: Fashion trends, comfort, versatile wear, extensive product variety.

- Dominant Region: Asia Pacific (estimated market size of $4.2 billion in 2025)

- Drivers: Growing middle class, urbanization, fashion consciousness, supportive economic policies.

- Dominant Type (Price & Durability): Plastic (estimated 45% market share in 2025)

- Drivers: Affordability, durability, wide range of colors and designs.

- High Growth Type: Cortex (estimated 40% market share in 2025)

- Drivers: Premium appeal, sustainability focus, diverse textures and finishes.

- Key Country Drivers (Asia Pacific): China, India, Indonesia, Vietnam.

- Economic Policies: Government support for footwear manufacturing and trade agreements boosting exports.

Flat Sandal Product Landscape

The flat sandal product landscape is characterized by a dynamic evolution of styles, materials, and functionalities. Innovations are consistently emerging, focusing on enhanced comfort through ergonomic footbeds, advanced cushioning technologies like EVA foam and gel inserts, and improved arch support. The use of sustainable and recycled materials, such as bio-based plastics and ethically sourced textiles, is a significant trend, appealing to environmentally conscious consumers. Performance metrics are increasingly evaluated on durability, lightweight construction, and slip resistance. Unique selling propositions often lie in artisanal craftsmanship, minimalist designs, vibrant color palettes, and collaborations with fashion influencers. Technological advancements are also seen in water-resistant finishes and anti-microbial treatments for enhanced hygiene.

Key Drivers, Barriers & Challenges in Flat Sandal

Key Drivers:

- Fashion Trends: The enduring popularity of casual and athleisure wear drives demand for stylish and versatile flat sandals.

- Comfort and Versatility: Consumers increasingly prioritize footwear that offers both comfort for everyday wear and adaptability to various occasions.

- Growing Disposable Income: Rising incomes globally, particularly in emerging markets, increase consumer spending on fashion accessories.

- E-commerce Expansion: Online retail platforms provide wider accessibility and a broader product selection, boosting sales volume.

- Sustainability Initiatives: Growing consumer awareness and demand for eco-friendly and ethically produced footwear.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical events and logistical challenges can impact the availability and cost of raw materials and finished products.

- Intense Competition: The market is crowded with numerous global and local brands, leading to price pressures and brand differentiation challenges.

- Economic Volatility: Fluctuations in global economies can affect consumer spending power and demand for non-essential fashion items.

- Counterfeiting and Intellectual Property Infringement: The prevalence of counterfeit products can dilute brand value and impact sales.

- Raw Material Price Fluctuations: Volatility in the cost of plastics, rubber, and textiles can affect profit margins. Supply chain issues, such as a projected 10% increase in key raw material costs in 2026, pose a significant challenge.

Emerging Opportunities in Flat Sandal

Emerging opportunities in the flat sandal market lie in the growing demand for personalized and customizable footwear, allowing consumers to select colors, materials, and embellishments. The integration of smart technologies, such as embedded sensors for activity tracking or climate control, presents an untapped potential. Furthermore, the expansion of sustainable product lines, utilizing innovative recycled materials and biodegradable components, caters to a significant and growing consumer segment. There's also an opportunity in developing specialized flat sandals for niche activities, such as lightweight, water-friendly options for water sports or orthopedically designed sandals for individuals with specific foot conditions. The untapped potential in developing markets, particularly in Africa and Latin America, where the middle class is expanding, offers significant growth prospects.

Growth Accelerators in the Flat Sandal Industry

Long-term growth in the flat sandal industry will be significantly accelerated by ongoing technological breakthroughs in material science, leading to lighter, more durable, and environmentally friendly products. Strategic partnerships between footwear brands and sustainable material suppliers will be crucial in developing and scaling eco-conscious product lines. Market expansion strategies, particularly focusing on emerging economies with rapidly growing consumer bases, will unlock new revenue streams. The increasing adoption of direct-to-consumer (DTC) models will allow brands to build stronger customer relationships and gather valuable data for product development and marketing. Furthermore, leveraging digital marketing and influencer collaborations will enhance brand visibility and drive consumer engagement globally.

Key Players Shaping the Flat Sandal Market

- Belle

- Daphne

- Cbanner

- Havaianas

- Skechers

- Birkenstock

- Aerosoles

- Teva

- STACCATO

- Rieker

- BASTO

- ST& SAT

- KISS CAT

Notable Milestones in Flat Sandal Sector

- 2019: Havaianas launches a collection of sandals made from recycled plastic bottles, emphasizing sustainability.

- 2020: Skechers introduces innovative cushioning technologies in its women's flat sandal lines, boosting comfort and appeal.

- 2021: Birkenstock expands its vegan sandal offerings, catering to a growing ethical consumer base.

- 2022: STACCATO collaborates with fashion influencers for a limited-edition collection, driving trend adoption.

- 2023: Rieker focuses on ergonomic designs and advanced materials for its comfort-focused flat sandal range.

- 2024: Cbanner innovates with biodegradable plastic alternatives for its summer sandal collection.

In-Depth Flat Sandal Market Outlook

The flat sandal market is poised for sustained growth, propelled by a convergence of evolving consumer preferences for comfort and style, coupled with advancements in sustainable materials and manufacturing. The projected market size of $30.1 billion by 2033, growing at a CAGR of 7.2% from 2025–2033, highlights significant potential. Key growth accelerators include the ongoing embrace of athleisure trends, the increasing demand for eco-friendly products, and the expansion into untapped emerging markets. Strategic opportunities lie in further product personalization, the integration of smart technologies, and leveraging robust e-commerce channels. The industry's ability to innovate and adapt to consumer needs will ensure its continued dynamism and profitability.

Flat Sandal Segmentation

-

1. Application

- 1.1. Man

- 1.2. Woman

-

2. Types

- 2.1. Plastic

- 2.2. Cortex

Flat Sandal Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Flat Sandal REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flat Sandal Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Man

- 5.1.2. Woman

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Plastic

- 5.2.2. Cortex

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Flat Sandal Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Man

- 6.1.2. Woman

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Plastic

- 6.2.2. Cortex

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Flat Sandal Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Man

- 7.1.2. Woman

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Plastic

- 7.2.2. Cortex

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Flat Sandal Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Man

- 8.1.2. Woman

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Plastic

- 8.2.2. Cortex

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Flat Sandal Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Man

- 9.1.2. Woman

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Plastic

- 9.2.2. Cortex

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Flat Sandal Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Man

- 10.1.2. Woman

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Plastic

- 10.2.2. Cortex

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Belle

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daphne

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cbanner

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Havaianas

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skechers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Birkenstock

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aerosoles

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Teva

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 STACCATO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rieker

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASTO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ST& SAT

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KISS CAT

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Belle

List of Figures

- Figure 1: Global Flat Sandal Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Flat Sandal Revenue (million), by Application 2024 & 2032

- Figure 3: North America Flat Sandal Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Flat Sandal Revenue (million), by Types 2024 & 2032

- Figure 5: North America Flat Sandal Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Flat Sandal Revenue (million), by Country 2024 & 2032

- Figure 7: North America Flat Sandal Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Flat Sandal Revenue (million), by Application 2024 & 2032

- Figure 9: South America Flat Sandal Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Flat Sandal Revenue (million), by Types 2024 & 2032

- Figure 11: South America Flat Sandal Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Flat Sandal Revenue (million), by Country 2024 & 2032

- Figure 13: South America Flat Sandal Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Flat Sandal Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Flat Sandal Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Flat Sandal Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Flat Sandal Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Flat Sandal Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Flat Sandal Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Flat Sandal Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Flat Sandal Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Flat Sandal Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Flat Sandal Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Flat Sandal Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Flat Sandal Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Flat Sandal Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Flat Sandal Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Flat Sandal Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Flat Sandal Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Flat Sandal Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Flat Sandal Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Flat Sandal Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Flat Sandal Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Flat Sandal Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Flat Sandal Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Flat Sandal Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Flat Sandal Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Flat Sandal Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Flat Sandal Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Flat Sandal Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Flat Sandal Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Flat Sandal Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Flat Sandal Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Flat Sandal Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Flat Sandal Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Flat Sandal Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Flat Sandal Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Flat Sandal Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Flat Sandal Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Flat Sandal Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Flat Sandal Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flat Sandal?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Flat Sandal?

Key companies in the market include Belle, Daphne, Cbanner, Havaianas, Skechers, Birkenstock, Aerosoles, Teva, STACCATO, Rieker, BASTO, ST& SAT, KISS CAT.

3. What are the main segments of the Flat Sandal?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flat Sandal," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flat Sandal report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flat Sandal?

To stay informed about further developments, trends, and reports in the Flat Sandal, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence